Original author: BitMEX

Ethereum (ETH) has recently made a strong breakthrough, and the market has begun to turn its attention to those altcoins that have solid fundamentals but have not yet made up for the rise . A BitMEX research article pointed out that Pendle, Hyperliquid and Aave have outperformed Bitcoin with strong user growth and revenue performance. If ETHs breakthrough can continue, this trend may spread to tokens whose prices are still far behind and have strong fundamentals.

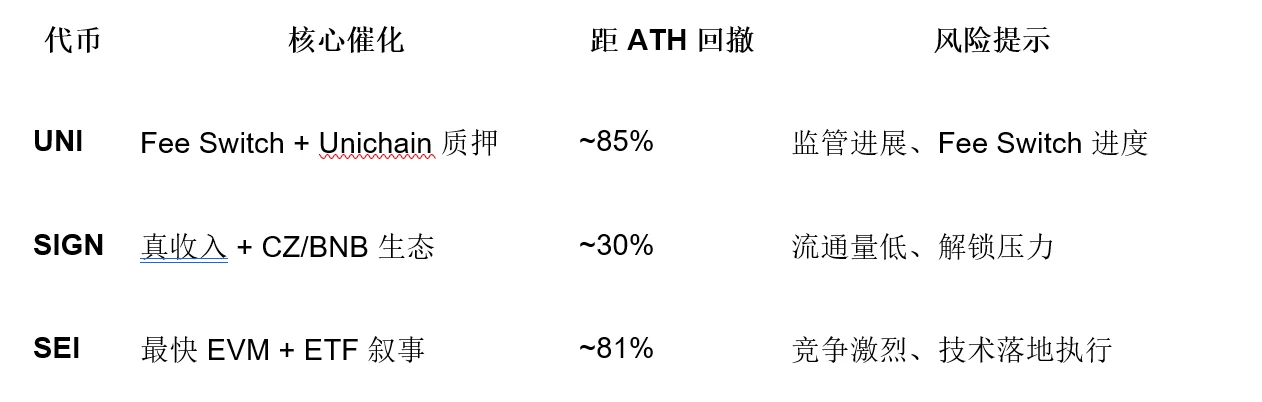

This article focuses on three tokens with clear narratives and catalysts that may usher in the next rise: $SEI, $UNI and $SIGN . We will sort out the core logic of each project, the latest market conditions (current price and retracement from historical highs), as well as key data such as trading volume, revenue, and unlocking progress, to help traders dig out high-winning Alpha , rather than entry-level popular science.

Disclaimer: The following content is only a compilation of market information and does not constitute investment advice. Please be sure to do your own research (DYOR) and bear the corresponding transaction risks. BitMEX is not responsible for any transaction results.

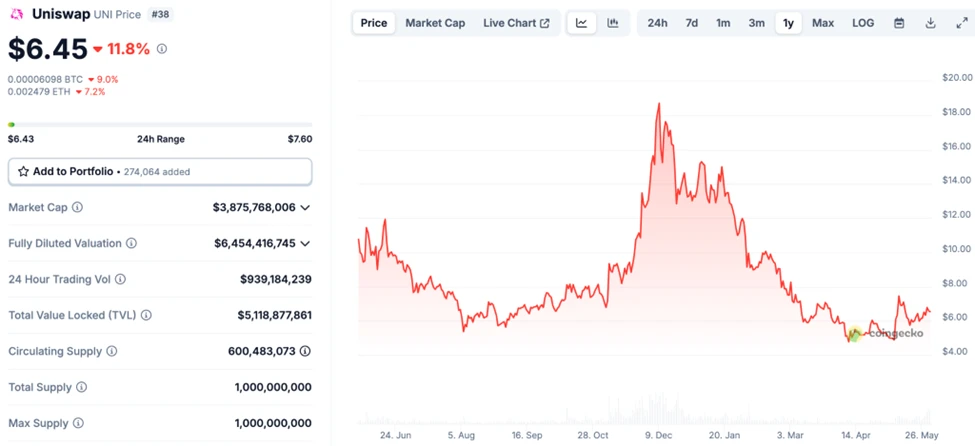

Uniswap (UNI): Ethereum ecosystem leader ushered in double catalysis

Trading pairs: https://www.bitmex.com/app/trade/UNIUSDT

If ETH is breaking through, then Uniswap s UNI is undoubtedly the first choice for ETH Beta : it is the largest decentralized exchange (DEX) in the Ethereum ecosystem and naturally benefits from on-chain activities and liquidity improvements. But UNIs bullish logic is not only that, two new catalysts have been added recently:

1. The regulatory haze has dissipated

In early 2025, the US SEC withdrew its investigation into Uniswap Labs and did not take enforcement action; at the same time, the US Congress is pushing a draft to clarify that token transactions without equity nature are not securities. This more friendly regulatory environment has greatly reduced the legal discount of DEX tokens.

2. Unichain Launch Staking Incentives

In February 2025, Uniswap Labs released the second-layer network Unichain (based on Optimism OP Stack), and stipulated that validators must stake UNI on the Ethereum mainnet to participate. Stakers can share 65% of the Unichain fees (basic fee + priority fee + MEV). This is equivalent to opening the long-lost Fee Switch mode for UNI, and may continue to tighten the circulation.

3. Basic data remains strong

30 -day trading volume: Approximately $ 84.5 billion

Annualized platform revenue: Approximately $ 929 million

Based on the current market value, the P/E is only 4.5 – 6.4 ; in comparison, Coinbase’s P/E is as high as 33 – 42.

TVL : About US$ 5.1 billion, multi-chain DEX trading volume has long been ranked in the top two.

Price: UNI is currently priced at around $ 6-7 , which is still about 85% lower than its all-time high of $ 44.92 in 2021. If Unichain usage expands and the mainnet Fee Switch is implemented, the supply and demand structure of UNI is expected to improve significantly.

Key points

Fee Switch: Reduce inflation + profit distribution

Unichain Staking: Introducing New Buys and Token Usages

Regulatory benefits: Removing doubts about token attributes and significantly increasing the possibility of institutional holdings

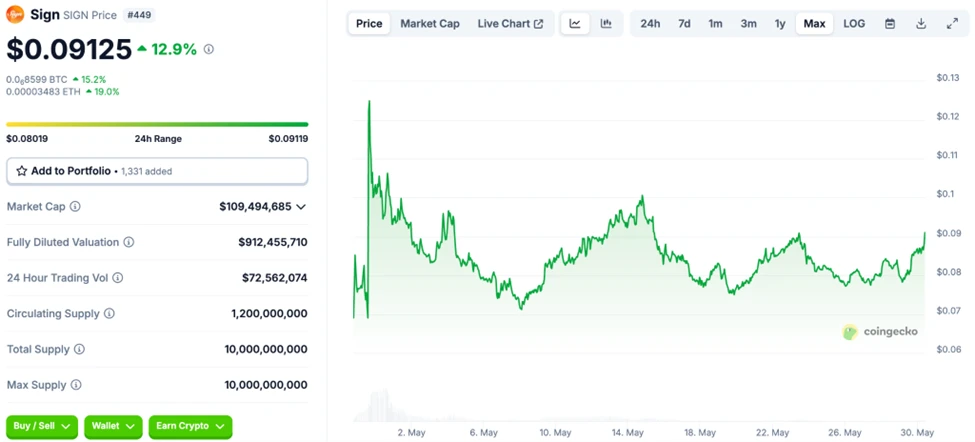

Sign(SIGN): A digital identity startup with real income

Trading pairs: https://www.bitmex.com/app/trade/SIGNUSDT

Sign focuses on on-chain identity and token distribution infrastructure . It only issued tokens in April 2025. Its market capitalization is still small, but it has already demonstrated rare commercial implementation and cash flow.

1. A real revenue model

SignPass: On-chain identity verification used by governments and businesses (already implemented in projects such as Sierra Leone residence permits).

TokenTable: Manages token issuance and attribution for 200+ projects, covering 40M+ users and $ 40+ billion worth of tokens.

2024 revenue: $ 15 million, the company has achieved positive cash flow.

2. CZ leads the investment + Binance empowers

In January 2025, Binance founder CZ invested $16 million through YZi Labs .

In April, Binance launched SIGN and airdropped 200 million SIGN to BNB holders, injecting initial liquidity and attention into the token.

3. Market location and price

Circulation: About 12% (1.2 billion in circulation / 10 billion in total supply)

Market capitalization: approximately $100 million ; FDV approximately $1 billion

Historical high: $0.126; current price: $ 0.07 – $0.09 , about 30% lower than the high .

Small market capitalization + low circulation + clear demand scenarios make SIGN flexible as an early growth stock. However, attention should be paid to the unlocking rhythm and project progress, as high volatility and high risk coexist.

Key points

Digital identity/ WLD alternative , with real users and revenue

Binance ecosystem support , potential for more integration

Small market capitalization + low circulation , large volume can easily lead to accelerated market conditions

SEI: The value depression of the parallel EVM narrative

Trading pairs: https://www.bitmex.com/app/trade/SEIUSDT

SEI is a high-speed Layer-1 for high-frequency transactions and is known as the fastest EVM chain. The Sei V2 upgrade in May 2025 will reduce the transaction termination time to < 0.5 seconds and the throughput to 200,000 TPS , greatly lowering the threshold for seamless migration of Ethereum dApps and entering the parallel EVM track , alongside Monad and MegaETH.

1. Compliance with US regulations + institutional entry

Canary Capital has applied for the SEI Collateralized ETF .

WLFI (Trumps DEFI project) spent $775,000 to buy 4.9 million SEI and included it in its investment portfolio.

TVL: has grown 5 times since Q1, exceeding US$500 million.

2. Valuation comparison highlights the low point

Market capitalization: approximately $1.2 billion (current price: $0.21)

FDV: approximately US$2.3 billion (53% of circulation)

Comparison: Monad’s private equity valuation is $3 billion , and its mainnet has not yet been launched.

Price: Still 81% retreat from the all-time high of $ 1.14 .

Key points

Fastest EVM, clear technical barriers

US capital/ETF story, compliance narrative support

Valuation discount, potential room for catch-up growth

Conclusion

ETHs breakthrough paves the way for the altcoin market, but the key to success is to select the right target . $SEI, $UNI and $SIGN have clear growth drivers and valuation mispricing characteristics, which are worthy of traders attention:

If ETH continues to strengthen, liquidity and risk appetite will tilt toward truly useful targets. Pay attention to the following indicators to find opportunities to enter or increase positions:

SEI: Ecosystem TVL, ETF approval progress

UNI: Trading Volume, Staking Growth Rate, Fee Switch

SIGN: Government cooperation is implemented, identity solutions add new users, unlock schedule

Following prudent position management, these three tokens may become the leading echelon in the next round of market. The market is changing rapidly, I wish you smooth trading and rich profits!

source:

https://www.aicoin.com/en/article/462428https://x.com/virtuals_io/status/1922788444591333778

https://www.gate.io/blog/7389/sign-token-soars-50-what-is-the-sign-project

https://fortune.com/crypto/2024/03/11/monad-paradigm-venture-capital-crypto-jump-bitcoin/