SignalPlus Volatility Column (20240416): Nervousness Spreads

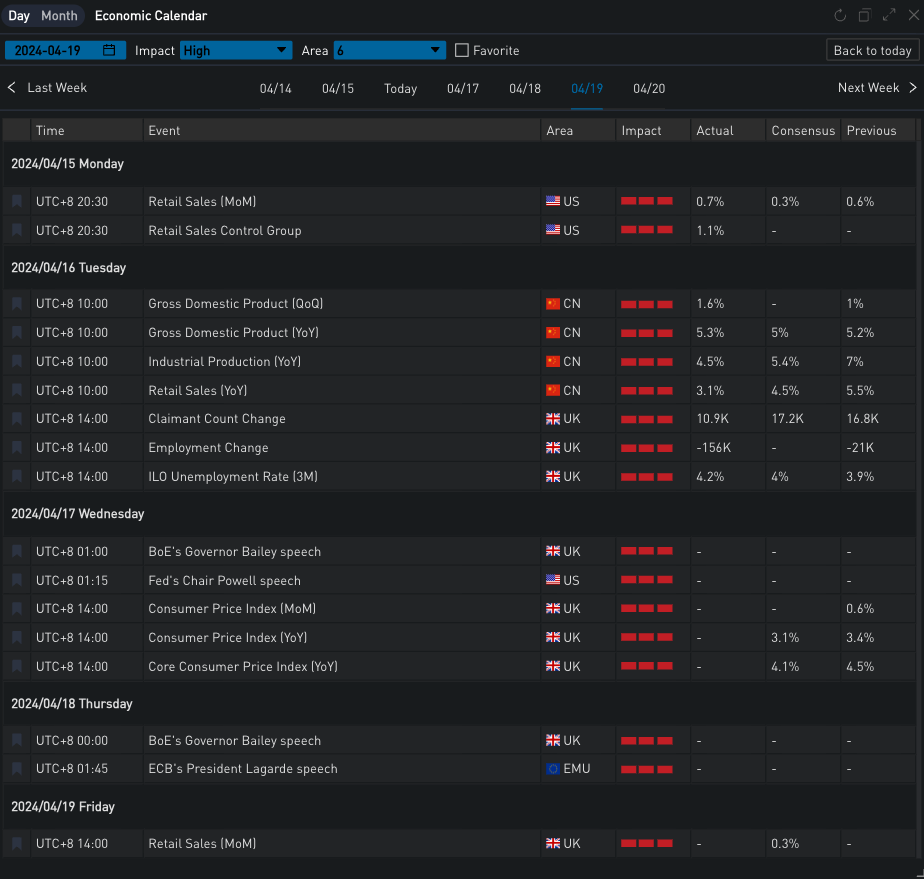

Yesterday (15 APR), US retail data showed strong performance, with a monthly rate of 0.7% month-on-month growth, far exceeding expectations by 0.4%. The previous value was also revised up from 0.6% to 0.9%. The market's expectations for the Fed's interest rate cut were further postponed. The probability of no interest rate cuts in June and August was 80% and 54% respectively. The US Treasury yield also gradually rose, with the two-year/ten-year yields reported at 4.946%/4.655%. US stocks were under downward pressure, with the Dow/S&P/Nasdaq closing down 0.65%/1.2%/1.79% respectively.

Source: SignalPlus, Economic Calendar

With the further escalation of the conflict in the Middle East and the repeated postponement of expectations for US interest rate cuts, digital currencies have also been fluctuating at low levels in a market filled with risk aversion. After a brief positive rebound brought about by the approval of ETFs in Hong Kong, BTC fell again and fell below the important support level of $62,000 several times.

Source: SignalPlus, BTC fell below the $62,000 support level several times

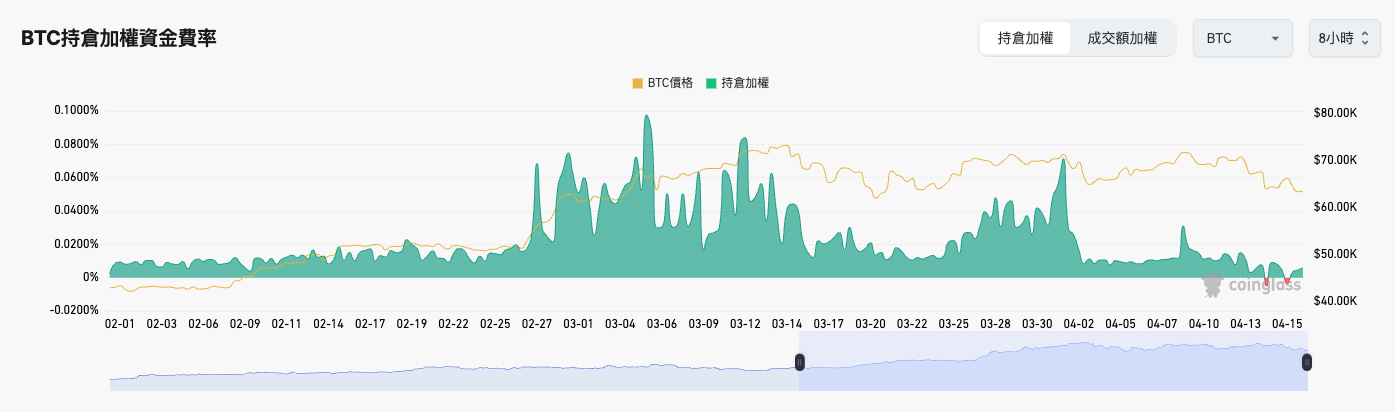

Judging from the data, this round of decline was mainly caused by the liquidation and stop-loss of futures longs, and the funding rate returned to a relatively neutral level (even reaching a negative value). On the bright side, this wave of deleveraging operations also allowed the overall BTC position (relative to early March) to enter a relatively healthy state.

Source: Coinglass, Funding rate returns to neutral, leverage market sentiment cools

On the other hand, the halving this week has a greater direct impact on the price of BTC. According to Bitfinex, a large number of BTC holders in centralized exchanges have chosen to leave recently, and the number of BTC in inactive addresses for more than one year has also dropped to a new low in the past 18 months. This reveals that long-term holders (LTHs) have reduced their positions or moved their positions out of exchanges in recent times. At the same time, short-term holders (STHs) are observed to be constantly absorbing their sold positions. If the Flow of STHs can continue, the price of the currency may continue to gain upward space.

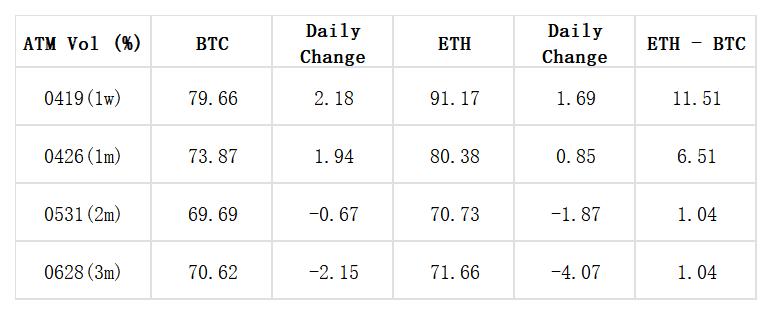

Source: Deribit (as of 16 APR 16:00 UTC+8)

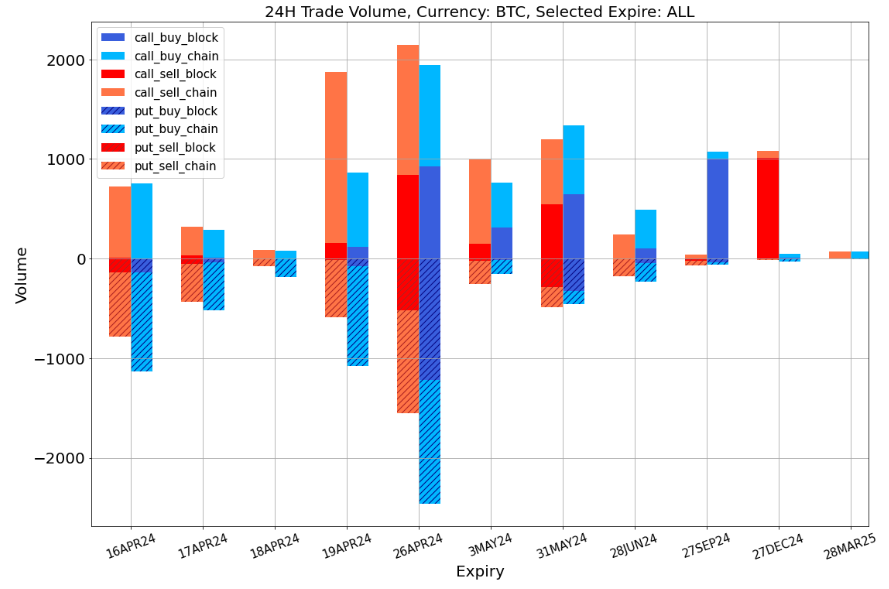

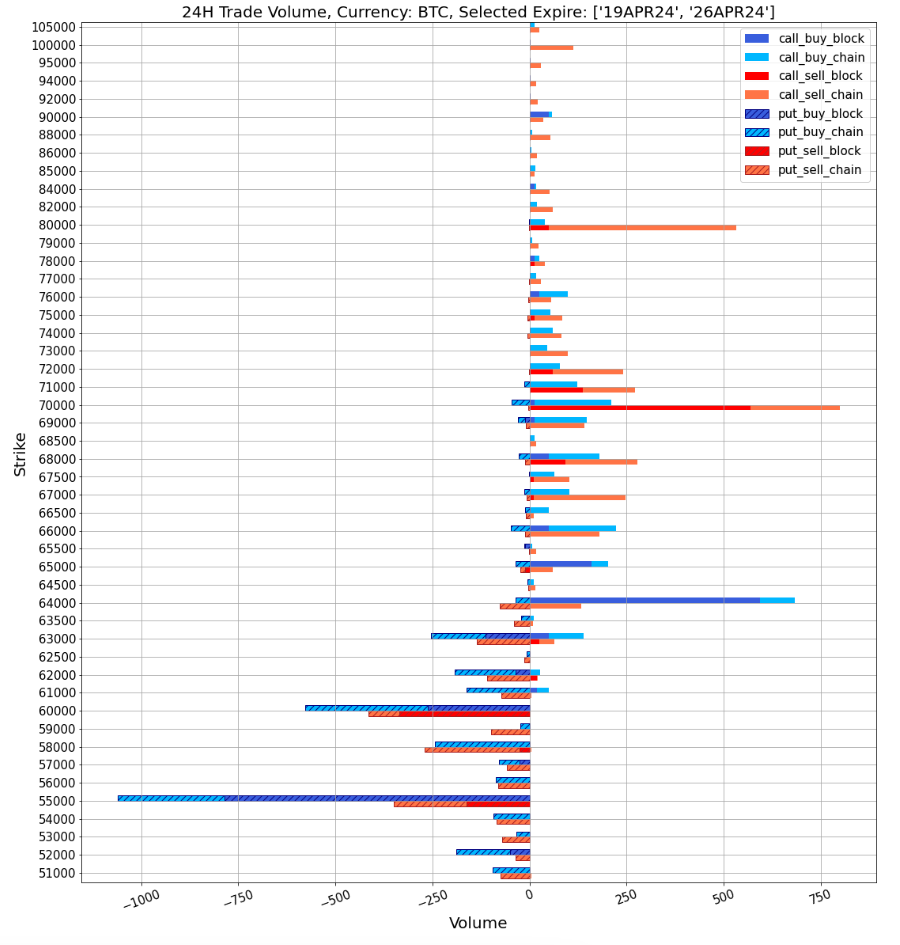

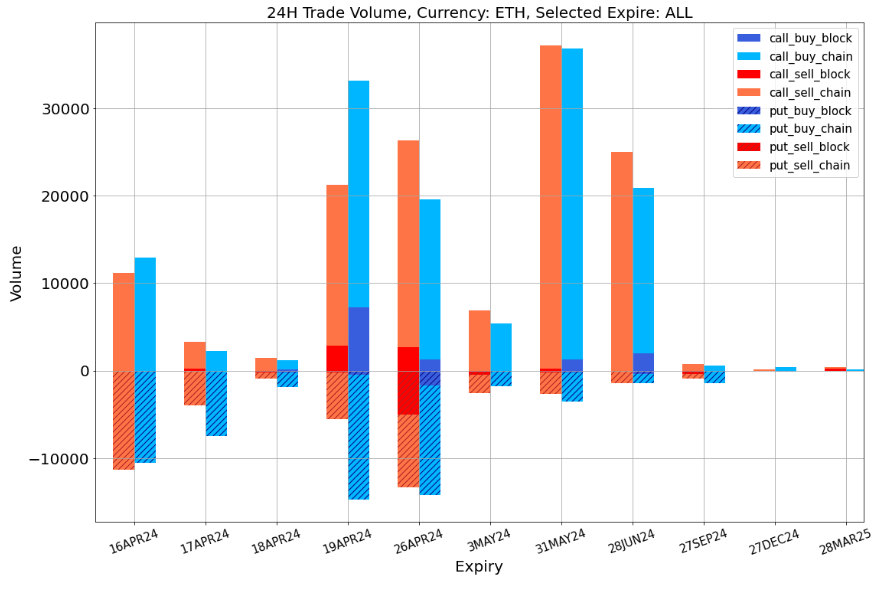

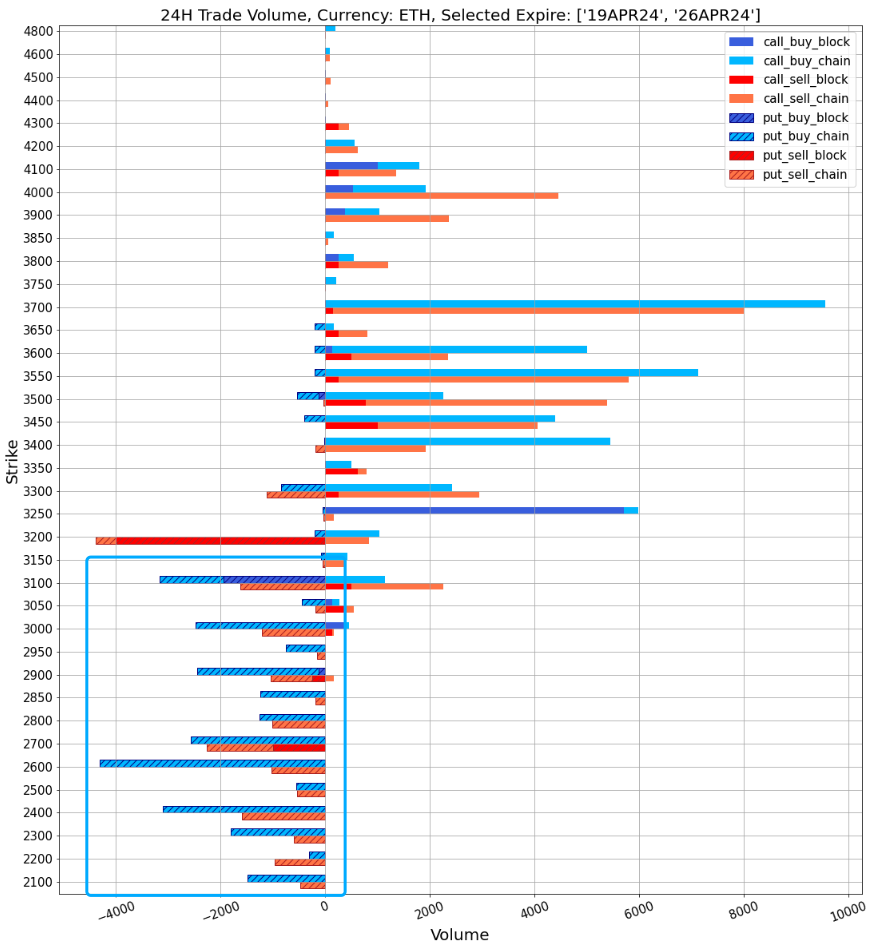

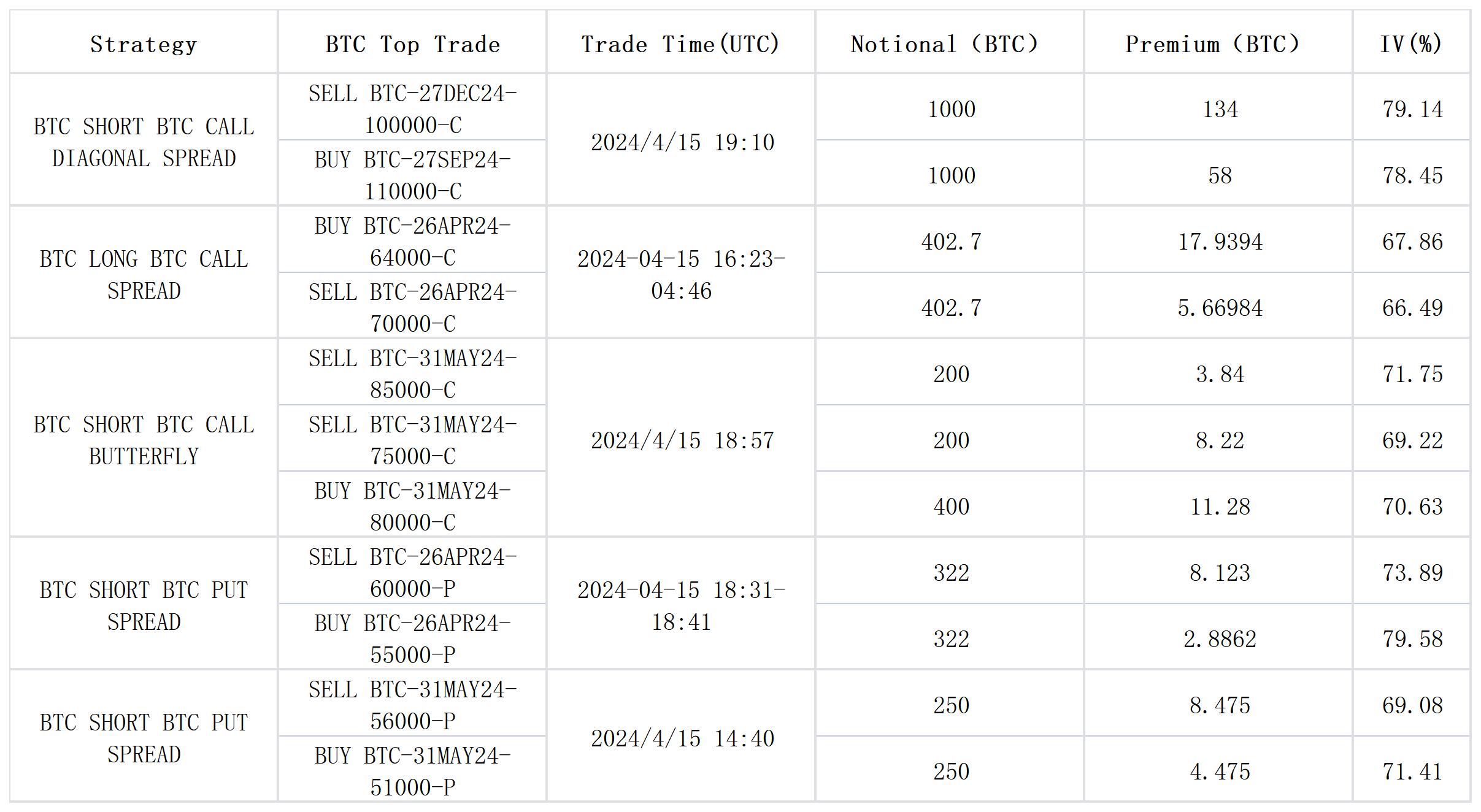

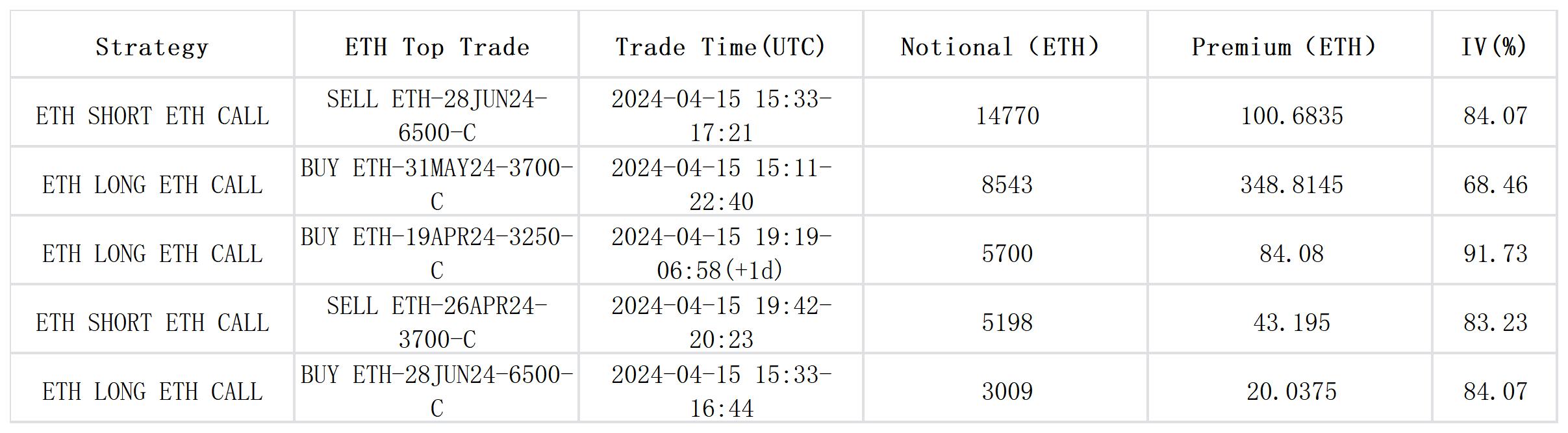

In terms of options, the front-end Vol Skew fell to the lowest point in the past three months. A considerable number of Long Put positions appeared at multiple important strike prices of BTC and ETH in April. At the same time, under such a high and steep IV Surface, the selling pressure of BTC front-end call options remained strong; the only few sell put spreads in bulk were also traded at a relatively far price below 60,000. The market's bullish enthusiasm was completely suppressed by the tense risk aversion sentiment in the past two days.

Source: SignalPlus, Vol Skew is at an all-time low

Source: SignalPlus

Data Source: Deribit, BTC transaction distribution

Data Source: Deribit, ETH transaction distribution

Source: Deribit Block Trade

Source: Deribit Block Trade

You can search for SignalPlus in the Plugin Store of ChatGPT 4.0 to get real-time encryption information. If you want to receive our updates immediately, please follow our Twitter account @SignalPlus_Web3, or join our WeChat group (add assistant WeChat: xdengalin), Telegram group and Discord community to communicate and interact with more friends.

SignalPlus Official Website: https://www.signalplus.com

Welcome to join the Odaily official community

Telegram subscription group: https://t.me/Odaily_News

Telegram chat group: https://t.me/Odaily_CryptoPunk

Official Twitter account: https://twitter.com/OdailyChina

Welcome to join the Odaily official community

Telegram subscription group: https://t.me/Odaily_News

Telegram chat group: https://t.me/Odaily_CryptoPunk

Official Twitter account: https://twitter.com/OdailyChina