$100 Proving Ground: Prediction Markets vs. Memecoin: Which Wins?

- 核心观点:预测市场比Meme币交易更具策略性。

- 关键要素:

- 预测市场基于可验证事件,风险可控。

- Meme币98.6%为骗局,波动性极大。

- 小额资本在预测市场可信息套利。

- 市场影响:引导资金流向更结构化投机方式。

- 时效性标注:中期影响

Original author: Baheet

Original translation: TechFlow

In a recent post, I posed the question: with just $100 in starting capital, which offers more opportunities for a trader: trading Memecoin (via the Pumpfun platform) or using prediction markets?

Original tweet link: click here

To me, it's like comparing a chess game to a casino slot machine: both have the potential for big payouts, but one rewards strategy, while the other relies on chaos and luck.

Next we will delve deeper and analyze the feasibility, risks, returns, advantages and capital impact.

Market Mechanism

Prediction Market

Prediction markets are structured forecasting tools; top platforms like @Kalshi and @Polymarket Allows users to trade based on the outcome of specific, verifiable events, such as election results, economic data releases, or specific price movements.

The price of a contract on a prediction market reflects the market’s perception of the probability of an event occurring. For example, a contract trading at $0.80 indicates an 80% probability of a “yes” outcome.

Furthermore, these markets are lauded for their “wisdom of the crowd” effect, where the collective knowledge of participants pools to provide astonishingly accurate predictions that cannot be replicated in the Memecoin space.

The value of prediction market contracts is tied to verifiable real-world events. This foundation gives prediction markets a certain legitimacy and is the core difference between them and Memecoin.

MemeCoin trading on Pumpfun

The Pumpfun platform allows users to quickly create and trade new tokens through a bonding curve, and as more buyers come in, the price will rise rapidly. This low barrier to entry has attracted a large number of untested new meme projects.

The lifecycle of a Memecoin typically follows a predictable, albeit chaotic, pattern. After reaching a certain market cap, the token is deployed to a decentralized exchange (like @Raydium ), typically experiencing an initial "pump-up" phase.

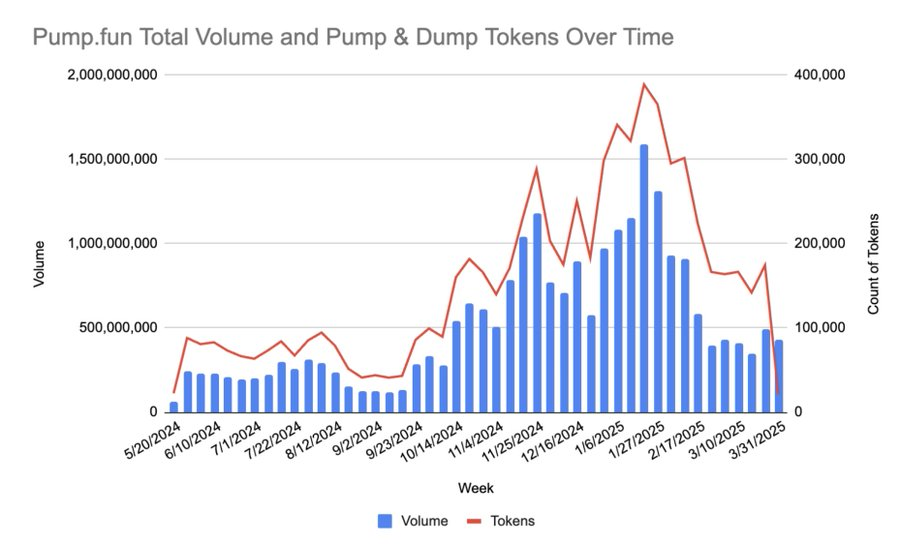

In fact, data from May 2025 shows that the majority of tokens fail after their initial offering.

@Solidus_Labs A report from [the source] shows that of the 7 million tokens launched on Pumpfun, 98.6% were identified as "runaway" or manipulative projects.

Accessibility

Both markets are very friendly to small amounts of capital and have almost no barriers to entry.

On the Polymarket platform, people can participate with as little as $10 in capital, betting on events like elections or cryptocurrency prices.

If you have $50-100, you can even spread your investments across 5-10 events and optimize your bet sizes with a better strategy.

Pumpfun offers a cheaper entry point, with the cost of creating a Memecoin being around 0.02 SOL (about $3-4 at current prices), and purchases can be made using only the change in your Solana wallet.

Initial trading usually occurs at a smaller market cap, say around $4,000, so $50-$100 can get you a decent share early on.

Aside from network fees, there are no formal minimum requirements, making it perfect for “crazy trading.”

Risk, Reward, and Reality

Prediction markets are known for their quantifiable risk; it’s clear and tied to the outcome of an event. While traders can lose their entire investment on a single contract, the odds and event criteria are clearly understood from the outset.

With well-researched forecasts, potential returns can be very high. While these returns may not be as dramatic as Memecoin’s gains, they are generally more sustainable and based on informed decisions.

Common risks in prediction markets include traders misjudging probabilities or insufficient market liquidity, but if only a small portion of a portfolio is bet, complete ruin is manageable and rare.

For most traders, a diversified prediction market portfolio offers a more structured way to participate in high-risk trades with more predictable outcomes.

Here is @Predictifybot Here’s an excellent article on how to diversify your prediction market portfolio:

Original tweet link: click here

Finally, the regulatory oversight of the U.S. Commodity Futures Trading Commission (CFTC, which oversees Kalshi) adds a layer of oversight and protection for participants, reducing the risk of fraud and manipulation.

On the other hand, the Memecoin ecosystem is rife with scams, manipulation, and wildly volatile price fluctuations. Projects can go bust, developers can drain liquidity, and investors’ tokens become worthless.

Memecoin’s value is based on hype and social sentiment, rather than any underlying utility, making it highly susceptible to social media trends and “insider” trading.

While many expect massive, life-changing returns, the reality is that such success is rare. Most participants either lose money or experience minimal gains.

What can you do with $100?

Effectively leveraging small amounts of capital (e.g., $100) on prediction markets and Pumpfun requires highly specialized and fundamentally different strategies.

I believe that the best strategy in prediction markets is to find events that are mispriced due to information asymmetry, but this hardly applies to Pumpfun's Memecoin.

Prediction Markets: Exploiting Information Asymmetry

$100 of capital won’t be enough to influence the prediction market, so your strategy must act like a savvy analyst. Your advantage comes from discovering information that the market collectively ignores.

How it works:

- Identifying information gaps: Market odds are based on the combined information of all traders. Low-volume markets may not have enough participants to truly operate efficiently, which provides an advantage to traders with small capital.

- Leverage overlooked expertise : If you possess specialized knowledge that few others in your market possess, you can leverage that information. This might include in-depth knowledge of local elections, specific technological developments, or unpopular legal cases or sports results.

- Focus on illiquid markets: Larger, liquid markets are generally more efficient, but small capital can focus on smaller, less-traded markets where odds may not yet reflect all available information.

As a small capital trader, your role is that of an information arbitrageur, and your goal is to find market inefficiencies caused by incomplete information.

Pumpfun: Everything for survival

The concept of information asymmetry on PumpFun is completely different and much harder to exploit. It involves less rational odds and more reliance on insider information.

How it works:

- Insider information is crucial: in Pumpfun, information asymmetry is often disadvantageous to ordinary traders. The creators of Memecoin have perfect information and many tools to manipulate trading.

- Social and emotional leverage: The most powerful “message” in this market is the viral potential of cryptocurrencies. Founders control the initial marketing push, often relying on influencers and social media strategies to create FOMO.

- Information asymmetry : There is an advantage here, if you join the Solana meme community or seize the opportunity before the token surges. However, the asymmetry is fleeting, with surges lasting from minutes to hours, and 97% of traders profit less than $1,000.

Unlike prediction markets, there is no real probability here, only the FOMO of the crowd.

The strategy is simple: get lucky or get out! With just $100, your Memecoin strategy looks like this:

- Get first crack at it: DYOR (do your own research) and quickly acquire new tokens in the hope of being part of the initial momentum.

- Use professional tools: Many traders use bots to monitor new token listings and market activity to gain a few seconds of head start.

- Manage risk through caution: always monitor price charts for signs of a “developer sell” and be prepared to sell immediately.

On PumpFun, your $100 isn’t used to exploit information asymmetry, but rather to invest in a market where that information is weaponized by more powerful players. Your success depends less on analysis and more on luck, timing, and avoiding falling victim to manipulative scams.

Final Thoughts

Ultimately, the choice between prediction markets and Memecoin trading on Pumpfun depends on the trader's risk appetite.

While both offer the potential for high returns, they achieve this through fundamentally different mechanisms.

Prediction markets, with their verifiable outcomes and potential regulatory oversight, offer a more structured and information-based approach to high-risk speculation.

Memecoin trading is more like gambling in a high-risk, unregulated casino. Although there is the potential for huge profits, the risk of losses is huge due to scams and extreme volatility.

The following is an article from @tradefoxintern Excellent post by , discussing why prediction markets will replace Memecoin:

Original tweet link: click here

Therefore, for those who prefer a more computational, research-driven approach, prediction markets are the clear choice.

And for those seeking huge, lottery-like returns and willing to navigate through thousands of scams, Pumpfun remains an option.

That's it!

John Wang : Mark my words, the prediction market will be 10 times the size of Memecoin!