Quick Look at Virtuals' New Launch Mechanisms: Pegasus, Unicorn, and Titan

- Core Viewpoint: Virtuals Protocol introduces three proxy launch models.

- Key Elements:

- Pegasus Model: Lightweight, focusing on distribution and community validation.

- Unicorn Model: Introduces ACP, linking capital to market performance.

- Titan Model: Provides structured large-scale launches for high-maturity teams.

- Market Impact: Offers customized launch solutions for projects at different stages.

- Timeliness Note: Medium-term impact

Original Author: Virtuals Protocol

Original Compilation: TechFlow

A Single Launch Model Is No Longer Sufficient

Virtuals Protocol was born to support builders, not to confine them to a single path. As the agent market evolves, so does our launch mechanism.

In 2024, our focus was on validating the feasibility of the agent market itself. Early launch prototypes prioritized speed and experimentation, aiming to verify whether agents could exist on-chain, be publicly traded, and begin coordinating real economic value. The goal of this phase was not optimization, but exploration.

By 2025, the focus shifted to "fair access." We introduced the Genesis model to ensure large-scale fairness, allowing everyone to participate through contribution rather than capital. This model successfully democratized launches and established transparency. However, over time, its limitations became apparent: fairness alone does not build conviction, and the lack of a built-in funding path makes it difficult for quality builders to sustain long-term development.

The Unicorn model emerged as a correction to the above issues. It recentered the system's focus on "conviction," rewarding early trust and providing asymmetric returns by linking capital to performance. For builders seeking funding and public accountability, the Unicorn model indeed achieved its intended effect. However, as the ecosystem matured, it became clear that different builders face different challenges.

Startup teams need distribution channels, growth-stage teams need capital formation, and teams with established credibility and large-scale launches need a clear market entry path.

A single launch model cannot meet all needs

Figure: Pegasus (left), Titan (middle), Unicorn (right)

We proudly introduce Pegasus, Unicorn, and Titan. These three mechanisms together form a unified agent launch framework, supporting early experimentation, conviction-based growth, and large-scale launches, while maintaining shared liquidity, unified ownership, and a coherent ecosystem.

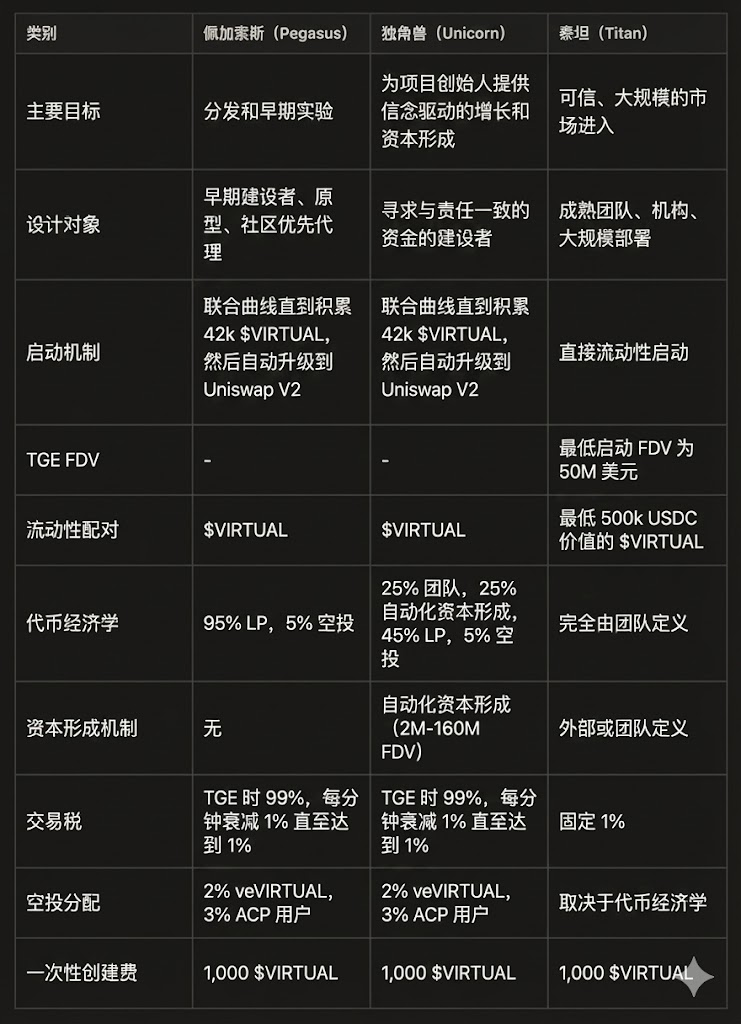

Launch Mechanism Comparison

Image translation: Gemini

How to Choose the Right Launch Mechanism?

Pegasus: Distribution-First, No-Preference Allocation

Pegasus is designed for early-stage builders who want to launch quickly, test ideas, and gain credibility through actual usage rather than preferential token allocation. It prioritizes distribution and community formation while keeping the launch structure lightweight.

Pegasus does not include protocol-reserved team allocations or automated funding mechanisms. Almost the entire token supply is allocated to liquidity, with only a small portion reserved for ecosystem airdrops. Founders wishing to hold tokens must purchase them under the same market conditions as everyone else, ensuring token holding is earned through performance, not pre-allocation.

Transparent price discovery is achieved through a bonding curve, which automatically transitions to Uniswap once a threshold is reached. Pegasus efficiently answers a core question: Does the market actually need this agent?

Unicorn: Conviction, Capital, and Accountability

Unicorn is designed for builders seeking to raise significant capital without sacrificing alignment. It introduces structures that reward conviction and reinforce accountability while maintaining open participation.

All Unicorn launches begin small and open, with no presales, whitelists, or restrictive allocations. Anti-sniper mechanisms prevent bots from dominating early trading, converting initial volatility into protocol-native buybacks that enhance liquidity.

The core feature of Unicorn is Automated Capital Formation (ACP). A portion of the team's tokens is automatically and transparently sold only after the project achieves genuine market traction, with proceeds ranging from $2 million to $160 million in Fully Diluted Valuation (FDV). Founders do not receive funding until the project proves its market value; they earn it through market validation.

Unicorn restores real meaning to ownership by tying rewards, funding, and credibility directly to performance, not promises.

Titan: Large-Scale Structured Launches Tailored for Credible Teams

Titan is designed for teams with a clear foundation in credibility, scale, and capital needs. Titan launches are for projects that have reached a high baseline of readiness.

This typically includes teams with existing products, a proven track record, institutional backing, or a clear real-world deployment path. Because these teams do not require early market validation, Titan does not rely on bonding curves, phased discovery, or protocol-enforced distribution mechanisms.

Titan launches require a minimum valuation of $50 million and must pair at least 500,000 USDC with $VIRTUAL for liquidity at the Token Generation Event (TGE). This requirement ensures market depth, reduces volatility from insufficient liquidity, and aligns Titan launches with builders prepared for large-scale operations.

The transaction tax for Titan launches is fixed at 1%. Tokenomics, vesting schedules, and distribution structures are fully defined by the founding team but must comply with standard protocol and compliance constraints.

Teams choosing Titan commit capital upfront and accept higher expectations for transparency, liquidity, and long-term engagement with the Virtuals ecosystem. In return, they gain a clear market entry or migration path, deep initial liquidity, and instant legitimacy without artificial constraints.

Titan exists to support agent projects already prepared to operate at an institutional or ecosystem scale.

Titan Migration

Titan also supports the migration of existing agent tokens into the Virtuals ecosystem. This path is for projects with active tokens, existing holders, or existing liquidity that seek deeper integration with the Virtuals stack, including $VIRTUAL liquidity, ACP compatibility, and long-term ecosystem alignment.

Titan migration follows the same baseline requirements as a Titan launch, including a minimum implied valuation of $50 million and at least 500,000 USDC paired with $VIRTUAL for liquidity. These requirements ensure market depth at migration, minimize disruption for existing holders, and maintain consistency for large-scale integration.

The Path Forward

The agent market is still developing. As it evolves, so does Virtuals Protocol.

Each launch mechanism in Virtuals is built on experience gained from builder practices and real market behavior. Early prototypes taught us how agents are born; the Genesis model showed how fairness scales; the Unicorn model proved how conviction and capital formation can align. Pegasus, Unicorn, and Titan synthesize these lessons into a flexible yet unbroken system.

This framework is not static but designed to adapt as agents mature, builder needs change, and the agent economy expands into new domains. Our goal is not to lock builders into a single model, but to ensure the right model is available at the right time, without sacrificing liquidity, ownership, or ecosystem coherence.

Through listening, deliberate iteration, and public launches, Virtuals Protocol continues to set the standard for how agents launch, grow, and integrate.

There has never been only one path for agent launches.

The only right way is to adapt to the market's current needs and maintain the discipline to evolve as the market changes.

– aGDP