Review of Q1 investment and financing: The bull market has entered the early to mid-term, with DePIN and GameFi attracting much attention

Original - Odaily

Author - Husband How

In the first quarter of 2024, the bull market has begun.

At the macro level, the Federal Reserve continues to maintain an attitude of stabilizing interest rates, but many Federal Reserve officials have revealed the possibility of cutting interest rates this year, and the market is full of expectations for interest rate cuts; the U.S. SEC approved a Bitcoin spot ETF at the beginning of the year, and after a brief market adjustment, the price of Bitcoin Successfully reached a record high, reaching a maximum of 73,777 USDT, and the total crypto market value in Q1 of 2024 reached a maximum of 2.9 trillion; however, the US SEC’s judgment standards for Ethereum spot ETFs are still unclear, paving the way for the final approval time in May.

From the perspective of the crypto market, the Meme coin sector may become the biggest winner in the crypto market at this stage. Public chains led by Solana have taken advantage of the communication attributes of Meme coins, and their ecological transaction volume and new transaction addresses have continued to break new highs. The birth of Meme coins has also begun. The accidental shift from the genre to the fund-raising genre created the myth that Meme Coin BOME was listed on Binance in three days; as the engine of the last bull market, the Ethereum ecology did not perform well this quarter. Although the Cancun upgrade is very popular, the encryption The market doesn’t seem to be “buying it.”

Under the influence of comprehensive factors, the performance of the primary market is quite impressive. The investment and financing in Q1 returned to the peak level of the last bull market in terms of quantity. However, from the perspective of amount, institutions still adopt the high-quality creation route.

Looking back at Q4 primary market investment and financing activities, Odaily found:

● The financing situation in the crypto market is improving. Compared with the previous cycle, it is currently in the early to mid-term of a bull market;

● The number of financings in Q4 was 411, and the total disclosed financing amount was US$2.276 billion;

● DePIN and GameFi cost quarterly popular financing sectors;

● The maximum single investment amount is US$100 million (EigenLayer).

Note: Odaily divides all projects that disclose financing in Q1 (the actual close time is often earlier than the news announcement) into five major tracks according to the business type, service objects, business model and other dimensions of each project: infrastructure, applications, technical service providers, Financial service providers and other service providers. Each track is divided into different sub-sections including GameFi, DeFi, NFT, payment, wallet, DAO, Layer 1, cross-chain and others.

The financing situation in the crypto market continues to improve. Compared with the previous cycle, it is currently in the middle and early stages of the bull market.

Last quarter reportThe core view is that the inflection point of the big cycle has appeared, and the financing performance of this quarter also supports the previous view. At the same time, as shown in the figure below, the red box shows the approximate range of the previous cycle. The current stage is from September 2023 to the present. Judging from the financing trend of the previous cycle, the monthly financing volume has reached the high point of the previous cycle. According to the time period, it is currently in the early to mid-term of the bull market.

This view is based on the bull and bear cycle rules of the primary financing market: Financing projects prefer to disclose financing information during the bull market stage, so it is a reference for judging the cycle of the current encryption market.

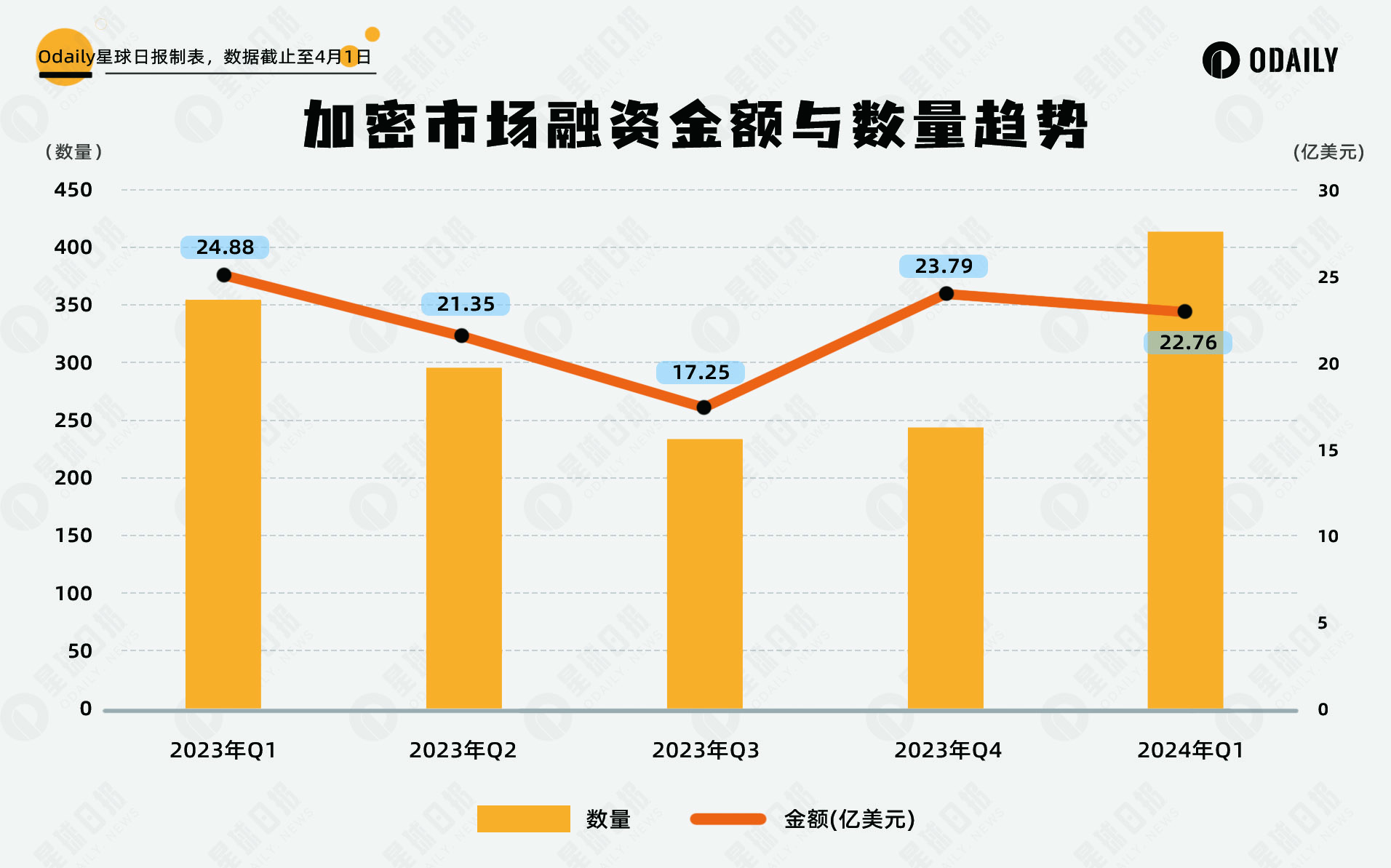

From the first quarter of 2023 to the third quarter of 2023, the global crypto market financing events and financing amounts have generally been on a downward trend (excluding fund raising and mergers and acquisitions). However, the overall trend will change in Q4 of 2023, and Q1 of 2024 will continue the previous quarter. The trend of financing volume continues to rise, indicating that the primary market financing profile is developing strongly.

The number of financings in Q4 was 411, with a total disclosed amount of US$2.276 billion

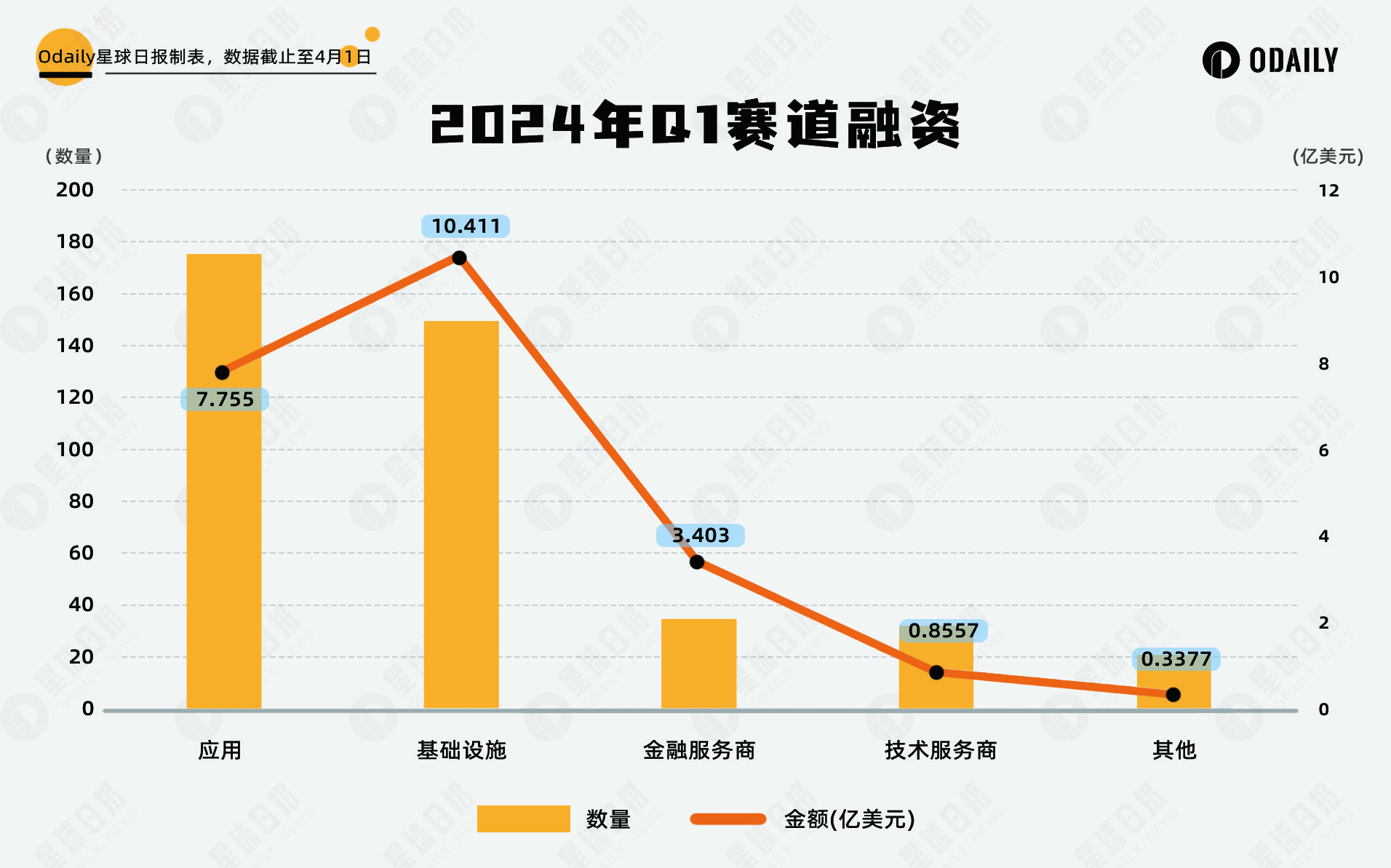

According to incomplete statistics from Odaily, a total of 411 investment and financing events occurred in the global encryption market from January to March 2024 (excluding fund raising and mergers and acquisitions), with a total disclosed amount of US$2.276 billion, distributed among infrastructure and technology service providers , financial service providers, applications and other service provider tracks, among which the infrastructure track received the largest amount of financing, approximately US$1.041 billion; the application track received the largest number of financings, 174.

Judging from the chart above, the financing amount of each track is basically the same as that of the previous quarter, but the number of financings has increased significantly, which means that more projects choose to contact financing at this stage and disclose financing-related information. Among them, infrastructure and applications are still the most important sectors for institutional investment, and the number of related track project financings has increased significantly.

DePIN and GameFi Cost Quarterly Hot Financing Sectors

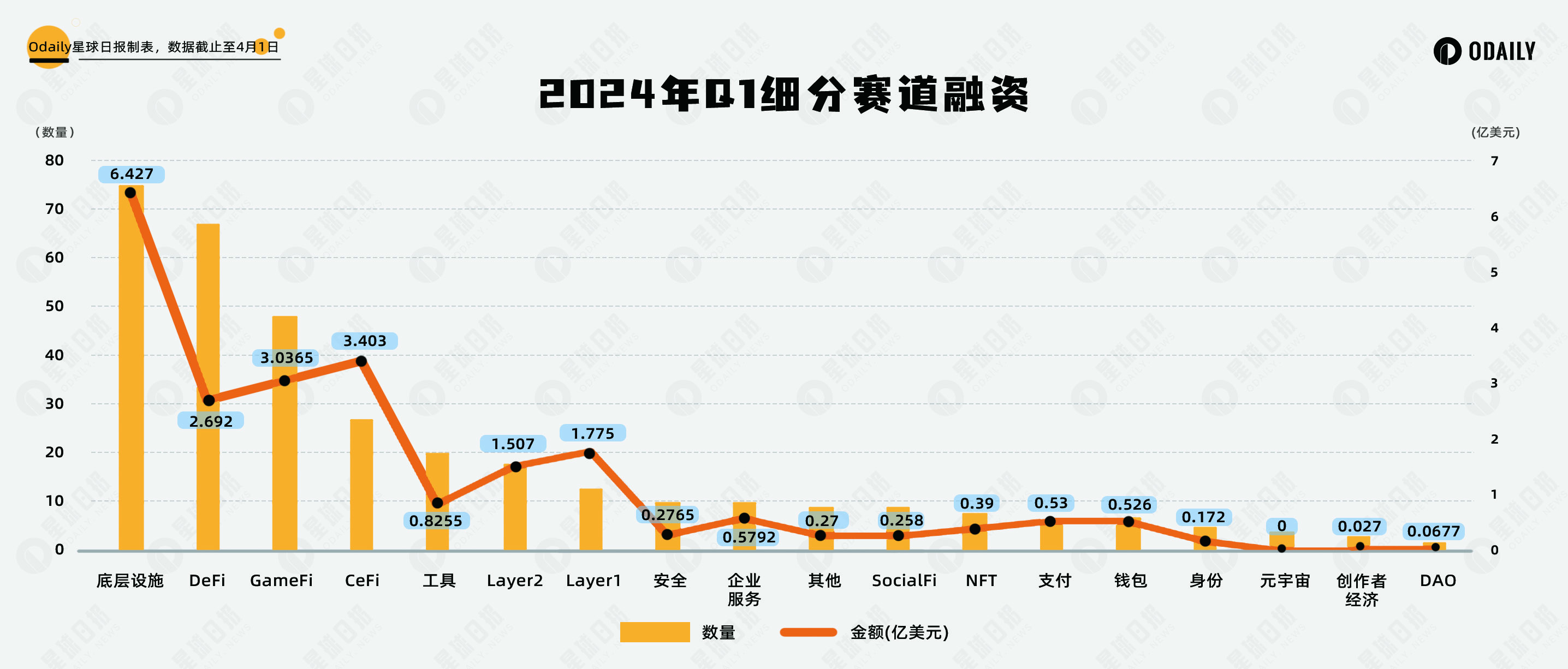

According to incomplete statistics from Odaily, financing events in Q4 segmented tracks are concentrated in underlying facilities, DeFi and GameFi, accounting for nearly half of the total financing events. Among them, there are 75 deals in the underlying facilities track, 67 deals in the DeFi track, and 67 deals in the CeFi track. 48 pens.

Judging from the distribution of the number of sub-track financings, investment trends tend to be in popular sectors. The DeFi sector to which RWA and re-pledge belong, the underlying facilities sector to which DePIN belongs, and the GameFi sector are sought after by institutions.

From the perspective of quantity and amount of Q1 investment and financing, underlying facilities have become a popular sector in this cycle as in the previous quarter. DePIN serves as an important bridge to communicate with Web2 and Web3. Institutional investment in it makes the encryption world gradually integrate with the traditional world. , aiding the process of mass adoption.

Secondly, in the DeFi track, although the amount of financing has decreased compared with the top sectors, RWA and re-pledge have become the main areas for capital bets. With the launch of tokenized funds by BlackRock, the worlds largest asset management company, RWA There is one more option for the underlying assets of the project.

In addition, the GameFi track is also very active in financing news, with a total of 48 transactions, ranking third. GameFi had a brief period of popularity last year, but there has been no breakthrough project yet. Capital has entered the market this quarter. GameFi may start a new round of popularity. Odaily launches weeklyChain Games WeeklyNew Alpha may be available.

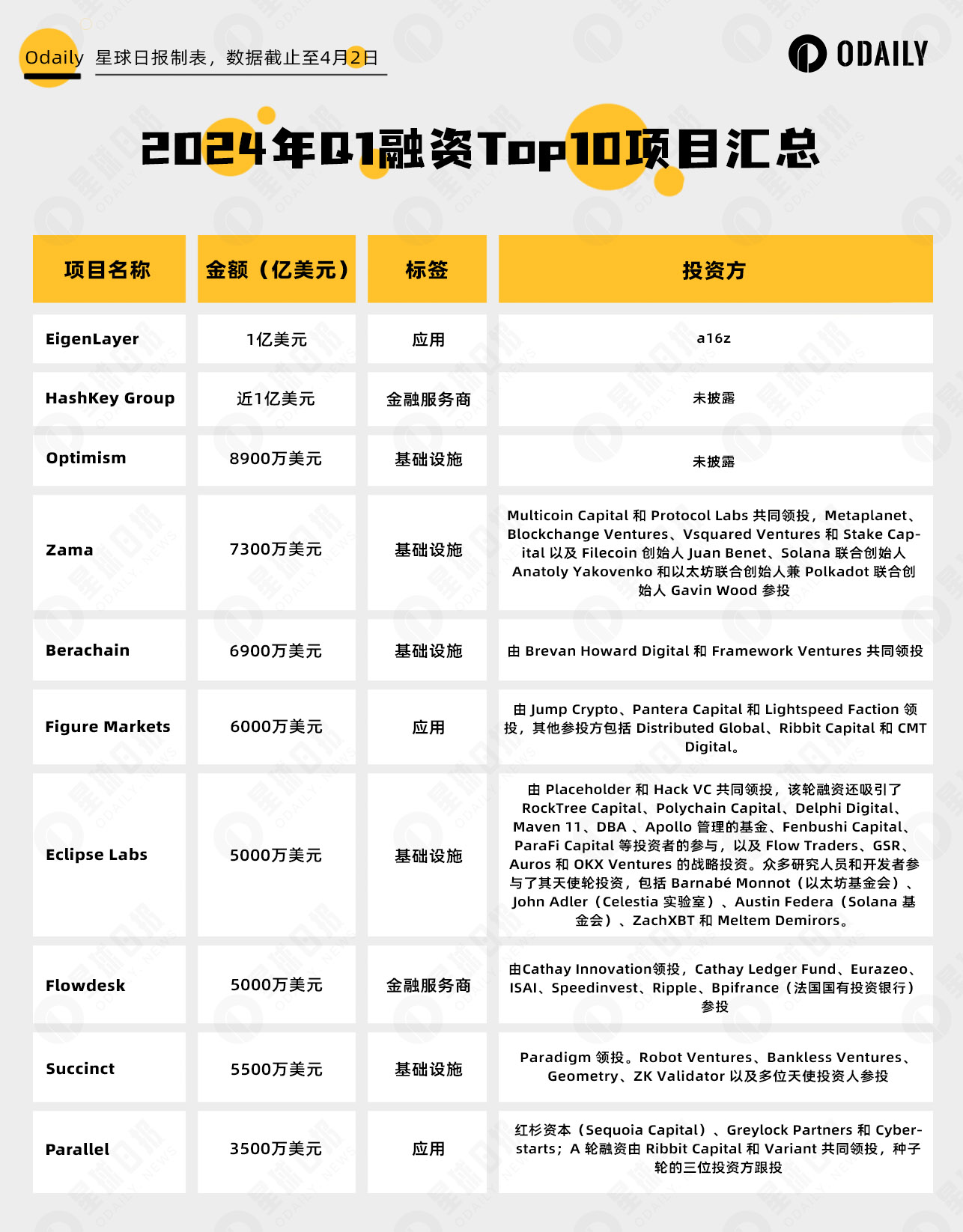

The largest single investment amount was US$100 million in EigenLayer

EigenLayer is a re-staking protocol on Ethereum that allows users to re-stake their $ETH into the consensus layer, thereby enhancing the security of the network and being extensible to other applications.

HashKey Group is a digital asset financial services group in Asia that provides new investment opportunities and solutions to institutions, family offices, funds and professional investors in the digital asset and blockchain ecosystem.

Optimism is an Ethereum Layer 2 utilizing Optimistic Rollup technology. Reduce costs and transaction times while retaining the security of Ethereum.

Zama is a cryptography company that develops open source homomorphic encryption tools. Its homomorphic encryption technology allows data to be processed without the need for decryption, used to create private smart contracts on public blockchains where only authorized users can view transactions and status.

Berachain is a DeFi-based EVM-compatible L1 built on the Cosmos SDK and powered by Liquidity Consensus Proof.

Figure Markets combines the liquidity of traditional finance with decentralized asset control. Figure Markets offers investors a variety of blockchain-native assets, including cryptocurrencies, stocks, and alternative investments. Figure Markets is launching a new decentralized custodial cryptocurrency exchange and blockchain-native secure marketplace incorporating multi-party computation (MPC) technology.

Eclipse is a customizable rollup provider compatible with multiple layer-1 blockchains, allowing developers to deploy autonomous rollups powered by the Solana operating system and select chains for security or data storage.

Headquartered in France and Singapore, Flowdesk is a crypto financial services company dedicated to building trading infrastructure and providing market making services to Web3 users.

Succinct is developing a decentralized validator network to secure blockchain applications and infrastructure through encrypted facts rather than relying on trust. The platform simplifies the proof supply chain and provides efficient and reliable proof generation services for Rollup and other applications using zero-knowledge proofs.

Parallel is a collectible sci-fi NFT trading card (TCG) game based on the ETH chain. Players can buy and collect cards and flexibly use different cards to combine decks that comply with the rules to play games and get rewards. .