Original author: TechFlow

A very obvious trend recently is that people are starting to be bullish on Ethereum again.

From shouting Ethereum is the oil of the digital age to the slogan ETH will rise to 10,000 appearing on EthCC... What else can revive ETH?

The answer to this question may not be on the chain, but in the U.S. stock market.

As Bitcoin reserves become a new trend for U.S. listed companies, Ethereum reserves have become the new darling of the U.S. stock market.

For example, last week, SharpLink announced that it had purchased another 7,689 ETH, making it the listed company with the largest ETH reserves; yesterday its stock price (SBET) also rose by nearly 30%;

BitMine (BMNR), a mining company focused on Bitcoin mining, recently announced the launch of a $250 million ETH asset reserve plan, intending to follow MicroStrategy. The companys stock price has risen 16 times in one month, and the short-term wealth effect has even exceeded some Meme coins.

In addition, another U.S.-listed Bitcoin mining company, Blockchain Technology Consesus Solutions (BTCS), followed a similar path and announced on Tuesday that it plans to raise $100 million to purchase ETH.

As the news came out, the companys stock price soared 110%.

There is also the more radical Bit Digital, whose main business is Bitcoin mining and Ethereum staking. It directly announced a full shift to Ethereum and the sale of Bitcoin. Yesterday, its stock BTBT once rose by about 20% during the trading session.

These four companies are a microcosm of the recent U.S. stock markets active embrace of the Ethereum narrative, and are also stars at the forefront of the capital market.

Speculative funds have limited attention span, and the market often cannot remember more latecomers, so you can see them scrambling to make official announcements. What they want is a clear attitude and mental positioning.

We also reviewed the similarities and differences between these companies in terms of business and underlying resources, to provide some reference for players who are more concerned about the linkage between coins and stocks.

Different businesses, but both seeking to turn losses into profits

Four companies, SharpLink (SBET), BitMine (BMNR), Blockchain Technology Consensus Solutions (BTCS) and Bit Digital (BTBT), are vying to bet on ETH, and each has its own business logic behind the surge in stock prices.

SharpLink (SBET): From gambling to gambling

SharpLink Gaming (SBET) is mainly engaged in online sports betting. It also works with sports media companies to help them develop strategies, products and innovative solutions.

However, the companys revenue in 2024 was only US$3.66 million, a 26% year-on-year drop; it turned a profit only by selling part of its business that year.

Before the transformation, SBET had a market value of approximately US$10 million, its share price hovered on the edge of delisting (less than US$1), shareholders’ equity was less than US$2.5 million, and it faced compliance pressure. Its traditional business had limited growth and it was difficult to break through in the highly competitive gaming industry.

In May 2025, SBET bought ETH crazily through a $425 million private placement and currently holds 205,634 ETH (as of July 9).

The large-scale financing to acquire ETH also made it one of the worlds largest publicly traded ETH holders, second only to the Ethereum Foundation.

Public data shows that more than 95% of SBETs ETH are deployed in the liquidity staking agreement, and it has currently received 322 ETH in staking rewards.

The cash flow generated through staking can indeed have a positive impact on optimizing the balance sheet, but more importantly, this strategy not only optimizes the financial structure, but also transforms SBET from a small company struggling on the edge of delisting into a crypto concept stock sought after by the capital market.

Against the backdrop of bottlenecks in its main business and the Ethereum ETF craze, SBET’s transformation is more like a gamble. The high proportion of ETH also makes it extremely vulnerable to price fluctuations. After all, ETH falls much more drastically than BTC.

BitMine(BMNR):From BTC mine to ETH vault

As the name suggests, BitMine Immersion Technologies (BMNR) is a Bitcoin mining company that relies on immersion cooling technology to mine blockchain gold at mines in Texas and Trinidad.

BMNR generates Bitcoin revenue through its own mining and hosting of third-party equipment.

In the first quarter of 2025, the company had revenue of $3.31 million, but high energy consumption and low profit margins (net loss of $3.29 million in 2024) made it difficult to move forward. Before the transformation, BMNR had a market value of only $26 million, and its mining business was constrained by high costs and fierce competition, with limited room for growth.

On June 30, the company announced a private placement, planning to purchase approximately 95,000 ETH, but the actual holdings have not yet been disclosed. However, after the announcement, BMNRs stock price soared from $4.50 to $111.50, a 3,000% increase since June.

At the same time, the rise in stock prices has also pushed up BitMines market value, which is currently around $5.7 billion. Unlike SBET, BitMine still retains its original BTC mining business, which also makes ETH reserves more like a short-term narrative.

Blockchain Technology Consensus Solutions (BTCS): Reinventing the old and making the narrative fit the business

BTCS is different from the above two companies, and its reserve of ETH is tenable in its historical business.

The company focuses on blockchain infrastructure and was founded in 2014. It is one of the early blockchain companies listed on Nasdaq. Its core business focuses on the infrastructure operation of Ethereum and other proof-of-stake (PoS) blockchain networks. Its main business includes running Ethereum nodes and providing data analysis platform ChainQ, providing pledge and data services for DeFi and enterprises.

But again, the companys financial performance was poor.

In 2024, BTCSs revenue was approximately US$2.6 million, a year-on-year decrease of 12%, mainly due to high node operating costs and intensified market competition. The net loss reached US$5.8 million, and it fell into a financial dilemma of high investment and low return.

BTCS has held ETH and run a validator node since 2021, and has accumulated 14,600 ETH, far earlier than the ETH reserve plans of the two listed companies mentioned above; in June and July of this year, BTCS accelerated the accumulation of ETH through AAVE DeFi lending and traditional financing, and issued an announcement on July 8 that it plans to launch a $100 million fundraising plan to further expand its ETH holdings.

Objectively speaking, increasing ETH holdings can enhance the staking capacity of the validator nodes in BTCSs main business, increase gas fee income and market competitiveness. The market is also quite receptive to this announcement, which also caused BTCSs stock price to surge by more than 100% in a single day, from $2.50 to $5.25.

Bit Digital (BTBT): Sell BTC and switch to ETH

Bit Digital, Inc. (BTBT) is a blockchain technology company headquartered in New York, USA. It was founded in 2015 and initially focused on Bitcoin (BTC) mining. Since 2022, it has gradually laid out Ethereum staking infrastructure, in addition to GPU cloud computing power and asset management services.

The company is also in financial loss. The financial report shows that in the first quarter of 2025, its revenue was US$25.1 million, and its loss after accounting adjustments was around US$44.5 million.

In July 2025, the company increased its ETH holdings to 100,603 (about $264 million) through a $172 million public offering and the sale of 280 BTC. ETH accounted for 60% of its assets, making it the company with the second largest amount of ETH after SharpLink.

It is obvious that these four companies all have poor financial conditions and low market capitalization, which is similar to some low-market-cap protocols in the crypto market with no revenue, and they quickly rose after gaining narratives and attention.

The key drivers behind the transformation

In a recent article , David Hoffman, founder of Bankless, had a very profound insight into the ETH reserve phenomenon:

The strategy is simple: put ETH on the balance sheet and then sell ETH to Wall Street... Ethereum itself has a lot of narrative highlights. All ETH needs is someone who is dynamic enough to excite Wall Street.

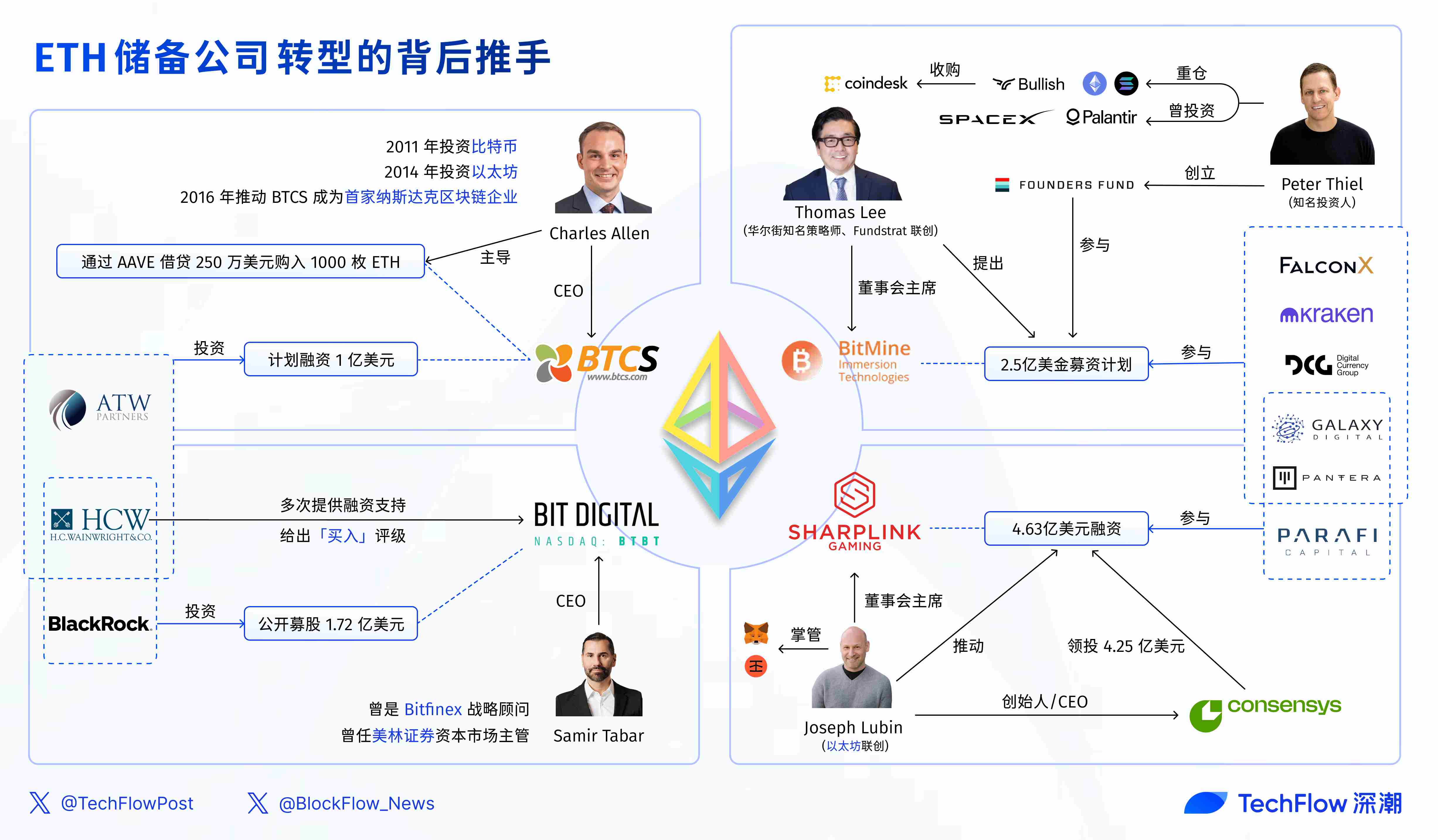

Connections and resources connect the crypto narrative into the traditional capital market. From cryptocurrency tycoons to investment banking giants, there are also different key figures behind these four companies.

SharpLink: Ethereum co-founder and his crypto gang

From being on the verge of delisting to becoming the largest holder of ETH, the operation behind it is inseparable from Ethereum co-founder Joseph Lubin .

As the founder and CEO of ConsenSys, Lubin is in charge of important infrastructure in the Ethereum ecosystem, such as the MetaMask wallet and Infura (the latter handles more than 50% of Ethereum transactions).

In May 2025, Lubin joined the SBET board of directors as chairman and personally promoted $463 million in financing. This is also closely related to the crypto VCs who have invested in various projects in the Ethereum ecosystem:

His own ConsenSys led a $425 million private placement in SBET, joining forces with ParaFi Capital (a top venture capital firm in the DeFi field, investing in Uniswap and Aave), Pantera Capital (an early investor in Ethereum, managing assets of over $5 billion), and Galaxy Digital (which manages Ethereum ETFs) and other institutions.

Although some in the community question whether this is a conspiracy of the Ethereum Foundation, Lubin’s connections and ConsenSys’ resources undoubtedly enable SBET to become a pioneer in the Wall Streetization of Ethereum.

BitMine: Thomas Lees collaboration with Silicon Valley VC

Thomas Lee , a well-known Wall Street strategist and co-founder of Fundstrat, is famous for his accurate predictions and is the driving force behind BitMine (BMNR) ETH reserve strategy.

Lee has been bullish on Bitcoin since 2017, predicting that ETH will reach $5,000-6,000 in 2024. In June 2025, he announced that he would serve as chairman of the board of directors of BMNR.

He mentioned the reason for betting on Ethereum in an interview:

“To put it bluntly, the real reason I chose Ethereum is that stablecoins are exploding. Circle is one of the best IPOs in five years, with a price-earnings ratio of 100 times EBITDA, which has brought very good performance to some funds... Stablecoins are the ChatGPT of the crypto world. It has entered the mainstream and is evidence that Wall Street is trying to equityize tokens. The crypto world is tokenizing equity, such as the tokenization of the US dollar.”

At the same time, he told CNBC that BMNR will become the MicroStrategy of Ethereum.

In the $250 million fundraising plan for BitMine proposed by Lee, we also see the presence of the well-known Silicon Valley VC Founders Fund, which was founded by Peter Thiel and has invested in SpaceX and Palantir. Since 2021, it has also begun to invest heavily in cryptocurrencies, including Ethereum, Solana and the Bullish Group, which also acquired CoinDesk.

In addition, crypto-native institutions such as Pantera, FalconX, Kraken, Galaxy Digital and DCG are also involved.

Bit Digital: CEO was once a Bitfinex consultant

Samir Tabar is the helmsman of Bit Digital (BTBT) ETH reserve strategy. He also has cross-border experience from Wall Street to the cryptocurrency circle.

Tabar was formerly the head of capital markets at Merrill Lynch. From 2017 to 2018, he served as a strategic advisor to Bitfinex , optimizing the transaction process of USDT on the Ethereum network. He joined Bit Digital in 2021.

In an interview with CNBC, Tabar called Ethereum a blue chip asset that will reshape the financial system, emphasizing its huge potential in stablecoins and DeFi applications. The traditional financial background and crypto experience provide more credibility for Bit Digitals transformation, and its blue chip asset remarks also cater to the narrative of revitalizing Ethereum.

In June 2025, Bit Digital raised $172 million through a public offering (ATM issuance) to purchase ETH; the main investors included BlackRock and investment bank underwriter HC Wainwright, which had provided financing support to Bit Digital on many occasions and reiterated BTBTs buy rating in 2025 with a target price of $5-7.

BTCS: Using AAVE to borrow and buy ETH

Compared with the previous three, BTCS CEO Charles Allen is relatively low-key.

However, he is also a veteran in the crypto industry. His blockchain experience began with Bitcoin investment in 2011, turned to Ethereum in 2014, and promoted BTCS to become the first Nasdaq blockchain company in 2016.

In June 2025, he led BTCSs action of borrowing $2.5 million through AAVE to purchase 1,000 ETH. In July 2025, it planned to raise $100 million. Investors also included ATW Partners and HC Wainwright. The former is a hybrid venture capital/private equity firm based in New York that invests in both debt and equity.

The commonalities we can see from these 4 companies are:

Each company has key figures related to the crypto community, and the fundraising targets of different companies also overlap.

Crypto funds and traditional funds that have invested in Ethereum are also the driving force behind the ETH reserve craze; the capital network of the Ethereum ecosystem has extensive tentacles, which may be another example of the robustness of the Ethereum network itself.

Money never sleeps. When ETH Reserve becomes the new Meme stock in 2025, the company will inevitably make a lot of people rich during the transformation. At present, this feast of coin stocks has not yet come to an end.