HIP-4 Proposal Interpretation: Is Hyperliquid Eyeing Prediction Markets?

- 核心观点:Hyperliquid提案进军预测市场。

- 关键要素:

- 技术复用性高,开发成本低。

- 用户群体与永续合约高度重叠。

- 需质押100万HYPE创建市场。

- 市场影响:拓展DEX边界,增加生态叙事。

- 时效性标注:中期影响。

Original author: David, TechFlow

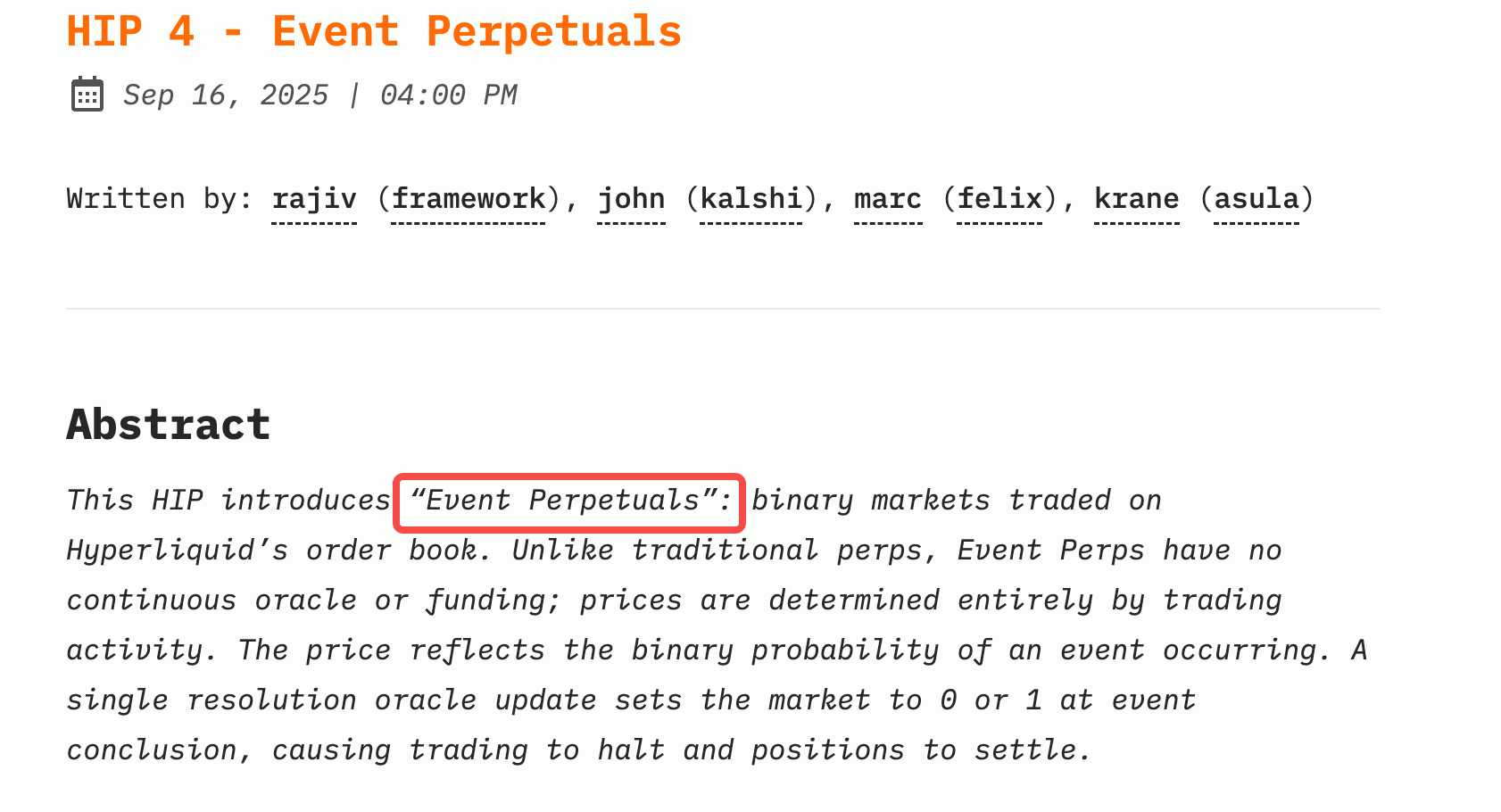

Yesterday, Hyperliquid released a new proposal , HIP-4.

Amidst the bombardment of various live-streaming coins and repurchase narratives, this proposal did not seem to spark much discussion in the crypto community; but after carefully reviewing the content of the proposal, we found that its content points to another hot narrative in the recent crypto market - the prediction market .

The core of the proposal is to launch a new type of transaction product called "Event Perpetuals" (event contracts).

In short, Hyperliquid wants to add binary prediction market functionality to its perpetual contract exchange. Users will be able to bet on events like "will the Federal Reserve raise interest rates?" and "will a certain token be listed on Binance this month?"

It is worth noting that the Hyperliquid proposal has an interesting lineup of authors: it includes investors from Framework Ventures, team members from the prediction market platform Kalshi , and developers from Felix Protocol and Asula Labs.

It is rare for competitors to participate in formulating plans. Kalshi itself is one of the major players in the US compliance prediction market.

This may suggest that Hyperliquid's prediction market business may not be aimed at disrupting existing players, but rather seeking some form of cooperation or differentiated positioning.

As the absolute leader in the perpetual contract market, Hyperliquid launched HIP-4 at this time. Is it because it sees the huge potential of the prediction market and wants to get a piece of the pie, or is it looking for new narrative support for the HYPE ecosystem?

Now it's a smooth business

The 2024 US election catapulted Polymarket to fame, with trading volume exceeding $3.6 billion. Entering 2025, prediction markets are even more of a darling for investors: Polymarket recently returned to the US market with its $1.12 billion acquisition of QCEX, and Kalshi partnered with Robinhood to launch a prediction market feature, with monthly trading volume consistently exceeding $800 million. Even traditional financial giants are eager to get involved.

Time magazine previously named Polymarket one of the “100 Most Influential Companies of 2025.” The reason is simple: prediction markets are redefining how information is discovered.

Faced with such market enthusiasm, would Hyperliquid not be tempted?

Although HIP-4 is currently just a proposal and still requires community voting and technical verification, judging from the level of detail of the proposal and the lineup of participants, it is clearly not a whim.

More importantly, this may be a "easy" business for Hyperliquid.

First, the technology is highly reusable.

Prediction markets and perpetual contracts share a high degree of technical similarity: both require order books, matching engines, and margin systems. For Hyperliquid, the development costs of adding Event Perpetuals are relatively low, and the trial-and-error costs are manageable. Even if the final results fall short of expectations, it will not significantly impact the core business.

Secondly, there is a natural overlap in user groups.

Traders of perpetual contracts and bettors in prediction markets are essentially speculators. They chase volatility, enjoy uncertainty, and are willing to bet on their own judgment. Hyperliquid already has a large number of such users, so why not provide them with more games to play?

Finally, the HYPE ecosystem needs new stories.

As one of the most successful DEXs of 2024, Hyperliquid's perpetual contract business is already quite mature. However, the capital market is always looking for growth, and the HYPE token needs more application scenarios to support its valuation. Prediction markets are not only a potentially promising business, but also a great story—it's sexy, imaginative, and relevant.

Rather than calling this a strategic transformation, it's more like a low-cost product line trial. If it works, it opens up a new market; if it doesn't, the original base remains.

HIP-4: A clever product extension

Let’s first understand a core question: Why can’t Hyperliquid simply add prediction markets to the existing system?

The proposal gives a vivid example: NFL game predictions.

Let's say the prediction question is "Will the Chiefs win the Super Bowl?" Using a traditional perpetual contract requires continuous oracle price feeds, with odds updated every three seconds. However, sports odds don't change continuously. After a single offensive or defensive possession, the odds can suddenly jump.

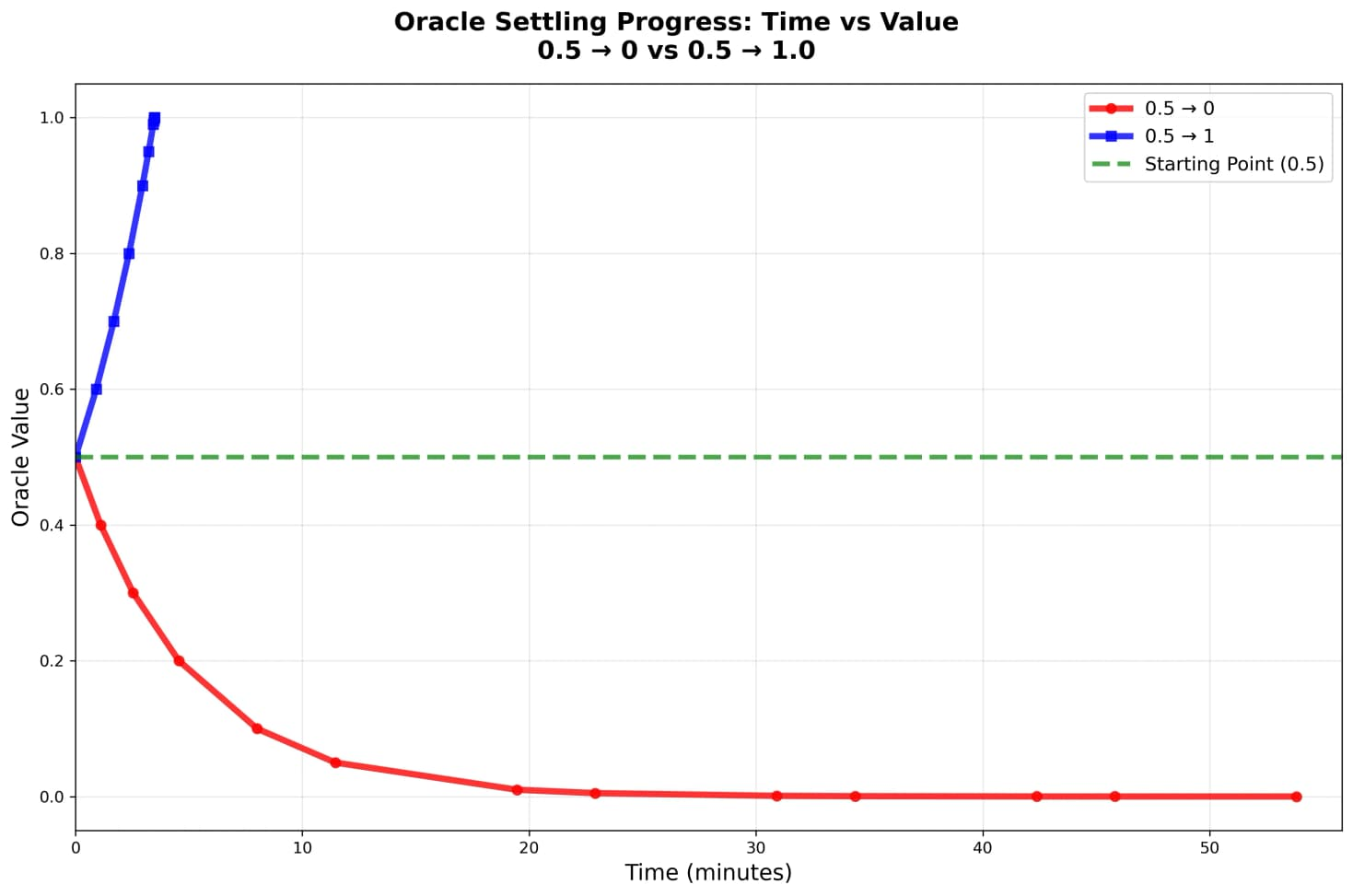

HIP-3 (Hyperliquid's existing market deployment specification) limits price fluctuations to a maximum of 1% per tick. This means that if the result of the competition is confirmed, it will take a full 50 minutes for the price to jump from 0.5 to 1.0.

During this period, traders who know the outcome can easily arbitrage.

This is why we need Event Perpetuals in the new HIP-4 proposal.

Event Perpetuals eliminates two core mechanisms of perpetual contracts: continuous oracles and funding rates. Prices are determined entirely by market transactions, with the final outcome (0 or 1) determined only at the end of the event via an oracle.

Interesting designs include:

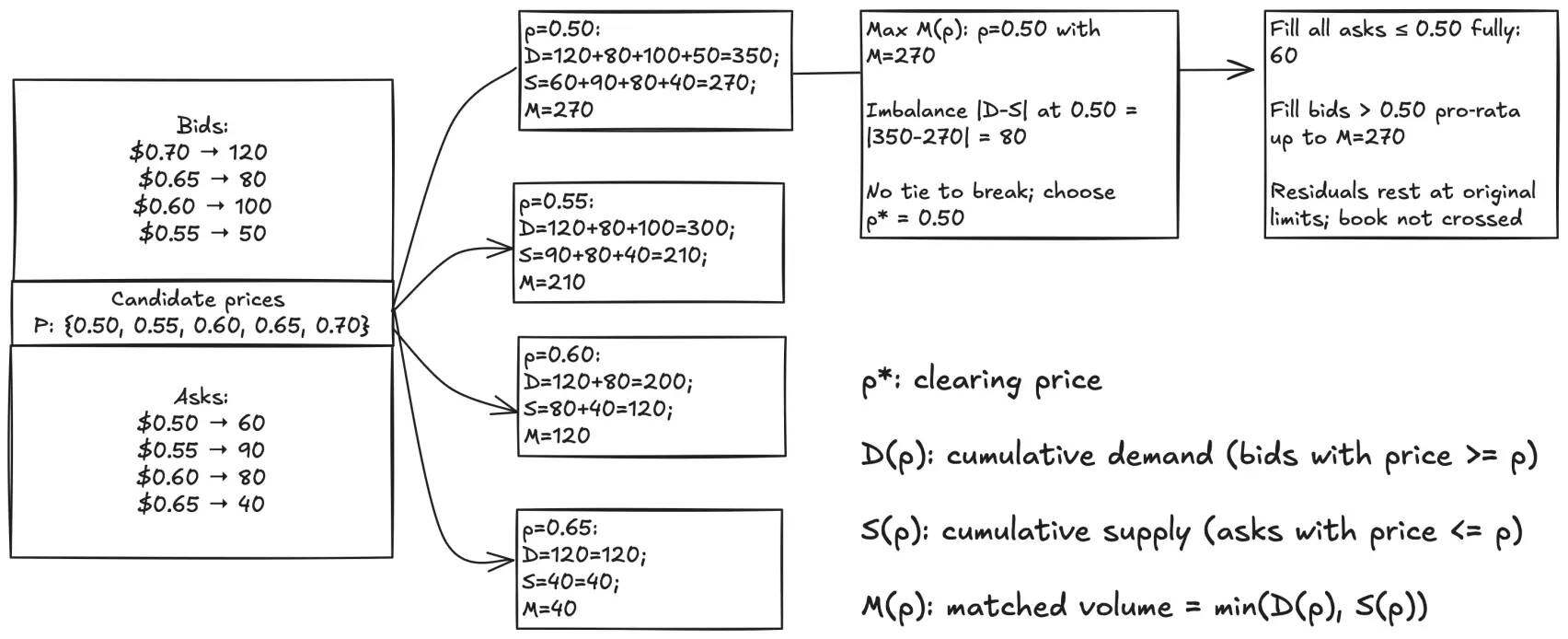

- Opening auction mechanism : 15-minute call auction to avoid initial price confusion

- 1x isolated margin : no leverage, reducing the risk of liquidation

- Slot reuse : New markets can be deployed immediately after market settlement, improving capital efficiency

On the surface, this is a technological innovation; in essence, this may be a business exploration that Hyperliquid wants to make.

The move from a single product to a product matrix is clear. Perpetual contracts, no matter how successful they are, are still just one product. If Event Perpetuals succeeds, Hyperliquid's infrastructure will be able to support a wider range of financial products:

Today it is the prediction market, tomorrow it may be options, and the day after tomorrow it may be structured products.

More importantly, Hyperliquid chose a smart way to expand: letting others create the market.

According to the proposal, any team that wants to create a prediction market on Hyperliquid (referred to as a "Builder" in the proposal) will need to stake 1 million HYPE tokens. These Builders are responsible for:

- Deciding what market to create (e.g., "Will Trump buy Bitcoin?")

- Set market parameters (settlement time, oracle source, etc.)

- Maintain market operations (provide initial liquidity, promotion, etc.)

In return, the Builder can earn up to 50% of the transaction fees in the market.

This design is ingenious. Hyperliquid doesn't need to determine which prediction markets will be popular; instead, the market decides. Teams willing to stake one million HYPE will naturally carefully choose markets with potential liquidity. If a Builder's market falls short, the Builder loses the opportunity cost; if the market takes off, both Hyperliquid and the Builder win.

This also explains why someone from the Kalshi team participated in the writing of the HIP-4 proposal.

They may be exactly the kind of professional builders Hyperliquid is looking to attract. Kalshi has extensive experience operating markets and understands what kind of prediction markets are liquid. If they are willing to join Hyperliquid to create a market, they will bring not only a market but also a complete set of proven operational methodologies.

For a DEX with a TVL of over $2 billion, this trial-and-error model is quite smart.

Challenges and opportunities

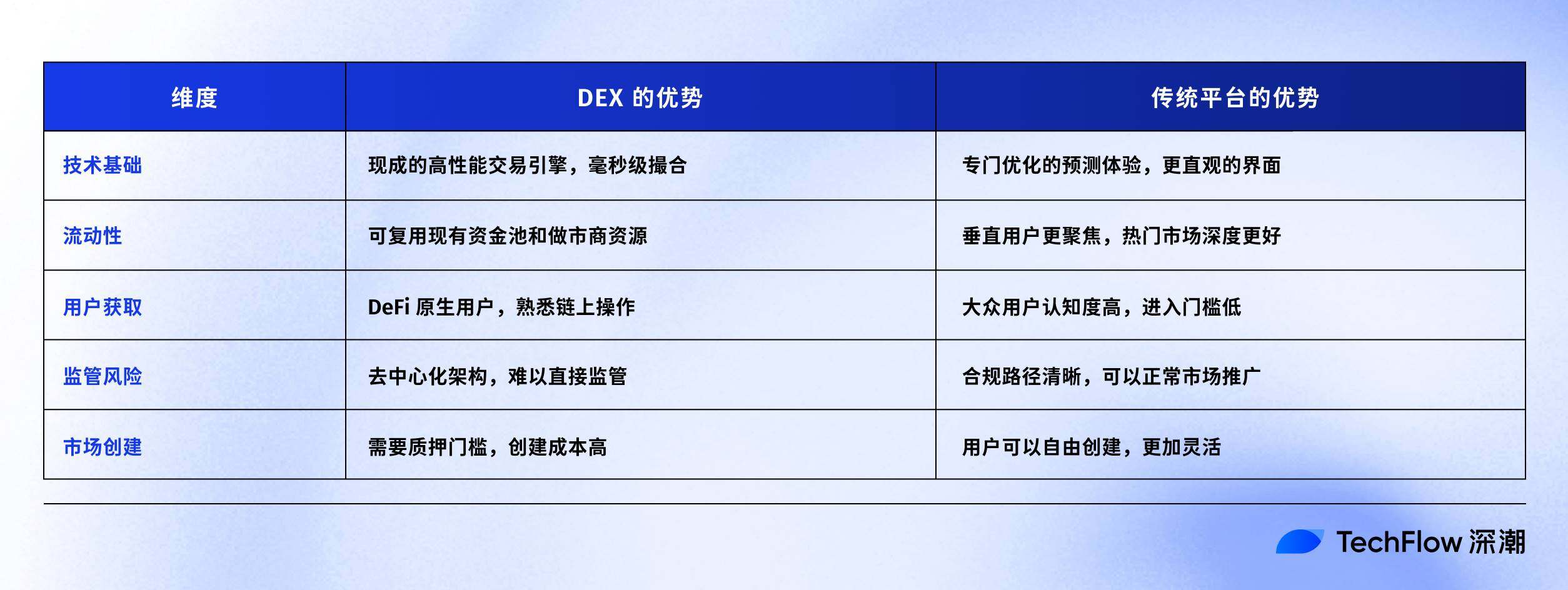

In theory, it seems natural for DEX to run prediction markets.

The technical architecture is highly reusable. The order book, matching engine, settlement system, margin management, and other core components of a perpetual contract DEX are also required for prediction markets.

But the reality may not be that simple.

The vitality of the prediction market comes from the diverse markets created by users.

On Polymarket, any user can create a market. This UGC model allows the platform to always remain fresh and topical.

Hyperliquid's HIP-4 proposal requires a 1 million HYPE stake to create a market. At current prices, this is equivalent to a multi-million dollar threshold. While this can ensure market quality and prevent the proliferation of junk markets, it can also stifle innovation and diversity.

Another challenge is the fragmentation of liquidity.

Perpetual contracts can share liquidity, and the depth of the ETH/USD exchange rate can support all ETH-related transactions. However, prediction markets cannot do this, as each event has its own independent funding pool.

This means that even if Hyperliquid has $2 billion in TVL, after being dispersed across hundreds or thousands of prediction markets, the depth of each market may be very limited. Shallow liquidity will lead to excessive slippage and a degraded user experience.

In addition, when users see Polymarket and Kalshi, they know that they are prediction markets. Hyperliquid is still mentally positioned as a sustainable DEX in the crypto world. If the proposal is implemented, subsequent user education and promotion will be the key.

So, where are the opportunities for Hyperliquid?

Certain predictions focused on specific crypto verticals may offer the most realistic path. For example, whether a token will be listed on a major CEX this month, or whether a key Ethereum upgrade will be delayed...

In these markets, Hyperliquid users are more knowledgeable, more interested, and more willing to bet than Polymarket users.

Is this good news for $HYPE?

In the short term, the impact may be limited.

First, this is just a proposal and hasn't been officially implemented yet. Even if it passes the vote, it will take at least several months from development to launch and then to generating actual revenue. There may be some market speculation, but it's unlikely to generate sustained price support.

Secondly, the scale of prediction market revenue is uncertain. Even if Hyperliquid were to capture 10% of Polymarket's market share (a monthly trading volume of $80 million), based on the typical DEX fee rate of 0.1%, monthly revenue would only be $80,000. For a project with a multi-billion dollar market capitalization, this incremental revenue is negligible.

But in the medium and long term, the significance may go beyond the financial aspect itself.

First, the increase in pledge demand.

If HIP-4 successfully attracts 10-20 builders to create the market, it means that 10-20 million HYPE will be locked. Although this is not much relative to the total supply, it is a real reduction in circulation.

More importantly, this demonstrates the value of HYPE as a “license” – holding HYPE not only allows participation in governance but also access to business opportunities.

Second, expand brand value.

If a professional team like Kalshi is truly willing to stake HYPE to create a market, it sends a strong signal: the professional prediction market brand recognizes Hyperliquid's future. This endorsement effect may be more valuable than direct revenue contribution.

The crypto market is never short of money; what it lacks is storytelling. The story of perpetual contract DEXs has already been told. If they can successfully enter the prediction market, every additional possibility will add another variable to the valuation model.

Exploring the boundaries of DEX

The author believes that the interesting thing about the HIP-4 proposal lies in an interesting trend: DEX is testing its own boundaries.

From simple token swaps to perpetual contracts, and now to possible prediction markets, you can see that successful DEXs are always actively expanding, turning convenient businesses into a means to increase their valuations and business.

Moreover, this expansion is unlike the popular crypto projects that rush to publicize any changes with a good news announcement to attract attention. Instead, it is more like a low-key test of the boundaries of technology, user acceptance, and regulatory tolerance.

For those who follow Hyperliquid, the best approach is not to over-interpret a single proposal, but to pay attention to the trends behind the proposal.

HIP-4 itself may succeed or fail, but the direction it represents, such as the platformization, ecosystemization, and integration of DEX, is likely the future direction. Projects that successfully expand their boundaries will receive higher valuation multiples, while those that remain complacent will gradually be marginalized.

As for whether Hyperliquid can get a share of the prediction market with Event Perpetuals?

Let the market answer. After all, this itself is a prediction worth betting on.