BitMEX Alpha: Circle’s share price is built on quicksand

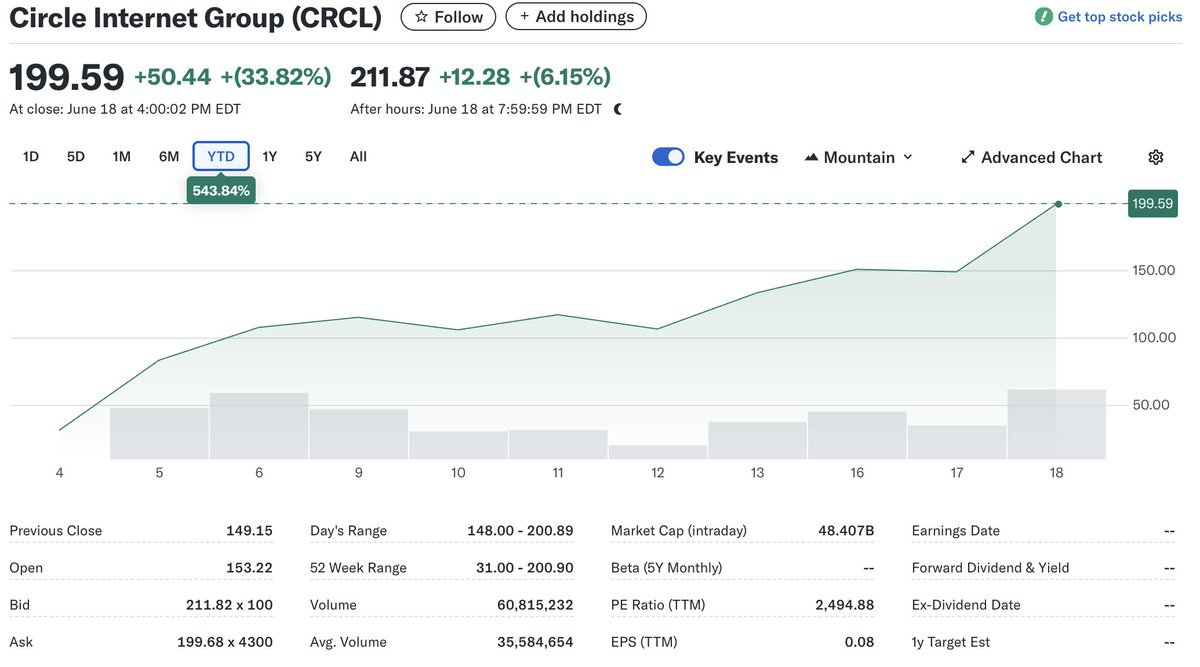

Although 2025 is hailed as the "Year of Stablecoins", key legislation is expected to be successfully implemented, and Circle's IPO has recorded an astonishing increase of more than 500%, upon closer inspection, Circle's $200 stock price may be built on quicksand. This article focuses on three core challenges, from distribution difficulties, interest rate risks to intensified competition, to see why $CRCL's high valuation may not last long.

1. Distribution Dilemma: Limited Growth

For stablecoins to become popular, channel distribution is crucial. However, Circle is in an awkward "middle ground" in this regard - it is neither an offshore crypto giant like Tether, nor fully integrated into the traditional U.S. financial system.

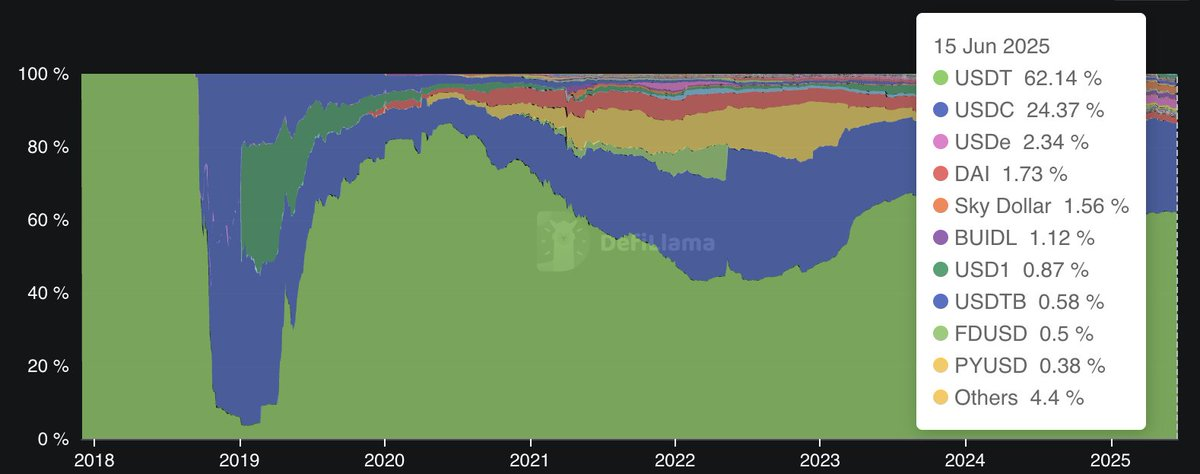

Market share

As of now, USDC only accounts for 24% of the total stablecoin circulation, and there is no obvious trend of further expanding its share.

(Data source: DefiLlama)

USDC is not the “unit of account” in the crypto market

Leading exchanges (such as Binance) generally quote and match transactions in USDT. USDT has a 67% market share due to its first-launch advantage and network effect; USDC only has 27%, and it is difficult to shake its position.

High Dependence on Coinbase

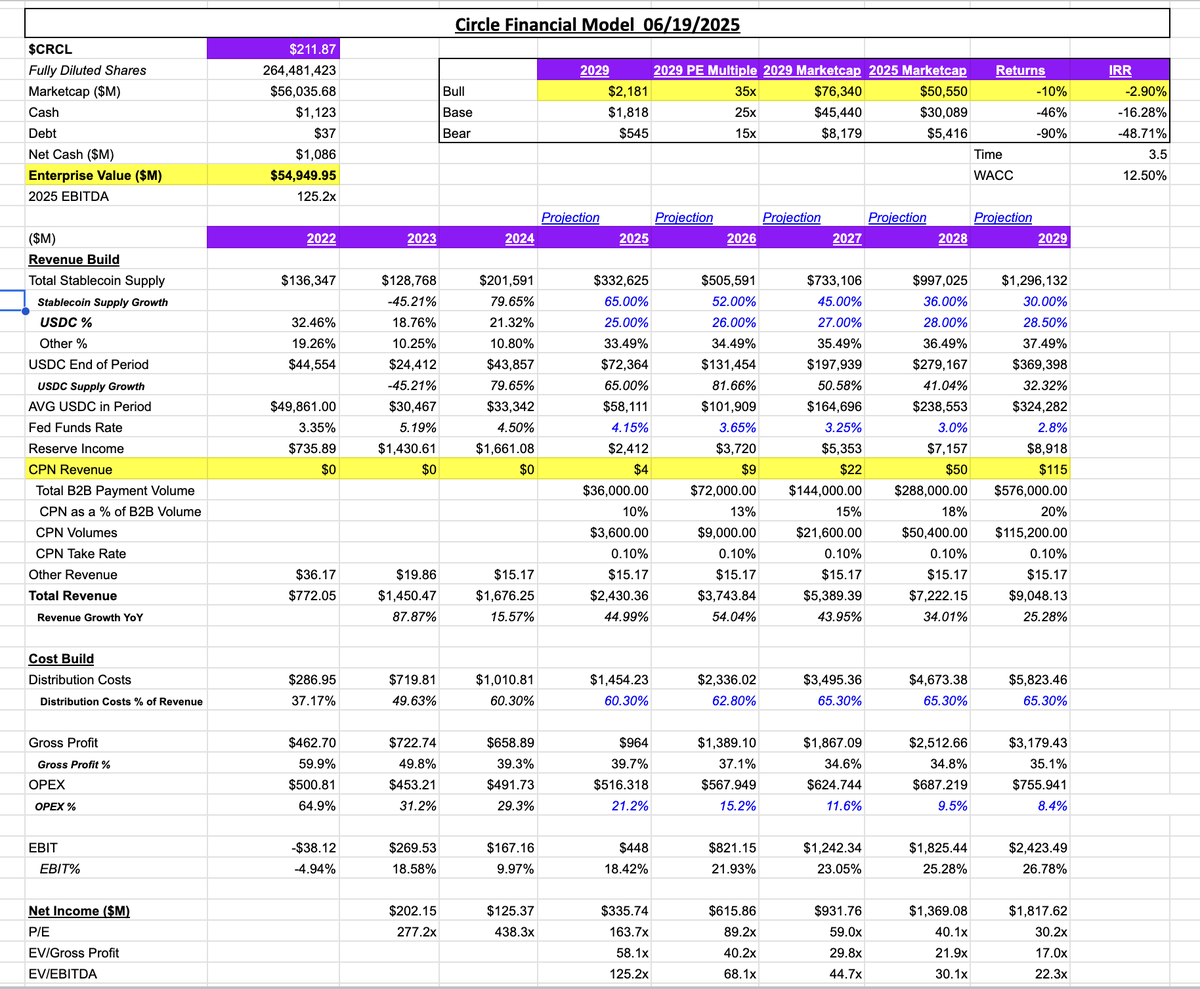

Circle needs to give 50% of its net interest income to Coinbase in exchange for its distribution network, which severely compresses its profit margins. Once the cooperation between the two parties is weakened, Circle will face huge risks.

Difficulty penetrating non-US markets

Boston-based Circle lacks deep connections with the Greater China and “Global South” markets, while Tether has been deeply rooted in these regions for many years and naturally has a distribution advantage.

Potential rivals are eyeing

Social media giants (Meta, X, etc.) and traditional banks are developing their own stablecoin solutions; once implemented, Circle’s channel space will be further squeezed.

2. The interest rate pressure caused by the Fed’s rate cut

Circle's business model is extremely dependent on the interest income generated by USDC reserves.

Reserve interest is the "lifeline"

A 2024 Circle report showed that 99.1% ($1.661 billion) of the company's revenue came from interest on its reserves.

Highly sensitive to rate cuts

In the next two years, the Federal Reserve is widely expected to enter a rate cut cycle. Once short-term yields decline, Circle's net interest margin (NIM) will be compressed and profitability will be greatly reduced.

Lack of diversified income

Currently, Circle has not established diversified business lines sufficient to hedge interest rate risks, and is particularly vulnerable to an interest rate cut environment.

3. Overvaluation: Can the high multiples be sustained?

After the IPO, Circle’s valuation indicators have been staggeringly high:

Such an aggressive multiple means that the market has fully priced in "high growth"; against the backdrop of restricted distribution, pressured spreads and intensified competition, it is extremely difficult to achieve corresponding growth.

Data source: Artemis

Conclusion: Be cautious about high valuations

Although Circle's IPO was highly anticipated, its share price of $200 as of June 20, 2025, is likely to have overdrawn future expectations. The company is in a distribution dilemma, overly dependent on Coinbase, and absent from key markets; the potential interest rate cut by the Federal Reserve will hit its main source of income hard; against this backdrop, the market has given it an extremely high valuation multiple - the risk is further magnified.

For investors, it is important to fully evaluate the above concerns before intervening in CRCL, and maintain diversified asset allocation and a long-term perspective to cope with the drastic fluctuations in the encryption and fintech sectors.