Bitget Research Institute: Strong Q1 inflation data postpones interest rate cuts, football fan tokens offer wealth creation opportunities

In the past 24 hours, many new hot currencies and topics have appeared in the market, and it is very likely that they will be the next opportunity to make money.

The sectors with strong wealth creation effects are: the new generation of popular MEME, BTC ecological new assets, and blue chip public chain sectors

Hot searched tokens and topics: Avalon Finance, Mocaverse, Paxos, RWA

Potential airdrop opportunities include: Zircuit, Nifty Island

Data statistics time: April 17, 2024 4: 00 (UTC + 0)

1. Market environment

Yesterday, after falling below $62,000, Bitcoin quickly rebounded to $63,000-64,000 and remained in a narrow range. Altcoins remained weak and their prices continued to fall. Bitcoin spot ETFs had a total net outflow of $58.03 million yesterday, with net outflows for two consecutive days. GBTC had a net outflow of $79.38 million in a single day.

On the macro level, the futures market shows that the market's expectations for the Fed's rate cuts have further declined after Powell's comments on inflation. Investors are now betting that there will only be one or two rate cuts this year, with an expected rate cut of around 40 basis points. There is no positive news for the cryptocurrency market at the macro level. The market correction continues. Under the general decline of the cottage market, some Solana Meme coins such as MEW have strong gains, indicating that funds are grouped together. In addition, with the European Cup approaching, you can pay attention to the football fan token sector.

2. Wealth-making sector

1) Sector changes: new generation of popular MEME (SLERF, MEW, BOME)

The main reason is that during the market crash, the wealth effect of altcoins generally weakened, and there were memes of whale wallets and smart money bottom-fishing. The overall popular memes rose strongly in the rebound.

Rising situation: In the past 24 hours, SLERF rose 4%, MEW rose 36.9%, the increase in the past three days was about 250%, and BOME rose 1%;

Factors affecting the market outlook:

Solana Ecosystem TVL and Capital Inflow: Currently, Solana Ecosystem TVL has exceeded 4.7 billion US dollars, and has risen by more than 100% in the past month. Currently, it is second only to ETH, TRON and BSC. If funds continue to flow in, the overall ecological currency price will rise further. At the same time, the speed of listing Solana tokens on various exchanges has significantly accelerated. The secondary market funds flowing into the exchange will also indirectly affect the Solana Ecosystem TVL.

Subsequent increase of MEW: For Solana Ecosystem Meme Token, the newly launched MEW is expected to break the ceiling, with a rapid increase. The token was very strong in the rebound after the market crash, doubling in a single day, and then OKX was launched. Due to the large amount of early airdrops, the project party is likely to have not yet made a profit on the asset, so the project party has the motivation to pull the market again to make liquidity and sell the token for profit.

2) Sector changes: New assets in the BTC ecosystem (RUNE, CKB, STX)

The main reason: the halving is imminent and the BTC ecosystem is active. The founder Casey’s genuine Runes protocol will be officially launched around the 20th of this month.

Rising situation: In the past 24 hours, Runestone rose by 8%, breaking through 5,000 US dollars again. CKB and STX fell less than other altcoins in the past 24 hours.

Factors affecting the market outlook:

Updates from BTC core developer Casey and other related project parties: Pay attention to the project party’s Twitter and TG/DC news releases. During the BTC halving period, the possibility of BTC ecological projects releasing positive news is very high. It is necessary to pay attention to the release of project news in a timely manner. The new asset protocol Runes is about to be launched on the mainnet, and there may be speculation on hot assets in the ecosystem;

CKB and STX have attracted much attention from the market during the halving period: CKB is favored as a UTXO Stack prototype project and is considered one of the best representatives of Bitcoin Layer 2 technology. Recently, asset issuance protocols based on RGB++ have gradually emerged, bringing a wealth-creating effect to the ecosystem. STX chose the threshold signature algorithm token T, and with the Nakamoto upgrade of STX on the 15th of this month, there is speculation in the market. In addition, the halving of Bitcoin will also bring new changes, and miners' income will be further reduced, requiring ecological prosperity to support income transformation. Investors can pay attention to the flow of funds in the ecosystem to assist investment decisions.

3) The sector that needs to be focused on in the future: football fan tokens

The main reason: With the opening of the European Cup/America's Cup approaching, the fan token sector began to warm up one and a half months in advance. During the market decline, the fan token sector was relatively resilient. The top tokens in the sector fell by about 10% in the past 7 days, which was stronger than the general 7-day decline of altcoins. SANTOS rose 30% in the past 24 hours, PSG rose 10%, and other fan tokens also rose sharply in a short period of time before falling back.

Specific currency list:

SANTOS: Santos FC Fan Token is a fan token of Santos Football Club based on BSC. Santos Football Club is a well-known Brazilian team. The token SANTOS was launched on Binance Launchpool and currently has the highest market value in the fan token sector.

PSG: Paris Saint-Germain Fan Token is the fan token of Paris Saint-Germain Football Club. It recently became the first Chiliz Chain node validator and pledged to repurchase PSG fan tokens with 100% of its accrued revenue.

LAZIO: Lazio Fan Token is a fan token of Lazio Football Club issued based on BSC and is also a Binance Launchpad project. The current FDV is 120 million US dollars.

3. User Hot Searches

1) Popular Dapps

Avalon Finance:

Merlin Chain's first lending protocol Avalon Finance currently has a TVL of over $140 million and more than 7,000 users, making it the largest lending protocol in Merlin Chain and the entire BTC ecosystem, and also setting a record for the fastest growing DeFi lending protocol in TVL in DeFi history. Avalon Finance completed a $1.5 million seed round of financing in March, with participation from SNZ Capital, Summer Capital, Matrixport Ventures, and others. Currently, Avalon Finance has launched a community airdrop plan with an airdrop ratio of up to 20%, and users can participate in early airdrops.

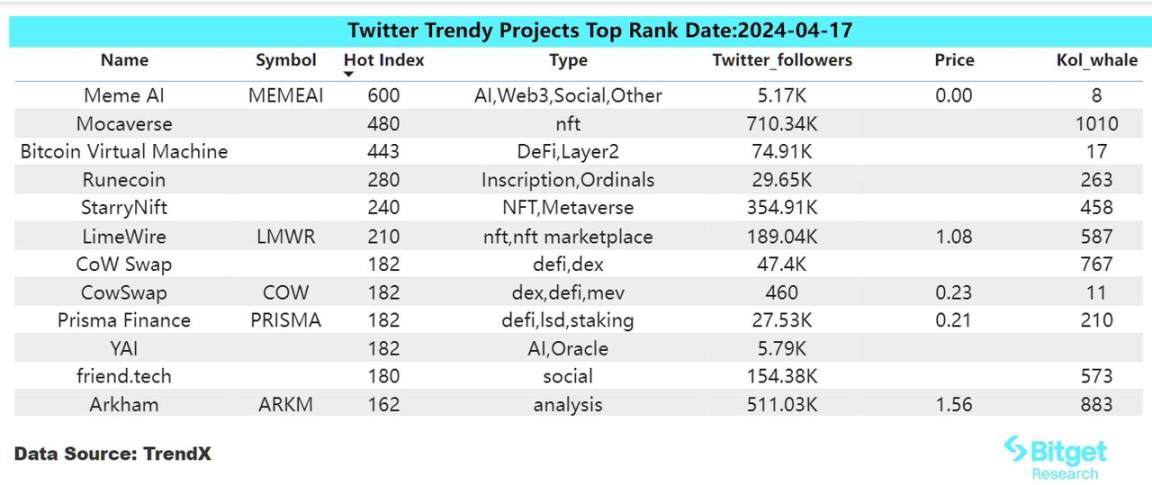

2) Twitter

Mocaverse: Animoca Brands' Web3 project Mocaverse announced the token economics. The total supply of the token MOCA is 8,888,888,888, of which 31.5% is for network incentives, 20% for the ecosystem and treasury, 1.5% for community sales, 13% for strategic partners, 10% for liquidity, 5% for operating expenses, 12% for the team, and 7% for issuing contributors and consultants. At the same time, 3 million PARAM tokens will be airdropped to Moca NFT holders. The token airdrop will continue. After the token is officially issued, users can participate after calculating the potential rate of return based on the currency price.

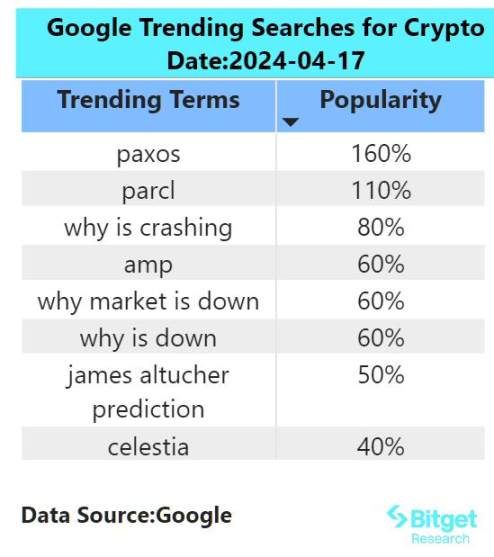

3) Google Search & Region

From a global perspective:

Paxos:

The price of USDP fluctuated violently in a short period of time. USDP briefly broke through $1.5 and is now quoted at $1.12. Due to the violent price fluctuations, the chain reception liquidation was triggered, and the liquidation amount on Aave v2 exceeded $2 million. Users who participated in related projects are advised to withdraw funds in time.

From the hot searches in each region:

(1) Mainstream currencies such as ETH and Solana have become popular searches in many countries in Asia:

Yesterday, both ETH and Solana became hot spots to varying degrees. For Solana, Zhu Su posted on social media: "Buy SOL at $135." Other content may imply that Zhu Su personally believes that the decline crisis has been resolved and it is time to start studying whether to buy the bottom. And ETH has seen multiple whale transfers to exchanges. The multi-signature address 0x A 97 took out 6,513 ETH staked from Lido and recharged 5,100 of them into OKX. Also yesterday, a whale transferred 5,000 ETH to Kraken, about $15.2 million.

(2) CIS in Europe, America, and Africa pay great attention to RWA:

Yesterday, the popular RWA project in the Solana ecosystem opened airdrops and was listed on multiple exchanges such as OKX and BITGET. Its token PRCL was open for claiming at 8:59 pm Beijing time, and the current trading price is 0.55. In addition, the permanent points ranking list will be launched after the first PRCL distribution next week. The permanent points will determine the second community distribution share of PRCL in the second half of the second quarter of 2024, resulting in an increase in the attention to RWA.

Potential Airdrop Opportunities

Zircuit

Zircuit is a parallel and AI-integrated Layer 2 public chain project based on zkRollup. It is invested by Pantera and Dragonfly. The current TVL of the project has exceeded 1.1 billion US dollars. Zircuit's current ecosystem is gradually improving, and it already includes functions such as staking, cross-chain bridges, and browsers. Users can also obtain airdrop qualifications by participating in ecosystem construction and community interaction.

Specific ways to participate: 1) Enter the staking page (https://stake.zircuit.com/) to participate in staking to win points; 2) Participate in node deployment to win points (https://build.zircuit.com/build).

Nifty Island

Nifty Island launched its public beta back in January this year. It is a Sandbox-style game that also incorporates the creative style of Roblox and Fortnite.

The Nifty Island airdrop event has already begun to incentivize community users to obtain ISLAND tokens. According to the airdrop rules published on its official social media account, user points will be rewarded based on factors such as the time users play the game, the number of players recommended, and the relevant NFT assets they own in their online wallets.

How to participate: 1) Create a game account and start building an island according to the game guide; 2) Earn more ISLAND by completing challenges or increasing island traffic.

Original link: https://www.bitget.com/zh-CN/research/articles/12560603808349

【Disclaimer】The market is risky, so be cautious when investing. This article does not constitute investment advice, and users should consider whether any opinions, views or conclusions in this article are suitable for their specific circumstances. Investing based on this is at your own risk.