Can Retail Investors Also Invest in Star Robot Companies? Virtuals Titan's First Project XMAQUINA New Token Offering Guide

- Core Viewpoint: XMAQUINA enables retail investors to invest in equity of star robot companies through a tokenized DAO.

- Key Elements:

- Holding $DEUS provides indirect investment exposure to equity in companies like Figure AI.

- As the first project under the Virtuals Titan model, its FDV reaches $60 million.

- 33% of tokens unlock immediately, with 67% released linearly over 12 months.

- Market Impact: Introduces a new asset class to the Web3+AI sector, potentially triggering FOMO.

- Timeliness Note: Short-term impact

Original Author: San, TechFlow

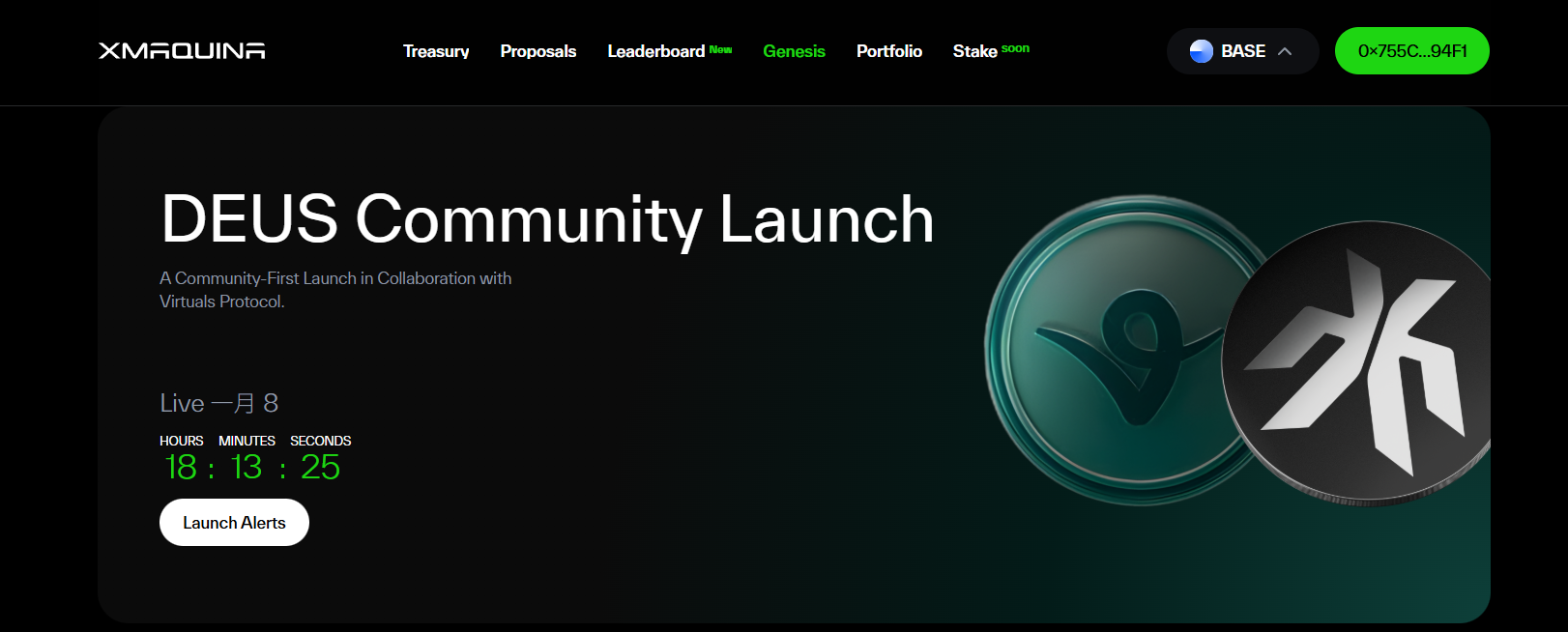

At 20:00 on January 8th, XMAQUINA, the first Titan mode launch project of Virtuals Protocol, will commence the public sale of its token $DEUS.

For those unfamiliar with the Titan mode, please refer to our other detailed introductory article: "Introducing Virtuals' New Launch Mechanisms: Pegasus, Unicorn, and Titan".

XMAQUINA focuses on the embodied AI concept, but unlike previous AI Agents, XMAQUINA offers primary market investment rights in leading humanoid robotics companies.

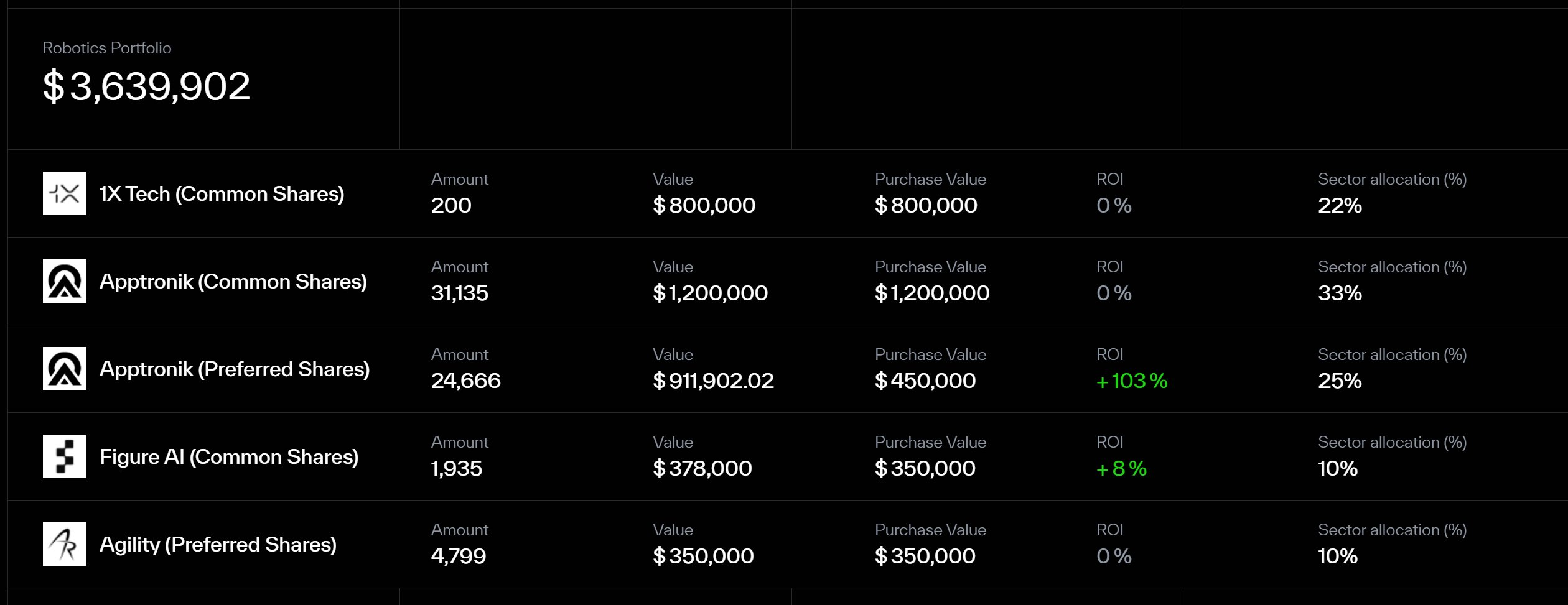

Currently, the project's DAO treasury holds equity in star embodied AI companies such as Figure AI, 1X, and Apptronik.

Holding XMAQUINA's native token $DEUS is equivalent to indirectly holding early-stage equity in these companies. This is the first time retail investors have had the opportunity to participate in the primary market of the embodied AI sector in this manner.

The community has also shown considerable anticipation for XMAQUINA.

Virtuals' New Mode

The market's attention on XMAQUINA largely stems from its status as the first launch project under Virtuals' new Titan mode.

To deeply understand XMAQUINA, one must first know about Virtuals' recently updated launch mechanisms.

On January 5th, Virtuals officially announced three new launch tiers:

Pegasus for small projects, Unicorn for medium-sized projects, and Titan specifically for large, mature projects, utilizing a fixed-price auction model.

The entry criteria for Titan mode are clear: a minimum FDV standard of $50 million, a $Virtual liquidity pool exceeding $1 million, a fixed 1% transaction tax, and project team-defined tokenomics.

These standards filter out a large number of projects lacking products or backing.

The XMAQUINA project's $60 million FDV just meets this threshold, $VIRTUAL contributions will be directly seeded into the liquidity pool, fulfilling all Titan's hard requirements.

From the mechanism design, it's evident Virtuals intends the Titan mode to onboard mature projects with actual business operations, rather than letting the AI Agent narrative continue to oscillate between memes and vaporware.

Project Information

XMAQUINA was founded in 2024, positioning itself as a decentralized DAO specifically investing in equity of humanoid robotics companies.

In one sentence, its narrative is: breaking the VC monopoly, allowing retail investors to gain primary market participation rights in leading embodied AI project companies by holding $DEUS.

According to official website information, the DAO's holdings in Apptronik have already appreciated over 100%, and its investments in several other embodied AI companies have also yielded good returns.

Such performance has further stimulated market FOMO for this project. After the launch announcement, the price of $Virtual rose over 20% in a single day and over 50% in three days.

The total supply of $DEUS tokens for this launch sale is 1 billion, with a launch price of $0.06 per token, corresponding to its $60 million FDV.

It is worth noting that $DEUS tokens acquired in this launch will have 33% unlocked immediately after TGE, with the remaining 67% vested linearly over 12 months.

Launch Information

XMAQUINA Launch Official Website

$DEUS Contract Address:

0x940A319B75861014A220D9c6c144d108552B089B

The XMAQUINA token $DEUS launch will commence on Virtuals Protocol at 20:00 Beijing Time on January 8th. A specific end time has not been announced yet.

This launch is open to all non-US wallets. Investors wishing to participate need to prepare USDC or $Virtual in advance, plus a small amount of ETH for gas. Note that gas fees may spike temporarily during the launch due to high participation.

This launch also features additional reward tiers.

Note: The above rewards are calculated based on the amount of USDC contributed. Users participating with $Virtual do not qualify for these additional rewards.

Furthermore, rewards do not stack; each wallet can only qualify for at most one tier, with no additional bonuses for exceeding amounts. All rewards, like the base tokens, are 33% unlocked immediately, with the remaining 67% vested linearly over 12 months.

Additionally, the immediately unlocked tokens from this launch cannot be transferred before the project's TGE, but they can be used to vote on which embodied AI company the project invests in. This model aims to focus community attention on long-term gains.

The participation process is very simple: connect your wallet on the official website, choose your participation method (USDC or $Virtual), input the amount, confirm the transaction, and you will receive the corresponding amount of $DEUS.

Community Evaluation and Discussion

Currently, the community is largely optimistic about the potential returns from the XMAQUINA launch. However, most of this optimism does not stem from the project's narrative or tokenomics, but rather from its status as the first launch project under Virtuals' new ecosystem mode.

Crypto blogger CJ_Blockchain also expressed his reservations about the project in a tweet, but explicitly stated at the end that he would still participate in this launch.

Source: Blogger @CJ_Blockchain, CFA's Tweet

On the other hand, many investors believe XMAQUINA's narrative provides a scarce opportunity for a large number of retail investors to participate in the primary market of excellent companies in the embodied AI industry, possessing scarcity in the current Web3+AI sector that could trigger market FOMO.

Source: Blogger @flywei's Tweet

For a crypto market that has been quiet for a long time, the debut of Virtuals' Titan mode indeed carries a lot of sentiment and expectation.

Moreover, as embodied AI companies like Unitree and Boston Dynamics appear more frequently in the public eye, public interest in investing in such companies has also ignited.

Compared to common AI software projects, embodied AI projects are more practical and typically have larger valuations and scales. It's clear that Virtuals' choice of XMAQUINA as the opening project for the Titan mode aims to cultivate a "big one" in the AI+Web3 field.

However, current crypto market liquidity remains poor, and investors should also be aware of related risks.

Whether XMAQUINA can achieve a successful opening, let's find out together tonight.