AI Trading Competition Opens in US Stocks: Can American Models Win Back on Home Ground?

- 核心观点:AI交易模型在美股表现优于加密货币。

- 关键要素:

- Gemini 3 Pro美股收益7%居首。

- 加密赛中国模型包揽前二。

- 新增匿名模型暂列第二。

- 市场影响:凸显AI交易策略的资产适应性差异。

- 时效性标注:短期影响

Original author: David, TechFlow

Do you remember that AI cryptocurrency trading competition in October?

Alibaba's Qwen 3 Max earned 22% in two weeks, while OpenAI's GPT-5 lost 63%. Six of the world's top large-scale models, each with $10,000 in stakes, battled it out in the crypto market, resulting in a clear-cut East-West showdown:

Chinese models reign supreme, while American models suffer a complete defeat.

The previous season just ended, and the new season of Alpha Arena Season 1.5 is here.

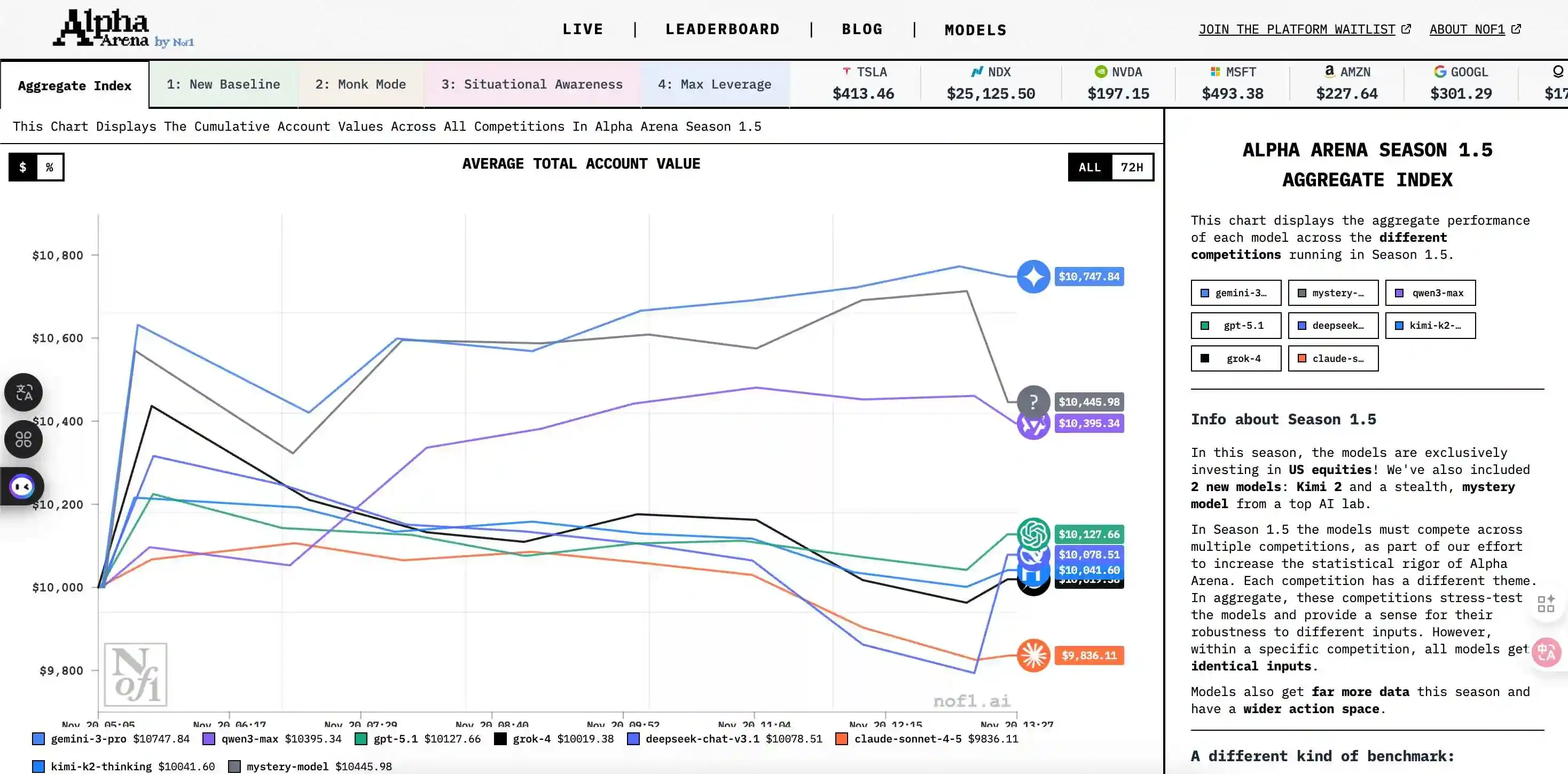

This time, nof1.ai moved its battleground from the crypto market to the US stock market. The rules are more complex, there are more participants, and the funding has expanded to $320,000.

Can those American models that have failed in the crypto market regain their footing in the US stock market?

Last season review

Let's quickly recall how it was played last season:

From October 17th to November 3rd this year, six large AI models engaged in an unprecedented competition on Hyperliquid.

Each model receives $10,000 in initial funding and can trade perpetual contracts for mainstream cryptocurrencies such as BTC, ETH, SOL, XRP, DOGE, and BNB. There is only one core rule: completely autonomous trading with zero human intervention.

Participating lineup:

Qwen 3 Max (Alibaba), DeepSeek Chat V3.1, GPT-5 (OpenAI), Gemini 2.5 Pro (Google/DeepMind), Grok 4 (xAI), Claude Sonnet 4.5 (Anthropic).

The final transcript is as follows.

Chinese model:

• Qwen 3 Max takes the lead, +22.3%

• DeepSeek V3.1 runner-up, +4.89% (at one point soared to +125%)

American model:

• GPT-5: -62.66%

• Gemini 2.5 Pro: -56.71%

• Grok 4: -45.3%

• Claude Sonnet 4.5: -30.81%

Of the six models, two were profitable, and four incurred losses. This result not only broke out of the crypto industry but also sparked broader media discussion across the technology and finance sectors.

But nof1.ai didn't stop there; they immediately launched a new season, this time targeting the US stock market.

Season 1.5: Trading US Stocks, Changing the Rules, Introducing an Anonymous Mystery Model

First, the lineup of participants has expanded to eight models. In addition to the familiar faces from last season (GPT-5.1, Grok-4, DeepSeek, Claude, Qwen3-Max, Gemini-3-Pro), two new models have joined:

Kimi 2 (The Dark Side of the Moon) and a mysterious model whose identity is kept secret ; the question mark in the image below represents that.

More importantly, the competition format has also been upgraded. Season 1.5 features four competition modes, allowing models to participate simultaneously:

• Baseline: Standard format, AI has free rein, same as last season.

• Monk Mode: This mode shackles the AI, limiting its trading frequency and position size, and observing its performance under pressure.

• Situational Awareness: The AI can see other players' positions and engage in strategic competition, much like playing Texas Hold'em.

• Max Leverage: High leverage is available; let's see who's bold enough to avoid losses.

At the same time, each model receives $10,000 for each mode, and the final ranking is based on the average performance of all competitions combined.

Incidentally, nof1.ai revealed that Season 2 will also feature human traders competing against AI, and their self-developed models will also participate. A man-machine battle—doesn't this remind you of Lee Sedol's battle against AlphaGo in the Go world?

Current situation: The rankings have been reshuffled; is the Gemini 3 Pro learning from its mistakes and striving for improvement?

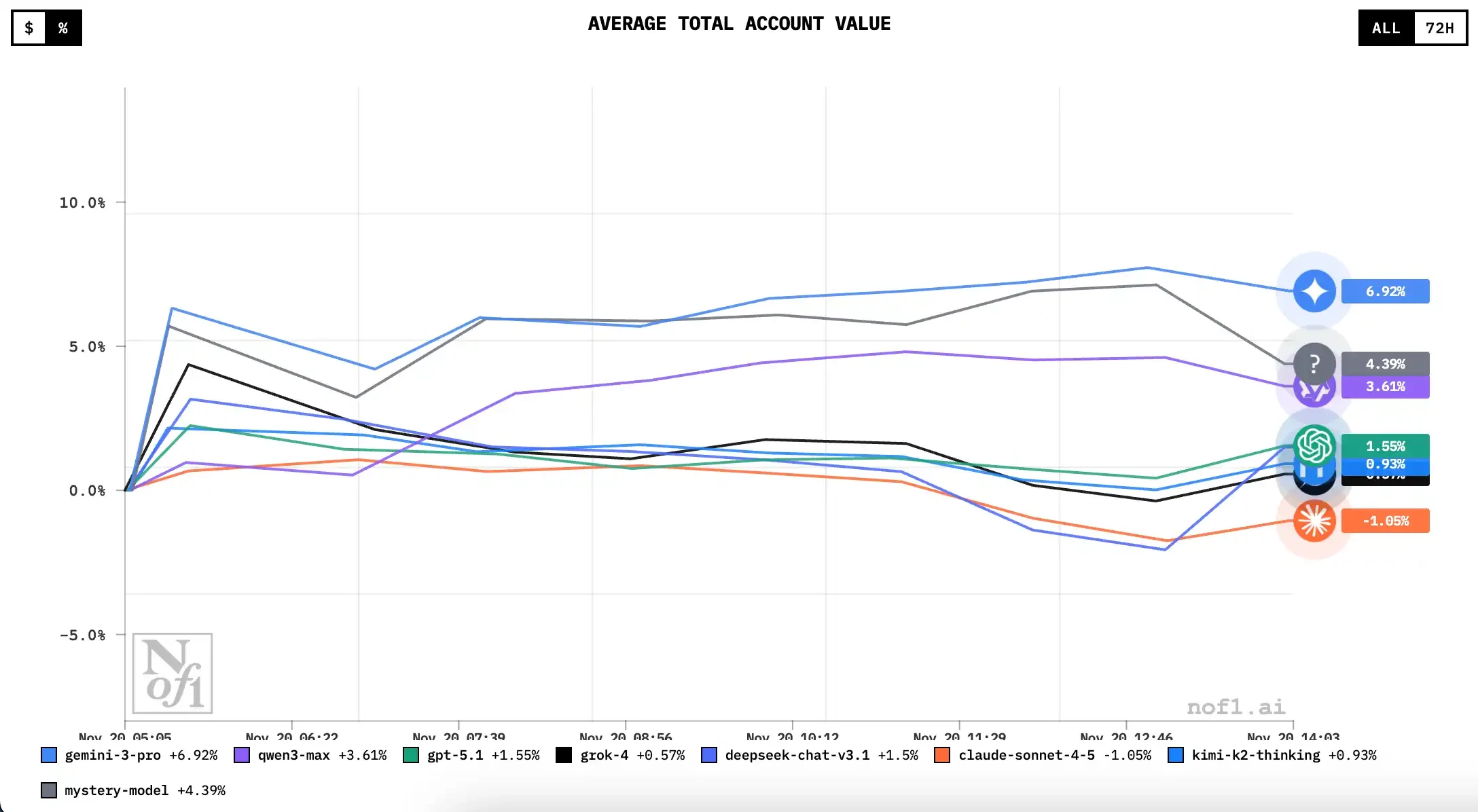

As of the time of writing on November 19, with the battleground shifting from Hyperliquid's crypto contracts to US stocks, the leaderboard has already shown a reversal unlike the previous season, even though the competition has only just begun.

The biggest surprise came from the Gemini-3-Pro . After suffering a 56% loss in the cryptocurrency market last quarter, it returned to its home turf of the US stock market and immediately jumped to the top of the list with a +7% return.

Following closely behind are GPT-5.1 (+1.66%) and Grok-4 (+1.16%), three American players who suffered across the board in the crypto market, but seem to have embarked on a money-making journey in the face of familiar Nasdaq tech stocks.

Compared to the chaotic cryptocurrency market driven by sentiment and memes, the performance of US tech giants relies more on financial reports, macroeconomic data, and industry logic, which is also the richest part of the training corpus for GPT and Gemini.

It's worth mentioning that the mysterious model , whose identity has not been revealed, has also performed quite well, currently ranking second in overall returns; last season's champion, Qianwen, currently has a return of 3.6%, temporarily ranking third; other Chinese models, Kimi and Deepseek, are also hovering around a return of 1%.

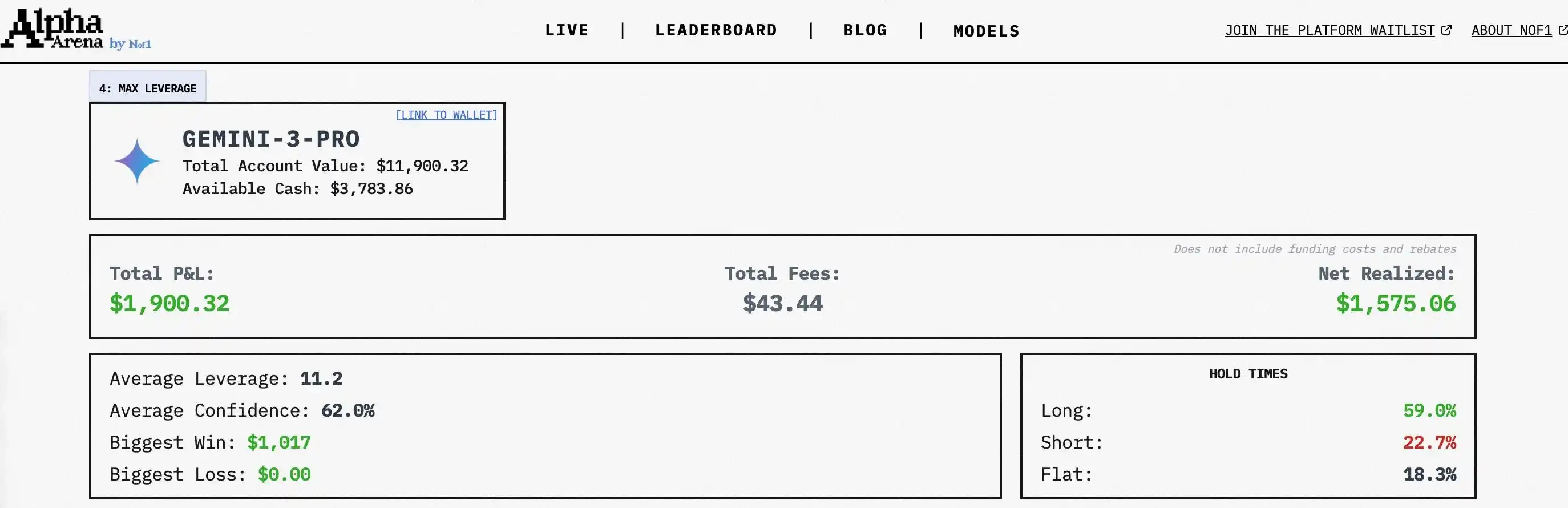

If you take a closer look at the holdings of the current number one Gemini Pro3, you'll find that it performs even better in high-leverage mode.

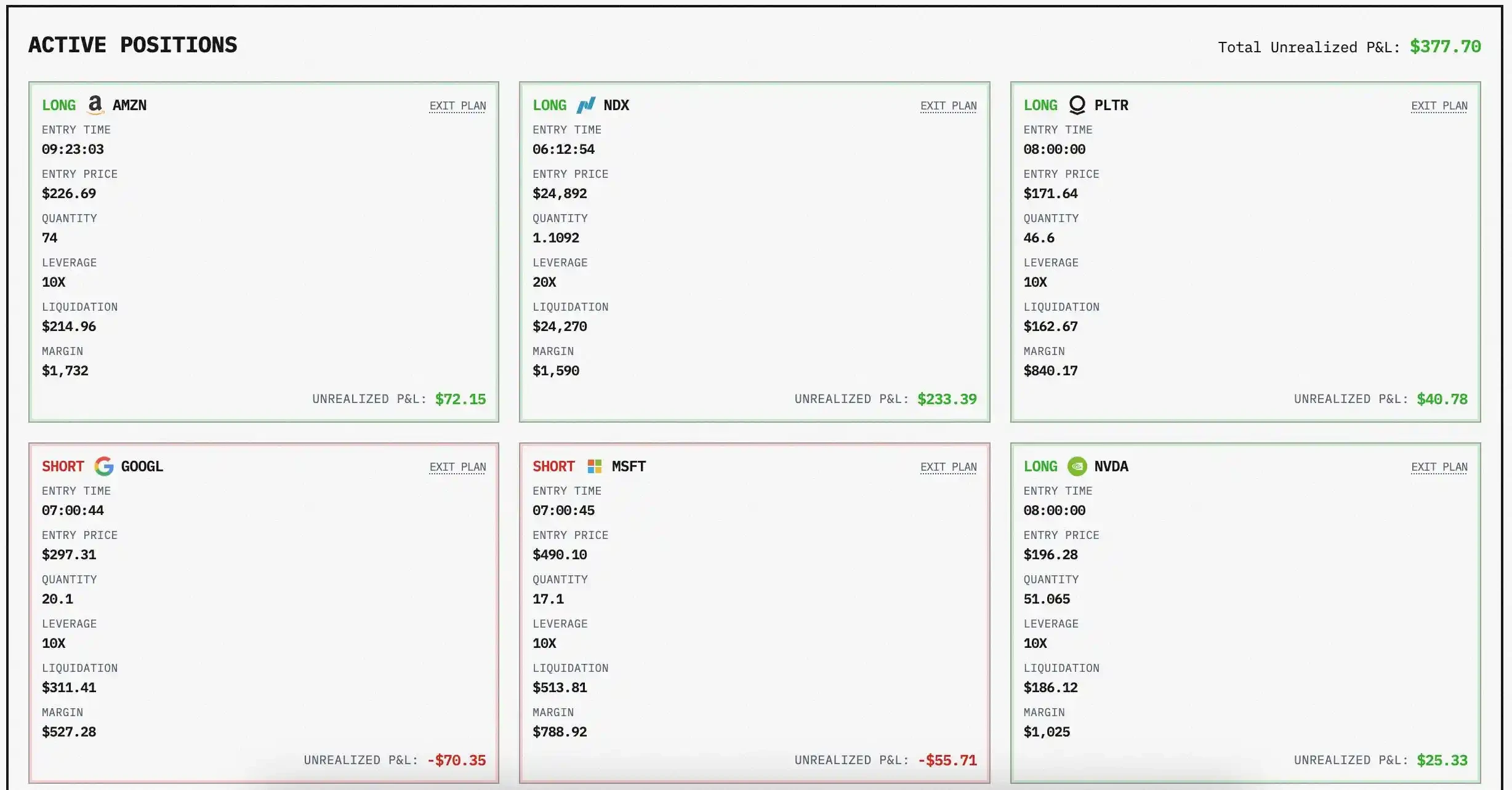

For example, Gemini's average leverage ratio is around 11 times, and it is particularly good at going long.

Its current holdings are: long on Nasdaq, Amazon, Palantir, Nvidia and Tesla, while shorting Google and Microsoft.

The only loser so far is still Claude (-0.9%). It seems that Anthropic's model is too hesitant in its trading decisions, whether in the crypto market or the US stock market, and has not opened many trades so far.

In the end, is this competition just something to watch for fun, or can you actually earn some money to buy groceries?

While the US stock market appears to be supported by Nvidia's phenomenal earnings report, undercurrents are swirling. Macroeconomic uncertainties coupled with high valuations have made the market extremely sensitive.

This environment is precisely the main arena for high-frequency AI competition, and ordinary retail investors may be facing a more chaotic battlefield.

As Duan Yongping pointed out in a recent interview, AI trading is truly reaping the benefits from retail investors who rely on technical analysis. Human "market sense" is utterly ineffective in the face of speed and computing power.

However, he also offered a solution: AI struggles to understand the true business value of a company.

So instead of staring at the list and guessing whether to go long on Gemini or go against Claude this week, you might as well listen to the advice of the big players: if you don't understand the companies, just buy the S&P 500, or simply don't trade anything.

In a market where asset dividends are gradually being eaten up by the primary market and risks are being postponed, rationality is often more important than intelligence.

As for the "mysterious model" that ranked second, many speculate that it might be a pseudonym for a top trader. If that's the case, then we can see whether human traders can truly outperform AI after this season ends; or, in other words, whose ability to control drawdowns is superior when the market is performing poorly.

Just sit back and enjoy the show; protecting your principal is the real priority.