With funds fleeing from crypto ETFs, how are companies like BlackRock faring?

- 核心观点:加密市场清算重创ETF,发行商收入锐减。

- 关键要素:

- 比特币和以太坊ETF资产净值蒸发约三分之一。

- 贝莱德等发行商年化手续费收入下滑超25%。

- 市场周期导致资金迅速从高费率产品流出。

- 市场影响:凸显加密ETF业务强周期性风险。

- 时效性标注:中期影响。

Original author: Prathik Desai

Original translation by Luffy, Foresight News

In the first two weeks of October 2025, Bitcoin spot ETFs attracted $3.2 billion and $2.7 billion in inflows, respectively, setting records for the highest and fifth highest single-week net inflows in 2025.

Prior to this, the Bitcoin ETF was expected to achieve "no consecutive weeks of capital outflow" in the second half of 2025.

However, the worst cryptocurrency liquidation in history occurred unexpectedly. This $19 billion asset wipeout still sends shivers down the spines of the crypto market.

In October and November, Bitcoin spot ETFs saw net inflows and net asset value.

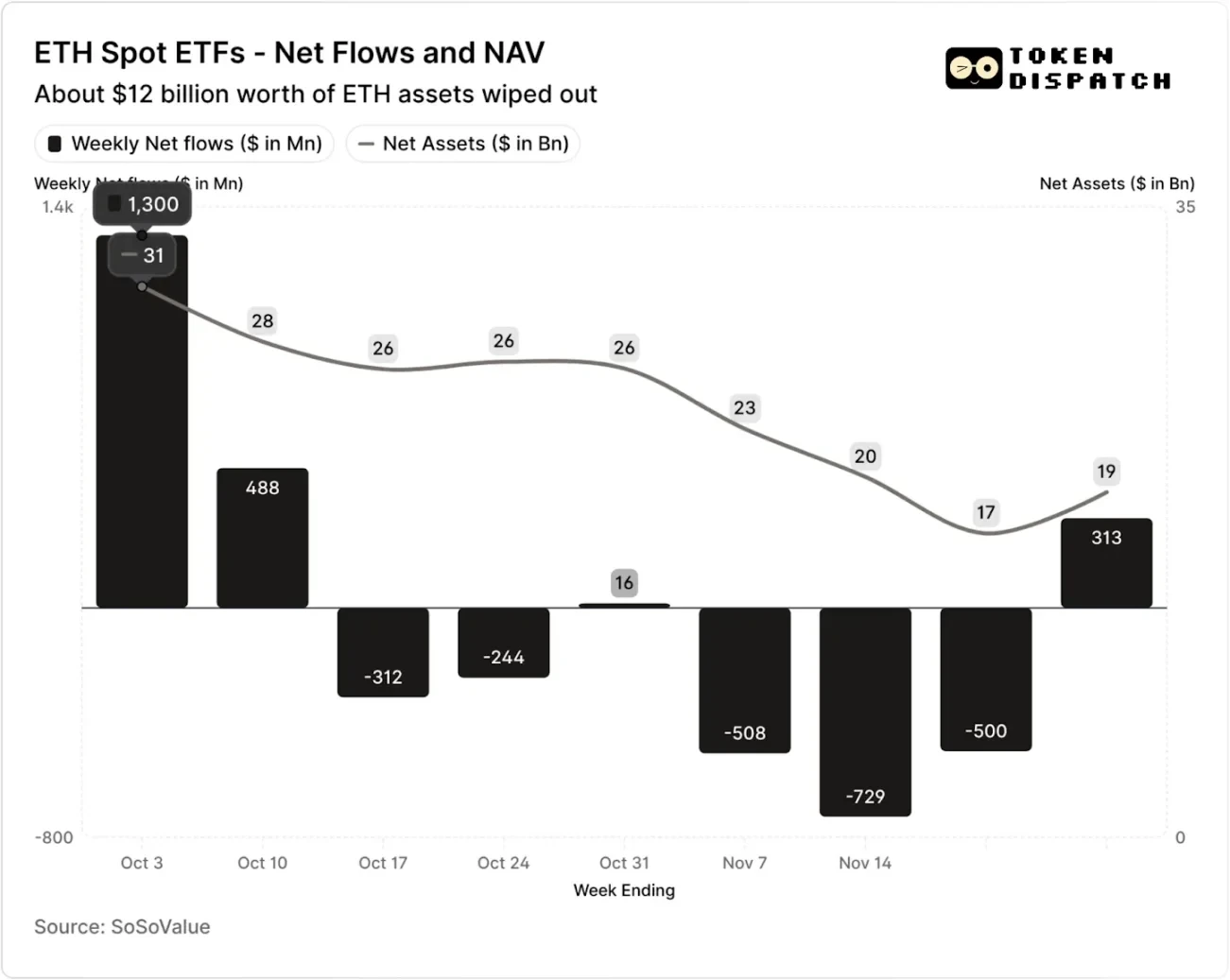

In October and November, Ethereum spot ETFs saw net inflows and net asset value.

However, in the seven weeks following the liquidation, Bitcoin and Ethereum ETFs experienced outflows for five weeks, exceeding $5 billion and $2 billion respectively.

As of the week ending November 21, the net asset value (NAV) managed by Bitcoin ETF issuers shrank from approximately $164.5 billion to $110.1 billion; the NAV of Ethereum ETFs nearly halved, falling from $30.6 billion to $16.9 billion. This decline was partly due to the drop in the prices of Bitcoin and Ethereum themselves, as well as the redemption of some tokens. In less than two months, the combined NAV of Bitcoin and Ethereum ETFs evaporated by about one-third.

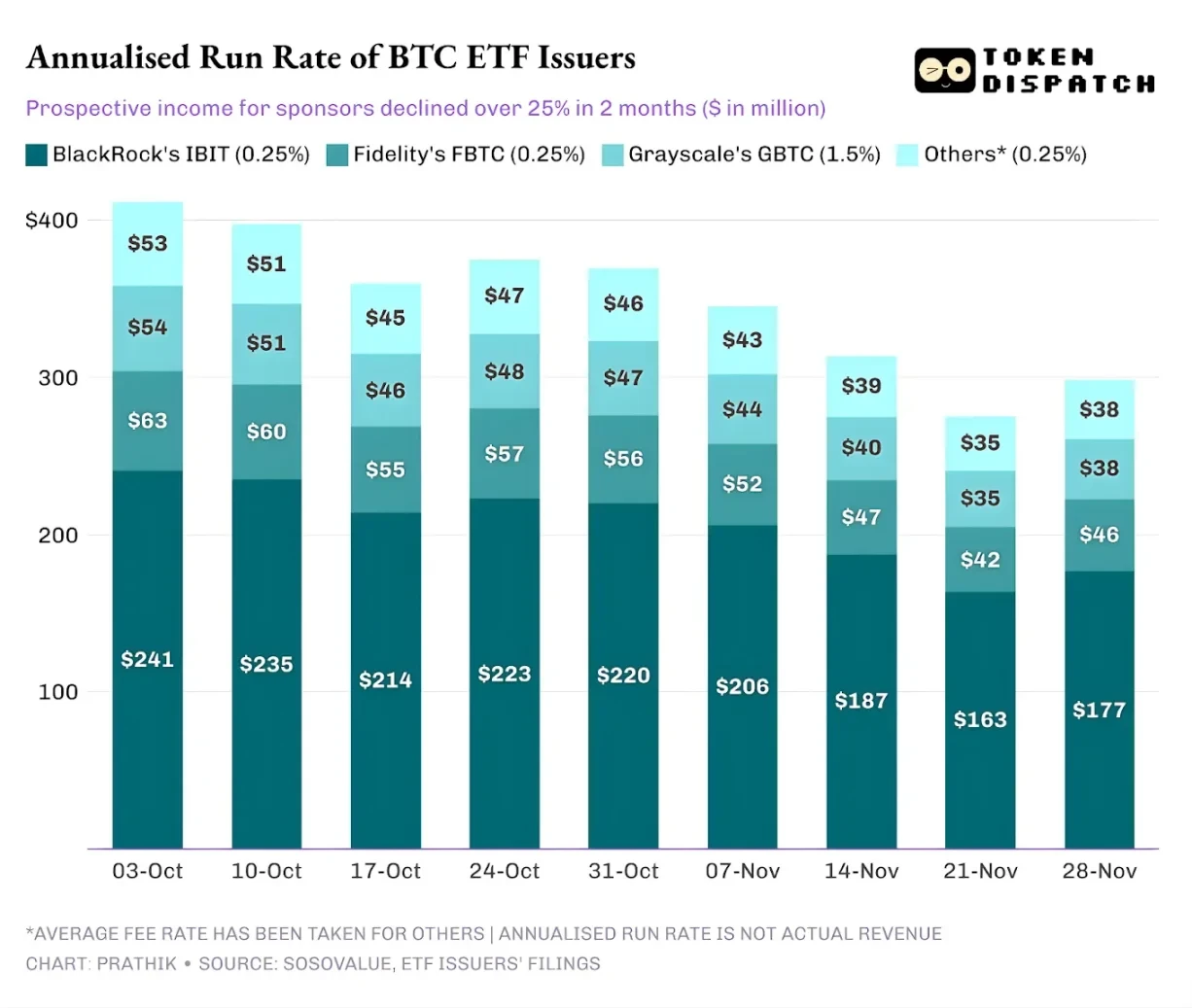

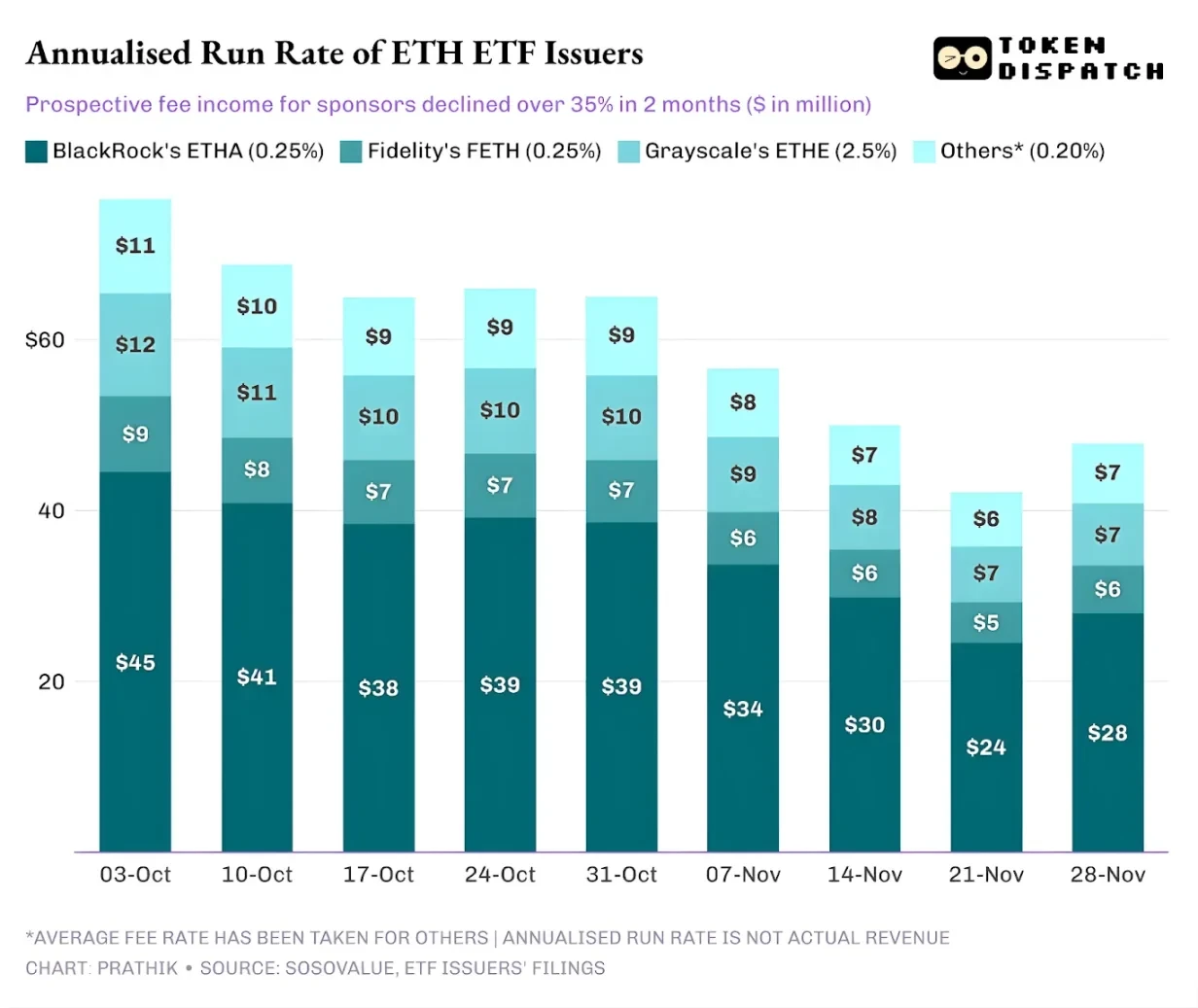

The decline in fund flows not only reflects investor sentiment but also directly impacts the fee income of ETF issuers.

Bitcoin and Ethereum spot ETFs are "money-printing machines" for issuers like BlackRock, Fidelity, Grayscale, and Bitwise. Each fund charges fees based on its asset size, usually published as an annual fee rate, but actually charged on a daily basis according to the net asset value.

Every day, trusts holding Bitcoin or Ethereum sell a portion of their holdings to cover transaction fees and other operating expenses. For the issuer, this means its annual revenue is roughly equal to its assets under management (AUM) multiplied by the fee rate; for the holders, this results in the gradual dilution of their token holdings over time.

ETF issuers charge fees ranging from 0.15% to 2.50%.

Redemptions or capital outflows do not directly result in profits or losses for the issuer, but outflows will lead to a reduction in the size of the assets ultimately managed by the issuer, thereby reducing the asset base from which fees can be collected.

On October 3, the combined assets under management of Bitcoin and Ethereum ETF issuers reached $195 billion, resulting in a substantial fee pool considering the aforementioned fee levels. However, by November 21, the remaining assets of these products amounted to only approximately $127 billion.

If annualized fee income is calculated based on weekend assets under management, the potential revenue of Bitcoin ETFs has dropped by more than 25% in the past two months; Ethereum ETF issuers have been even more affected, with annualized revenue declining by 35% over the past nine weeks.

The larger the issuance size, the more severe the fall.

From the perspective of a single issuer, the flow of funds reveals three slightly different trends.

For BlackRock, its business is characterized by both "scale effects" and "cyclical volatility." Its IBIT and ETHA have become the default choices for mainstream investors allocating Bitcoin and Ethereum through ETFs. This allows the world's largest asset manager to charge a 0.25% fee based on its massive asset base, especially when its assets reached record highs in early October, resulting in substantial profits. However, this also means that when large holders chose to reduce risk in November, IBIT and ETHA became the most direct targets for selling.

The data is sufficient to prove this: BlackRock's annualized fee income for Bitcoin and Ethereum ETFs declined by 28% and 38% respectively, both exceeding the industry average decline of 25% and 35%.

Fidelity's situation was similar to BlackRock's, only on a smaller scale. Its FBTC and FETH funds also followed a "flow-then-out" pattern, with the market enthusiasm in October ultimately being replaced by capital outflows in November.

Grayscale's story is more about "legacy issues." Once upon a time, GBTC and ETHE were the only large-scale channels for many US investors to allocate Bitcoin and Ethereum through brokerage accounts. However, with institutions like BlackRock and Fidelity leading the market, Grayscale's monopoly has disappeared. To make matters worse, the high fee structure of its early products has led to continuous capital outflow pressure over the past two years.

The market performance in October and November also confirmed this tendency among investors: when the market is doing well, funds will shift to products with lower fees; when the market is weakening, they will reduce their holdings across the board.

Grayscale's early crypto products had fees 6-10 times higher than low-cost ETFs. While high fees can boost revenue figures, these exorbitant expense ratios continuously drive investors away, reducing the size of their asset base that generates transaction fees. Remaining funds are often constrained by friction costs such as taxes, investment instructions, and operational procedures, rather than stemming from investors' active choices; and every outflow of funds serves as a reminder to the market that more holders will abandon high-fee products once better options become available.

These ETF data reveal several key characteristics of the current institutionalization process of cryptocurrencies.

The spot ETF market in October and November demonstrates that the cryptocurrency ETF management business, like the underlying asset market, is cyclical. When asset prices rise and market news is positive, inflows of funds drive up transaction fee revenue; however, once the macroeconomic environment changes, funds quickly withdraw.

While large issuers have established efficient "fee channels" for Bitcoin and Ethereum assets, the volatility in October and November proved that these channels are also susceptible to market cycles. For issuers, the core issue is how to retain assets during a new round of market shocks and avoid significant fluctuations in fee income due to changes in macroeconomic trends.

While issuers cannot prevent investors from redeeming their shares during a sell-off, income-generating products can mitigate downside risk to some extent.

Covered call option ETFs can provide investors with premium income (Note: Covered call options are an option investment strategy where investors sell a corresponding number of call option contracts while holding the underlying asset. By collecting premiums, this strategy aims to enhance portfolio returns or hedge some risks), offsetting some of the price declines of the underlying asset; collateralized products are also a viable option. However, such products must first pass regulatory review before they can be officially launched on the market.