Institutional-Grade RWA Infrastructure 2026 Panorama: Five Major Protocols Reshaping a $20 Billion Market

- Core Viewpoint: Institutional-grade RWA tokenization is transitioning from concept to large-scale application.

- Key Elements:

- The market size has approached $20 billion, showing significant growth.

- Five major protocols (Rayls, Ondo, etc.) cater to different institutional needs.

- Yield arbitrage, regulatory refinement, and mature infrastructure are the three main drivers.

- Market Impact: Driving the migration of trillions of dollars in traditional assets on-chain.

- Timeliness Note: Medium-term impact

Original Author: Mesh

Original Compilation: TechFlow

To be honest, the development of institutional-grade RWA (Real World Asset) tokenization over the past six months deserves close attention. The market size is approaching $20 billion. This isn't hype; it's real institutional capital being deployed on-chain.

I've been following this space for a while, and the recent pace of development is astonishing. From treasury bonds and private credit to tokenized stocks, these assets are migrating to blockchain infrastructure faster than the market anticipated.

Currently, five protocols form the foundation of this space: Rayls Labs, Ondo Finance, Centrifuge, Canton Network, and Polymesh. They are not competing for the same clients but rather addressing different institutional needs: banks require privacy, asset managers pursue efficiency, and Wall Street firms demand compliant infrastructure.

This isn't about who "wins," but about which infrastructure institutions choose and how trillions in traditional assets migrate through these tools.

The Overlooked Market Nears the $20 Billion Mark

Three years ago, tokenized RWAs were barely a category. Today, on-chain deployed assets for treasury bonds, private credit, and public stocks are nearing $20 billion. This is a significant increase from the $6-8 billion range at the beginning of 2024.

Honestly, the performance of the sub-sectors is more interesting than the total size.

According to a market snapshot from early January 2026 provided by rwa.xyz:

- Treasury Bonds and Money Market Funds: Approximately $8-9 billion, accounting for 45%-50% of the market.

- Private Credit: $2-6 billion (small base but fastest growth, 20%-30% share).

- Public Stocks: Over $400 million (growing rapidly, primarily driven by Ondo Finance).

Three Key Drivers Accelerating RWA Adoption:

- Appeal of Yield Arbitrage: Tokenized treasury products offer 4%-6% returns with 24/7 access, compared to the T+2 settlement cycle in traditional markets. Private credit instruments offer 8%-12% returns. For institutional treasurers managing billions in idle capital, the math is compelling.

- Gradual Maturation of Regulatory Frameworks: The EU's Markets in Crypto-Assets (MiCA) regulation is now enforced across 27 countries. The US SEC's "Project Crypto" is advancing on-chain securities frameworks. Meanwhile, No-Action Letters are enabling infrastructure providers like DTCC to tokenize assets.

- Maturation of Custody and Oracle Infrastructure: Chronicle Labs handles over $20 billion in Total Value Secured, and Halborn has completed security audits for major RWA protocols. This infrastructure is now mature enough to meet fiduciary standards.

Nevertheless, the industry faces significant challenges. The cost of cross-chain transactions is estimated at $1.3 billion annually. Price spreads of 1%-3% exist for the same asset on different blockchains due to capital movement costs exceeding arbitrage profits. The conflict between privacy needs and regulatory transparency requirements remains unresolved.

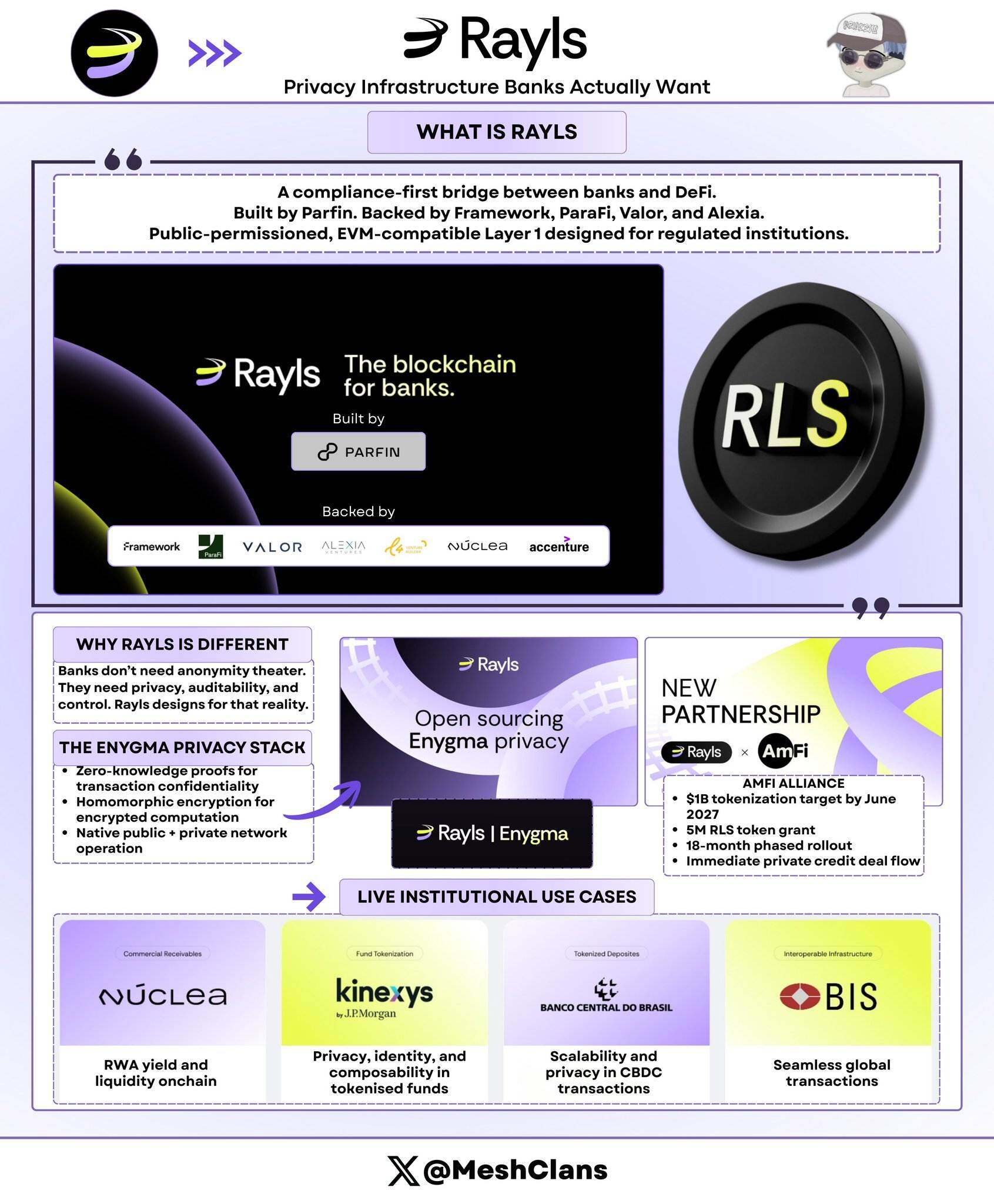

Rayls Labs: The Privacy Infrastructure Banks Actually Need

@RaylsLabs positions itself as a compliance-first bridge connecting banks to decentralized finance (DeFi). Developed by Brazilian fintech Parfin and backed by Framework Ventures, ParaFi Capital, Valor Capital, and Alexia Ventures, its architecture is a public-permissioned, EVM-compatible Layer 1 blockchain designed for regulated institutions.

I've been following the development of its Enygma privacy tech stack for a while. The key isn't the technical specs, but its methodology. Rayls is solving the problems banks actually have, not what the DeFi community imagines banks need.

Core Features of the Enygma Privacy Tech Stack:

- Zero-Knowledge Proofs: Ensures transaction confidentiality.

- Homomorphic Encryption: Enables computation on encrypted data.

- Native Operation Across Public Chains and Private Institutional Networks.

- Confidential Payments: Supports atomic swaps and embedded Delivery-versus-Payment (DvP).

- Programmable Compliance: Selective data disclosure to designated auditors.

Real-World Use Cases:

- Central Bank of Brazil: Used in a cross-border CBDC settlement pilot.

- Núclea: Regulated receivables tokenization.

- Multiple Undisclosed Node Clients: Used for privatized DvP workflows.

Latest Developments

On January 8, 2026, Rayls announced the completion of a security audit by Halborn. This provides institutional-grade security certification for its RWA infrastructure, a crucial step for banks evaluating production deployment.

Furthermore, the AmFi alliance aims to tokenize $1 billion in assets on Rayls by June 2027, supported by a 5 million RLS token incentive. AmFi is Brazil's largest private credit tokenization platform, bringing immediate transaction flow to Rayls with an 18-month concrete milestone. This is one of the largest institutional RWA commitments in any blockchain ecosystem today.

Target Market and Challenges

Rayls targets banks, central banks, and asset managers requiring institutional-grade privacy. Its public-permissioned model restricts validator participation to licensed financial institutions while ensuring transaction data confidentiality.

However, Rayls's challenge lies in proving market traction. Without public TVL data or announced client deployments beyond pilots, the $1 billion AmFi target by mid-2027 becomes its key test.

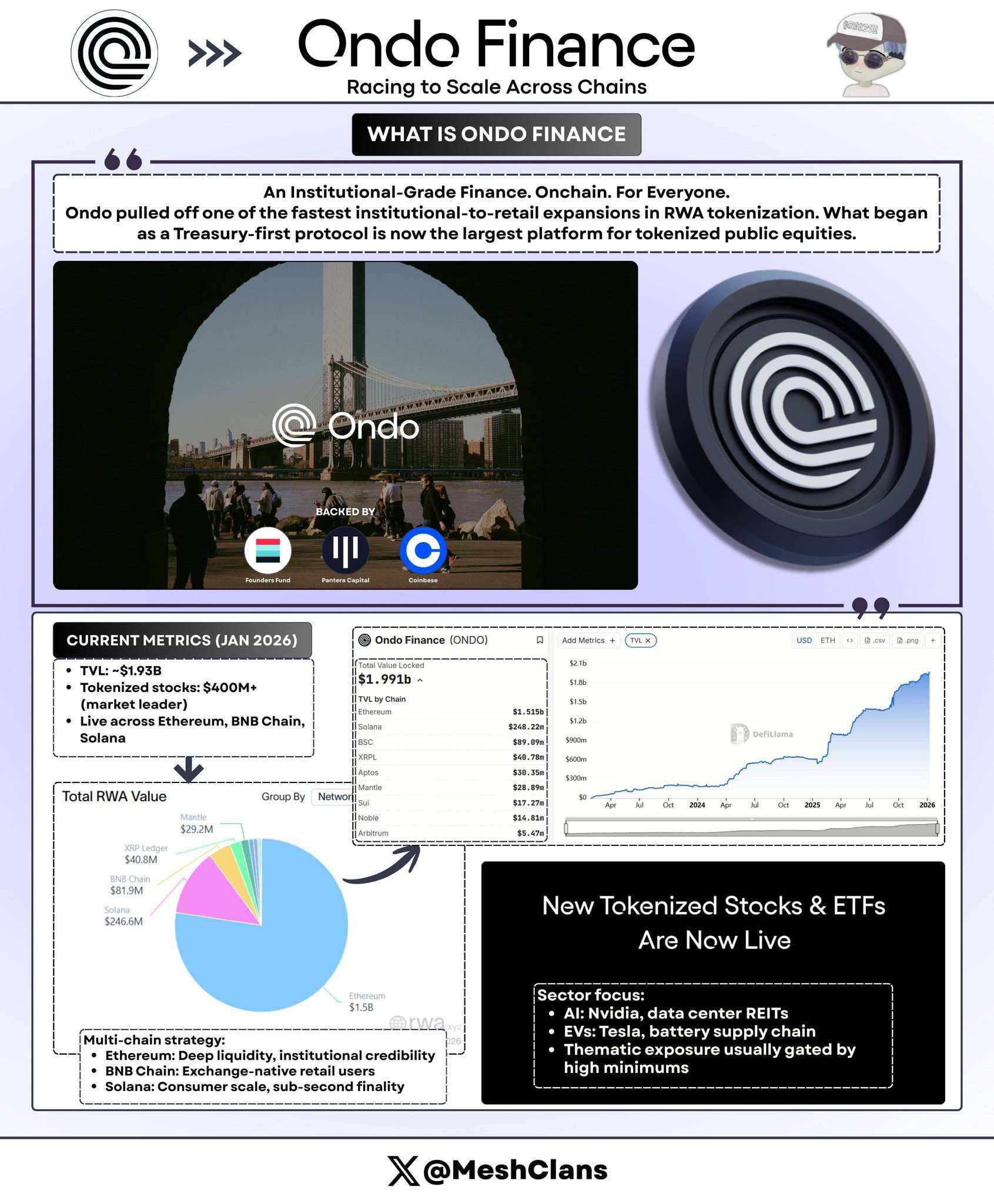

Ondo Finance: The Blitz-Scale Race for Cross-Chain Expansion

@OndoFinance has achieved the fastest expansion from institutional to retail in RWA tokenization. Starting as a treasury-focused protocol, it's now the largest platform for tokenized public stocks.

Latest Data as of January 2026:

- Total Value Locked (TVL): $1.93 billion.

- Tokenized Stocks: Over $400 million, commanding a 53% market share.

- USDY Holdings on Solana: Approximately $176 million.

I've personally tested the USDY product on Solana; the user experience is seamless. Combining institutional-grade treasuries with DeFi convenience is the key.

Latest Moves

On January 8, 2026, Ondo launched 98 new tokenized assets in one go, covering stocks and ETFs in AI, EV, and thematic investment sectors. This isn't a small test; it's a blitz.

Ondo plans to launch tokenized US stocks and ETFs on Solana in Q1 2026, its most aggressive push into retail-friendly infrastructure. According to the product roadmap, the goal is to list over 1,000 tokenized assets as expansion progresses.

Sector Focus:

- AI Sector: Nvidia, Data Center REITs.

- EV Sector: Tesla, Lithium Battery Manufacturers.

- Thematic Investing: Niche sectors traditionally limited by high minimum investments.

Multi-Chain Deployment Strategy

- Ethereum: For DeFi liquidity and institutional legitimacy.

- BNB Chain: To capture exchange-native users.

- Solana: For mass consumer use with sub-second finality.

Honestly, Ondo's $1.93 billion TVL while its token price declined is the real signal: protocol growth over speculation. This growth is driven by institutional treasuries and DeFi protocols seeking yield on idle stablecoins. TVL growth during the Q4 2025 market consolidation indicates real demand, not just chasing hype.

By establishing custodian-broker-dealer relationships, completing Halborn audits, and launching on three major blockchains within six months, Ondo has built a lead that's hard to catch. For comparison, its competitor Backed Finance has only about $162 million in tokenized assets.

However, Ondo still faces challenges:

- Price Volatility During Non-Trading Hours: While tokens are transferable 24/7, pricing still references exchange hours, creating arbitrage spreads during US overnight trading.

- Compliance Constraints: Securities laws require strict KYC and accreditation checks, limiting the "permissionless" narrative.

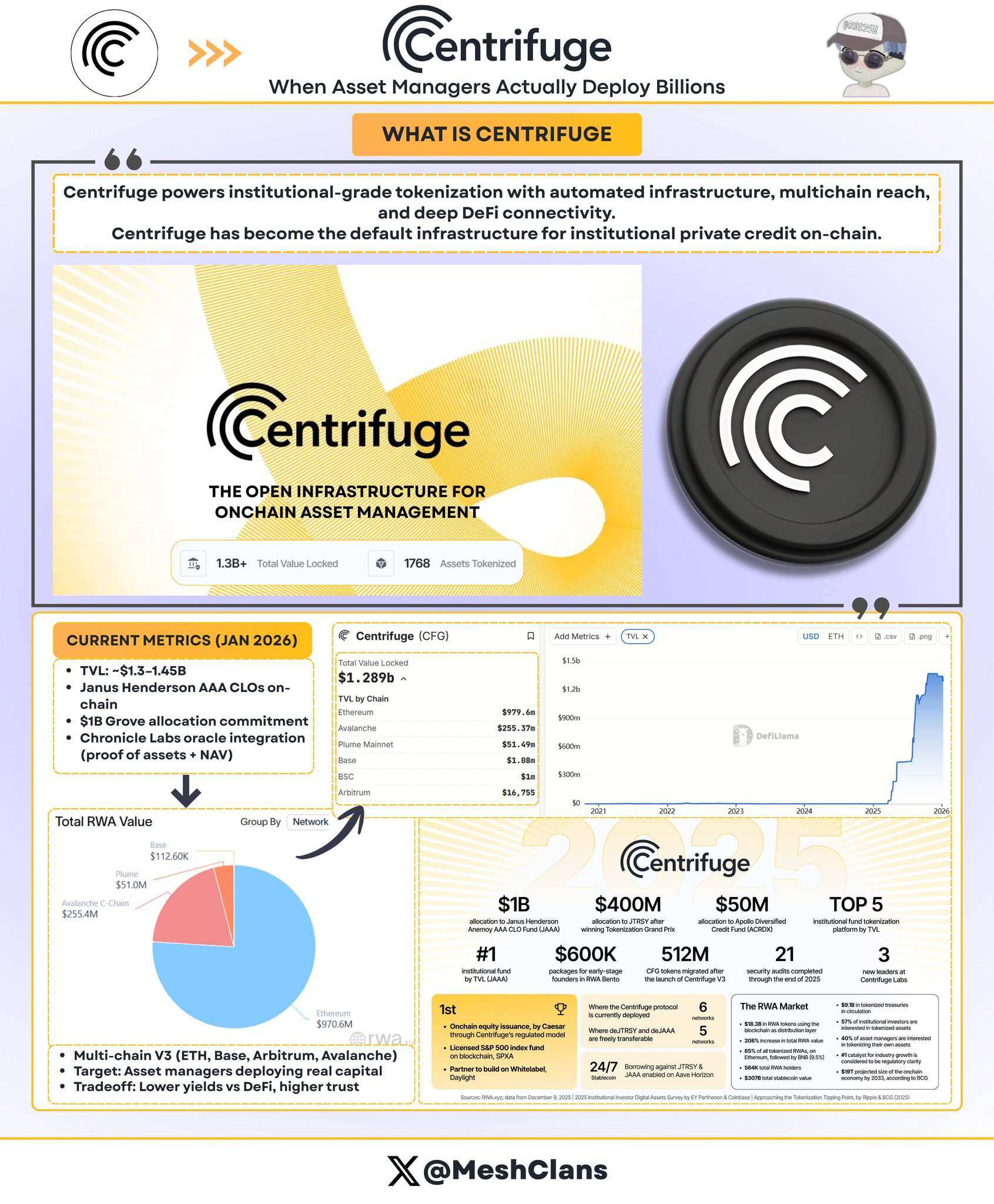

Centrifuge: How Asset Managers Actually Deploy Billions

@centrifuge has become the infrastructure standard for institutional-grade private credit tokenization. As of December 2025, the protocol's TVL has surged to $1.3 - $1.45 billion, driven by actual deployed institutional capital.

Major Institutional Deployment Cases

1. Janus Henderson Partnership (Global asset manager with $373 billion AUM)

- Anemoy AAA CLO Fund: A fully on-chain AAA-rated Collateralized Loan Obligation (CLO).

- Uses the same portfolio management team as its $21.4 billion AAA CLO ETF.

- Announced expansion plans in July 2025, targeting an additional $250 million on Avalanche.

2. Grove Capital Allocation (Institutional credit protocol from the Sky ecosystem)

- $1 billion committed allocation strategy.

- $50 million initial launch capital.

- Founding team from Deloitte, Citigroup, BlockTower Capital, and Hildene Capital Management.

3. Chronicle Labs Oracle Partnership (Announced January 8, 2026)

- Proof of Asset framework: Provides cryptographically verified holding data.

- Enables transparent NAV calculations, custody verification, and compliance reporting.

- Provides dashboard access for LPs and auditors.

I've been tracking the oracle problem in blockchain, and Chronicle Labs' approach is the first that meets institutional needs: providing verifiable data without sacrificing on-chain efficiency. The January 8th announcement included a video demo showing this solution is live, not a future promise.

Centrifuge's Unique Operating Model:

Unlike competitors that simply wrap off-chain products, Centrifuge tokenizes credit strategies at the origination stage. The process:

- Issuers design and manage funds through a single transparent workflow.

- Institutional investors allocate stablecoins for investment.

- Funds flow to borrowers after credit approval.

- Repayments are distributed proportionally to token holders via smart contracts.

- AAA-rated assets offer APYs between 3.3%-4.6%, with full transparency.

Multi-Chain V3 Architecture Supports: Ethereum; Base; Arbitrum; Celo; Avalanche.

The key is that asset managers need proof that on-chain credit can support multi-billion dollar deployments, and Centrifuge has delivered. The Janus Henderson partnership alone provides multi-billion dollar capacity.

Furthermore, Centrifuge's leadership in industry standards (co-founding the Tokenized Asset Coalition and Real-World Asset Summit) solidifies its position as infrastructure, not just a product.

While the $1.45 billion TVL proves institutional investment demand, the targeted 3.8% APY pales compared to historically higher-risk, higher-reward DeFi opportunities. Attracting DeFi-native liquidity providers beyond the Sky ecosystem allocation is Centrifuge's next hurdle.

Canton Network: Wall Street's Blockchain Infrastructure

@CantonNetwork is the institutional blockchain's answer to DeFi's permissionless ethos: a privacy-preserving public network backed by Wall Street's top firms.

Participating Institutions

- DTCC (Depository Trust & Clearing Corporation)

- BlackRock

- Goldman Sachs

- Citadel Securities