A 3-minute history of Memecoin: past and future

This article comes from:1kx

Original author:Freezer

Compiled by: Odaily Wenser

As the intersection of digital currency and Internet culture, Meme coins have many participants in every bull and bear cycle. Due to their strong appeal, rapid spread, and attractive return potential, Meme coins have once again become a hot topic nowadays.

This article will cover:

Meme coin origin: POW type Meme coin

How Meme coins evolve with cycles: ICO period, coin issuance boom, DeFi summer, Solana boom

The impact of NFTs on the meme currency landscape

Recent Developments and Emerging Trends in Meme Coins

Potential Risks and Opportunities of Meme Coins

What is Meme?

Meme is a vehicle for spreading cultural ideas and symbols that can be spread from person to person. Similar to genes, different Memes have different abilities to spread; Memes that resonate will last, while Memes that are innocuous will be quickly forgotten.

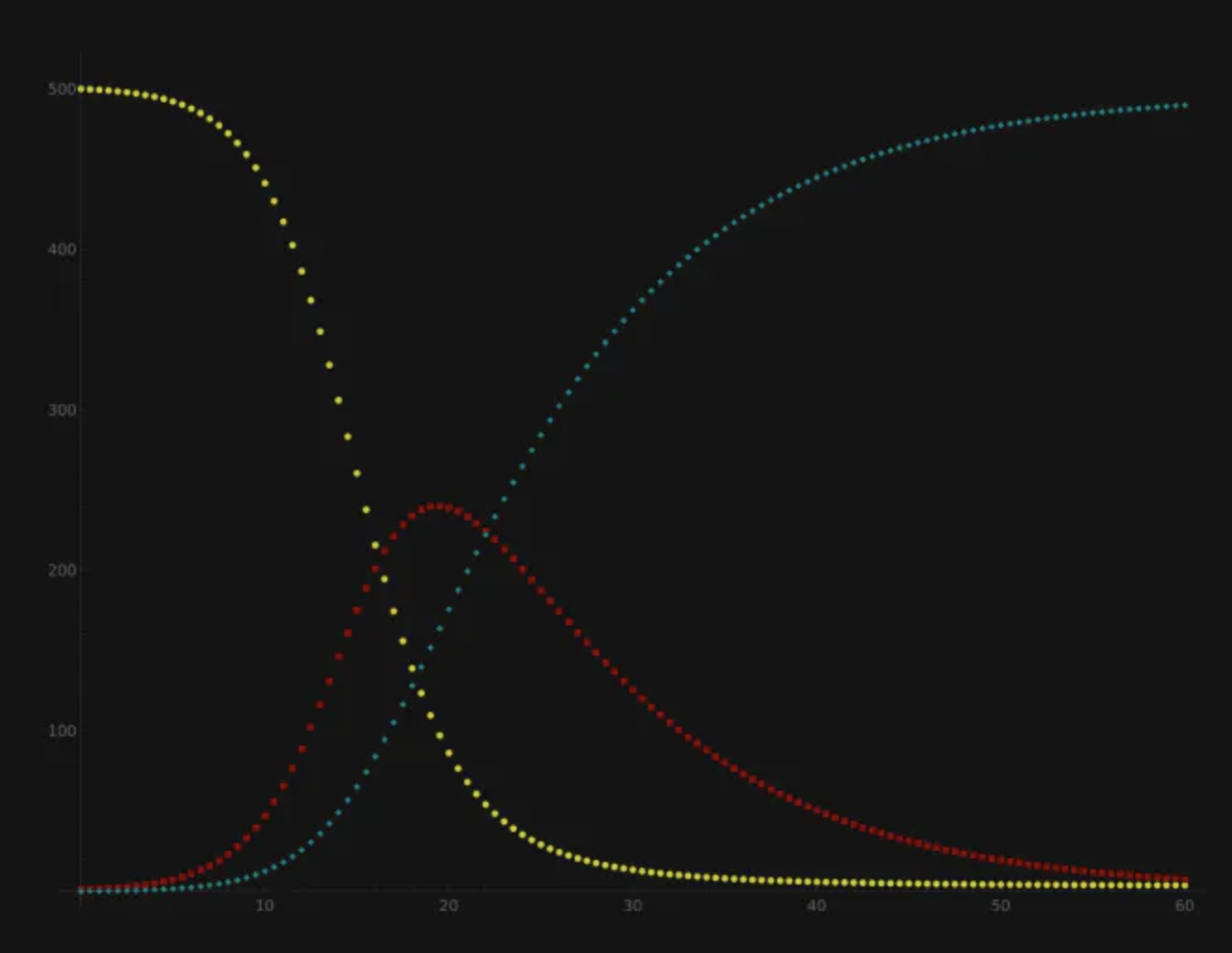

The Internet has accelerated the spread of memes and cultural ideas by giving rise to the concept of “internet memes,” which are often spread in the form of pictures, videos, GIFs, and jokes.an academic studyComparing the spread of Internet hot memes to a disease: Meme spreads in a viral mode, infecting different individuals in a SIR model similar to disease spread.

Internet memes spread like an infectious disease.

Meme Coin is a cryptocurrency whose value is derived entirely from the Internet memes associated with it, thus bringing economic value to the concept of Meme.

With the emergence of Meme coins, cultural concepts and symbols and their dissemination have evolved into investment targets that can be traded and speculated. Their value depends on their relevance to the Meme itself and its ability to capture attention, creating a new market where cultural influence can be quantified and have economic value.

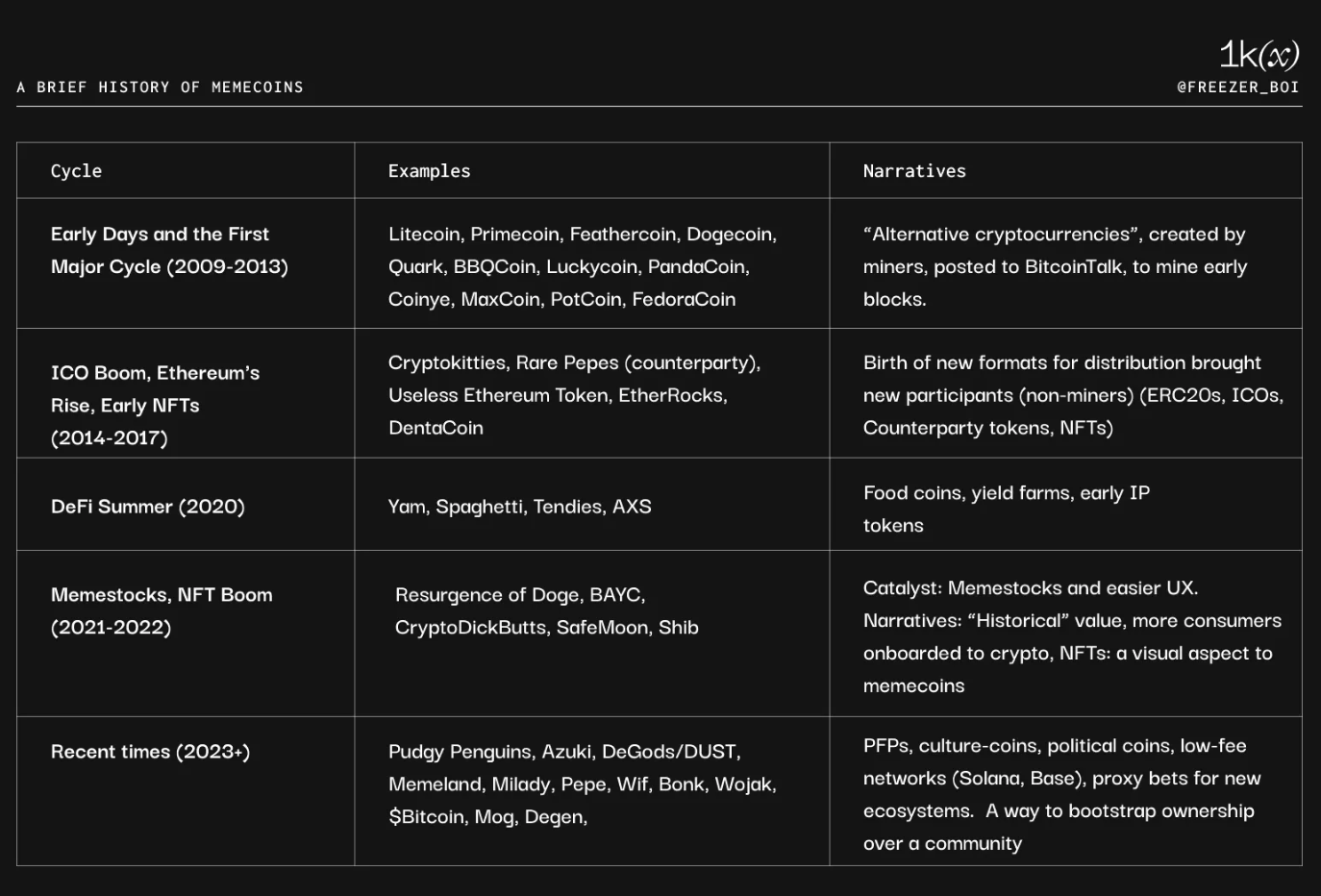

A Brief History of Meme Coins: Past and Future

Here is a brief review of the cryptocurrency cycle and the meme coins born within it::

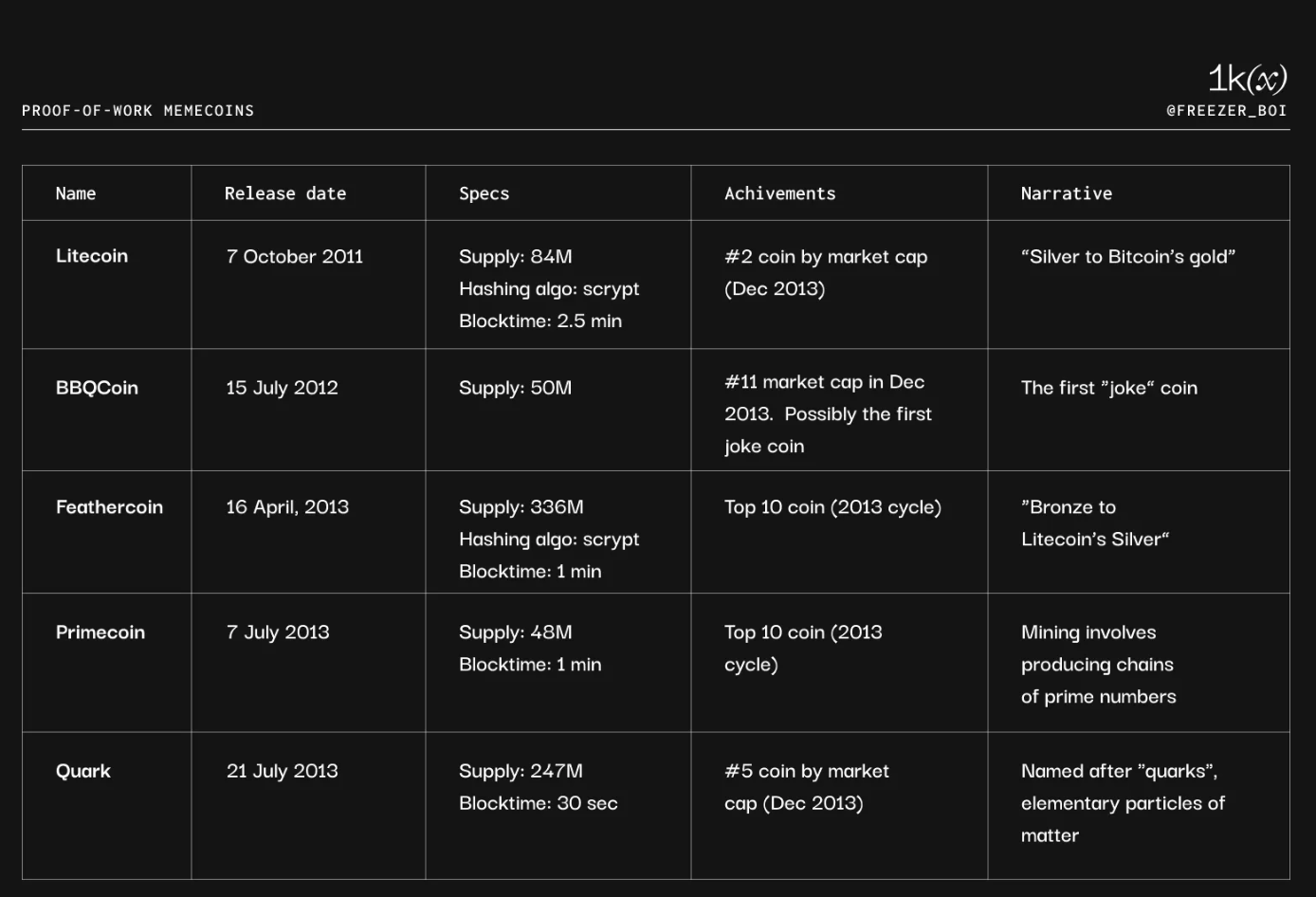

POW type Meme coin

POW type Meme coins are mainly designed for miners who allocate resources to mining and selling coins. Many meme coins from this period first appeared on Bitcointalk and similar cryptocurrency forums. Although many coins have not been listed on exchanges, there are still some coins that have successfully been listed on centralized platforms that have long been closed, such as Cryptsy and BTC-E. A Meme coin is usually distinguished by name ID, brand image, hash algorithm, block time and total supply, which in turn constitutes its overall narrative or Meme connotation.

The first wave of cryptocurrencies after Bitcoin are considered Meme coins. Because beyond novel ideas, they offer very limited value.

The following are specific examples:

With the exception of Litecoin, these currencies have all been declared dead (specifically reflected by low trading volume and market capitalization, no exchange support, and vulnerability to 51% attacks). There may be many reasons: for example, the power of Meme is not stable enough (lack of cultural continuity), and the problem of a single acquisition method (each Meme coin is actually a complete blockchain).

Litecoins ability to be active to this day may be mainly attributed to the appeal of Bitcoins powerful Meme value as digital gold, its first-mover advantage compared to other currencies, and the continued support of many existing exchanges.

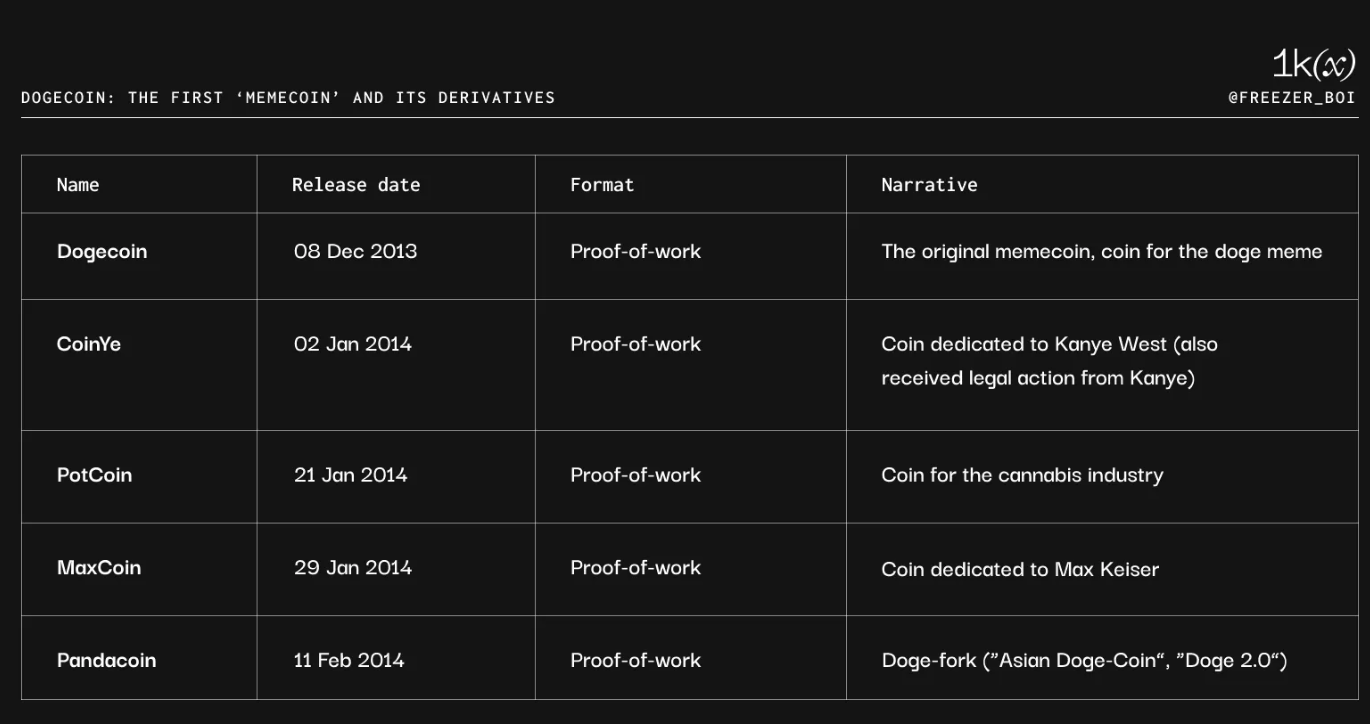

Dogecoin: The first Meme coin

The original Doge Meme (“much wow,” the Shiba Inu named Stinky Orange) began in the summer of 20134 chanand spread on Reddit. Riding on this cultural craze, Dogecoin was launched on December 8, 2013 by Jackson Palmer and Billy Markus on the Bitcointalk forum. It is the first cryptocurrency based on Internet Meme.

The success of Dogecoin has brought about a new class of coins that are eclectic, humorous, satirical, and use the characteristics of celebrities (such as Kanye West, Max Keizer), animals (such as Pandacoin) or attempts to appeal to a specific group of people as memes. These are all currencies launched in the proof-of-work (PoW) manner on Bitcointalks Alternative Cryptocurrency sub-forum. Specs became less important and Meme became more important. Some examples include:

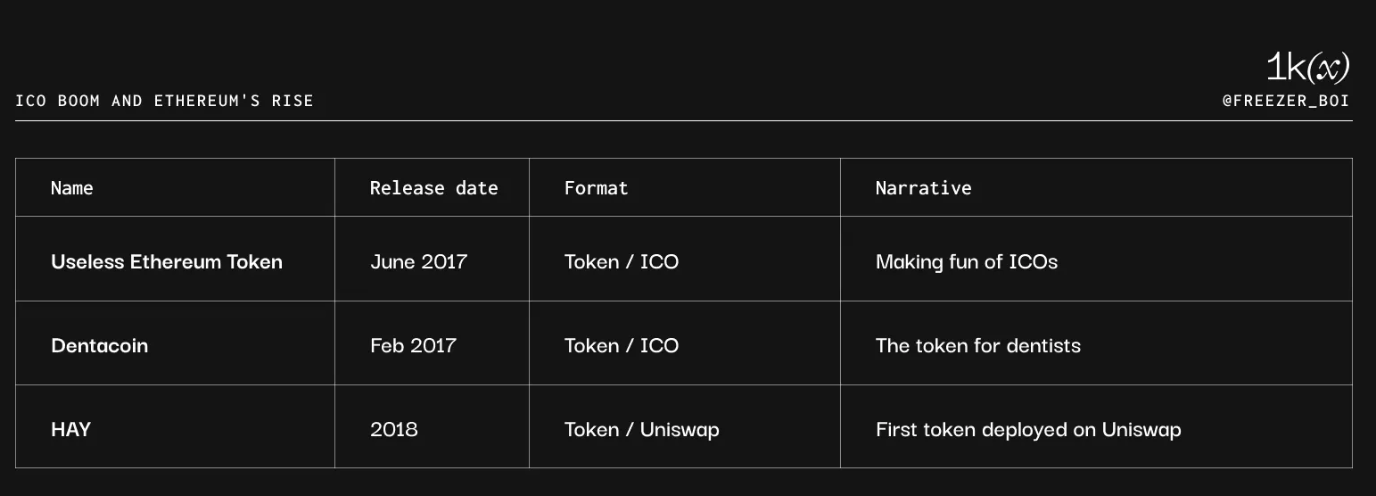

ICO boom and the rise of Ethereum

The rise of Ethereum has brought a wave of innovation, which has gradually led to more new cases, better user experience, and more new users.

Some specific improvements include:

-Easier to issue tokens under ERC 20 standard

-Attracted new user groups besides miners

-Token creators can make money through ICO sales (different from POW type tokens with zero pre-mining)

-Interoperability, one ecosystem, one wallet unification through ERC 20

The ICO era has brought a wave of more “serious” projects:theDAO, Filecoin, Tezos, EOS, Cardano, Tron and Bancor, they all try to have some practicality or specific purpose beyond Meme value.

There are also some meme coins that, although not extremely well-known, still attract some attention.

For example, published in June 2017Useless Ethereum Token (useless Ethereum token), which teased the concept of an ICO and thereby raised 310 ETH.

Dentacoin, although it originally meant dentists cryptocurrency, it is regarded more as a Meme coin and reached a market value high of US$2 billion in January 2018.

HAYCOINIt was the first ERC 20 token deployed to Uniswap v1 and was also a Meme coin created during this period (2018). Uniswap founder Hayden Adams launched this token as a test token for the Uniswap protocol. At the time, it didn’t generate much reaction or trading volume, but in 2023 it was rediscovered for its historical significance.

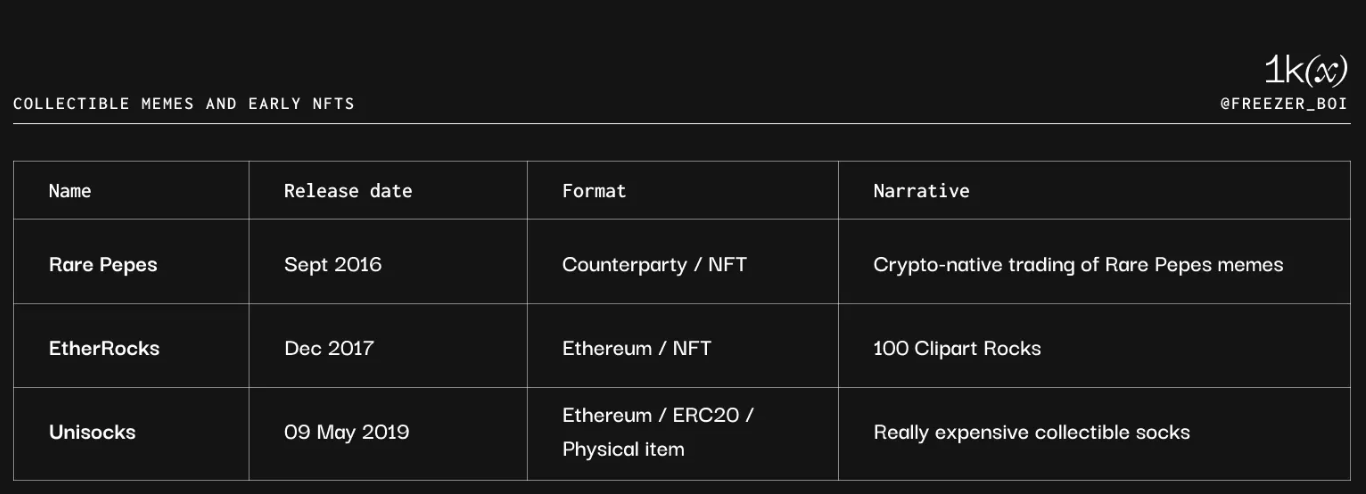

Memes and early NFTs with collectible properties

Outside of the cryptocurrency world, an offshoot of the Pepe the Frog Meme is known as Rare Pepes. These memes are generally not released publicly. Once released, they will be watermarked with RARE PEPE DO NOT SAVE.

Between 2016 and 2018, a group of Counterparty protocol (a smart contract protocol built on Bitcoin) developers and Pepe meme enthusiasts created Rare Pepe Wallet, Pepe Cash, and planned the Rare Pepe transaction on the Counterparty protocol. memes (rare Pepe memes).

Rare Pepe is generally considered to be the second NFT collection ever, and it still holds some value, with some even selling for over $500,000.

After the release of CryptoPunks, MoonCats and CryptoKitties, NFTs began to become one of the mainstream on Ethereum, that is, non-fungible tokens pointing to pictures and other media. In 2017, a Reddit user namedEtherRocksA series of NFTs containing 100 colorful clipart stones, which were initially viewed as a joke. It didnt create any buzz at the time (only 30 were minted), but later the series was discovered and sparked a buying frenzy. In August 2021, the floor price of this series of NFTs was already as high as 305 ETH (worth $1 million at the time).

Another example of a meme coin with collectible properties isUnisocks(SOCKS), launched by Uniswap founder Hayden Adams on May 9, 2019. He prepared 500 pairs of physical socks, and 1 SOCK (ERC 20 token) can be exchanged for one pair. At the time of writing, each pair of socks still costs a whopping $53,000 — making them possibly the most expensive socks in the world.

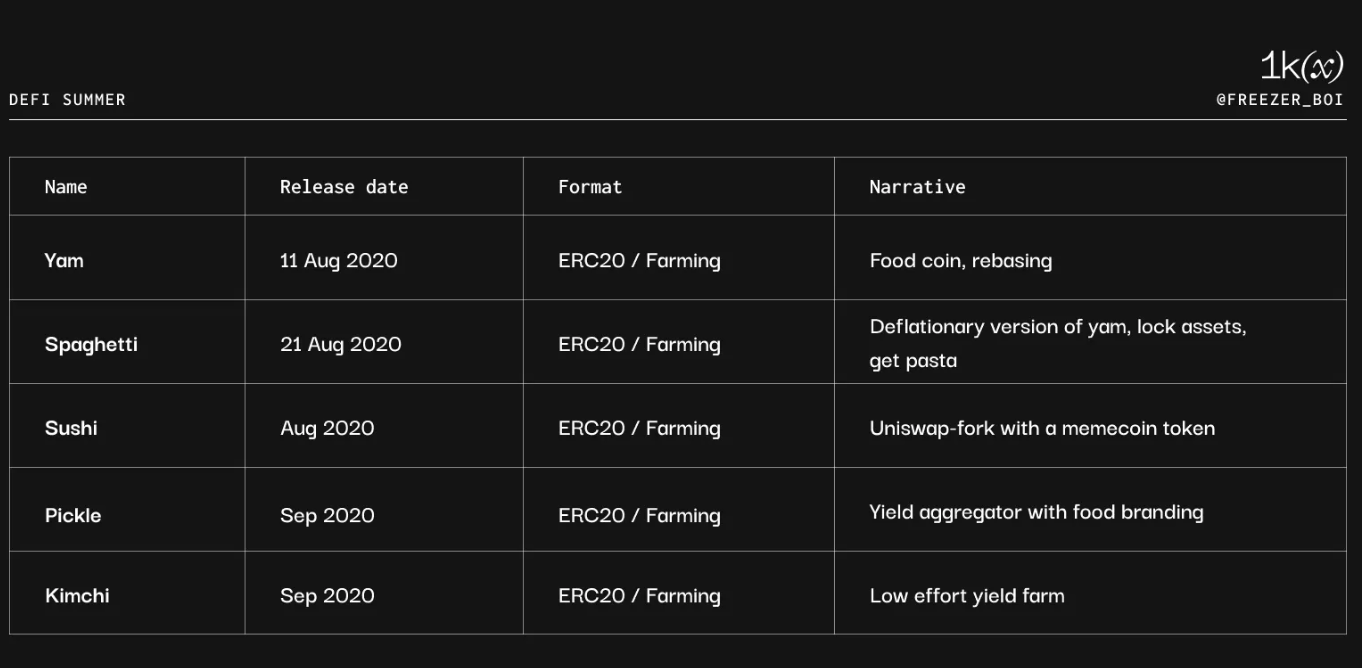

DeFi Summer

In June 2020, Compound Finance pioneered a new token distribution method - liquidity mining. Users lock assets to provide liquidity and are rewarded with tokens.

This new gameplay led to the emergence of the DeFi Summer and eventually gave birth to the emergence of mining coins and liquidity mining - these tokens provide an annualized rate of return of 10,000% (in Meme currency (calculated in the form) in exchange for users locking liquid assets in the corresponding contract.

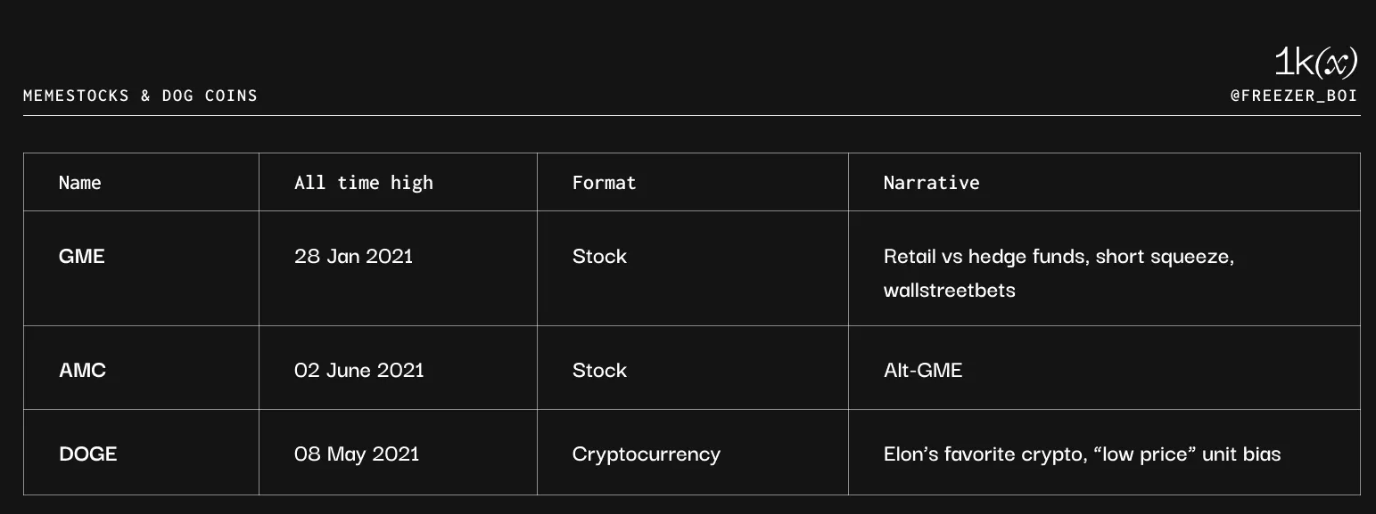

Meme Stocks and Various Dogecoins

Stimulus checks (a grant or benefit sent by the government), interest rate cuts, cheap money, and COVID lockdowns have created a high-risk environment throughout 2021.

At the beginning of 2021, retail investors in the stock market gathered on the Reddit forum and continued to spread Gamestock related memes by posting pictures/videos, which in turn promoted the rapid rise in Gamestops stock price. Thanks to the convenience of Robinhood, a free mobile app, many people are able to participate.

The “GME” frenzy prompted many people to start speculative buying of other assets on Robinhood. DOGE has been listed on Robinhood since 2018, with a price of 0.008 cents at the end of January 2021, which is a very attractive price for retail investors. In early February 2021, Musk began to release a large number ofPromote Doge Memeoftweets. In May of the same year, DOGE prices hit an all-time high, with a market capitalization of $90 billion.

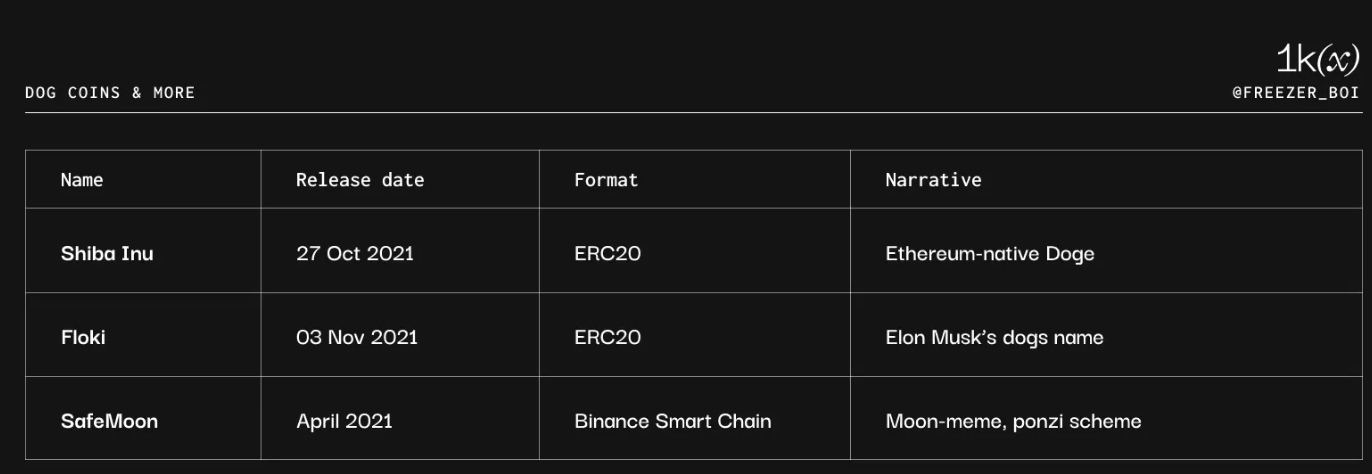

The popularity of DOGE has led many people to start hyping other crypto-native meme coins including Shiba Inu, Floki and Safemoon, and the market value of these coins has increased rapidly in just a few months.

NFT craze: Meme coins with pictures

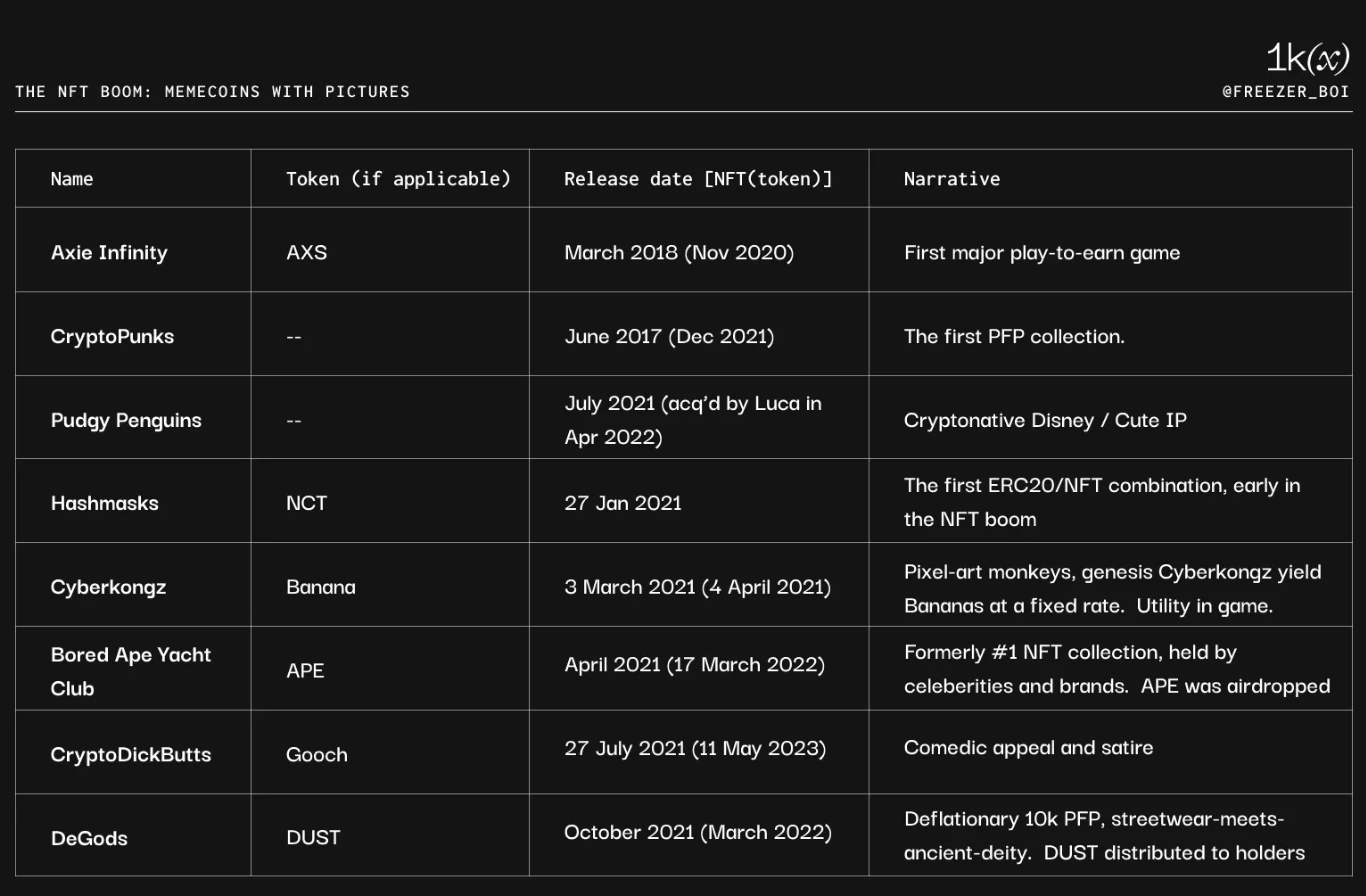

With the standardization of ERC 721 and the development of universal marketplaces like OpenSea, NFTs create a new crypto asset class: a unique visual expression of a broader sense of “culture” or “meme”.

Take some familiar NFT collections, such as CryptoPunks, Bored Apes, Squiggles and Pudgy Penguins. NFTs are used as avatars on platforms such as Twitter and Discord, and many people use them as identifiers to expand their influence. These PFP avatars signify prestige and cultural club membership. Many NFTs make holders rich quickly, but once their NFTs are sold, they will also have to leave the community. In order to reward Diamond Hands, some NFT projects will issue a Meme Coin (ERC 20 token) to their community as a concentrated expression of liquidity, utility and cultural currency.

Some examples of NFT projects (and their meme coins, if included) from this period include:

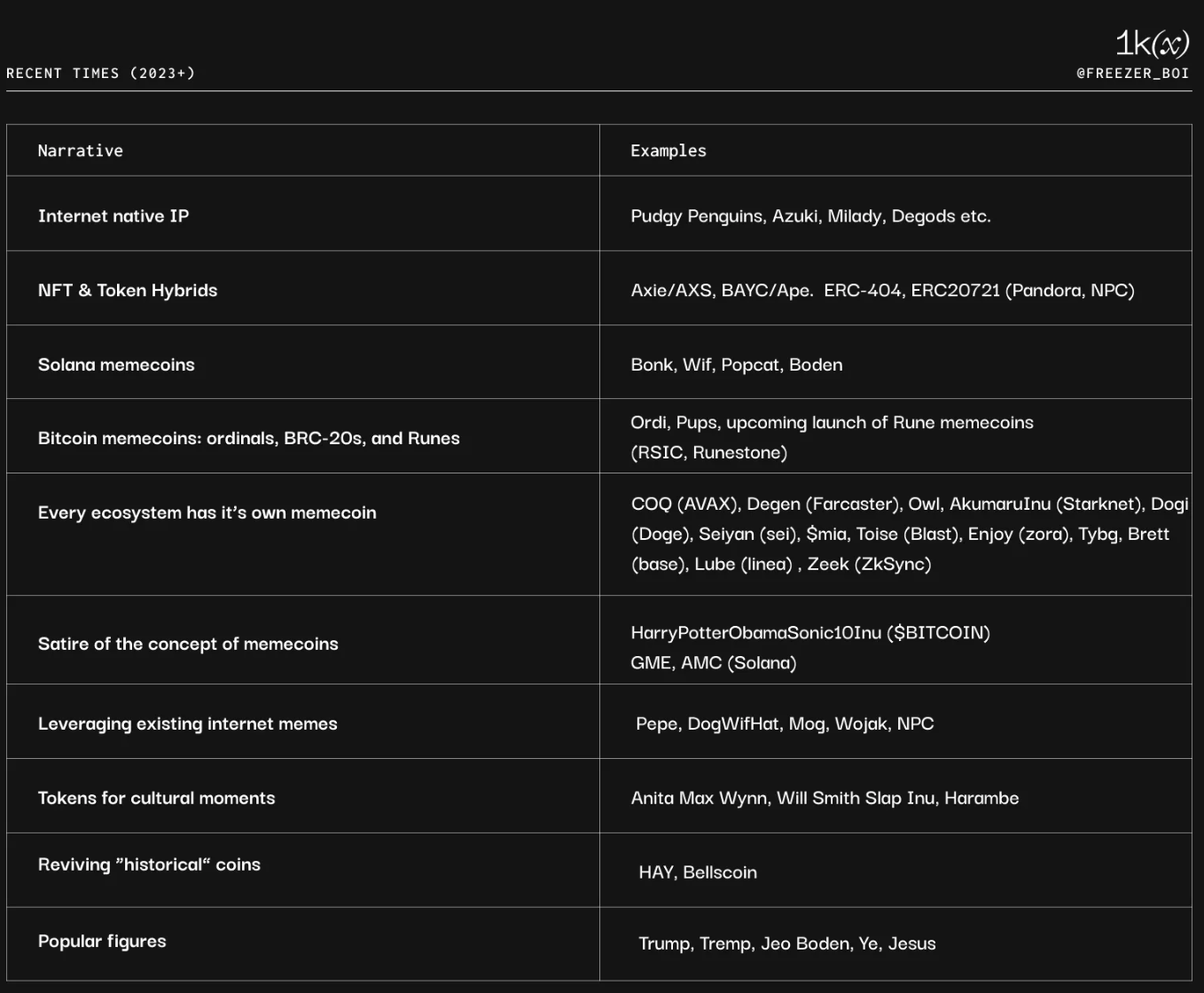

Near term (2023 onwards)

As cryptocurrencies recover from the bear market, new memes, cultures, ideas, and ecosystems continue to emerge. Meme coins are one of the few categories that can continue to find growth (in terms of transaction volume, market capitalization growth, social attention, etc.), and it has attracted a lot of attention recently.

Recent meme coin narratives include:

something in common

There are different types of Meme coins in each cycle:They are expressed in different ways depending on the underlying technology (POW coins, ERC 20 tokens and NFT). They are one of the earliest application forms of new technologies or components.

Although meme coins are generated through different types of media, they accumulate value in similar ways:They all require attention, narrative, and hype to survive and spread. While new media is always exciting initially, long-term value can only be maintained through sustained attention. It is not enough to exist in the form of NFT, and it is not enough to be an asset in the form of Ordinal. Attention is highly cyclical, and after the initial hype of a media form ends, it requires more, lower-level attention-driving elements.

Meme first, token last:As with the most successful meme coins, such as doge, pepe, and dogwifhat, their Internet memes emerged first, and the tokens used their existing popularity to spread.

Crypto-native Meme is ready to go:Crypto-native projects have successfully created Meme beyond the Web3 circle. One example is the emergence of crypto-native IP, just as NFT projects like Pudgy Penguins are doing.

Low price is Meme:Since the earliest days of altcoins, people have loved investing in tokens that have lower prices due to their larger supply. If an extremely low-priced token gradually rises to $1, it could make its holder an overnight millionaire. The price itself can be seen as a Meme.

Strong community + marketing:Meme coins require a strong community, founders or “spokespersons” who can create content, promote the brand and spread the “meme”.

Natural cold start to professional team:The first wave of Meme coins developed naturally, usually with fair launches and no insider or team distribution. These cold starts have many benefits, but they also come with certain risks, such as project runs and funds being stolen. A new possibility is that Meme coin projects can also have a professional team who are motivated to attract more attention based on their existing resources, such as PFP avatar projects.

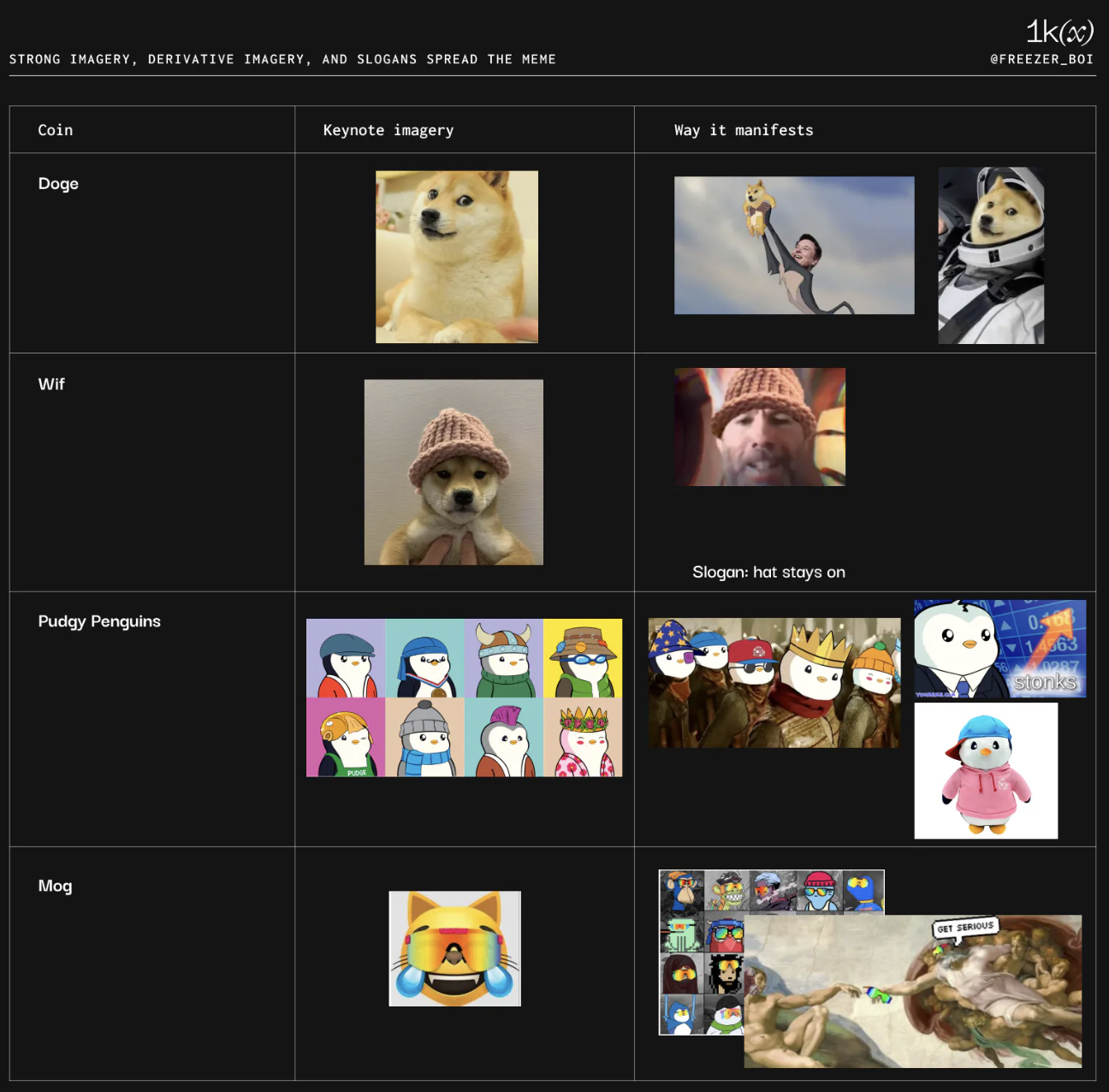

Highly recognizable pictures, derivative materials and Meme communication slogans:Picture material is the main medium for Meme to spread on social networks. Usually, it starts with a key symbol, which is represented in different forms.

Existing opportunities

At present, the total market value of Meme coins exceeds 60 billion US dollars, and the daily trading volume exceeds 13 billion US dollars, so it has huge financial value.

Since the only function of a meme is to spread into other peoples minds, catching the next meme can be a lucrative opportunity. Creators and investors work for the meme by spreading it, and in the process receive financial rewards for becoming early believers.

Whether it’s used as a lottery to get rich, influenced by specific people, or used as a basis for speculation on social trends and social ideas, meme coins have been growing explosively since the inception of cryptocurrencies.

Main risks

Despite the opportunities, Meme coins are not without risks. Many meme coins tend to attract quick-money seekers who are trying to get rich overnight, and many people view them as lotteries or gambling. Another situation that happens almost every day is running away and smashing the market. According to a recent report by blockchain analytics firm CipherTrace, project scams accounted for 99% of crypto fraud in 2023, causing losses of $2.1 billion. It is necessary to check some basic conditions of the Meme coin project, such as the status of LP tokens (whether they have been destroyed or held excessively centrally), team allocation, transfer taxes, and whether contract rights have been given up.

There is also regulatory uncertainty regarding Meme coins. The most well-known regulation of Meme coins comes from the Thai Securities and Exchange Commission’s June 2021 ban on tokens that have “no clear purpose or substance” and whose prices are influenced by social media trends and KOLs.

Another major problem is that memes that are caused purely by a lack of interest, attention, and sharing, rather than other malicious behavior, may not survive. These investment losses may result in hostility or apathy among the holder community.

The Meme currency market is highly volatile and risky. Odaily reminds users to pay attention to asset security and choose targets carefully.