Strategy Analysis: How to achieve a super high win rate in Polymarket through insider trading?

- 核心观点:追踪内幕交易可提升Polymarket收益。

- 关键要素:

- 诺贝尔奖市场提前9小时泄露结果。

- Monad空投市场集体押注暴露内幕。

- 新钱包大额单向下注为典型特征。

- 市场影响:提升预测准确性,加速价格发现。

- 时效性标注:短期影响

Original author: The Smart Ape

Original translation: AididiaoJP, Foresight News

How to Find Polymarket Insiders

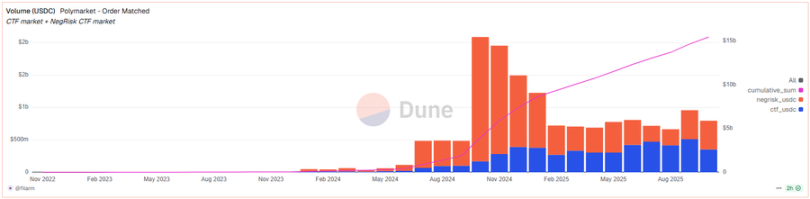

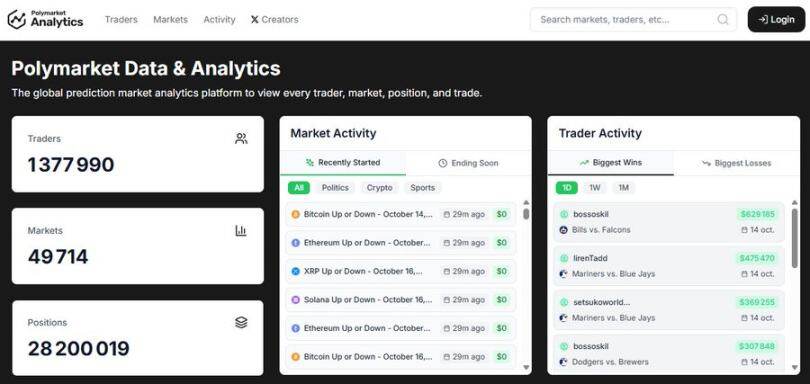

Polymarket is a large and rapidly growing marketplace, with over $15 billion in trading volume since its launch.

What’s fascinating is that there are many advanced strategies that users can use to profit, such as arbitrage, liquidity provision, discount capture, high-frequency trading, and more.

It’s still an early and evolving market that’s now entering a regulatory phase, which means there are still a lot of opportunities.

But one approach remains largely underutilized: insider analysis.

Polymarket is an open platform, meaning anyone can create a market on anything. Some markets are based entirely on public information, such as “Who will win the next World Cup?”, while others focus on events that a small group of people already know the answer to, such as “Who will win the next Nobel Peace Prize?”

In the Nobel Prize market, the committee responsible for selecting the Nobel laureates clearly knows the results before anyone else, and some of them may quietly use this information to trade on Polymarket.

If you can track the movements of these insiders, you can actually bet on the correct outcome with near certainty because the insiders know exactly what is going to happen.

Another example is "Monad airdrop before October 31st".

The project team and those close to the project already know if it will happen, so anyone who can track these wallets has a huge advantage.

There are several ways to detect potential insider activity.

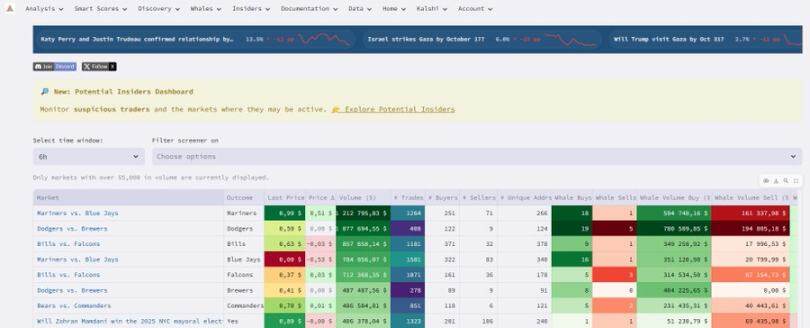

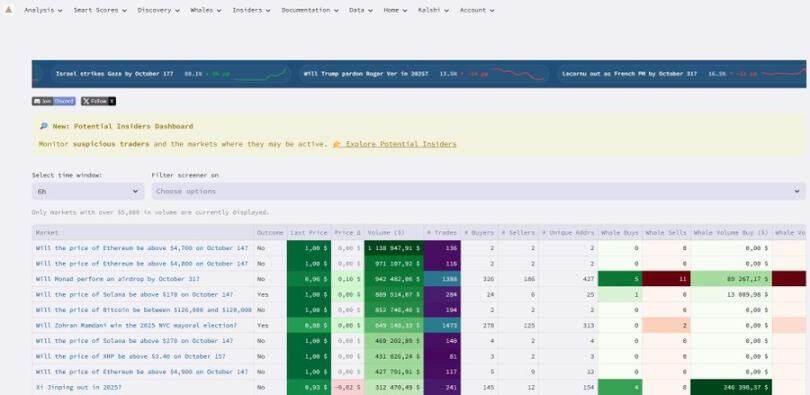

The easiest way is to use Hashdive(dot)com, which is currently the best Polymarket analysis tool, providing a wide range of indicators and data for each market.

- Start by choosing a market where there is likely to be insider activity, such as a monad airdrop.

- Clicking into that market will take you to a detailed page with analysis and indicators.

- Scroll down to the Possible Insider Traders section.

Let’s take the first trader on the list as an example:

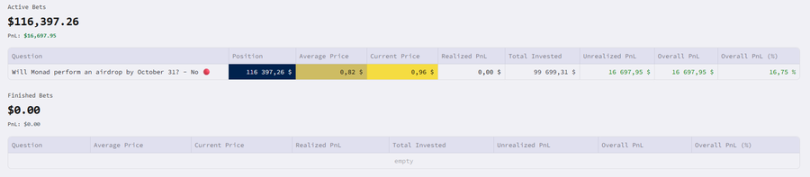

He put $100,000 on "no," and it was the only market he was trading.

That's suspicious, a new wallet investing a lot of money in a single market.

This person is most likely a member of the Monad team or has a close relationship with them.

The goal is not to focus on one trader, but to analyze the collective activity of the group.

Some may be true insiders, others may just be following the trend; the key lies in the overall pattern.

In this example, almost all of the top traders bet on “no”.

The top eight wallets all sided with the same side, each using a new wallet and holding large positions in only one or two markets.

This is a clear signal: insiders seem convinced that there will be no Monad airdrop before October 30th.

Currently, the No side is trading at around $0.83, which means there is a potential for a guaranteed gain of nearly 17% by October 30th.

It is normal that some markets do not have a "Possible Insiders" section.

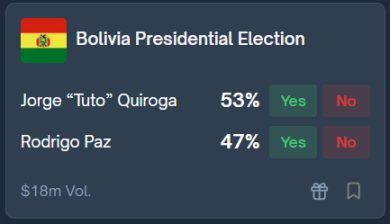

For example, there can’t really be insiders in the Bolivian presidential election because, in a close race, no one really knows how people will vote.

So the key is to choose markets where insider information is likely to exist and track the movements of insiders as early as possible.

The sooner you spot these movements, the higher your potential profits.

If you wait too long, more insiders will come in, the price will move, and your profit margin will shrink.

Your advantage depends entirely on your ability to spot them early.

Nobel Prize Case

A great example of this strategy in action is the market:

"2025 Nobel Peace Prize Laureate."

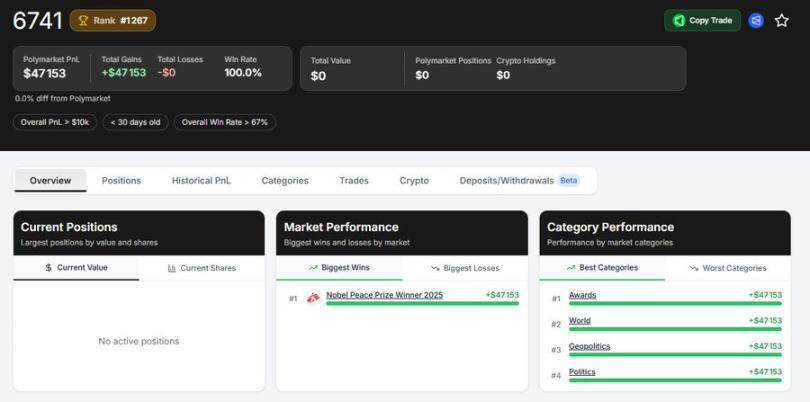

Some traders apparently received information nine hours before the official announcement.

In just a matter of seconds, Maria Machado's chances of winning jumped from 3.6% to 70%, long before the results were made public.

This was clearly an insider move, with someone leaking the decision in advance.

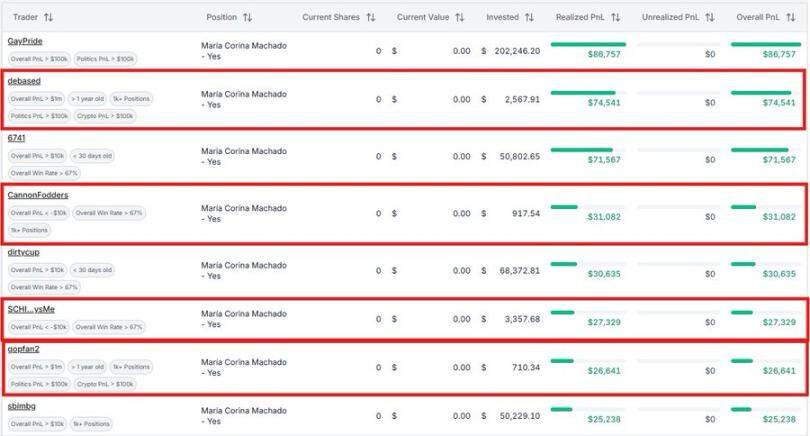

Some traders have seen 20x returns, either because they followed the insiders’ patterns or because they were insiders themselves:

Debased turned $2,500 into $75,000

CannonFodders turns $900 into $30,000

Gopfan 2 turns $700 into $26,000

They all jumped in as soon as Maria Machado's odds started to mysteriously surge.

These people could be members of the Nobel Committee, people close to the committee, or even investigative journalists who discovered the leak.

In any case, the facts are clear: some people had reliable information nine hours before the official announcement.

When the Polymarket win rate jumps from 3% to 70% in a matter of minutes, it’s undeniable that insiders are in action.

Norwegian authorities even launched an insider trading investigation into the case.

They reportedly focused on wallet “6741,” which placed a $50,000 bet hours before the results were announced.

That wallet had only traded once, and only on this market, which immediately caught attention.

Why having insiders is actually a good thing

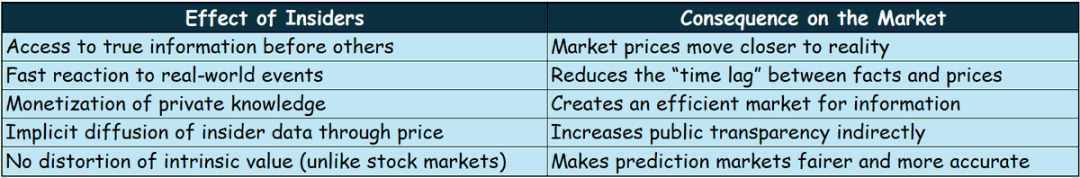

At first you might think that insiders are bad for Polymarket, but in reality, they help it achieve its true purpose.

Polymarket's true mission is not about making or losing money.

Rather, it reveals a collective truth about future events.

The more insiders there are, the more accurate the price will be.

The more reliable the information provided by the market.

Take the Nobel Prize as an example.

I didn’t need to wait for the official announcement, Polymarket already told me who the winner was.

In this sense, Polymarket got ahead of all the major media outlets, which is what makes it so powerful.

Insiders with reliable information help correct pricing errors and indirectly pass this knowledge on to everyone else through price changes.

This is a super efficient information dissemination mechanism.

Without insiders, prices reflect only opinions and speculation.

With them, prices reflect hidden but real facts.

This is why some economists, such as the creators of the concept of “prediction markets,” believe that insider trading is beneficial in this context:

It closes the gap between belief and reality.

It also creates a truth-incentive system:

If insiders trade based on real information, they will profit.

If they are wrong or lie, they lose money.

There is no incentive to spread fake news because they will pay for being wrong.

The most important thing is that the insiders here do not harm others.

This is not like a token market where insiders are dumping tokens to retail traders.

Prediction markets are voluntary and traders are aware of the risk of insufficient information.

This is a game of probability, not a long-term investment.

Therefore, as long as the rules are clear, insiders can improve the accuracy of forecasts without causing systematic unfairness.

Tools to track them

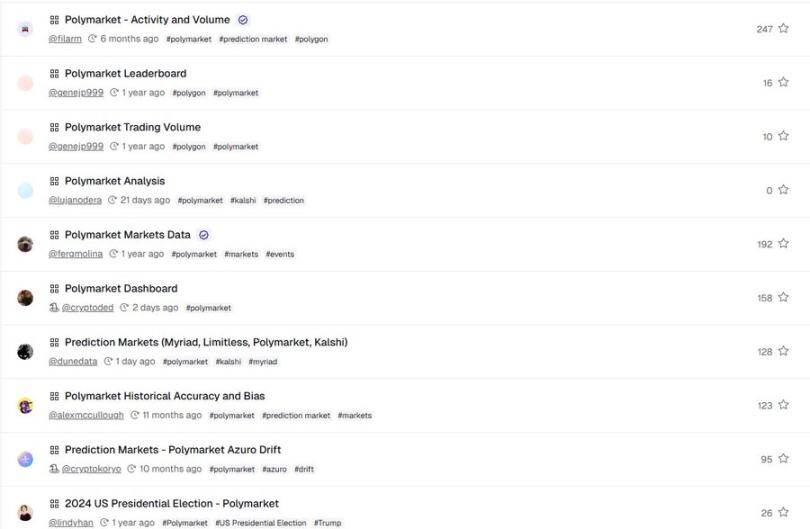

Here are some of the most useful tools for analyzing Polymarket data.

This list is not exhaustive and new tools are constantly emerging.

Dune Dashboards: Dozens of Polymarket dashboards, some global (volume, users, transactions), others specialized (insiders, airdrop trackers, whales, etc.).

PolymarketAnalytics(dot)com: One of the most complete tools. It allows you to track market traders in real time, discover top alerts, whales, smart money and analyze performance.

Hashdive(dot)com: Another powerful analytics platform. Each market page includes in-depth metrics, as well as a new “Insider” section to help you identify potential insider traders.

@polyburg: Tracking the movements of “smart money” before it goes mainstream on Polymarket.

@Polysights: Aggregates real-time and historical data and applies an AI/ML layer to generate advanced analytics, trends, arbitrage ideas, and alerts.

@whalewatchpoly: Real-time monitoring of large transactions and well-known wallets.