From conservative to progressive, Coinbase copied classmates' homework

Original | Odaily Planet Daily ( @OdailyChina )

Author | Dingdang ( @XiaMiPP )

In 2025, with the return of the "pro-crypto" President Trump to the White House, the GENIUS Act and the CLARITY Act were successively proposed to redraw the regulatory boundaries for digital assets. In February, the SEC halted its two-year law enforcement investigation into Coinbase, relieving it of a heavy compliance burden.

With this momentum, Coinbase is redefining its strategic role in the crypto world. It is no longer a trading platform that "only does spot trading and emphasizes compliance", but is trying to use the US regulatory system as an anchor to fully expand its crypto territory. From the institutional layout under the chain to the ecological extension on the chain, Coinbase is gradually building a financial ecosystem that spans the entire picture of trading, derivatives, infrastructure and payment.

Its expansion logic is not a single-dimensional product stacking, but rather advancing in multiple key directions simultaneously within the compliance framework:

Launched perpetual contracts that comply with the CFTC regulatory framework, officially entering the high-leverage derivatives market;

Seamlessly connect Base ecosystem assets to the Coinbase App through DEX, breaking the traditional barriers to currency listing;

Apply for MiCA crypto license in Luxembourg and plan to expand to Malta, intending to layout the EU market;

It is seeking SEC approval to launch “tokenized stocks” to connect traditional securities trading on the chain.

These four initiatives anchor different institutional and asset boundaries respectively, and also connect the future vision that Coinbase wants to build: without touching the regulatory red line, building a new financial ecosystem that spans centralized finance (CeFi) and decentralized finance (DeFi), on-chain and off-chain.

This strategy is based on a clear logic: the clearer the regulatory framework, the more conducive it is for local compliant companies to unleash their advantages; and the competition among institutional platforms is ultimately not about who is faster, but about who can build the largest functional space within the regulatory order.

A compliance test field in the early years, a regulatory beneficiary today

Coinbase was born in 2012, when Bitcoin just broke through $10 and was in a wild growth period. Unlike many early projects, it chose a unique path: not issuing coins, not doing ICOs, actively embracing regulation, and participating in this decentralized experiment in the most "atypical" way. In 2014, Coinbase became the first crypto platform to obtain a multi-state money service business (MSB) license in the United States; after the bull market in 2017, facing the SEC's investigation of ICOs and the CFTC's strict supervision of derivatives, it further strengthened its compliance system, carefully screened listed assets, controlled leverage risks, and introduced legal experts to improve risk control mechanisms.

In 2021, Coinbase landed on Nasdaq and became the first publicly listed crypto company. This is not only a milestone for the company itself, but also marks the first positive recognition of crypto assets by the traditional financial market. However, after the listing, Coinbase did not move forward in a big way, but entered a stage of cautious stability in the cracks of regulation. After the collapse of FTX, US regulation was tightened across the board. Coinbase was once under pressure due to the controversy over unregistered securities, but its transparent financial structure, rigorous compliance system and robust risk control strategy made it one of the few "survivors" that stood firm.

In 2025, US regulation will reach a turning point. Thanks to the Trump administration's cryptocurrency-friendly stance and the GENIUS and CLARITY Act, Coinbase is moving forward with a global vision. In addition to its efforts in the domestic market, Coinbase is weaving a global compliance network to consolidate its position as a trusted cryptocurrency leader. On June 17, CEO Brian Armstrong said in a post that he would go to London to meet with British policymakers, calling on "the UK to seize the institutional first-mover advantage" and sending a signal of contact with the third institutional fulcrum outside the EU and the United States.

Perpetual Contracts: A Compliance Breakthrough in the High-Leverage Battlefield

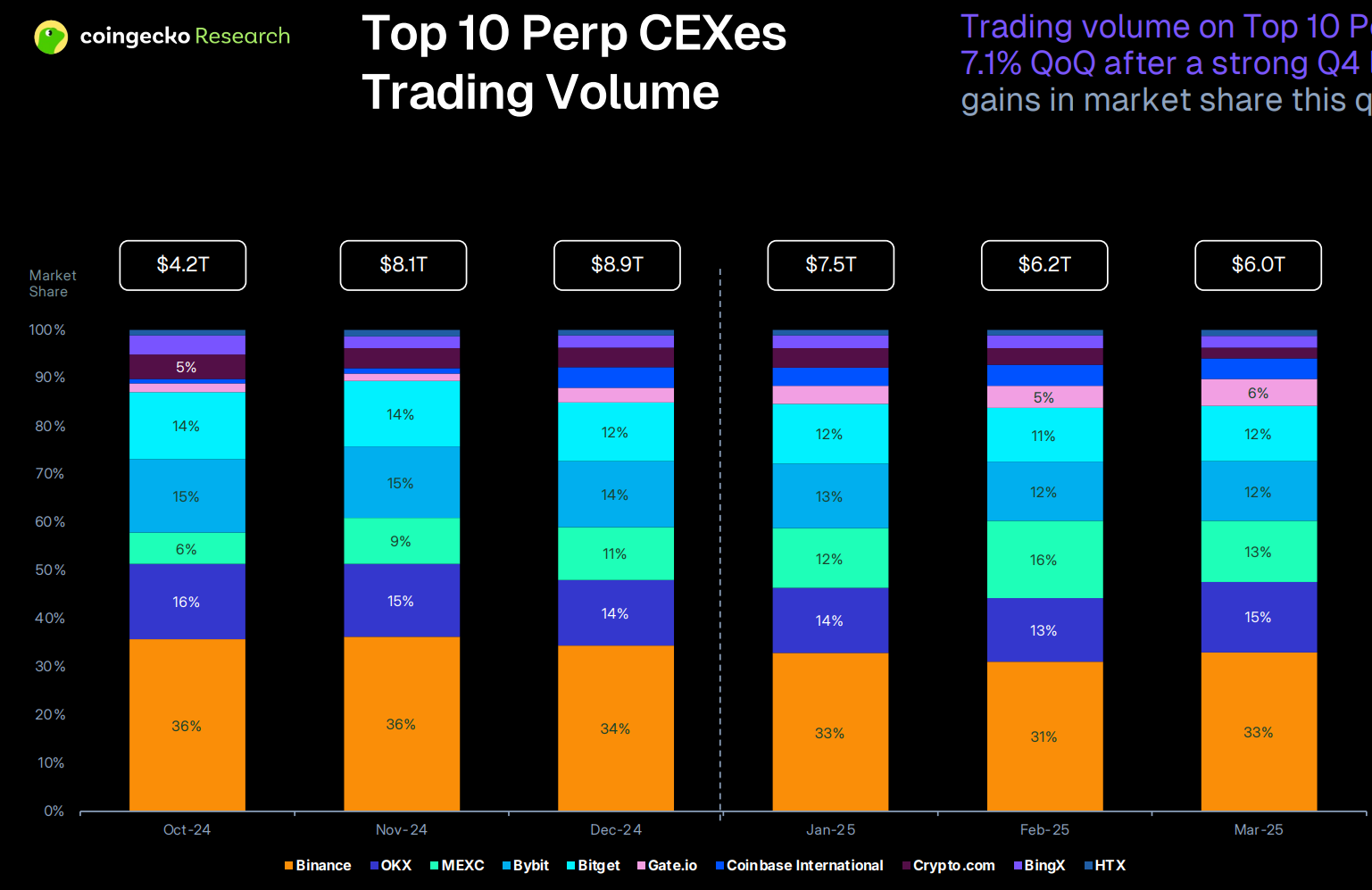

In the field of crypto trading, perpetual contracts are a high-profit area and a sensitive area for regulation. According to the Q1 2025 report released by Coingecko , the cumulative derivatives trading volume of the top ten trading platforms in the world reached 19.7 trillion US dollars, three times that of the spot market. Binance occupies about 32% of the market share, while Coinbase International only accounts for 5%.

But the root of the gap is not in technology, but in strategic choice. For many years, Coinbase has always used compliance as a moat and remained restrained in high-leverage products. This conservative strategy has won it the relative trust of the SEC and CFTC, and successfully completed the listing process, but it has also missed a trillion-dollar market opportunity.

Today, this situation is being rewritten. Recently, Coinbase announced that it has obtained CFTC approval to officially launch perpetual contract products under the compliance framework and announced its entry into the high-frequency derivatives track. This collision of "compliance + high leverage" means that Coinbase no longer avoids the main battlefield of profits, but hopes to enter the core competition area as a rule maker.

This is not just an attempt to "make up for shortcomings", but also an active update of Coinbase's identity. Coinbase hopes to build an institution-friendly and regulatory-approved derivatives ecosystem without deviating from the original intention of supervision, and to create a "regulatable" global liquidity center outside of platforms such as Binance.

Base: From Layer 2 to Strategic Open Interface

The Base ecosystem is a rising star in Coinbase's strategy. In 2023, Coinbase launched the Base network based on Optimism's OP Stack. As a Layer 2 that does not issue coins, it attempts to solve two problems: first, to help developers deploy on-chain applications with a lower threshold; second, to guide Coinbase's more than 100 million registered users into Web3, rather than letting them "stop at the buy button."

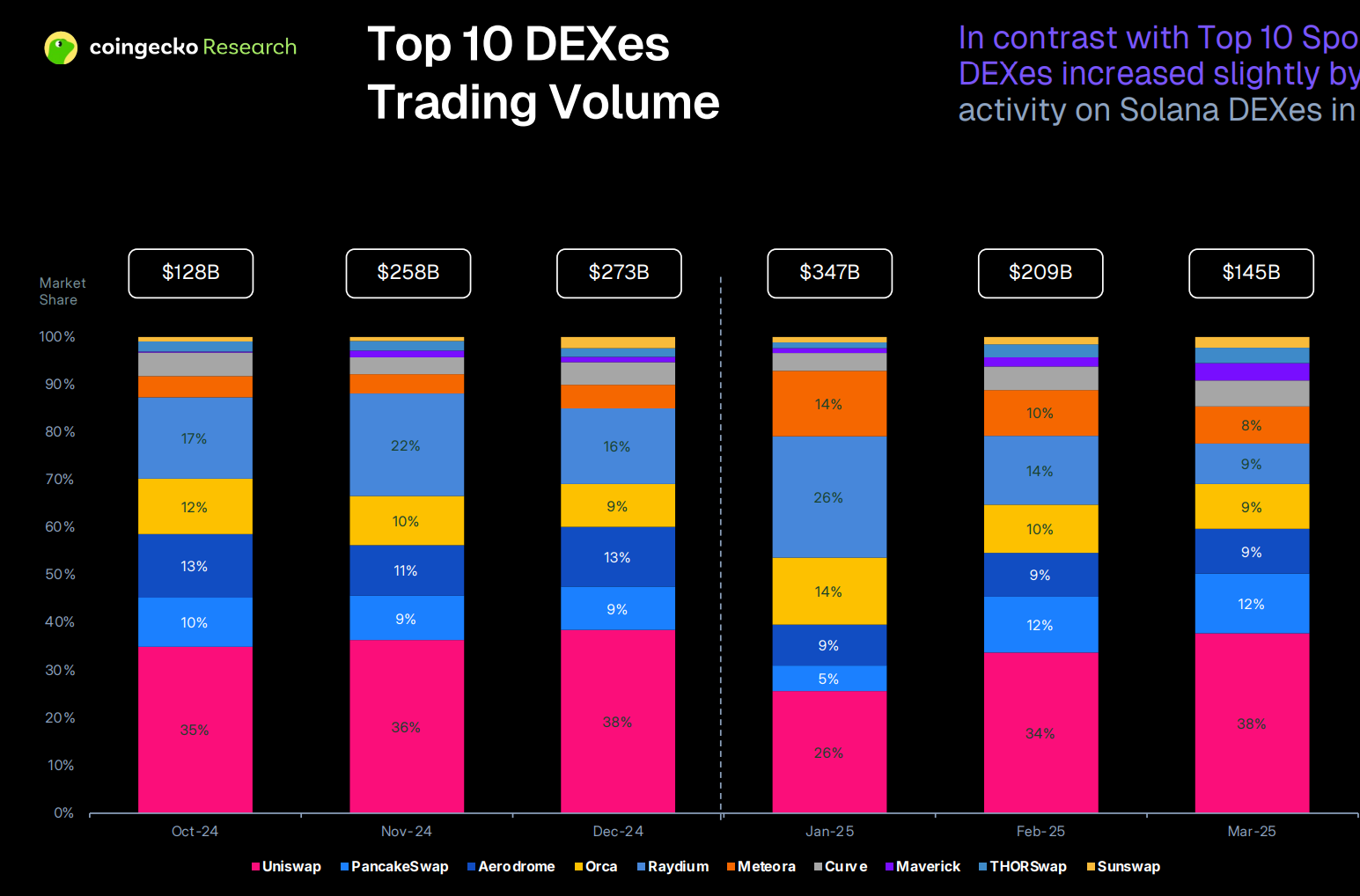

Base is growing very rapidly. In the early days, it quickly ignited the popularity of the social and financial tracks by relying on Friend.tech, AerodromeFi, etc., and also verified the feasibility of the combination of "traffic entrance + on-chain infrastructure". As of June 2025, its total locked volume (TVL) has reached 3.92 billion US dollars. At present, the transaction volume of Base on-chain DEX ranks among the top three, with a market share of between 13% and 19%. Among them, Aerodrome, as the native DEX of Base, started later than Uniswap and PancakeSwap, but it has occupied 9% to 13% of the market share, becoming one of the most direct beneficiaries of Base's growth dividend.

Recently, Coinbase announced that it supports access to high-quality assets on Base through the DEX mechanism, opening up a closed loop from "ecosystem to platform". The assets that users trade on the Coinbase App may come from the automated issuance and community pricing on the Base chain, rather than the traditional centralized listing process. This marks the transformation of Coinbase from a simple asset entry to a connector for the on-chain ecosystem.

Base's identity has also changed: it is no longer just a Layer 2, but an "ecological interface" in Coinbase's strategy. It connects developers, aggregates users, links products, and finds a balance between on-chain governance and centralized brands. In the future, Base is expected to become the hub of the Web3 ecosystem, not only carrying innovative scenarios such as DeFi and NFT, but also becoming a bridge between on-chain assets and the real world through docking with traditional finance (such as JPMD tokens). This openness and inclusiveness makes Base play an increasingly core role in Coinbase's territory.

In the latest development, JPMorgan Chase announced that it will pilot the issuance of JPMD tokens (representing US dollar deposits) on the Base chain. The first transfer will be completed within a few days and will only be open to institutions. JPMD is seen as a compliant alternative to stablecoins, with scalability, and may support interest-bearing and deposit insurance in the future. This not only confirms Coinbase's ability to integrate with traditional finance, but also indicates that Base is becoming an important fulcrum for the on-chainization of sovereign assets. Every step of Coinbase is paving the way for the deep connection between blockchain and the real world.

Tokenized securities: an on-chain mirror of traditional finance

In addition to expanding cryptocurrency trading, Coinbase is trying to expand into a broader range of assets.

Yesterday, Paul Grewal, chief legal officer of Coinbase, said that the company is applying for approval from the U.S. Securities and Exchange Commission (SEC) to launch a "tokenized stock" trading service. This means that traditional financial assets such as stocks will circulate on the blockchain in the form of tokens, opening up a new path for the integration of traditional finance and blockchain technology.

If approved, Coinbase will compete directly with traditional brokerages such as Robinhood and Charles Schwab, and may reshape the underlying logic of securities trading. Users can directly trade on-chain stocks through the Coinbase platform and enjoy the transparency, efficiency and global accessibility brought by blockchain technology. This move marks the strategic transformation of Coinbase: from a simple crypto trading platform to a core on-chain securities infrastructure, becoming a key link between centralized finance (CeFi) and traditional finance (TradFi).

If the SEC approves the plan, Coinbase will improve its strategic layout in the traditional financial market. This will not only provide crypto users with more diverse asset choices, but will also attract traditional investors to enter the blockchain ecosystem and promote the deep integration of on-chain and off-chain financial systems. This move is not only a forward-looking exploration of Coinbase's future financial landscape, but also a powerful manifestation of promoting institutional innovation in a strictly regulated environment.

Coinbase One: A Crypto On-ramp for Users

In terms of C-end user experience, Coinbase is strengthening its financial service closed loop through a subscription system. Coinbase now launches a new subscription level, Coinbase One Basic, with a monthly fee of $4.99 or an annual fee of $49.99, which includes a monthly fee of $500 in free transaction quota, an annualized 4.5% return on USDC, and account security.

In addition, annual payment users will be able to apply for the Coinbase One credit card this fall, which supports the American Express network and can return up to 4% of their spending in Bitcoin. The card is intended to expand the real-world payment scenarios of crypto assets and further open up off-chain consumption paths. Coinbase One has become an important fulcrum for Coinbase to build a compliant, stable, and long-term sustainable user financial portal.

Conclusion: The protracted battle of institutional expansion

Coinbase's expansion journey has long surpassed the transformation framework of traditional exchanges, but is a grand practice of reshaping the financial landscape on the institutional track. It must not only maintain the trust of off-chain supervision, but also embrace the infinite possibilities of on-chain innovation; it must not only create a simple and easy-to-use product system for more than 100 million users, but also compete with regulatory agencies such as the SEC, CFTC, and MiCA for the right to speak in rule-making.

This is not a fast-paced "speed race", but a protracted battle that tests endurance and wisdom. Every step taken by Coinbase is answering a core proposition: how to find a balance between regulation and innovation and build a new financial order that is both compliant and open?

In the future, whether Coinbase can fully expand its product capabilities and scenario boundaries based on the US regulatory system will still take time to verify. But it has taken a key step: becoming the most institutionally trusted bridge between CeFi and DeFi, and providing a replicable sample for the integration of blockchain technology into the global financial system. In this era full of variables, Coinbase's exploration is not only the self-evolution of the enterprise, but also a profound reflection on the path of integration between blockchain and the real world.

Its story is still being written.