STRK变更大额代币解锁时间,流通预期产生多大变化?能否提振币价?

Original | Odaily

Author | Nan Zhi

On the evening of February 20th at 20:00, STRK went live on OKX and reached a high of 3.99 USDT within the first hour of trading. Then, at 21:00, Binance opened STRK trading, reaching a peak of 7.71 USDT.

After opening at a price and market value far exceeding expectations, STRK started to decline as token claims continued. It fell to the current lowest point of 1.67 USDT the day before, and then fluctuated in the range of 1.8 ~ 1.9 USDT.

Today, StarkWare announced a modification to the lock-up schedule for early contributors and investors' tokens. The oscillating trend stopped, and the price started to rise, with an intraday increase of over 10%, returning above 2 USDT.

In this article, Odaily will analyze the current data of STRK, the circulation of tokens before and after the lock-up change, and the valuation.

Data Analysis

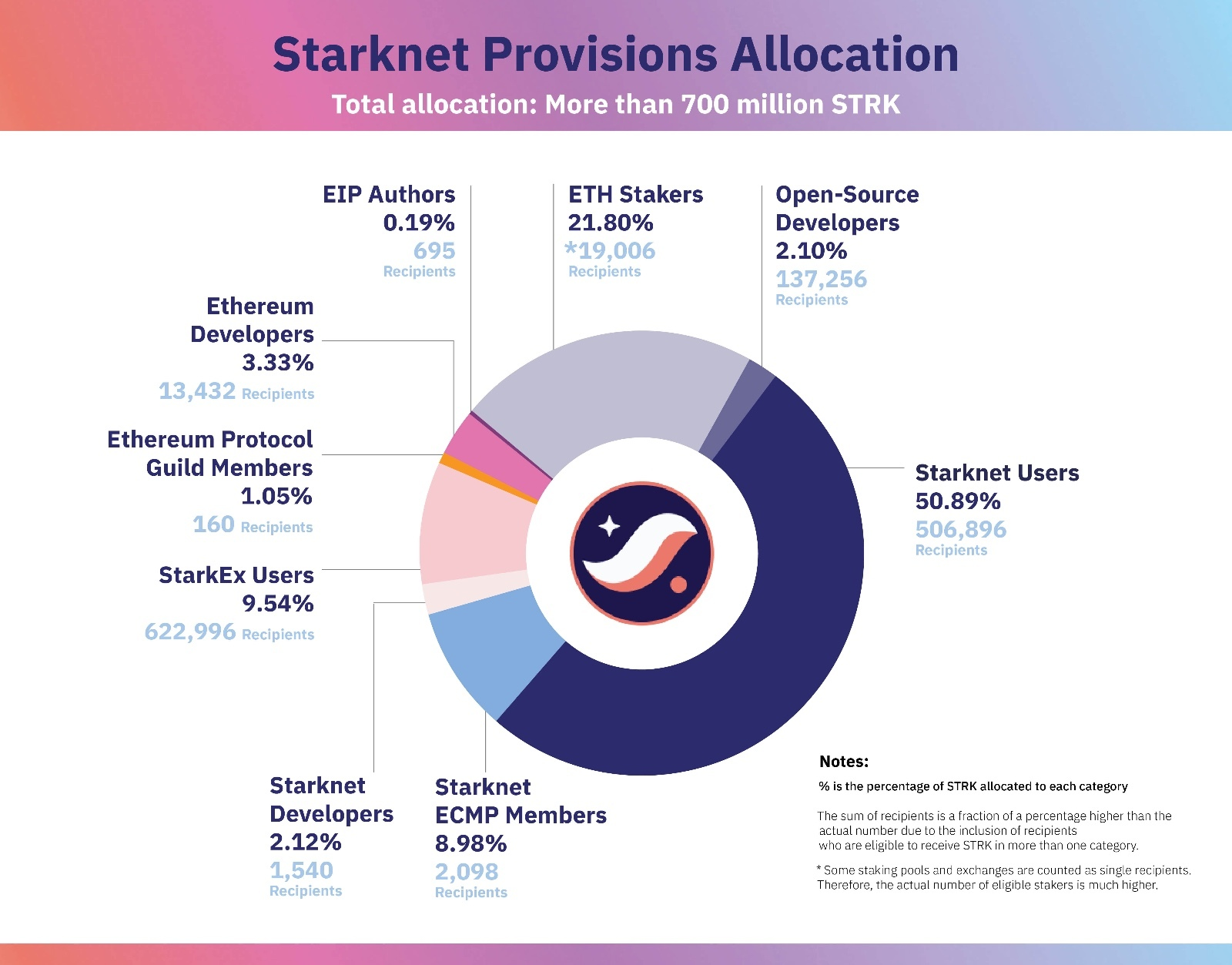

Previously, Starknet announced that it would distribute over 700 million tokens through the "Provisions Plan" airdrop program, involving various types of users. The allocation targets and ratios are shown in the following figure.

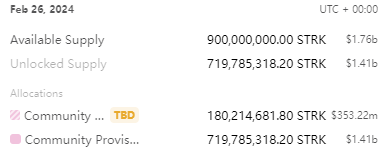

According to the data disclosed by token.unlocks, the specific amount of the airdrop is 719.7 million tokens, and an additional 180 million tokens for community distribution will be announced with specific plans. If calculated based on the current price of 2.1 USDT, the maximum circulating market value in the worst case scenario would be 9 × 2.1 = 18.9 billion US dollars.

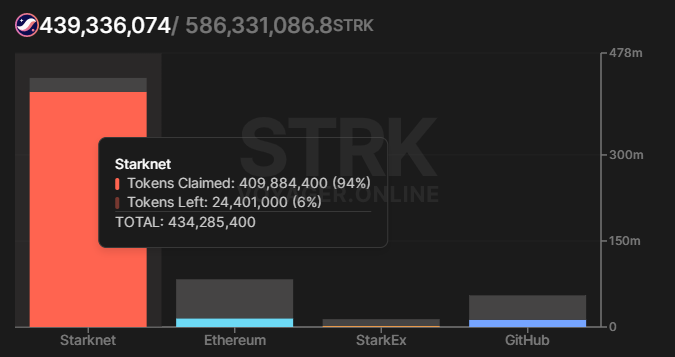

And Starknet officially released a drop claim query website, recording the drop claim situation of four types of users (Starknet, Ethereum, StarkEx, GitHub). These four types of users can receive a total of 5.86 billion tokens, of which 74.9% has been claimed, a total of 439 million tokens. Among them, the most important Starknet users have claimed 94%, leaving only 24.4 million tokens. The potential selling pressure is relatively low.

Finally, according to the Starknet browser's VOYAGER data, the current real-time circulation of STRK is 5.9 billion, corresponding to an actual circulating market value of 1.239 billion US dollars.

Official opinion change, modify the unlocking schedule

Starkware co-founder has previously stated that delaying lock-up is not the right approach

Prior to the official token airdrop, Eli Ben-Sasson, co-founder and CEO of Starkware, emphasized Starknet's roadmap and explained why he believed that "unlocking a large amount of investor and early contributor shares during the initial release of STRK" was not a big issue in an interview with Decrypt.

Ben-Sasson said that the structure of the Starknet airdrop is indeed different from traditional models, but this is an advantage rather than a disadvantage for Starkware. The team believes that what users care about is whether developers in the Starkware or Starknet ecosystem will still be on the Starknet network and continue to drive its development in three months or one year. He can guarantee that the only focus of Starkware's 150 employees and its expanding team is to promote the development of Starknet.

Regarding concerns that investors may rush to sell the STRK tokens in April and affect the price of STRK, Ben-Sasson emphasized that extending the token lock-up period cannot prevent this situation from happening, and this concern may also arise one year later. Starkware made this decision because it believes that these people have received the rewards they deserve for their contributions, and there is no inappropriate use of the airdrop structure by individuals or the team. When focusing on long-term development, unnecessary delays in the lock-up period are not the right approach.

Amending the Unlock Schedule

Early this morning, Starkware posted on the X platform stating that after listening to feedback from ecosystem friends and partners, it is changing the lock-up schedule for StarkWare's early contributors and investors (tokens) to make it more gradual.

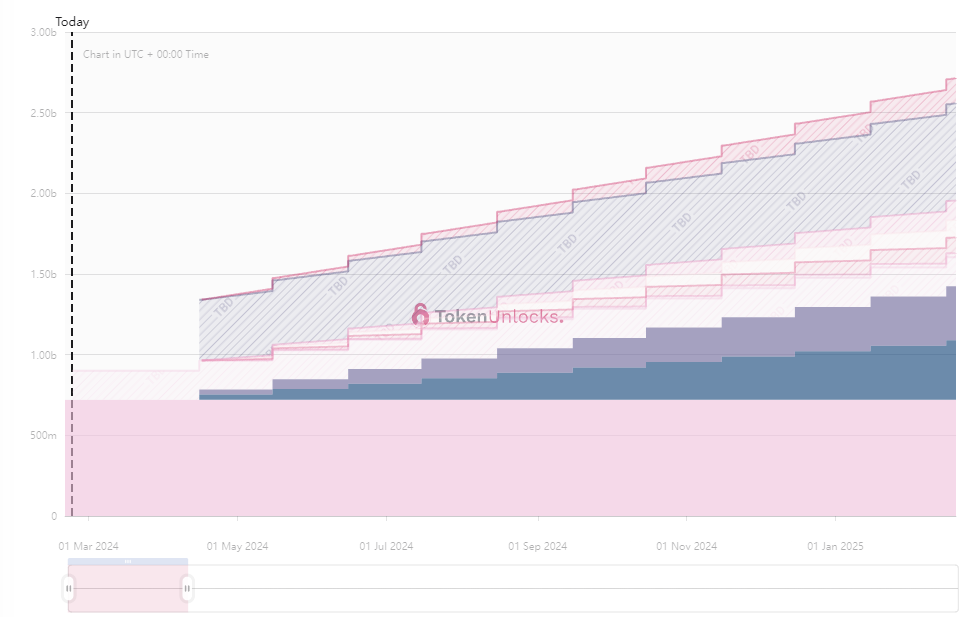

Previously, approximately one-third of the tokens held by these early contributors and investors (about 1.3 billion tokens) would be unlocked on April 15. The revised unlock schedule is as follows:

Only 64 million tokens will be unlocked on April 15, instead of the originally planned 1.34 billion tokens;

The release will be changed to linear unlocking, with a rate of 64 million tokens per month until March 15, 2025;

Thereafter, it will be changed to 127 million tokens per month for the next 24 months until March 15, 2027.

According to the new unlock plan, the 580 million tokens held by early contributors and investors will be unlocked by the end of 2024, instead of the previous plan of 2 billion tokens.

By the end of 2025, an additional 1.4 billion tokens will gradually be unlocked, followed by another 1.5 billion tokens by the end of 2026, and 380 million tokens will be unlocked by March 15, 2027.

The updated token unlocking schedule for the next year is shown in the following graph:

Data Comparison

Based on the TVL data from L2 Beat and the market value data from CoinGecko, the top ten L2 data is as follows. Starknet's TVL skyrocketed to fourth place (including the market value of STRK), but the circulating market value remains high as well. Calculated based on circulating market value ÷ TVL, it falls into the high valuation category. However, the official team has launched the Starknet DeFi Spring with token airdrops to stimulate interaction, and it may activate the ecosystem through various activities and token incentives.

Conclusion

The unlocking and modification of Starknet is quite significant, but it only eliminates the panic expectation of a large-scale sell-off in the future. The number of active projects in the Starknet ecosystem is still relatively low, and the fundamentals have not changed significantly. Combined with the current high circulating market value, the modification of the unlocking schedule mainly serves as a bottom-building function for the token price. Whether Starknet can successfully attract users and funds during the recent DeFi Spring activity still remains to be seen.