Despite its stock price plummeting by half, Strategy has secured long-term capital investment; a look inside its "mysterious shareholder group."

- 核心观点:MicroStrategy股价大跌但机构持仓结构稳定。

- 关键要素:

- 上市公司及散户持仓占比近50%。

- 获德银等大型机构及多国央行持有。

- Q3机构增持量是减持量的2倍。

- 市场影响:反映主流资金对比特币概念的复杂态度。

- 时效性标注:中期影响。

Original article by Odaily Planet Daily ( @OdailyChina )

Author|Wenser ( @wenser2010 )

Amid market volatility, the stock price of Strategy, a "leading BTC treasury company," continued to decline. Despite the company's recent announcement of a $1.44 billion dividend reserve to support dividends and interest payments, it failed to restore market confidence—coupled with previous news of a potential removal from the MSCI index, its stock price once plummeted by nearly 10%.

However, judging from its shareholder structure, Strategy still attracts some long-term capital, including institutions like Deutsche Bank with $1.6 trillion in assets under management. Odaily Planet Daily will analyze Strategy's representative shareholder holdings in this article for market participants' reference. Also recommended reading: $1.44 billion in dividend reserves secured, yet stock price plunges 10%—what are Strategy's real problems?

Strategy (MSTR) Shareholder Structure Revealed: Listed Company and Retail Investors Account for Nearly 50%

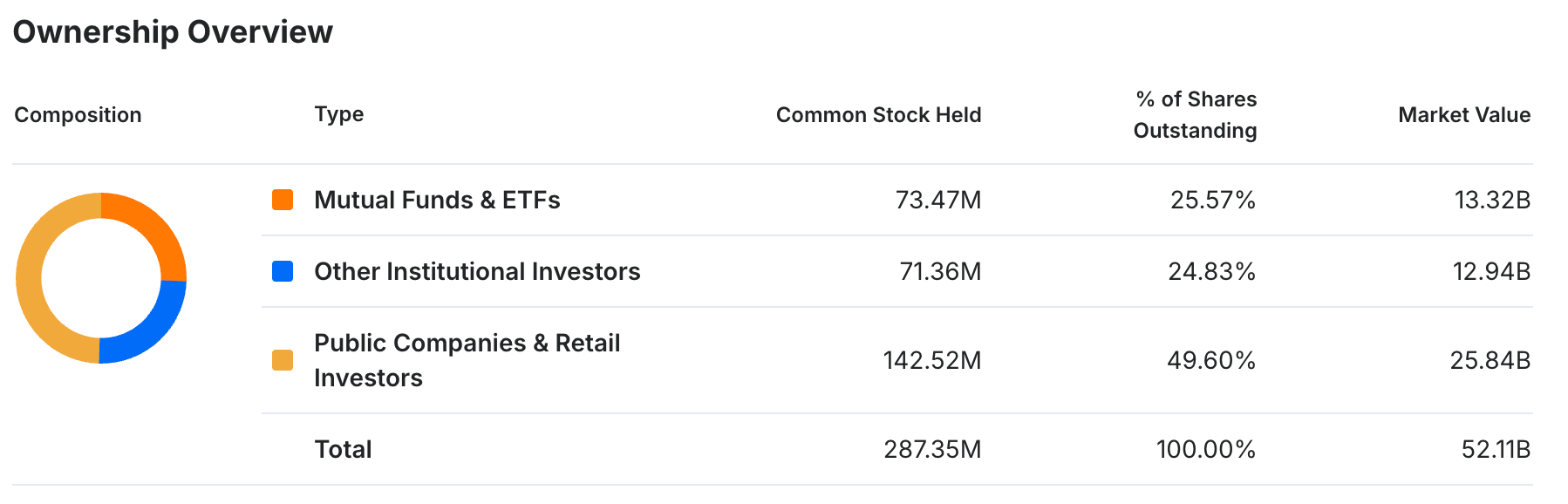

According to Investing.com , as of the end of Q3 of this year, Strategy's common stock holdings primarily consist of mutual funds and ETFs, institutional investors, listed companies, and retail investors.

- Mutual funds and ETFs accounted for 25.57% of the holdings;

- Institutional investors accounted for 24.83% of the holdings;

- The shareholding ratio of listed companies and retail investors is 49.6%.

- Currently, Strategy (MSTR) has approximately 287 million shares outstanding, with a total market capitalization of approximately $52.1 billion.

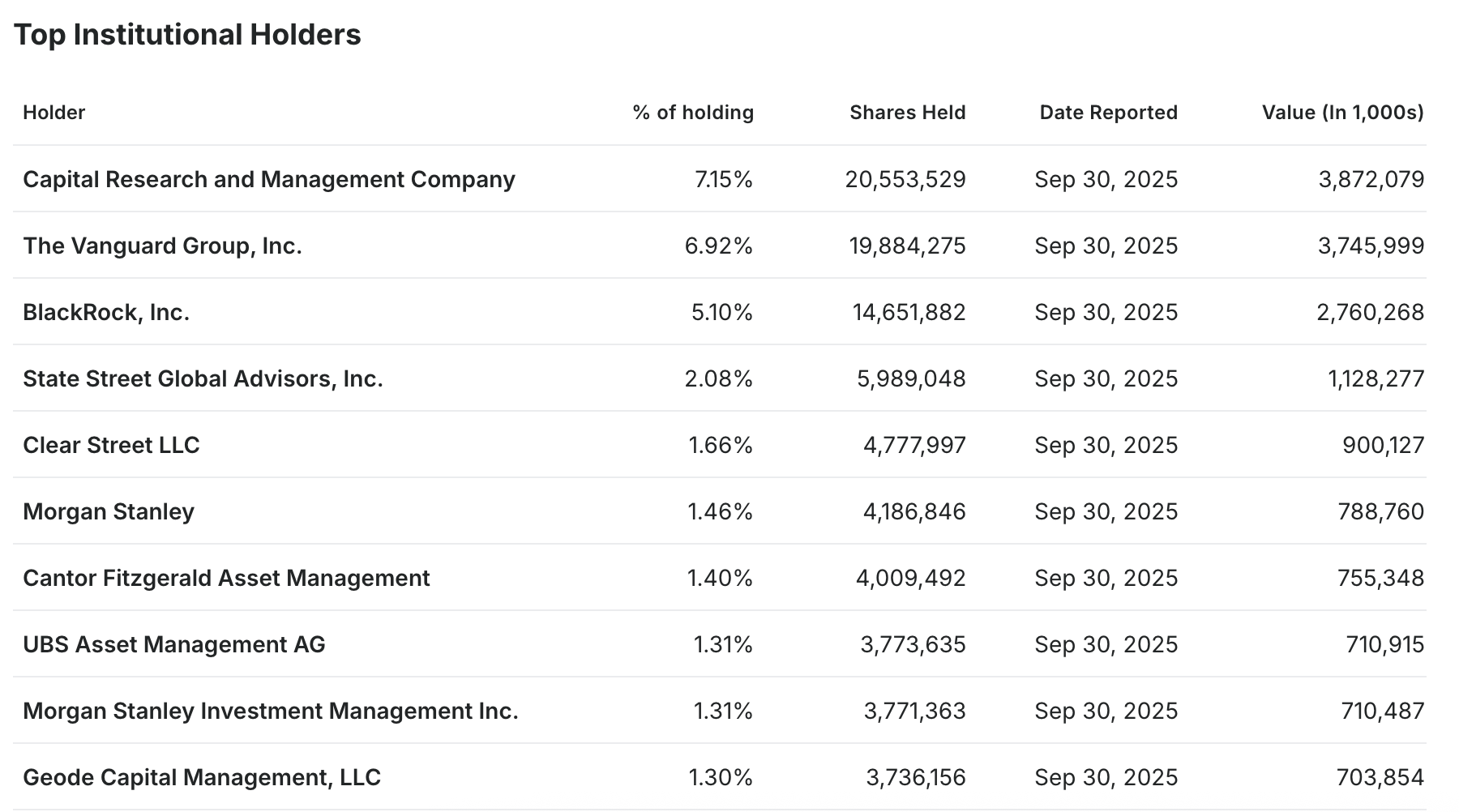

Among institutional investors, Strategy's shareholders include globally renowned companies such as Vanguard Group, BlackRock, Morgan Stanley, and UBS Asset Management.

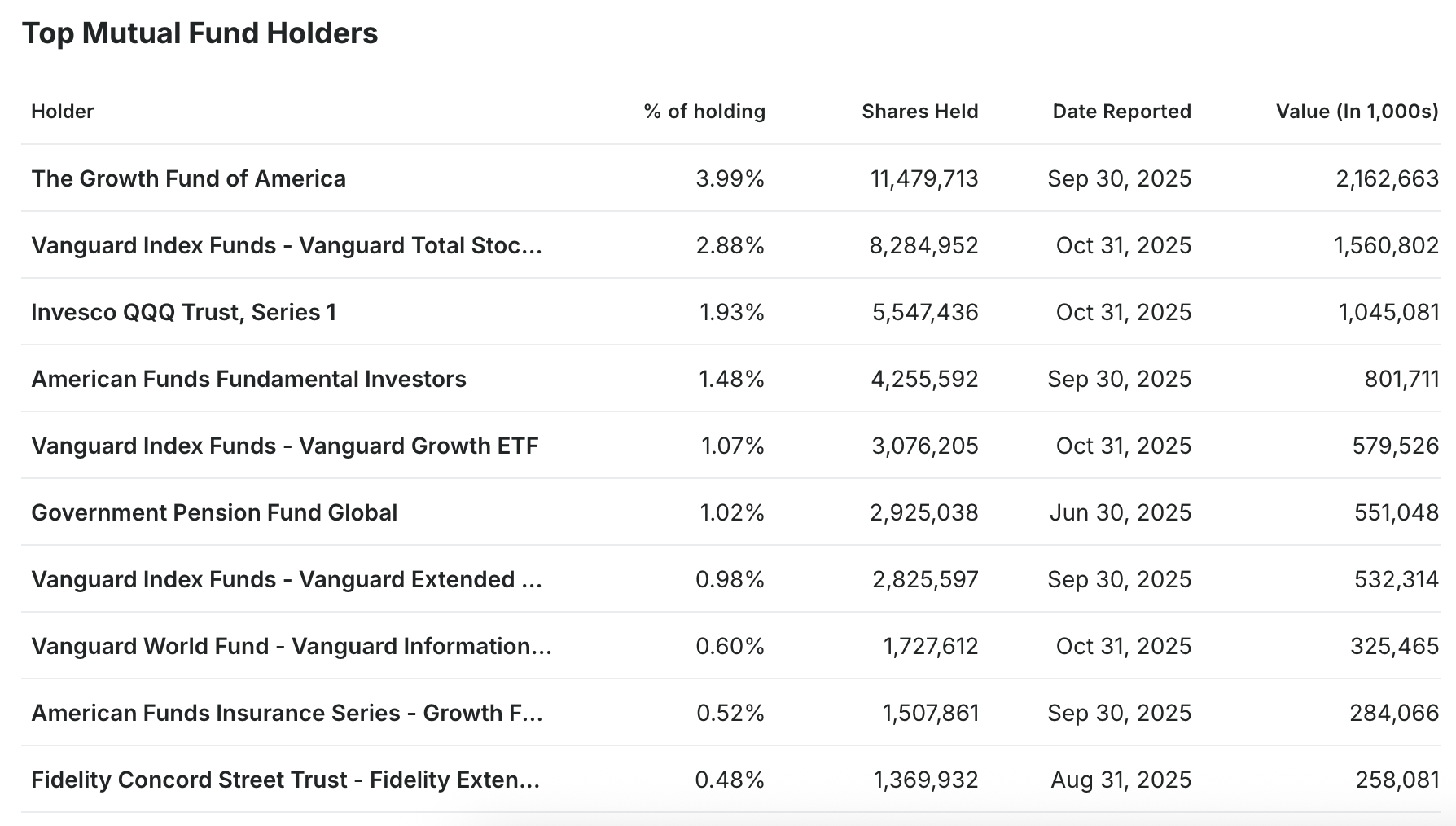

Among mutual funds, Strategy's shareholder list remains extremely impressive, with the top-ranked shareholders being well-known funds in the industry.

Next, aside from the usual asset management institutions, we will focus on introducing some of the more representative shareholders separately, so that everyone can better understand the many "mysterious shareholders" behind Strategy, which is known as the "first BTC concept stock" and the "leader of the DAT trend".

National Banks and Major Banks: The "Hidden Rich" in Strategy's Stock Holdings

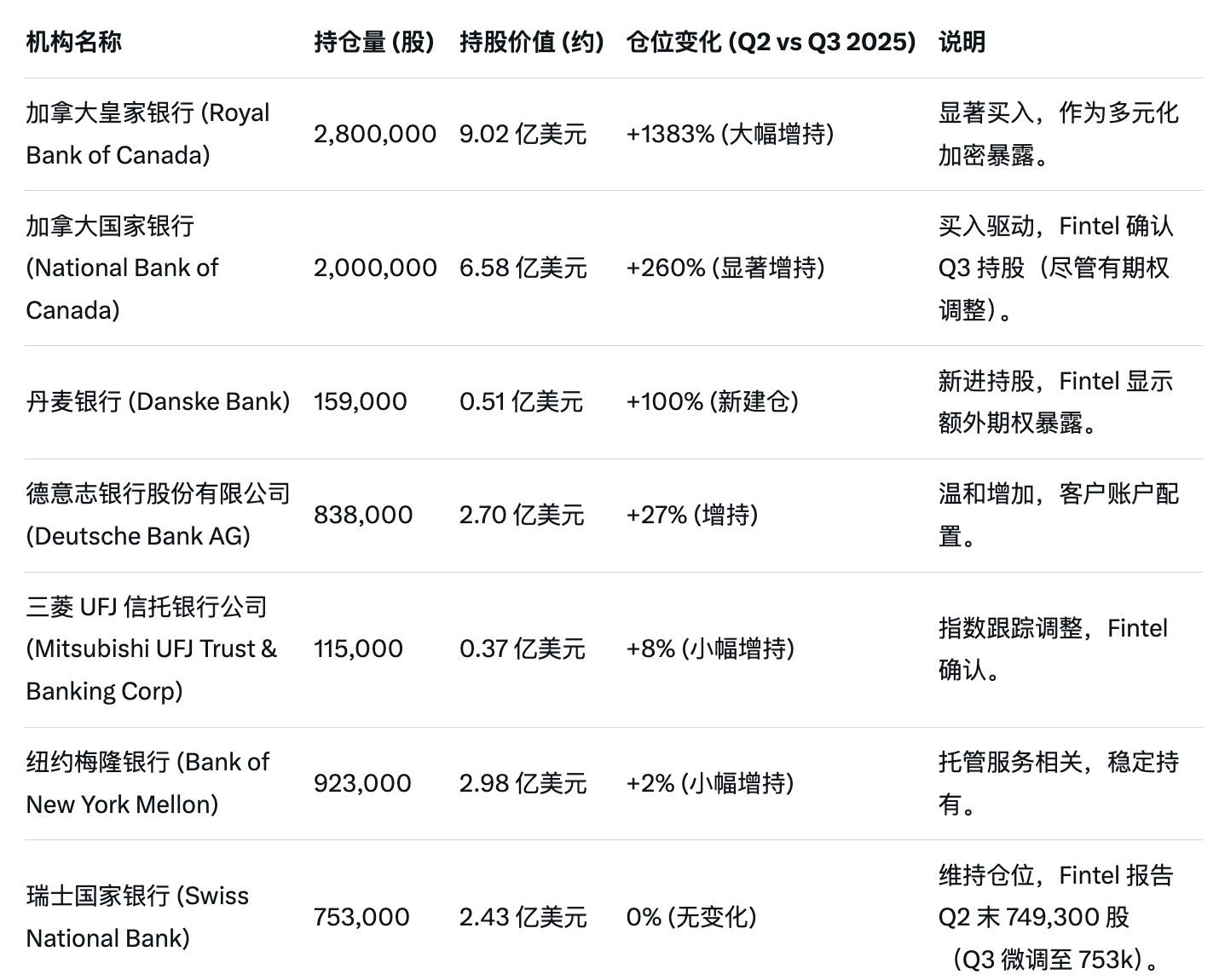

Among Strategy's shareholders, the most unique group is undoubtedly the central banks and large banks of major sovereign nations. Although the main reasons for these central banks holding Strategy shares are often to implement diversified investment strategies or to increase their indirect exposure to BTC assets, their asset holdings are an undeniable fact and the most direct way of "voting with their feet."

According to Stockzoa , as of the end of Q3, the following are the information on central banks and major banks holding Strategy shares:

Besides the banks mentioned above, some central banks, after briefly holding Strategy shares, soon liquidated their holdings due to market volatility or their own asset allocation requirements. For example, the Central Bank of Norway held approximately $500 million worth of MSTR shares at the beginning of the year, and subsequently increased its holdings, at one point holding approximately 2.98 million MSTR shares. It finally liquidated all its holdings in Q2 of this year, worth approximately $1.2 billion, with a paper loss of approximately $200 million. The Central Bank of Saudi Arabia (Saudi Arabian Monetary Authority) also disclosed holding 25,600 MSTR shares , indirectly holding exposure to BTC assets, but it may have already liquidated its holdings.

Pension and Endowment Funds: Potential Players Among Strategy's Q3 Holdings

Aside from banking institutions, pension funds and endowment funds are also among the "main forces" of Strategy's stock holders. Moreover, given their massive capital size, the future prospects for further increases in Strategy's stock holdings may still depend on their performance.

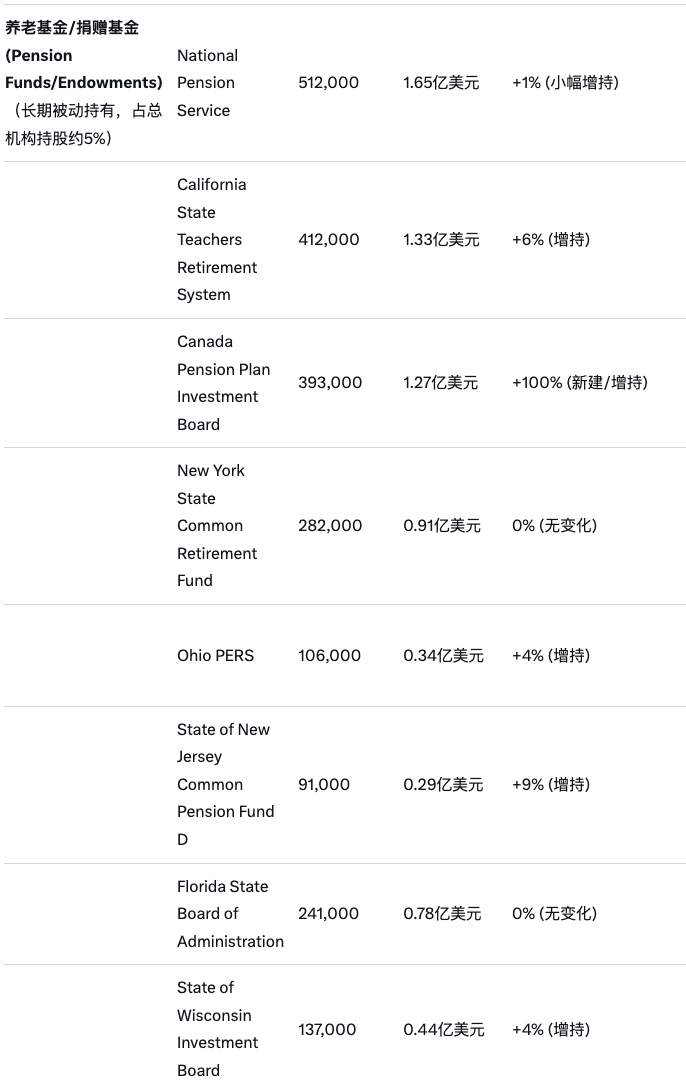

Similarly, according to Stockzoa , as of the end of Q3 (compared to Q2), the following information pertains to pension funds and endowment funds holding Strategy shares (compiled from Grok):

These mainly include national pension funds, state pension funds, industry foundations, and the Canada Pension Plan, among other organizations.

Hedge Funds: "Shark Predators" Among Strategy Shareholders?

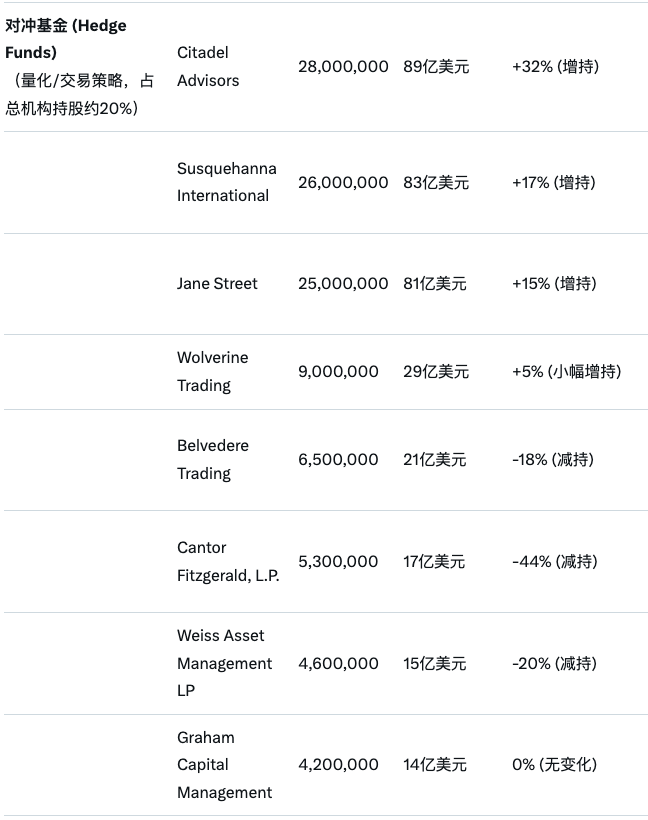

Among Strategy's shareholders, hedge funds are perhaps the most astute and sensitive to market trends. Therefore, in Q3, although most hedge funds chose to increase their holdings of MSTR stock, crypto brokers such as Cantor Fitzgerald, LP and Weiss Asset Management LP, as well as established hedge funds, still chose to reduce their stock holdings.

According to Stockzoa , as of the end of Q3 (compared to Q2), the following information shows the hedge funds holding Strategy shares (compiled from Grok):

Looking at Strategy's shareholder changes from a data perspective: Institutions remain the main holders, with buying power far exceeding selling power.

Beyond the group classification perspectives mentioned above, some hidden information can also be gleaned from the changes in Strategy's institutional shareholders data.

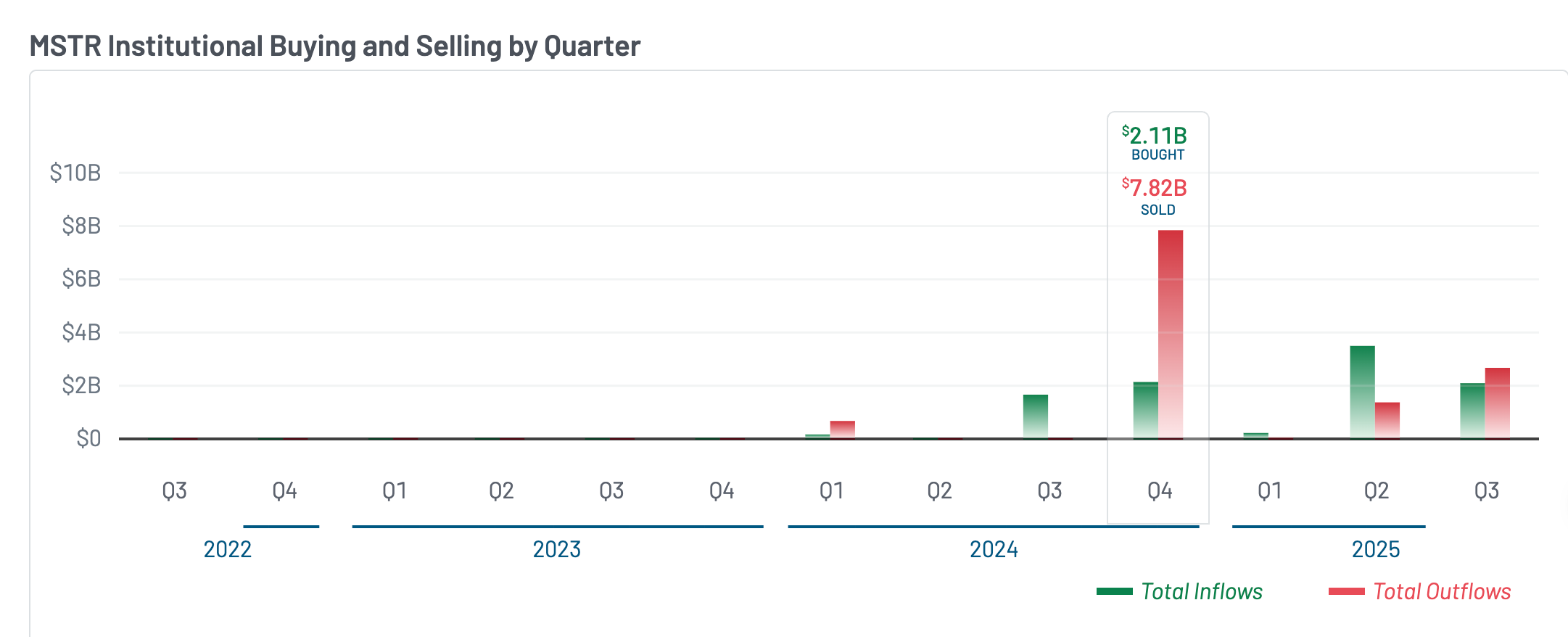

Strategy's stock trading data is relatively balanced and well below historical peaks.

According to data from Marketbeat , Strategy& stock inflows reached a record high of 7.82 billion shares sold and 2.11 billion shares bought in Q4 2024, resulting in a staggering buy-sell ratio of nearly 1:4. In contrast, in Q3 of this year, these figures dropped to 2.64 billion shares sold and 2.07 billion shares bought, with a buy-sell ratio of approximately 1:1.25, indicating a relatively balanced market. From this perspective, Strategy& stock has not entered a so-called "market crash" but rather is experiencing normal fluctuations.

Behind the institutional holdings data: The amount of institutional holdings that increased was twice the amount of institutional holdings that decreased.

According to data from the Nasdaq website , institutional holdings currently account for approximately 55.84% of Strategy's stock, with a total of 1,293 institutions holding the stock. Among them, 646 institutions increased their holdings, 505 institutions reduced their holdings, and 142 institutions maintained their positions.

Furthermore, the number of shares purchased by institutions that increased their holdings was approximately twice the number of shares sold by institutions that reduced their holdings (30.51 million shares vs. 16.26 million shares), indicating that the market was able to absorb the buying pressure on Strategy's shares. Meanwhile, many more institutions chose to remain unchanged, holding as many as 102 million shares, accounting for about two-thirds of institutional holdings, which indirectly highlights institutional investors' confidence in Strategy's future prospects.

Based on the above information, despite the sharp drop in stock price, Strategy's fundamental holdings and institutional holdings structure have not deteriorated significantly. As the market gradually recovers, it may bottom out and rebound, embarking on a new upward trend.