The Second Half of the BTC Ecosystem Competition: Who is the Optimal Solution for Value Carrying?

- 核心观点:BTC L2技术路径多样,生态繁荣尚早。

- 关键要素:

- 闪电网络TVL超4000 BTC。

- 雷电网络用户近5万。

- BitVM实现链上图灵计算。

- 市场影响:推动BTC资产流动性和应用创新。

- 时效性标注:中期影响。

By Evan Lu, Waterdrip Capital

From the Ordinals protocol's popularity in 2023, which sparked the rapid development of the Bitcoin ecosystem, to the present day, the Bitcoin ecosystem has, in just a year and a half, completed the evolutionary path that Ethereum took years to complete. By the end of Q1 of this year, the 1.0 cycle of the Bitcoin ecosystem had gradually come to an end. Bitcoin's price, reversing its previous summer slump, has broken through $110,000 and $120,000 per coin, reaching new all-time highs. However, the market performance of Bitcoin-related tokens on exchanges has been less than satisfactory. However, a single year is inherently insufficient for a technology to progress from conception to development, implementation, and widespread adoption. This is even more crucial than implementing new technologies on Bitcoin, the largest store of value network.

Observing the different technical paths of the Bitcoin ecosystem reveals that we are still in its developmental phase. True prosperity for the Bitcoin ecosystem is still far from here. Therefore, the debate over the Bitcoin L2 path has only just begun.

BTC Ecosystem 1.0 and 2.0

Since Bitcoin is widely recognized as "digital gold," why is there still a need to promote the development of the Bitcoin ecosystem? This is because the Bitcoin network's extremely simplified scripting language, coupled with the PoW consensus mechanism, ensures extremely high security and decentralization; however, this also limits Bitcoin's scalability and programmability. As the underlying anchor asset of the entire crypto industry, Bitcoin actually has a significant amount of value that has yet to be fully realized. Imagine if only 10% of Bitcoin (approximately 2.1 million coins) were used in DeFi. At $100,000 per coin, a whopping $210 billion in asset liquidity would be released!

From the perspective of ecological composition, the BTC ecosystem can be divided into the infrastructure layer (L2) and the upper-layer financial protocol (BTCFi); the following will mainly focus on the interpretation and comparison of the BTC infrastructure technology path.

In the 1.0 era of the Bitcoin ecosystem, a defining characteristic was a "TVL-first" approach—first transferring Bitcoin to the Layer 2 network through an asset bridge or custodian, then deploying DeFi protocols on Layer 2 to activate Bitcoin's liquidity. This approach was also employed by early Ethereum sidechains, most notably Polygon. This approach was highly user-friendly for crypto users who had come from the Ethereum era. The underlying logic was essentially the EVM's Layer 2, but with the Bitcoin network as the underlying layer. This technical approach allowed for rapid accumulation of funds and a user base. However, its drawback was also significant: the security of Bitcoin assets could not be guaranteed.

The 2.0 era of the Bitcoin ecosystem returns to fundamental technological innovation: achieving breakthroughs in security, efficiency, and native compatibility. From the mainnet launch of the Raiden Network to the active advancement of technologies like ZK Rollup, RGB, and BitVM, we're seeing more and more projects exploring how native assets on the blockchain can be more secure, efficient, and natively generated and transferred on Layer 2. For developers, this presents a new opportunity for innovation; for VCs, it marks a significant turning point in the Bitcoin ecosystem's transition from a valuation-driven approach to a product-market fit (PMF)-driven approach.

A Panoramic Comparison of BTC L2 Technical Paths

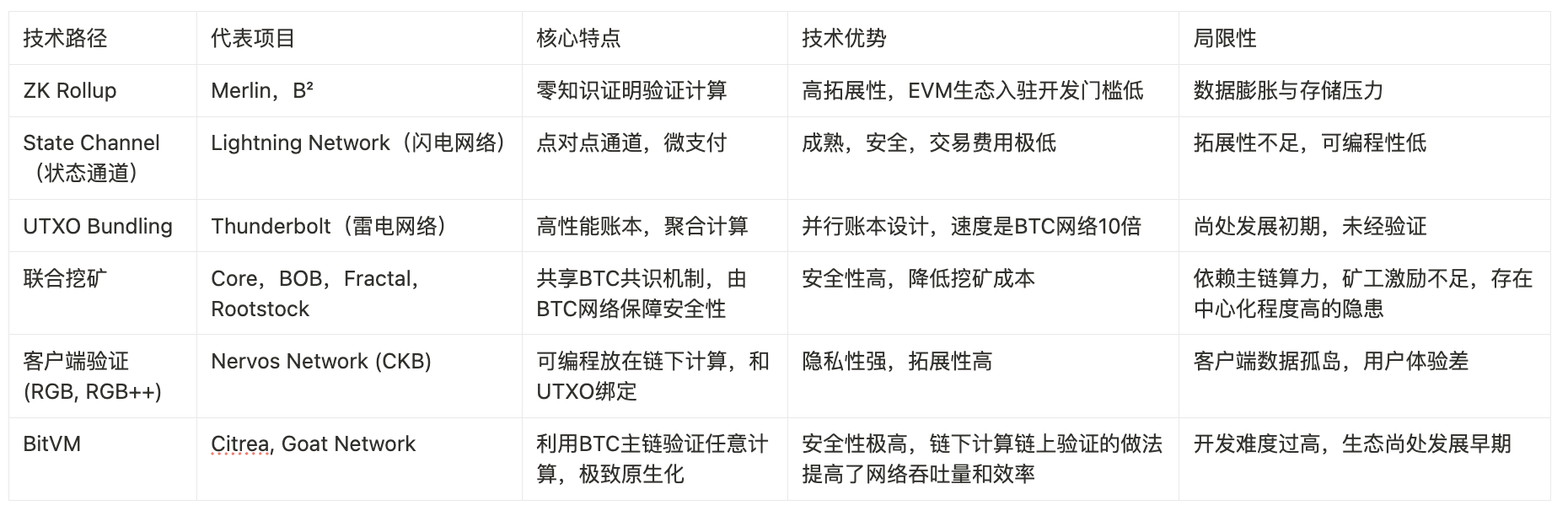

The existing technology stack can be categorized into several technical paths, as shown in the table below. However, a deeper dive into each technical path and the projects it represents reveals that even different technical paths often share common solutions, and that different technologies and stacks can have a parent-child relationship.

Comparison of different technical paths for BTC L2. Data source: https://worried-eagle-e5b.notion.site/BTC-21b34b2a8d7a80cb83c1d0021e3a5696

Based on the six well-known technical paths, this table selects 15 BTC L2s and compares their TVL data with the technical solutions they have adopted through data visualization:

Overview of BTC L2 development, data source: https://worried-eagle-e 5 b.notion.site/BTC-21b34b2a8d7a80cb83c1d0021e3a5696

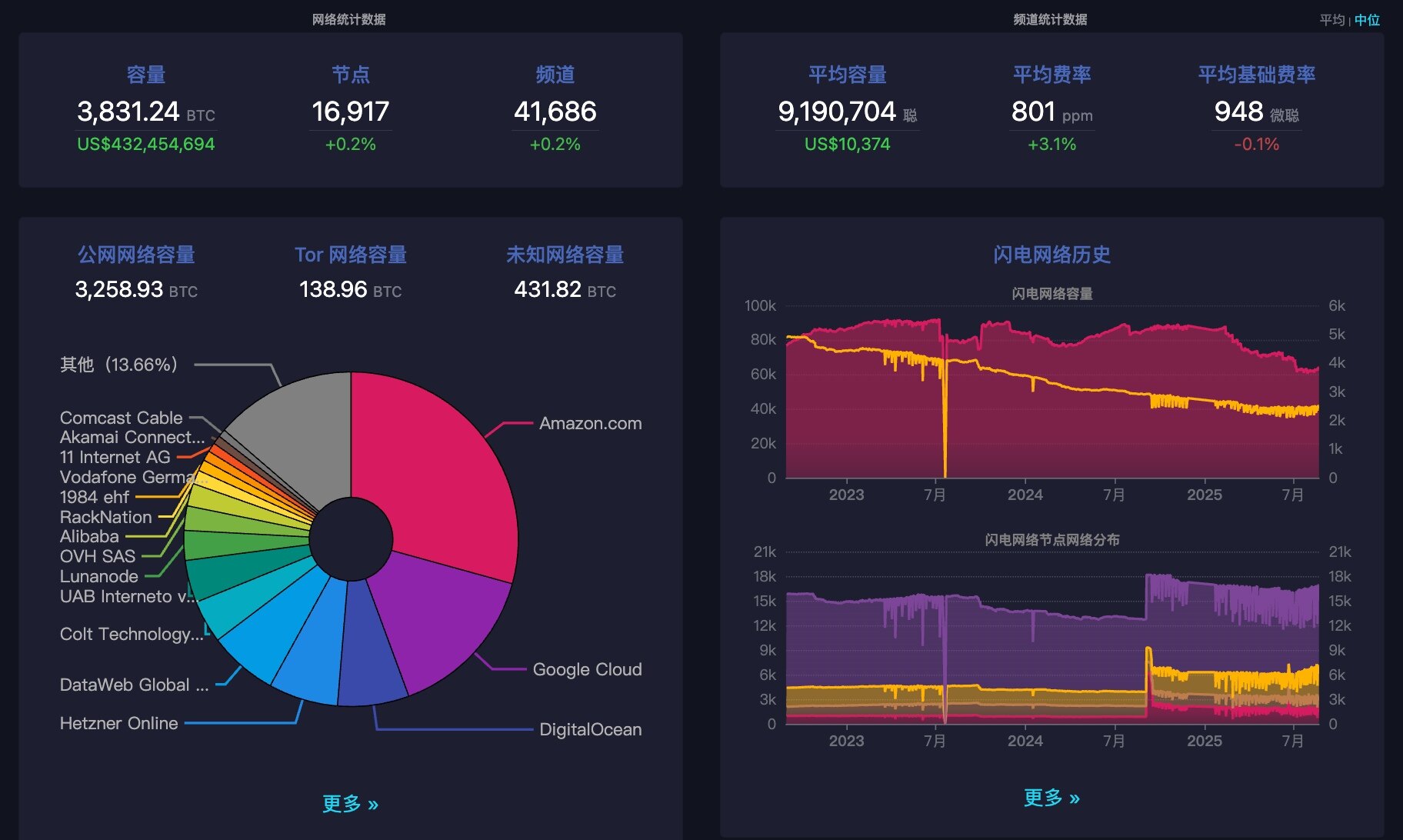

As can be seen, the TVL of most L2 platforms has dropped significantly due to market influence. Furthermore, while the TVL of the Lightning Network has increased compared to last year, the amount of BTC locked in the Lightning Network has undoubtedly decreased compared to last year's amount of BTC.

Overview of different technical paths for BTC L2

BTC's most orthodox L2 solution: Lightning Network

Arguably one of the earliest L2s on BTC, it involves users creating a 2-of-2 multi-signature address on-chain, establishing a bidirectional payment channel. This channel is secured on the main chain using a hashed timelock contract (HTLC) to ensure that, after multiple off-chain interactions, the transaction is securely settled on the main chain with the latest state. Throughout this process, only the two transactions—opening and closing the channel—are written to the main chain, while a large number of intermediate transactions are completed off-chain, significantly saving block space and improving efficiency.

However, the early Lightning Network only supported BTC as a payment currency, significantly limiting its application scenarios. To address this, Lightning Labs launched the Taproot Assets protocol (TA protocol), which supports the issuance of native assets on the BTC network while maintaining seamless compatibility with the Lightning Network. The TA protocol, based on BTC's UTXO model and the 2021 Taproot upgrade, records asset status using a sparse Merkle tree (MS-SMT) structure, writing only the root hash of transaction data to the chain, ensuring a clean data structure on the Bitcoin mainchain. TA assets can also be embedded in Lightning Network channels for rapid transfer, enabling the concept of "stablecoins circulating on the Bitcoin network."

In addition, not only stablecoins, but also RWA assets and project tokens can be issued on BTC. The BTC multi-asset trading network will be truly built with the introduction of the TA protocol.

Development Progress

As of June 2025, the Lightning Network will have been online for 10 years and is operating stably, with over 16,000 nodes and 41,000 active channels. Last year, when BTC broke $100,000 per coin, the total locked-up capacity exceeded 5,000 BTC. Today, it remains close to 4,000 BTC.

An overview of Lightning Network data, source: https://mempool.space/zh/lightning

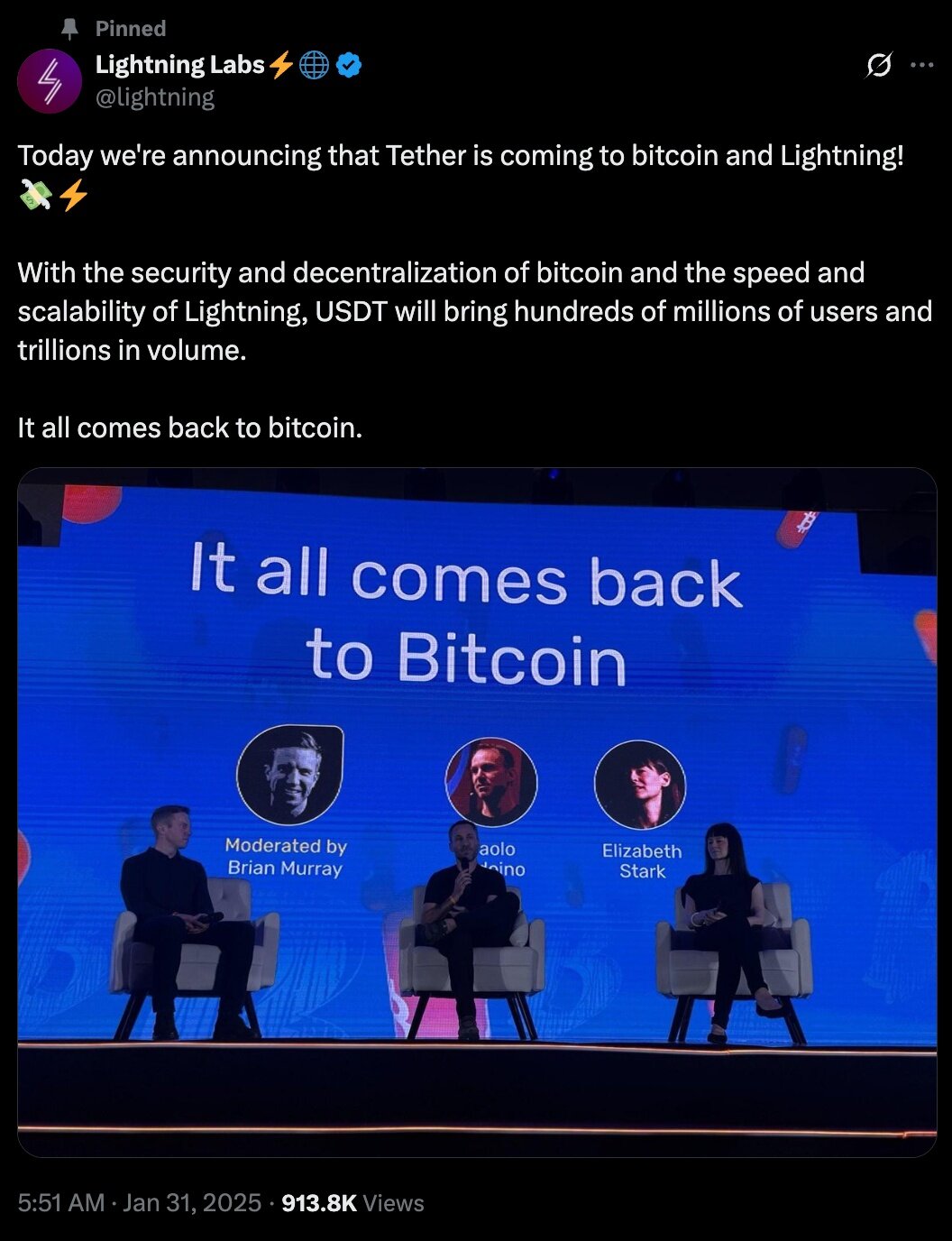

In Q1 this year, Tether, the company behind USDT, announced that it would issue USDT through the TA protocol to enter the Lightning Network ecosystem, which means Tether's recognition of the Lightning Network.

Lightning Lab (parent company of Lightning Network) announced that Tether has been connected to the Lightning Network. Data source: https://x.com/lightning/status/1885083485678805424

Furthermore, an ecosystem based on the Lightning Network is gradually taking shape. For example, the financial infrastructure protocol Lnfi aims to become the preferred platform for BTC and Taproot assets, covering the entire asset issuance, fundraising, revenue generation, and trading process. Its core product, LN Exchange, boasts a daily trading volume of $30 million, and LN Node offers over 5% trustless BTC returns. Lnfi recently joined forces with Tether and Lightning Labs at X Space to discuss the opportunities and challenges of issuing stablecoins on the Lightning Network.

X Space of USDT ON LIGHTNING, data source: https://x.com/i/spaces/1 vOxwXmjVbRKB

Furthermore, "AI Agent + Micropayments" is gradually building a new payment system, leveraging the security of the BTC network. AIsa is a prime example. Its principle leverages the millisecond-level response time of the Lightning Network and the robust security of the BTC network to address the massive microtransactions that traditional systems struggle to support. It provides AI service providers and enterprises with real-time, efficient, and affordable payment capabilities. AIsa supports operations such as automatic micropayments of just $0.0001 per API call, real-time settlement via DePIN nodes, and intelligent cross-chain path optimization, all with minimal human intervention.

Limitations and Challenges

While the Lightning Network has matured significantly in recent years, its scalability remains limited by network effects and channel design, resulting in limited network capacity. While the TA protocol addresses this shortcoming at the asset layer, its requirement for users to build their own nodes for security raises the barrier to entry, and product refinement remains a work in progress.

For example, BitTap offers users of the TA protocol the ability to self-host their wallets. Focused on addressing decentralization and usability issues within the Lightning Network and TA ecosystem, BitTap has launched a decentralized browser plugin wallet and will soon be launching a stablecoin payment wallet app. Users can make payments and transfers with stablecoins on both the Lightning Network and TA layers, while also supporting secure and free cross-layer transfers (Bridge) between the Lightning Network and TA layers.

Bitcoin Thunderbolt: native ledger expansion

Just last month, the Raiden Network officially launched its mainnet. This was also announced in an official press release from HSBC. This marked the first time that a leading authority in traditional finance has expressed positive interest in and recognized blockchain infrastructure, particularly Bitcoin.

Strictly speaking, the Raiden Network is not a traditional BTC L2, but rather a native ledger expansion solution based on a soft-fork compatible with the BTC mainnet. Its core technology lies in expanding the OP_CAT instruction of the BTC scripting language and combining it with UTXO bundling technology to achieve high-performance contract execution.

Similarities and differences with Lightning Network:

Unlike the Lightning Network, which requires constant open payment channels for off-chain interactions, the Raiden Network employs a decentralized, asynchronous design, enabling off-chain UTXO ownership transfers between users without the need for direct trust or persistent connections. Key to this is the introduction of a Byzantine Fault Tolerant (BFT) committee to manage Schnorr signatures, enabling off-chain delegation of asset ownership and on-chain finality. Under the 3f+1 model, this mechanism can tolerate up to f malicious nodes, ensuring transaction security and consistency even in an asynchronous network.

Furthermore, through UTXO bundling technology, the Raiden Network can aggregate multiple UTXOs, achieving transaction speeds and efficiency over 10 times that of the BTC network. Regarding asset protocols, the Raiden Network proposed Goldinal's unified standard for BTC's layer-one assets. Combined with its BitMM (Bitcoin Message Market) system, this system implements a native on-chain AMM on the BTC network.

The Raiden Network utilizes a verifiable and adaptable signature component to implement a recursive off-chain UTXO transfer structure, operating through native Bitcoin Core logic. This acceleration mechanism, built from the mainchain architecture, not only maintains Bitcoin's security and censorship resistance but also supports the transfer of native Bitcoin assets such as BRC-20 and Runes.

Development Progress

The Raiden Network is jointly promoted by some OG miners, HSBC Bank, BTC core developers, and Nubit community contributors. It is one of the few protocols in the current BTC technology stack with formal academic endorsement.

Currently, access to the Raiden Network is limited to users who have obtained a Boosting Code. This code is distributed in limited quantities by core contributors such as Nubit through the community, and comes with a rare BTC native airdrop reward.

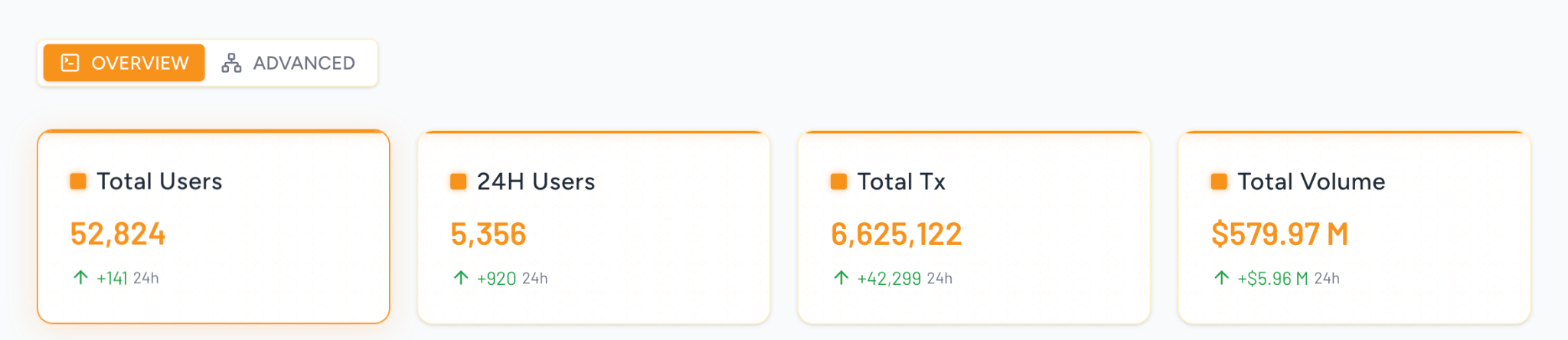

As of mid-June, the Raiden Network mainnet has nearly 50,000 users and a total transaction volume of nearly 4 million:

Overview of Raiden Network on-chain data, data source: https://data.thunderbolt.lt/?new

Limitations and Challenges

The Raiden Network's technology stack offers a glimpse into another possible implementation of BTC L2. As the mainnet hasn't yet launched, its product's PMF still requires market validation. Furthermore, while the BFT committee model offers superior security compared to traditional bridging solutions, its widespread acceptance within Bitcoin's ultra-decentralized community remains a question mark.

Merged Mining

Merged mining is a technology that allows miners to mine for multiple blockchains simultaneously without consuming additional computing resources. Stacks and Fractal are two representative projects that utilize this mechanism, but they employ different solutions for consensus and block verification. Stacks utilizes a unique Proof of Transfer (PoX) consensus mechanism. In this mechanism, Stacks miners bid for the right to generate a Stacks block by submitting BTC on the BTC mainnet. The successful miner receives the block inclusion privilege and the corresponding mining rewards.

Bitflow is a decentralized exchange (DEX) based on the Stacks mainnet, supporting trading of BTC, Stacks tokens, BRC20, Runes, and other BTC-native assets. Furthermore, in December 2024, Bitflow launched the Stacks-based Bitcoin Rune automated market maker (AMM), the first Rune AMM on BTC L2.

Core, based on merged-mining, has slightly improved its consensus mechanism: called Satoshi Plus, Core's consensus mechanism combines delegated proof-of-work (DPoW) and delegated proof-of-stake (DPoS). Bitcoin miners delegate their computing power to validators on the Core chain, leveraging Bitcoin's robust mining infrastructure to provide security for the Core chain. This computing power, known as "delegated proof-of-work (DPoW)," is performed by Bitcoin miners and mining pools. Meanwhile, CORE token holders can stake or delegate their tokens to validators, participating in the network's security and governance. This stake is known as "delegated proof-of-stake (DPoS)." Through this combination, Core Chain integrates Bitcoin miners into the security of Turing-complete smart contracts, unlocking functionality and utility beyond simply maintaining the Bitcoin ledger and providing them with purely supplemental income rewards in the form of CORE tokens.

Fractal, on the other hand, is pursuing a scaling solution. Its technical principle is to employ a recursive scaling structure, creating multiple independently operating extension layers on the BTC mainnet, forming a tree-like structure to improve transaction processing capacity and speed. Furthermore, while retaining the PoW mechanism, Fractal introduces a hybrid mining mechanism called "Cadence Mining." For every three blocks produced, two are generated through permissionless mining, while the remaining one is generated through Bitcoin's merged mining.

Fractal Bitcoin has also re-enabled the OP_CAT opcode, an instruction that existed in earlier versions of Bitcoin but had long been disabled. OP_CAT concatenates two strings into one. Theoretically, a script using OP_CAT could expand a single byte of data into over a terabyte. Without strict limits, this unlimited expansion could be exploited by malicious actors to launch DoS attacks, bringing down nodes or causing network congestion. For this reason, OP_CAT was disabled by the community early on. The "cleaned" version of OP_CAT adopted by Fractal now offers developers more flexible script processing, showing particular promise in on-chain large integer calculations and smart contract functionality. Despite technical improvements, the re-enablement of OP_CAT could still pose security risks in extreme scenarios.

Development status:

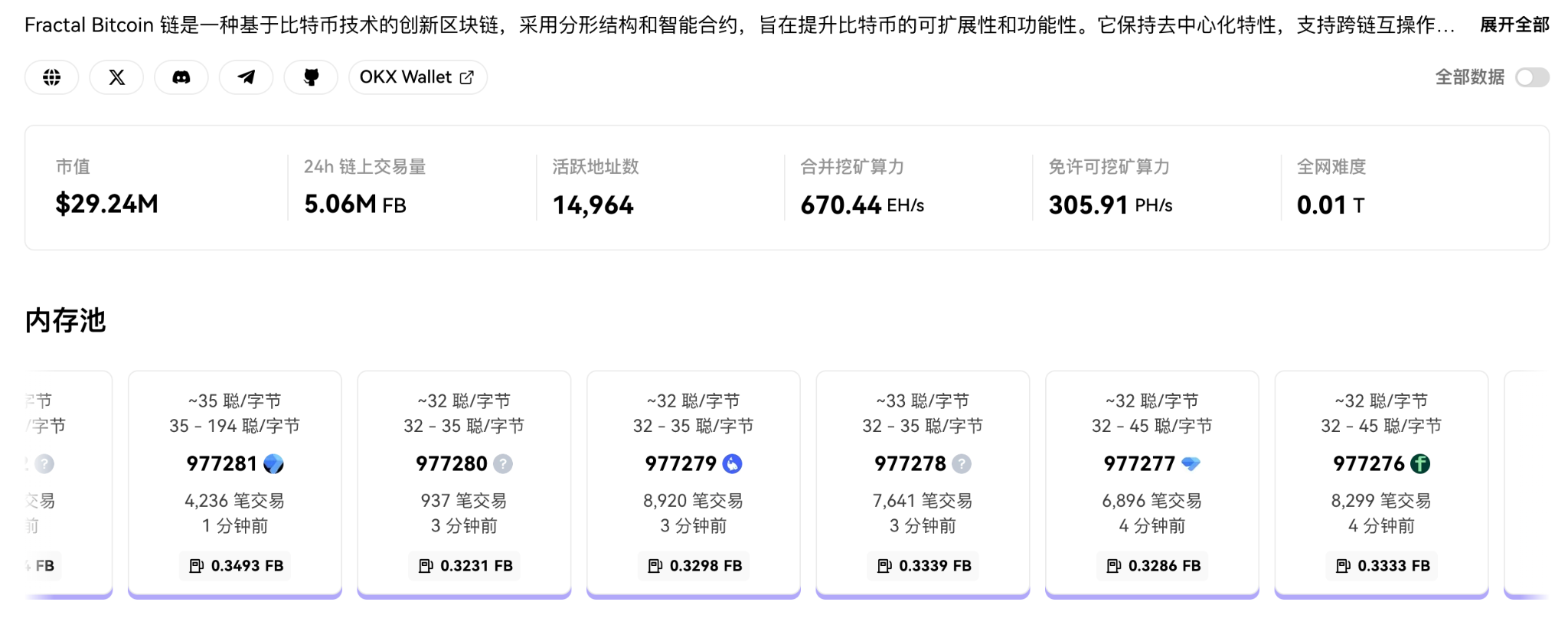

Fractal Bitcoin has already begun to take shape, with a market capitalization of approximately $20.12 million, a daily trading volume of 1.43 million FB, and over 1.76 million active addresses. Its combined mining hashrate reaches 648.13 EH/s. With a mining difficulty of 0.01 t, it's still in its early stages.

Fractal on-chain data overview, data source: https://www.oklink.com/fractal-bitcoin

RGB & RGB++

In the early morning of August 7, 2025, the BTC extension solution RGB protocol, which had been preheated for two years, was finally launched on the BTC mainnet.

RGB, originating from a technical architecture proposed by the LP/BNP Association, is an off-chain asset issuance and smart contract protocol based on the UTXO model of the Bitcoin network. One of RGB's most highly regarded technical features is that data running on RGB is compressed and encapsulated into each UTXO on the Bitcoin network. Through "single-use seals" and "client-side validation" mechanisms, private changes and verification of asset status are achieved. Each asset status is bound to a specific Bitcoin UTXO, and when that UTXO is spent, the asset status is updated accordingly. This design eliminates the need to publicly disclose asset ownership and status changes on-chain, enhancing privacy. The RGB protocol is also compatible with the Lightning Network and has the ability to build DeFi logic.

RGB version 0.12 is now available. Data source: https://x.com/lnp_bp/status/1943318227854950809

Bitlight Labs: The first wallet to support RGB assets, an official member of the RGB Association

Bitlight Labs is committed to leading the original BTC Fi by developing native smart contract infrastructure for BTC and the Lightning Network. Furthermore, Bitlight Labs is not only a board member of the RGB protocol standard development association (INP/BP), but also a core contributor to the development of the RGB protocol, making it an indispensable core product of the RGB ecosystem.

Bitlight Labs' product, the Bitlight Wallet, is a wallet specifically designed for the Lightning Network and RGB protocol. Recently, in conjunction with the official launch of the RGB mainnet, the company launched the first RGB mainnet-based asset token, "RGB," forging.

BitMask Wallet:

Bitmask was the first wallet to support NFT assets on the RGB protocol. The team behind Bitmask was one of the most significant early contributors to the protocol, focusing its product development on privacy and user control. Recently, BitMask has been working on achieving full interoperability between RGB and RGB++ and is currently preparing for the mainnet launch, aiming to truly achieve a perfect combination of privacy, programmability, and ease of use on the Bitcoin network.

From RGB to RGB++:

Nervos (CKB) is a popular project that implements BTC L2 using RGB logic and, building upon RGB, has proposed the concept of RGB++. RGB++ introduces "isomorphic binding" technology, mapping BTC UTXOs to Nervos CKB cells. Leveraging CKB's Turing-complete smart contract capabilities and on-chain verification mechanisms, it improves the efficiency and security of asset status management. In RGB++, asset status changes are not only recorded on the BTC chain, but also accompanied by corresponding transactions and status verification on the CKB chain, achieving collaborative on-chain and off-chain verification.

Although RGB++ has achieved asset mapping between BTC and CKB, cross-chain interaction based on the characteristics of the RGB protocol is still not concise enough when processing some specific transactions, posing security risks.

Following the ETH L2 idea: ZK-Rollup

The core of Rollup is to package a large number of off-chain transactions to generate a cryptographic proof (Proof), and submit it to the main chain for verification using ZK technology.

One of the most popular BTC L2

Merlin is a Bitcoin Layer 2 network that continues this philosophy. It is also an EVM-compatible Bitcoin Layer 2. Merlin utilizes a multi-party computation (MPC) wallet solution, with user assets co-managed by Cobo (a Hong Kong-based cryptocurrency custodian). Furthermore, Merlin utilizes ZK-Rollup technology for verification, compressing large amounts of transaction data before submitting it to the Bitcoin mainnet to ensure data integrity and security.

Since its launch, Merlin has become one of the most sought-after Layer 2 projects in the Bitcoin ecosystem. Its total value locked (TVL) reportedly reached $3.5 billion within 30 days of its launch, attracting over 200 projects to deploy and run on its platform. Merlin Chain supports a variety of Bitcoin Layer 1 native assets, such as BRC-20 and BRC-420, and expands the breadth of its ecosystem through compatibility with Ethereum.

Strengthening the security of BTC bridge

Unlike traditional monolithic Rollups, B² employs a 1.5-layer architecture: the Rollup layer handles transaction execution and status updates, while the Data Availability (DA) layer operates independently and stores raw transaction data. This data is then periodically submitted to the Bitcoin mainnet for finality verification after off-chain labeling and organization.

B² Network's DA (Data Availability) layer — the B² Hub — belongs to Layer 1.5. It first slices batch data using Reed-Solomon + KZG encoding, then aggregates the zero-knowledge proofs submitted by Layer 2 into Taproot commitments and submits them to the Bitcoin mainnet, thus inheriting the finality and immutability of the Bitcoin network.

B² Network uses a decentralized blob storage and light node sampling mechanism. Any validator only needs to randomly sample a very small percentage of blocks to detect data integrity with a high probability, significantly reducing synchronization and verification costs.

In terms of consensus, the B² Hub only needs to submit short commitments and validity proofs, eliminating the mainnet's burden of large data volumes. Rollup batch publishers are responsible for availability, forming a modular architecture of "outsourced validity + guaranteed availability." By decoupling the DA from the execution layer, B² Rollup can scale and update shards in parallel, while maintaining a security boundary anchored to the Bitcoin chain, achieving high throughput, low costs, and L1 security.

This approach has two advantages. First, its modular design allows for unlimited horizontal expansion without requiring any modifications or upgrades to the BTC network. Furthermore, B² Hub, the DA layer of the B² Network, aggregates storage proofs and state transition proofs and submits them to the Bitcoin network, integrating the security of the Bitcoin network.

However, the final confirmation of L2 transactions must first be confirmed and aggregated by the B² Hub, and then confirmed on the BTC network. This is a passive confirmation on the BTC network, which falls under the optimistic mode. Furthermore, the aggregation of zero-knowledge proofs into Taproot commitments for optimistic verification on the BTC network is still in the proof-of-concept (POC) stage and has not yet been finalized.

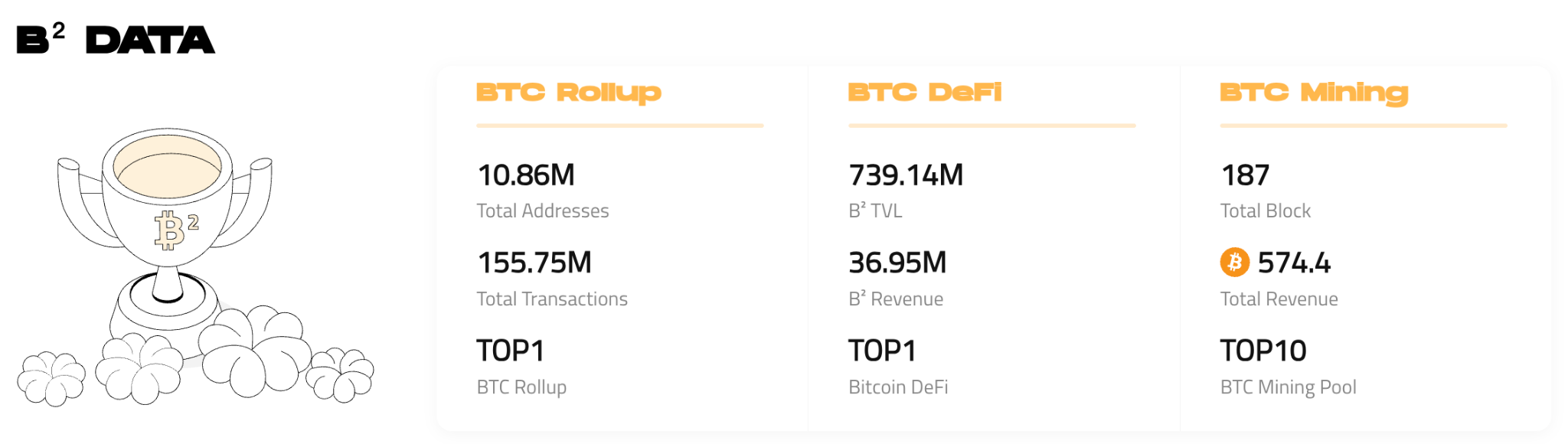

Project Progress: From Technical Implementation to User Ecosystem

To date, BSquare's total locked-in value (TVL) has exceeded $600 million, with a peak daily on-chain transaction volume of $900 million and 500,000 active users. The platform ecosystem encompasses over 100 DApps, covering scenarios such as DeFi, lending, and AI agent applications.

BSquare on-chain data overview, data source: https://www.bsquared.network/

BSquare also launched the first BTC interest-earning mining pool, "Mining Square," a "Yu'e Bao" for miners, providing a solution with native BTC returns. The pool currently accounts for 1% of the total network computing power and ranks among the top 10 mining pools in terms of computing power.

Implementing a Turing Machine with BTC Script? Decoding BitVM

BitVM is an extension protocol built on the BTC mainnet. Its core goal is to create a universal virtual machine environment that can support any verifiable computation without changing the consensus mechanism. Its principle draws on the idea of optimistic rollup: the majority of computation is performed off-chain, and only in the event of a dispute is the relevant computational process submitted to the chain for verification in the form of a "fraud proof." Similar to Ethereum's Arbitrum, BitVM uses a mechanism of off-chain computation + on-chain verification, but its unique feature is that it utilizes Bitcoin's scripting system (Bitcoin Script) to construct "logic gate circuits" to simulate a Turing-complete virtual machine. (Similar to Qin Shi Huang's human column computer in the game The Three-Body Problem)

BitVM doesn't run EVM or WASM directly on-chain. Instead, it translates these high-level virtual machine operations into combinations of the most basic logic gates in Bitcoin Script (such as AND, OR, and NOT), using these logic gates to construct a massive "fraud verification circuit." All transaction data and computations are processed off-chain, and only when a challenge occurs are the data and computational steps (in the form of Merkle Proofs, etc.) submitted to the chain.

BitVM 2 is an optimized version of the original BitVM, introducing a more modular computational structure and circuit compression mechanism. It also incorporates mechanisms such as interactive fraud proofs, timelock scripts, and multi-signatures to enhance the protocol's practicality and security. BitVM 2 places a greater emphasis on optimizing on-chain data submissions and seeks to introduce script opcodes, such as OP_CAT, which may be activated in the future, to improve circuit construction efficiency.

Current Development

The BitVM initiative is gradually moving from theory to practice, with Citrea being a representative project. Citrea executes a large number of transactions off-chain and submits the results and proofs to the Bitcoin network for verification via BitVM. This achieves efficient scalability and security for Bitcoin's Layer 2 (L2) blockchain. Citrea is also the first solution capable of implementing universal Layer 2 settlement on Bitcoin, with all proofs natively verified within blocks on the Bitcoin network. Currently, Citrea's mainnet has not yet officially launched and is still in the testnet phase.

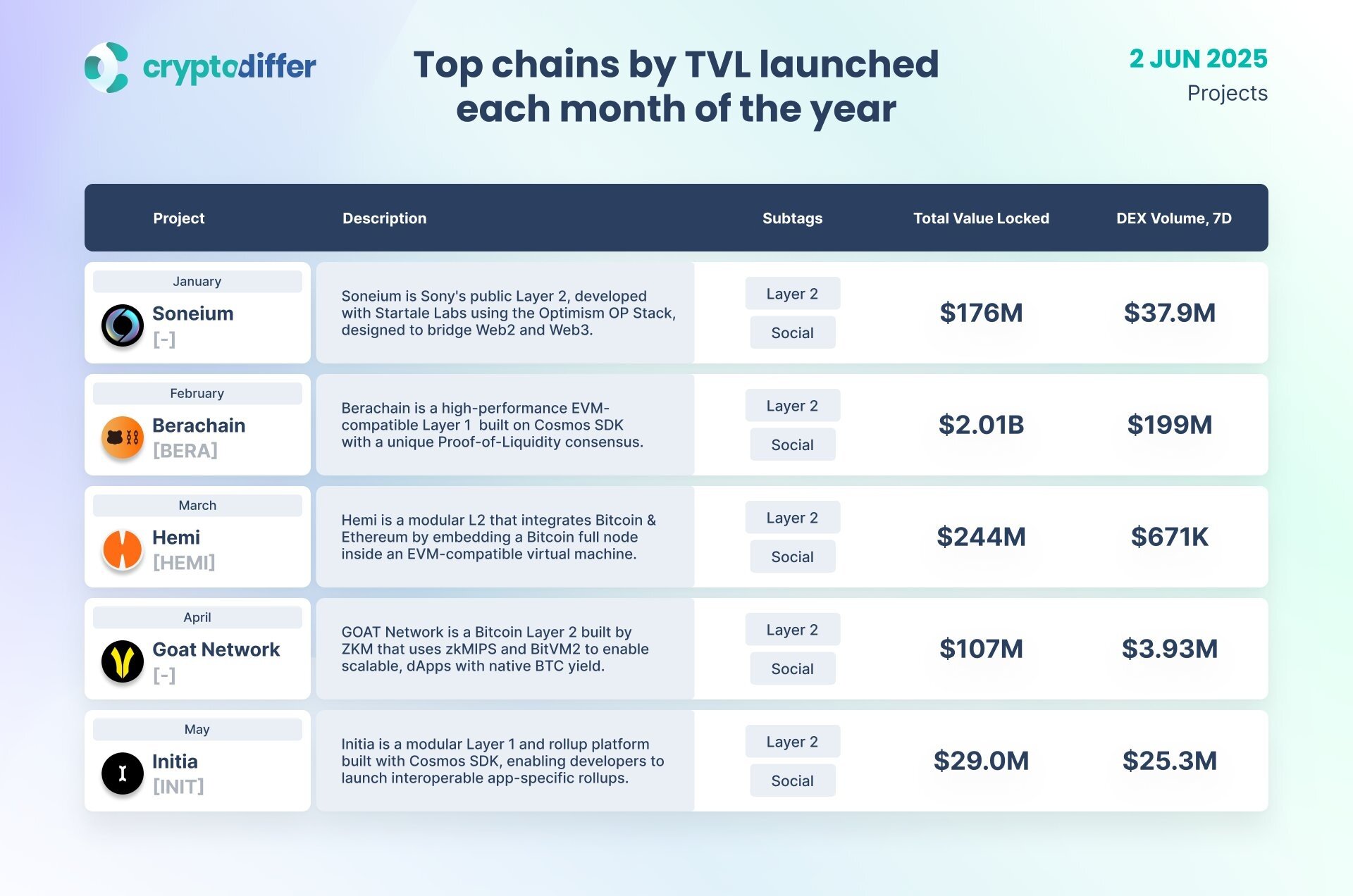

For example, the Goat Network is dedicated to exploring the possibilities of BitVM 2. Goat's white paper demonstrates a fraud proof mechanism based on circuit logic and Merkle tree structures. Goat emphasizes expanding Bitcoin computation into a Turing-complete state machine and attempts to build a new Bitcoin L2 framework, allowing smart contract execution and asset interaction to occur natively on the Bitcoin mainchain. Goat's implementation also includes the integration of a data availability layer (DA layer) and optimized circuit compression mechanisms, propelling BitVM from experimental implementation to practical deployment.

As of June this year, Goat Network's locked-in amount has exceeded US$100 million.

Top chains by TVL launched each month of the year, CryptoDiffier; Data source: https://x.com/GOATRollup/status/1929596963286114614

Although the protocol advantages of the BitVM series are very obvious: it is extremely native, can achieve Turing-complete computing without changing the BTC consensus, and has extremely high security and nativeness; and its structure naturally supports fraud proof, low data on-chain rate and extreme decentralization.

However, BitVM's disadvantages also stem from its technology: the logic gate circuits constructed by BTC Script, emulating EVM or WASM, are inherently complex and massive. Consequently, BitVM development is extremely complex, and the workload involved in circuit construction is enormous. Furthermore, there is currently a lack of a mature developer ecosystem and standardized tools.

Multiple paths are being taken, but the battle for value remains undecided.

Each BTC L2 solution has its own technical focus. For example, the Lightning Network focuses on payment efficiency and, after years of development, has formed a mature node network suitable for micropayments and off-chain settlement. RGB and RGB++ prioritize asset security, utilizing client-side verification mechanisms to safeguard asset status. The ZK-Rollup approach, largely leveraging mature EVM solutions and rigorous module security verification, currently boasts strong composability and cross-chain scalability, making it more adaptable to scenarios like DeFi and AI Agents. BitVM pursues ultimate nativeness, implementing smart contract capabilities on-chain without altering BTC consensus. While still in its early stages, it represents a push towards the limits of BTC's computing power.

While the outcome remains uncertain, we can see that a truly viable solution must meet three key criteria: native BTC compatibility, verifiable security, and strong support for upper-layer applications. Furthermore, the trend toward technology stack integration is becoming increasingly evident, with examples like the Lightning Network combined with stablecoins and the exploration of ZK Rollup integration with RGB.

In the future, the Bitcoin L2 ecosystem will undoubtedly see a multi-faceted competitive landscape, with different solutions serving different core scenarios: payments, contracts, assets, storage, and AI. These solutions will collaborate across a wide range of sectors, supporting the long-term prosperity of the Bitcoin ecosystem. This competition is far from over; the true winner will be determined by both asset retention capabilities and the developer ecosystem. As the world's most powerful consensus asset, Bitcoin's ecosystem will continue to expand due to the influx of US dollar stablecoins and L2 modular innovations, ushering in a two-way upgrade of "payment sovereignty + contract expansion."

The recent passage of the GENIUS Stablecoin Act in the United States marks a gradual clarification and improvement in global stablecoin regulation. The legal inclusion of "payment stablecoins" in the US dollar system is expected to accelerate the entry of USDT, USDC, and other emerging stablecoins into on-chain payment scenarios. As Tether's CEO noted, emerging markets are the primary market for stablecoin adoption, with 60% of USDT's growth driven by actual payment demand outside the crypto community.

The GENIUS Act provides a clear legal path for the on-chain use of stablecoins and paves the way for BTC L2 to carry US dollar assets. USDT, the earliest stablecoin born on the BTC network, is now leading the way back into the BTC ecosystem. This is not only a return to its technological roots but also demonstrates the strategic value of BTC as a settlement layer. It is foreseeable that a future stablecoin payment system built on BTC L2 will be the most native, secure, and consistent with the spirit of Bitcoin. Leveraging BTC L2's composability and asset agreement capabilities, the BTC network is expected to meet real-world payment and settlement needs, achieving a symbiotic relationship between stablecoin circulation and value accumulation.

References:

https://eprint.iacr.org/2025/709

https://riema.notion.site/Bitcoin-Thunderbolt-1d7f5aa90cdd803b8a73d080c83af098

https://x.com/kevinliub/status/1919499375035756580?s=46

https://www.theblockbeats.info/flash/289746

https://mp.weixin.qq.com/s/iMQPXFPWBpT 9 dQLyR 8 rzUg

https://www.btcstudy.org/2023/09/12/the-potential-of-RGB-protocol/