Economic Truth: AI Drives Growth, Cryptocurrency Becomes a Political Asset

- 核心观点:AI是当前经济唯一增长引擎,市场已脱离基本面。

- 关键要素:

- 市场波动由系统性资金流动驱动,而非经济数据。

- AI资本支出支撑GDP,掩盖劳动力市场疲软。

- 贫富差距扩大,加密货币成年轻群体重要资产。

- 市场影响:市场将更受情绪和资金流动主导,政策向AI与能源倾斜。

- 时效性标注:中期影响

Original author: arndxt

Original translation by: Chopper, Foreign News

If you've read my previous articles on macroeconomic dynamics, you might already have a glimpse of what's going on. In this article, I'll break down the current state of the economy for you: the only engine driving GDP growth is artificial intelligence (AI); all other areas, such as the labor market, household finances, affordability, and asset accessibility, are declining; and everyone is waiting for a "cycle turning point," but there is no such thing as a "cycle" at present.

The truth is:

- The market is no longer driven by fundamentals.

- AI capital expenditure is the only pillar to avoid technological decline.

- A wave of liquidity is expected in 2026, but the market consensus has not even begun to price in this.

- The wealth gap has become a macroeconomic obstacle forcing policy adjustments.

- The bottleneck for AI is not GPUs, but energy.

- Cryptocurrencies are becoming the only asset class among young people with real growth potential, which gives them political significance.

Do not misjudge the risks of this transformation and thus miss a golden opportunity.

Market dynamics decoupled from fundamentals

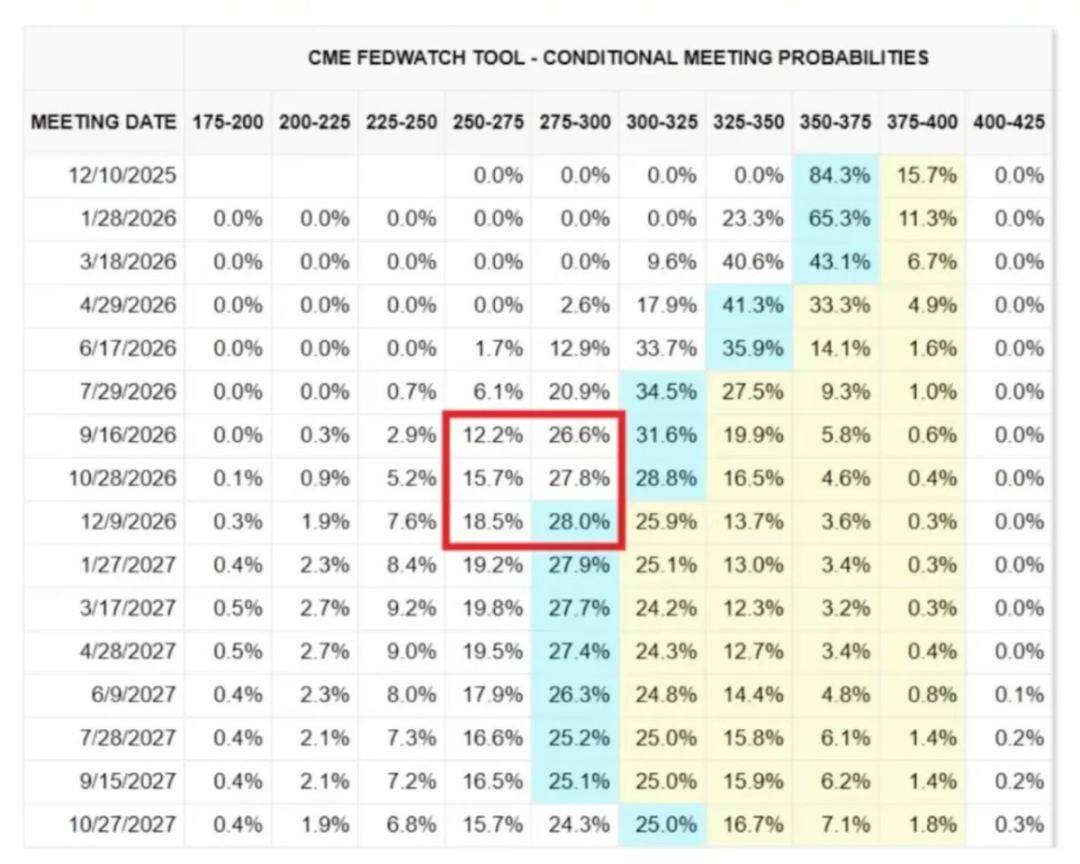

The price fluctuations over the past month have been completely unsupported by new economic data, yet they have been triggered by a shift in the Federal Reserve's stance, resulting in significant volatility.

The probability of an interest rate cut has fluctuated repeatedly, shifting from 80% to 30% and back to 80%, influenced solely by comments from a few Federal Reserve officials. This phenomenon confirms a core characteristic of the current market: the influence of systemic capital flows far outweighs proactive macroeconomic perspectives.

The following is evidence at the microstructural level:

1) Volatility-targeted funds mechanically reduce leverage when volatility spikes and increase leverage again when volatility falls.

These funds don't care about the "economy" because they adjust their investment exposure based on only one variable: the degree of market volatility.

When market volatility increases, they reduce risk by selling; when volatility decreases, they increase risk by buying. This results in automatic selling when the market is weak and automatic buying when the market is strong, thus amplifying both directions of volatility.

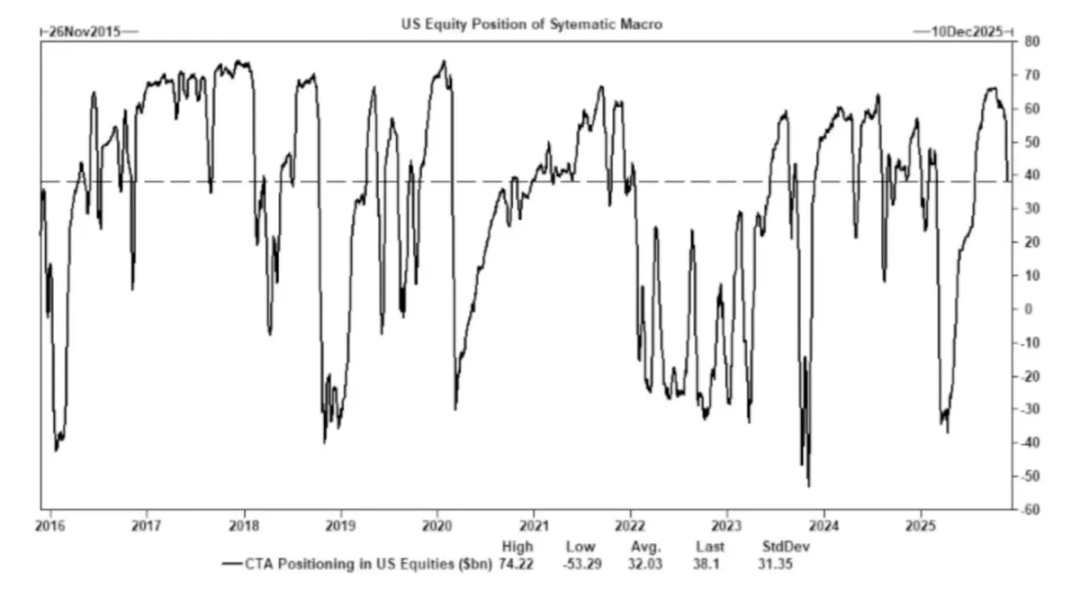

2) Commodity Trading Advisors (CTAs) will switch long and short positions at preset trend levels, thereby generating forced flows.

CTA follows strict trend rules, with no subjective "opinions" whatsoever; it is purely mechanical execution: buy when the price breaks through a certain level, and sell when the price falls below a certain level.

When enough CTAs touch the same threshold at the same time, even if the fundamentals remain unchanged, it can trigger large-scale coordinated buying and selling, and even drive the entire index to fluctuate for several consecutive days.

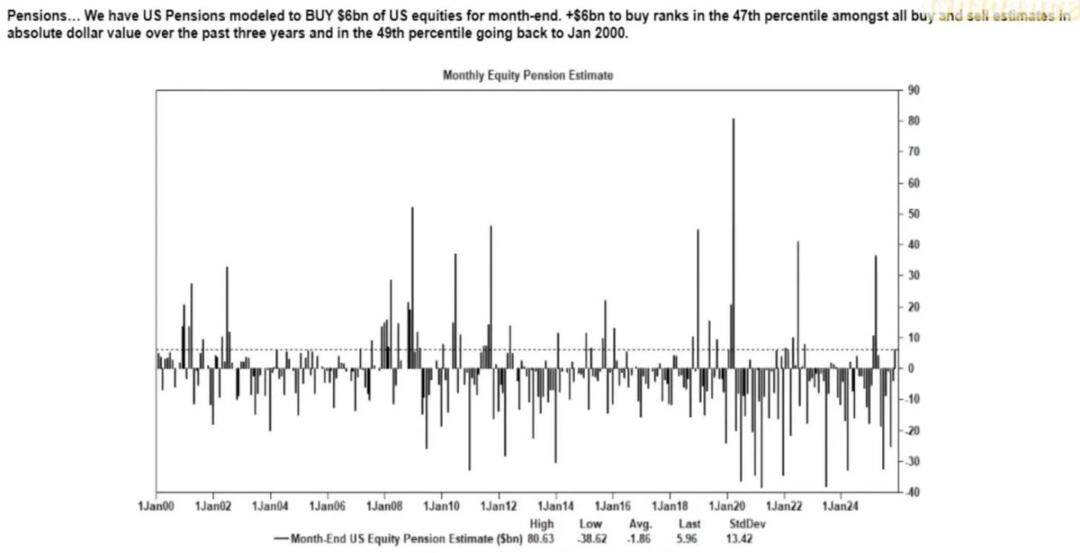

3) The stock buyback window remains the largest source of net equity demand.

Corporate stock buybacks are the largest net buyers in the stock market, exceeding the purchases by retail investors, hedge funds, and pension funds.

During the buyback window, companies inject billions of dollars into the market every week, which leads to:

- There is inherent upward momentum in the market during the buyback season.

- The market weakened significantly after the buyback window closed.

- Structural buying unrelated to macroeconomic data is forming.

This is the core reason why the stock market can still rise even when market sentiment is low.

4) An inverted volatility (VIX) curve reflects a short-term hedging imbalance, not "panic".

Normally, long-term volatility (3-month VIX) is higher than short-term volatility (1-month VIX). When this relationship reverses, it is often interpreted as "escalating panic," but nowadays this phenomenon is driven more by the following factors:

- Short-term hedging demand

- Options market makers adjust positions

- Weekly options fund inflows

- Systematic strategies for month-end hedging operations

This means that a surge in the VIX does not necessarily indicate panic, but rather is a result of hedging fund flows.

This distinction is crucial: volatility is now driven by trading behavior, not narrative logic.

The current market environment is more sensitive to sentiment and capital flows: economic data has become a lagging indicator of asset prices, while the Federal Reserve's communications have become the main trigger for volatility. Liquidity, positioning, and policy tone are replacing fundamentals as the dominant factor in the price discovery process.

AI is key to avoiding a full-blown recession

AI has become a stabilizer for the macroeconomy: it has effectively replaced cyclical hiring needs, supported corporate profitability, and maintained GDP growth even when the labor market is weak.

This means that the US economy's reliance on AI capital expenditures is far greater than policymakers publicly acknowledge.

- Artificial intelligence is suppressing labor demand from the lowest-skilled and most easily replaceable third of the workforce. This is often where cyclical economic downturns first manifest themselves.

- Increased productivity masked what appeared to be a widespread deterioration in the labor market. Output remained stable because machines absorbed the work previously done by entry-level labor.

- With fewer employees and higher corporate profit margins, households shoulder the socioeconomic burden. This shifts income from labor to capital—a typical recession dynamic.

- Capital formation related to artificial intelligence has artificially maintained the resilience of GDP. Without capital expenditure in the field of artificial intelligence, overall GDP figures would be significantly weaker.

Regulators and policymakers will inevitably support AI capital expenditures through industrial policies, credit expansion, or strategic incentives, because the alternative is an economic recession.

Inequality has become a macroeconomic constraint.

Mike Green's estimate of a poverty line of approximately $130,000 to $150,000 sparked a strong backlash, a phenomenon that precisely illustrates the deep resonance surrounding this issue.

The core truth is as follows:

- Childcare costs exceed rent/mortgage payments

- Housing is structurally unsustainable

- Baby boomers dominate asset ownership

- Young people only hold income and have no capital accumulation.

- Asset inflation widens the wealth gap year by year

The widening wealth gap will force adjustments in fiscal policy, regulatory stances, and asset market intervention. Meanwhile, cryptocurrencies, as a tool for young people to participate in capital growth, will increasingly demonstrate their political significance, prompting policymakers to adjust their attitudes accordingly.

The bottleneck to scaling up AI is energy, not computing power.

Energy will become the new central narrative: the large-scale development of the AI economy cannot be separated from the simultaneous expansion of energy infrastructure.

Discussions about GPUs have overlooked more critical bottlenecks: power supply, grid capacity, nuclear power and natural gas production capacity construction, cooling infrastructure, copper and key mineral resources, and data center site selection restrictions.

Energy is becoming a limiting factor for the development of AI. In the next decade, the energy sector (especially nuclear power, natural gas, and grid modernization) will be one of the most leveraged investment and policy directions.

A dual-track economy is emerging, and the gap continues to widen.

The U.S. economy is splitting into two major sectors: a capital-driven AI sector and a labor-dependent traditional sector, with little overlap and increasingly divergent incentive structures.

The AI economy continues to expand:

- High productivity

- High profit margin

- Light labor dependence

- Strategic protection

- Attracting capital inflows

The real economy continues to shrink:

- Weak labor absorption capacity

- Consumers are under great pressure

- Liquidity decline

- Asset centralization

- Inflationary pressures

The most valuable companies of the next decade will be those that can reconcile or leverage this structural divide.

Future Outlook

- AI will receive policy support because the alternative is recession.

- Liquidity driven by the Ministry of Finance will replace quantitative easing (QE) as the main policy channel.

- Cryptocurrencies will become a political asset class tied to intergenerational equity.

- The real bottleneck for AI is energy, not computing power.

- Over the next 12-18 months, the market will continue to be driven by sentiment and capital flows.

- The wealth gap will increasingly dominate policy decisions.