Original author: Nico

Original translation: TechFlow

In early April of this year, I conducted a quantitative analysis of the current state of the “ Solana Meme Coin Market ” (commonly known as “the trenches”).

Now let’s look back and see what changes have taken place during this period!

introduction

Since our last analysis, there have been some new developments in the market:

There are rumors about the Pumpfun Token ICO, and the private sale is ongoing;

Axiom achieves market dominance and launches new platforms;

Competition among major Launchpad platforms has intensified, and there has been a trend of diversification and expansion.

In the past, many trading infrastructures were often referred to as bots, but I think it is more accurate to call them terminals now. With the advancement of technology, many traditional robots have been eliminated, and only robots for mobile terminals, social scenarios and niche needs are still active.

Pumpfun Token ICO: Market Focus

What we know so far:

It plans to raise $1 billion, with a fully diluted valuation (FDV) of $4 billion, which will be fully released at launch;

The ICO will be conducted through top centralized exchanges (CEXs) and the Pump.fun platform;

Participation in ICO requires KYC (identity verification);

Early investors in the private placement phase still need to comply with the lock-up period rules;

There will likely be an airdrop event, and the airdrop size is expected to be around 10%.

Impact on the Trenches:

The release of Pump Token is likely to become a very hot market event;

As one of the few popular tokens on Solana with long-term investment value, Pump Token is expected to form a healthy growth flywheel with its revenue model;

In the short term, it may drain liquidity from the Solana ecosystem and the “trench” market, but in the long run, if the incentive mechanism is appropriate, it will have a positive impact on the development of the ecosystem;

Airdrop activities may bring about a wealth effect, attracting participation from old users, existing users, and new users.

I expect Pump Token’s FDV to fall in the $10-20 billion range, not far from HYPE but higher than ENA, and possibly among the top 10-20 tokens.

Battle of trading terminals

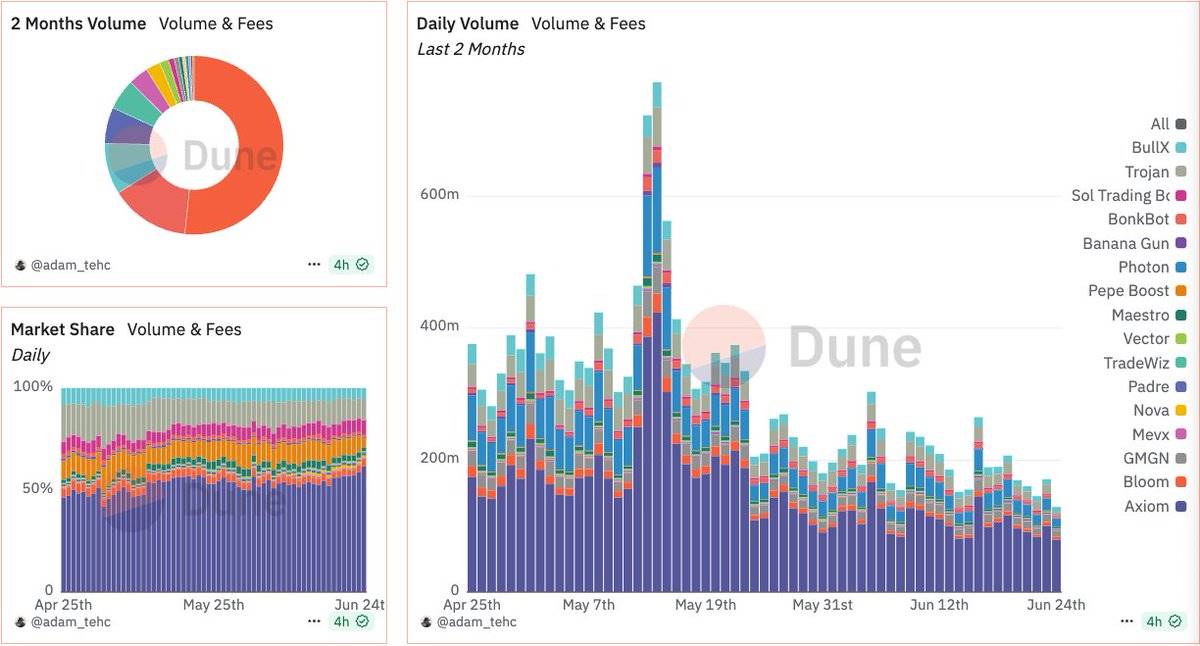

Over the past two months, the activity of all trading terminal platforms has experienced a gradual downward trend.

Currently, Axiom has broken through 60% market share and is firmly in first place, Photon is in second place, and GMGN, Trojan and BullX are competing for the remaining market share. Bloom and Bonkbot have maintained a certain market relevance, while emerging competitors such as Padre and Nova are also beginning to attract more attention.

Trading Terminal Market Share (Snapshot as of June 25, 2025)

Axiom: Market share 61% / Cumulative transaction fees $137 million / Daily active users (DAU) approximately 33,000-45,000

Photon: Market share 9.9% / Cumulative transaction fees $410 million / DAU about 20,000-30,000

BullX: Market share 5.8% / Cumulative transaction fees $197 million / DAU about 10,000-20,000

GMGN: Market share 6.8% / Cumulative transaction fees $78 million / DAU about 10,000

Trojan: Market share 4.8% / Cumulative fees $187 million / DAU over 20,000

With trading robots and terminals generating a cumulative revenue of around $1 billion, this space has attracted a lot of competitors. I have spoken to many people who are interested in developing their own terminals and competing, but the general consensus is that it is an uphill battle as market volumes are gradually decreasing. However, this situation may change after the release of Pumpfun Token.

It is important to note that the most popular and profitable platforms today do not necessarily have the best user interface, feature set, speed or data accuracy. However, they have won the market by virtue of their superior distribution capabilities, which is the key.

I plan to write a dedicated article that will delve deeper into the battle between technology and distribution capabilities and how that influences the choices of specific user groups, so stay tuned.

Battle of Launchpad

During April and May, we saw the rise of the following Launchpad platforms:

@RaydiumProtocol ’s Launch Lab

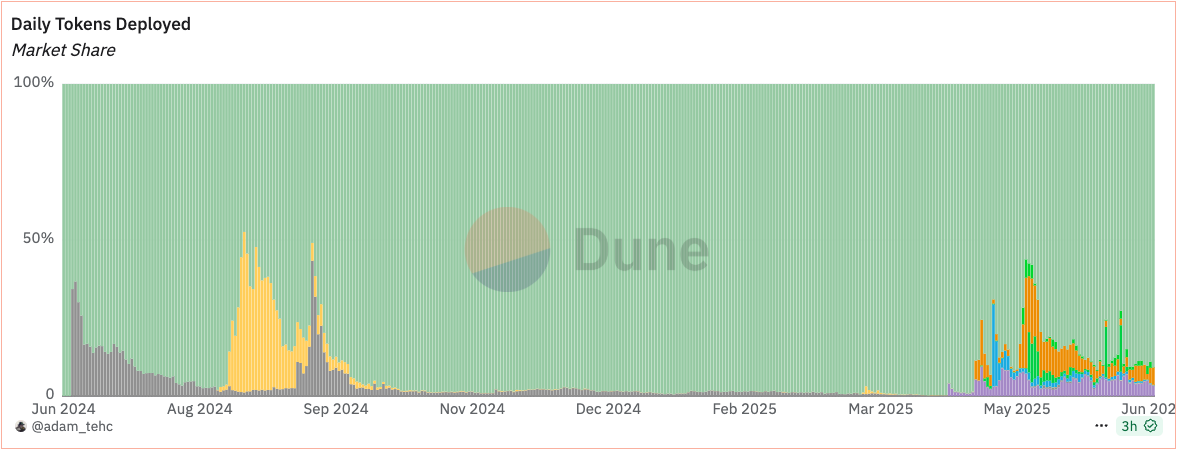

While these competing launchpad platforms attracted a lot of attention in the early days, their market share is gradually declining. However, the success of tokens like $USELESS on the letsbonk.fun platform has attracted more attention, positioning it as a launchpad with less competition but more support from the Bonk ecosystem.

Orange(Bonk), Green(Believe), Purple(Raydium Launchlab)

In June, only the bonded coins of Pumpfun and LetsBonk platforms showed significant activity. From the data, green represents Pumpfun and orange represents LetsBonk, and green occupies most of the market, followed by orange. The number of bonded coins on the Pumpfun platform is about 200, while that on the LetsBonk platform is between 10-30. However, the growth rate of both platforms is on a downward trend.

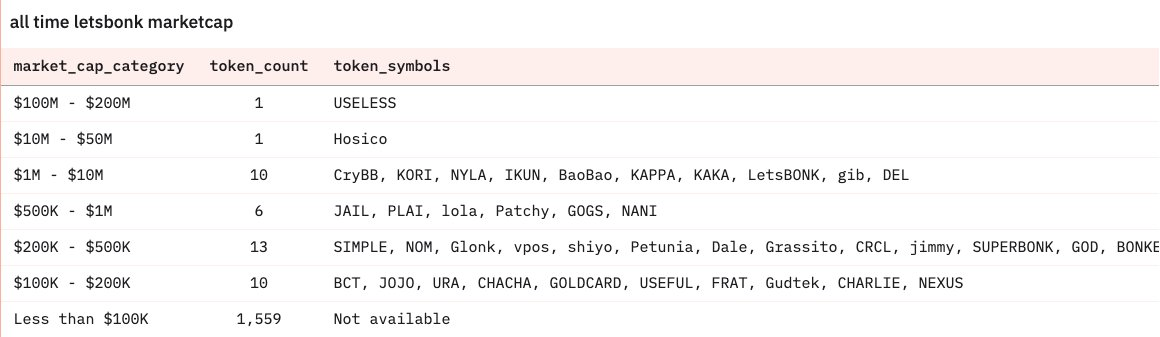

LetsBonk

On the LetsBonk.fun platform, the total market capitalization (mcap) of all its tokens is less than $200 million, mainly concentrated in the following tokens:

$USELESS: Market cap of $140 million

$HOSICO: Market cap reaches $22 million

$CryBB: Market cap of $11 million

Among them, $USELESS stands out, and is enthusiastically supported and promoted by Bonk community members such as @theunipcs.

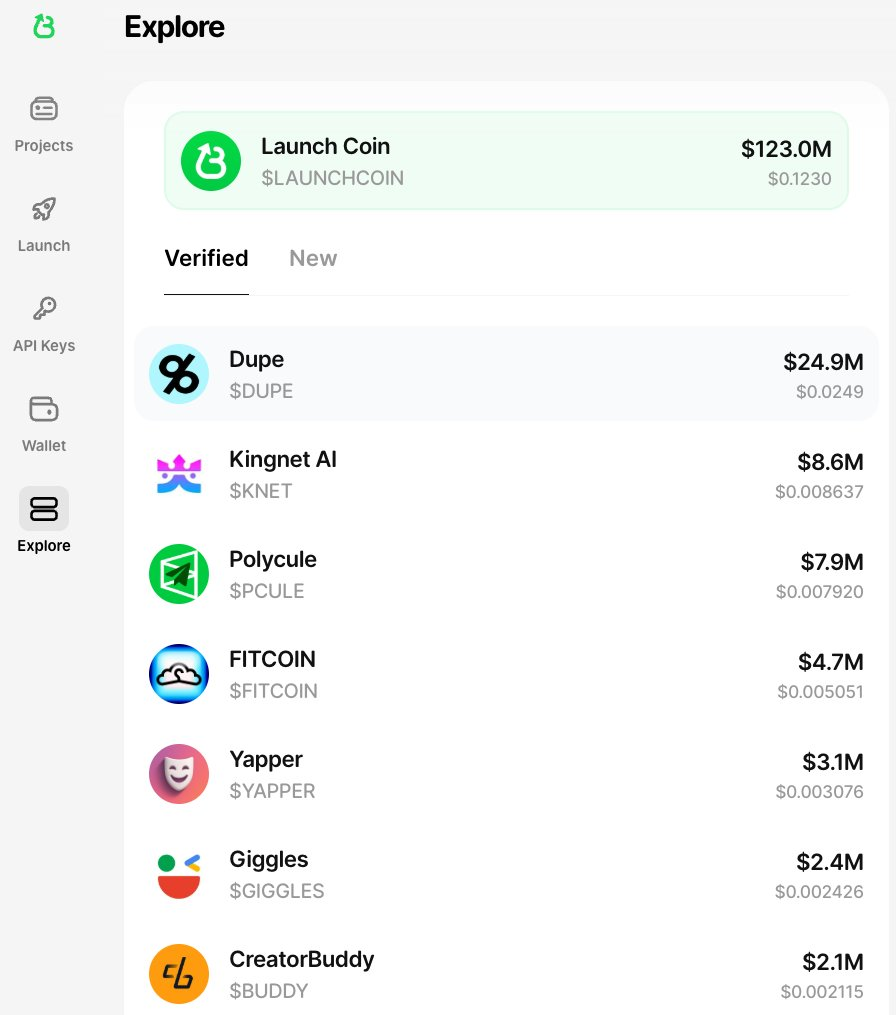

Believe

The emergence of the Believe platform can be said to be unexpected but logical. It focuses on the Internet Capital Markets and aims to raise funds and increase visibility for start-up projects with practical uses by issuing tokens, and is no longer limited to simple Meme Coins.

Launch Coin is its official token, which performs the best and focuses on launching token launch plans through Twitter. Although this concept is not new, the Believe platform attempts to change the market rules through innovation.

The platform has introduced restrictions on sniping new tokens, such as imposing taxes on transactions by the first buyers, to punish snipers who extract excessive liquidity, while encouraging creators to buy and hold their own tokens for the long term, theoretically driving token prices up further.

This series of measures brought a short but interesting market boom. However, Launch Coin is still the main beneficiary of the Believe ecosystem, absorbing most of the liquidity, while other tokens occasionally fluctuate due to surges in demand.

The community has generated a lot of discussion and controversy (both support and criticism) about its founder @pasternak , and is looking forward to the platform entering the next stage of the flywheel effect. At present, it seems that related efforts are still ongoing.

I recommend staying up to date with the latest developments on the Believe platform and checking out the following filters:

Believe App Screener (by @0x_ultra) and Believe Screener

Launch Lab

The top tokens worth paying attention to on Raydium’s Launch Lab platform are actually all launched through the Lets Bonk platform, and Launch Lab only serves as a backend execution tool, mainly used to create Raydium-based liquidity pools.

Pumpfuns activities and metrics

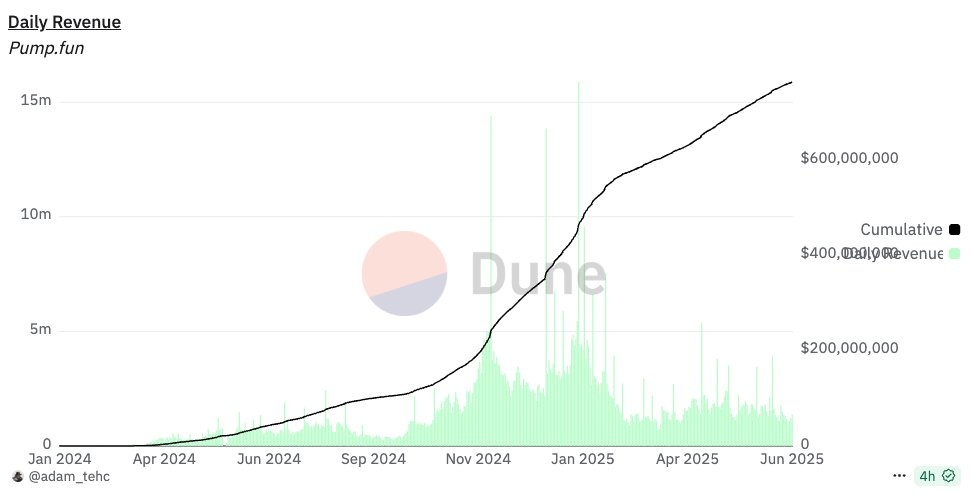

As a Launchpad platform, Pumpfun has generated up to $765 million in fee income to date, which can be regarded as almost pure profit, with an average daily income of between $1 million and $2 million.

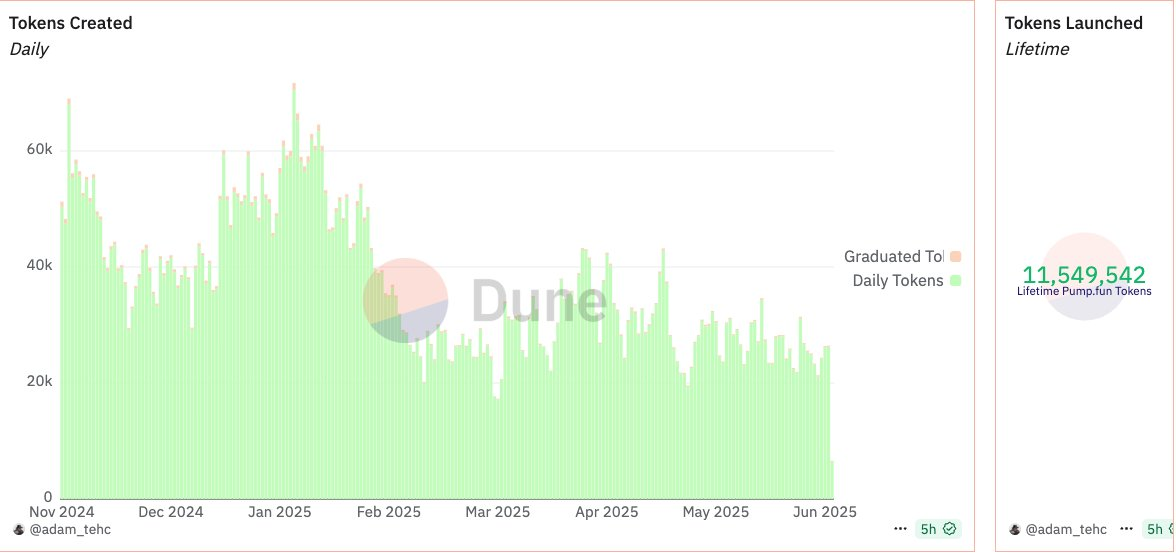

A total of 11.5 million tokens have been created on the platform, but the pace of token issuance has slowed since the $TRUMP token.

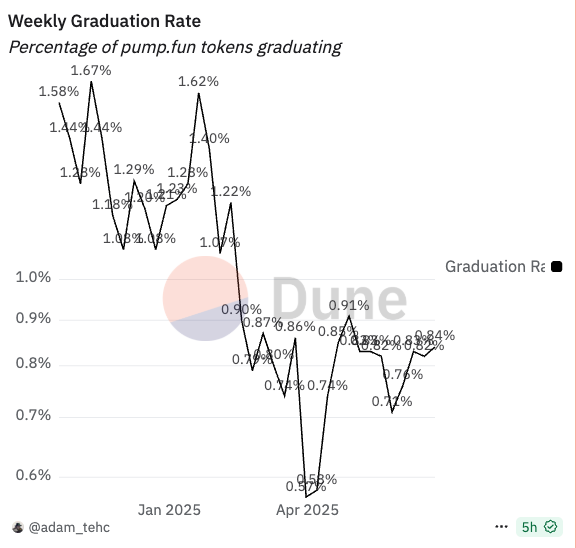

The graduation rate (successful completion of the goal) for tokens also dropped significantly, but appears to have recovered slightly and stabilized at around 0.8% currently.

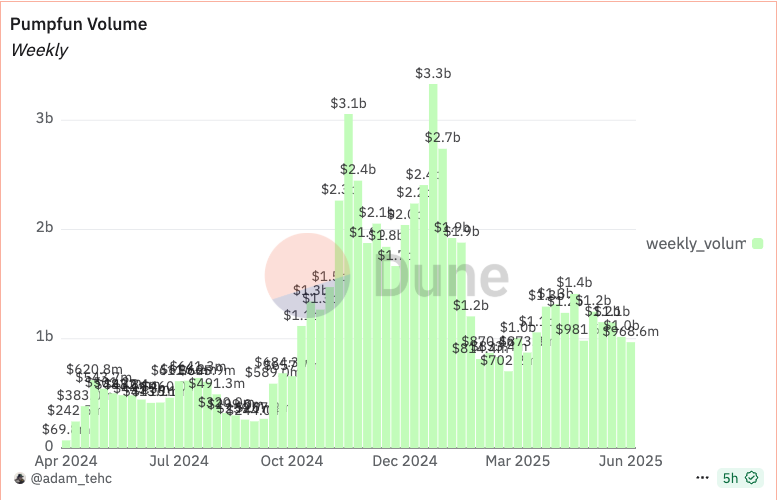

Volumes rose significantly in March and April but have since declined and are currently trending downwards at around $1 billion per week.

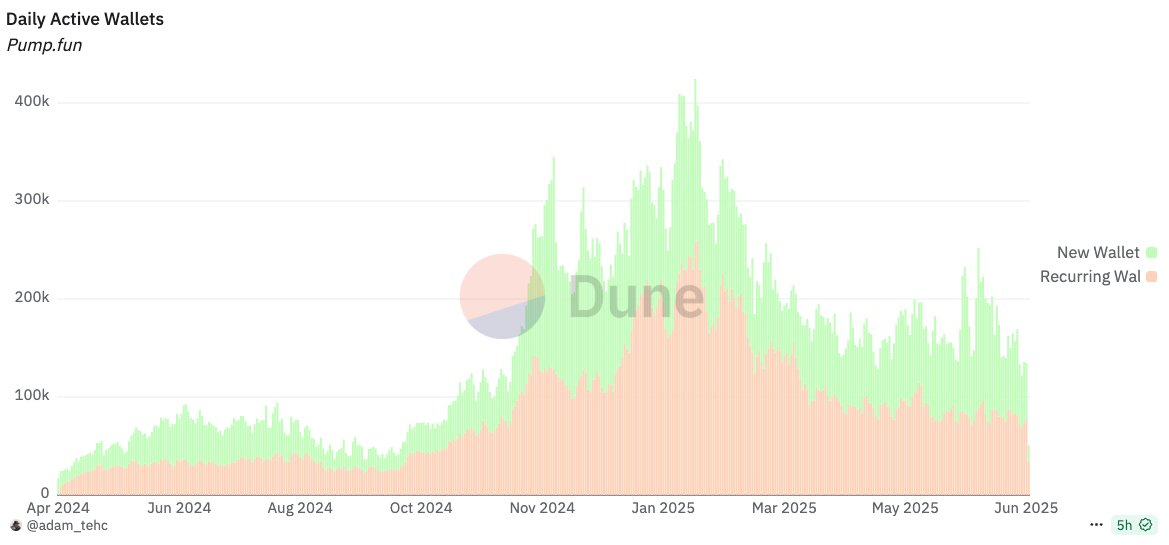

User activity is also decreasing, in line with activity in March/April when there was a surge in users, many of whom were new wallets. Now, there are about 70K+ active users and 50K+ new users per day.

PumpSwap

On the PumpSwap platform, token creators earned $6.6 million in transaction fees through the platform.

The platforms overall revenue reached US$93 million, of which US$73 million went to liquidity providers (LPs) and US$18 million belonged to the platform protocol.

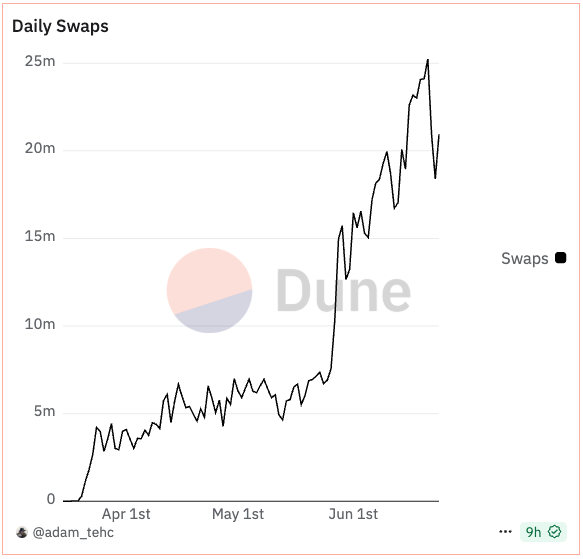

Despite the decline in trading volume, the number of daily transactions continues to increase, indicating that PumpSwap’s market share in decentralized exchanges (DEX) is gradually expanding.

Interesting market insights

For those unfamiliar with the Solana Meme Coin market, here are some interesting trends:

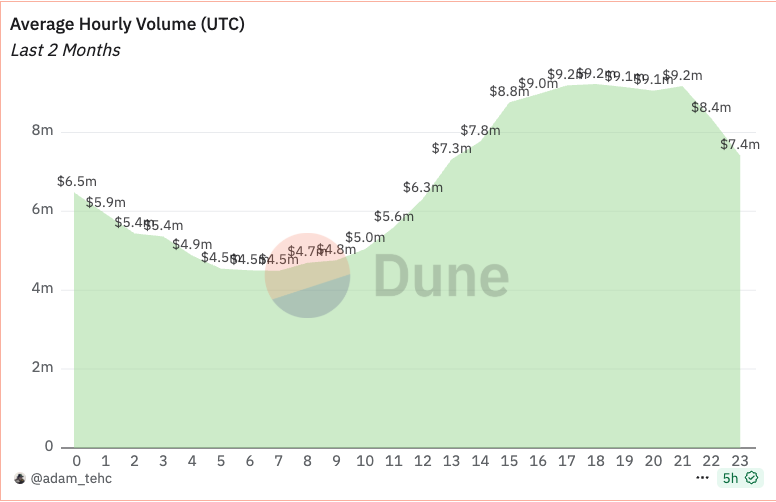

Daily trading volume starts to rise from 10-11 UTC and reaches a peak at 15-20 UTC, which is highly consistent with US daytime working hours.

Not only does daily trading volume show cyclical fluctuations, but the average transaction size and number of transactions also show similar patterns.

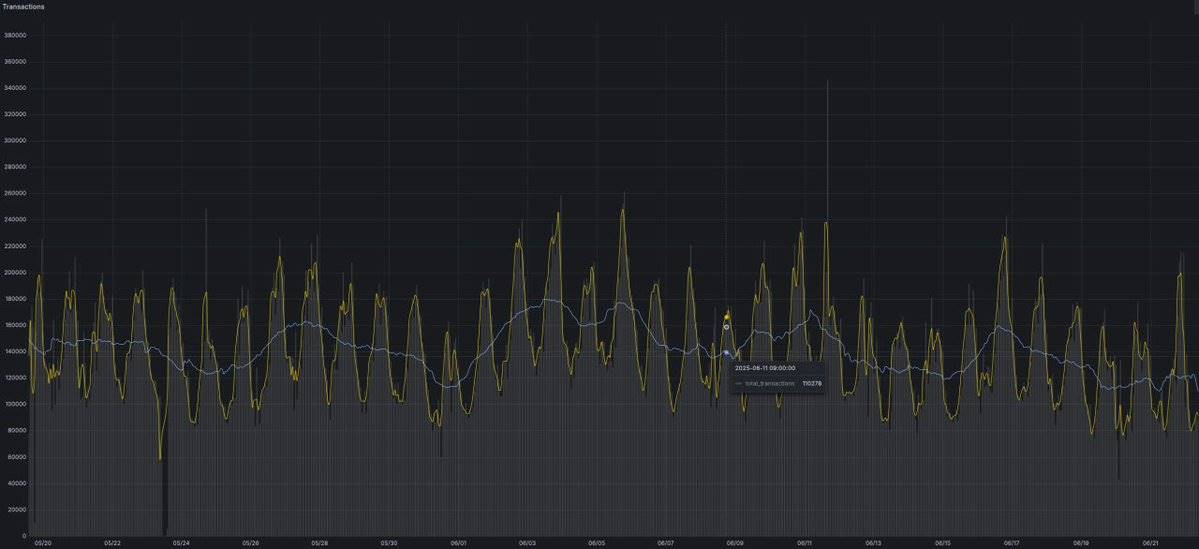

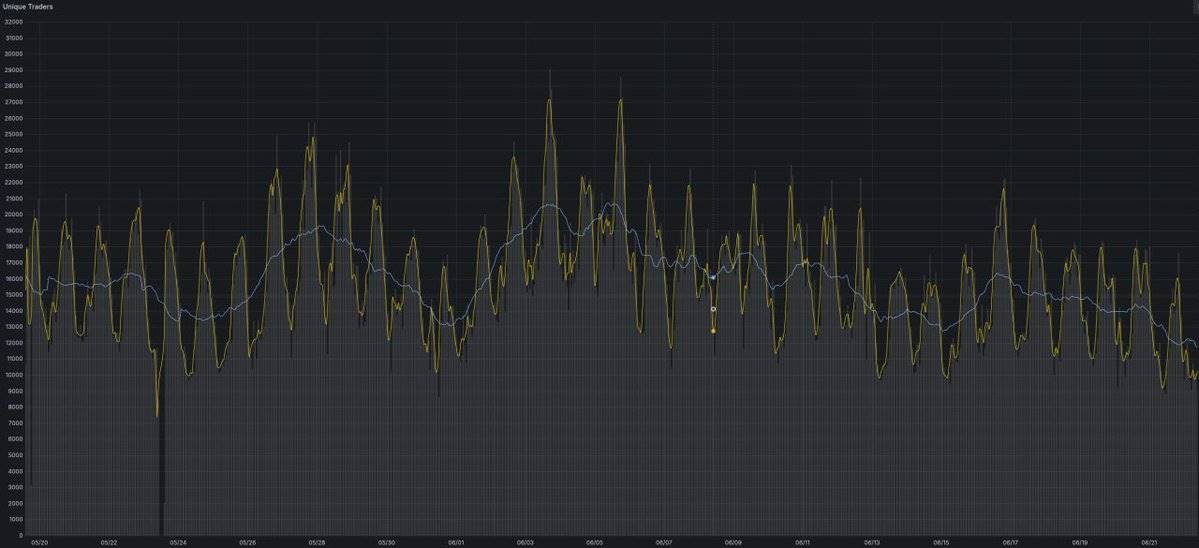

The data shows that the 3-hour moving average (yellow) and 24-hour moving average (blue) of the number of transactions show certain cyclical changes.

Number of independent traders

Trading volume typically decreases by 10-15% on weekends but remains relatively stable during the weekdays.

References:

Dune dashboards by @Adam_Tehc , his dashboards can be found here: https://dune.com/adam_tehc

Transaction count and unique user periodicity chart by @idatsy

Some data comes from @whale_hunter_ s dashboard: https://dune.com/whale_hunter

Welcome to join TechFlow official community