Fairness or multiples? Understanding Pump’s dominance from the copycat market promoted by the founder of Whales Market

Original | Odaily Planet Daily

Author | Nanzhi

Last night, @dexter_cap, the founder of Whales Market, launched a Pump.fun-like platform, Whales.meme, and airdropped the platform's first token, GMCAT, to GM pre-sale participants and xWHALES holders. The market value of GMCAT once rose to more than $10 million, but has now fallen back to $2.5 million. Why did the platform survive for only one night? In this article, Odaily Planet Daily will interpret the platform and its differences from Pump.fun, and analyze the source of Pump.fun's dominance.

Whales.meme

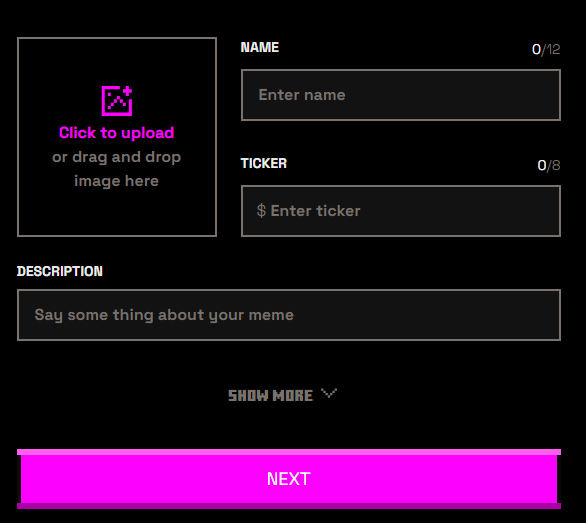

The overall operation logic of Whales.meme is consistent with Pump.fun. First of all, for developers, they can create a new token within seconds, only need to provide the token name, picture and description, and can also add TG, X account, website and other information to attract users and build a community.

For users, transactions are generally conducted within the internal market. When a certain progress is reached, the platform will combine the invested funds and tokens into LP and start DEX trading.

In terms of details, Whales.meme made a key change, changing the internal market share to a "share system". Each token in the internal market transaction is divided into 200 shares, and users can only trade 1 share at a time . After the opening, tokens are allocated according to the user's share ratio. Pump does not limit the number of transactions for users. In extreme cases, it can be a few addresses that purchase all the chips, or thousands of addresses.

Where does Pump.fun’s dominance come from?

In addition to GMCAT, the first token issued by the Whales.meme platform is NYL, which currently has a market value of only US$20,000. Generally speaking, the first token of a platform should perform well. Why is the actual performance so poor?

First of all, product quality is a key factor. Frequently crashed websites and limited purchasing channels restrict users’ purchasing desire and path. However, product-market fit is a more fundamental issue .

Pump has been launched for about 5 months. It is very simple in terms of function. There are also many imitations with slight innovations, but Pump still occupies a significant dominant position. Why? We believe that these imitations are more pursuing "fairness", but the market or users essentially want "the purest and most profitable casino" .

Why do users buy Meme? For most users, they hope to buy a token with a super high multiple to obtain a large profit. Although the high multiple difference of Pump.fun's internal market is a convenient way for DEV to harvest, it is also a possibility for users to "get rich overnight". The advantage of Whales.meme's separation of internal market shares is that it is difficult for DEV to buy a large number of chips and then dump them to users, but it also means that users can only buy a small number of tokens, and it is difficult to have enough profit space.

Why does the fairness narrative fail here? During the period when the inscription was popular, "fair launch" was considered the fundamental factor for the inscription to subvert other tokens. Why does fairness not work in the Pump.fun mode? The answer is that "multiples" are the driving force, and "fairness" is just the icing on the cake. In the early days of inscriptions, the cost of engraving a set of high-volume inscriptions, such as rats and mice, was only a few hundred thousand dollars, and the room for growth was still high, so users were willing to participate. But in the frenzy period, such as VMPX in May 2023 and Rune last month, the extremely high cost and initial market value made the room for growth extremely compressed. The so-called "those who should get on the bus have already got on the bus", resulting in a large number of peaks at the opening.

Therefore, fair projects will not be the disruptors of Pump.fun. Its real challengers are either homogenized products that take services and products to the extreme, or purer Meme casinos. However, with the increasing severity of harvesting and PvP, perhaps after draining users' funds, energy and psychological expectations, it will be Pump.fun itself that will defeat it.

References

" Pump PVP Manual: Sickle and Leek Promote Mutual Evolution "