Yesterday (27 MAR) Fed Waller delivered a hawkish speech after the market closed, saying that there is currently no sign of an urgent need to cut interest rates. The current interest rate level may be maintained for longer than expected, and the number of interest rate cuts may be reduced this year. At the same time, he also said that he hopes to see We will wait until at least a few months of inflation data to improve before we cut interest rates. Tonights core PCE data will be the first important inflation data after this speech, and we will see if it can slow down to below 0.3% month-on-month as market expectations. Show a good transformation.

Source: SignalPlus, Economic Calendar

Source: SignalPlus & TradingView

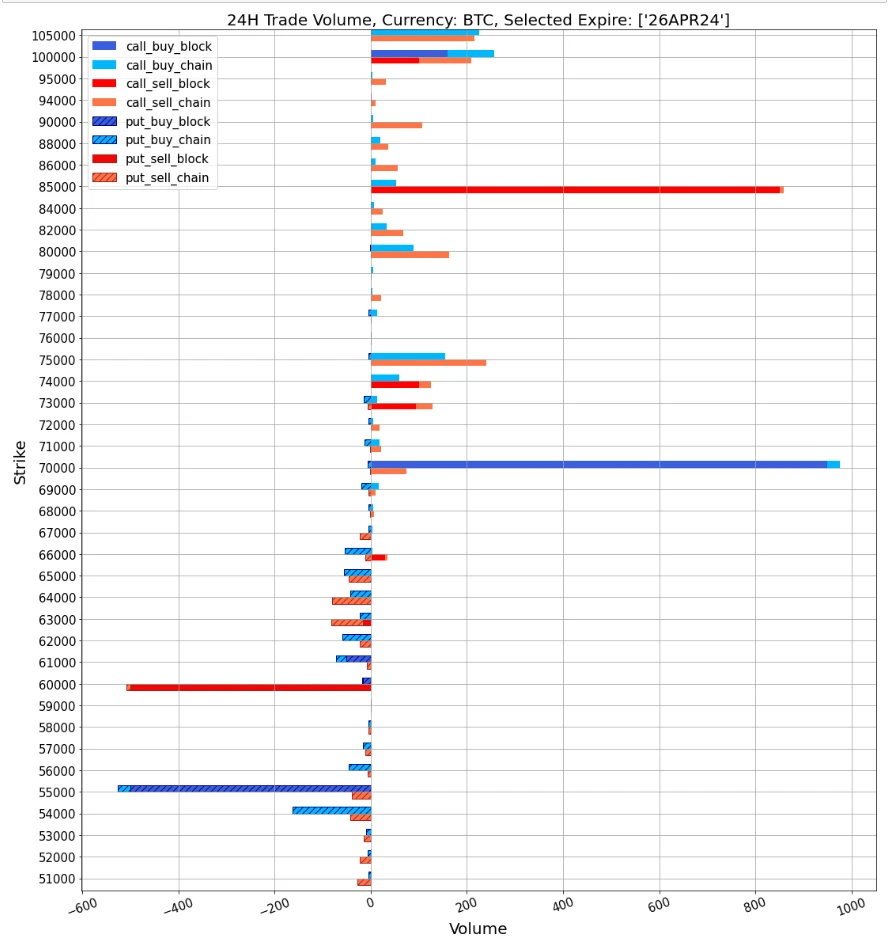

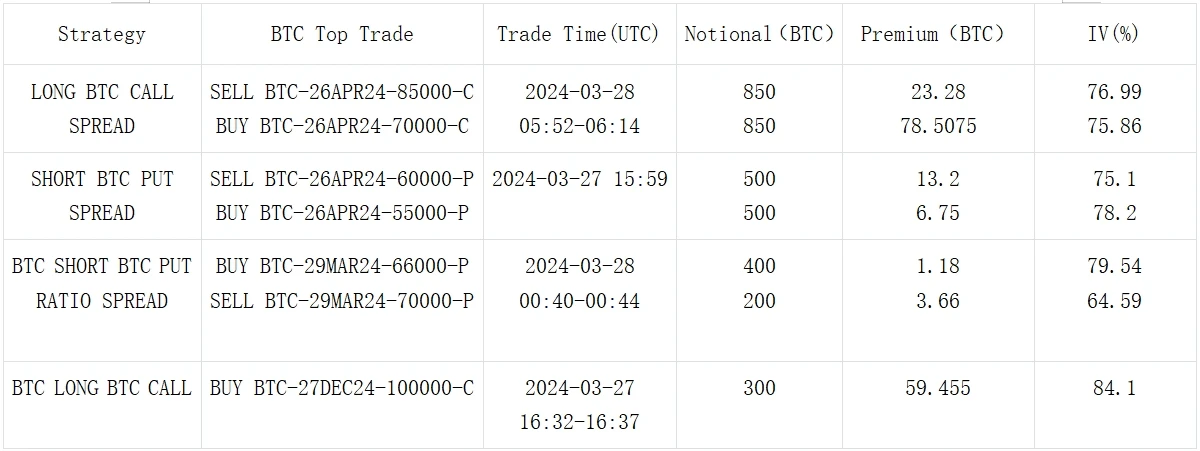

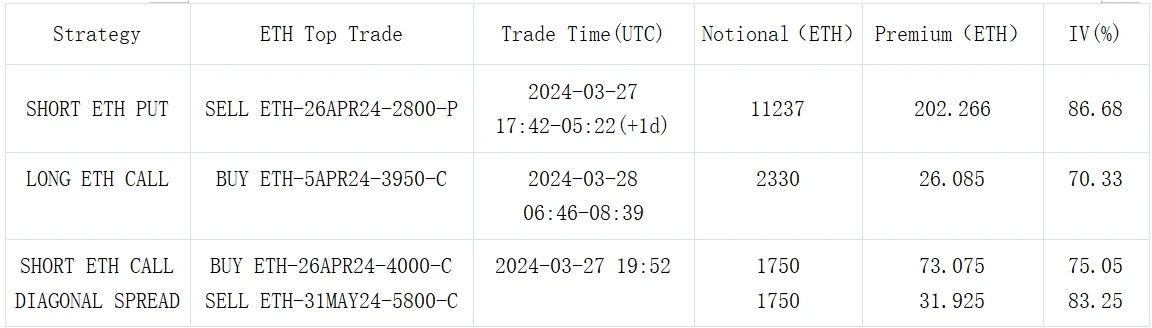

The digital currency experienced a fluctuation shortly after the U.S. stock market opened. The price of BTC once touched the $72,000 mark and then quickly fell to around 68,500. The reasons for this fluctuation may include the U.S. District Judge ruling that the SEC’s lawsuit against Coinbase can continue. causing its share price to fall and putting pressure on BTC prices at the same time. But then the price rebounded steadily to recover all the losses, and returned to above 70,000 US dollars, boosting market confidence. It can be seen from the options data that although the Vol Surface did not change significantly, most of the transaction records of BTC and ETH showed Long Call/Call Spread and Short Put/Put Spread strategies with unified direction, such as BTC 26 APR 24 70000/85000 Call Spread (850 BTC per leg) and Sell ETH 26 APR 24 2800 Put (11237 ETH from Deribit)

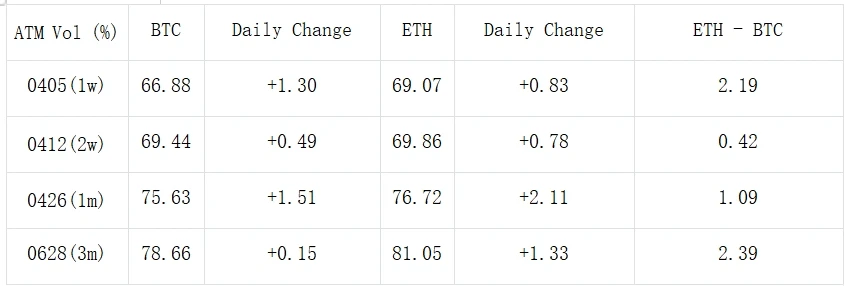

Source: Deribit (as of 28 MAR 16:00 UTC+8)

Source: SignalPlus

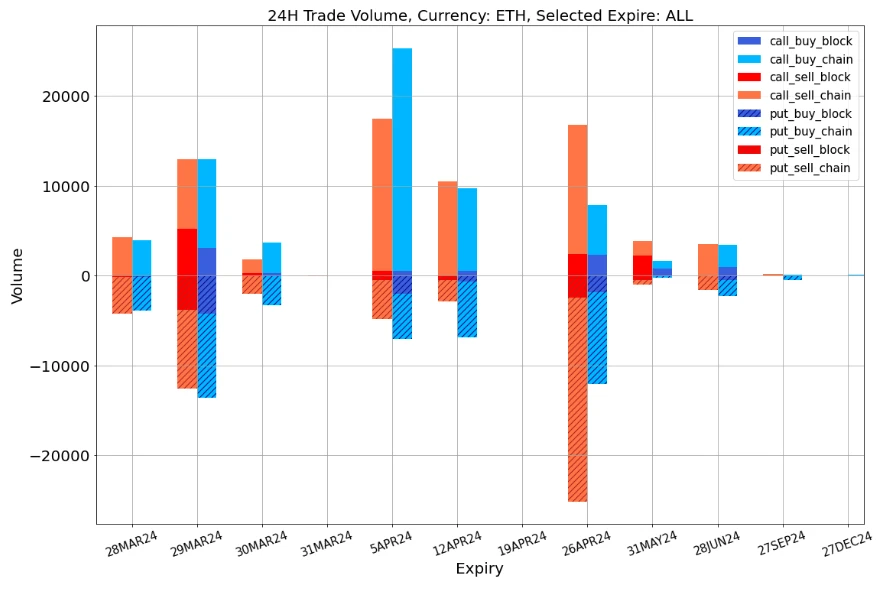

Data Source: Deribit, ETH transaction distribution

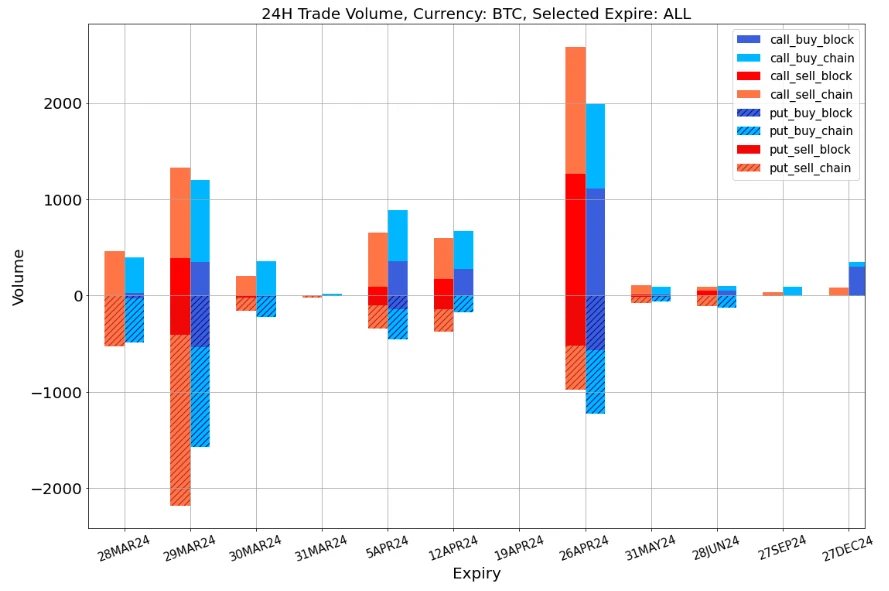

Data Source: Deribit, BTC transaction distribution

Source: Deribit Block Trade

Source: Deribit Block Trade

You can search for SignalPlus in the Plugin Store of ChatGPT 4.0 to get real-time encryption information. If you want to receive our updates immediately, please follow our Twitter account @SignalPlus_Web3, or join our WeChat group (add assistant WeChat: xdengalin), Telegram group and Discord community to communicate and interact with more friends.

SignalPlus Official Website:https://www.signalplus.com