Predicting Market's True and False Gambling Gods: Debunking the 8,300x Miracle; Manipulating Prices to Pocket $230,000

- Core Viewpoint: The article reveals two recent controversial incidents on the prediction market platform Polymarket. One involves a trader using multiple accounts in a "Sybil attack" to fabricate high returns for hype, while the other involves a trader manipulating spot market prices to reversely harvest trading bots on the platform, exposing vulnerabilities in credibility verification and rule design within this field.

- Key Elements:

- Trader ascetic claimed to have turned a $12 principal into over $100,000 through 16 consecutive bets on Polymarket, achieving an 8,300x return, but the data was questioned as being fabricated through hundreds of "Sybil" accounts.

- Another trader, a4385, in the XRP "15-minute up/down" market, first bought a large number of "up" chips on Polymarket, then pumped the XRP price with approximately $1 million in spot trading just before settlement, successfully profiting $233,000.

- a4385's operation exploited low weekend market liquidity and the simplistic response of individual market-making bots on Polymarket to price signals, achieving the harvesting of bots at an extremely low cost (approximately 0.25% slippage and fees).

- The barrier to entry for individuals developing trading bots on Polymarket is relatively low, leading to widespread bot liquidity but also making them easy targets for manipulation and harvesting.

- These incidents highlight the difficulty in distinguishing true from false information in prediction markets and the challenges existing mechanisms face in preventing market manipulation and false advertising.

Original|Odaily (@OdailyChina)

Author|Wenser (@wenser 2010)

As a hot sector that has continued to rise since the beginning of the year, the prediction market is no stranger to wealth creation miracles.

However, behind these miracles, discerning whether they are genuine wonders achieved through astute timing and skillful maneuvering, or fabricated hype designed to deceive, requires a keen eye. Recently, a trader on X claimed to have achieved an "8300x miracle" on Polymarket, turning a $12 principal into over $100,000 in profits through successive bets, only to be exposed for allegedly using multiple accounts for fraud and hype. Meanwhile, another trader reportedly made $230,000 by manipulating the price of XRP in a "15-minute up/down prediction" market, effectively executing a one-sided harvest against betting bots on Polymarket.

On the stage of betting for or against, some attempt to dance with lies, while others exploit rule loopholes for unfair gains. In the gamble of right and wrong, there is no unbeatable strategy, only flexible tactics.

From $12 to $100,000: The 8300x Miracle - Polymarket's Living Billboard vs. Trader's Fraud Scheme

The story begins with a post detailing a journey from a $12 principal to $100,000 in profit, achieving an 8300x return.

On January 16th, trader ascetic posted, claiming to have doubled his principal 16 consecutive times through "all-in bets on Bitcoin's short-term volatility," ultimately reaching the milestone of turning $12 into $100,000 in profit. He emphasized that he had "specifically shared his betting strategies and reasoning" throughout the process.

Subsequently, he shared his Polymarket account link in the comments, stating that such wealth creation miracles can only happen on Polymarket (Odaily Note: Does this sound familiar? Platforms previously praised with similar phrasing by traders include, but are not limited to, OpenSea, Blur, Pump.fun, Hyperliquid, Aster, etc.).

The comment section then erupted into a "frenzied celebration by Polymarket community members," with countless people congratulating him. Even Polymarket's Global Growth Lead, LeGate, commented: "Congrats, brother! I think you earned it! Congrats on the @PolymarketTrade badge!" (Odaily Note: This account is for Polymarket's active trader community.)

If you thought this was just another routine "overnight riches bragging post," you might have underestimated the drama.

Soon, the narrative of the "8300x return miracle on Polymarket" took a sharp turn.

From Betting Miracle to Fraud Scheme: 8300x Return Data Questioned

On the same day, January 16th, a trader named Moses, who claims to be "ranked 515th in Polymarket trading for 2025," questioned trader ascetic's account data: "Have you ever wondered why his account balance in the first post was $3,000? The answer is simple: he runs a massive 'sybil farm.' He didn't start with $12, but with hundreds of accounts, each funded with $10 to $20. Once one account reached $2,900, he started posting. Since then, he has made seven trades, all wins.

But note, he bet his entire balance each time. A real trader wouldn't do that. He's just chasing clout, doing whatever it takes.

Failing to get enough volume, he even seems to use other accounts for wash trading to hit his desired price.

Before blindly trusting 'influencers,' always do your own research. Attached are some of his failed sybil accounts, which only made up to $1,000."

Moses later added in the comments that all these accounts were created 7 months ago, participated in random markets continuously, and all started the same challenge on the same day 2 months ago. The entire "$10 to $100,000" story is fake!

Furthermore, he provided screenshots and links to the alleged sybil account profiles:

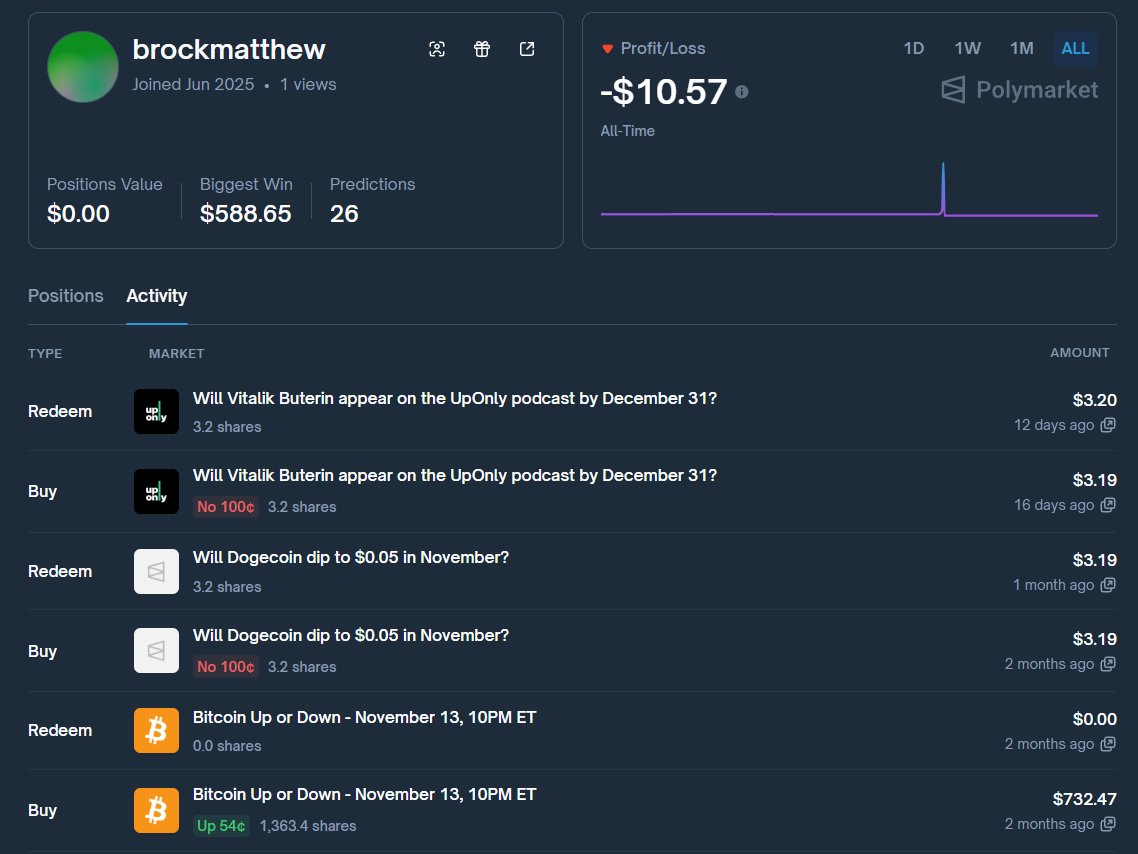

- Account 1: https://polymarket.com/@brockmatthew;

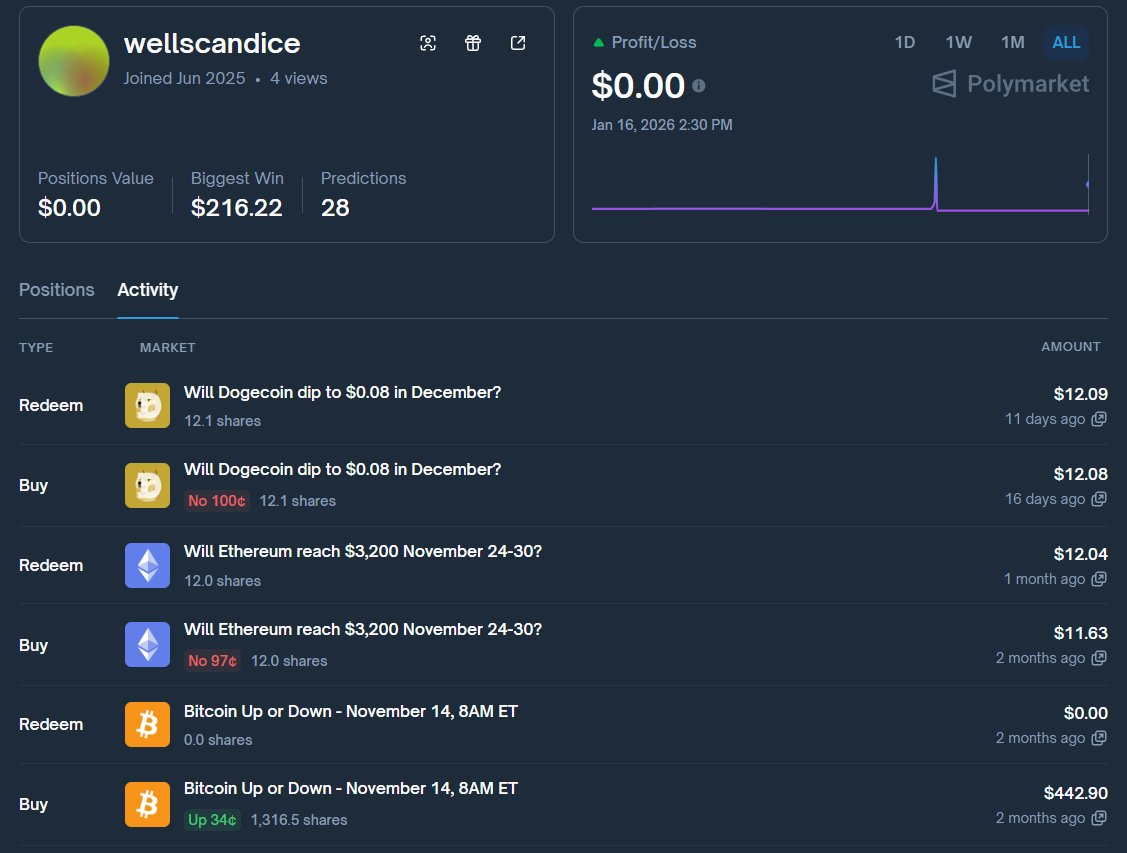

- Account 2: https://polymarket.com/@wellscandice;

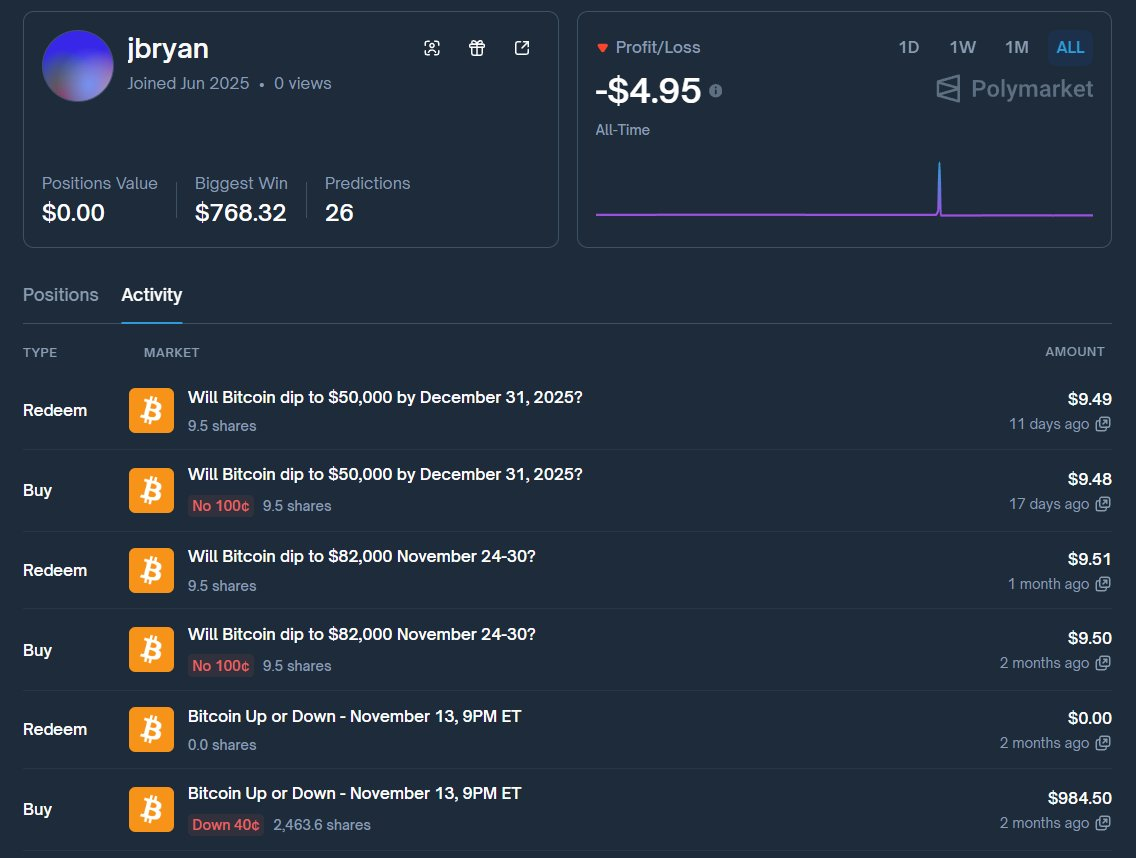

- Account 3: https://polymarket.com/@jbryan.

Although ascetic later responded in the comments, stating that the wallets and accounts mentioned by Moses were unrelated to him, and some members of the ZSC DAO (a Polymarket trader community) voiced support, calling Moses's actions a cyber attack, the connections between ascetic's bot-like comment replies, his Polymarket account, and several accounts with similar behavioral patterns significantly undermined the credibility of this "8300x return miracle."

Someone in the comments also mentioned it was hard to understand his motive, as "winning 7 consecutive all-in bets" itself is impressive. However, others pointed out this was likely a "game of casting a wide net with bots."

Somewhat ironically, Moses's own bio labels his journey as "from $1 to $1,000,000"—whether this is a real track record or a personal goal remains unknown.

Compared to the dubious case of ascetic, the following example of a trader who profited $230,000 by manipulating the price in the XRP "15-minute up/down prediction" market might be more worthy of study for whale players.

Trader Uses Binance Spot to Counter-Harvest Prediction Market: $1M Principal Nets $230K Profit

On January 18th, Polymarket trader PredictTrader exposed a trader's operation, likening it to a scene from *The Wolf of Wall Street*—by harvesting liquidity from trading bots, he made $233,000 in just a few hours, largely unnoticed by the broader market.

The timing chosen by this trader, a4385, was also extremely clever—it was a Saturday night when market liquidity was thin, and Binance's spot order book liquidity was relatively poor.

In the "XRP Up/Down – Jan 17, 12:45-1:00 PM ET" market, he heavily bought "Yes" shares.

His counterparties were the common "individual market makers" on Polymarket—various trading bots. (Odaily Note: Market making on Polymarket is relatively simple, with a low barrier to entry for individual developers, making trading bots very popular now.) By 10 minutes into the trading period, XRP had dropped about 0.3% from the opening price, but he had pushed the "Yes" share price to 70%. The trading bots saw a profit opportunity but unwittingly fell into the price trap set by the trader, selling him even more "Yes" shares.

Ultimately, the trader bought $77,000 worth of "Yes" shares at an average price of 48%.

Just two minutes before the market settled, a wallet on Binance bought approximately $1 million worth of XRP spot, pushing its price up about 0.5%. A few seconds after settlement, this $1 million in spot was quickly sold off.

In other words, the cost of this price manipulation was approximately—0.25% one-way trading slippage + fees.

Using a Binance VIP 4 account (0.06% fee) (easily attainable) and 0.25% two-way slippage, the total cost would be around $6,200, and the actual operational cost might be even lower. By repeating this operation multiple times and exploiting the weekend liquidity gap, the trader drained the funds of several bot wallets.

Some bots were shut down in time, while others reacted too slowly and lost all their funds—including @aleksandmoney, which lost its entire year's profit (approximately $160,000).

a4385 Polymarket account link: https://polymarket.com/profile/0x506bce138df20695c03cd5a59a937499fb00b0fe

In conclusion, we hope traders betting for or against in the prediction market can distinguish fact from appearance. Sometimes, the truth is not always objective, and the standards and rules determined by platforms are man-made.