Funding rate hits record, ALPACA contract last dance before liquidation

Original | Odaily Planet Daily ( @OdailyChina )

Author: Golem ( @web3_golem )

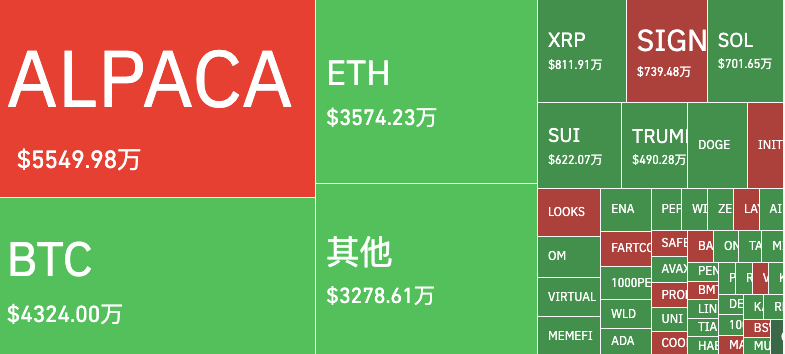

There are always new things happening in the field of crypto contracts that are hard to understand. On April 24, Binance announced that it would delist ALPACA and other tokens on May 2. However, contrary to common sense, ALPACA did not fall but rose instead. It has risen more than 30 times since the announcement, and has risen to $1.27 today. At the same time, according to Coinglass data, the liquidation volume of ALPACA 24H contracts has exceeded BTC and ranked first, reaching $52.0413 million.

Spot prices surged, and the contract trading volume was huge. Astute users immediately understood that this was a "short squeeze" carefully arranged by the market makers. Because the delisting of Binance is a typical bad news in the market, a large number of users rushed to short ALPACA, which was about to be delisted on May 2. Among them, there were also some traders with millions of funds. However, the mantis stalks the cicada, and the oriole is behind. The logic of traders "selling the news" was also used by the market makers.

Simply put, the dealer's operation method is to first hold a huge long position, and then pull up ALPACA in the spot market to make the contract funding rate negative. At this time, a large number of short-selling users must pay "interest" to the dealer.

Of course, it is certain that Binance will delist ALPACA. If the contract market’s regulation is to settle funding fees every 8 hours, it is obviously not worth the loss if the dealer continues to operate for more than a few days. In the end, the dealer dared to let go of the game thanks to the exchange’s bold operation.

The frequency and upper limit of the exchange's funding rate settlement have been adjusted, and the market makers are ecstatic

At 1:00 am Beijing time on April 25, Binance Futures announced the adjustment of the funding rate settlement frequency of the ALPACA U-margin perpetual contract. The funding rate settlement frequency will be adjusted from once every four hours to once every two hours. Subsequently, on April 25, the funding rate settlement frequency will be shortened from once every two hours to once every hour.

Binance's move made the market makers ecstatic. As of April 26, the price of ALPACA was raised to $0.34. The reason is that the payment direction and frequency of the funding rate directly determine how quickly and frequently the longs can get the rate income paid by the shorts. Originally, it was settled every 4 hours (6 times a day), but it was changed to settlement every hour, so there can be 24 funding payments a day instead of 6 times. This also makes the market makers more motivated to push up the spot price of ALPACA, because:

Ability to cash in profits faster : receiving fees every hour means that the funding income is more timely, reducing the opportunity cost of capital occupation time.

Better for capturing fluctuations in funding rates : funding rates will change dynamically when the market fluctuates, and hourly settlement enables bookmakers to capture soaring negative rates more flexibly.

Perhaps Binance also realized that something was wrong, so at 18:00 (Beijing time) on April 29, it adjusted the upper limit of the funding rate of the ALPACA U-based perpetual contract to +4.00%/-4.00%, setting a historical record for the contract funding rate.

After the announcement, ALPACA plummeted, falling to a low of around $0.065.

The last dance before automatic liquidation

It was thought that this farce of long-short game would stop here, and ALPACA would reach the expected ending of "zero". But unexpectedly, ALPACA started to rise again today, with the price reaching a maximum of $1.27, a daily increase of more than 380%. The reason for the pull-up is actually hidden in the Binance announcement. In the announcement of Binance's delisting of ALPACA on April 24, the liquidation of ALPACA contracts was described as follows:

Binance Futures will automatically liquidate ALPACA’s perpetual contracts at 17:00 (ET) on April 30, 2025, and will delist ALPACA’s perpetual contract trading pairs after the liquidation is completed. From 16:30 (ET) on April 30, 2025, users will not be able to add new positions in the perpetual contracts of the above-mentioned tokens.

Therefore, for the market makers, today is the last dance before ALPACA is automatically liquidated. At this time, raising the spot price can maximize its profits. If the market makers do not raise the price at this time, then once liquidated, all positions will be liquidated at a low price by market price or taker liquidation. After the market is raised, even if it is automatically liquidated, it can be closed at a higher price to recover part of the value. At the same time, because the lower limit of the funding rate has been relaxed to -4.00% and settled every hour, if there are still people shorting , the market makers holding long positions continue to raise the market. Under the mechanism of hourly settlement, this part of "passive income" can be continuously collected from the shorts.

When the clock struck 17:00, ALPACA ended its "evil life" in the Binance Futures market, with its price falling to around $0.6, a drop of 58.4%. After it was officially removed from the spot market on May 2, where will it go?

For spectators like me, today is a day to watch the crazy operations of the contract bosses. I still remember that the last amazing contract operation was the self-exposure liquidation of the hyperliquid whale (see " Why did the Hyperliquid whale self-explode and close its position? Who bears the millions of dollars in losses? "). It can be seen that no matter whether the positions and rules are open and fixed, there will always be people who can take advantage of opportunities and magnify their profits.