CertiK: 2025 Skynet RWA Security Report

- 核心观点:RWA高速增长但安全风险演变。

- 关键要素:

- RWA市值达260亿美元,五年增五倍。

- 2025年安全损失1460万美元,风险转链上。

- 美债代币化增400%,成主流入口资产。

- 市场影响:推动行业安全标准与透明度提升。

- 时效性标注:中期影响。

CertiK has released its 2025 Skynet RWA Security Report. The report indicates that RWA tokenization is reshaping the blockchain financial landscape at an astonishing pace. By mid-2025, the RWA market is projected to exceed $26 billion, a fivefold increase from approximately $5 billion in 2022, making it one of the most dynamic segments in the digital asset ecosystem. RWA is becoming a critical bridge between traditional finance (TradFi) and decentralized finance (DeFi), but at the same time, its security threats are also emerging with new characteristics.

CertiK has released its 2025 Skynet RWA Security Report. The report indicates that RWA tokenization is reshaping the blockchain financial landscape at an astonishing pace. By mid-2025, the RWA market is projected to exceed $26 billion, a fivefold increase from approximately $5 billion in 2022, making it one of the most dynamic segments in the digital asset ecosystem. RWA is becoming a critical bridge between traditional finance (TradFi) and decentralized finance (DeFi), but at the same time, its security threats are also emerging with new characteristics.

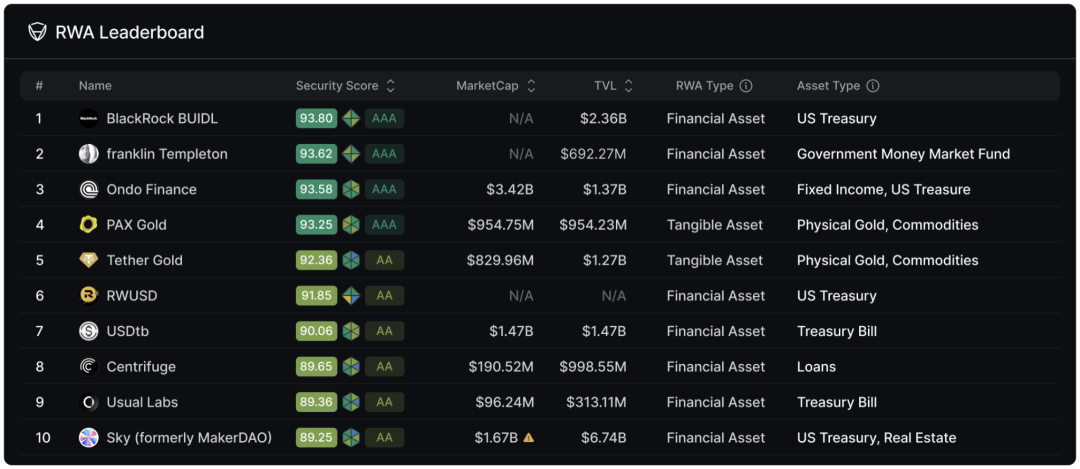

Skynet RWA Ranking

The report released the Skynet RWA Rankings. The top ten projects for the first half of 2025 are: BlackRock BUIDL, Franklin Templeton On-Chain Fund, Ondo Finance, Paxos Gold, Tether Gold, Binance RWUSD, Ethena USDtb, Centrifuge, Usual, and SKY (MakerDAO RWA Vaults). These projects cover a variety of sectors, including government bonds, gold, stablecoins, and accounts receivable, representing the diverse development direction of the RWA ecosystem.

The report released the Skynet RWA Rankings. The top ten projects for the first half of 2025 are: BlackRock BUIDL, Franklin Templeton On-Chain Fund, Ondo Finance, Paxos Gold, Tether Gold, Binance RWUSD, Ethena USDtb, Centrifuge, Usual, and SKY (MakerDAO RWA Vaults). These projects cover a variety of sectors, including government bonds, gold, stablecoins, and accounts receivable, representing the diverse development direction of the RWA ecosystem.

These protocols demonstrate the highest standards in the RWA industry with compliant legal structures, transparent proof of reserves, and institutional-grade security measures. Their practices in compliance, transparency, and risk management are setting new benchmarks for the entire industry.

The double-edged sword of RWA growth and security risks

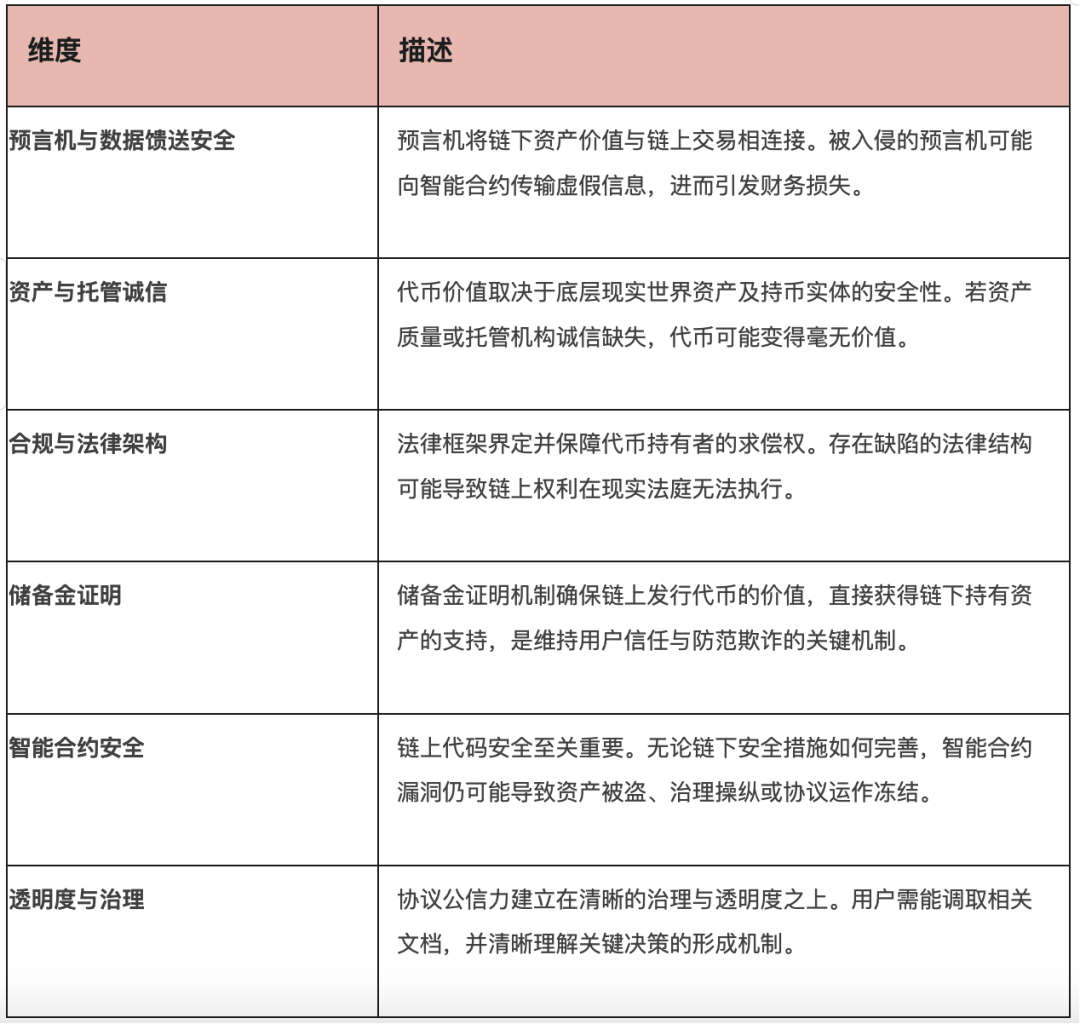

Tokenizing RWAs unlocks enormous value potential, bringing efficiency and transparency to the financial system. However, the security risks associated with these assets far exceed traditional smart contract vulnerabilities, encompassing issues such as oracle manipulation, custodian and counterparty risk, unenforceable legal frameworks, and fraudulent proof of reserves.

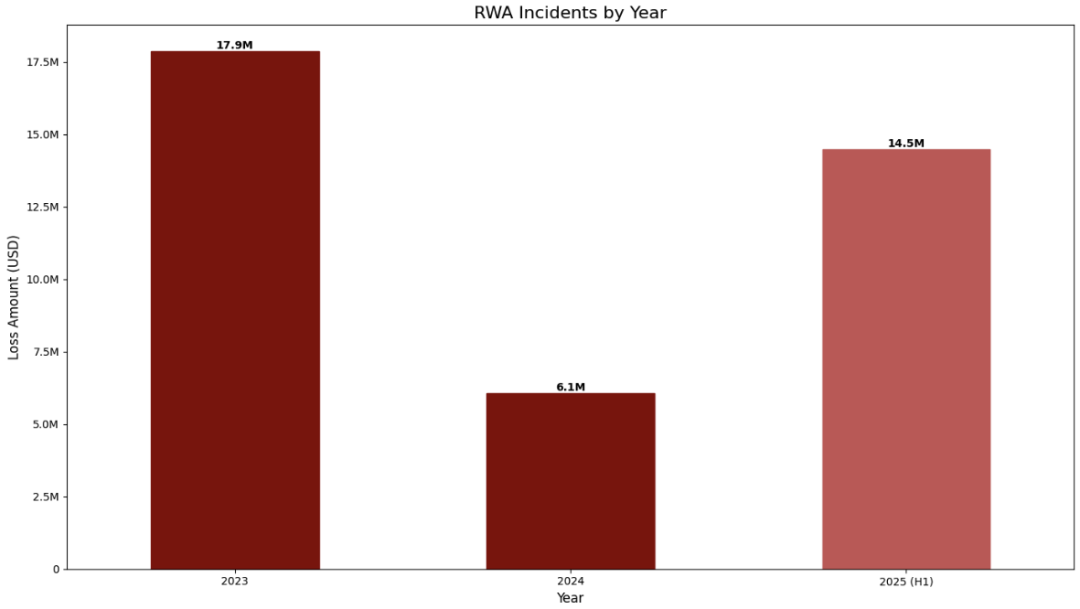

Amount of losses from RWA incidents over the years

On the other hand, the threat landscape for RWAs has undergone a significant shift over the past two years. In the first half of 2025, losses from RWA-related security incidents reached $14.6 million, compared to just $6 million in 2024. More notably, the sources of risk have fundamentally shifted: while the primary threat in 2023 and 2024 came from off-chain credit defaults, such as borrowers failing to perform, losses in 2025 were almost entirely due to on-chain and operational vulnerabilities.

This shift indicates that the RWA security landscape is undergoing a profound evolution, with the risk focus gradually shifting from off-chain financial defaults to on-chain technical vulnerabilities and operational management errors.

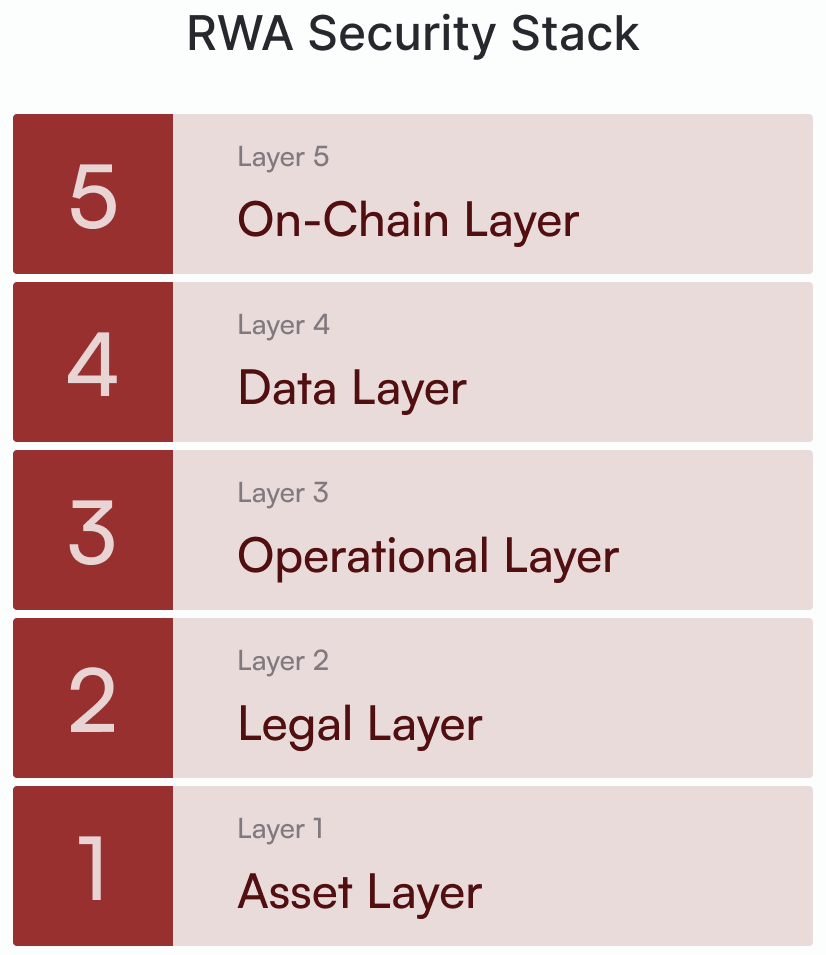

The "Five-Layer Security Stack" and the Skynet Scoring Framework

RWA Security Stack Framework

To help the market identify and manage risks more systematically, CertiK proposed a "five-layer security stack" model in the report, covering five levels: assets, law, operations, data, and on-chain. From oracle security and proof of reserves to compliance and governance mechanisms, it forms a full-stack security assessment method.

Building upon a five-layer security stack, CertiK has launched the Skynet RWA Security Scoring Framework, which comprehensively assesses risk across six key dimensions: assets, legal, operations, and smart contracts. The Skynet Security Framework is built upon the RWA Core Risk Dimensions, each corresponding to its potential impact on the overall security and stability of the RWA protocol. This structure ensures that critical off-chain components representing the latest and most significant risk vectors are appropriately weighted in the final assessment.

RWA Security Scoring Framework

RWA Security Scoring Framework

Outlook: From 26 billion to trillion-level market

The report also summarizes three core trends in the RWA field:

- U.S. Treasury products dominate the market: the scale of tokenized U.S. Treasury bonds has increased by 400% year-on-year and has become the "entry asset" for RWA.

- Integration of income and stablecoins: Emerging stablecoins distribute government bond interest directly to users, reshaping the stablecoin landscape.

- Deep involvement of traditional financial giants: The participation of institutions such as BlackRock and Franklin Templeton has improved compliance and transparency standards and accelerated the mainstreaming of the industry.

As of mid-2025, the total market value of RWAs has exceeded US$26 billion and is expected to continue to grow rapidly in the future. Boston Consulting Group predicts that by 2030, up to US$16 trillion in assets may be tokenized globally.

CertiK concluded its report by emphasizing that RWA security has become a key issue for the healthy development of the entire Web 3 ecosystem. A transparent and systematic security assessment framework will help investors, institutions, and regulators make more robust decisions in the trillion-dollar market of the future.

Conclusion

As the world's largest Web 3.0 security company, CertiK possesses deep industry insights and provides a wide range of security incident analysis, security guides, and annual and quarterly security reports, delivering critical security information to the industry. Visit the Skynet platform (skynet.certik.com) for more stablecoin ratings and on-chain security updates.

Please click the link to read the full 2025 Skynet RWA Security Report for more comprehensive analysis, insights, and recommendations.