The real alpha is not you who is struggling to find the target, but you who are familiar with this set of mental methods

Original title: Mind-shifts Amidst The Chaos

Original author: The Learning Pill ( @thelearningpill )

Compiled by: Asher ( @Asher_0210 )

In the uncertain world of crypto markets, technical analysis and token economics provide limited support. The real competitive advantage comes from the way of thinking: the psychological model that can influence decision-making under complex market conditions. In other words, successful crypto investment does not rely solely on fundamental analysis or market trends, but on mastering how to think in terms of probability, deeply understand the second-order effects of the market, seek asymmetric investment opportunities where the returns far outweigh the risks, build anti-fragile strategies that can gain greater resilience in turbulence, clearly evaluate the opportunity cost of each investment, identify and follow emerging market narratives, effectively manage your attention to avoid noise, maintain a long-term investment perspective, avoid linking personal identity to investment performance, and focus on optimizing the investment process rather than a single transaction result.

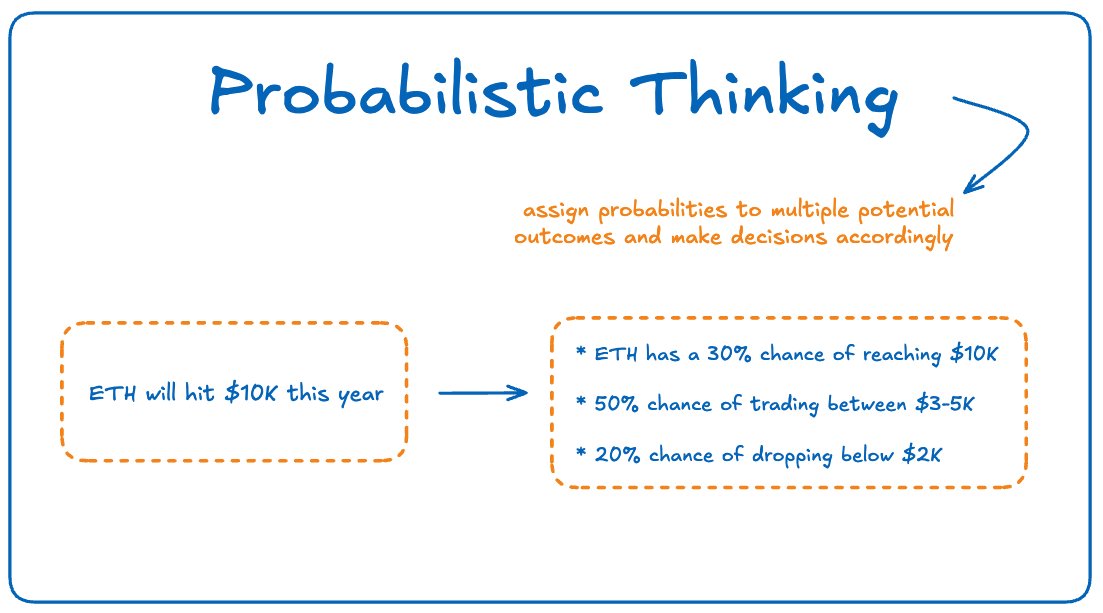

1. Probabilistic thinking: replacing certainty with odds

Most crypto investors get stuck in binary thinking: "This project will definitely go up 10x" or "The market will definitely crash." This absolutist way of thinking leads to overconfidence, incorrect position allocation, and emotional collapse when predictions fail. Effective crypto investors are different. They assign probabilities to multiple possible outcomes and make decisions accordingly. Instead of saying "ETH will definitely go up to $10,000 this year", it is better to say "ETH has a 30% probability of going up to $10,000, a 50% probability of fluctuating between $3,000 and $5,000, and a 20% probability of falling below $2,000."

Probabilistic thinking allows one to:

Allocate positions reasonably according to risk;

Prepare response plans for a variety of possible scenarios;

Make rational decisions amid uncertainty;

Keep your emotions calm during extreme market fluctuations.

When using probabilistic thinking, investors are never completely wrong but simply adjust the probability distribution as new information becomes available.

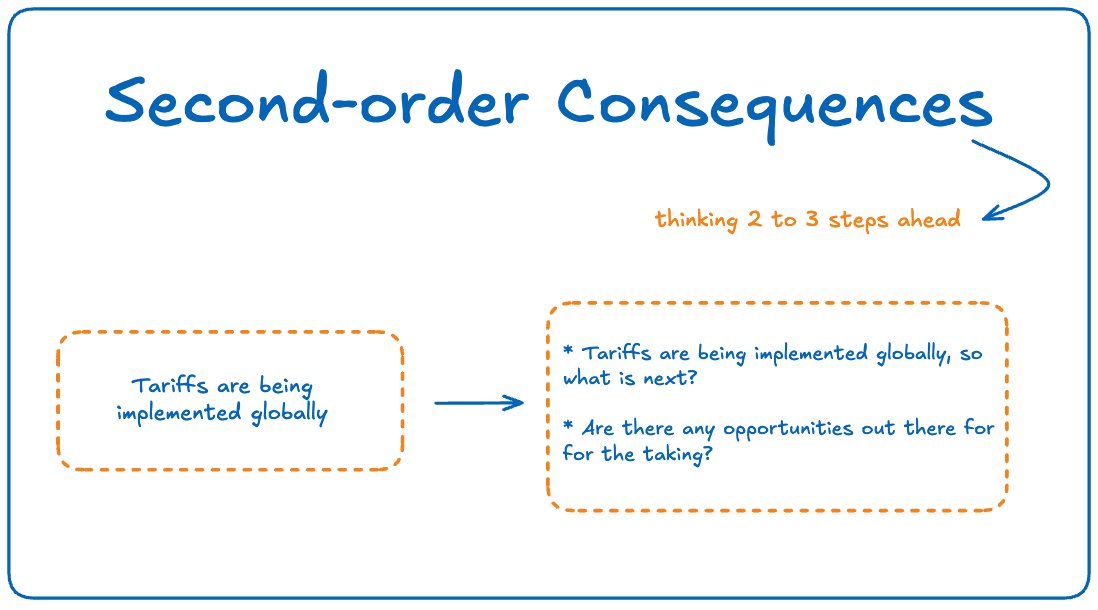

2. Second-Order Effects: Insights Beyond the Surface

Ordinary investors tend to only react intuitively to news, while efficient crypto investors ask: "What will happen next?" For example, when China banned crypto mining, many people panicked and sold. But those who thought from the perspective of second-order effects realized that this would lead to the decentralization of mining, which might enhance Bitcoin's long-term risk resistance, and thus made corresponding arrangements.

Second-order effects can train people to automatically think two or three steps ahead, helping to:

Predict market trends in advance;

Identify hidden risks behind seemingly positive news;

Find hidden opportunities in seemingly negative news;

Plan ahead before the public reacts.

The most profitable insights often lie in these second- and third-order effects, which many investors completely ignore.

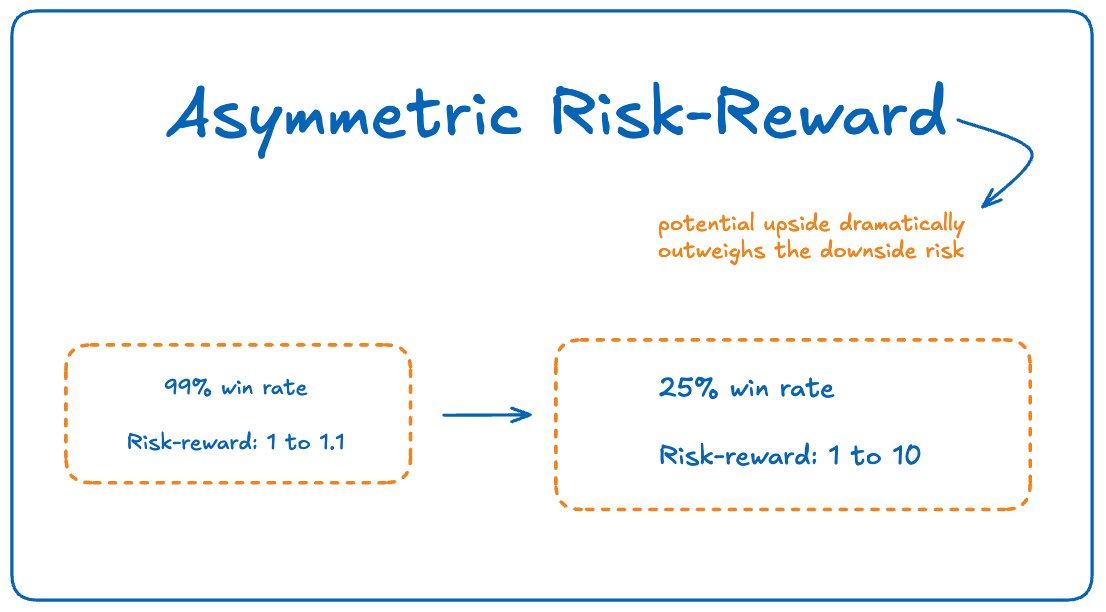

3. Asymmetric Risk-Reward: The Only Game Worth Playing

Conventional wisdom tells you to look for "good investments," but effective crypto investors look for asymmetric investment opportunities where the potential for gains significantly outweighs the downside risk. Asymmetric risk-reward means that a portfolio should be able to withstand numerous small losses while also being able to capture the occasional large gain, including:

Sizing your positions so that even a complete failure won’t cause significant damage to your portfolio;

Look for opportunities where you might lose 1x but earn 10x, 50x , or even 100x;

Trading lower success rates for greater gains;

Avoid situations where modest gains come with catastrophic downside risk.

Especially in crypto, where the distribution of returns follows a power law, a single life-changing winner can outperform decades of “safe” traditional investing.

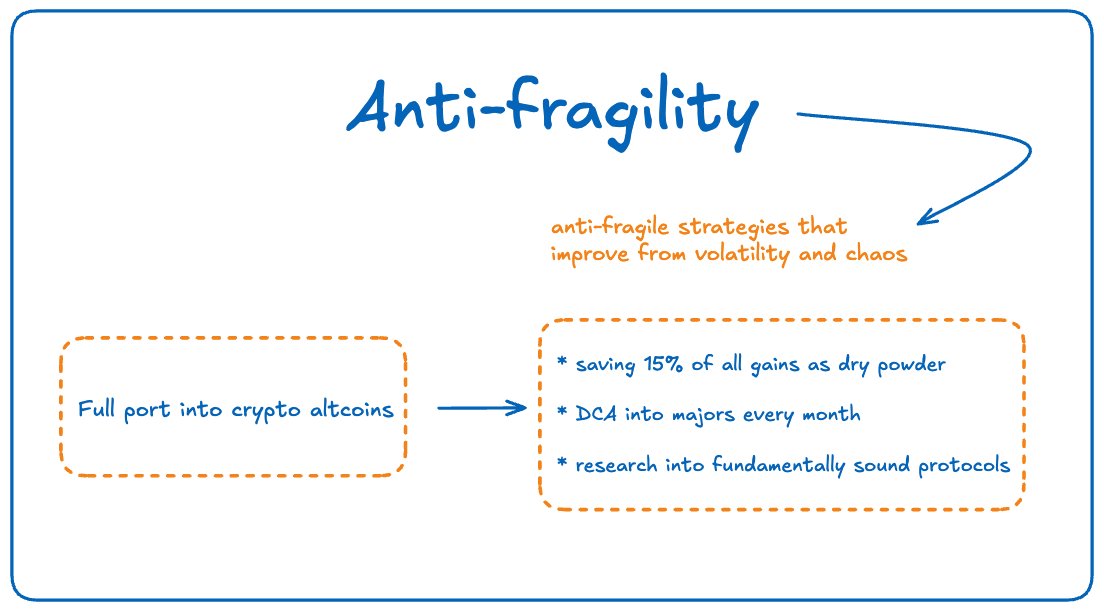

4. Antifragility: Benefiting from Chaos

Most investors aim for resilience, which is the ability to survive volatility. But effective crypto investors build anti-fragile strategies to make themselves stronger in market turmoil. Anti-fragility includes:

Maintain sufficient cash reserves to use in case of a market crash;

Accelerate the DCA in a downtrend;

Focus on protocols that are able to attract users/increase revenue during periods of market stress;

Using volatility itself as part of a strategy (such as options strategies).

While others are simply trying to weather the storm, antifragile investors are quietly taking the opportunity to strengthen their positions.

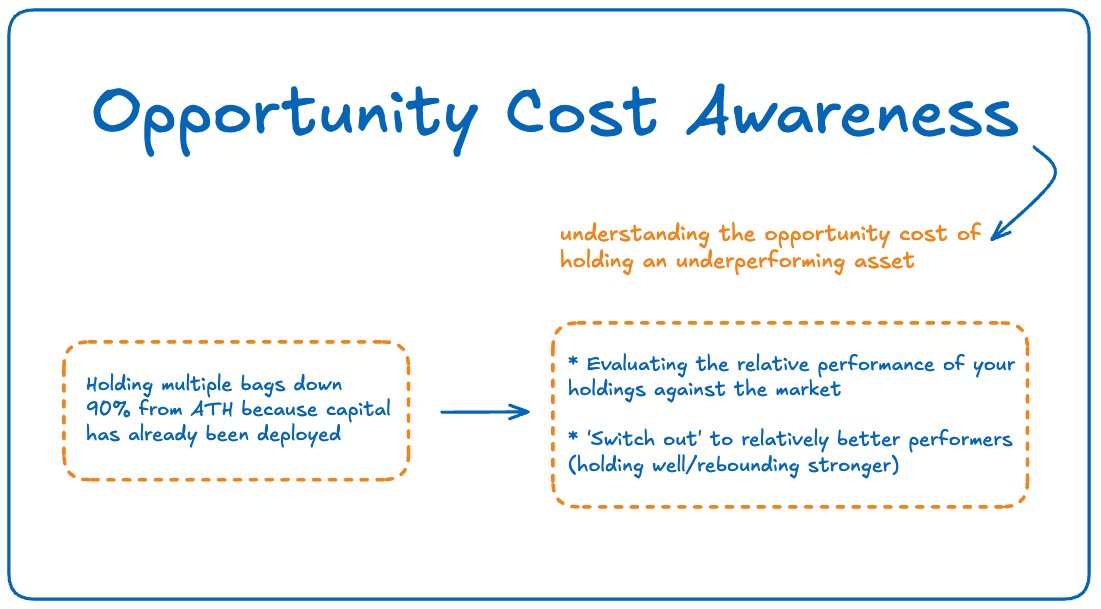

5. Opportunity cost awareness: the hidden tax of wrong decisions

Every investment decision has a shadow cost, which is "what could have been done with these funds more profitably". Effective crypto investors will closely calculate the opportunity cost to improve the efficiency of their portfolio. Opportunity cost awareness means:

Evaluate your positions regularly to see if there are better opportunities;

Dare to cut losses when capital can be used more efficiently;

Understand that holding underperforming assets is not “neutral” but is wasting capital;

Set clear stop-loss criteria and liquidate positions that fail to achieve target performance in a timely manner.

The true cost of a mediocre investment is not just lower-than-expected returns, but also missed opportunities that could have produced superior returns.

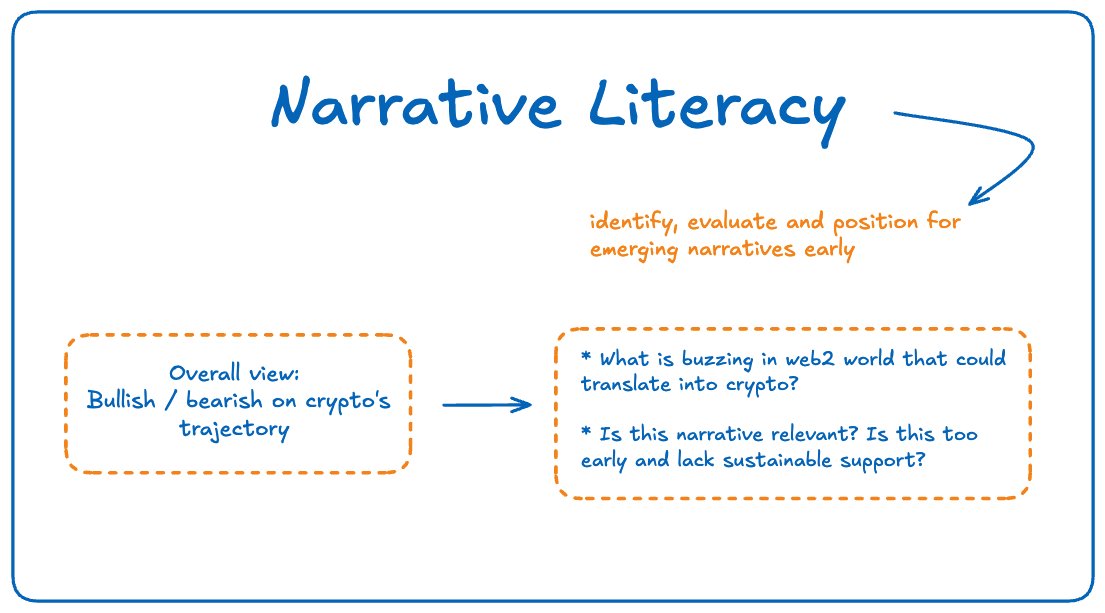

6. Narrative literacy: Read the market before the story is written

Markets will move based on narratives rather than fundamentals when attracting capital flows. Being able to identify, evaluate, and position upcoming market narratives early may be the biggest competitive advantage in the crypto market. Narrative literacy means:

Distinguish between short-term hype and stories with lasting value;

understanding which narratives can actually drive sustained capital flows;

Identify if a narrative is approaching saturation or exhaustion;

Get in front of narrative shifts rather than chasing established trends.

It’s not just about following the hype, but about gaining a deep understanding of why certain ideas capture the market’s collective imagination and what that means for capital flows.

7. Cognitive Focus: Protect Your Attention

In the 24/7 information flow of the crypto world, the most scarce resource for investors is not capital, but attention. Effective crypto investors will try their best to focus on the project because they know that most "news" is actually noise, which hinders focused analysis, including:

Create information filters to exclude low-signal inputs;

Establish clear criteria for deciding what is worthy of attention;

Building systems to help investors identify true signals from the noise;

Schedule dedicated deep work time for research and analysis.

The highest rewards come from thinking deeply about a few things, rather than superficially focusing on everything.

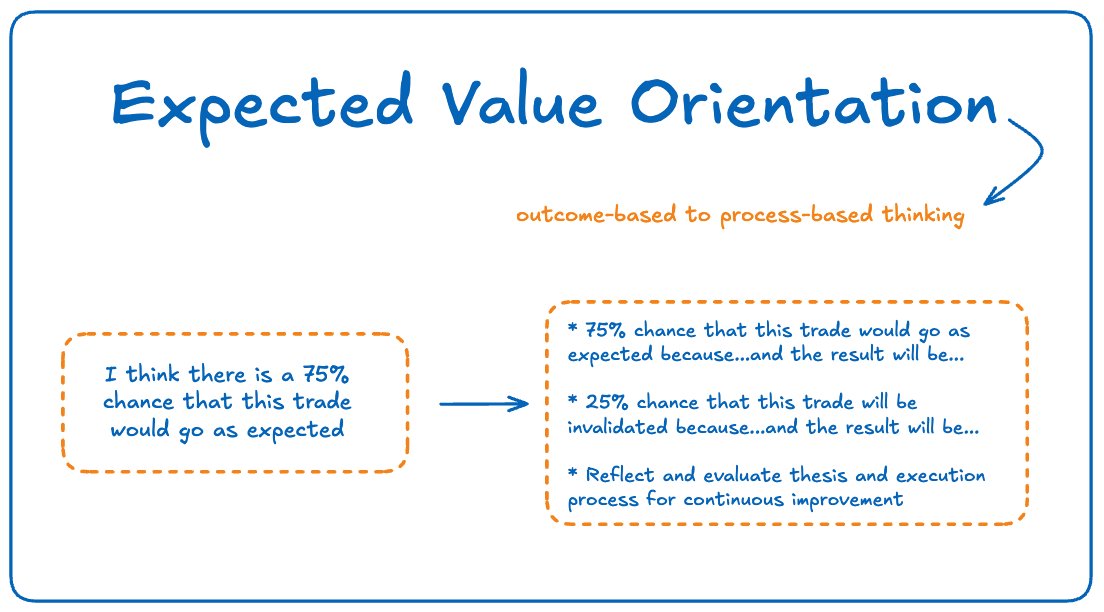

8. Expectation-oriented: Focus on the process, not the results

Most investors are always too focused on a single transaction result, while efficient crypto investors focus on the positive expected value of their decision-making system over multiple iterations. The shift from result-oriented to process-oriented means:

Don’t be discouraged by inevitable losses;

Evaluate decisions based on information available at the time, rather than looking at them in hindsight;

Continuously improve the decision-making process rather than dwelling on individual transactions;

Understand that even good decisions may lead to undesirable results in the short term.

By focusing on the expected value of multiple decisions, rather than the outcome of a single transaction, you can build a sustainable approach that builds over time.

The real Alpha lies in the way of personal thinking

As the crypto market matures, investors’ greatest competitive advantage will be their mindset. The mental models described above are more than just abstract concepts; they are practical thinking tools that can help separate investors from those who linger in FOMO and panic.

The good news is that while markets are unpredictable, mindset is manageable. By consciously cultivating these mindset shifts, investors can maintain clarity and confidence during the most turbulent times of the market, something most participants lack. Don’t update your trading strategy or mindset just to cope with the current market cycle.