We may have misunderstood $JESSE; it's generating revenue for the Base chain.

- 核心观点:创作者代币是Rollup变现的创新方案。

- 关键要素:

- Base通过创作者代币增加交易费用。

- 代币机制激励创作并产生投机。

- 模式存在赞助与策展的冲突。

- 市场影响:可能推动Rollup收入但需优化机制。

- 时效性标注:中期影响。

Original author: Auditless Research

Original translation: Deep Tide TechFlow

Content coins may be the only way to get Rollups excited about creators. But be aware that the big players always win.

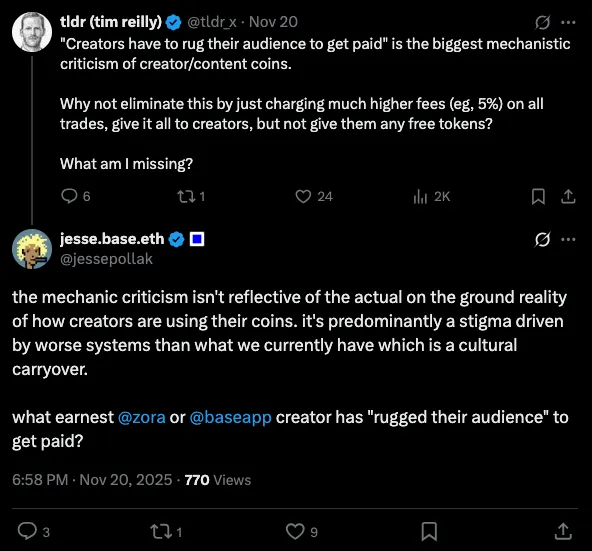

Crypto Twitter's reaction to the launch of $JESSE was not friendly:

(The tweet above is actually one of the more rational and down-to-earth criticisms I've seen.)

Others pointed out some issues:

- Poor timing : The launch coincided with an article by David Phelps, in which he complained that Base was too focused on creator tokens;

- Extraction issue : Some believe that $JESSE extracts a large amount of transaction fees from sales;

- The issue of frantic buying : Because $JESSE used the Zora x Doppler bond curve auction mechanism, it unexpectedly attracted a large number of buyers.

But I don't agree with these concerns.

The timing was indeed a bit unfortunate, but I suspect that Jesse had already planned the release time and chose his birthday as the special occasion.

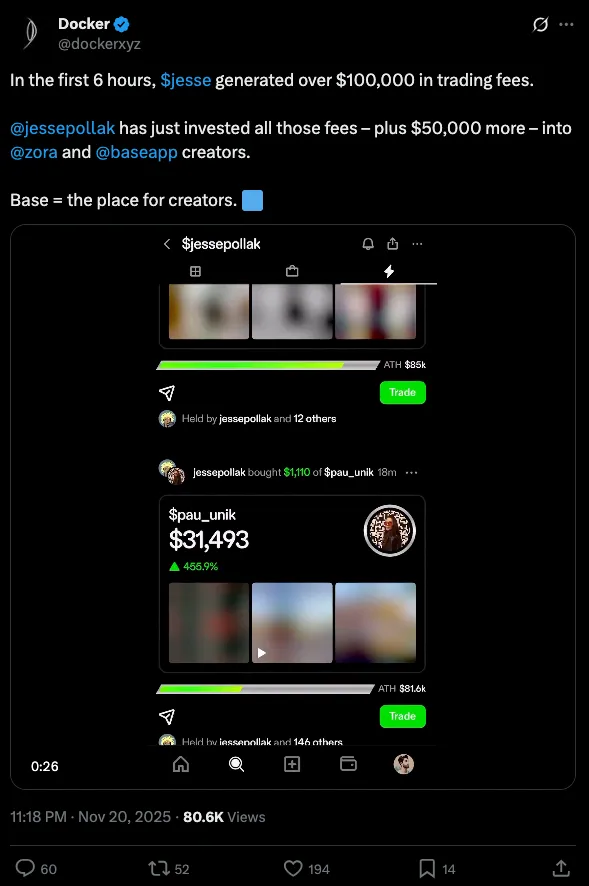

The withdrawal argument is also untenable. During his birthday livestream, he was able to reinvest the fees into other creators on Base. He also claimed that he had no intention of selling the tokens.

Ultimately, Doppler and 11AM had a very good discussion about the issue of the flash sale:

We will explore the advantages and disadvantages of different auction mechanisms in more detail next week, but Austin's research on auction mechanisms far surpasses that of those who complain about the rush to buy on X (formerly Twitter).

If it wasn't out of malice, why would Jesse do that?

The real reason for promoting creator tokens

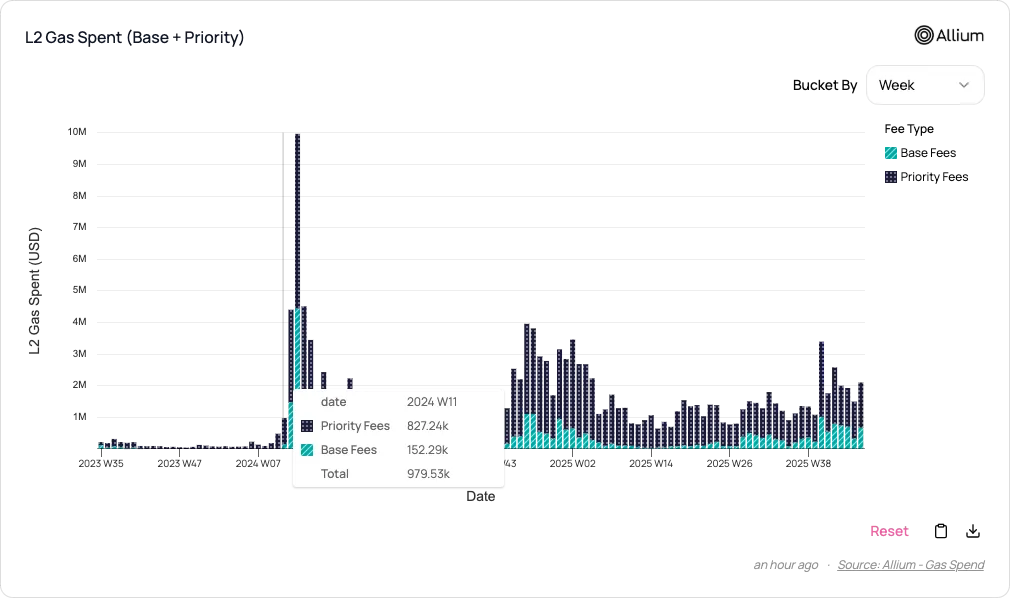

Most of the sorter revenue for Rollup comes from transaction fees.

To date, Base has earned more revenue from meme token trading than from any other activity. The issuance of new tokens and the resulting speculative trading volume are significant drivers of transaction fees.

Source: Allium

It's highly likely that Base is spending more than ever before on its core team, funding, events, proprietary applications (such as the Base App), and support for its founders. However, these expenditures haven't significantly increased Base's contribution to Coinbase's financial statements as a rollup.

Creator tokens and content tokens are a very clever solution to this problem:

- Their issuance even exceeded that of meme tokens (token issuance is the main battleground for Rollups).

- They can stimulate trading and speculative activities;

- They are built by converting attention into on-chain fees, and almost anything that can go viral can be tagged with a content token.

- Unlike meme tokens, they don't even require any underlying economic activity, community support, or commitment.

While users view soaring gas fees as a negative, from a Rollup's perspective, creating an excessive demand for block space is actually a sign of success.

No other form of monetization for creators can achieve the same effect:

- Payments : Transactions of any form of payment (such as donations) are insufficient, especially payments to creators.

- Rewards : Base does use reward mechanisms to support the Base App ecosystem, but these rewards have a negligible impact on revenue.

- Advertising : There are almost no ads on the chain, so they cannot contribute to the sorter fee.

Are creator tokens really a good thing?

We've learned why creator tokens are a key area of focus for Base, but are they really the best mechanism for users and creators?

Source: Zora Docs

The flywheel effect logic of creator tokens is simple:

- If you publish content, a Content Coin will be generated, and you will own 1% of its supply.

- Each content token can only be purchased with your Creator Coin. If you issue Creator Coins, you will hold 50% of their supply (unlocked gradually).

- The demand for content tokens will naturally drive the demand for creator tokens. This mechanism incentivizes you to create high-quality content while earning rewards through holding creator tokens and transaction fees.

In some ways, content tokens behave similarly to Patreon's membership subscriptions. If you spend $1,000 to purchase a content token, your opportunity cost is the potential return on that $1,000 invested in other markets. The forgone returns are essentially like paying a creator subscription fee. In return, the creator may reward you for holding these tokens. These rewards could be tiered like Patreon's, or distributed proportionally or randomly (like a lottery).

However, creators don't directly receive subscription fees unless they sell their own creator tokens. Therefore, even if your costs are paid through a revenue-generating subscription, not all costs are effectively passed on to the creators you support unless they "cash out" (i.e., "rug"). Jesse also points out this issue:

Furthermore, content coins also possess attributes similar to fan collectibles. As an artist's popularity increases, the rewards they can offer to "subscribers" become more valuable. Therefore, content coins have a speculative element. Even if you don't care about supporting an artist or earning rewards, you might still buy content coins simply to speculate on their potential future reward value (whether material or non-material). This is similar to buying a first-edition CD from your favorite artist, which you might resell at a higher price in the future.

However, this characteristic of creator tokens also brings significant drawbacks : they have essentially become a financial instrument, and their market may attract institutional participants who possess more advanced tools than ordinary fans.

Just as true fans need discerning eyes, patience, and dedication to identify, preserve, and invest in classic CDs or related merchandise, the market for content tokens also needs genuine fans to support it. On the other hand, a savvy trader can profit from content tokens simply by using flash sales or other speculative methods.

When you exit a "membership," you need to sell tokens, which creates slippage. Ironically, the lower the liquidity of creator tokens, or the greater your contribution to the creator, the higher the slippage you face. Content tokens, in a way, penalize the most generous sponsors.

The house always wins.

My core problem with the creator token model is that it attempts to combine sponsorship and curation to maximize transaction volume, but it may end up with the worst of both.

- True sponsors have to deal with issues such as price volatility, adversarial market participants, and transaction taxes.

- Curators lack clear guarantees for future rewards because creator tokens are not explicitly tied to creator equity or other value streams. In effect, curators are speculating on potential demand for unknown future rewards.

- This model tends to place creators' revenue upfront , which may result in significant transaction fees during the initial price discovery phase, but the sustainability of long-term transaction volume is uncertain ($JESSE's performance will be a point of observation). This mechanism does not truly achieve incentive alignment between creators and token holders.

The end result is that the underlying blockchain and trading venue (in this case, Uniswap) extract far more revenue than a simple membership-based payment solution would.

You could argue that the curatorial market does offer an additional function, but the two (sponsorship and curation) cannot be clearly separated.

In contrast, we can examine Craig Mod's model. He built his own membership system, focusing on keeping the setup as streamlined as possible, and succeeded.

He can proudly say that no one has lost their hard-earned money for supporting him.

What attracts me to Craig's model is that it focuses on the creation itself (such as books), rather than the content or the creator personally.

Personally, I believe that a creator economy centered on interaction is less effective than a model based on the exchange of genuine value . Content should merely be a discovery mechanism and a means of public creation, not the core product. To some extent, a free, foundational tier can be provided for users to experience.

I also believe these problems can be solved, and there is no doubt that the Zora and Base teams are working on it.

At the very least, creator tokens represent a completely new approach to monetizing creators. Even if it ultimately fails to become the optimal solution, it's still worth a try.