The man behind Hyperliquid was an apprentice at Binance Labs seven years ago.

- 核心观点:Hyperliquid创始人从币安孵化营学员成长为竞争对手。

- 关键要素:

- 2018年参与币安孵化营照片曝光。

- 曾创立预测市场项目Deaux理念超前。

- Hyperliquid日交易量达数十亿美元。

- 市场影响:推动去中心化交易所竞争与创新。

- 时效性标注:长期影响

Original author: David, TechFlow

What can change in 7 years?

In the crypto world, seven years can transform a young person standing in a group photo at Binance Labs’ incubator into a competitor that Binance has to take seriously.

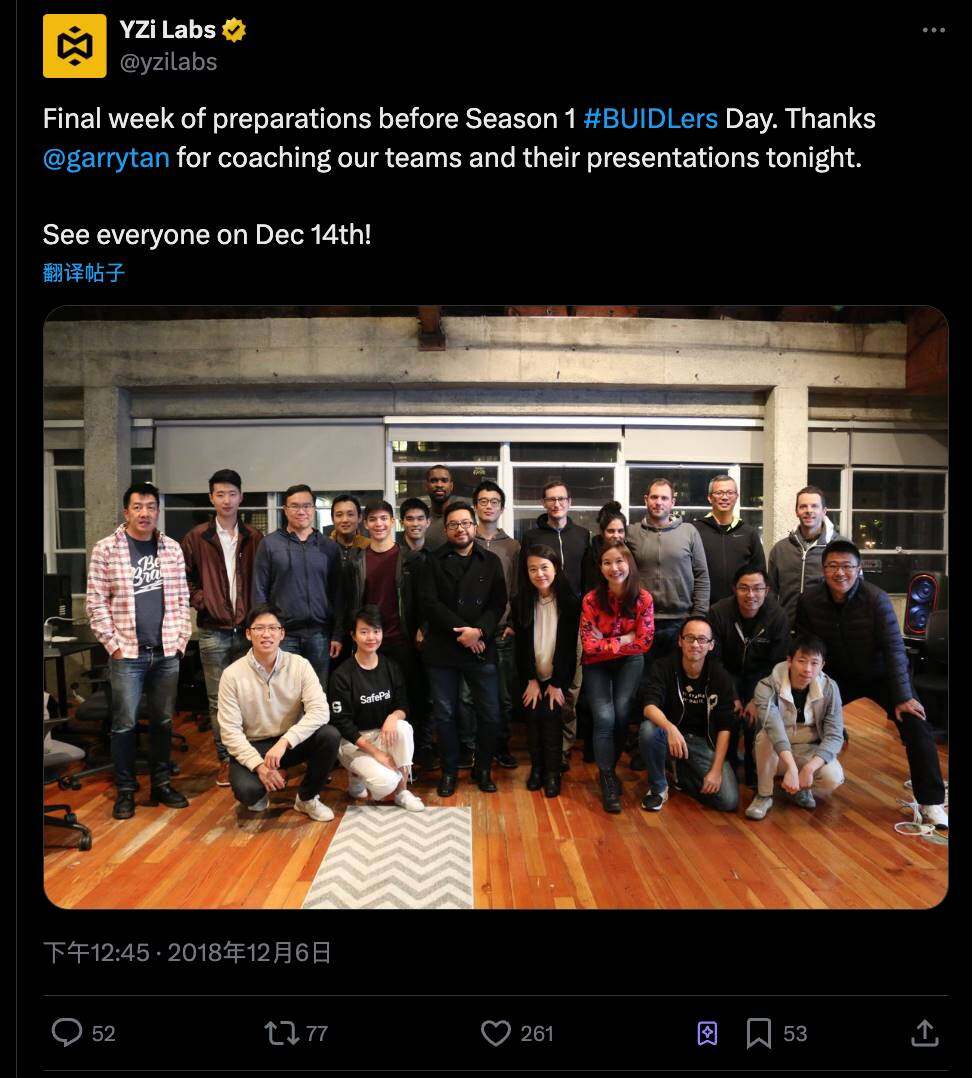

Recently, the following long-forgotten photo was suddenly unearthed, igniting heated discussions on social media.

Just looking at the photo, you might think it’s just an ordinary group photo released by YZi Labs (formerly Binance Lab) in 2018. The content probably shows that Garry Tan, the boss of the well-known venture capital incubator Y Combinator, was invited to give lectures and guidance to the founders of new projects in the BUIDLers incubation program.

The man in black clothes in the center of the picture is Garry, but the focus is on his back:

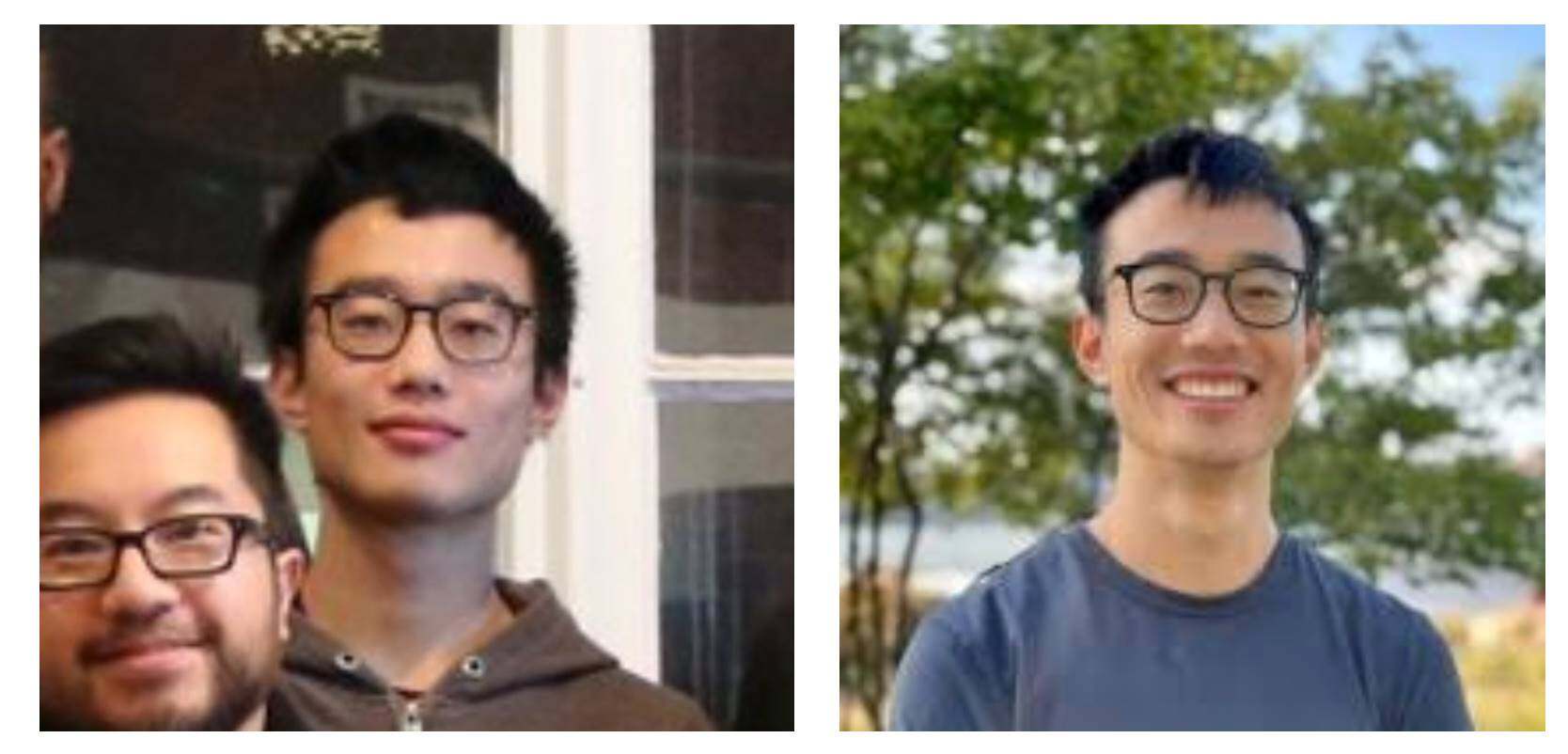

This young man, wearing glasses, a light-colored sweater, and a slightly youthful expression, looks remarkably like Jeff Yan, the current founder of Hyperliquid. If you zoom in on this photo and compare it to Jeff's recent public photos, the similarities are indeed striking.

Considering Hyperliquid's current position in the Perp DEX field, with daily trading volumes of billions of dollars, and to some extent becoming a direct competitor to Binance's contract business, the significance of this photo is more than just "archaeology".

The comment section quickly exploded.

Many people @ Jeff's account chameleon_jeff to ask if it was the same person. Some also pointed out that Binance may have inadvertently cultivated a competitor.

In any case, if the photo is true, then a technical founder who completed the transformation from an incubator learner to a giant challenger in 7 years is itself a sample worth analyzing.

In the early days of predicting the market, Jeff was ahead of many versions.

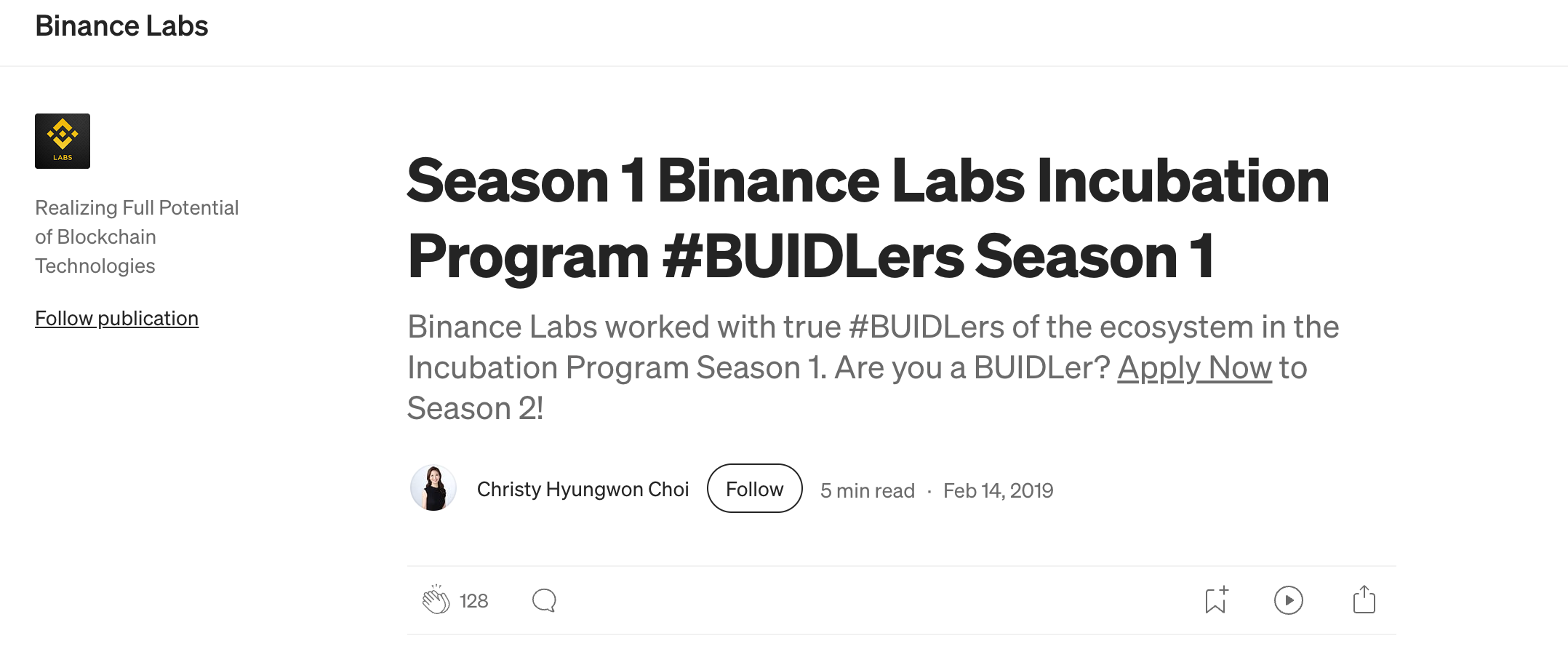

The archaeology of Jeff in the photo above is not groundless; more powerful evidence comes from the official records of Binance Labs.

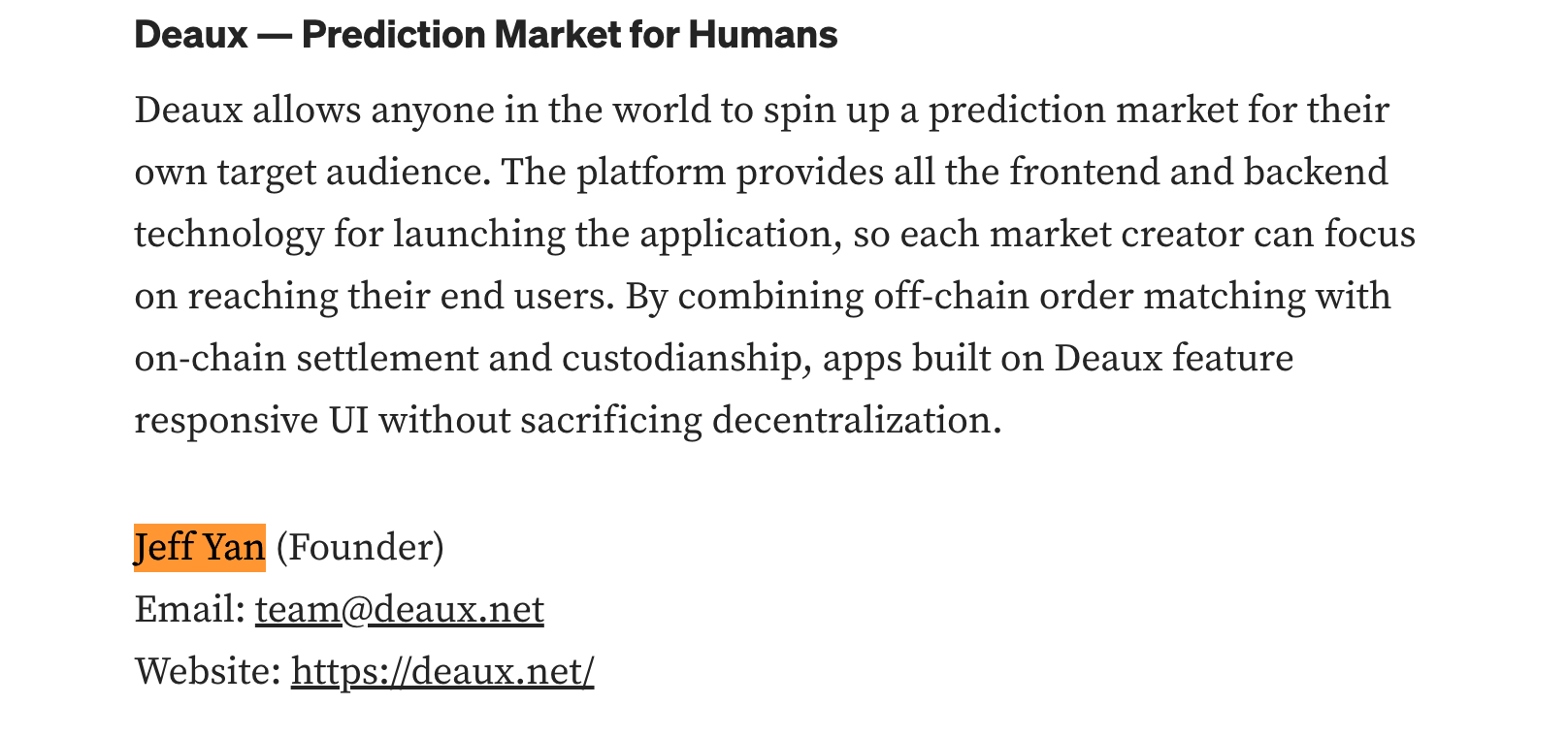

In the Medium article they published, a project called Deaux appeared in the list of Season 1 incubation projects in 2019, and its founder was Jeff Yan.

What is Deaux? Simply put, it is a decentralized prediction market platform .

From what was described at the time, what Deaux wanted to do was:

It allows anyone to create prediction events on-chain, and users can bet on these events, with prices determined by market supply and demand. It uses a hybrid architecture, with order matching completed off-chain and final settlement executed on-chain.

This design was already quite advanced in 2018, requiring both performance and decentralization, providing a cryptographic infrastructure for prediction markets.

Yes, this is what Polymarket is doing today. From this perspective, Jeff is indeed N versions ahead.

This isn't just hindsight. Based on publicly available information, Deaux's design philosophy focuses on hybrid on-chain and off-chain trading, high-performance order matching, and decentralized settlement, similar to today's Hyperliquid.

Jeff saw the right direction and designed a sound plan, but Deaux never took off. Its website is now defunct, and its social media accounts are still up in 2019.

The price of being ten steps ahead may be being born at the wrong time.

In 2018, the crypto market had just fallen from its bull run into a cold winter. Users were focused on when the price would rebound, rather than how to profit from on-chain prediction markets. More importantly, the crypto infrastructure at the time, including public chain performance, wallet experience, and user education, was still immature.

A product that requires frequent transactions and is sensitive to delays would find it difficult to provide a smooth experience under the technical conditions at the time.

But a project's failure doesn't necessarily mean failure. Around 2020, Jeff founded Chameleon Trading , the predecessor of Hyperliquid. Whether it's prediction markets or derivatives trading, it's essentially a game of "order matching + risk management."

This time, he set his sights on perpetual contract trading, a more mature market with more rigid demand and clearer users.

The timing was also perfect. FTX’s collapse in 2022 sent market trust in centralized exchanges plummeting to a freezing point, igniting demand for decentralized trading.

But Jeff did not take the old path of copying Uniswap or copying dYdX. Instead, he chose a more difficult but more thorough path and built his own L1 chain.

At the same time, it does not rely on external liquidity providers, but instead allows users to directly participate in market making through the HLP (Hyperliquid Liquidity Provider) mechanism. More radically, it adopts a zero-fee model and relies on token economics and ecological growth to support operations.

From Deaux to Hyperliquid, you can see the consistency of Jeff's projects: they are all on-chain/off-chain hybrids, high-performance order books, and decentralized settlements.

But this time, he chose the right track and the right time.

Invisible founder

Interestingly, despite the growing buzz about the photo on X, Jeff himself never commented on it.

Looking through Hyperliquid's Twitter account, you can hardly see Jeff's personal photos or life sharing, only product updates, technical documents, and the occasional meme;

Jeff's own account rarely touches on building his personal IP, but rather discusses product development, optimization, and market insights. His last tweet was on September 23rd.

This relatively low-key style doesn't seem to fit in with the crypto industry's emphasis on strong marketing and attention-grabbing. Most founders are keen on AMAs, podcasts, and conference appearances, turning their personal IP into part of the project.

Jeff, however, seems to be taking a different approach, focusing on code and products, using trading volume and user growth to address criticism. Perhaps this is one of the reasons he's been able to make it from the Binance Labs incubator to where he is today: he's not particularly concerned with external noise, focusing on building coherent products.

From apprentice to competitor

From an apprentice in the incubation camp in 2018 to becoming a leading player in the perpetual contract DEX in 2025, the reason why old photos of Jeff have caused discussion is simply because everyone is impressed by Jeff's persistence and that the projects incubated by Binance Labs at that time may now become their competitors.

From the perspective of the spectators, do you think Binance is nurturing a tiger to harm itself?

The crypto industry has always advocated marginal disruption and open innovation. The previous Binance Labs was more like an inclusive incubator that chose openness rather than control.

It may be easier to understand this by comparing the incubator to a martial arts gym:

A master teaches you kung fu, but doesn't require you to follow him forever. You can open your own studio, or even challenge your master. It's hard to call this a betrayal; it's more like a legacy.

If Binance Labs only invests in “non-competing” projects, or is worried that the founders of incubated projects will become bigger, can it still be called an incubator?

Therefore, incubators cannot demand loyalty.

On the other hand, Binance Labs may have invested in the right person, a founder with potential, even if the product this founder later creates competes with the parent company.

From a longer-term perspective, Binance, as an industry giant, is not just about its own profits, but also about driving prosperity for the entire crypto ecosystem. If Binance were to stop incubating new projects simply because it "might foster competitors," that would be truly short-sighted.

More importantly, competition may be good for the industry and players.

The rise of Hyperliquid has forced other exchanges to continuously improve product experience, fee structure, transparency and even wealth effects.

Users have more choices and can vote with their feet.

In a sense, what Jeff did is the same logic as when Binance challenged traditional exchanges:

Redefine what an exchange should be with better products. This time, the challenge shifts from Coinbase and Bitfinex to Binance itself.

So what can we learn from this melon-eating incident?

Perhaps the true revelation of this story lies not in the superficial drama of “Binance fostered a competitor,” but something deeper:

Knowledge can spread, talent can flow, competition can occur, and ideally everyone can benefit from the crypto ecosystem .