Original - Odaily

Author - Fan Jiabao

Whales Market, is a peer-to-peer primary market platform based on the Solana chain that allows users to pre-exchange tokens before the official token issuance.

Previously, for small and medium-sized investors, there were basically three ways to obtain tokens - airdrops, secondary market transactions and tokens as incentives. The Whales Market allows users to trade their own tokens that have not yet been listed on exchanges (such as Portal, STRK) or airdrop points (Magic Eden Points, Grass Points) and whitelists. This move revitalized the liquidity of the earlier market and can be regarded as a great innovation.

Introduction to use

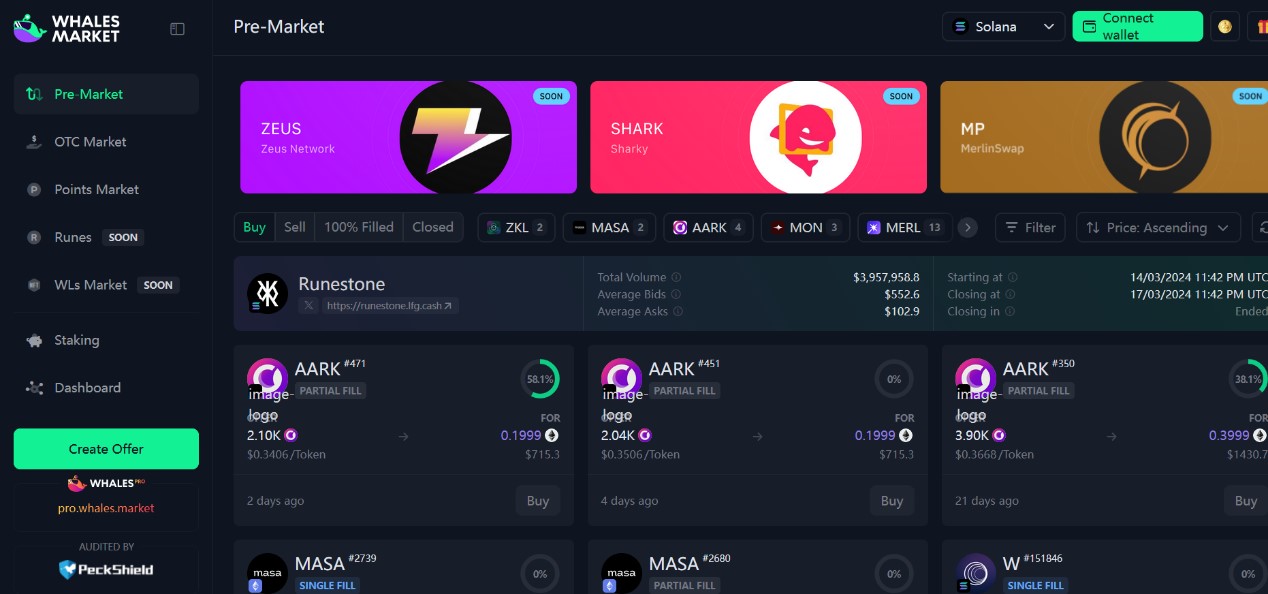

Currently, Whales Market supports three types of transactions, namely Pre-Market, OTC market and Points Market, and will soon launch two trading functions: Runes and WLs market (whitelist market).

Pre-Market

Pre-Market trades tokens that have not yet officially been listed on exchanges, while Whales Market provides an opportunity to gamble on prices in advance.

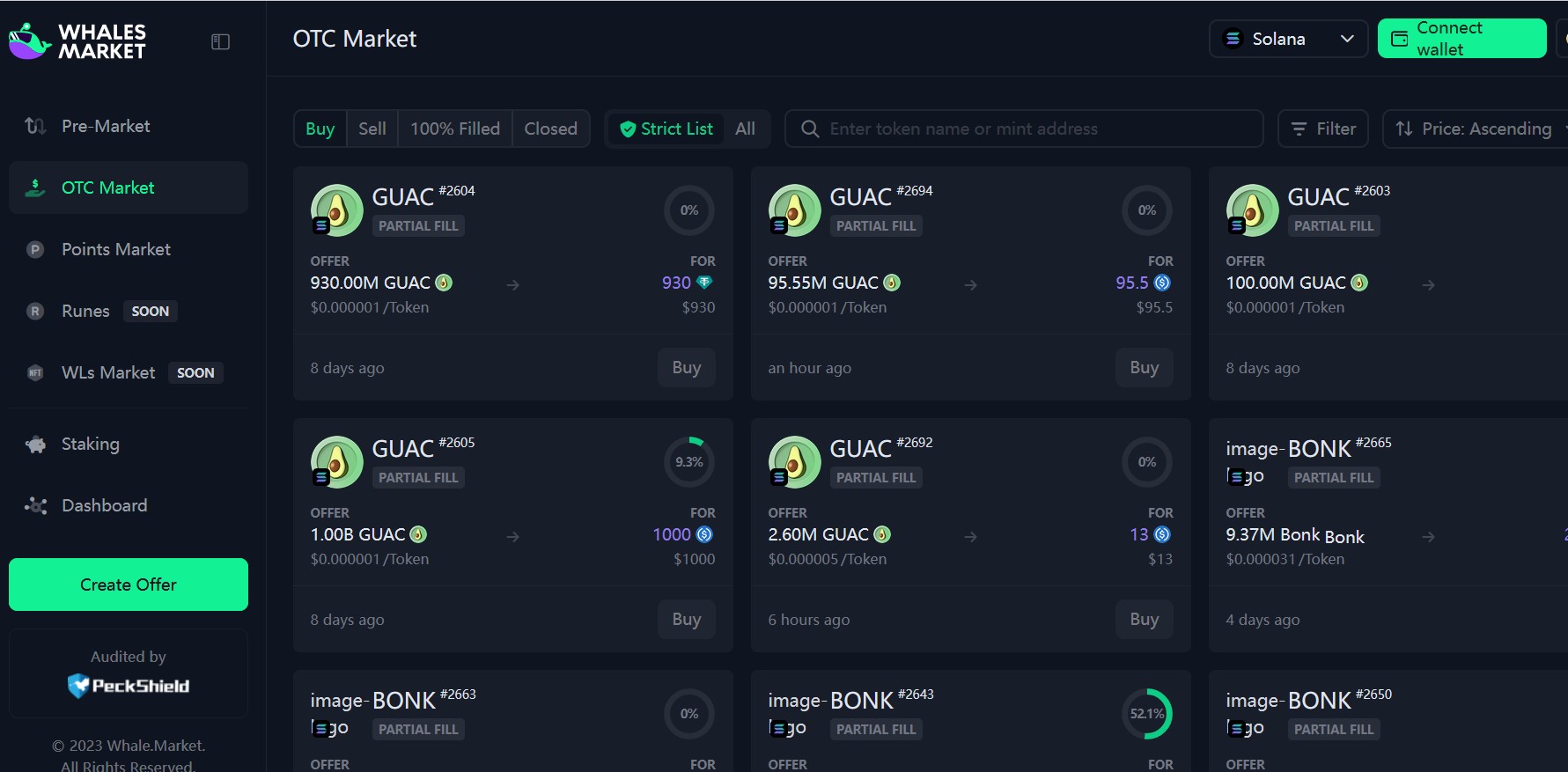

OTC Market

On exchanges, placing trading orders on illiquid tokens (such as many low-interest tokens) will generate a large amount of slippage tolerance. In this case, peer-to-peer OTC trading seems to be the better model. There are two types of OTC transactions in Whales Market. One is a certified pending order with a blue shield logo, which means that Whales Market has conducted security screening and certification on it. The second type is ordinary OTC transactions, which are not filtered by Whales Market and are even more mixed.

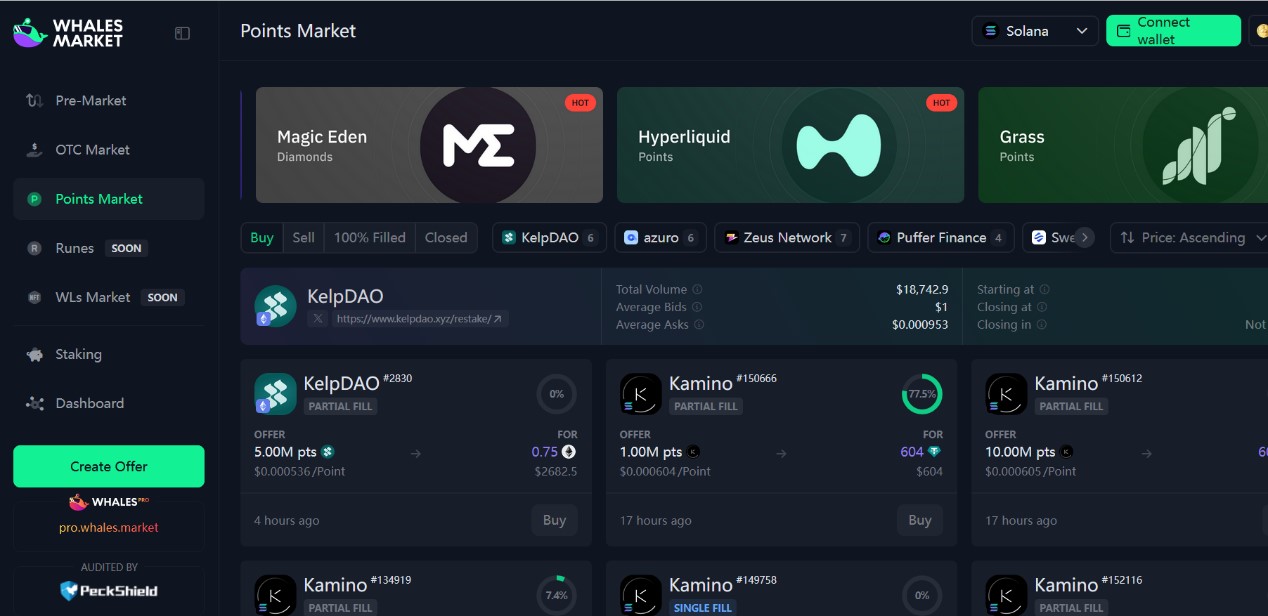

Points Market

When we complete the airdrop task, we will receive points, which can be used to receive the airdrop after the token is officially issued. For various reasons, such as the expectation that the official token price will drop later, the need for capital turnover, etc., there are often people who want to sell points from token airdrop activities. And naturally there will be people who want to buy points to seize the opportunity. Pre-Market allows users to trade points in advance and then deliver them after the airdrop, adding a part of the game.

Order book-style peer-to-peer trading

In order to match transactions as much as possible under limited liquidity, Whales Market adopts the point-to-point method of placing orders between buyers and sellers. That is, either party selects the currency, quantity and price to sell/purchase, creates a buy/sell order and continues to hang it in the market until the order is satisfied to complete the transaction. As shown in the figure, the GUAC token purchase order displays the purchase order quantity, total price, token unit price, and the percentage of the order that has been completed.

double mortgage mechanism

In addition, Whales Market also utilizes a double collateral mechanism to secure transactions. Regardless of whether it is the placing order or the taker, the buyer or the seller, both parties involved in the transaction must pay a deposit equal to the order amount. If one party breaches the contract and terminates the final token delivery, then the other party can receive the deposit from the faulty party as compensation.

Introduction to token mechanism and fundamental analysis

The tokens of Whales Market are called WHALES, with a total of 100 million coins.

Token release status

65% is used for incentives, linearly released within 4 years, and token governance is conducted by the DAO.

9.5% of the team, locked for 9 months, and released linearly within 36 months.

7.5% is used to provide liquidity, with 2.5% reserved for CEX listings.

7% were sold in the private placement round.

Income Distribution

60% is allocated to WHALES token stakers.

20% is used to pay for subsequent development costs.

10% to buy back and destroy tokens.

10% is allocated to holders of LOOT and xLOOT (the founder’s previous project).

Token pledge

Users can stake WHALES in the staking interface on the operation page to obtain the governance token xWHALES. As mentioned earlier, xWHALES will provide rewards to users.

In addition, Whales Market will destroy 1% of unstaken tokens every month starting on March 15 to ensure the good operation of the project.

Introduction to project fundamentals

According to data from CoinGecko, as of the date of writing this article (2024.3.28), the price of $WHALES is $1.99, with a market value of $39.17 million, accounting for 21% of the total circulating supply of $193 million.

The highest point was $4.41 on February 26, which was a 57% drop from the highest point. The lowest point was on January 8, which was $0.08 when the project was just launched. In other words, the current price is the original 200 times.

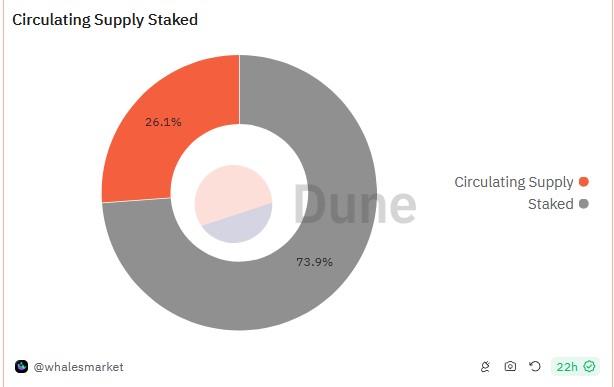

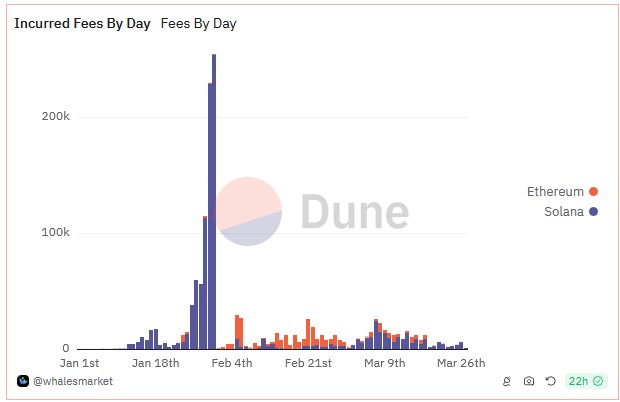

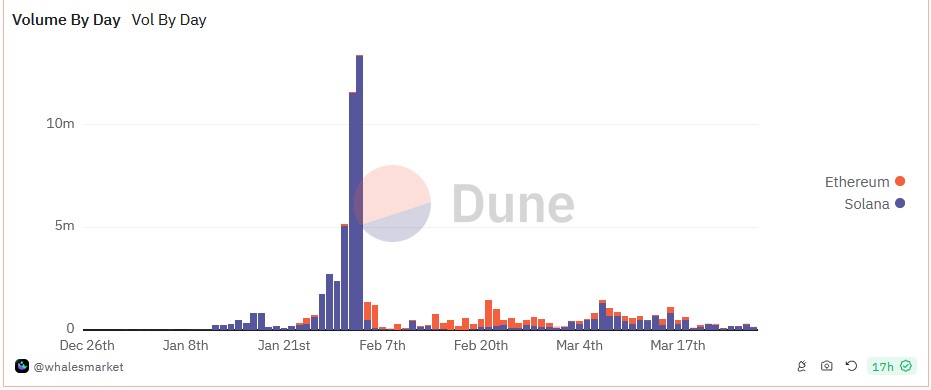

According to data from Dune, as of now, the number of users of Whales Market is 25,150, and the staking ratio is 73.9%. Meanwhile, $1.02 million in revenue has been shared as planned.

In addition, the founder and manager is Dexter, who has developed the Telegram robot project Lootbot and is developing a new AI project gm.ai.

Project prospects and market value estimates

Whales Market has obvious advantages and disadvantages:

advantage

The tokens of Whales Market are released linearly, so there is no need to worry about a large number of releases in a short period of time in the future to dilute the price.

Whales Market’s token empowerment is simple, direct, and effective.

The use of a repurchase and destruction mechanism can combat the inflationary impact of token release.

Most of the tokens are being pledged. A large number of cancellations or increases in pledges will be monitored on the chain, which can prevent giant whales from suddenly destroying the market.

The track is novel and has unlimited potential, and new features will be developed in the future.

shortcoming

The current circulating supply is only 21%, and most of the tokens have not yet been released.

In the recent receipt airdrop mode on the Solana chain, founder Dexter transferred the sol raised on the chain to the exchange, causing user dissatisfaction and concerns about the Whales Market that Dexter is responsible for.

The token has risen hundreds of times as much as it did initially, and early profit-takers are at risk of losing their profits.

Project market value estimate

Considering that there is currently no platform with the same track, we make an estimate based on data such as price-to-earnings ratio:

According to data on Dune, the current number of tokens in circulation is 4 million, and the number of pledged tokens is 12.19 million.

Considering that the current development of Whales Market is relatively stable, the current non-pledge ratio can be used to calculate the monthly destruction ratio, which is 0.274* 0.01 = 0.00274 = 0.274%, that is, 0.274% of tokens are destroyed every month. Counting only the main incentive token, the proportion of tokens released each month also results in a 1.35% increase in tokens. In other words, Whales Market is currently an inflationary model.

As mentioned above, the market value of Whales Market is US$39.17 million, and the distribution income is US$1.02 million. Considering that transactions on Whales Market mainly occur after January 10, excluding the period when new projects are launched, the dynamic price-earnings ratio calculation range is set as For 2.5 months, the calculated P/E ratio is 8.3. However, considering that whales’ token inflation this year will increase the total number of tokens in circulation by about 20%, the final dynamic price-to-earnings ratio for this year is 9.96. Compared with most other DeFi projects, such as AAVE, the P/E (this years income/this years dividend) is basically above 20, which shows that Whales Market still has room for market value growth in 2024.

Whales Market promises that the protocol revenue will continue to be greater than the impact of inflation, ensuring a lower limit of user income, which is also its advantage.

According to data on Dune, Whales Market’s transaction volume will surge when big projects are launched, such as Ether.Fi, Blast, Jupiter, etc. This will undoubtedly lead to user growth, increased revenue and higher token prices. Considering that 2024 is likely to be a bull market year, there will be many high-quality projects listed on the Whales Market.

Conclusion

Whales Market is on a novel track with few competitors, and the tokens have empowerment and governance guarantees. Moreover, as big projects are launched one after another, we are still optimistic about the development of Whales Market in 2024 as long as there are no more controversial incidents such as the recent transfer of founders’ fundraising to exchanges.