The overall crypto market has plummeted. What is the economic signal behind it?

Original|Odaily

Author|jk

Over the past 24 hours, the global cryptocurrency market has experienced a dramatic price swing. From the evening of April 12 to the early morning of April 13, the market values of major digital currencies such as Bitcoin, Ethereum and various other small tokens generally fell. This sudden market turmoil has aroused widespread concern among market participants. Analysts are trying to decipher the reasons behind this phenomenon, including possible external economic factors, policy changes or sharp shifts in market sentiment.

Market summary

From a macro perspective, the total market value of cryptocurrency fell to $2,537.9 billion, a 24-hour drop of 7.3%. Deadline for article writing,Bitcoin is now at $66,814, down 4.91% in 24 hours, and once fell below $66,000; Ethereum is now at $3,217, down 8.16% in 24 hours, and once fell below $3,100, with a maximum drop of 9.34%; SOL fell below 150 The U.S. dollar later rebounded to $151, a 24-hour drop of 12.57%. The correction of altcoins has been even more severe, with mainstream currencies such as MATIC, XRP, DOGE, and BCH all experiencing declines of more than 20%. The previously popular MEME currency BOME has experienced a maximum decline of more than 50%.

Bitcoin price action in the early hours of April 13. Source: Coinmarketcap

According to Coinglass data, the total liquidation volume in 24 hours was US$878 million, of which long positions reached US$784 million.

Reason behind

As far as the market is concerned, many people are already worried about whether it will be a precursor to the interruption of the bull market. Currently, there are several different views on this plunge in the market:

One theory is that this plunge is due to the correction before the Bitcoin halving. Several key reasons why the market may experience a correction before the Bitcoin halving include:

First, since the block reward for Bitcoin mining will be halved, miners will receive fewer Bitcoins for the same mining work.This reduction in potential revenue may force them to pay higher operating costs next quarter while selling Bitcoin at the current relatively high levels,Increase supply pressure on the market thereby driving down prices.

Secondly, high market expectations and speculation about the halving event may push up prices before the event, and once these expectations are not met, prices may reverse sharply as a result.Additionally, if the market is heavily bought too early before an event, any small trigger close to the event could lead to massive profit-taking,This resulted in a sharp drop in prices.

Finally, based on historical patterns and psychological expectations, investors often guide current market actions based on historical patterns. Market expectations are high given that past halving events have sometimes resulted in significant price increases. However, if these expectations start to look too optimistic, investors may start selling their positions ahead of the halving to take advantage of the current high prices, which could cause the market to decline.

Therefore, while the halving itself is a positive sign for Bitcoin, the uncertainty and speculation leading up to the halving could lead to significant market volatility and price corrections.

From a macro perspective,The Feds balance sheet continues to tighten, reducing the supply of dollars on the market. Reductions in U.S. dollar liquidity, especially in the global financial system, often lead to price declines in risk assets, including stocks and cryptocurrencies.Because cryptocurrency markets are very sensitive to changes in liquidity, outflows can cause sharp price drops. Additionally, when markets anticipate that U.S. dollars will become more scarce, investors may shift to more stable or traditional assets and reduce their exposure to cryptocurrencies.

And according to Arthur Hayes,

The Bitcoin block reward is expected to be halved on April 20. This is often seen as a bullish catalyst for the crypto market.I agree that this will drive prices higher in the medium term; however, price action directly around the halving may be negative. The narrative that halvings are good for cryptocurrency prices is well-established. When a majority of market participants agree on a certain outcome, the opposite often occurs.This is why I think Bitcoin, and cryptocurrencies in general, will see a decline in price around the time of the halving.

Considering that the halving occurs during a period when U.S. dollar liquidity is typically tight, this will add fuel to the boom in crypto assets. The timing of the halving further weighed on my decision to take a break from trading until May.…so I choose to sell.

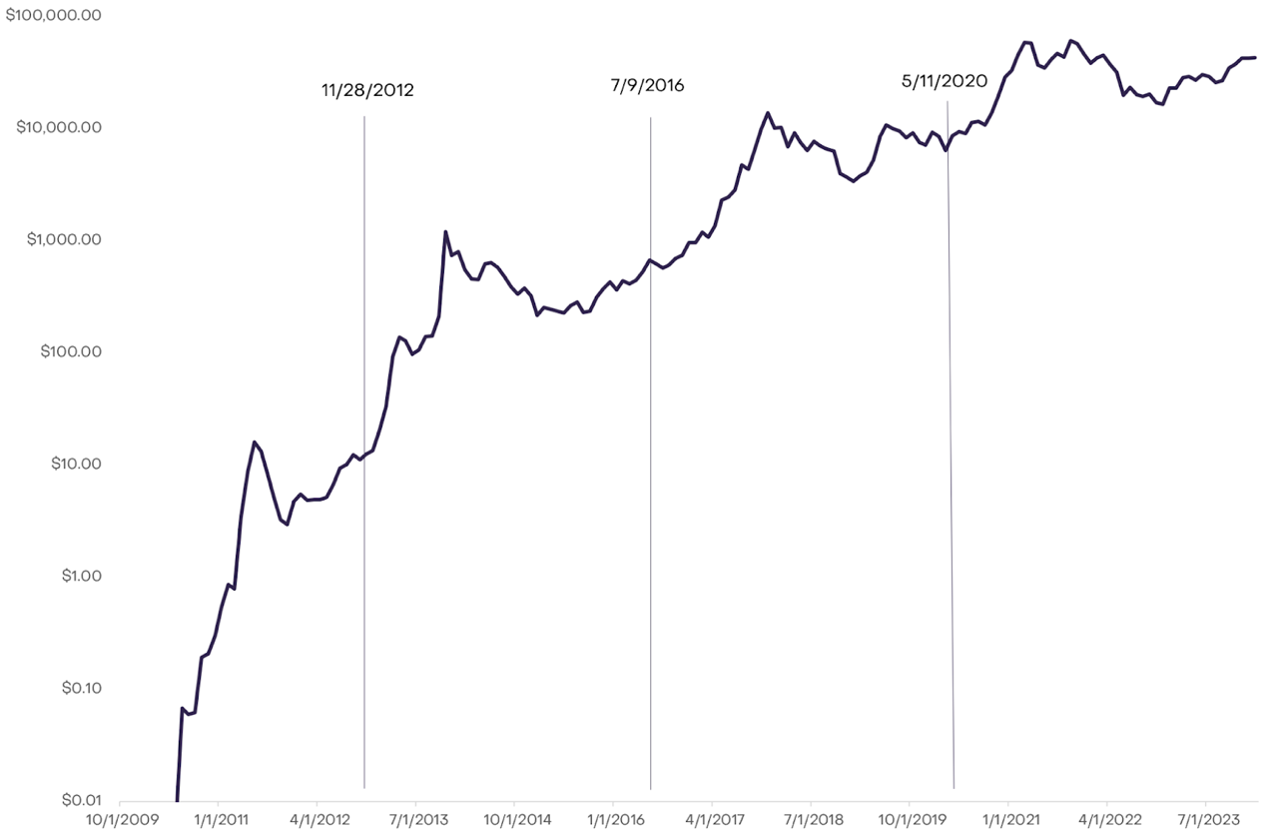

Bitcoin price trend before and after halving, source: Grayscale

Despite the current uncertainty facing the market, many investors and analysts remain optimistic about the long-term prospects for cryptocurrencies. They believe that this price adjustment may provide long-term investors with a good opportunity to enter the market. Every adjustment in the market is a test of investor sentiment and market trends, and is also a layout period for potential future growth.