2026 Crypto Market Lies and Truths: Will Retail Investors Bail Me Out? The Prediction Market Has Just Begun

- Core View: The article argues that the current crypto market is being "held hostage" by the US stock market's macro bubble. Bitcoin's narrative is shifting from a risk asset to a safe-haven asset, potentially rendering the traditional four-year cycle obsolete. Based on Peter Thiel's thinking framework, the article focuses on analyzing core trends like RWA, privacy, regulation, and DAT that will shape the market in 2026.

- Key Elements:

- Macro Bubble & BTC Narrative Shift: US stock valuations are at historic highs, influencing the crypto market. BTC is transitioning from a risk asset to a safe-haven asset hedging against macro uncertainty and fiat currency devaluation, but this narrative shift is not yet complete.

- RWA/Tokenization is the Growth Driver: RWA (Real World Assets) is seen as a long-term growth trend driven by institutional capital, with the market size predicted to reach trillions to tens of trillions of dollars by 2030, far exceeding the current total crypto market cap.

- Institutional Capital Will Dominate: The next wave of market capital will primarily come from institutions, not retail investors. Institutions prefer tokens with clear product-market fit, those that generate cash flow, or offer "dividend-like" properties.

- Privacy Demand Shifts to Infrastructure: Privacy coins for retail (e.g., Monero) are constrained by regulation. The real opportunity lies in blockchain infrastructure providing privacy for institutional transactions (e.g., Canton Network).

- Ethereum L1 is Scaling Directly: Through technologies like ZK-EVM and PeerDAS, Ethereum L1 is scaling to thousands of TPS while maintaining decentralization, potentially altering the "everything moves to L2" narrative.

- Regulatory Complexity: Clearer regulation is not an unalloyed good. For example, banning interest on stablecoins could push capital to DeFi protocols, but regulations like MiCA also increase compliance costs, potentially stifling innovation and leading to market concentration.

- DAT's Net Positive Impact: Digital Asset Treasuries (DAT) could become an "IPO moment" for altcoins, providing institutions with compliant exposure. If managed well, DAT could be a net positive factor for the crypto market in 2026.

Original Author: Ignas | DeFi Research

Original Compilation: Odaily

Guide: DeFi researcher Ignas continues last year's "Truths and Lies" series, using Peter Thiel's thinking framework to analyze the 2026 crypto market.

Core View: The U.S. stock market bubble has hijacked crypto assets; BTC is completing the narrative shift from a risk asset to a safe-haven asset; the 4-year cycle may have already expired. The article covers multiple main themes including RWA, privacy, regulation, DAT, with extremely high information density.

Main Text:

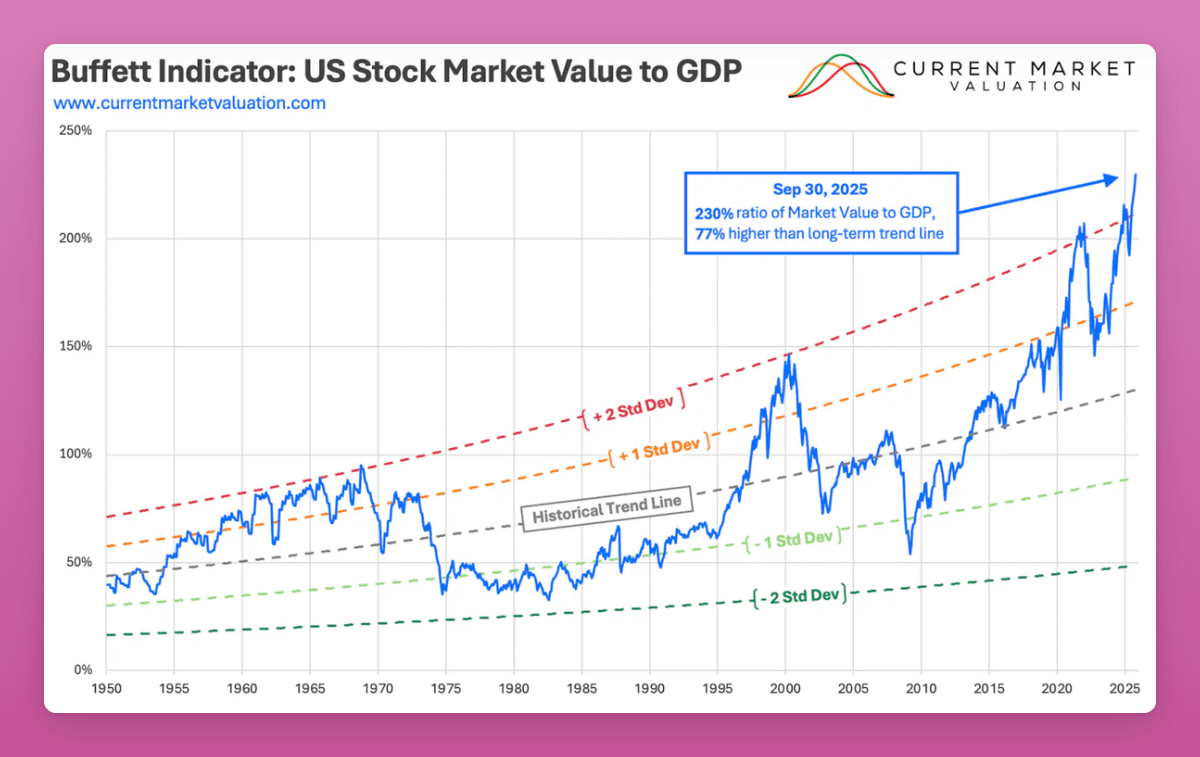

The U.S. stock market is in a "bubble" zone, with valuations comparable to the peak of the 1999 dot-com bubble.

Caption: Source Gemini, data for reference only

The current P/E ratio has reached 40.5x, higher than the 32x before the 1929 crash.

And the "best single measure of valuation" in Warren Buffett's words—the ratio of total market cap to GDP—is now 230%, 77% above the long-term trend. Before the 1929 crash, this ratio was 130%.

Caption: Source Link

Of course, this time might be different. You could call it the "currency debasement trade"—the declining purchasing power of the dollar, the global need to inflate away debt.

But the statement that "the currency debasement trade is real" might be a "non-obvious lie."

If that were true, the line in the chart below should be flat.

If money supply doubles → stocks double → the ratio stays the same.

But in reality, this line is going straight up.

This indicates stock prices are rising 28 times faster than money creation.

Or perhaps AI is truly transformative, and traditional metrics no longer apply.

Add in macro uncertainty, inflation, escalating wars, and it's natural for people to worry.

As Ollie wrote, people live in "pervasive economic anxiety."

"You don't have to be a prophet to know that, for most people, the desire of this age is stability, ownership, and upside exposure. We are still children of capitalism, our desires are inherently capitalist."

"So for most people, the clearest answer is to hold stocks and equities, and then predictably endure another 12 months of Trump waving his fists and proclaiming genius."

Naturally, fewer and fewer people are willing to bet 100% of their portfolio on altcoins now.

But the outlook for BTC might be different.

I treat BTC as a safe-haven asset: a hedge against macro uncertainty, the collapse of the international order, and fiat debasement (even if that debasement isn't happening).

This is a "non-obvious truth" I shared in my blog last year.

Too many people still see BTC as a risk asset, believing it only rises when the macro is stable and the Nasdaq soars.

It's this narrative conflict that's suppressing the price. Fearful holders need to capitulate to buyers who see BTC as digital gold.

I hope the "great rotation" can be completed this year, with BTC solidifying its status as a safe-haven asset.

But there's a huge risk: the stock market, along with all assets, goes off a cliff... and crypto goes with it.

Therefore, given this macro bubble backdrop, I want to focus on the medium-term trends I believe will shape the 2026 crypto market.

There's no better entry point than distilling the truths and lies for 2026.

First, crypto is a prisoner of this macro bubble.

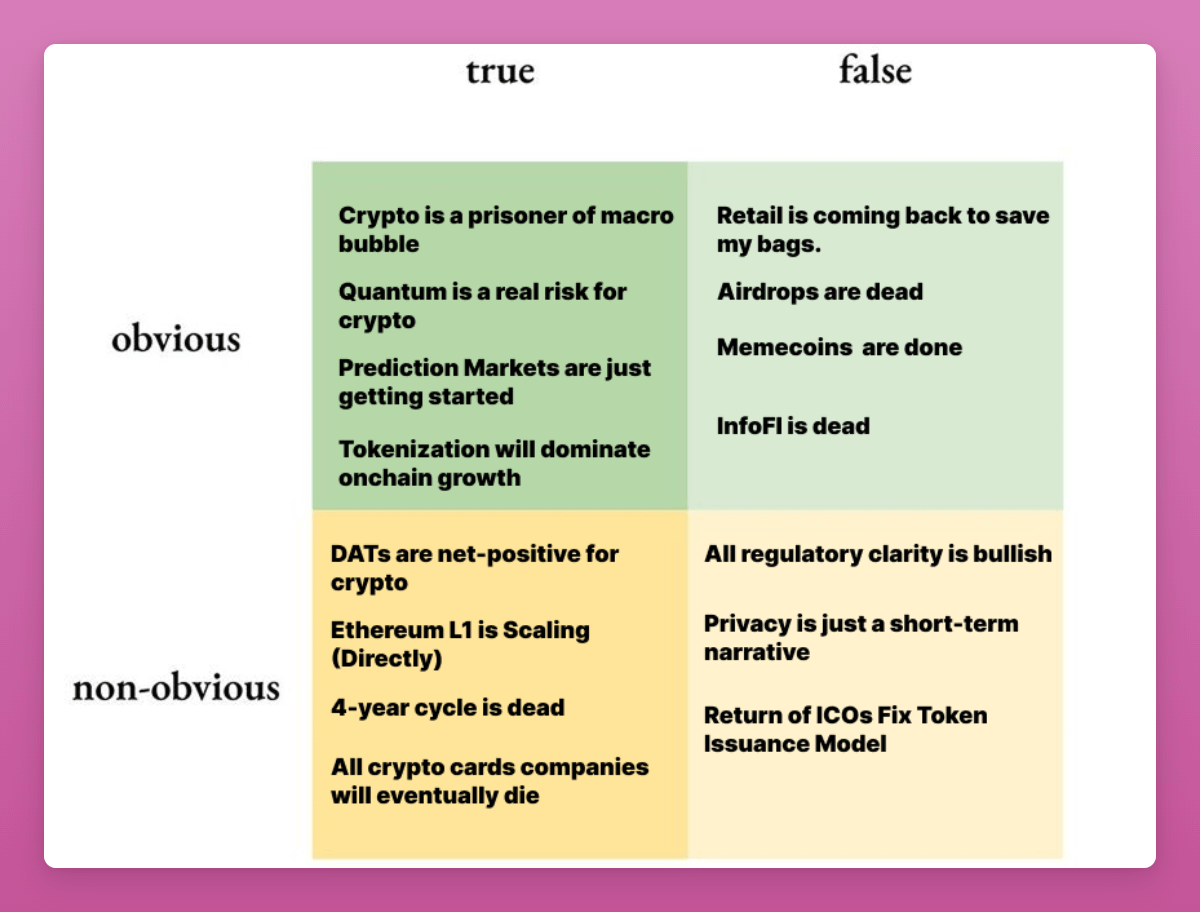

Same as last year, I'm using the thinking framework originally proposed by Peter Thiel and later adapted for crypto by Matti from Zee Prime Capital.

"If you listen to the current discussions and narratives, what do you think are the obvious truths, what are the obvious lies? What are the non-obvious truths, what are the non-obvious lies?" — Matti

Non-obvious truths and lies are harder to spot, but they reveal what is about to become clear to everyone. These are the best trading opportunities.

It's a difficult puzzle. I challenge you to come up with your own non-obvious truths/lies. I bet it's harder than you think. As Matti wrote:

"If your insights are only in the obvious domain—you probably don't have anything unique to offer, you'll just be competing with a lot of people."

Obvious Truths and Lies

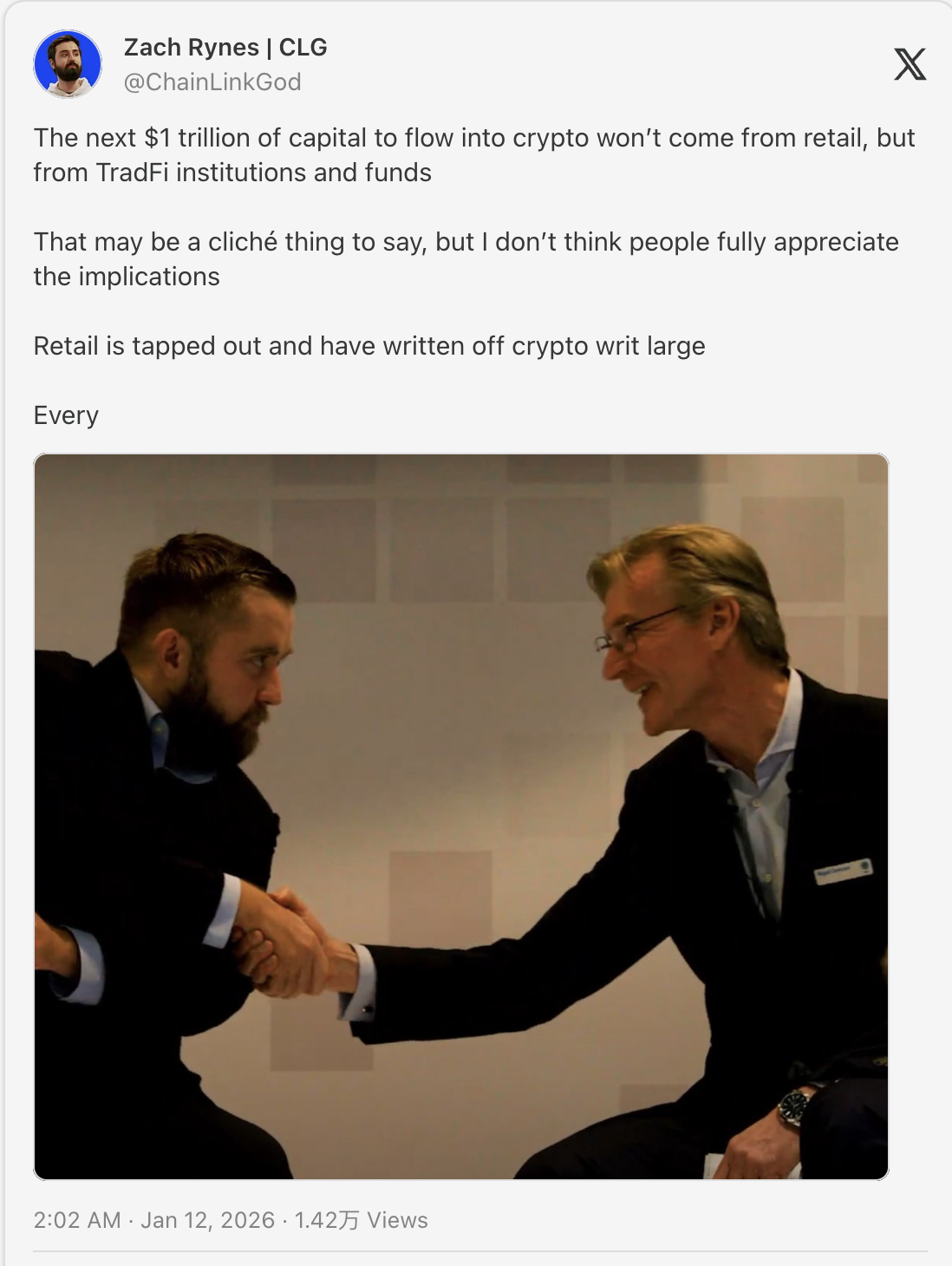

Lie: Retail Investors Will Come Back to Be the Bag Holders

Crypto Twitter seems to still be waiting for the "normies" to return.

But retail has been beaten up, and they are more anxious than ever in the current macro environment. They've been harvested by ICOs (2017), NFTs (2021), and Memecoins (2024) in waves. Each trend has been value extraction, with retail acting as exit liquidity.

Therefore, the next wave of capital is likely to come from institutions.

This is the view of Zach from Chainlink, and I think it makes a lot of sense.

Unlike retail, institutions won't buy vaporware. They won't buy "governance rights" for protocols with zero revenue.

They will buy tokens with "dividend-like" attributes (fee switches, real yield), projects with clear PMF (stablecoin issuers, prediction markets), and assets with clear regulatory clarity.

In fact, Tiger Research predicts that "utility-oriented tokenomics have failed. Governance voting rights have not attracted investors." They predict projects unable to generate sustainable revenue will exit the industry.

But I have a concern for 2026.

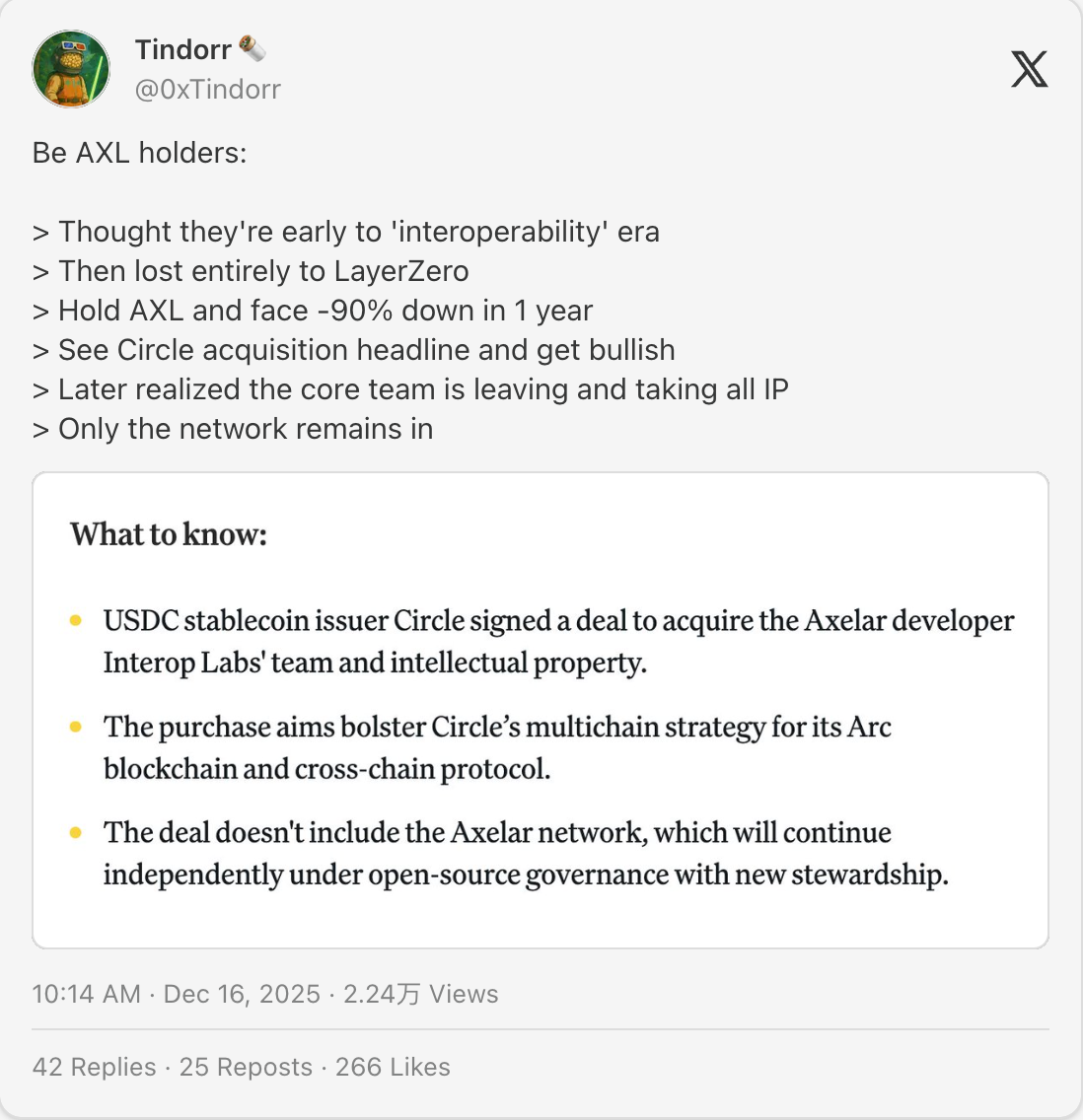

If tokens cannot provide this value, institutions will bypass the token and directly buy equity in the development company (like Coinbase acquiring the Axelar team but not the token).

We've already seen conflicts of interest between token holders and equity holders (Aave Labs vs DAO).

If we don't solve this, we end up with smart money owning equity (the real value) and retail owning tokens (exit liquidity).

For crypto to succeed, value must flow to the token, not the Labs company. Otherwise, we're just rebuilding the same traditional financial system.

This will be a major issue to watch closely in the coming year.

Truth: Quantum Risk is Real

The risk here has two layers:

- The real risk of quantum computers "breaking blockchain" or wallets relying on non-quantum-resistant technology

- The perceived risk that investors believe quantum risk is real

Because 1) very few people truly understand quantum technology, and 2) the crypto market is driven by narratives, emotions, and momentum, making it vulnerable to FUD attacks.

What I mean is, until these risks are fully resolved, quantum risk will continue to suppress crypto prices.

We don't need a quantum computer to actually empty Satoshi's wallet to see BTC drop 50%. We just need a "quantum breakthrough" headline from Google or IBM to trigger massive panic.

In such a scenario, I foresee a potential rotation into quantum-resistant chains, especially Ethereum.

- Ethereum already has quantum resistance planned in its roadmap (The Splurge). Vitalik has also explicitly expressed this need.

- Bitcoin could erupt into civil war over a hard fork to upgrade its signature algorithm (from ECDSA to a quantum-resistant scheme).

- New L1s might launch with "post-quantum cryptography" (PQC) as a primary selling point (don't fall for it).

But if BTC fails to prepare and erupts into civil war, it will drag down all crypto assets as market makers, hedge funds, etc., rebalance their portfolios.

Truth: Prediction Markets Are Just Getting Started

Rarely in crypto is an opportunity as obvious as prediction markets.

This view comes from a16z crypto's research advisor Andy Hall, and it's too accurate to ignore.

Prediction markets entered the mainstream in 2024. But in 2026, they will become bigger, broader, and smarter.

Andy says prediction markets are moving beyond questions like "who wins the US election" towards hyper-specific outcomes.

- More Contracts: Real-time odds on everything. Geopolitics, supply chains, maybe even "Will Ignas launch a token?"

- AI Integration: AI agents will scan the internet for signals to trade these markets, making them more efficient than any human analyst.

The biggest trading opportunity is: who decides the truth? As markets scale, adjudicating bets becomes a problem. We saw this with the Venezuela invasion (?) and Zelenskyy markets. Existing solutions (UMA) failed to capture nuance, leading to disputes and "scam" accusations.

Thus we need decentralized truth. Andy predicts a shift towards decentralized governance and LLM (AI) oracles to resolve disputes.

Maybe the POLY token will play a role in this? Where is your trading opportunity?

Lie: Airdrops Are Dead

I have to include this one.

Airdrops have been, and still are, the easiest way to make money in crypto. Many think airdrops are dead because 1) it's harder to get large rewards, and 2) sybil detection has improved.

But if you are a real user, trying new apps daily and using them, I believe the payoff is worth it.

The Neofinance airdrop should start in 2025, but the real money-printing opportunities are Polymarket, Base, Opensea, Metamask...

It's even better if CT thinks airdrops are dead. Fewer farmers, less competition.

Lie: Memecoins Are Finished

To be honest, I don't like memecoins. But sometimes I still trade them.

Winning money on memecoins is intellectually interesting 😉, sensing where sentiment will shift next. The volatility is exciting, no need to research tokenomics, revenue streams, etc. That's the appeal of memecoins.

Institutional-grade L1s, revenue sharing, or governance tokens don't offer that thrill. 4-year unlocks are boring. Utility tokens are actually less attractive than pure sentiment-driven memecoins when measured by revenue.

And financial nihilism won't disappear on January 1st. Regulation won't ban them either.

When the crypto market turns bullish, memecoins will reappear. The incentives for KOLs to shill are too high. Retail is too hungry for 1000x wins.

If degen trading is your thing, keep an open mind (and wallet).

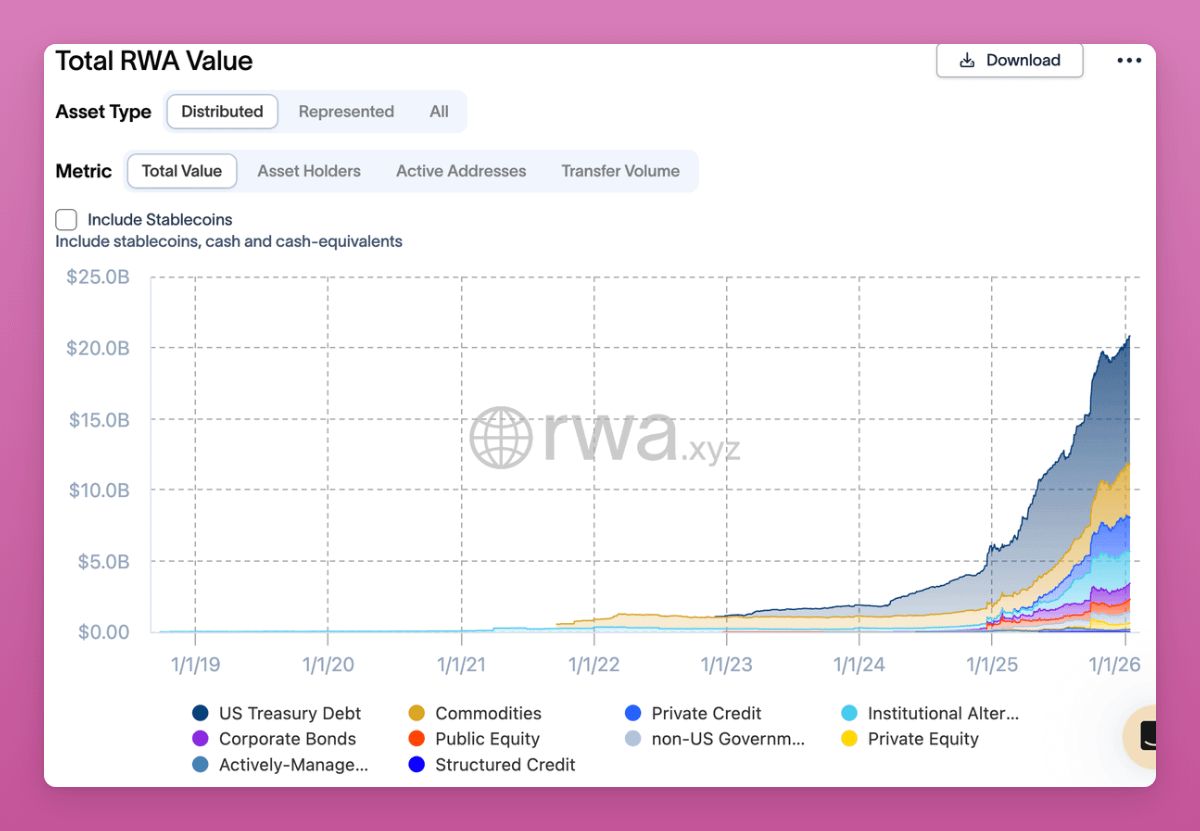

Truth: Tokenization/RWA Will Dominate Crypto Growth

In 2025, few charts have been going straight up.

But the growth of RWAs and tokenized assets is one of them.

RWAs are very different from circular DeFi, NFTs, prediction markets, or perpetual contracts. RWAs are not speculative hype. This is a long-term shift driven by institutional capital finding product-market fit.

Their predictions for 2030 vary widely:

- McKinsey (Conservative): $2-4 trillion

- Citi: $4-5 trillion

- BCG + ADDX: $16 trillion

- Ripple + BCG: $18.9 trillion by 2033

- Standard