1. Outlook

1. Macro-level summary and future forecasts

The Federal Reserve released the FOMC meeting statement and economic forecasts on March 19, maintaining the policy interest rate unchanged at 4.25%-4.50%, and plans to further slow down the balance sheet reduction starting in April. The meeting statement emphasized the increase in economic uncertainty, lowered the economic outlook for the next three years, and raised the inflation outlook. However, in the past week, the three major US stock indexes closed higher, and panic sentiment eased slightly. Against the backdrop of slowing economic growth, continued inflationary pressures, and intensified geopolitical risks, stock and bond markets may continue to fluctuate. Investors need to pay close attention to economic data, policy signals, and geopolitical developments.

2. Cryptocurrency market changes and warnings

Last week, the cryptocurrency market as a whole maintained a low-level rebound, and this trend brought investors a glimmer of hope for a market recovery. Some investors believe that after the previous deep adjustment and shock, the market has released certain risks, and it is relatively safe to enter the market at this time when the market rebounds from a low level, which has great profit potential.

However, although the market shows a trend of oversold rebound, investors still need to remain cautious and avoid blindly chasing more. They should continue to look for right entry signals, that is, wait until the market trend is clear before making decisions.

3. Industry and track hot spots

L1 Domin Network, which monetizes user consumption data, has received investments from well-known institutions such as Animoca, Kucoin and DWF; Level is a decentralized stablecoin protocol that issues lvlUSD, a fully collateralized stablecoin with DeFi native returns. Level improves the composability and practicality of permissionless finance by deeply integrating leading DeFi protocols; Privy is a wallet infrastructure platform designed to seamlessly integrate cryptographic functions into applications. It enables developers to easily create and manage self-hosted wallets, perform on-chain transactions, and integrate blockchain functions through a single API.

2. Market hot spots and potential projects of the week

1. Potential track performance

1.1. A brief analysis of L1 Domin Network, which is invested by well-known institutions such as Animoca, Kucoin and DWF and monetizes user consumption data

Domin Network is designed to address the lack of a secure and transparent system for aggregating and verifying consumer data while ensuring data ownership and consent. In an era of growing data privacy concerns, traditional data exchange models often fail to provide sufficient transparency and consumer control.

Given the urgency of this issue, Domin Network has proposed a solution that leverages blockchain technology to revolutionize the dynamics of data exchange. By securely aggregating consumer data on-chain and establishing an exchange system that gives consumers data ownership, Domin Network introduces a groundbreaking approach to data management. The project encourages active consumer participation by incentivizing data sharing while providing tangible benefits to businesses. Through this innovative solution, Domin Network aims to solve fundamental challenges in the area of data authorization and ownership, thereby bringing win-win value to consumers and businesses.

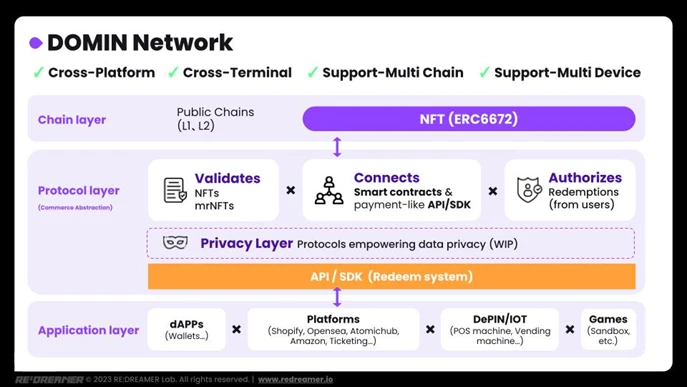

Solution Overview

Domin Network provides innovative solutions to overcome the challenges of standardization and high development costs, facilitating the integration of the real world (IRL) and blockchain technology.

● Break through data silos

Domin Network is committed to bridging the gap between decentralized applications (dApps) and traditional applications, using non-fungible tokens (NFTs) to promote collaboration within the ecosystem. By connecting dApps and traditional applications (Apps) with NFTs, Domin Network breaks down system silos and enables seamless collaboration and data exchange across platforms.

● Multiple data utilization

Domin Network enables real-world (IRL) data in various formats, integrates more than 10,000 application devices, and promotes on-chain business development. This model ensures that different types of data can be effectively used in the blockchain network, improving the versatility and practicality of blockchain applications.

● Modular DePIN function

Domin Network provides open source technology that enables real-world data to be tokenized and driven on any DePIN (decentralized private information network). By providing modular DePIN functions, Domin Network encourages developers to build applications on its platform, drive innovation, and enhance the flexible application of IRL data in the blockchain ecosystem.

● Trusted data Rollup process

With its node structure, Domin Network ensures the integrity and reliability of consumer data through a trusted data Rollup process. dApps within the network can access verified consumer data through authorization proof, thereby enhancing trust and transparency in the data exchange process.

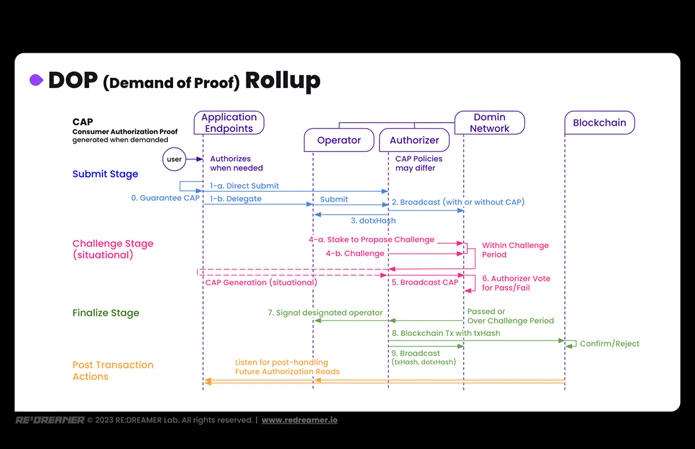

DOP Rollup

The DOP Rollup consensus mechanism builds a bridge between the application layer and the blockchain layer. Its underlying protocol supports connecting to the Web2 platform through APIs/SDKs and connecting to the Web3 infrastructure through smart contracts. This cross-network processing method maintains the integrity of transactions and processing in a hybrid version of the optimistic Rollup.

Its key design is to maintain traceability and allow proof of transaction proposals to be submitted under strong demand. This can be indicated by the presence of staked tokens or nodes, network participants, who continuously earn rewards by processing real-world transactions.

Submission Phase

Step 0: The processing entity must ensure that it can provide a proof of consumer authorization (CAP) when required. Implementation methods include: pre-generation, partial generation, managed service, account abstraction, or delegation. In the future, the generation or verification of CAP may be more complex to meet additional requirements, but this will not change the processing framework.

Step 1: The application endpoint submits the transaction directly to the authorization node (Authorizer) or delegates the operation node (Operator) to submit it on its behalf, thereby simplifying the onboarding process for network users.

Step 2: The authorized node broadcasts the transaction it plans to process. Based on the transaction priority, it decides whether to provide CAP directly.

Step 3: The authorization node returns the Domin transaction hash (dotxId) to the operation node.

Challenge Phase (Situational)

Step 4: If some nodes suspect that the broadcasted transaction is invalid, they can raise a challenge during the challenge period. The operating node needs to provide additional pledge for the challenge to prevent excessive challenges.

Step 5: The authorized node starts the CAP generation process and broadcasts it to the network for inspection.

Step 6: Authorized nodes verify CAP and vote on the transaction:

○ Passed: The challenge proposer suffers stake loss or is slashed due to causing extra work for other nodes, and the processing node will receive additional rewards.

○ Failure: All processing nodes cannot obtain rewards, and the staked tokens of the authorized nodes will be cut.

Final Stage

Step 7: After the vote is passed, expires, or the challenge period ends, the transaction is deemed valid, the operating node and the authorized node receive rewards, and the authorized node notifies the operating node to process subsequent transactions.

Step 8: The authorized node sends the blockchain transaction to the target chain based on the transaction priority.

Step 9: The authorized node broadcasts the blockchain transaction hash (txHash) and the Domin transaction hash (dotxHash) to the Domin network.

Reviews

Domins mission is to drive innovation, empower consumers, and revolutionize the way consumer data is leveraged on the blockchain, ultimately shaping the future of digital commerce and interaction. Features include:

● Aggregate and validate business and consumer data

● Ensure consumer authorization

● Provide unparalleled value

● Setting new standards for the use of consumer data

1.2. Can the decentralized stablecoin protocol Level, led by Polychain and Dragonfly, become a new star in the field?

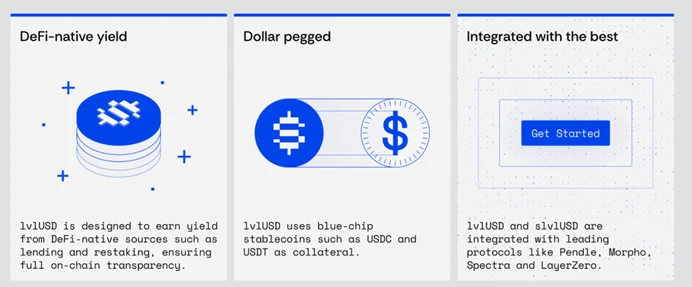

Level is a decentralized stablecoin protocol that issues lvlUSD, a fully collateralized stablecoin with native DeFi yields. Level improves the composability and utility of permissionless finance through deep integration with leading DeFi protocols.

lvlUSD is designed to be fully backed by USDC and USDT, the largest and most liquid fiat-backed stablecoins on the market. lvlUSD can only be minted without permission using USDC and USDT, which form the reserve of lvlUSD and are used to generate yield in lending protocols. Profit certificates from some lending protocols (representing Levels lending positions) are deposited into the re-pledge protocol to generate additional rewards.

Lending income is returned to users through the ERC-4626 staking mechanism. lvlUSD can be staked to receive slvlUSD, which will increase in value as the protocol distributes income to the staking contract, thereby accumulating income.

Both lvlUSD and slvlUSD can be freely transferred, traded, exchanged, and used in integrated DeFi protocols.

As a decentralized stablecoin, lvlUSD generates returns through reliable DeFi sources and is committed to providing scalable, risk-adjusted return solutions while maintaining full on-chain transparency and minimizing centralized counterparty risk and operational risk.

Key Factors

● lvlUSD: a stablecoin fully backed by USDC and USDT

Minting and Redemption: lvlUSD can only be minted without permission using USDC and USDT, which constitute the reserve of lvlUSD. Redemption is currently restricted and requires permission approval.

Yield and Reward Generation: USDC and USDT in the lvlUSD reserve are used in DeFi lending protocols to generate income. Currently, all reserve funds are deposited in Aave and will be dispersed to other lending protocols such as Morpho in the future. The income certificates of these lending protocols (such as Aaves aUSDC and aUSDT) are packaged as waUSDC and waUSDT, becoming assets that can accumulate income. In addition, part of waUSDC and waUSDT is re-pledged to Symbiotic to earn additional re-pledge rewards.

The re-pledged assets serve as economic security guarantees for EigenLayer’s AVS (Actively Validated Services), providing shared security benefits.

Revenue and Reward Distribution: All lending income and re-staking rewards are initially collected by Level. Currently, Level returns all income to users:

○ The lending income is distributed to slvlUSD holders through the staking contract.

○ Restaking rewards are distributed to lvlUSD holders through the farming contract.

● slvlUSD: the revenue accumulation version of lvlUSD

Profit acquisition

slvlUSD represents the staked lvlUSD and can accumulate income. Users need to stake lvlUSD to the staking contract/vault to obtain slvlUSD, which represents their share in the vault.

slvlUSD will appreciate as the revenue is distributed, ensuring that staking users receive stable revenue growth.

Profit amplification mechanism

All lvlUSD reserves are used to generate returns for the lending protocol, but only slvlUSD holders can enjoy these returns. Therefore, the yield of slvlUSD is higher than the base yield of the lending protocol.

When less lvlUSD is staked, the yield on slvlUSD is higher, and vice versa.

Release and Redemption

When a user unstakes, slvlUSD will be destroyed and the user will receive lvlUSD in proportion. The share of lvlUSD redeemed depends on the total lvlUSD balance in the staking contract and the issued slvlUSD supply. After unstaking, you need to wait for a 7-day cooldown period before you can withdraw lvlUSD.

Reviews

Tron Research believes that stablecoins built on lending protocols can not only provide better risk-adjusted returns, but also enhance user composability and practicality. Since Level began distributing income in December 2024, the annualized yield (APY) of slvlUSD has always been better than most mainstream income-generating stablecoin competitors. Please note that historical performance does not represent future returns.

Secondly, anyone can easily verify the reserve status of lvlUSD and its revenue generation mechanism to ensure openness and transparency.

Reserve assets are stored in smart contracts rather than relying on centralized counterparties or custodians, fundamentally reducing centralization risks.

Reserve management is automatically executed by audited and open-source smart contracts, reducing operational risks caused by human intervention.

Unlike the income certificates of traditional lending protocols, lvlUSD has been deeply integrated into leading DeFi protocols, including Pendle, Spectra, Morpho and LayerZero, improving the liquidity and application scenarios of assets. With Level, users can not only enjoy the benefits brought by lending protocols, but also obtain higher income potential and wider DeFi practicality.

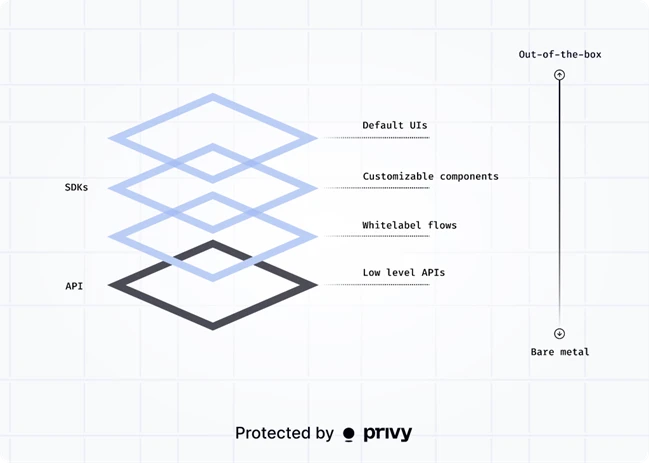

1.3. Understanding Privy, a highly scalable wallet infra protocol invested by Coinbase and Paradigm

Privy is a wallet infrastructure platform designed to seamlessly integrate crypto functionality into applications. It enables developers to easily create and manage self-hosted wallets, perform on-chain transactions, and integrate blockchain functionality through a single API.

Privy supports multiple authentication methods, including email, SMS, and social login, optimizing the users on-chain experience and onboarding process. The platform is compatible with multiple blockchain networks, such as EVM-compatible chains and Solana, and provides enhanced features such as gas fee payment and portable accounts.

Core Features

User Guide

Privy helps developers seamlessly onboard users, regardless of crypto experience.

● Provides an authentication library that supports connecting to existing wallets or automatically creating self-hosted wallets.

● Ensure users’ smooth access to the Web3 ecosystem without complicated on-chain operations.

Wallet Infrastructure

Privy allows developers to flexibly create user wallets or universal wallets, supporting various cross-chain application scenarios.

● Provides user-centric abstractions that can be used for user authentication and wallet generation.

● Provides wallet centralization abstraction, allowing developers to create wallets with authorized keys for easy control and management.

Engineering principles

Technical decisions are moral decisions. Privy adheres to the following engineering philosophy:

Safety first

● Distributed key sharding is used to ensure that Privy cannot access user keys and only the user can use them.

● Keys are only reassembled in the secure execution environment (SGX/TEE) and are only used to sign messages or execute transactions.

● Regularly undergo rigorous security audits to ensure users have complete control and privacy over their wallets.

Highly flexible

● Privy allows applications to have deep access to users and their wallet data, supporting highly customized product experiences.

● Directly call Privy through API to support each user to have multiple wallets to meet various business needs.

Easy to integrate

● Out-of-the-box UI components allow applications to support authentication and wallet functions within minutes.

● The UI is highly customizable and can even be fully white-labeled, allowing the Privy experience to seamlessly integrate into your app.

● Provides convenient fund management methods and supports advanced functions such as smart wallet creation.

Cross-chain compatibility

● Supports all EVM compatible chains as well as Solana, and can link external wallets to Privy accounts.

● Privy is at the forefront of distributed systems. When you want to build on a new public chain, Privy is ready to support you.

Privy provides a powerful customizable layer to meet various Web3 application scenarios and make crypto applications more competitive.

Reviews

Judging from the official doc, Privy is mainly built around identity authentication and wallet infrastructure, allowing developers to easily create better encryption products.

Users can quickly integrate Privy in minutes to achieve:

● Convenient user guidance: create an embedded self-hosted wallet, connect to an existing wallet, and securely sign on-chain transactions.

● Powerful wallet infrastructure: The front-end directly generates user wallets, or the back-end creates universal wallets, supporting cross-chain management.

2. Detailed explanation of the projects of interest this week

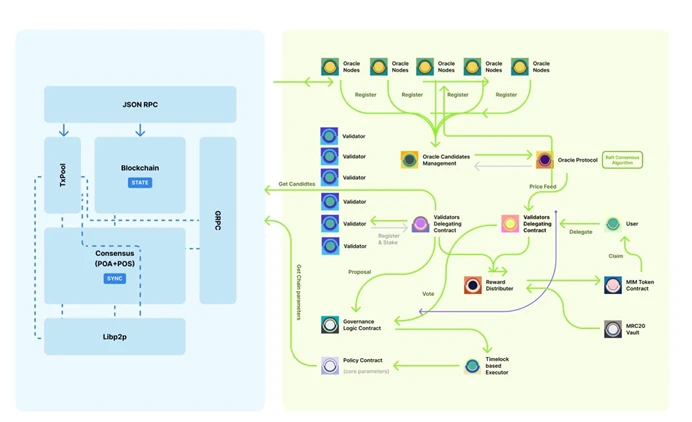

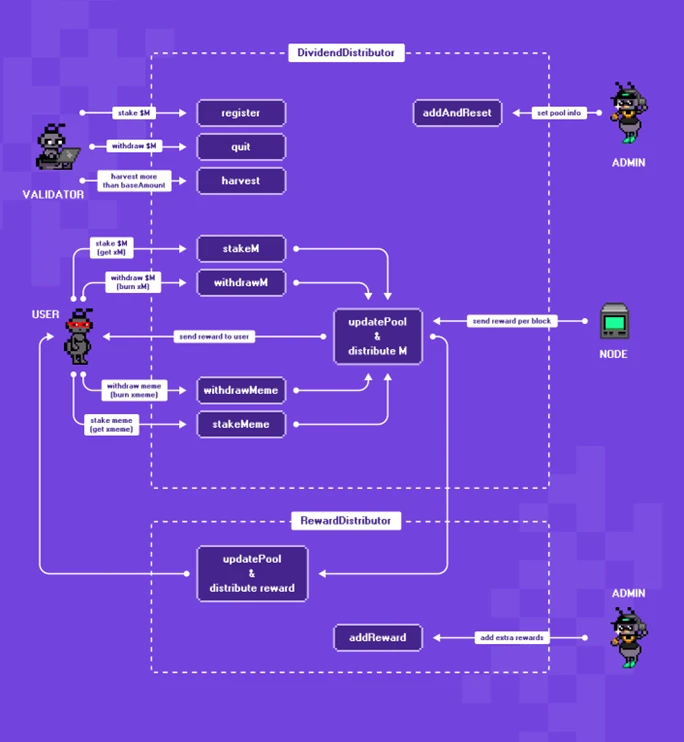

2.1. Unlock the deep value of memecoin! Detailed explanation of the industrys first EVM-compatible L1 chain Memecore with PoM (Proof of Meme) consensus mechanism. What are the innovations?

Introduction

MemeCore mainnet is an EVM-compatible L1 cross-chain mainnet that uses the Meme verification mechanism for security protection. Through the cooperation of different mainnets and meme coin communities, MemeCore uses the Proof of Meme mechanism for multi-chain cross-chain staking for security. Users can delegate their meme coins to validators to enhance security and obtain double block rewards.

Main Features

● EVM-compatible: The MemeCore network is compatible with the Ethereum Virtual Machine (EVM). Users and developers familiar with the Ethereum network can easily access MemeCore.

● Cross-chain consensus: The PoM (Proof of Meme) algorithm is based on a cross-chain staking architecture and enhances security through cross-chain cooperation.

● Dual rewards: MemeCore is the first mainnet to offer a dual block reward system. PoM participants receive both $M and ERC-20 tokens as rewards for creating real blocks.

Technical Analysis

Consensus Architecture (PoM)

● Epoch

Epoch is a new concept introduced relative to Ethereums Proof of Stake (PoS). Epoch is a parameter set in the configuration file in the Geth code and can be modified if necessary. The initial setting of Epoch is one day. During each Epoch, the selected validators generate blocks using a PoA consensus algorithm similar to Clique. After each Epoch, a new set of validators will be selected from the governance delegation contract.

● Consensus Time The newly designed consensus mechanism can reduce the block time, thereby increasing transaction throughput. The current network block time is 7 seconds.

● Reward generation

$M tokens are the native tokens of the Memecore ecosystem. Each time a block is generated, the core Geth code will mint the tokens and allocate them to the reward contract. The number of rewarded tokens will be adjusted based on future hard forks, depending on the consensus of the community.

● Penalty mechanism (TBA)

Memecore has implemented a penalty mechanism that monitors network performance metrics, including block generation times, node downtime, and other important parameters. Designated monitoring roles will be responsible for transmitting these performance data to the penalty contract. If the performance does not meet the established standards, the penalty contract will execute the Slash function in the Validator Candidate contract.

This penalty process is divided into two stages: first, the $M tokens staked at the time of registration are deducted as a direct economic penalty; second, the penalized validator node will be excluded from the next round of validation. This exclusion will result in a reduction in the $M reward that the validator could have received.

Validator

The MemeCore chain operates using the Proof of Meme (PoM) consensus mechanism, which aims to achieve short block times and low transaction fees. Validators with the highest staked amount have the opportunity to generate blocks. Through penalty mechanisms such as double signature detection, the security, stability and finality of the network are ensured.

The chain uses a real-time election process to select the top 7 active validators for block production based on the staking ranking. This list of validators is updated every 10 blocks and refreshed approximately every 70 seconds. To become an election candidate, a validator must first stake a certain amount of assets into the system contract.

● What is a validator?

Validators on the MemeCore network play a key role in maintaining security and generating blocks. They use the PoM consensus mechanism to handle transaction packaging and block verification to ensure the stability of the network. In return, validators will receive $M token rewards for their contributions to ensuring system security.

● Economic model

Validators and delegators earn two types of rewards: $M tokens and ERC-20 tokens. For example, if the reward for generating a block is 1,000 $M tokens, these tokens are not given directly to the block proposer. Instead, they are distributed among validators and delegators in proportion to their respective stake ratios.

Pledge and entrustment

The MemeCore chain also has a built-in reward contract for distributing non-$M rewards to validators and delegators.

● Validator election Validators are divided into two different roles:

○ Active validators: These are the top 7 validators at any time, and are selected based on their ranking. Active validators are entitled to generate blocks and receive block rewards. The contract sets the number of validators to 7, but this number can be modified in the future through the governance system.

○ Candidate validators: These are validators ranked below the top 7. While they are not eligible to generate blocks or receive block rewards, they can still accept delegations to improve their ranking in the next round of elections.

The ranking is updated every 10 blocks and is determined by the total number of tokens staked by the delegator.

● System Contract

● System Reward Contract: Delegators can stake $M and memecoin through this contract to help validators reach the top 7 rankings. This contract acts as a vault, collecting rewards for each block and distributing them to delegators according to system rules.

● Additional Reward Contract: This contract allows external project teams to store ERC-20 rewards and then distribute them to delegators according to the system reward formula. The system has built-in multiple contracts (i.e. system contracts) to support staking operations, allowing delegators to stake $M and memecoin.

● Validator set contract: responsible for regularly electing validators. This contract also temporarily holds validator rewards.

● Reward distribution

7 active validators share 99% of the rewards equally, and the validator who generates the block will receive an additional 1% reward. Of the rewards received by the validator, 25% will be distributed to the delegator who staked memecoin, and 75% will be distributed to the delegator who staked $M tokens. The remaining 1% reward is a bonus for the current block generation validator and its delegator.

● Validator Operation

● Register as a validator: To ensure the security of the network, becoming a validator on the MemeCore chain requires a minimum of self-delegated $M. $M holders can become validators by initiating a RegisterValidator transaction through the Validator Set contract.

● Reward Collection: When delegators collect their rewards, the validator will deduct a certain percentage of the fees as a reward. The validator can withdraw these fee rewards.

Client Operation

Delegators are holders of $M or memecoin who stake their tokens to validators to share rewards. Delegators have the flexibility to choose any active or candidate validator, switch between them, revoke delegation and claim rewards at any time. In return, delegators receive X tokens (X$M or Xmemecoin) as proof of their delegation, which can be used in the MemeCore ecosystem.

Summarize

In summary, the advantages of Memecore include:

● EVM-compatible: The MemeCore network is compatible with the Ethereum Virtual Machine (EVM). Users and developers familiar with the Ethereum network can easily access MemeCore.

● Cross-chain consensus: The PoM (Proof of Meme) algorithm is based on a cross-chain staking architecture and enhances security through cross-chain cooperation.

● Dual rewards: MemeCore is the first mainnet to offer a dual block reward system. PoM participants receive both $M and ERC-20 tokens as rewards for creating real blocks.

3. Industry data analysis

1. Overall market performance

1.1 Spot BTCETH ETF

1.2. Spot BTC vs ETH price trend

BTC

Analysis

Last week, BTC broke through the first-line resistance of $84,700 despite relatively difficult circumstances. However, after forming an upward channel at the hourly level, the rebound momentum weakened again. Although the price has temporarily stabilized above $85,000 as of press time, the strongest resistance facing BTC is about to come, which is the intersection of the upper track of the upward channel, the upper track of the descending wedge and the Fibonacci retracement line, which is approximately around $89,300. Judging from the current bullish rebound momentum, the probability of breaking through this resistance area in a short period of time is low. The probability of peaking and retreating to around $84,000 in the second half of this week is increasing. Therefore, users can temporarily formulate short-term trading strategies according to the three effective indicators in the figure.

ETH

Analysis

For ETH, the rebound continues to be weak, but it can still look up to the first-line resistance near US$2,310. During this period, as long as the price continues to run in the upward channel, the short-term rebound can be considered healthy and sustained. Once it effectively falls below the lower track of the channel, it can be turned into a bearish idea. A break below this means that ETH may continue to look for a second bottom near US$1,800 in the next period of time.

On the contrary, if the rebound can break through and stabilize in the area near $2,310, it would be more appropriate to continue to be bullish to the $2,610 to $2,660 range.

1.3. Fear Greed Index

Analysis

Index changes this week:

● March 18, 2025: The index is at 34, indicating that investor sentiment is in a state of fear.

● March 19, 2025: The index dropped slightly to 32, continuing to maintain fear sentiment.

● March 20, 2025: The index rebounds to 49, reflecting a neutral market sentiment.

● March 21, 2025: The index returns to 31 again, indicating increased fear.

● March 22, 2025: The index remains at 32, in line with the trend this week.

These fluctuations highlight the markets sensitivity to a variety of factors, including regulatory changes and macroeconomic indicators. Phases of fear sentiment can mean potential buying opportunities as they may indicate that assets are undervalued. However, investors still need to conduct in-depth research and consider multiple indicators before making investment decisions.

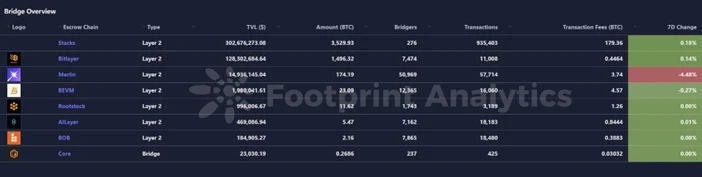

2. Public chain data

2.1. BTC Layer 2 Summary

Analysis

Between March 17 and March 23, 2025, some notable developments occurred in the Bitcoin Layer 2 ecosystem:

Starknet Mainnet Release: As an important Layer 2 expansion solution for Ethereum, Starknet successfully launched its mainnet from March 17 to 24. This upgrade aims to improve the scalability and decentralization of Ethereum by introducing a staking mechanism and improved governance functions.

Bitget Wallet and Cryptorefills Collaboration: On March 19, Bitget Wallet and Cryptorefills reached a cooperation, allowing users to use cryptocurrencies to pay for travel services in more than 180 countries. This cooperation allows users to seamlessly book air tickets, hotels, and purchase gift cards through Layer 2 solutions, promoting the popularization of crypto payments.

CME Group Launches Solana Futures: On March 17, CME Group launched Solana futures contracts, making Solana the third cryptocurrency to be included in CME’s regulated derivatives market after Bitcoin and Ethereum. This launch is expected to increase institutional investors’ attention and liquidity to the Solana ecosystem, indirectly promoting the development of Layer 2 solutions on Solana.

Regulatory developments: The U.S. Securities and Exchange Commission (SEC) held the first roundtable of its cryptocurrency working group on March 21 to discuss regulatory approaches for digital assets. While the meeting did not specifically focus on Layer 2 solutions, such regulatory developments could affect the entire cryptocurrency ecosystem, including the development of Layer 2 projects.

2.2. EVM non-EVM Layer 1 Summary

Analysis

From March 17, 2025 to March 23, 2025, several important developments occurred in the EVM (Ethereum Virtual Machine) and non-EVM Layer 1 blockchain space:

EVM Layer 1 Development:

Converge Blockchain Launch: Securitize and Ethena Labs launched Converge, an Ethereum-compatible blockchain designed to merge traditional finance with decentralized finance (DeFi). Converge supports smart contracts and decentralized applications (dApps) on Ethereum without modification. Initial partners include Pendle, Avara, Ethereal, Morpho, and Maple Finance.

Ethereum Hoodi testnet deployment: Ethereum developers launched the Hoodi testnet on March 17 for final testing of the Pectra upgrade. This upgrade aims to improve Ethereums scalability and usability by reducing Layer 2 data availability costs, increasing staking limits, and introducing account abstraction. If the test is successful, the upgrade may be deployed to the Ethereum mainnet around April 25.

Starknet Mainnet Launch: Starknet, a Layer 2 scaling solution for Ethereum, plans to launch its mainnet between March 17 and 24. The launch focuses on staking mechanisms, operational decentralization, and governance independence, aiming to enhance Ethereum’s scalability and decentralization.

Non-EVM Layer 1 Development:

TRX integrated into Solana: Justin Sun announced that TRX, the native token of the TRON blockchain, will be integrated into the Solana blockchain. This integration aims to enhance the capabilities of smart contracts, NFTs, and DeFi applications by combining Solana’s fast infrastructure with TRON’s active ecosystem.

CME Group Launches Solana Futures Contracts: CME Group launched Solana (SOL) futures contracts on March 17, pending regulatory review. These futures offer market participants the opportunity to hedge or speculate on Solana price fluctuations. The futures contract is cash-settled and based on the CME CF Solana USD reference price.

XDC Network Development: XDC Network, an enterprise-grade Layer 1 blockchain, continues to make progress in the trade finance and enterprise solutions space. Its EVM-compatible architecture supports a range of decentralized applications designed to revolutionize and decentralize trade finance through the tokenization of real-world assets and financial instruments.

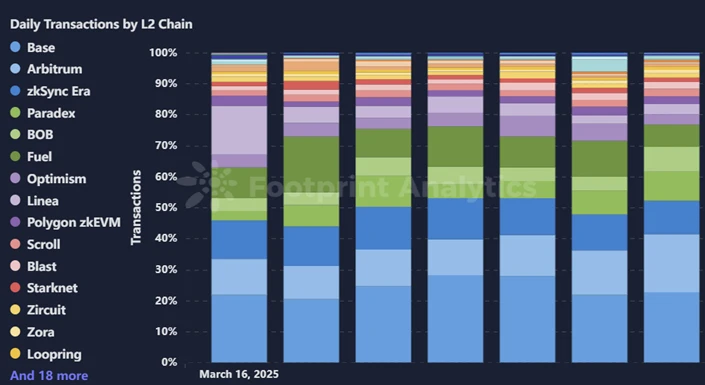

2.3. EVM Layer 2 Summary

Analysis

Between March 17 and March 23, 2025, the Ethereum Layer 2 (L2) ecosystem saw several important developments:

1. Starknet mainnet officially launched: Starknet, a leading Layer 2 scaling solution, successfully launched its mainnet from March 17 to 24. This move aims to improve Ethereums scalability and decentralization by implementing a staking mechanism and governance independence. The launch of the mainnet marks a key step towards a fully decentralized Layer 2 network.

2. Ethereum Pectra upgrade test: The Ethereum Foundation’s development team launched the “Hoodi” testnet on March 17 to conduct final testing of the Pectra upgrade. The Pectra upgrade aims to enhance smart contract and wallet functionality by reducing Layer 2 data availability costs, increasing staking limits, and introducing account abstraction. The successful test laid the foundation for the mainnet deployment as early as April 25.

3. ZKsync Ignite Program Ends: ZKsync announced the end of the Ignite program on March 17, stopped reward distribution, and decided not to launch a second season. This move stems from a strategic adjustment. The team will focus on developing Elastic Network, solving interoperability challenges, and adjusting funding strategies based on market conditions. A summary report is planned to be released on March 30, detailing these changes and future plans.

4. Gitcoin GG 23 community funding rounds announced: Gitcoin announced six community funding rounds for GG 23 on March 17, including Regen Coordination, GoodDollar GoodBuilders, Token Engineering the Superchain Retro Round, Regen Rio de Janeiro, Gitcoin Grants Garden, and Web3 for Universities. Each round provides approximately $21,000 in funding. In addition, the application period for the open source software project OSS Program began on March 17, and the QF donation period is scheduled for April 2-16.

5. Hemi Network Mainnet Launch: Hemi launched its mainnet on March 12, aiming to integrate the two major blockchains, Bitcoin and Ethereum, into a super network with enhanced scalability, security, and interoperability. The mainnet launch attracted more than $300 million in total value locked (TVL) and deployed more than 50 protocols, marking an important milestone in cross-chain integration.

4. Macro data review and key data release nodes next week

Last week, the Fed decided to keep the target range for the federal funds rate between 4.25% and 4.50%, the first time the central bank has decided to keep interest rates unchanged since its meeting in late January.

Beginning in April, the Fed will slow the pace of decline in its securities holdings by reducing the monthly redemption limit for Treasury securities to $5 billion from $25 billion. At the same time, the Committee will maintain the monthly redemption limit for agency debt and agency mortgage-backed securities at $35 billion.

Important macro data nodes this week (March 24-March 28) include:

March 26: U.S. EIA crude oil inventories for the week ending March 21

March 27: U.S. initial jobless claims for the week ending March 22

March 28: U.S. core PCE price index annual rate in February

V. Regulatory policies

During the week, US President Trump reiterated in a video speech at the Digital Asset Summit that he would end the governments regulatory war on cryptocurrencies and Bitcoin. Market sources also believe that the United States may use gold reserves to increase funds for Bitcoin reserves, and the trend of cryptocurrencies is showing a warming trend. At the same time, the United States may introduce historic legislation on stablecoins, which will create a good example for the regulation of crypto policies in other countries and regions.

US: Trump will end the war on cryptocurrency regulation

U.S. President Trump delivered a video speech at the Digital Asset Summit, saying, The United States is already ahead in the field of cryptocurrency and next-generation financial technology. We are ending the previous governments regulatory war on cryptocurrency and Bitcoin. He also said, I call on Congress to pass landmark legislation to establish simple, common-sense rules for stablecoins and market structure. He also said that this will expand the dominance of the U.S. dollar. Trump also said, We will make the United States the undisputed Bitcoin superpower and the worlds crypto capital.

Switzerland: Central Bank is exploring synthetic CBDC

The Swiss National Bank (SNB) has taken the lead with its pilot wholesale central bank digital currency (wCBDC) for settling tokenized securities trades on the SIX Digital Exchange (SDX). The Swiss National Bank recently released its annual report, which outlines other related activities, including exploring what is sometimes called a synthetic CBDC - a private tokenized currency backed by central bank funds.

Germany: Bans further issuance of USDe tokens

Germanys Federal Financial Supervisory Authority announced that it had found serious flaws in Ethena GmbHs approval process for the USDe token and ordered immediate enforcement measures to prohibit Ethena GmbH from further offering its USDe tokens to the public and instruct the company to have the custodian freeze the corresponding asset reserves.

South Korea: Plans to impose sanctions on BitMEX, KuCoin and other exchanges

South Koreas financial authorities are planning to impose sanctions on crypto exchanges such as BitMEX, KuCoin, CoinW, Bitunix and KCEX that are not registered with the Financial Intelligence Unit (FIU) but provide Korean-language website services. The FIU said that the above-mentioned exchanges have not registered as virtual asset service providers (VASPs) in accordance with regulations and are therefore considered to be operating illegally. Relevant officials said that they are negotiating with the Korea Communications Standards Commission to consider plans to block access to these unregistered overseas exchanges, and specific measures are expected to be introduced this year.