Original author: Zackary Skelly, Chris Ahsing

Original compilation: Frank, Foresight News

The cryptocurrency industry is growing rapidly, but industry salary data is very scarce, especially comprehensive analytical data, which may become a key stumbling block for crypto startups seeking strategic growth. Therefore, the annual salary survey conducted in this report is to fill in the gaps. This blank.

In short, this report will provide a more granular set of crypto-compensation-related data, hopefully in a way that is easy to understand and useful for anyone setting, negotiating, or trying to understand compensation (whether it’s a recruiting team, a candidate, or an industry observer ) is a useful way to provide a clear picture of salary trends in the crypto industry.

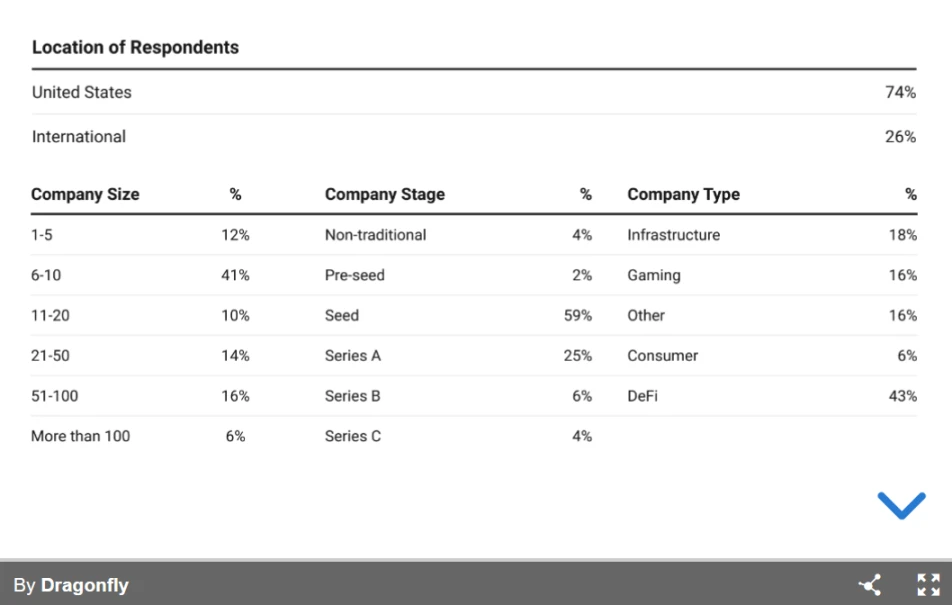

Demographic Information Records

The analysis in this report is based on a survey of 49 portfolio companies in 2023 and is based on available data to reflect overall trends. While further study of data with a larger sample size will help confirm these trends, we recommend that the of respondent response rates and the following points to explain the survey results:

Role: Cryptoengineering refers to engineers who focus on protocol or blockchain development, Marketing includes sales, marketing and business development, and compensation reflects total target revenue including commissions;

Reporting methodology: We ask companies to select preset salary ranges among employees at different seniority levels so that we report average minimum and maximum salary ranges. For founder compensation, however, we use the median value based on free responses in the survey;

Founders shareholding: The founders compensation part is mainly based on the percentage of equity/tokens owned, and there is no distinction between the two;

“International” definition: “International” refers to companies that are not located in the United States.

Non-traditional definition: Non-traditional financing companies have either conducted public token sales or are DAOs;

Rounding: Some numbers (such as demographic information) may contain very small errors due to rounding;

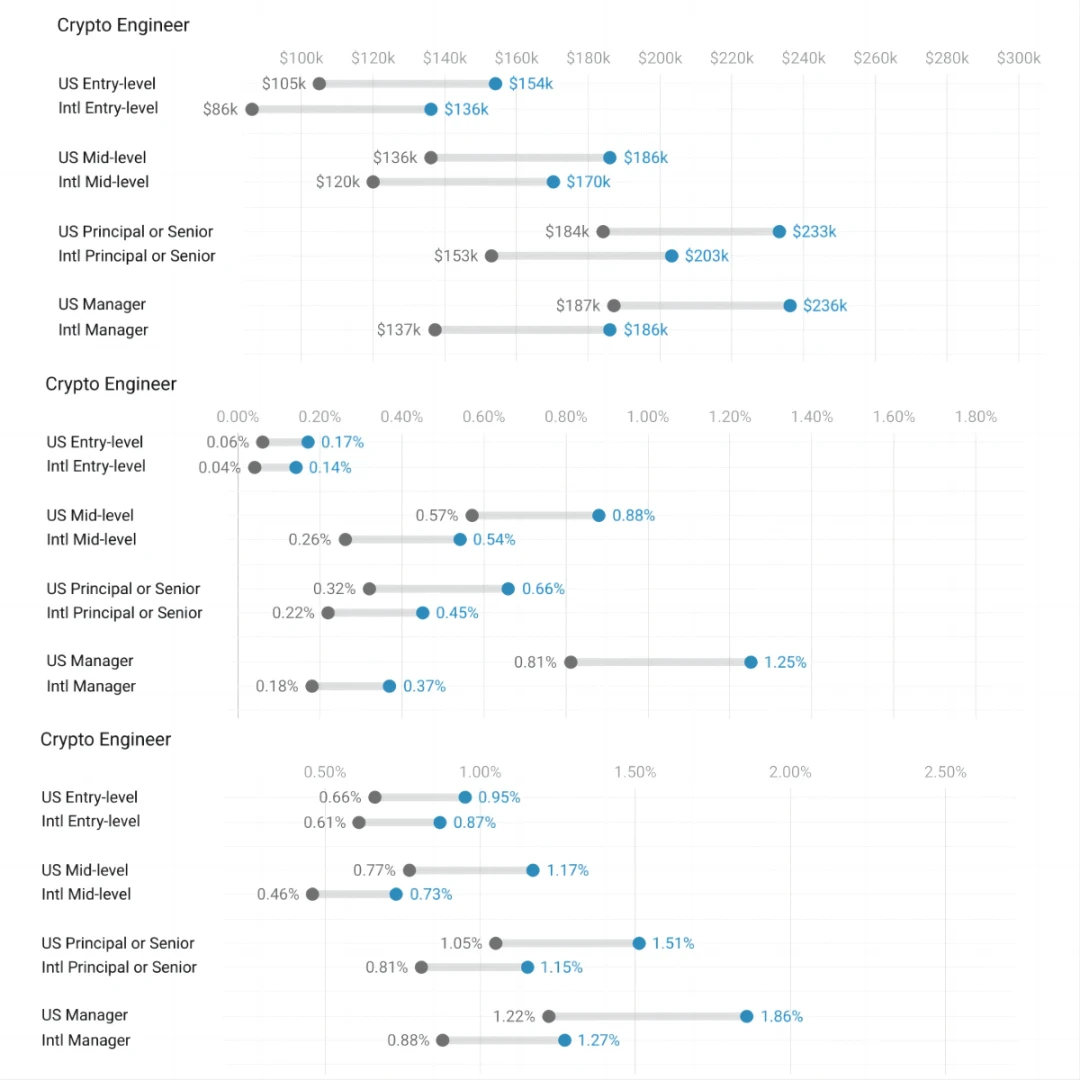

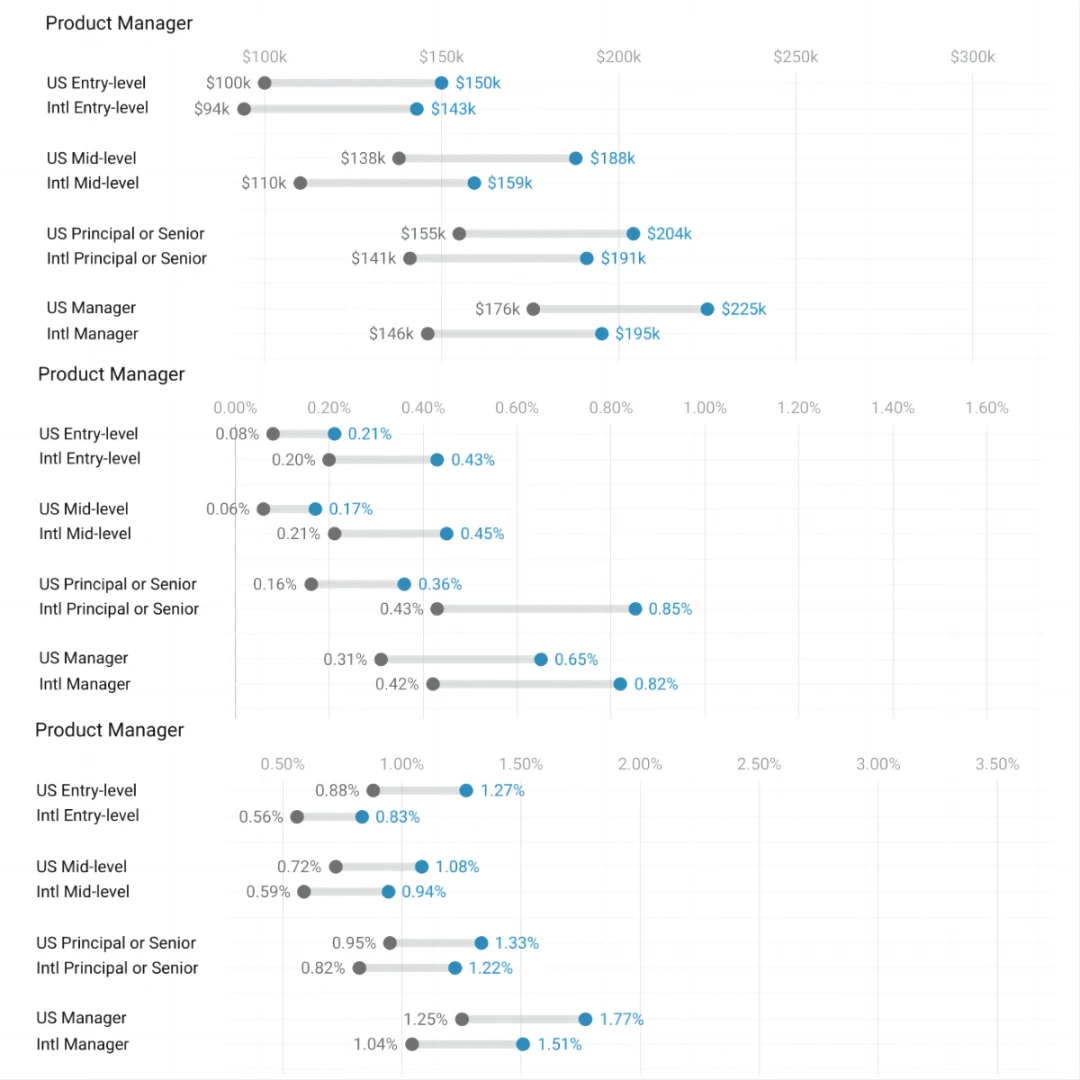

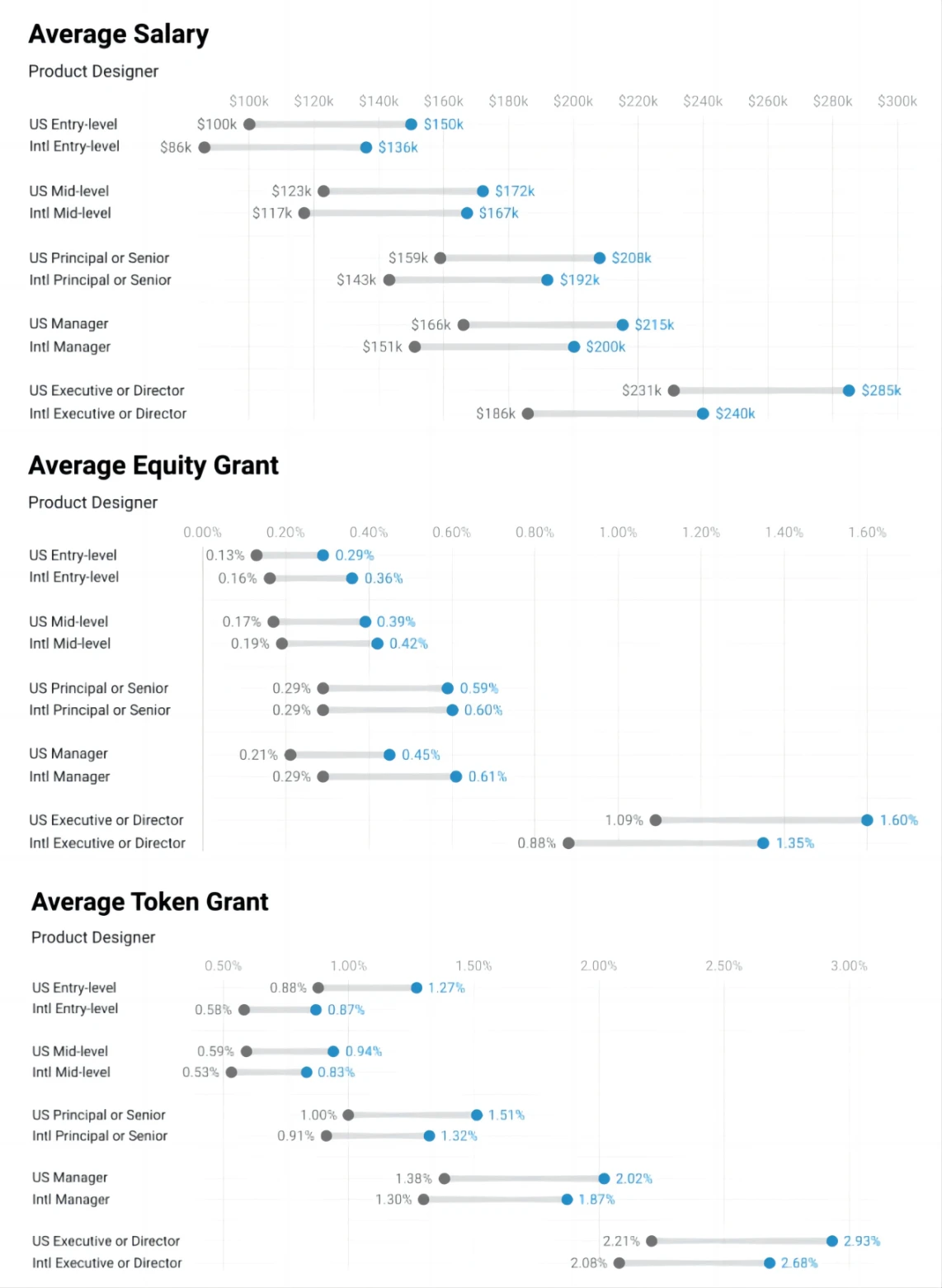

Salary, equity and token compensation ranges

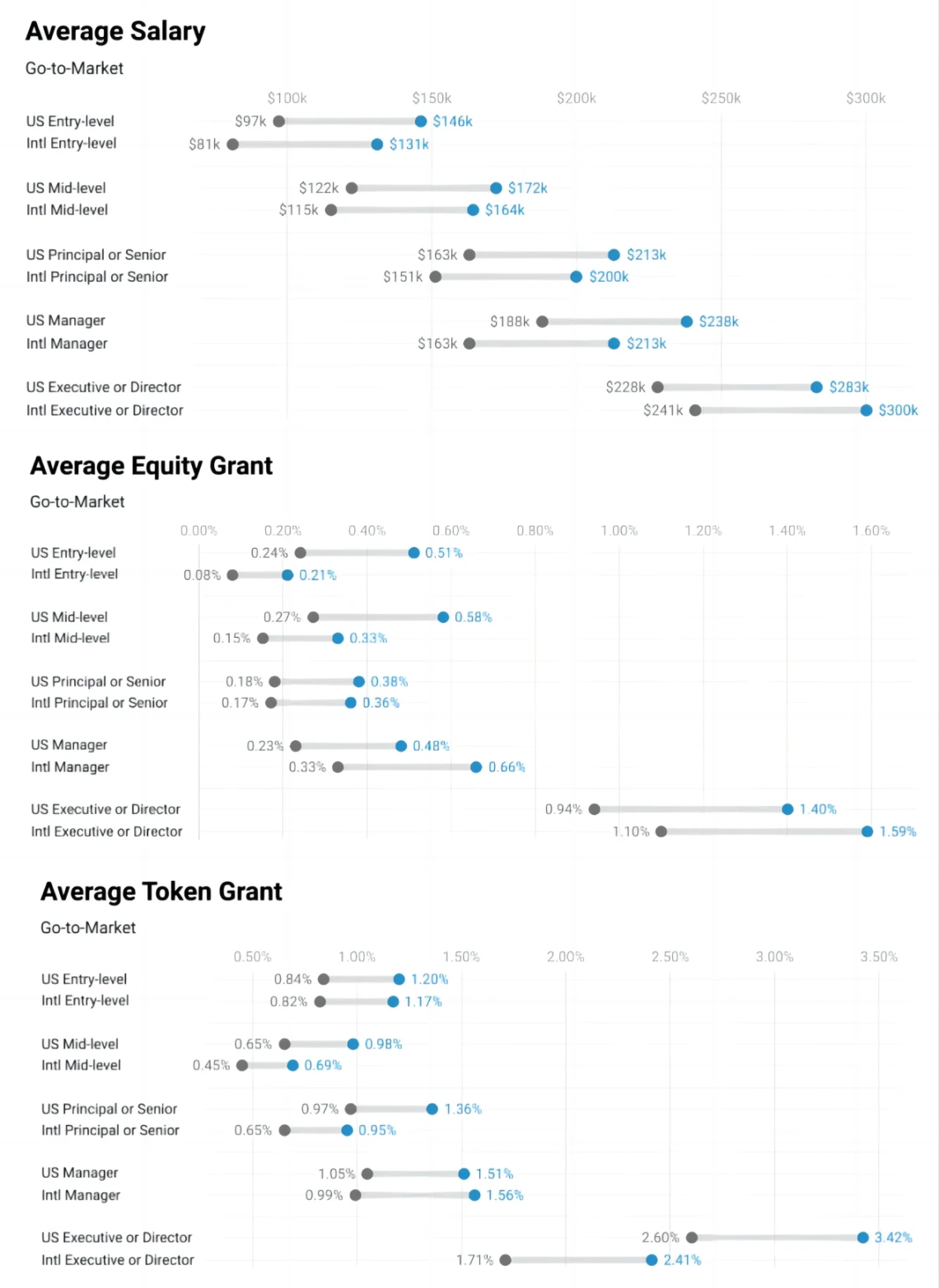

Here are salary, equity, and token compensation ranges for different employee roles, broken down by U.S. and international companies: Software Engineer, Cryptozoology Engineer, Product Manager, Product Designer, and Marketer.

Compensation is higher in the United States for nearly all positions and seniority levels compared to international companies. On average, U.S. companies have roughly 13% higher compensation and about 30% higher equity and token reward programs.

Some interesting data and outliers:

Equity and token plans for product designers at international companies are closer to U.S. figures than for other positions;

Product manager positions at international companies are unique among all positions in having significantly higher equity compensation across the hierarchy;

Executive/director-level salaries and equity in the marketing department of international companies are higher than similar positions in U.S. companies;

Observations on Robustness and Reliability:

Observations on compensation: The data shows that compensation across roles and seniority levels is generally reliable, especially when comparing U.S. and international markets;

Observations on equity and tokens: In the United States, data on equity is relatively reliable, and data on token compensation may be more reliable, especially for international data and lower seniority levels;

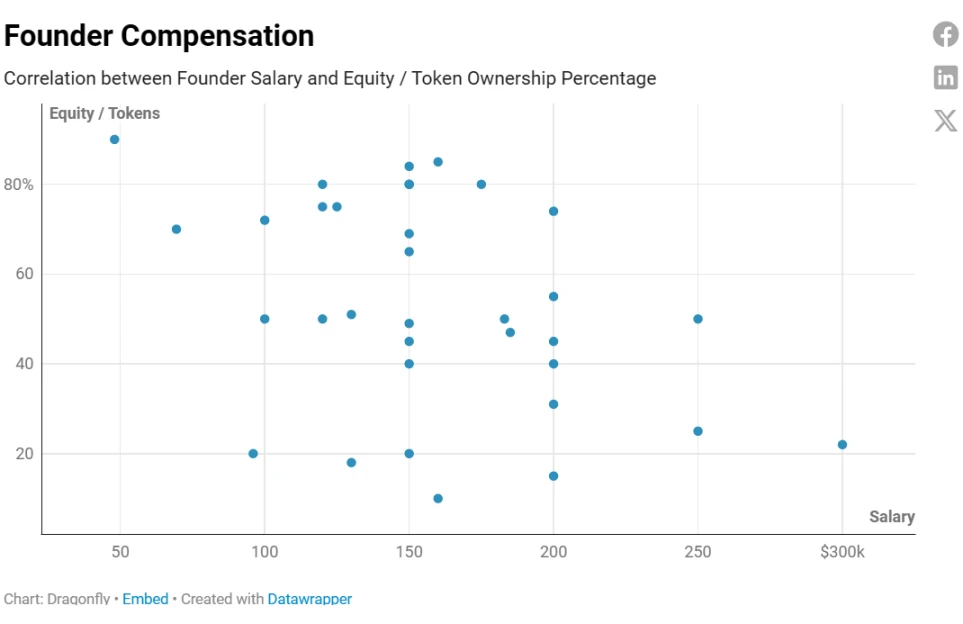

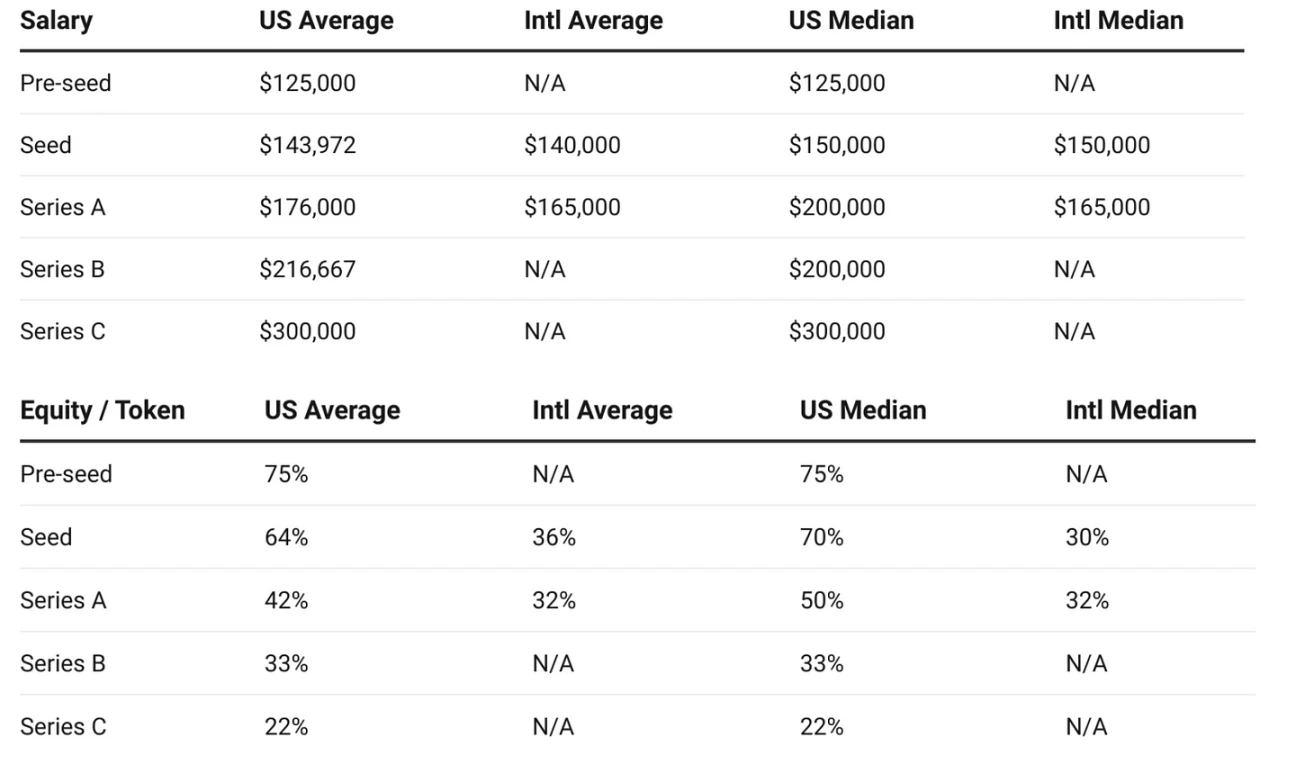

Founder compensation

As expected, founder compensation increases and equity/token holdings decrease as the company raises more funds, likely due to stake dilution.Most founders report that their compensation was below average before their Series B round.

The lack of international data on seed, Series B, and Series C stages makes it difficult to compare founders of U.S. and international companies. However, interestingly,When comparing the Seed and Series A stages, U.S. founder compensation is typically slightly higher, but equity ownership is significantly higher, especially at the Seed stage.

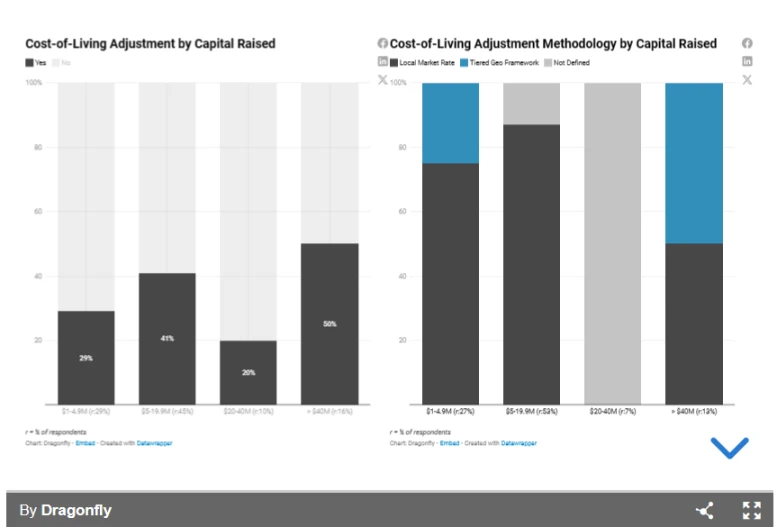

Cost of Living Adjustment and Methodology

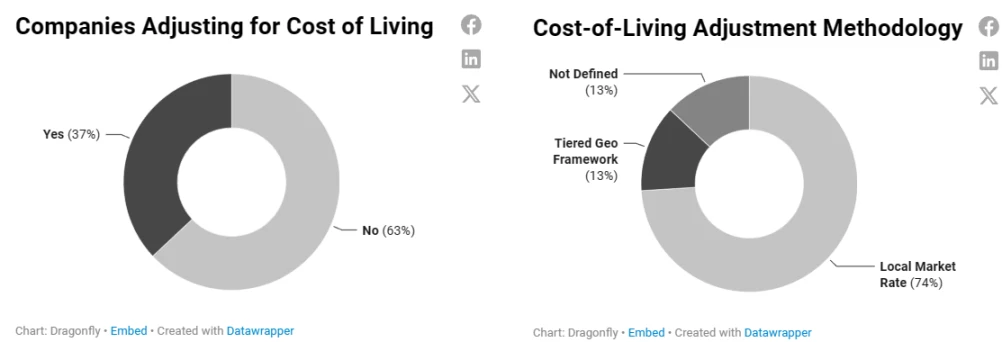

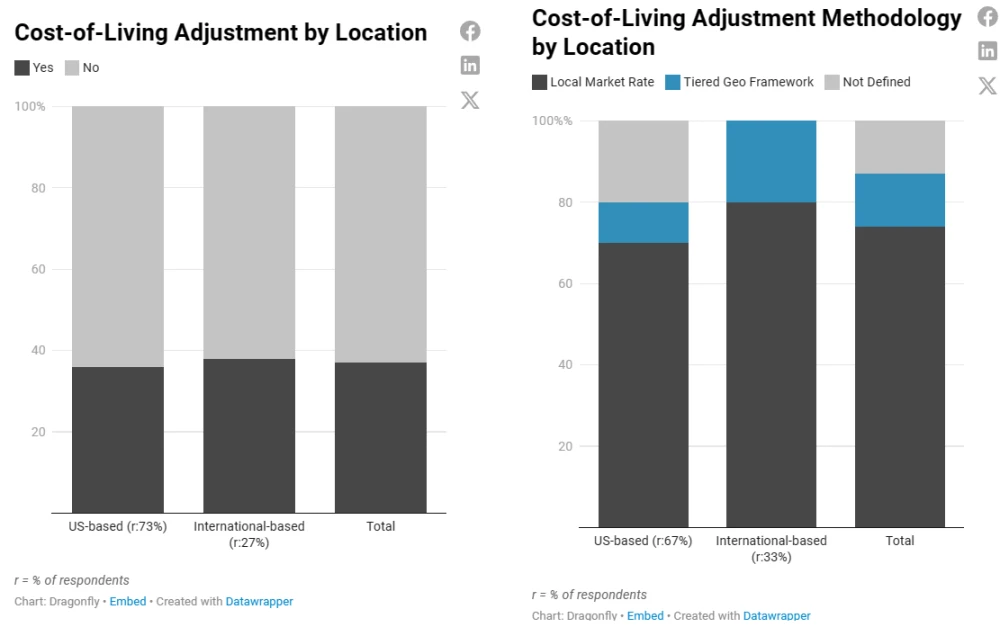

Most companies do not adjust pay based on cost of living (COL).

Among companies making adjustments, we see two common approaches:

Adjust based on local market prices (a very popular method);

Or adjust within a hierarchical geographic framework. With this approach, companies first benchmark salaries from a specific location (usually a very competitive area) and then apply a percentage of each individuals offer based on geographic tiers (sometimes determined using radius from major metropolitan areas) adjustments aimed at balancing internal pay equity with external competitiveness across geographies;

Companies that dont adjust compensation based on cost of living, often assuming their compensation is strictly tied to the value someone creates for the company, regardless of their location, will continue to maintain a competitive advantage when it comes to hiring speed and attracting top talent. Having said that, we always encourage companies to consider the most sustainable way to build a high-performing team within their budget.

The team may also decide not to make cost-of-living adjustments due to the fairness of overall purchasing power in different parts of the world. Not everyone living in a high-cost-of-living area can give up their life and move to a cheaper place to take advantage of the cost difference. Come the benefits.

We assume well see more of a middle-ground situation in the future, where some companies shift from cost-of-living to labor-cost adjustments, which you can think of like this:

Cost of living: We will adjust your salary based on local market rates in your area;

Labor costs: We will adjust your salary based on the demand for the position you hold in your region;

For example, the cost of living may be lower in some remote areas of Texas, but since petroleum engineers are in high demand there, this will drive up the pay for those positions.

There is not yet enough industry data to easily apply labor cost adjustments (especially in the crypto space, such as the demand for protocol engineers in a specific city/country). However, many payroll experts and data providers are considering this model, and we do think teams could benchmark and adapt against more standardized/common roles.

Having real-time salary and hiring demand data is key, and it can be helpful to supplement this with data available in the market and salary data you collect from candidates. We may explore trends related to this in our next compensation survey, although we haven’t seen many teams taking this approach yet.

In summary, we expect recruitment strategies to differ depending on the role: e.g.If you are recruiting for a non-differentiated engineering position (e.g., a general front-end engineer), you will pay this candidate an adjusted salary; however, if you are recruiting for a globally competitive, differentiated position (e.g., Solidity Engineer) ), you may need to pay them strictly based on the value of their work.

Ultimately, it comes down to the recruiting dilemmas we often discuss: speed, cost, and quality. You may only be able to optimize two of these three factors at any given time.

When it comes to adjusting for cost of living, both U.S. and international companies show similar rates, although international companies are slightly more likely to use local market rates for adjustments.

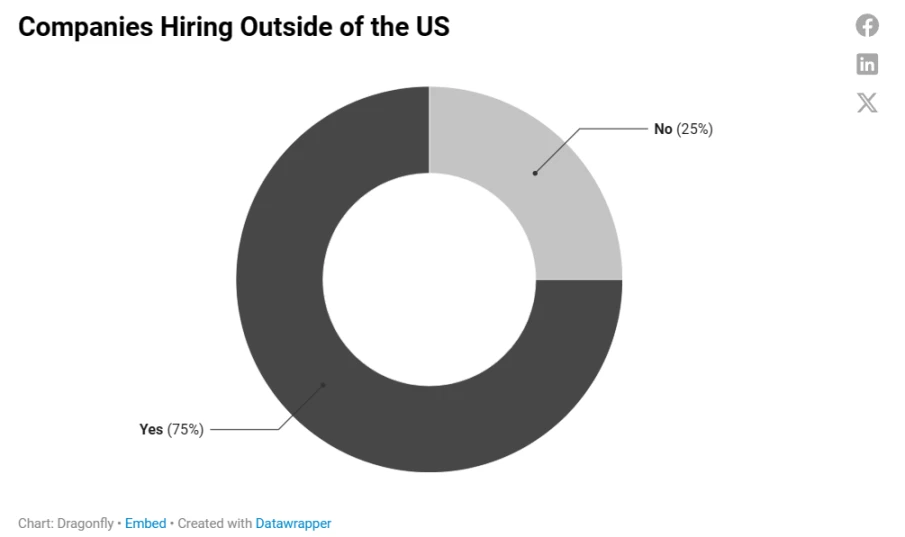

75% of all companies surveyed, regardless of size, stage or funding status, recruit talent outside the United States.

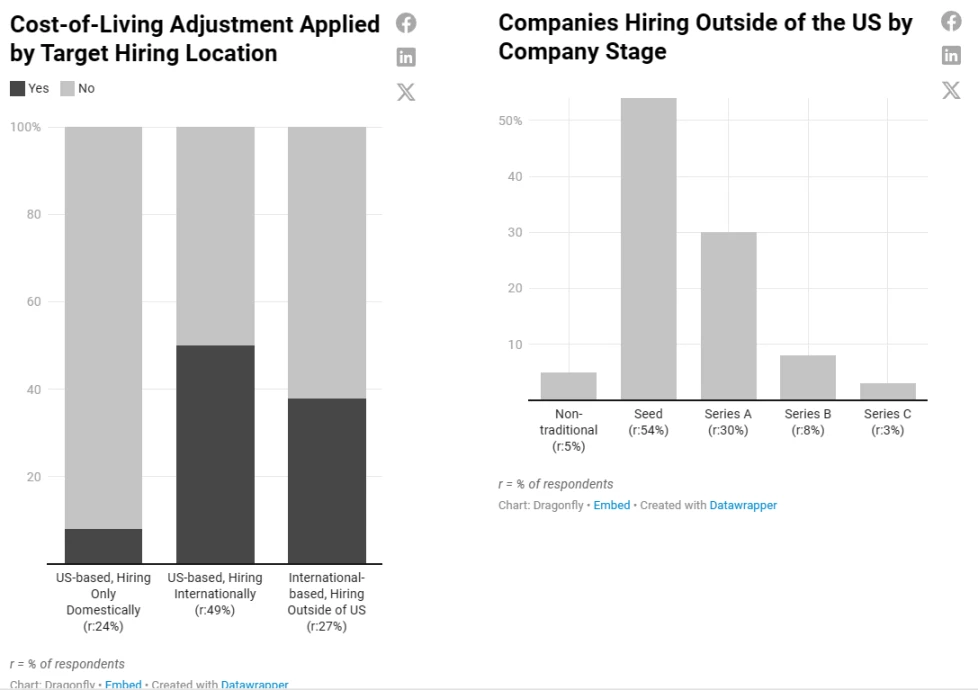

U.S. companies hiring solely within the U.S. are less likely to adjust based on cost of living - this may be an underlying statement about the competitiveness of the U.S. hiring market and the relative stability of the cost of living compared to international locations. For U.S. companies recruiting international talent, It is half adjusted and half not adjusted.

All internationally located companies hire outside of the United States, and most do not adjust for cost of living.

Companies tend to reduce hiring outside the U.S. during later stages of funding, however, it’s worth noting that the majority of respondents for this particular analysis were based in the United States.

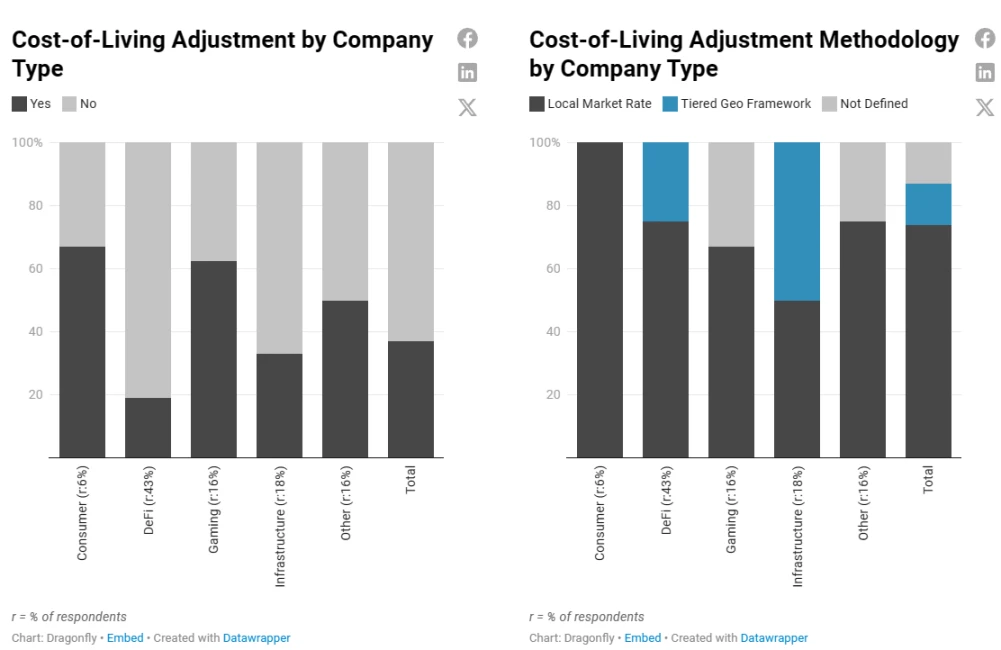

While most companies adjust to local market rates, infrastructure companies (which all recruit internationally and are among the largest and best-resourced companies in this survey) are most likely to use more intensive hierarchical geographical approach.

Theres a clear trend here: Most companies wont adjust to cost of living in the early stages, but as the company matures, this becomes increasingly likely.

Seed and Pre-seed companies with 1-10 employees are less likely to adjust for cost of living, allowing them to be more competitive in hiring becauseEstablishing a solid core team at this time will have a profound impact on the entire life cycle of the company.

Additionally, they may lack the operational expertise or resources to deploy more complex compensation structures and budgeting strategies, and may not be recruiting in as many locations.

The increase in the likelihood of adjusting for cost of living over time is particularly evident across firm sizes.

Paying local market compensation is preferred across nearly all company sizes, stages, and funding levels, demonstrating its appeal as a fair, competitive cost-of-living adjustment method (this is in addition to ad hoc undefined The easiest way.).

Note that once you decide which course to choose, it can be difficult to reverse a cost-of-living adjustment decision and keep it fair, and doing so can impact employee morale, perceptions of fairness, and the companys brand.

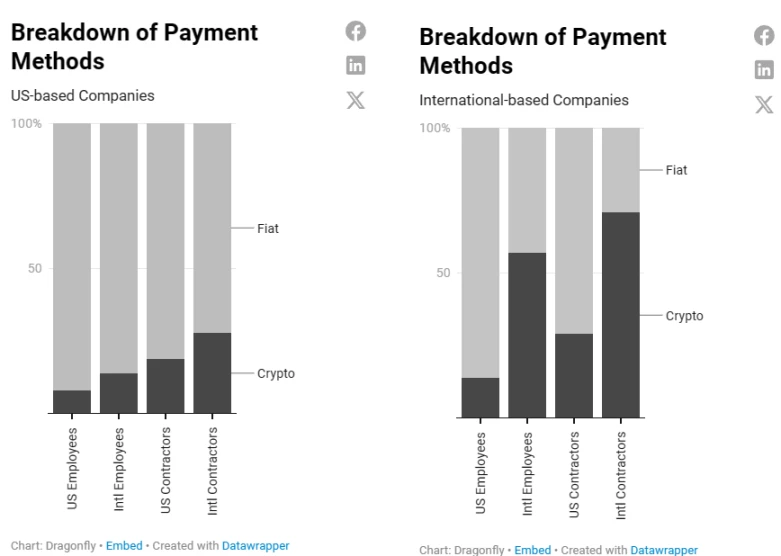

Payment Methods (Fiat vs. Cryptocurrency)

In most cases, companies use fiat currencies to pay salaries.

International companies are at the forefront when it comes to paying in cryptocurrencies such as USDC, especially when it comes to paying international employees. Regardless of location, U.S. companies are more likely to use cryptocurrency to pay contractors than employees; they are also more likely to use cryptocurrency to pay international employees, whether they are employees or contractors.

Companies paying with cryptocurrencies internationally often do so to simplify cross-border transactions, mitigate exchange rate fluctuations, and/or take advantage of tax benefits in certain jurisdictions.Cryptocurrency payments are also useful for companies with employees spread across areas with limited banking infrastructure or where privacy is required (such as those with anonymous contributors).

As cryptocurrency regulations and the legal distinction between employees and contractors continue to evolve, global employee payroll providers such as Liquifi are streamlining the adoption process by incorporating compliance into their services and supporting cryptocurrency transactions natively, over time. As time goes on, we wouldnt be surprised if this situation has an impact.

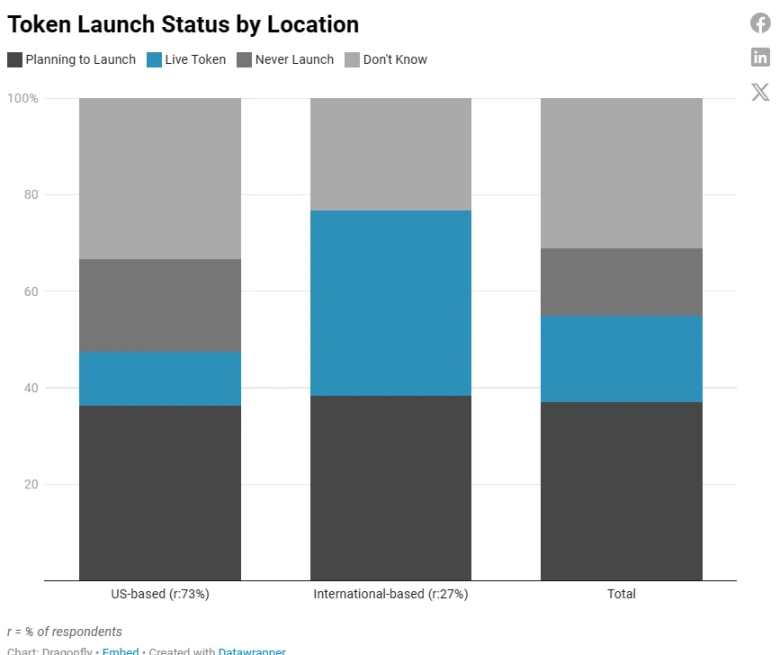

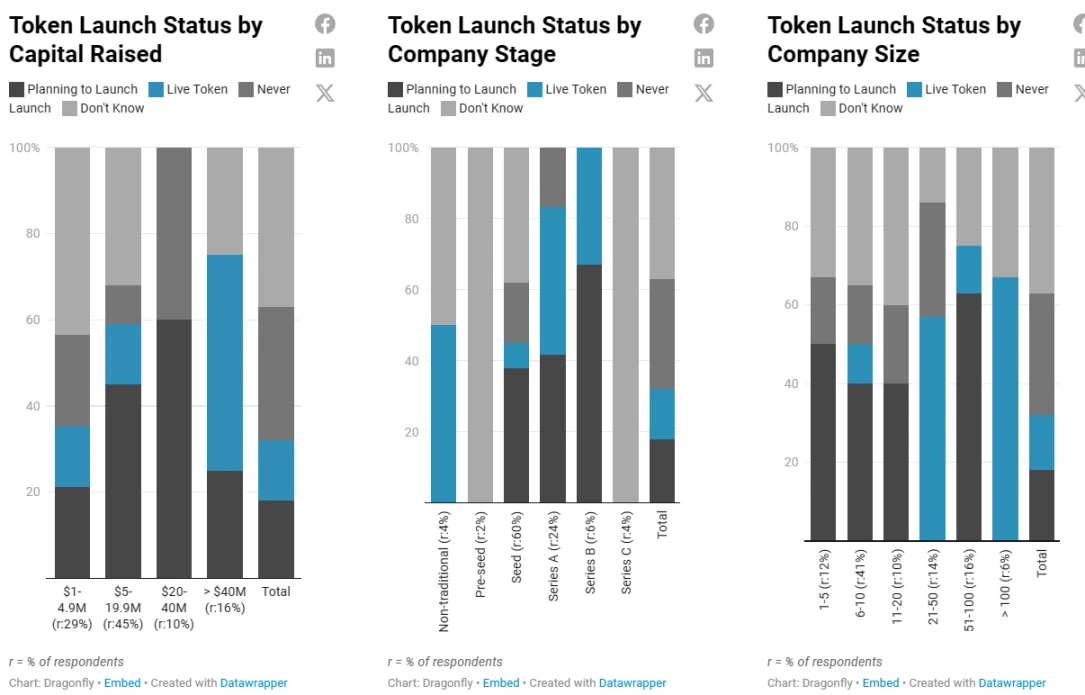

Possibility of the company owning the token

Companies in our portfolio are strongly considering token adoption, with only 14% explicitly saying they will never launch a token.

International companies are more inclined to adopt tokens, with a higher proportion owning tokens or planning to launch tokens. While some companies are uncertain about future plans, none have completely ruled out the possibility.

U.S. companies may have a more diverse response given the regulatory environment, with fewer companies owning actual tokens, more teams hesitant about plans, and more teams choosing not to adopt tokens altogether.

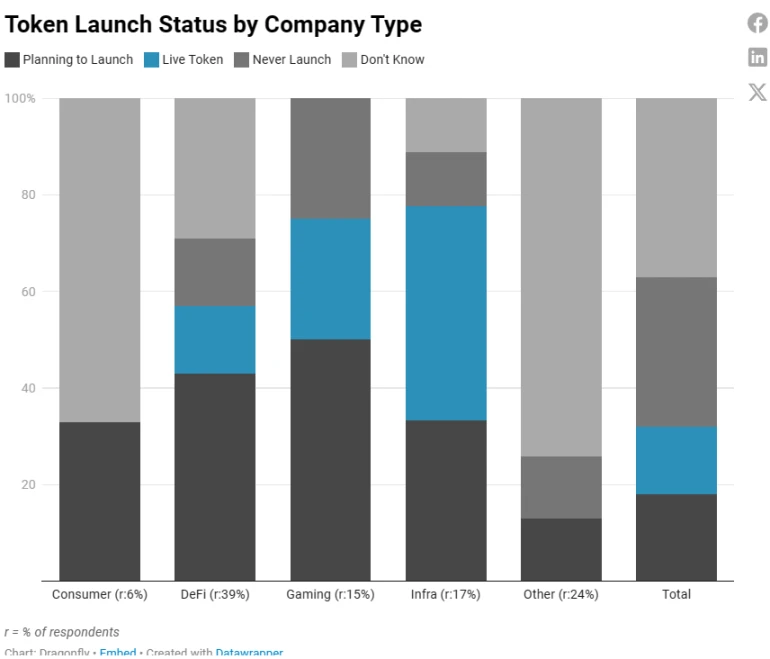

Overall, infrastructure companies are leading the way in token adoption, with more than three-quarters of them either having tokens in use or planning to launch one. These companies may use the token as a base currency (especially L1 and L2 blockchains).

They are closely followed by gaming companies, highlighting the growing importance of tokens for in-game assets, currency, rewards, incentives, gated content (special content that requires tokens to unlock), and occasionally governance. The DeFi space is also prominent, with tokens tied to their governance, staking and rewards business models.

Consumer-oriented companies have shown initial interest, often integrating tokens into more traditional business models, while there is considerable uncertainty in the “other” category.

While the data generally suggests that companies are more likely to plan and launch tokens as funding amount, stage, and size increase, these factors do not form a simple narrative.

Small startups, especially at the seed stage with funding ranging from $1 million to $4.9 million, are interested in exploring tokenization, but few are launching tokens at this early stage. There is a clear upward trend in launching tokens as a companys headcount increases and more financing is secured, especially during the Series A and Series B funding stages.

Companies raising $20 million to $40 million are a special case, actively planning to launch tokens, but none of them have actually launched a token. They fall under the Seed, Series A and Series B funding stages.

For the largest companies, with more than $40 million in funding and more than 100 employees, participation in token activity is significantly higher. An interesting counter-example is the hesitancy of Series C companies; they may be rethinking how the token fits into an already mature product, or are considering using the token in a new project/joint venture.

Relatedly, 75% of all companies raising more than $40 million (the highest funding range in the report) are focused on infrastructure development, an area that inherently requires large amounts of capital and often integrates tokens into in its products.

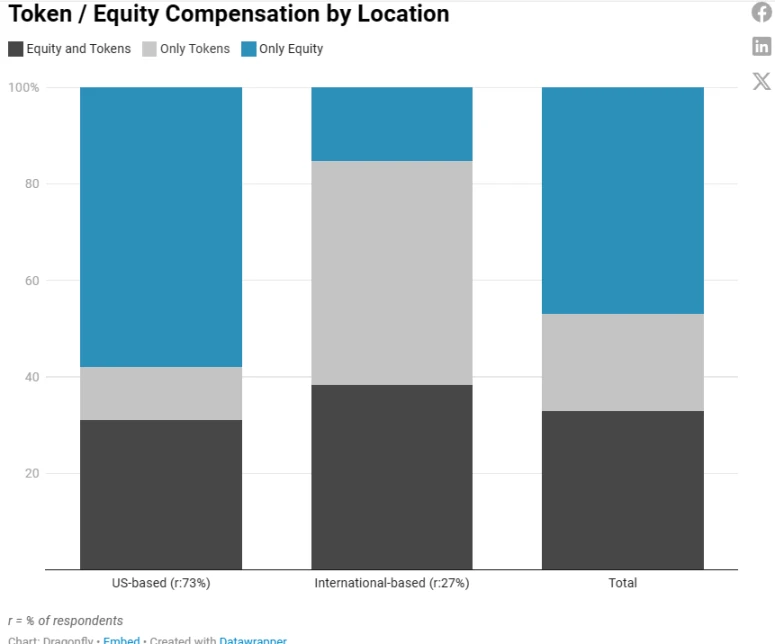

Token/Equity Compensation Plan

Companies often offer compensation in one of several ways—salary plus equity, tokens, or a combination of the two. When planning compensation or evaluating offers, it’s critical for both founders and candidates to consider how the company generates value. , and whether the value is reflected in tokens or equity.

Nearly half of companies only give out equity as compensation. It is important to note, however, that most companies that have indicated that they may launch tokens in the future (but are not sure yet) are currently only issuing equity, while all projects with active tokens receive tokens as part of their compensation. Something to consider is that companies that are unsure may eventually change their minds.

We’ve seen other reports of fewer companies offering tokens as compensation over time, and we’re curious to see how this plays out as our own data accumulates.

There are a handful of companies, both American and international, that offer a combination of equity and tokens as compensation. Beyond that, however, preferences vary:More U.S. companies only issue equity, and more international companies only issue tokens(As mentioned before, in general, international companies seem to be more inclined toward tokens).

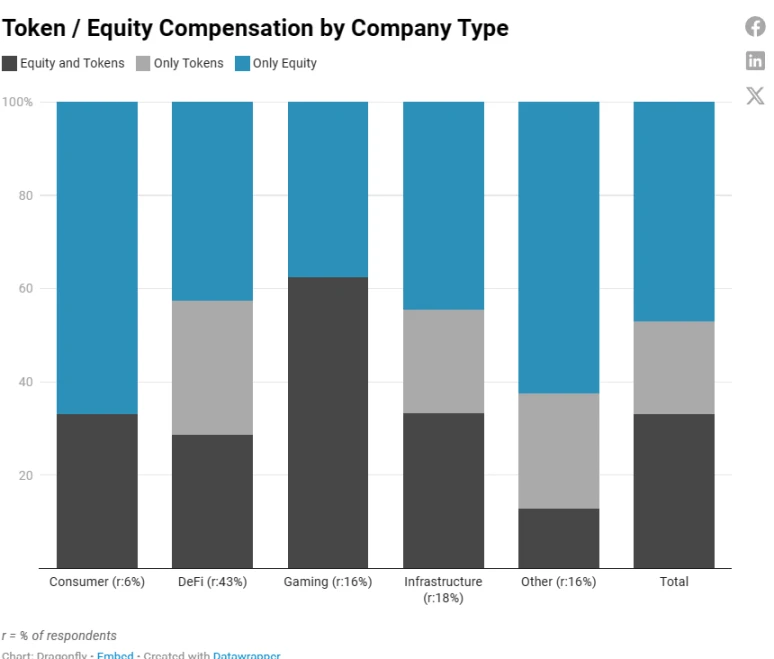

While infrastructure companies are most likely to have or plan to launch tokens, most infrastructure companies only issue equity, rather than just tokens or a mix of the two.

The DeFi space (another space where tokens are more prevalent) follows a similar trend, albeit with a slightly more balanced approach to compensation. Gaming companies have shown a strong preference for offering both equity and tokens,It’s worth noting that no gaming company only offers tokens.

All consumer and other types of companies either don’t know if they will launch tokens or ultimately plan not to launch, so it’s understandable that the vast majority only offer equity.

Examining factors such as financing amount, company stage and company size, we noticed the following:

first,The earliest stage startups primarily use equity incentives, with compensation strategies diversifying as the company receives more substantial seed financing.

In the Pre-Seed stage, we see all companies offering equity incentives only (as mentioned before, all Pre-Seed companies surveyed did not know if they wanted to launch a token). A handful of companies that have raised seed rounds of $1 million to $4.9 million are starting to offer token incentives, but overall, they are still dominated by equity incentives.

Those raising $5 million to $19.9 million are typically still in the seed stage and have more than 10 employees. Overall, more and more companies are starting to offer token incentives, and are more frequently offering a mix of equity and token incentives.

Second, as employee headcount grows, companies often prefer to offer both equity and token incentives.

The relationship between tokens and equity

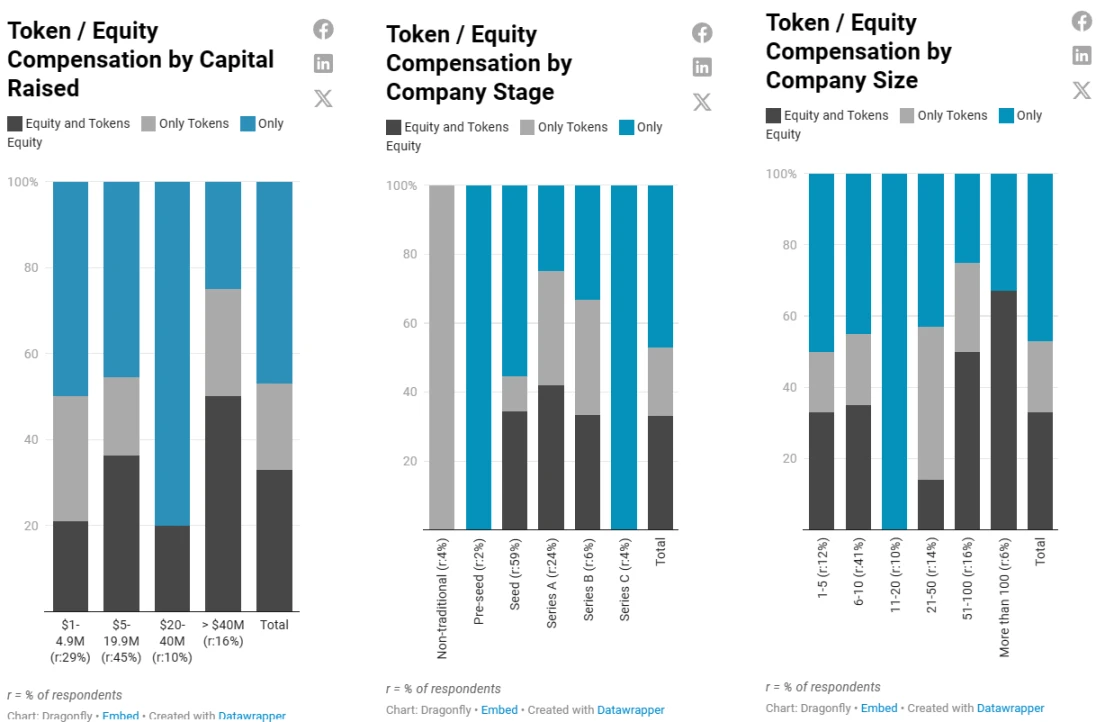

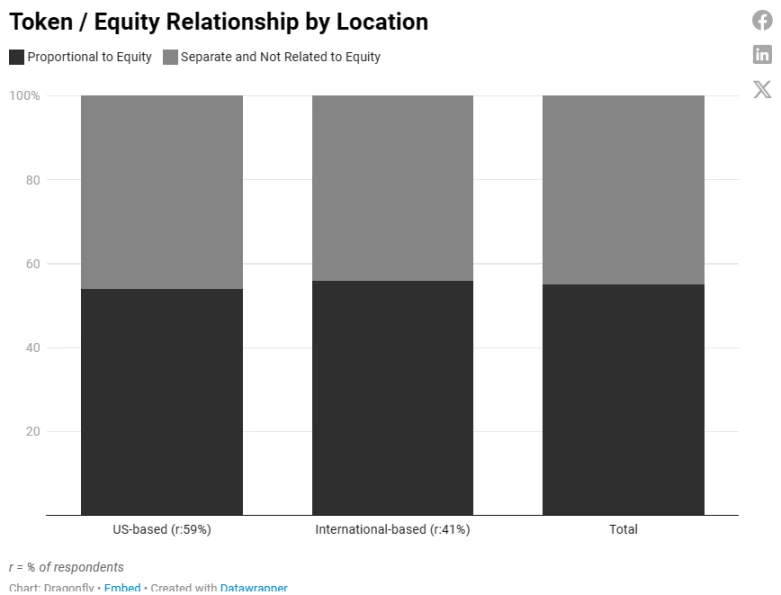

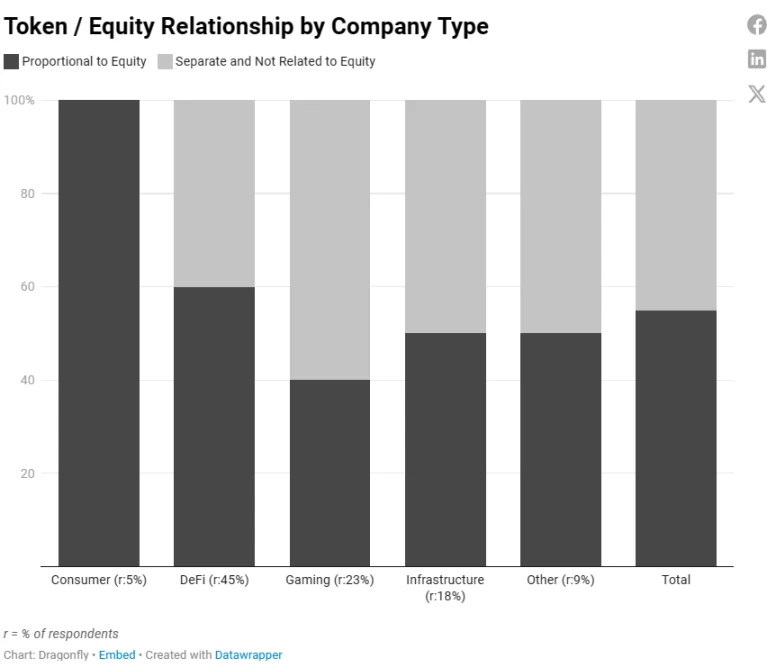

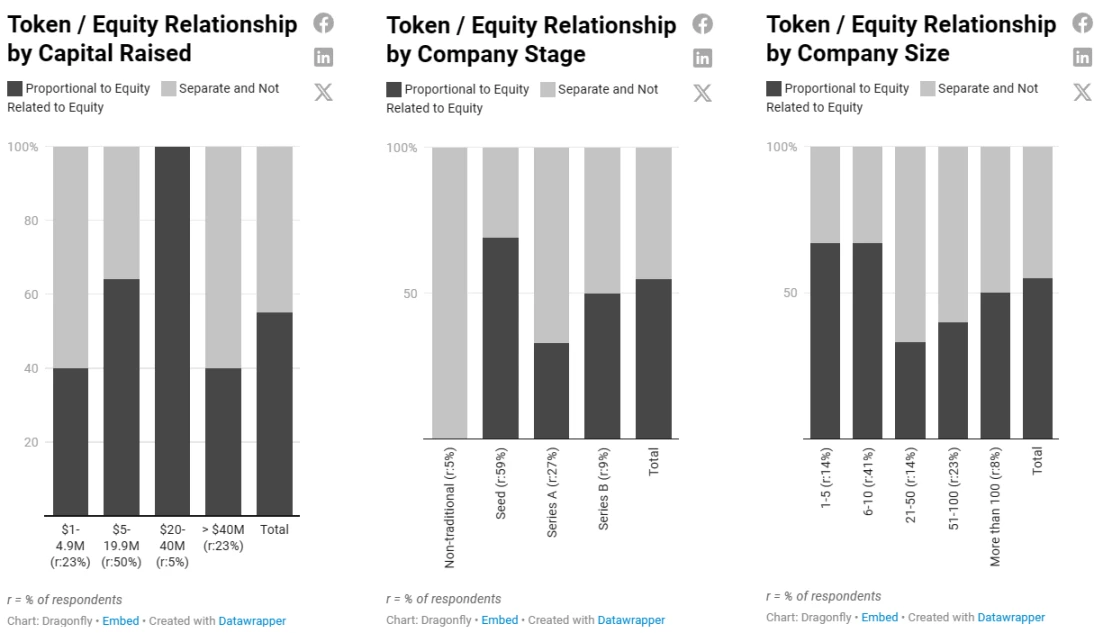

Most companies offer tokens proportional to equity (which may indicate they are using the “token ratio” calculation described below).

U.S. and international companies show a balanced distribution of tokens to equity, but with a slight preference for the ratio.

The preference for proportionality is also relatively balanced across company types, with infrastructure companies and “other” companies equally represented.

Smaller early-stage teams (seed rounds, 1-10 employees) prefer a proportional allocation of equity and tokens (however, this trend is not consistent across funding levels at all early-stage funding stages).

As the company grows, the preference for proportional relationships moderates, and no clear dominant strategy emerges.

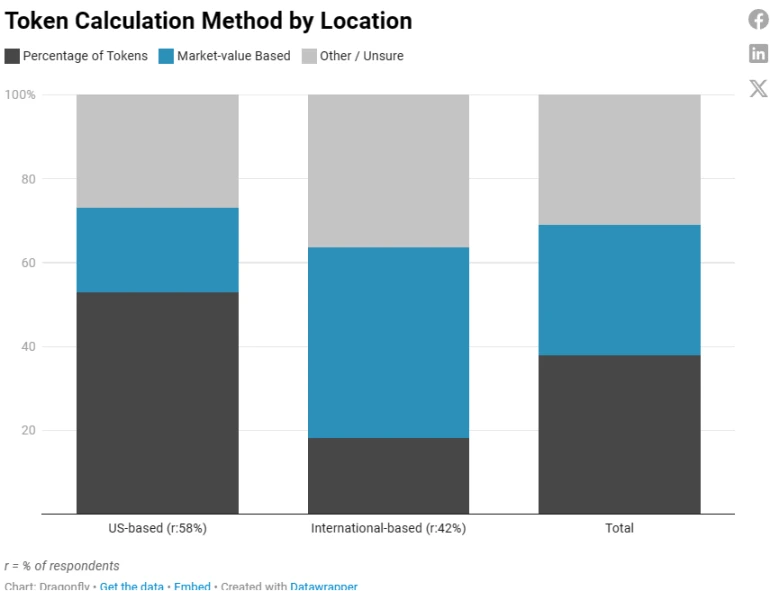

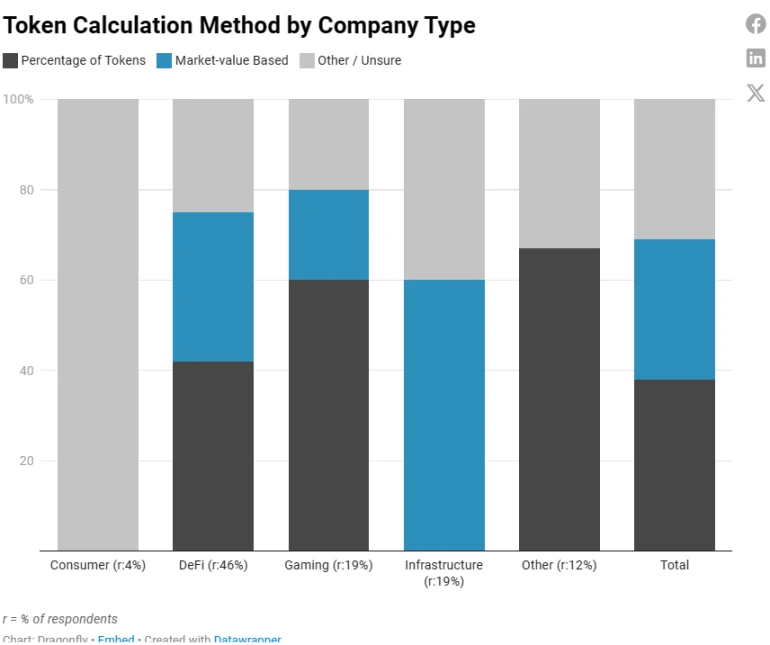

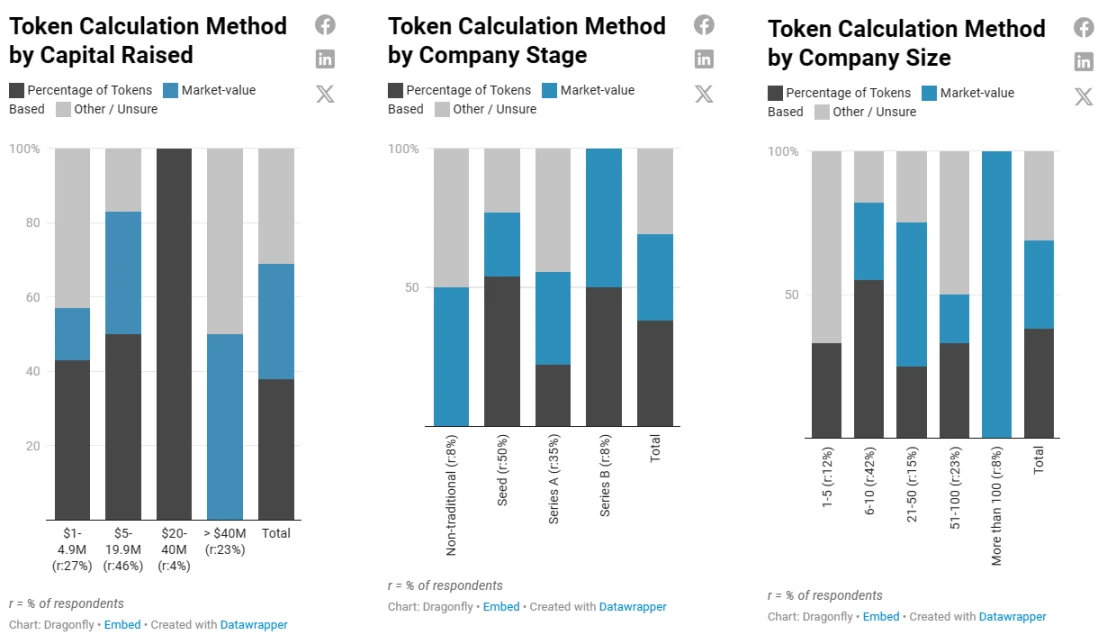

Token calculation method

In a previous article, we examined and outlined the methods used by companies to calculate the number of tokens issued to employees. This report is not intended to be a thorough discussion of best practices, nor is it intended to cover all approaches.

That being said, the most common and well-defined methods we see are:

Market value-based: Teams with active tokens use this method to first determine the total dollar value they intend to provide to employees. They then calculate the number of tokens to vest based on the fair market value of the tokens at the time of calculation, vesting, or vesting. In the mentioned article, we observed that most teams prefer this approach because of its simplicity and ease of implementation. However, we recommend using this method with caution, as the value of token grants can fluctuate significantly due to market fluctuations, resulting in discrepancies in the token market cap table. In this sense, tokens are somewhat similar to public stocks, but they lack the same protections and stability. It is unusual for teams without active tokens to adopt this valuation method. Typically, we see them rely on verbal agreements to commit future tokens based on equity allocation ratios. Another approach is to perform a market value calculation on the fully diluted value of the future tokens locked by the venture capital firm. Considering that VC firms’ token prices are fixed, this provides a fair basis for compensation before the token goes public (interestingly, we haven’t heard of any firm doing this);

Token scaling: This approach attempts to mimic the way traditional startups calculate equity-based rewards. It is the only method that takes into account market fluctuations and mitigates employee compensation inequities while minimizing unnecessary token dilution and preserving asymmetric upside for employees. Effective use of the token scaling method requires diligent planning, which ideally should start from the early stages. In summary, you can take the same distribution band as you would for staking and adjust it based on the specifics of the token, ultimately awarding a fixed percentage of the token pool;

“Other” methods may include annual vesting, performance-based bonus structures, using a sliding scale between equity and tokens, and uncertain methods.

All in all, most companies use the “token ratio” approach.

There are obvious differences in geographical distribution,The US team prefers to use the “token ratio” method。

Different industries also have different preferences for token calculation methods: gaming and other types of companies are more likely to use the “token ratio” method, while infrastructure companies are more likely to use market value-based methods.

As the size of financing and the amount of capital raised increases, more and more companies are adopting market value-based methods.

Companies raising seed rounds and companies raising less than $40 million mainly use the “token ratio” method. Market value-based calculations are more popular starting with Series A rounds, especially in companies with 21-50 employees, and are more common in Series B rounds and companies with more than 100 employees. It is worth noting thatCompanies raising more than $40 million tend to use a balance of market value-based calculations and other less clear-cut methods.

We recommend that early-stage teams use the “token ratio” method. While we intuitively understand why late-stage teams would prefer a market value-based approach (e.g. once a token’s price is determined, its price may be less speculative and more data from time-weighted or volume-weighted averages can be used); Or it could give them more flexibility with their remaining token reserves), but we are working with the team on the reasons for this trend.