How does Puffer Finance resolve the Ethereum node operation problem through “re-staking”?

In the context of LST competition, market competition hotspots such as decentralization, DeFi enhancement, and full chaining have emerged frequently. How can Ethereum resolve the real dilemma of node centralization? Let's take a look at the 10th TinTin AMA event to see the technical solutions of Puffer Finance, a native liquidity re-staking platform, to optimize the user participation project process and revenue feedback with the re-staking concept, and look forward to the prospects and future of Ethereum development.

The 10th TinTinAMA event was successfully held at 20:00 on May 22. The live broadcast invited Amir, the founding contributor of Puffer Finance, and Steven, the contributor, to gather in the live broadcast room to explore Puffer Finance's project construction experience and share Puffer Finance's realistic path to achieve Ethereum's decentralized future vision. This online event attracted more than 27,000 viewers, and many viewers also interacted closely with the guests in the live broadcast room.

Friends who missed the live broadcast can click to replay:

🧩 Twitter Space: https://twitter.com/i/spaces/1lDGLPoljyvGm

Puffer Finance Project Overview

As the competition in the LST track becomes increasingly fierce, the monopoly competition among the top projects intensifies. Facing the pain points and crises of the pledge track, Puffer Finance was born. As a native liquidity re-staking platform built on EigenLayer, Puffer Finance accumulates POS and re-staking rewards by introducing native liquidity re-staking tokens (nLRT). Its core development goal is to maintain the "trusted neutrality" of Ethereum to enhance the decentralization of Ethereum.

Puffer Finance’s decentralized operations

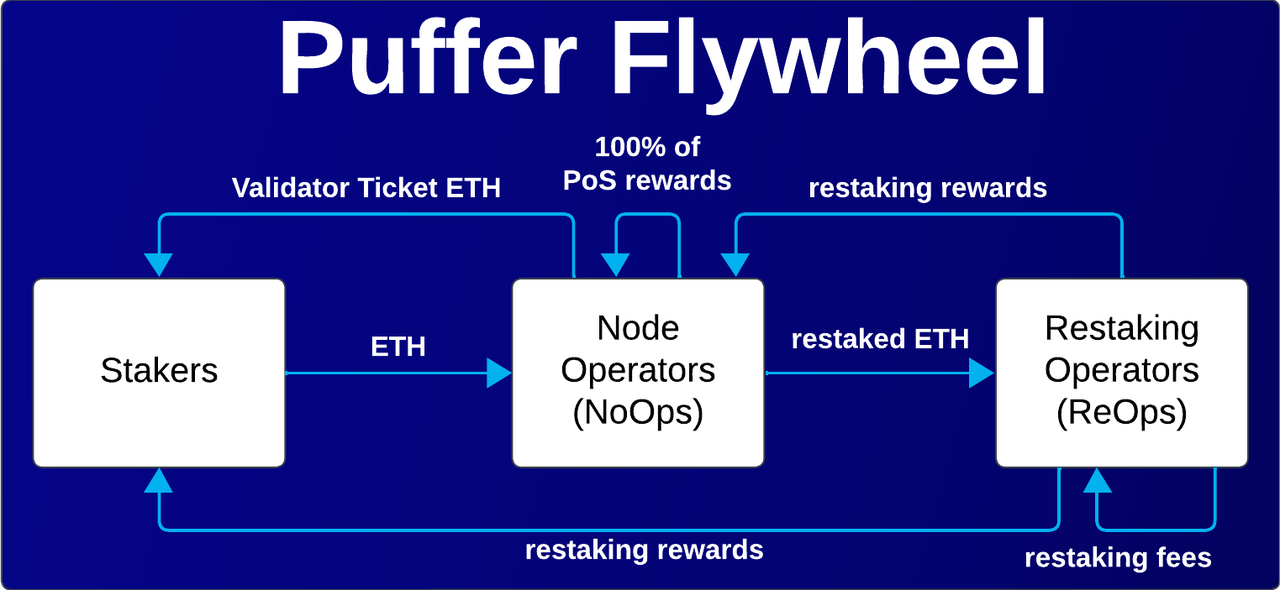

According to the founding contributors of Puffer Finance, Puffer Finance has announced the launch of the mainnet through its official website. The project has entered the "fourth chapter". Users can deposit ETH, stETH or wstETH. Just holding pufETH can earn points for all cooperative projects. At the same time, plans are made to update the existing points system. "Users stake Ethereum to obtain pufETH (Puffer's native liquidity re-staking token) and PoS rewards. PufETH holders can use the liquidity of the token to increase their income with the help of the DeFi platform." Amir showed the audience in the live broadcast room how Puffer Finance's users participate and the project operation process.

“Currently, Ethereum’s credible neutrality and censorship resistance have been seriously threatened. To solve this dilemma, Puffer Finance has proposed a new staking solution that uses the native liquidity staking protocol (nLRP) and deeply integrates with EigenLayer to increase yields and Ethereum staking rates,” Steven explained.

Highlights of project development with low threshold and high return

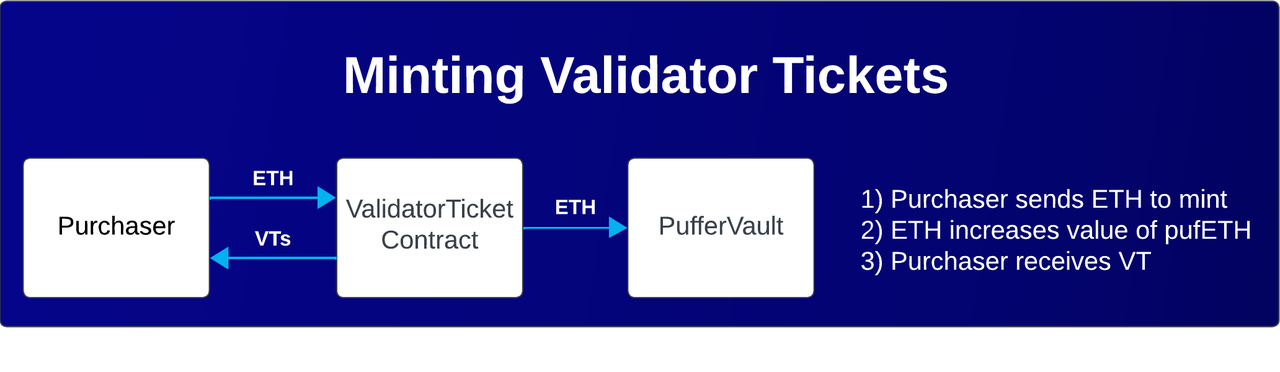

In order to improve the decentralization and credible neutrality of Ethereum, Amir pointed out that the initial establishment of Pufffer was mainly to ensure the security of funds through anti-slashing technology, and at the same time proposed an innovative design of VT validator notes to improve the efficiency of node funds, and combined with Eigenlayer's re-staking architecture to increase the benefits of nodes. Currently, the technical architecture of Puffer Finance is being updated and released, using trusted execution environment and hardware support such as SGX to achieve anti-slashing protection.

Native liquidity re-staking protocol, improved hardware efficiency and enhanced returns

Puffer Finance is a permissionless native liquidity re-staking protocol dedicated to helping Ethereum become more decentralized. To achieve true decentralization and permissionless node participation in verification, there are many challenges that need to be addressed. For example, some nodes can take away all the execution layer and consensus layer revenues and do not share them with the protocol and liquidity stakers, which will cause users to lose the corresponding reward opportunities. Therefore, we have made a clever design to prevent EVM theft during the process of improving the protocol," Amir analyzed.

In the process, Puffer Finance also took innovative approaches, using easy-to-verify and low-threshold channels to create opportunities for users to enter the project platform and ensure that users receive more efficient reward guarantees. Amir pointed out that "Puffer's computing stack is almost modular and very flexible, which can improve the hardware efficiency of node operators, while combining Eigenlayer's re-staking concept and technical architecture to improve users' sustainable returns."

No trust environment required, node offline security control

In addition to the security and hardware support introduced by Amir, Puffer Finance has also upgraded the AVS service and node forced offline function. "When providing AVS services, just like Ethereum PoS verification, there may be risks of fines and confiscations, which will threaten the user's underlying assets. To address this challenge, Puffer uses the Secure-Signer tool, based on a hardware-supported trusted execution environment, to ensure that large-scale fines and confiscations do not occur. In addition, if a node suddenly goes offline unintentionally, the system needs to take certain measures. For this reason, Puffer designed the Guardian role to initiate an Exit Message on the chain to force the node to go offline, thereby ensuring the safety of user assets. At the same time, the entire design process takes into account the security and decentralization of private keys," Steven explained.

Improve Puffer user experience and increase engagement

As for improving the user experience, Amir pointed out that Puffer creates a user-friendly environment so that users don't have to worry about actually running nodes and infrastructure. With a familiar interactive interface, users can experience a similar look and feel to Ethereum. "Puffer Finance is planning to migrate to Layer 2 to further reduce the user's gas fee cost; in addition, the team also plans to introduce some features such as account abstraction to make digital asset management and operation more convenient and secure. These are expected to see functional updates in the next subsequent versions, providing participants with low risk and higher reward income."

In the face of this problem, Steven added from a more macro perspective of industry development. He believes that user experience is a "balance" issue in all walks of life. It is necessary to ensure the decentralized concept of the project and maintain the user experience. Puffer Finance is now actively promoting the design adjustment of the UI interface, striving to attract more users to participate, and cooperating with more well-known Layer 2 projects to enable users to increase their income at a low cost.

Incentive strategy for individual nodes to participate in staking

In order to allow more node operators to participate in the staking and verification of Puffer Finance, the team has also formulated some incentive strategies and measures. "The specific strategy is to provide low-margin staking (low bond) to lower the capital threshold for node operation. In addition, we hope to improve the efficiency of staking as much as possible and return part of the risk-bearing rewards to the nodes, which will further motivate the enthusiasm of node participation. Although the overall AVS service in the market may not be launched in a short time, we hope to attract more node operators to participate through these incentive policies," said Amir.

“Re-staking” logic ensures Puffer security

When the industry analyzes the highlights of Puffer Finance's project, the key word that cannot be avoided is "re-staking". In terms of the obvious positive attribute of increasing user benefits, the improvement and optimization of Puffer Finance's staking mechanism allows participants to obtain re-staking income from Ethereum and Eigenlayer. To this end, the team has also upgraded modular components to ensure that Puffer Finance brings more benefits to users while meeting security requirements.

Risk AVS anti-slashing mechanism reduces verification risk

"First, we will take a conservative and robust approach to select AVS and determine which ones can join Puffer nodes and provide verification services for them. Puffer's anti-slashing technology may have considerable punitive properties, so it is necessary to create an anti-slashing mechanism and technical support in AVS; secondly, we will transfer and reduce the number of shares entrusted to each risk-bearing operator to obtain the best returns with lower risks and protect users at both the Ethereum and Eigenlayer levels," Amir started with the concept of AVS and analyzed the anti-slashing mechanism of Puffer Finance.

Re-staking to accumulate income and increase mortgage returns

Then, Steven started from the important technology of re-staking to meet network security, and pointed out that the liquidity staked tokens are used as the underlying assets of the new middleware verification service, and the stakers and validators can obtain more benefits from it, which helps to improve the security and decentralization of the new network. Through re-staking, the liquidity stakers can obtain multiple benefits from both Ethereum PoS verification and AVS verification.

Furthermore, Puffer Finance can provide a more native, low-risk token for future AVS - ETH as a collateral asset for AVS verification, allowing PufETH holders to benefit from Web3 infrastructure and adhere to the decentralized value concept consistent with Ethereum in the business logic of re-staking. Re-staking node operators perform AVS verification services on behalf of AVS and charge commissions. These re-staking income increases the value of pufETH; NoOps bears additional risks on its collateral and will receive a portion of the re-staking rewards as compensation.

Looking to the future: Puffer Finance continues to empower Ethereum

In the fierce market competition, Puffer Finance relies on the concept of distributed and decentralized computing nodes, using TEE-based trusted execution environment technology and hardware support such as SGX to achieve node anti-severance, ensure the security of mortgage assets, and bring more income rewards to users.

In May last year, Puffer Finance received a grant from the Ethereum Foundation to support the open source remote signature tool Secure-Signer; in August of the same year, it completed a $5.5 million seed round of financing; this year, Puffer Finance received a strategic investment from Binance Labs and completed an $18 million Series A financing in April. Puffer continues to be on the fast track of project development.

“In the Ethereum ecosystem, we plan to cooperate with well-known project parties such as Cubist, focus on anti-slashing technology and key management mechanisms, provide more revenue channels, strive to achieve the vision of helping Ethereum decentralize, and contribute to the sustainable development of Ethereum,” Amir said.