What are the whales on the blockchain secretly buying? Bitget reveals its coin listing mechanism

Original author: Nancy, PANews

The chain is becoming a new battlefield for CEX (centralized exchanges). In recent times, innovative gameplay such as Binance Alpha and Bitget chain trading not only provide the public with convenient and efficient chain trading paths, but the points mechanism has also created a new paradigm for airdrops, greatly stimulating market participation enthusiasm.

In fact, with the continuous improvement of infrastructure, the increasing richness of product ecology and the explosive growth of on-chain assets, on-chain transactions have gradually become the mainstream of the market. In particular, emerging narratives represented by MEME and AI Agent have attracted a large number of new users to the on-chain world with their wealth-creating effects and strong community driving force.

Under this market trend, CEXs including Bitget have keenly captured the potential of the on-chain economy and tried to bridge the gap between CeFi and DeFi with more friendly product forms. In addition to supporting users to trade on-chain assets directly on the CEX interface, Bitget also injects more liquidity into the on-chain economy through a series of innovative products and mechanisms, while promoting itself to become a key hub connecting the on-chain and off-chain, thereby consolidating its core market competitiveness.

As CEXs compete for on-chain high ground, how does Bitget transform the high walls of interaction into traffic channels?

As more and more users and assets pour into the on-chain world, this field, which was once exclusive to geeks and early players, is rapidly becoming lively and complex. Airdrop hunters, DeFi farmers, MEME hunters, stablecoin financial management people... diverse groups of players together constitute an increasingly diverse ecosystem. They drive the continuous expansion of asset scale and also promote the continuous iteration of on-chain infrastructure - such as smarter wallets, more efficient cross-chain bridges, more accurate oracles, and faster and cheaper Layer 2.

However, in this seemingly prosperous on-chain world, a reality that cannot be ignored is gradually emerging: the threshold for on-chain interaction is still high. Complex operation procedures, information asymmetry, cumbersome gas fee mechanism, fragmented cross-chain experience, security risks everywhere... All kinds of pain points have built up a series of "invisible walls" that block the footsteps of countless potential users. This is not only a technical problem, but also a gap in user experience. How to achieve more efficient on-chain interaction while ensuring user safety and lowering the operation threshold is becoming the core proposition of the new round of Web3 innovation and expansion.

At the same time, the on-chain world is moving towards a new stage of "high-density interaction", and CeFi (centralized finance) is also facing a continuous impact on the on-chain ecosystem. Users are no longer satisfied with simple transactions, but are pursuing to quickly capture on-chain trends and opportunities under the premise of safety and convenience, especially the rise of the MEME craze.

Bitget on-chain transactions are becoming a new entry point for redefining the on-chain experience, and also a new tool for exchanges to enhance platform liquidity and attract market attention.

As the on-chain ecosystem continues to prosper, the wealth effect is becoming one of the key driving forces to attract users. Bitget on-chain transactions are rapidly building their unique advantages in early project discovery and value capture with their high-frequency listing rhythm and high-quality asset screening capabilities.

According to Bitget's first-announced coin listing strategy, its on-chain trading coin listing process follows a three-step strategy of "intelligent capture and preliminary review + manual review + online execution" (as shown in the figure below), emphasizing efficiency, security and trends. This will not only help the platform gain a first-mover advantage in the fiercely competitive on-chain ecosystem, but also help users screen more reliable potential assets.

Since its launch on April 7, Bitget has launched at least 120 tokens in less than two months. In terms of type, most of them are popular assets such as MEME and AI, which are in line with the focus and preferences of current users on the chain; in terms of the frequency of listing, at least 2 tokens are launched every day on average, showing its high sensitivity to market hotspots and its ability to respond quickly to user needs.

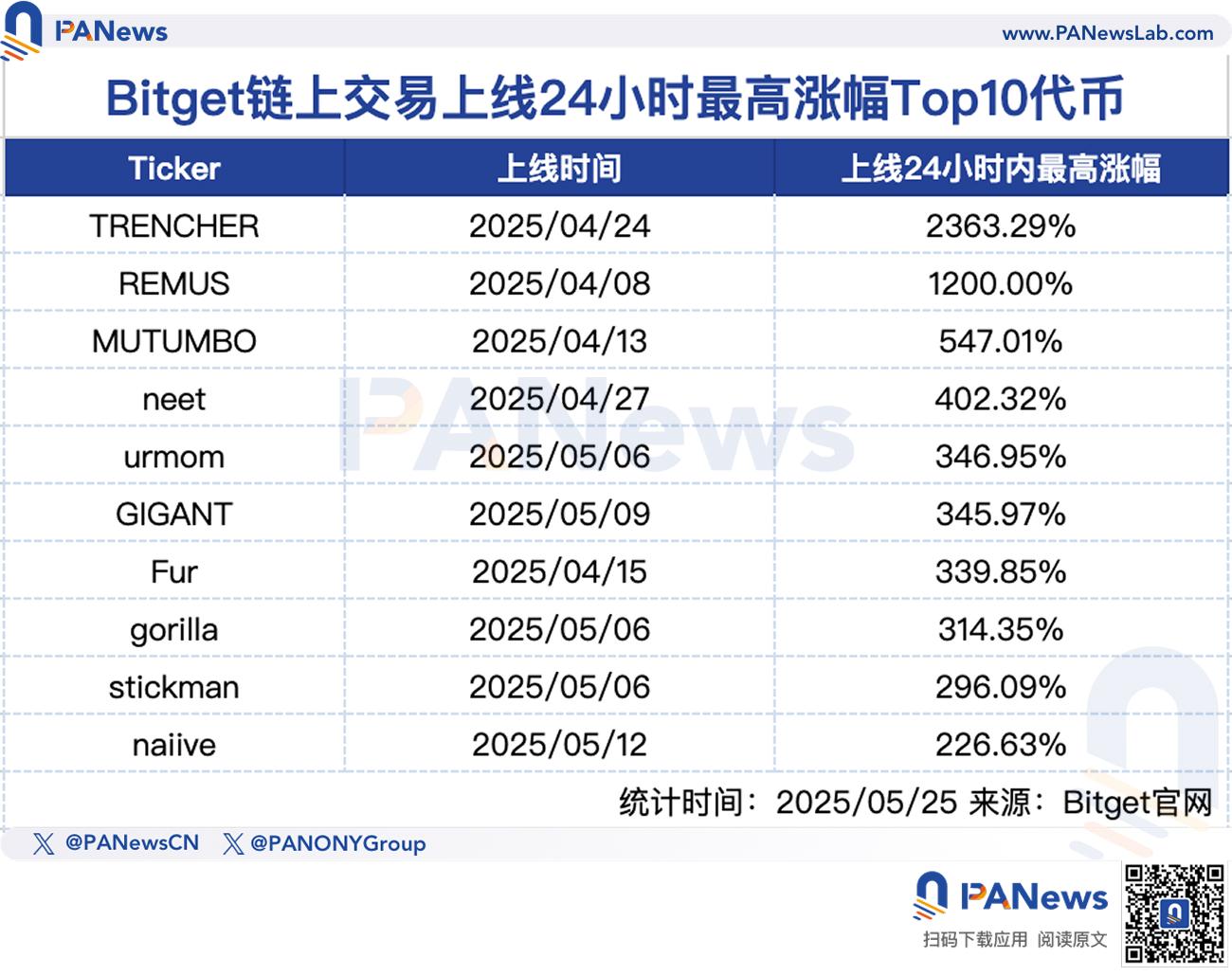

What is even more interesting is that many projects have shown extremely attractive returns on investment. According to PANews statistics, the top ten tokens with the highest increase within 24 hours of Bitget's on-chain trading were ranked, with an overall average increase of 638.25%, reflecting its strong market performance and the strength of capital pursuit. Among them, TRENCHER, MUTUMBO and REMUS have achieved amazing returns of several times or even dozens of times. Most of these tokens are early assets that have not yet landed on mainstream exchanges such as Binance, which further confirms Bitget's foresight and independent judgment in capturing early high-quality assets. From the perspective of time distribution, Bitget's on-chain trading continues to produce "dark horse" projects, which not only effectively attracted market attention, but also strengthened its brand influence in early asset discovery.

In addition, the value of Bitget's on-chain transactions is not only reflected in its early launch of new products, but also in its continuous empowerment of high-quality assets. So far, 8 projects traded on the Bitget chain have been included in Binance Alpha, which is not only a reflection of the time difference, but also a concentrated display of the platform's ability in project judgment, trend capture and resource integration.

For example, Bitget's on-chain transactions were the first to launch tokens such as FHE, gork, and AIOT, and these projects were subsequently included in Binance Alpha, demonstrating its rapid capture of market trends and first-mover advantage, and the average maximum increase of 526% more effectively broadened the platform's market exposure window. The three major projects, TROLL, gorilla, B 2, and BANK, achieved the same frequency coverage as Binance Alpha on the day of their launch, which is not only a coincidence of market sentiment and hot spot resonance, but also reflects the efficient synergy system established by Bitget between project screening mechanisms, currency listing rhythm control, and cutting-edge research trends. In addition, in terms of user experience, compared with Binance Alpha, Bitget's on-chain transactions use a non-sensing Gas fee mechanism, which can significantly reduce users' operating costs while improving the trading experience, effectively stimulating user activity, and forming a positive trading cycle.

The introduction of the points gameplay has also become an important tool for various exchanges to significantly improve the user stickiness and market activity of the platform, as well as the dominance of resources. From the point gameplay of Bitget's on-chain transactions, it cleverly balances the benefits of ordinary users and high-frequency traders through low-threshold participation and dual reward mechanisms, taking into account fairness and incentives, providing a variety of return paths for novice and veteran traders, and demonstrating efficient user incentives and platform growth strategies. Since its launch, Bitget has launched two rounds of on-chain points challenges, with 50,000 platform coins BGB issued as airdrop rewards in each round.

In summary, as on-chain interactions move towards a new stage of high density and high frequency, users' expectations for trading platforms have long gone beyond the "tool" level and turned to comprehensive considerations of experience, efficiency and value capture capabilities. Bitget on-chain transactions not only build an advantage in capturing early high-quality assets through high-frequency new listings and forward-looking screening, but also break the "on-chain wall" through mechanisms such as non-sensing Gas and point incentives, significantly optimizing the user experience and stimulating user activity.

Six core functions reconstruct the on-chain trading experience, making it as smooth as CEX

As a secret weapon to bridge the gap between CeFi and the on-chain world, Bitget on-chain trading is a one-stop tool that not only redefines the on-chain trading experience, allowing users to avoid switching repeatedly between CeFi and DeFi, but also avoids having to bear cumbersome processes and high learning costs.

Bitget on-chain transactions redefine the on-chain transaction experience through six major core functions:

Instant on-chain transactions: Users can directly use USDT or USDC in their spot accounts to trade on-chain assets without creating a wallet or managing private keys. This feature greatly reduces the learning curve for novices while allowing professional users to quickly seize market opportunities.

Full transparency: Help users build data-driven investment strategies by transparently displaying key indicators such as contract data, number of holders, FDV and liquidity.

Real-time Token Ranking: Through the “Hot Recommendation” and “New Token Recommendation” functions, users are presented with the most promising token rankings based on real-time (blockchain scanned every 60 seconds) on-chain data (such as price increase, transaction volume, user activity).

AI-driven screening function: Introducing AI-driven asset screening function, using advanced algorithms to analyze massive on-chain data and user behavior models to intelligently screen potential tokens, helping to efficiently discover high-quality assets, improve decision-making efficiency, and reduce emotional investment risks.

Cross-chain support: Supports the three major public chains of Solana, Base and BNB Chain. Users can capture multi-chain opportunities in one stop without manual switching or bridging. More networks are planned to be expanded in the future.

· No-feel Gas mechanism: Gas fees are automatically processed, users do not need to worry about configuration, and transactions are executed efficiently and at low cost.

From this point of view, from asset discovery to transaction execution, from chain selection to fee settlement, Bitget on-chain transactions always build product logic around user experience. It not only meets the needs of veterans on the chain who pursue speed and efficiency, but is also particularly suitable for novice users who have just entered the market, and can easily, efficiently and safely navigate the on-chain ecosystem. By lowering the threshold for use and improving the convenience of transactions, Bitget on-chain transactions are injecting new users and liquidity into the on-chain ecosystem, helping to promote the popularity and prosperity of the entire on-chain world.

From incentive tools to ecological binding, Bitget accelerates on-chain layout

"2025 will be a key year for CEX to go deeper into DeFi. But currently DeFi is still too complicated for many novice users, especially those who have just purchased their first cryptocurrency on a mobile app. In this process, CEX will become a gateway to the crypto world, serving millions of users. CEX will not disappear, but will adapt to changes, and DeFi will become a core part of its adoption. Bitget is already moving in this direction, transforming from a centralized exchange to a comprehensive Web3 platform." Bitget CEO Gracy Chen has repeatedly emphasized in public that Web3 is one of Bitget's key business layout directions.

In addition to opening up on-chain transaction channels, Bitget is also building a panoramic ecosystem covering CeFi and DeFi through a series of strategic product and mechanism upgrades under the background of the accelerated evolution of the on-chain world. Prior to this, Bitget acquired and launched products such as the multi-chain wallet Bitget Wallet and on-chain coin earning, as well as expanding the on-chain application scenarios of the platform coin BGB, broadening the path for users to participate in the on-chain world, and continuing to deepen its on-chain ecological layout.

Among them, it is worth mentioning that Bitget has made a key upgrade to the destruction mechanism of the platform currency BGB this year. This change not only injects more imagination space on the chain into BGB itself, but also indicates the evolutionary direction of the deflationary logic of the platform currency. In April this year, Bitget issued an announcement stating that in order to improve the compliance and transparency of BGB and the destruction plan, and at the same time better empower the BGB ecosystem, and promote its application scope from off-chain to on-chain, from the encryption field to the real world scenario, the quarterly destruction of BGB is based on 30 million BGB, linked to the "on-chain gas fee", and the new destruction mechanism is based on the actual use scenario of BGB. This mechanism means that BGB is no longer just a platform incentive tool, but a deflationary asset with real on-chain use value, and its destruction scale will directly reflect the actual use of BGB in the on-chain ecology.

In fact, the current platform coins are collectively entering the "post-value management era". The competition is not only about whether to destroy, but whether to build a sustainable and flexible deflation mechanism and a strong market influence. The application of BGB is not limited to basic platform scenarios such as transaction fee discounts, financial management, new listings, and real-life payments. This dynamic deflation that links on-chain usage behavior with the destruction mechanism will further enhance its presence on the chain, thereby enhancing the practicality and intrinsic demand of BGB, opening up a new narrative space for its long-term value, and gradually becoming a "pass" and "value center" connecting CeFi and the on-chain ecology.

It is foreseeable that the deep integration of platform coins into the on-chain ecosystem is becoming a major trend. In fact, on-chain transactions have inherent advantages such as openness and transparency, but they also face challenges such as high technical barriers, high security risks, and unstable transaction efficiency. CEX, with its user base, liquidity advantages, and mature infrastructure, can improve the depth of on-chain transactions and price stability, lower the threshold for user use, and at the same time, CEX attracts traditional users to enter the Web3 ecosystem, and provides exposure opportunities and liquidity support for on-chain projects, ultimately realizing the interconnection between CeFi and DeFi in terms of liquidity and users.

Standing at the turning point of the popularization of Web3, Bitget is user-centric and, by opening up the product closed loop between on-chain and off-chain, it not only innovates the trading experience, but also builds an on-chain value system with sustainable growth logic.