Coinbase bets on Midas, RWA surges again

Original - Odaily

Author-husband how

As BlackRock launched the tokenized fund BUIDL, which attracted US$160 million in funds within a week, and Ondo, as the leading project of the RWA sector, allocated the underlying assets of the product OUSG (U.S. Short-term Treasury Bond ETF) to BUIDL, RWA once again became Popular forum for community discussion.

As one of the important bridges between the crypto industry and real assets, RWA has been highly anticipated since its conception. However, only a few well-known projects such as Ondo and MarkerDAO are actually well-known and adopted RWA projects.

However, recent RWA projectsMidasCompleted US$8.75 million in seed round financing, with participation from institutions such as Coinbase Venture and GSR. With the support of well-known institutions, Midas has entered the public eye.

Below, Odaily will explain to you the overview of the Midas project and its subsequent development prospects.

Surface RWA, actual stablecoin interest earning

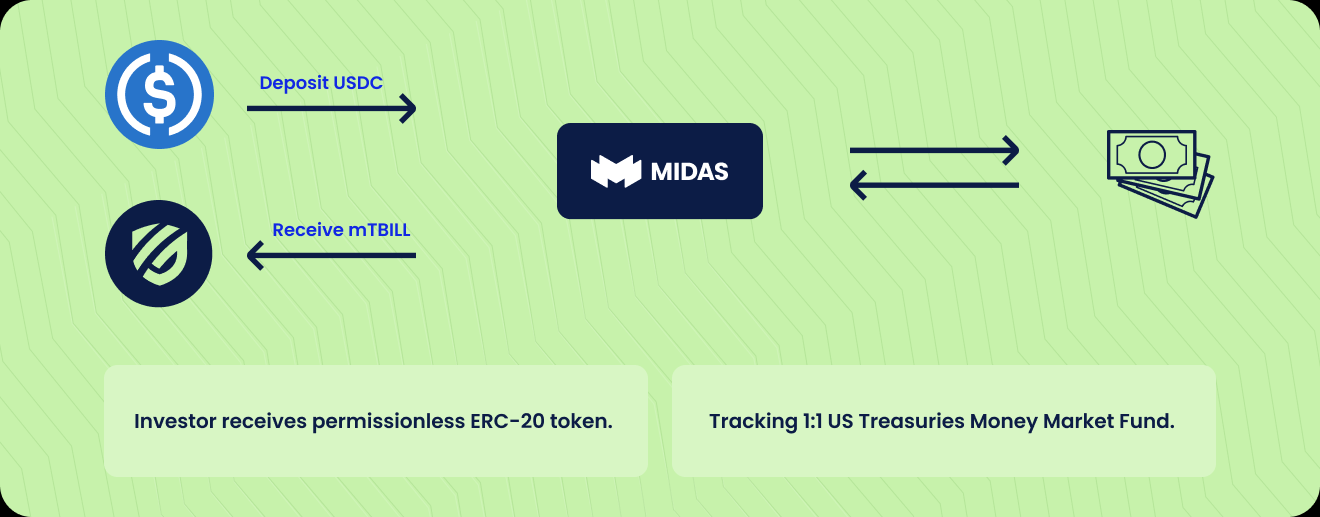

Midas is an asset tokenization protocol that converts tokenized real-world assets into permissionless ERC 20 tokens and allows tokens to be circulated in DeFi projects. The first asset tokenization product launched by Midas is mTBILL. Currently, mTBILL has an annualized return of 5.23% and a TVL of US$3.03 million.

The underlying asset of mTBILL is the iShares $Treasury Bond 0-1 yr UCITS ETF (IB 01.L), which has $14.6 billion in AUM and daily trading volume totaling $25.18 million,Annualized return is 5.26%, rated AA by SP. Each mTBILL token is linked to each share of IB 01.L at a 1:1 ratio.

IB 01.L As the underlying Treasury securities mature, the assets are reinvested, thereby increasing the funds net asset value (NAV). As the net asset value of the overall fund accumulates, the value of each corresponding token increases in turn. Therefore, mTBILL product redemption will be calculated based on the current net asset value.

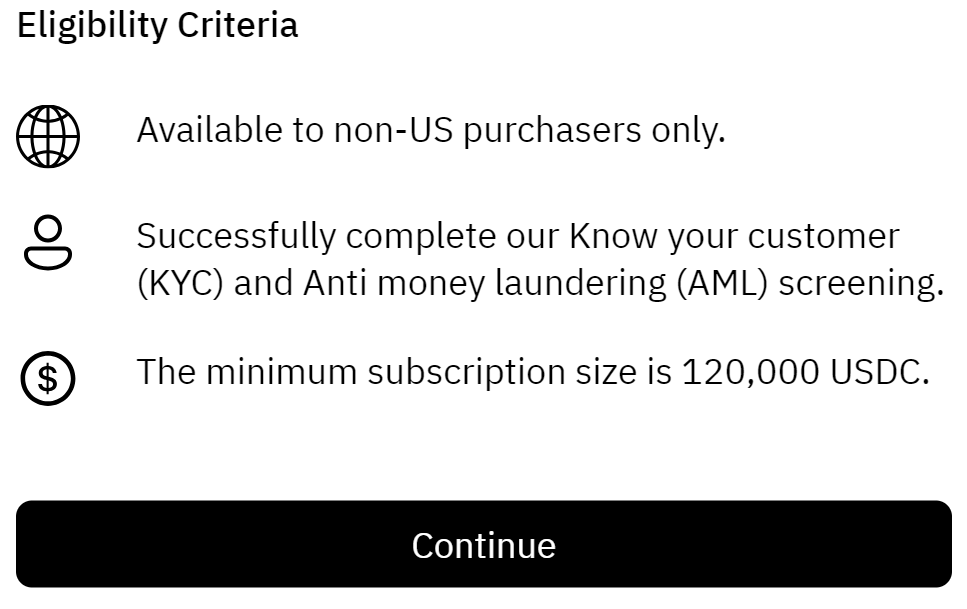

Like other RWA projects, mTBILL products are purchased and redeemedKYC and AML review required, U.S. individuals and institutions cannot participate, and other countries are not restricted. andearlyInitial purchase threshold requires 12,000 USDC, not low, but it does not specify what kind of investors are allowed to buy, as long as the funds meet the requirements.It is worth noting that the project party did not clearly indicate the threshold requirements for asset redemption, but only stated the purchase threshold. If part of the mTBILL share is purchased in the secondary market, whether it can be redeemed immediately still needs further confirmation, and although the project party elaborated as Immediate response, but the purchase and redemption process takes some time.

The flow chart of the mTBILL product is as follows. After the user completes the KYC and AML review, the user can enter the token into the contract through USDC, or deposit funds through bank wire transfer. The project party will provide the tokenized note mTBILL.But there is a point of doubt. mTBILL will track IB 01.L at a ratio of 1:1. The project team did not elaborate on the subsequent movements of the tokens after the tokens are entered into the contract address. For example, through which company will purchase IB 01.L, or by default It was purchased by the Midas project party on its own, but there was no third-party supervision, nor did Ondo provide an SPV as a risk isolation site.

In addition, Midas’ main focus in the RWA sector is DeFi that does not require tokens. After buyers buy mTBILL, they can participate in related DeFi projects on the chain, mainly lending, without the need for the other party to have KYC qualifications. Traded in the market, but if asset redemption is to be carried out, the redeemer must meet KYC and other relevant audits. Midas move is to review the entrance and exit of mTBILL, and there are no restrictions on the behavior during the process.

In terms of rates, Midas does not charge issuance fees at the initial stage of the project, but only charges an ETF management fee of 0.07%. It is not yet known whether there will be any subsequent charges.

Generally speaking, in most RWA projects dominated by institutional and high-net-worth investors,Midas Protocol Highlights RWA Products’ On-Chain DeFi Usage, integrating RWA products into the existing DeFi ecosystem to provide additional product yields and utilization. Although support for related lending protocols has not yet been seen at this stage, Midas is still in its early stages. With the support of institutions such as Coinbase and GSR, DeFi use cases may continue to expand. Interested investors should also pay attention to the risk points mentioned in the previous article - product related instructions are not yet complete.