Deconstructing BTC Price Performance: Trump’s Trade and Bitcoin’s Glass Ceiling

Original author: The Giver

Original translation: TechFlow

This is a very long thread intended to chronicle my journey through the rise in Bitcoin price since October 15th. I will reiterate my original points from my guest appearance on the @100 0x Pod .

Before we get started, I want to make it clear that this is not a recommendation to go long or short any coin, especially since open interest and positions are extremely crowded in the coming week. It is very likely, even very likely, that we will challenge the All-Time High (ATH). This could have a significant right side effect. Specifically, I think it may be very difficult to manage a new short position here. That being said, next -

Today, I hope to define the nature and intensity of the capital flows that have entered Bitcoin since mid-October. I will discuss the $250 billion increase in BTC and the $400 billion increase in total crypto market capitalization since Bitcoin's $59,000 low, and describe the constrained capacity that I believe exists in the fourth quarter of 2024, which I do not believe will be materially breached.

My view is twofold: 1) It is necessary that new money remains limited; the strong inflows we have observed over the past two weeks are largely speculative; and 2) the excess liquidity needed to produce a rally like we have seen in 2021 does not exist.

However, I believe the following principles are severely overlooked and little discussed, primarily because analysis of rising prices is very superficial and is often only addressed when prices fall.

You need to believe:

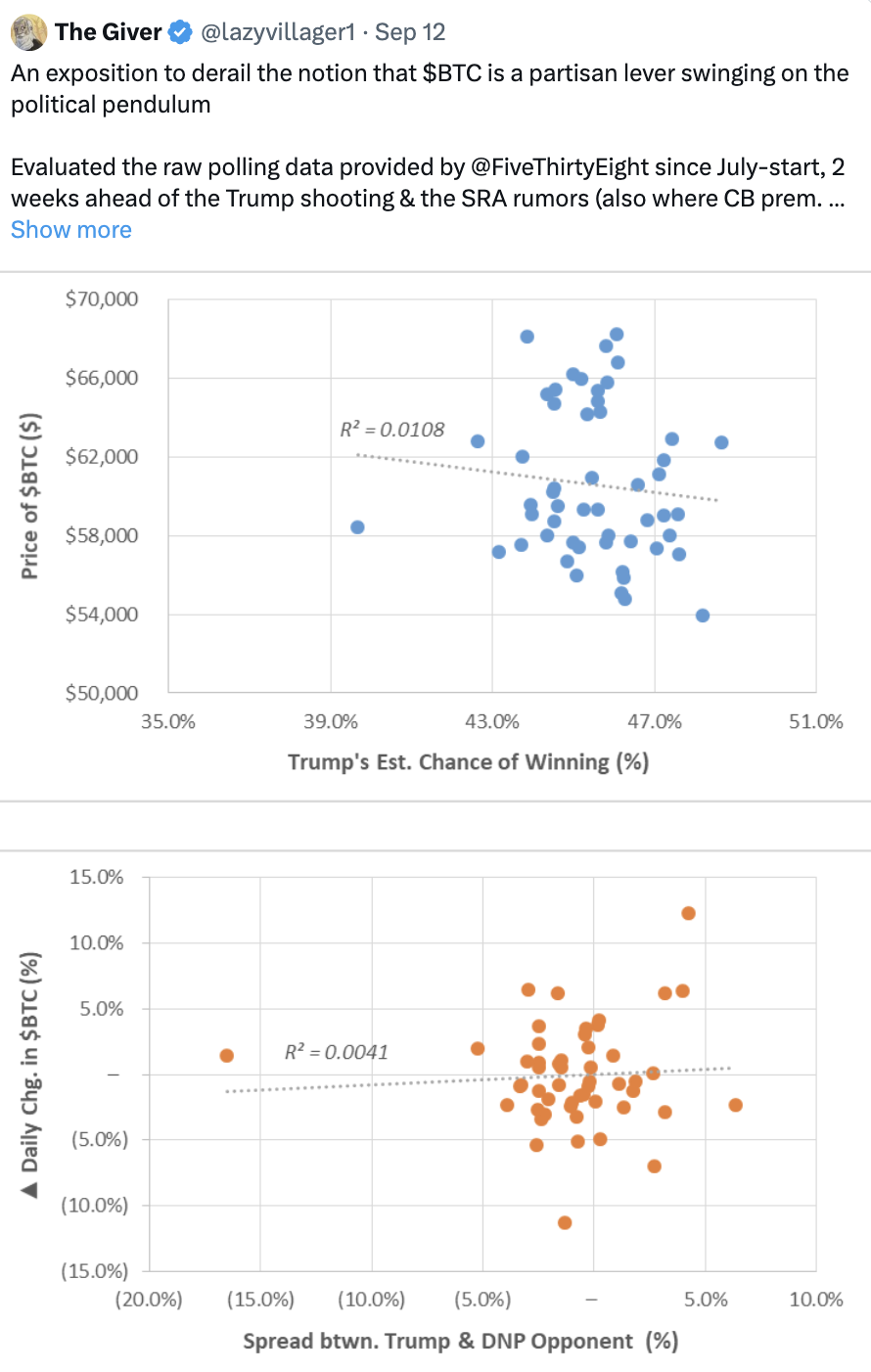

1) The direction of the election does not drive price-dependent outcomes; instead, Bitcoin is currently being used as a liquidity tool to hedge against a Trump victory.

2) The “easing conditions” that made a new aggregate high today were not enough. Interest rates and other popular heuristics are not nearly as strongly correlated with genre liquidity as popular rhetoric suggests, and the signs are that prices are ultimately suppressed rather than experiencing price discovery.

Restate previous point

When Bitcoin broke out around 61,000/62,000 during the Columbus holiday, it made me want to revisit the events of that time. So, from that week (which will be presented later on the @100 0x Pod ), I predicted the following, which I have summarized below:

BTC.D increases (and BTC itself could challenge $70,000 before election results)

Meanwhile, major and altcoins generally fell relative to BTC - because the speculative funds mentioned in point 1 only focused on BTC as a leverage to hedge against Trump's victory

Initial inflows (cost basis between 61,000 and 64,000) were sold off before the actual election, leaving new directional (and speculative) money

By the effects of 1 to 3, no matter who wins, Bitcoin will fall in the medium term

Therefore, I recommend going long BTC and short “everything else”.

Why do capital flows have a mercenary nature?

I have three main understandings of this positioning:

1) Microstrategy is the tool of choice for large-scale investments and risk exposure: rapid expansion is often accompanied by local highs.

2) The market consensus is wrong about the “Trump trade”; the impact is not causal, i.e. an increase in Trump’s odds does not linearly create opportunities for BTC to outperform, but rather the basket of assets that have risen this month reflects an underestimation of a Trump victory.

3) A new participant has emerged in this cycle - this capital is different from previous participants - it has no intention of recycling funds within the ecosystem; crypto-native funds are already fully deployed and the possibility of spot following is low.

Microstrategy Case Study

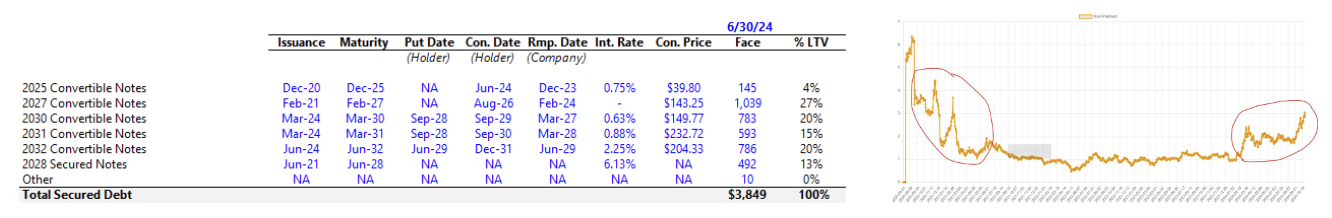

I think Microstrategy is one of the most misunderstood investment vehicles currently: it is not just a simple holding company for BTC, but more like a FIG (NOL (net operating losses) are covered by new capital raising) whose core business revolves around generating illiquid net interest income (NIM).

NIM is a concept that can be most easily understood by the return that insurance companies seek on long-term deposits, usually in the form of a liquidity premium (like bonds), where ROE (return on equity) is greater than ROA (return on assets).

In the case of MSTR or any other stock, MSTR is used to compare two aspects:

Expected BTC price growth (defined as BTC yield)

Weighted Average Cost of Capital (WACC)

Microstrategy can be described as an under-leveraged business with a light asset load — the business’s obligations were mostly covered before BTC reached $10-15K, making it very capital efficient:

It has efficient access to credit markets, having arranged over $3 billion of convertible bonds, generally with the same structure: <1% coupon and 1.3x conversion premium cap, redeemable if the exercise price exceeds the actual price at some point in the future. However, looking at its 2028 secured notes, we can see that MSTR has a fixed cost of debt of around 6% (already repaid).

Therefore, we can visualize MSTR's overall cost of capital from a credit perspective, using the implied probability assigned to achieving 1.3x MOIC, using a hybrid convertible bond instrument.

If for 5 years you collect $1 per year (no redemptions), then for the lender to maintain a balance between providing the convertible bond and paying the $6/year note, that means the $5 per year gap for 5 years must be filled by a lump sum payment of $30 in the 5th year.

Therefore, the following formula can be derived: 5 + 5/(1+x)^1 + 5 + 5/(1+x)^2 + 5 + 5/(1+x)^3 + 5 + 5/(1+x)^4 must equal 30/(1+x)^4. This is equivalent to a cost of capital of about 9%, while the current debt-to-market ratio implies a cost of equity of about 10%.

In simple terms: if the BTC yield, i.e. the annual expected growth rate of BTC, can exceed 10%, then MSTR's premium should expand relative to the net asset value (NAV).

Through this framework, we can come to an understanding that the premium reflects overeager sentiment, or expectations that BTC will soon expand - therefore, the premium itself is reflexive and tolerant, rather than lagging.

So when we overlay this premium onto the BTC price, we see two periods where the premium was above 1 — the first half of 2021 (when BTC first approached $60,000), and the peak in 2024 when we previously approached $70,000+.

I think that as the stagnation premium ends tomorrow, the stock market understands this and anticipates that the proceeds will be used to buy BTC, and is expressing this expectation in two ways:

Buying MSTR in advance, predicting the premium will recalibrate to ~1-2x, as Saylor may buy more BTC;

Direct purchases of BTC were not only to cater to Trump’s victory, but also to Saylor’s buying intentions (inflows through IBIT).

This theory fits in with the options market (which is biased towards the short term), which has seen increasing activity predicting a BTC price of $80,000 by the end of the year, matching the implied BTC gains created by the MSTR purchase (1.10x $73,000 ≈ $80,000).

The question, however, is: What type of buyer is this? Are they here to glean the $80,000+ price discovery?

How did this new money affect price action in October?

Despite initial correlation via algos and perpetual contracts, the lack of consistent follow-through across nearly all assets except BTC has led to speculation that the current bid is simply inflows via MSTR and the BTC ETF.

We can draw several conclusions from this:

ETH ETF: Despite over $3 billion in new inflows into ETH ETFs since mid-October, there is virtually no net inflow. Similarly, ETH CME open interest (OI) also appears unusually flat, leading us to conclude that this buyer is not inclined to diversify and is only interested in Bitcoin.

BTC open interest on exchanges and CME is also at or near all-time highs. Futures open interest on the coin is at its highest point this year at 215,000 units, 30,000 units higher than mid-October and up 20,000 units since last weekend. This behavior is reminiscent of the desperation to gain exposure we saw before the launch of a BTC ETF.

Altcoins’ strength against BTC waned until mid-October, with Solana’s strength following ETH and other altcoins in a lackluster and unattractive performance. In absolute terms, other altcoins are actually down for the month, at around $220 billion compared to $230 billion on October 1st.

What happened to Solana on October 20th? I think the growth in SOL (+$10bn) mostly reflects the unexpected repricing of meme assets (looking at the GOAT chart and underlying AI space, these phenomena are happening a lot on Solana). Users must buy Solana when entering the ecosystem and convert to Solana when they make profits, which is consistent with the L1 fat tail theory and reflects the larger trend we have seen on APE and DEGEN this year. During this period, I believe about $1bn of wealth was created and SOL was passively held during the election.

4. The first stablecoin reduction this year will result in a lack of self-generated dollars to generate new demand (slowdown) beyond what is created today.

We’ve seen a similar repricing phenomenon in traditional markets – we can observe how this demand is emerging through the Trump Media & Technology case study: The stock is trading at $50 today, compared to around $12 on September 23rd with no new earnings or news releases. To put this into context, Trump Media is now worth about the same as Twitter – an increase of $8 billion in one month.

Therefore, two possible conclusions can be drawn:

Bitcoin's use as a liquid proxy simply reflects money being invested in election bets, and does not reflect sustainable long-term positioning as implied by other narratives such as rate cuts, loose policy, and a productive labor market. If it were the latter, the market's performance should be more consistent, and other risk proxies (gold when the dollar is weak, SPX/NDX otherwise) should show more even strength over the month.

The market had fully anticipated a Trump win; the money was not stable and unwilling to participate in the broader ecosystem, even though today’s positioning suggests it should/will participate. This fractal is not what crypto natives were prepared for, as this type of buyer did not exist in the past.

What does this new buyer refer to?

When analyzing the composition of participants, historically the following categories have typically been included:

Speculators (short/medium term, often create deep capital troughs and peaks, very sensitive to prices and rates)

Passive bidders (via ETFs or Saylor, though he is buying in blocks) are price insensitive and happy to support pricing because they have ingrained HODL behavior in typical 60/40 portfolio construction.

Arbitrage bidders (price insensitive but rate sensitive) – employ capital but have no overall impact on price and may be the initial movers of the early year limelight.

Event-driven bidders (creating open interest expansion during a specific time period), such as the ETH ETF and the Trump summer campaign, are what we believe we are seeing now.

Category 4 bidders have a playbook for the summer, which can be expressed through my previous tweet about Bitcoin as partisan leverage (next tweet).

This suggests that buying behavior is indeed impulsive and jumpy, but this buyer doesn’t care about the election outcome (which can be interpreted as the lack of linear correlation between Trump’s odds and Bitcoin price). They may be de-risking like Greyscale bidders did when ETF trading went live, involving closed-end funds for BTC/ETH.

BTC as a lever for two-party bargaining

(See tweet for details)

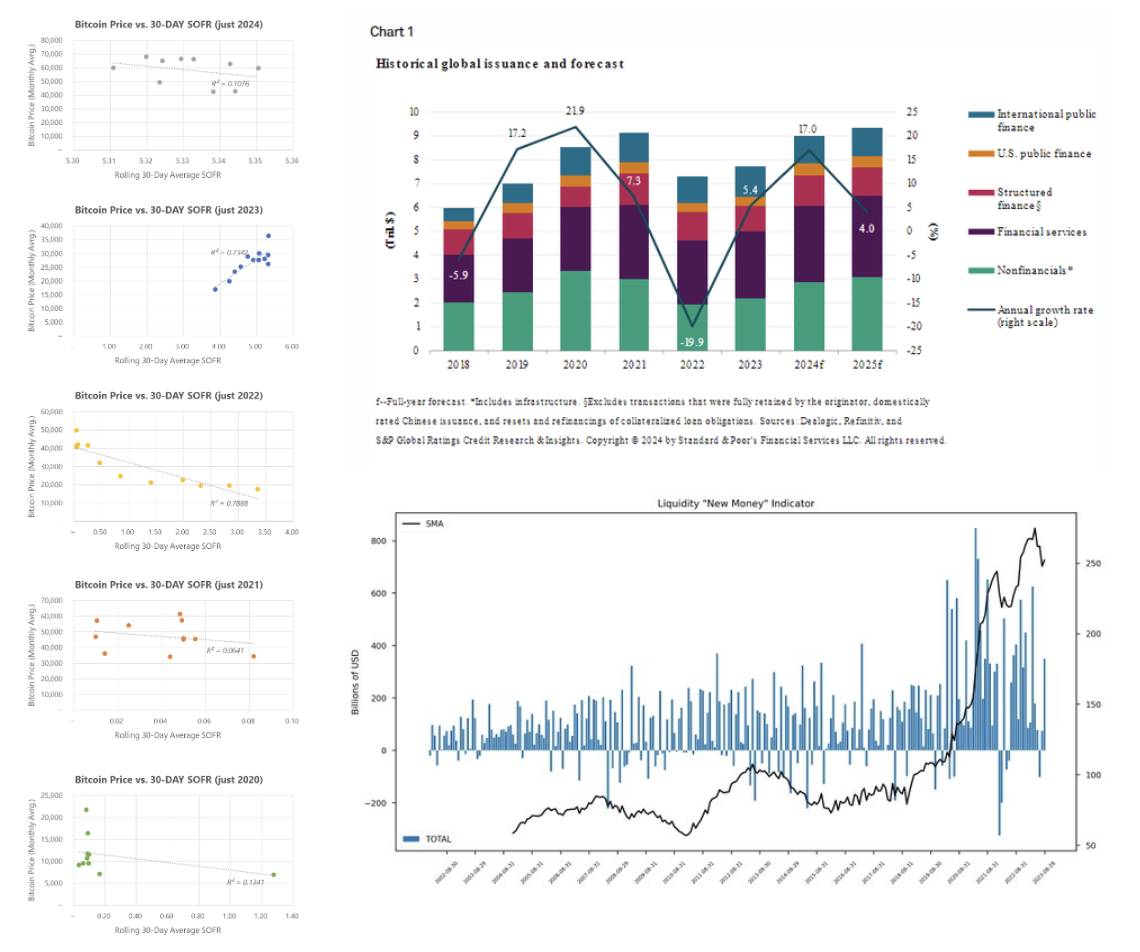

How do interest rates affect the price of Bitcoin?

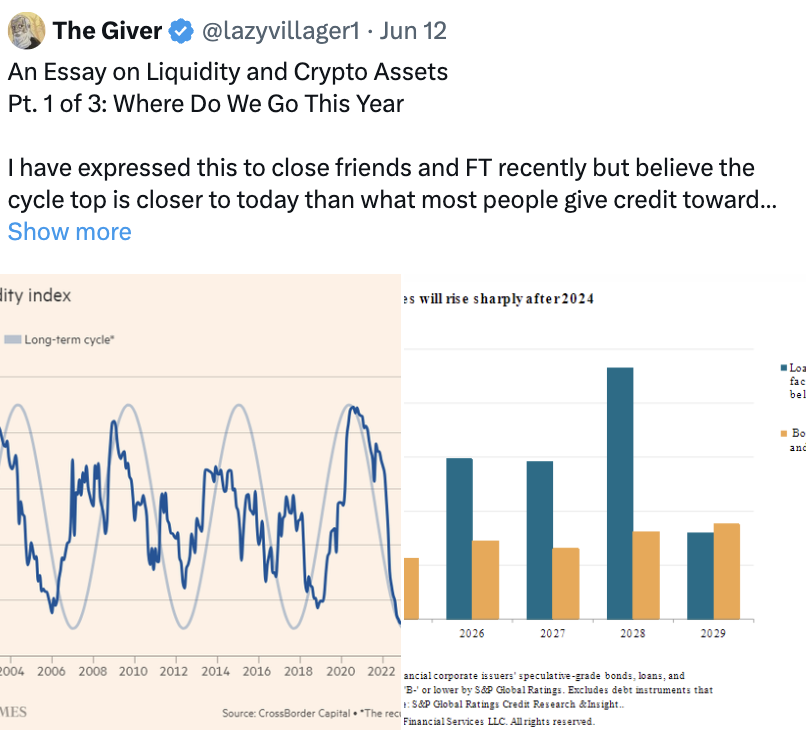

In June/July (next tweet), I hypothesized that it would be difficult to view rate cuts as a simple aspect of easing. In this tweet and subsequent posts, I will debunk this theory and discuss a key missing variable that I believe is causing us to overestimate demand for Bitcoin: excess liquidity.

First, let's compare Bitcoin's price to historical SOFR (interest rate) independently over the past 5 years. This shows that the correlation is very strong in 2022 and 2023, while 2020, 2021, and 2024 seem to be scattered. Why is this? Shouldn't lower interest rates make borrowing easier?

The problem is that, unlike those exceptional years, borrowing markets are already quite strong in 2024, suggesting that rate cuts are coming. One unique mechanism is that the average low-grade debt is issued with shorter maturities (so maturities are in 2025-2027), dating back several years to the “highs last” period.

You can also look at the debt index created by @countdraghula (ignores QE) to get an overview of actual debt growth.

Likewise, the stock market has been very strong: “The S&P 500 has surpassed any consecutive rallies of the past decade, totaling 117 weeks” (without a -5% return). The previous longest rally was 203 weeks, when the economy was recovering from the depths of the global financial crisis.

In other words, credit and stock markets created a massive recovery rally without a recession.

My reasoning is this: We experienced unique mechanisms in 2021 and 2023 (COVID and SVB failure) which led to liquidity injections. New facilities were constructed using the power of the Fed's balance sheet.

Business/liquidity cycle is broken

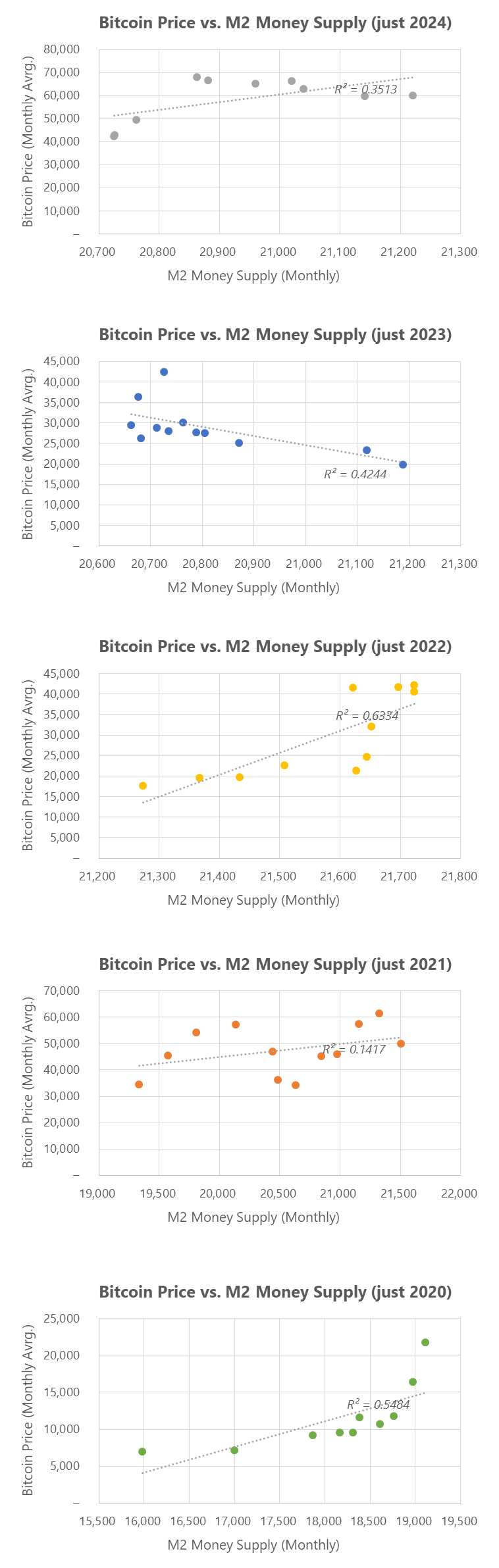

Bitcoin and M2 Correlation: Demonstrating How Emergency Measures Create Growth and Volatility

Bitcoin's growth is often seen as the biggest antecedent, however, since 2022, Bitcoin's correlation with M2 is weakening (and starting to resemble the 2021 peak again). I think this is closely related to the current government's willingness to open up its balance sheet to achieve financial stability. This is done at all costs.

So the key question is - what exactly is Bitcoin? Is it a leveraged stock? Is it a chaos asset? What conditions must occur in order for price discovery to occur when the underlying market (~$2 trillion) is already so large that it almost matches the TOTA L1 highs we saw in 2021?

I think these questions are unlikely to be answered during this year’s transition in office.

How emergency measures support Bitcoin: COVID-induced quantitative easing in 2021

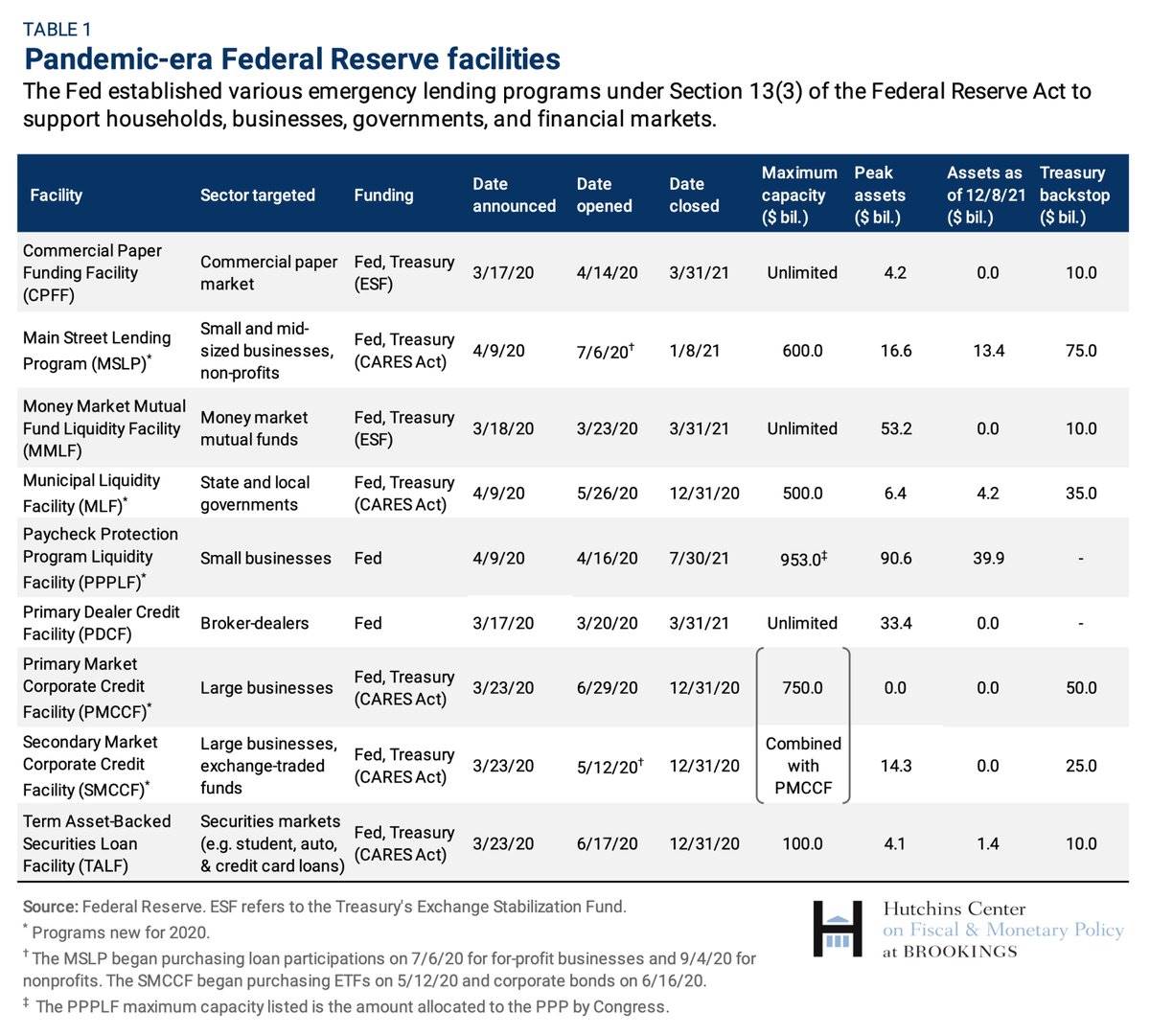

I think using 2021 fractals to visualize future price action is flawed. In 2021, ~$2 trillion was pumped through at least a few projects. The expiration dates of these projects coincide very interestingly with Bitcoin’s price action (PA).

On March 15, 2020, the Fed announced plans to purchase $500 billion in Treasury bonds and $200 billion in mortgage securities. This rate doubled in June and began to slow in November 2021 (and doubled again in December 2021).

The PDCF and MMLF (which provides loans to prime money markets through the stabilization fund) mature in March 2021.

Direct lending was reduced from 2.25% to 0.2% in March 2020. Direct lending to companies through the PMCCF and SMCCF was introduced, ultimately supporting $100 billion in new financing (increased to $750 billion to support corporate debt) and bond and loan purchases. This will taper between June and December 2021.

Through the Cares Act, the Fed is preparing to provide consumers with $600 billion in 5-year loans, and the PPP is scheduled to end in July 2021. According to a report in December 2023, about 64% of the 1,800 loans at that time were still outstanding. As of August, 8% of these loans were past due.

This rate of money injection and creation is quite unique. This is also clearly reflected in the price action in 2021 - peaking in Q1 and Q2, falling in the summer (when many projects ended). Finally, when these projects stopped completely, the price of Bitcoin experienced a huge downward fluctuation.

Further easing in 2023: Bank failures

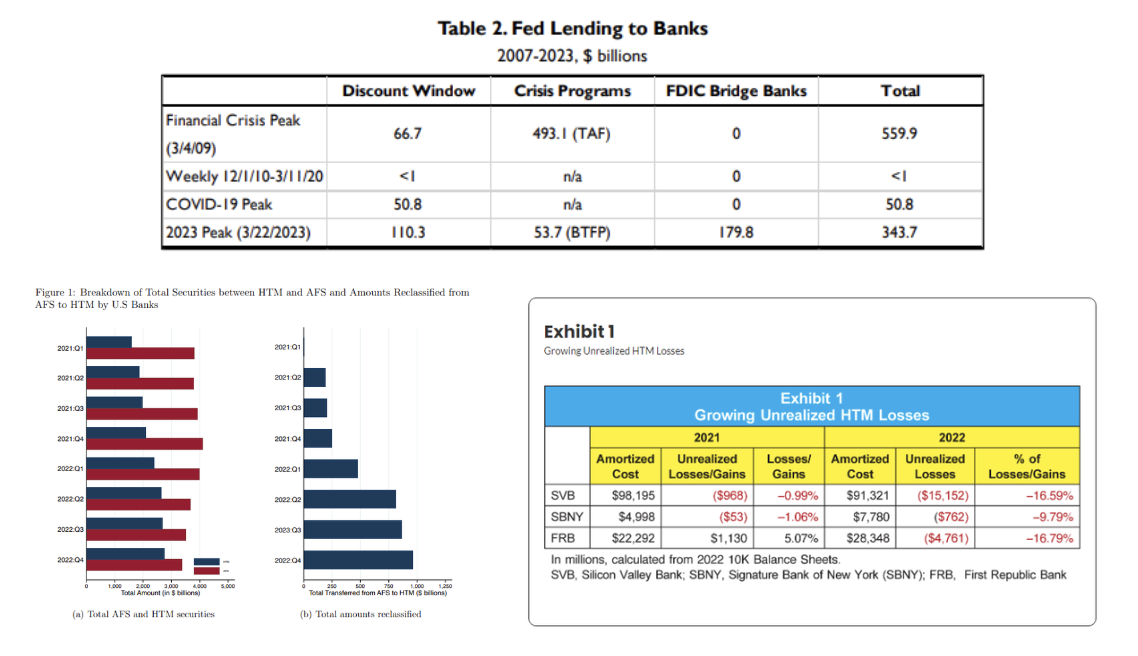

According to the Fed’s balance sheet, as of March, BTFP’s total loans totaled $65 billion, and the discount window peaked at $150 billion. The Fed also lent about $180 billion to bridge banks to resolve the crises of Silicon Valley Bank (SVB) and Signature Bank.

To put this into context, during this period, the Fed’s lending levels to banks were about 6.5 times higher than during the pandemic.

The reason is obvious: all those held-to-maturity (HTM) securities on banks’ balance sheets are unrealized losses. These losses do not need to be reported under FASB accounting rules. In 2022, US banks’ HTM portfolio grew from $2 trillion to $2.8 trillion, mostly due to relabeling them as HTM. This would normally be acceptable (the market value of long-term fixed-income securities has suffered due to persistently high interest rates), but actual depositor demand has led to a run on the banks, forcing liquidity to be realized – which involves writing down these securities.

Bitcoin’s price discovery has been largely liquid since March 2023, following the launch of the program — which halted new loans in March 2024 — and it is during this period that the crypto asset became overheated and saw a short-term correction.

The Glass Ceiling: Why It Exists

In general, I think the order of operations is:

Capital was activated following what was most likely a US government sell-off (central bank discount) and MSTR front-loaded, pushing prices from 59,000 to 61,000 via premium expansion.

The move from $61,000 to $64,000 occurred over the long weekend, primarily due to the impact of the Trump hedge. Some funds exited last week as prices corrected downward to $65,000, leaving some specific buyers with a still very high cost basis (over $70,000) this week.

ETFs continue to support spot prices (even though Bitcoin’s Beta has not risen) driven by Trump’s directional opportunities, while laggards continue to lag and lack capital recovery despite expanding holdings.

Bitcoin buying remains static within its own ecosystem and is unwilling to “engage” elsewhere.

Why I don’t think there will be strong price discovery in 2024:

Lack of re-staking (measured by total DeFi value locked compared to 2021).

There was too much confidence in the degree of volatility that would actually occur after interest rates were cut.

Absence of very strong government stimulus (emergency injection).

The reaction in other markets was muted (eg stocks, gold, etc).

Actually, the last part - some potential upside risks (some I have already considered, some I think are not relevant in this time frame)

The M7 gains this week totaled about $15 trillion. If they perform well (which I thought would be hard to beat for most companies a month ago), some of this new money could flow in and be invested in Bitcoin and its related assets. I believe Alphabet was up $10 in after-hours trading earlier today.

China’s stimulus measures (which I believe are already reflected in Bitcoin investments) continue to expand beyond previous announcements.

The impact of primaries on markets remains sticky, however, the results of 75 elections show an opposite and more grim view: link .

Inflation hedges unwind from base measures (which were very strong during the IRA bill passed by Democrats) and move into Bitcoin and gold for a longer period during the Trump presidency.

Overall, I think if Trump wins, the market will reach a higher level, and Harris (as another candidate) may not be valued enough and may be underestimated. Therefore, even with the above risks, the market's expected value can still be guaranteed.