Infrastructure Competition in High Volatility Cycles: New Divergence in Crypto Trading Platforms from BitMart's 2025 Annual Performance

- Core Viewpoint: In 2025, the cryptocurrency market entered a phase of high volatility and structural divergence. The competitive focus for trading platforms shifted from traffic acquisition to long-term infrastructure development, including system capacity, product completeness, and compliance capabilities. BitMart's business performance serves as a typical case study of this trend.

- Key Elements:

- Market Environment Changes: Fluctuating macro liquidity, faster institutional capital flows, and regulatory institutionalization have led to high market volatility and intensified divergence in asset performance.

- Technical System Upgrade: BitMart completed its third-generation upgrade for spot and futures systems. Spot trading latency was reduced to 2ms, order processing capacity reached 200,000 orders per second, and futures performance improved by over 10x.

- Asset Screening Mechanism: The logic for listing assets shifted towards "fast and screenable." Products like the Discovery Zone formed a "discovery-issuance-trading" pathway, with newly listed assets accounting for nearly 50% of the total.

- Futures Business Deepening: The competitive focus shifted towards risk control and trading experience. BitMart launched its Futures 2.0 version, introducing mechanisms like Slippage Protection and Guaranteed Take-Profit/Stop-Loss to mitigate the impact of extreme market conditions.

- Product Boundary Expansion: Expansion into payments (BitMart Card), asset management (Earn, RWA), and Web3 infrastructure (DEX, Aggregator). Assets under management for financial products grew by 468% year-over-year.

- Compliance and Security Development: Introduction of mature compliance tools, coverage of 49 U.S. states for its U.S. site, and a systematic overhaul of its security architecture to address complex risk environments.

The cryptocurrency market in 2025 did not continue the simple narrative of a one-sided bull run. Against a backdrop of fluctuating macro liquidity, faster-paced institutional capital flows, and the gradual institutionalization of global regulations, the market as a whole entered a phase characterized by high-level volatility coexisting with structural divergence. Following its record highs, Bitcoin experienced significant pullbacks, the performance gap between top-tier assets and mid-to-low-tier assets widened, and the competitive logic among trading platforms also shifted—gradually moving from "traffic and speed of new listings" towards "system capacity, product completeness, and compliance capabilities."

In this context, some platforms have begun to focus their efforts on underlying infrastructure and long-term capacity building. BitMart's 2025 business performance presents a rather typical sample of this trend.

System Capability Becomes the Core Variable in a High-Volatility Environment

As institutional participation increases, the market's demand for trading system stability and matching efficiency during extreme market conditions has risen significantly. In 2025, BitMart completed the third-generation upgrade of its spot and derivatives trading systems, introducing a sharding architecture and a self-developed high-performance storage engine, effectively reconstructing the core trading pipeline.

Public data indicates that its spot system's average latency has been reduced to 2ms, with order processing capacity increased to 200,000 orders per second. The performance of its derivatives system improved by over 10 times, with latency dropping to 7ms, demonstrating significantly enhanced stability during high-concurrency market conditions. Concurrently, the platform optimized deposit and withdrawal channels for multiple mainstream public chains, reducing average withdrawal times by approximately 50%, which to some extent alleviated capital turnover pressure during periods of high volatility.

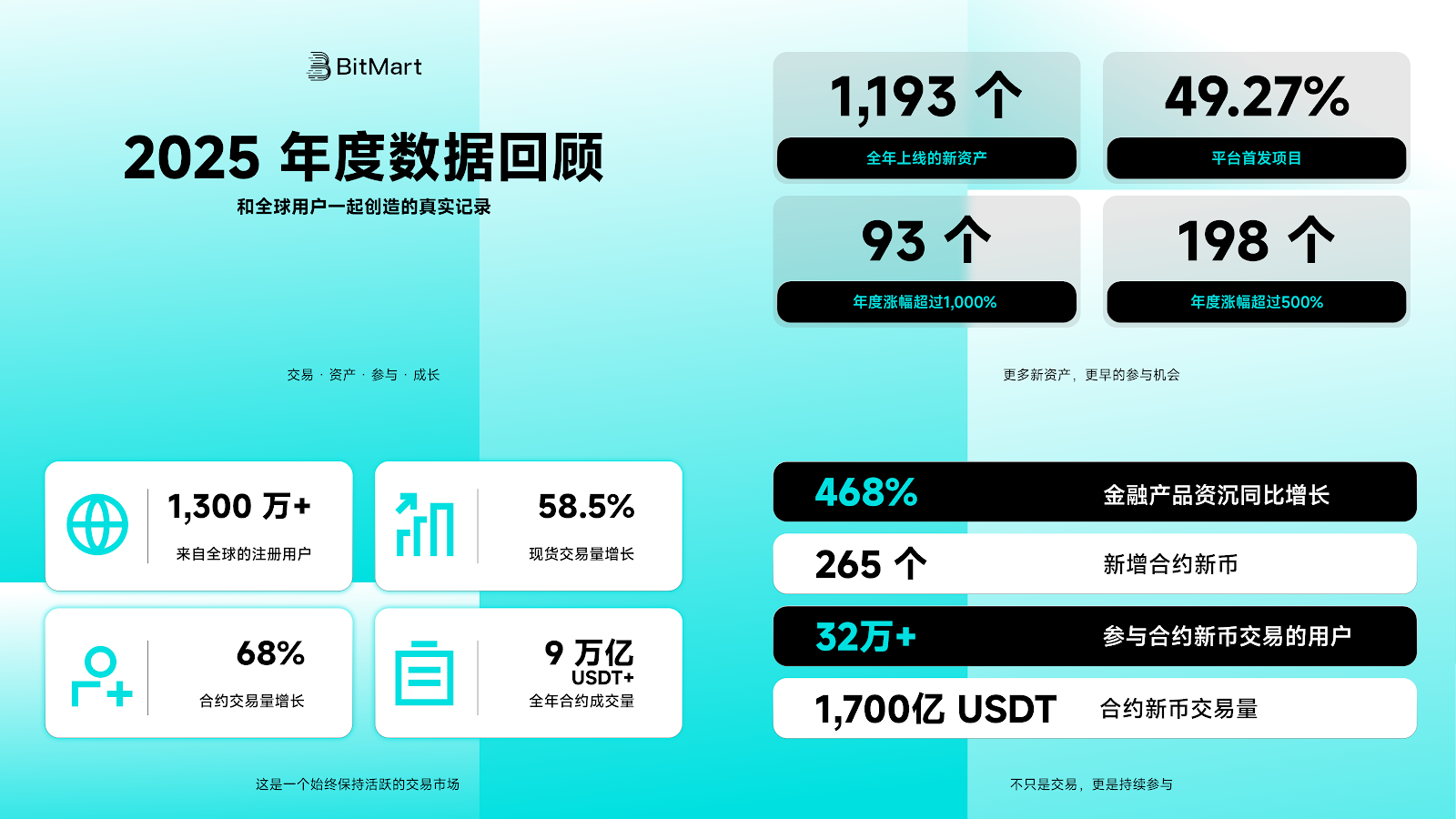

These technological upgrades were not merely about "performance metrics" but were directly reflected in business data. In 2025, BitMart's global registered user base surpassed 13 million, with spot trading volume increasing by 58.5% year-over-year and derivatives trading volume growing by approximately 68%. The annual derivatives trading volume exceeded 9 trillion USDT.

The Shift in Listing Logic: From "Fast" to "Fast and Filterable"

In a cycle of intensified market divergence, assets relying solely on narratives and sentiment are more susceptible to pressure, raising the bar for trading platforms' asset screening and distribution mechanisms.

In 2025, BitMart listed a total of 1,193 assets, with initial exchange listings accounting for nearly 50%. The results show that the performance of some newly listed assets significantly outperformed the market average, with the number of projects achieving annual gains exceeding 500% and 1,000% remaining in a high range. Behind this, the platform began organizing early-stage asset supply in a more structured manner.

Products including the BitMart Discovery Zone, LaunchPrime, and Pre-Market Trading have gradually formed a complete path of "Discovery — Launch — Trading." By year-end, the Discovery Zone had cumulatively listed nearly 400 tokens, with related trading volume exceeding 1.3 billion USDT. Such mechanisms have, to some extent, lowered the barrier for users to participate in early-stage assets and improved the efficiency of asset distribution.

(Image material sourced from BitMart official)

Competition in Derivatives is Evolving from Features to Mechanisms

In the derivatives sector, the competitive focus in 2025 shifted away from merely the number of trading pairs or leverage multiples, moving more towards risk control and the finer details of the trading experience.

BitMart launched its Derivatives 2.0 version within the year, restructuring the product architecture and user interaction flow. It also continued investing in liquidity building, bringing the depth of some major trading pairs close to or on par with top-tier platforms. More notably, some of its innovations in derivatives mechanisms, such as the Slippage Protection Plan, Guaranteed Take-Profit/Stop-Loss, and Market Order Slippage Limits, aim to reduce the impact of execution deviations on users during extreme market swings.

Furthermore, the launch of Copy Trading 2.0 introduced an AUM-based incentive mechanism similar to traditional asset management logic, encouraging more long-term and stable strategy performance. Data indicates a significant increase in related trading volume compared to the previous version.

Extending Product Boundaries: Trading Platforms Evolving into Comprehensive Service Providers

In 2025, the boundaries of trading platforms expanded further. BitMart's focus was notably concentrated on payments, asset management, and Web3 infrastructure.

On the fiat and payment side, the platform established a parallel deposit system comprising third-party gateways, card purchases, and P2P trading. It also launched the BitMart Card, covering over 160 countries and regions, designed to bridge on-chain assets with real-world consumption scenarios. P2P business transaction volume grew by over 300% year-over-year, with penetration significantly increasing in several emerging markets.

In asset management, product lines such as Earn (Savings), Crypto Loans, and RWA products expanded simultaneously, with the overall Assets Under Management (AUM) for financial products growing by 468% year-over-year. Concurrently, the platform built DEX and aggregator infrastructure from the ground up, integrating with ecosystems like Solana, paving the way for on-chain trading and future multi-chain expansion.

(Image material sourced from BitMart official)

Compliance and Security Gradually Becoming Long-Term Competitive Barriers

As regulatory frameworks become clearer, compliance capabilities are transitioning from a "bonus" to an "entry requirement." In 2025, BitMart integrated several mature compliance tools for KYC, AML, and Travel Rule compliance and established partnerships with multiple custody and clearing institutions.

At the regional level, its U.S. site now covers 49 states, establishing a localized operational system built around high-standard regulated markets. Simultaneously, the platform underwent a systematic overhaul of its security architecture, encompassing real-time risk control, blacklisted address databases, on-chain tracking, and a 7×24 security response mechanism to address a more complex risk environment.

A Phase-Specific Observation

Overall, BitMart in 2025 appears to be more focused on "laying the groundwork" for the next market phase. In a cycle of high volatility and gradually materializing regulations, the competitive focus for trading platforms is shifting from short-term traffic acquisition to a comprehensive contest of system capability, compliance standards, and product completeness.

As the market moves further towards institutionalization and rule-based operation in 2026, whether platforms oriented towards infrastructure and long-term capacity building can translate this into more stable growth in the new cycle remains to be validated by the market. However, it is certain that the differentiation among crypto trading platforms has entered a deeper, more substantive stage.