From encryption to Nvidia: Can the Bitget RWA index contract activate new variables in the trillion-level US stock market?

- 核心观点:RWA指数永续合约降低美股投资门槛。

- 关键要素:

- 加权多发行方定价机制。

- 支持最高10倍杠杆交易。

- 24小时全球交易美股标的。

- 市场影响:吸引华语投资者参与美股市场。

- 时效性标注:中期影响。

Original author: OneShotBug

RWA continues to bring us more surprises.

The US stock market is a vibrant and exciting one, with a constant stream of impressive unicorns and entrepreneurial success stories, such as Nvidia, which soared to the top of the market after a meteoric rise in market capitalization. This has attracted many Chinese-speaking investors eager to try their hand. However, obstacles such as high transaction fees, cumbersome account opening procedures, and foreign exchange controls make direct US stock investment difficult.

As a practical application of the RWA concept, stock tokenization offers a new investment avenue. RWA contracts issued by platforms like xStocks and Ondo allow investors to indirectly invest in the US stock market through tokenized assets, avoiding the cumbersome processes and high fees of traditional stock markets.

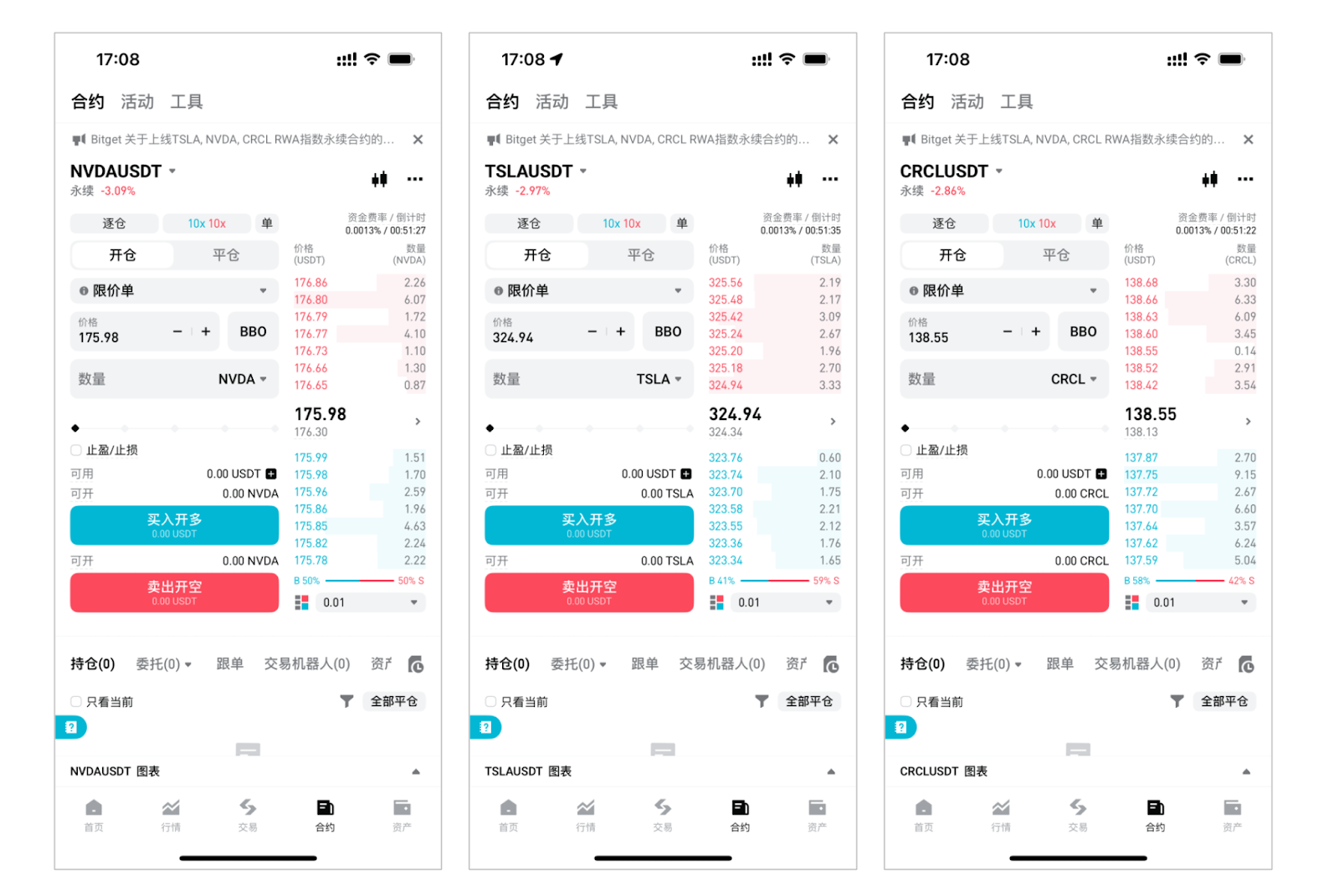

This article focuses on Bitget's recently launched "RWA Index Perpetual Contract," which initially launched popular US stocks including Nvidia (NVDA), Tesla (TSLA), and Circle (CRCL). The product also offers further innovations based on the RWA contract: it uses a weighted approach to price calculations for products from multiple issuers and allows for flexible investment with high leverage. Overall, this appears to be a tokenized US stock investment product well-suited for Chinese-speaking investors.

Next, I will quickly introduce the RWA index perpetual contract product and analyze its product advantages, risk management mechanism and market opportunities.

Why is the cryptocurrency world focusing on stock tokenization?

As the brightest star in the ongoing deep integration of the cryptocurrency market and the traditional financial market, stock tokenization has built a bridge between the crypto market and the traditional stock market.

With the rapid development of blockchain technology, nearly all tokenized assets are gradually entering the blockchain space. From the initial stablecoins to traditional financial assets such as real estate, bonds, and funds, and now to the popular tokenized stocks, each innovation strives to eliminate obstacles and barriers in traditional finance through blockchain, breaking down limitations such as time and location.

The core of stock tokenization lies in converting traditional stock assets into digital tokens on the blockchain, enabling 24/7 global trading, fractional share purchases, and more efficient cross-border transactions. This model is particularly attractive to global retail investors, especially those in emerging markets, as it addresses long-standing pain points such as difficulty opening accounts, remittance difficulties, and inconsistent trading hours.

While stock tokenization is not a new concept, platforms like FTX and Binance attempted to launch related products as early as 2020, but these attempts ultimately failed due to regulatory pressure. However, with the recovery of market demand and improvements in technical conditions, stock tokenization has once again become a hot topic for investors in 2024. The continued development of RWA products is expanding opportunities for investors to participate in US stock investment through tokenization.

What is RWA Index Perpetual Contract?

The RWA Index Perpetual Contract is Bitget's first innovative financial product. According to its official website, the RWA Index Perpetual Contract's greatest innovation lies in its use of a multi-issuer weighted pricing mechanism. Each index is formed by integrating token prices from multiple platforms (such as xStocks and Ondo), aggregating multiple stock tokenized assets into a single weighted index. This weighted pricing allows Bitget to aggregate token prices from multiple issuers.

This pricing mechanism makes the RWA Index Contract more flexible and stable, and provides greater market transparency. Investors can clearly understand the weight of each token in the contract and obtain a comprehensive market pricing through the weighted index in the contract.

Actual transactions can be completed on multiple platforms such as the Bitget official website and App. You can find them by searching for the name of the relevant product in the contract. Currently, the three products online are NVDA TSLA and CRCL, and they support USDT trading pairs.

Opportunities for Chinese-speaking investors: Zero barriers to entry in the US stock market

For investors, the US stock market is a market brimming with opportunities, especially with fast-growing global leaders like Tesla and Nvidia. However, for many Chinese-speaking investors, direct investment in US stocks has been fraught with obstacles. First, investors must open an account through a traditional brokerage platform, a process that often involves cumbersome procedures such as submitting extensive identity verification documents and tedious tax filings. Furthermore, many investors face high fees, including account management fees, trading commissions, and remittance fees, which undoubtedly significantly reduce investment returns.

In addition to these traditional barriers, foreign exchange controls also pose a significant challenge for Chinese investors. Even if investors are willing to pay the fees, they often cannot directly access opportunities in the US stock market due to market access restrictions.

Because of this, direct investment in US stocks is not only a cumbersome process for many Chinese investors, but also requires them to overcome numerous obstacles. The high-threshold investment environment makes them reluctant to invest.

Bitget's RWA Index perpetual contract offers investors a zero-barrier investment method, allowing them to easily participate in the trading of tokenized US stocks through the platform. Investors no longer need a traditional stock account or even traditional banking systems for fund exchange. This further demonstrates Bitget's expertise in innovative products, allowing investors to access a wide range of cryptocurrencies without complex processes.

Risks and opportunities of high leverage trading

In addition to breaking through traditional investment barriers, RWA Index perpetual contracts also provide investors with a highly leveraged trading mechanism. With a maximum leverage of 10x, investors can achieve higher returns on tokenized US stock trading with a relatively small investment.

Of course, in highly leveraged trading, even small market fluctuations can lead to significant financial losses. Therefore, investors must exercise extreme caution when choosing leveraged trading, closely monitoring market changes and adjusting strategies promptly to avoid excessive losses due to adverse fluctuations.

To help investors better manage risk in high-leverage trading, Bitget has implemented a number of risk management measures. These measures are designed to minimize potential losses and protect investors' funds during market fluctuations.

- Trading Hours: 24 hours a day, Monday through Friday, from 12:00 AM on Monday to 12:00 AM on Saturday, Eastern Time (UTC-4). RWA contracts are also suspended during US public holidays.

- Market freeze: Prices are frozen on weekends and during stock market holidays to avoid liquidation. Order cancellations are supported, but new order submissions are suspended. Funding fee settlement will resume when trading resumes.

- Leverage limit: The initial leverage limit is set at 10 times, and the isolated margin model is supported.

- Risk Fund: Bitget has allocated a risk fund for each RWA Index perpetual contract to mitigate potential risks arising from extreme market volatility. The risk fund is initially funded with 50,000 USDT and serves as a compensation fund during periods of significant market volatility. This fund provides investors with an additional layer of protection, mitigating the risks associated with high-leverage trading.

- Position Limits: Bitget also sets position limits for individual accounts to prevent individual investors from over-holding, which could impact market liquidity and stability. By limiting the maximum position held by an individual investor, Bitget can better manage market risk and prevent excessive trading by a single investor from destabilizing the market.

These measures provide investors with stronger protection when using high leverage. Regardless of market volatility, investors can feel a certain degree of safety net, reducing potential risks in transactions.

Conclusion

From the real stock on-chain promotion by Kraken, Bybit and Robinhood, to the compliant token issuance by xStocks, Dinari and Ondo, to Tron Inc.'s attempt at "reverse entry of on-chain assets into the market", this round of asset structure reconstruction is not just about innovation in smart contracts or product forms, but also about whether a complete on-chain financial ecosystem can be built.

It is against this backdrop that the RWA Index Perpetual Contract emerged. It not only opened the door to the US stock market for Chinese-speaking investors but also built a bridge between the crypto and traditional stock markets. Whether the convergence of the two will truly transform investor investment practices and become a mainstream trend remains uncertain.

I don't know the answer, but I believe that in the face of an ever-changing market, we should try more cutting-edge, innovative products. After all, investing is a game, and every decision is a race between the future and opportunity.