CoinShares Mining Report: The Bitcoin Cycle Code Hidden Behind the Halving

Original author: James Butterfill

Original compilation: Frank, Foresight News

Summary

Growth and sustainability issues: The Bitcoin mining network grew by 90% in 2023, raising questions about its environmental sustainability and profitability, especially the efficiency and energy costs of the mining network;

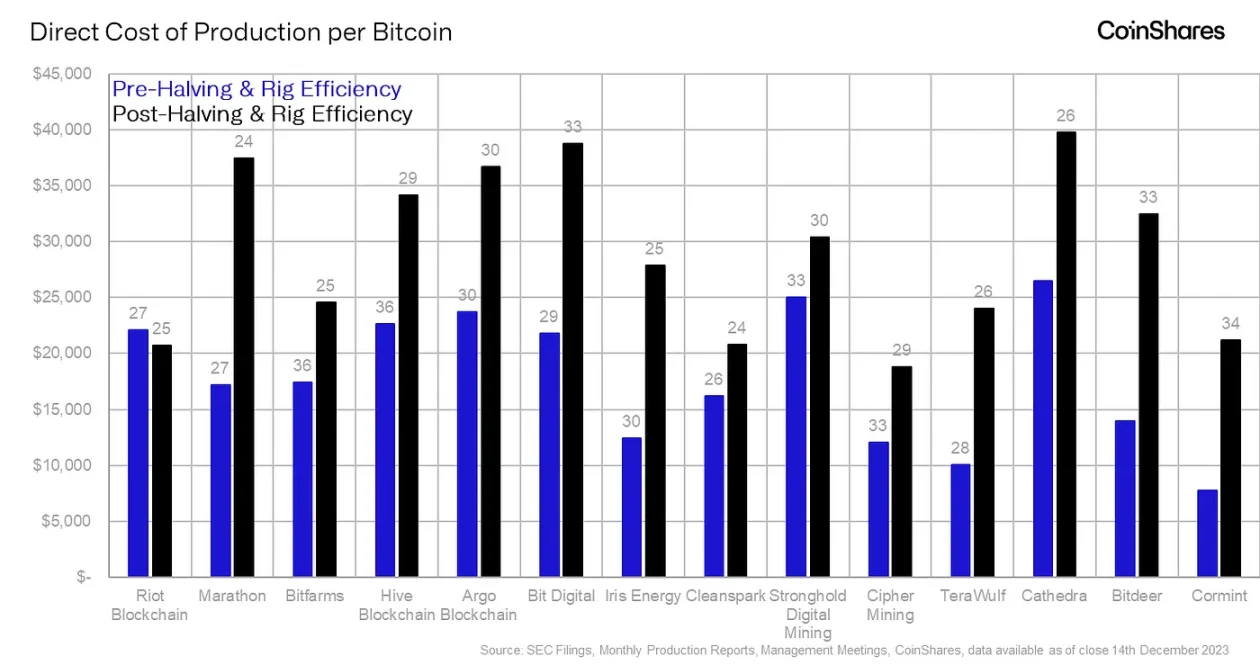

Dynamic changes in mining difficulty and computing power trends: The difficulty adjustment mechanism of Bitcoin mining ensures inelastic changes in the supply of BTC, which also leads to higher-cost miners likely to be trapped due to reduced immediate income after the halving. Dilemma, this article evaluates the average production cost of each BTC after the halving, and the results show that the average cost is $37,856;

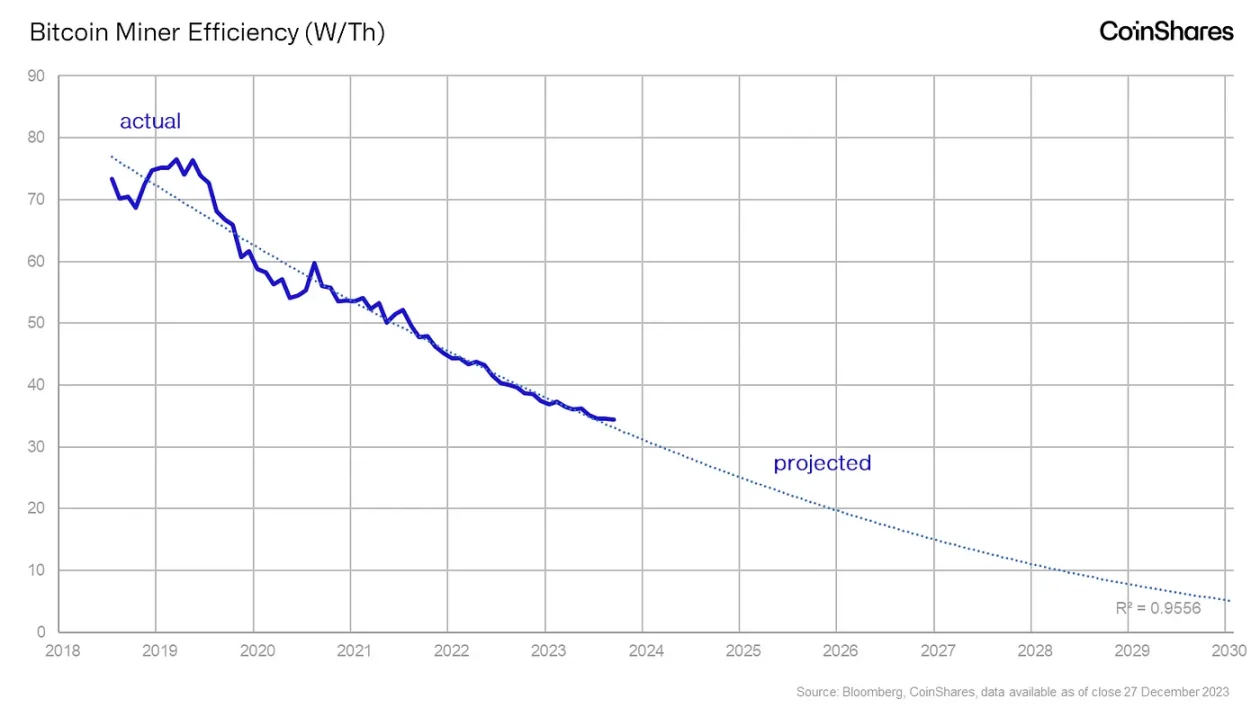

Mining network efficiency improvements: Despite the ever-increasing power demands of mining networks, efficiency has improved significantly. Using random number data helps analyze the efficiency of different mining models. The current average efficiency of the Bitcoin mining network is 34 W/T, which is expected to drop to 10 W/T by mid-2026;

Bitcoin mining and environmental impact: Bitcoin mining usually uses abandoned resources in remote areas. Daniel Batten said that currently about 53% of Bitcoin mining uses sustainable energy, so it can significantly reduce emissions caused by natural gas combustion. This is a major environmental issue;

Financial analysis of miners after the halving: After the halving in 2024, the production costs and profit structure of miners will change. The analysis of this article focuses on the different cost structures of listed mining companies and their vulnerability to the Bitcoin halving;

Conclusion and miner positioning: Most miners will face the challenge of high SGA costs and must reduce costs to remain profitable. Even if the Bitcoin price remains above $40,000, only a few mining companies are expected to be profitable;

Growth of Bitcoin Mining Network

The Bitcoin mining network has experienced rapid growth, with computing power increasing by 104% by 2023. This rapid expansion raises concerns about its sustainability, both from an environmental perspective and from the profitability of the mining network, both of which we aim to address in this article.

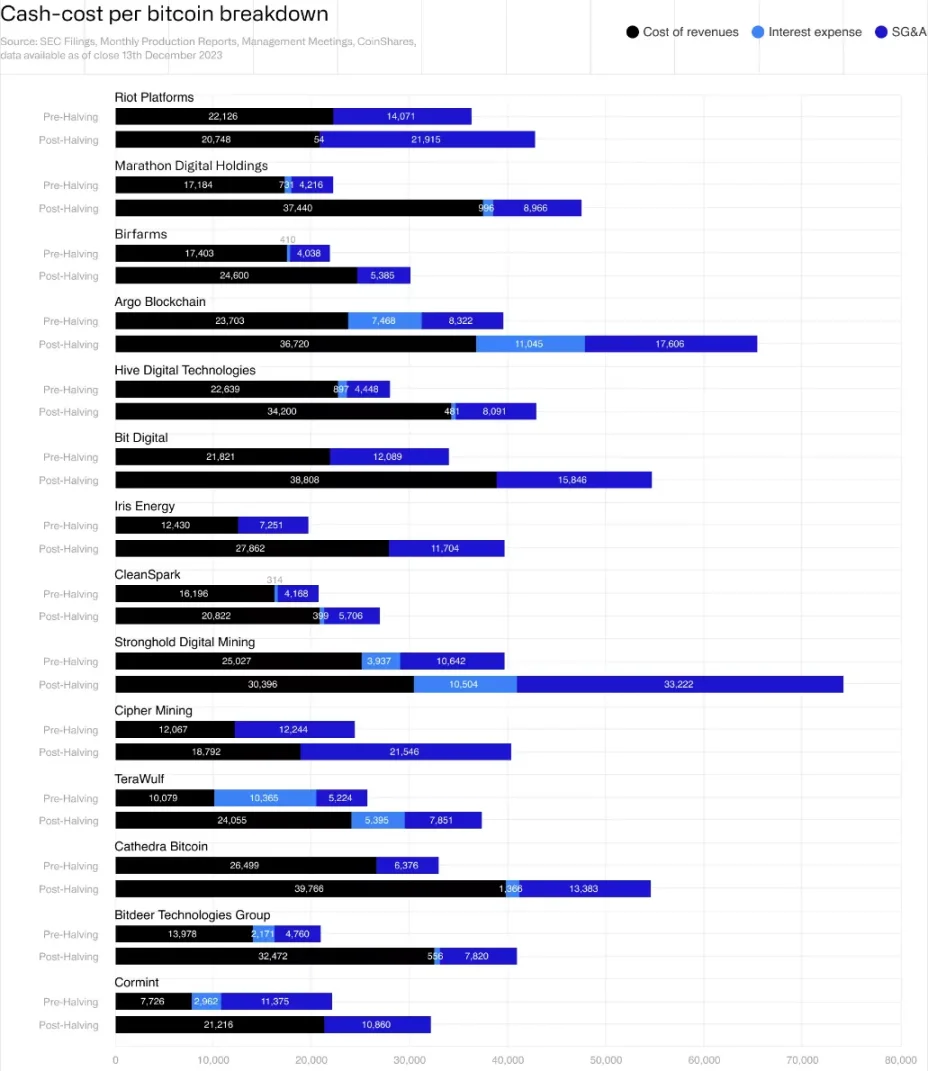

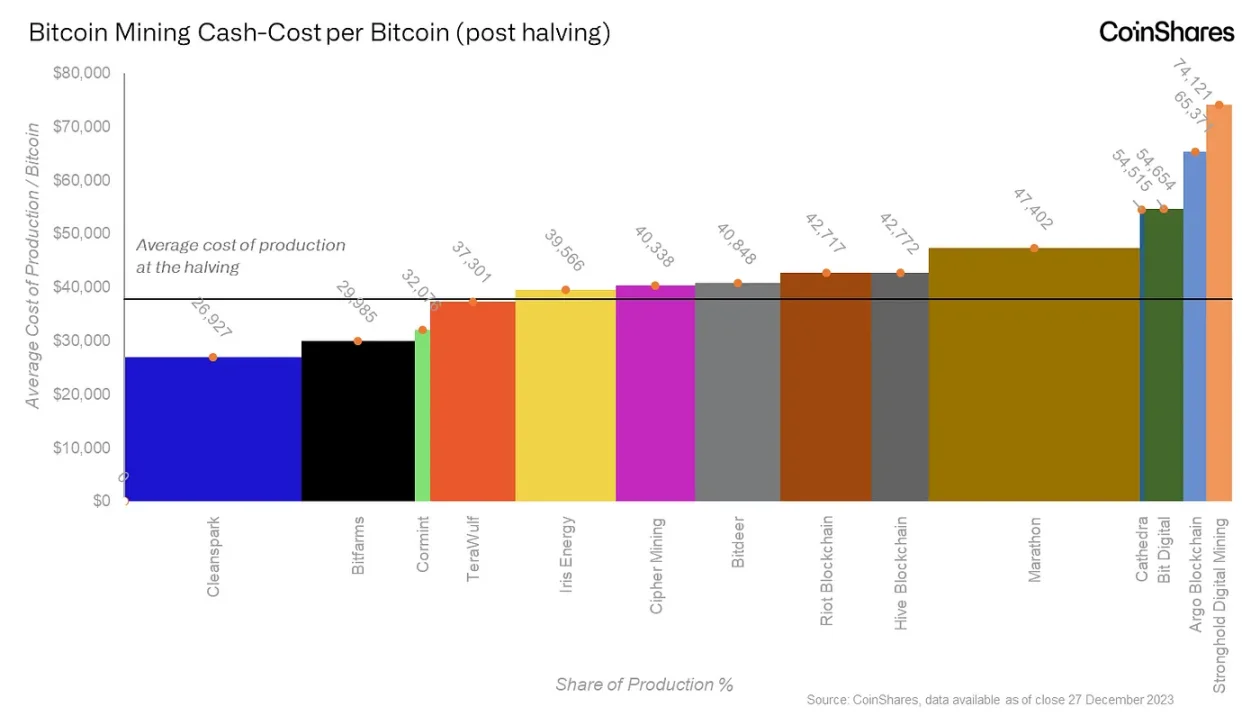

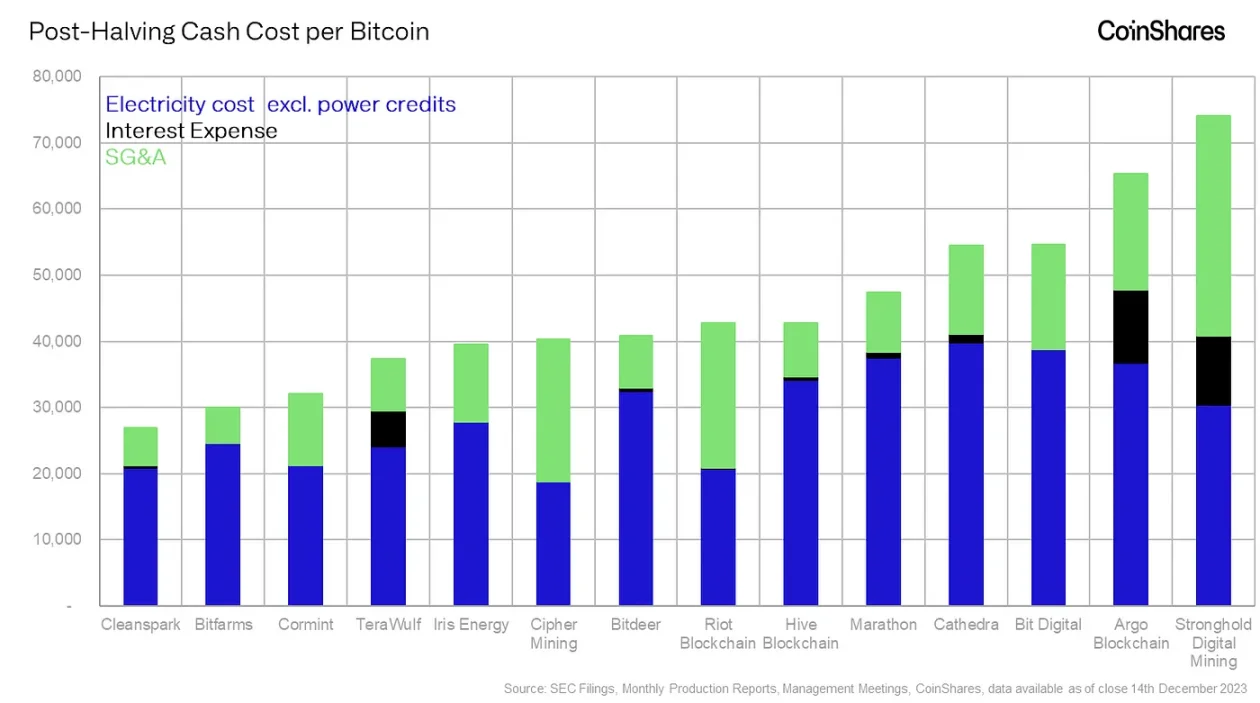

Our final post-halving average cost of Bitcoin production per miner is shown below, highlighting an average cost of production of $37,856.

While Bitcoin mining has some similarities to traditional mining, such as the consumption of energy to produce valuable assets, the similarities largely end there. A unique self-regulatory mechanism called difficulty adjustment in the Bitcoin mining process ensures that the BTC supply maintains strict inelastic changes:

At some point in the Bitcoin mining cycle, miners on the upper end of the cost curve will start to feel the impact and hashrate will start to decline - because the price increase is not enough to offset the increase in mining difficulty.

Whether there are 2 or 2 million miners in the network, the number of Bitcoins to be mined remains the same until the next scheduled halving event. This means that if the networks collective computing power increases significantly, the mining difficulty will be adjusted upward to keep the BTC production rate stable, thereby squeezing higher-cost miners out of the market.

Our analysis therefore focuses on the different cost structures of listed miners and those most vulnerable to the latest halving in April 2024.

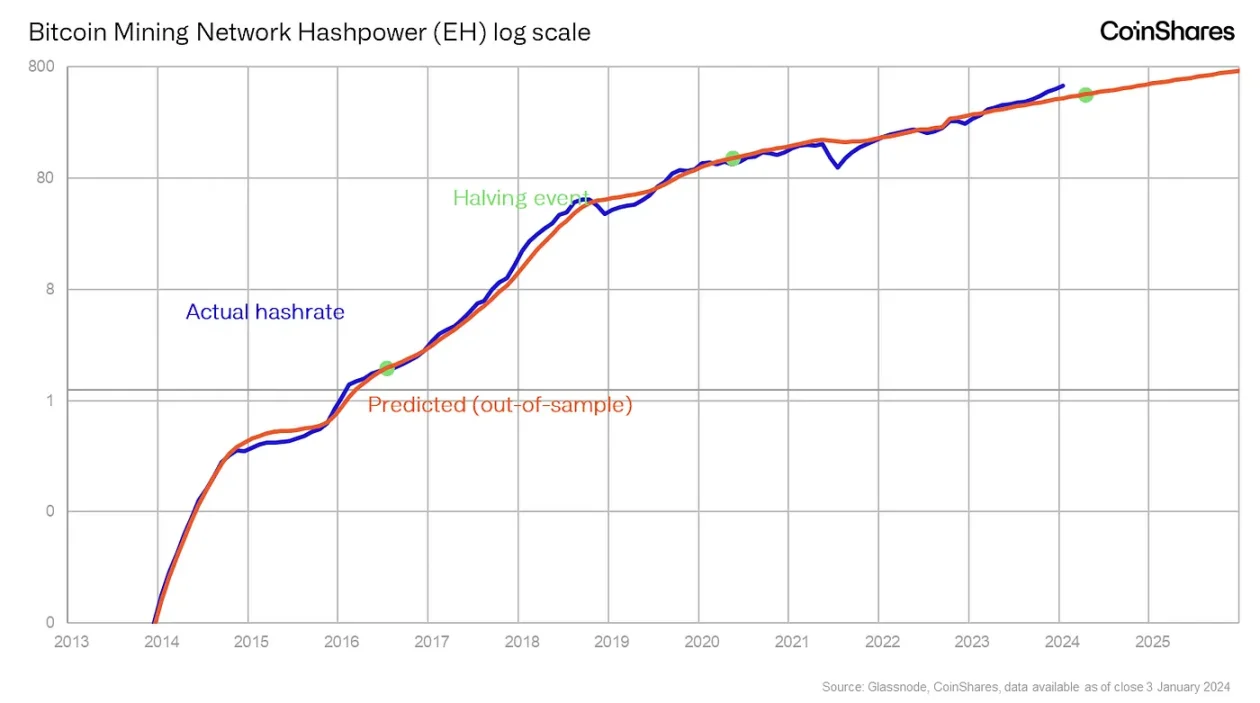

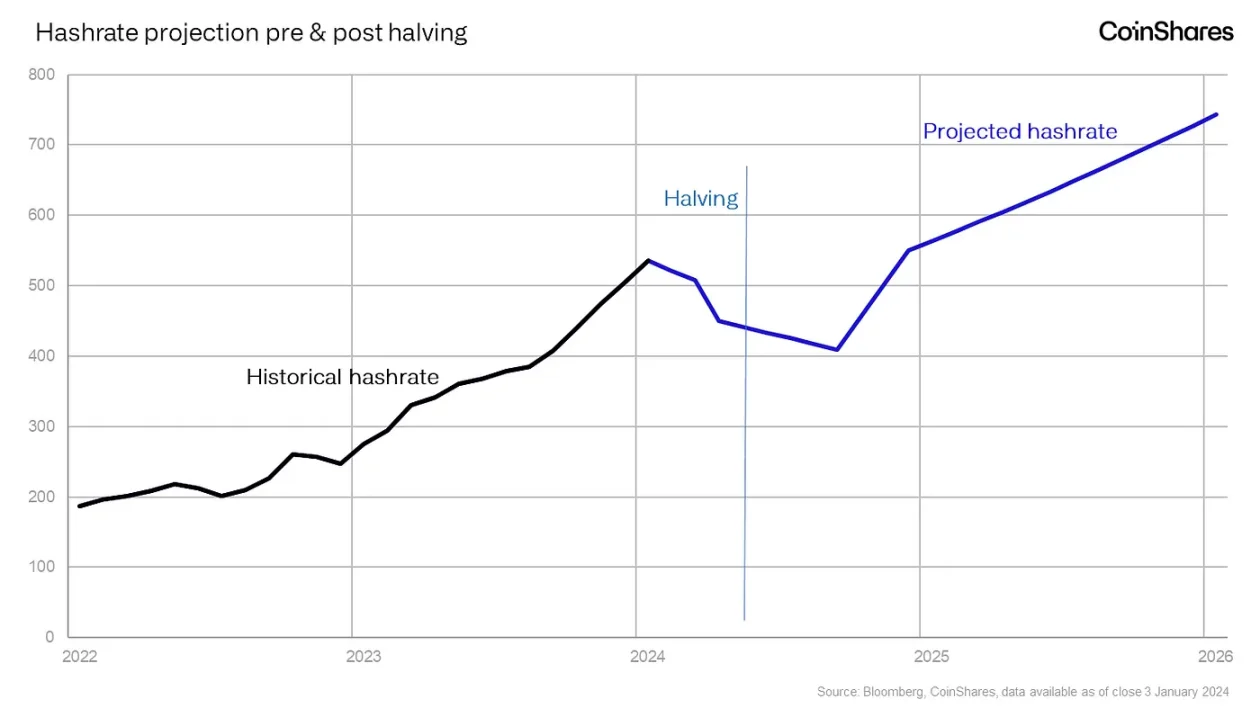

To predict where computing power will grow in the future, our best approach is to analyze historical patterns. Qualitative reasoning suggests that hash rate growth will be driven in part by Bitcoin’s price: a positive price outlook may encourage miners to increase hash rate, seeing it as profitable, but be aware that this depends on assumptions about future prices.

A review of historical data shows that mining activity did increase during the halving event. However, because of its exponential growth, it is challenging to identify a clear cycle. We have done some work on this.Work. Since computing power tends to be an unstable number, using deviations from historical data trends will produce more accurate results than purely qualitative methods.

A key issue is that most trend lines contain future information, meaning that the trend lines we see today would have been different in the past, so the most reliable method is to calculate a trend line based on out-of-sample data that does not subject to future developments.

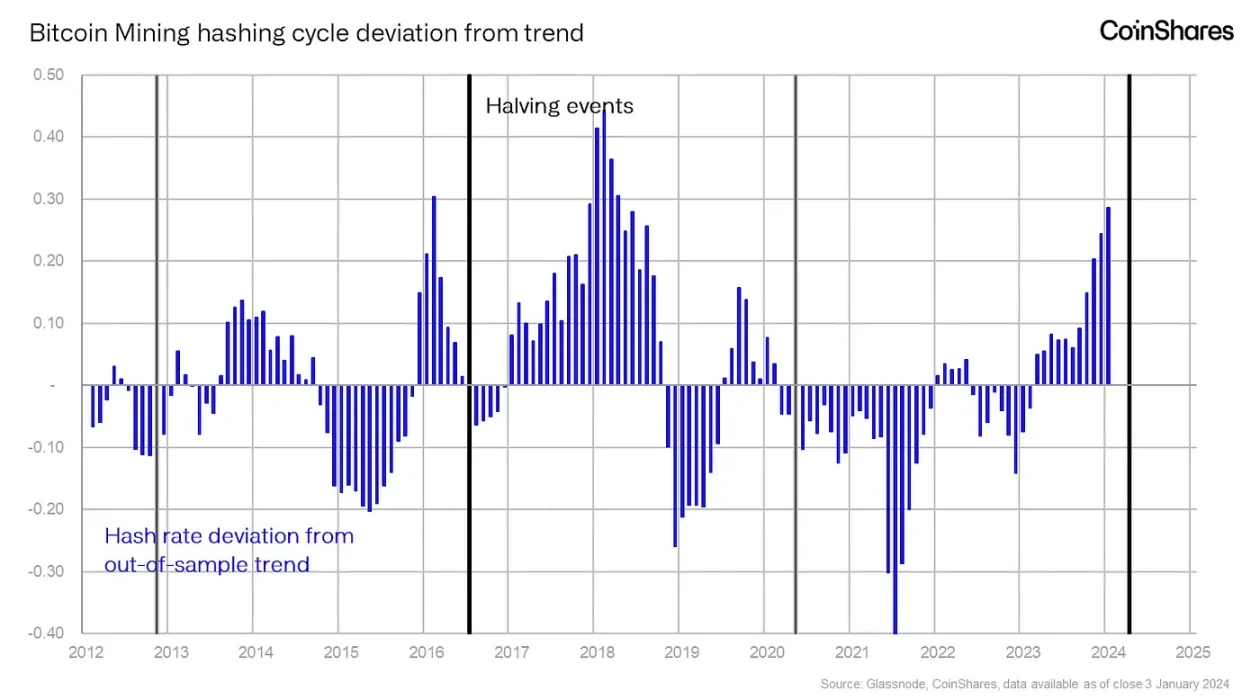

The data shows that an interesting regular pattern occurs between halving cycles, which indicates that from a historical perspective, the current peak of computing power is not uncommon at the corresponding event point of the cycle. The chart below shows this more clearly. The cyclical nature of this change.

Since the first Bitcoin halving in 2012, and the subsequent halvings in 2016 and 2020, a pattern has emerged whereby hashrate will typically drop approximately 9% below the trend line after the halving, which typically Lasts about six months. 2020 is somewhat special. Due to China’s mining ban, this period was greatly extended, resulting in a 42% drop below the trend line.

Still, this pattern typically involves an initial drop in hashrate, followed by a recovery midway through the cycle, followed by a surge in activity about a year before the next halving.

This cycle is logical: To remain competitive in anticipation of the halving, miners increased capital expenditures, pushing hashrate significantly above trend. After the halving, miners’ direct income decreased, affecting their capital expenditure cycle. The current cycle is no exception. It is worth noting that the peak of computing power growth usually occurs about four months before the halving, which may be due to the Bitcoin boom that caused the mining difficulty to soar, thus forcing miners and mining machines with higher production costs to exit. The current mining difficulty is at an all-time high and is consistent with the “relative” peaks observed in previous cycles.

What’s the future of Bitcoin’s computing power? Taking historical trends as a guide, we may expect that by the time of the halving in April 2024, the computing power will return to the trend line of around 450 EH/s. After six months, it may drop further to 410 EH/s. Thereafter, according to trend line predictions, the computing power will increase sharply to approximately 550 EH/s by the end of 2024.

This halving will likely eliminate miners at the upper end of the cost curve, giving those with ample liquidity the opportunity to purchase mining hardware at a discount. This scenario depends heavily on whether the price rises above the average cost of production per miner, and may require a significant price drop, or a significant drop in transaction fees, such as a drop in Ordinals usage.

Improve mining network efficiency

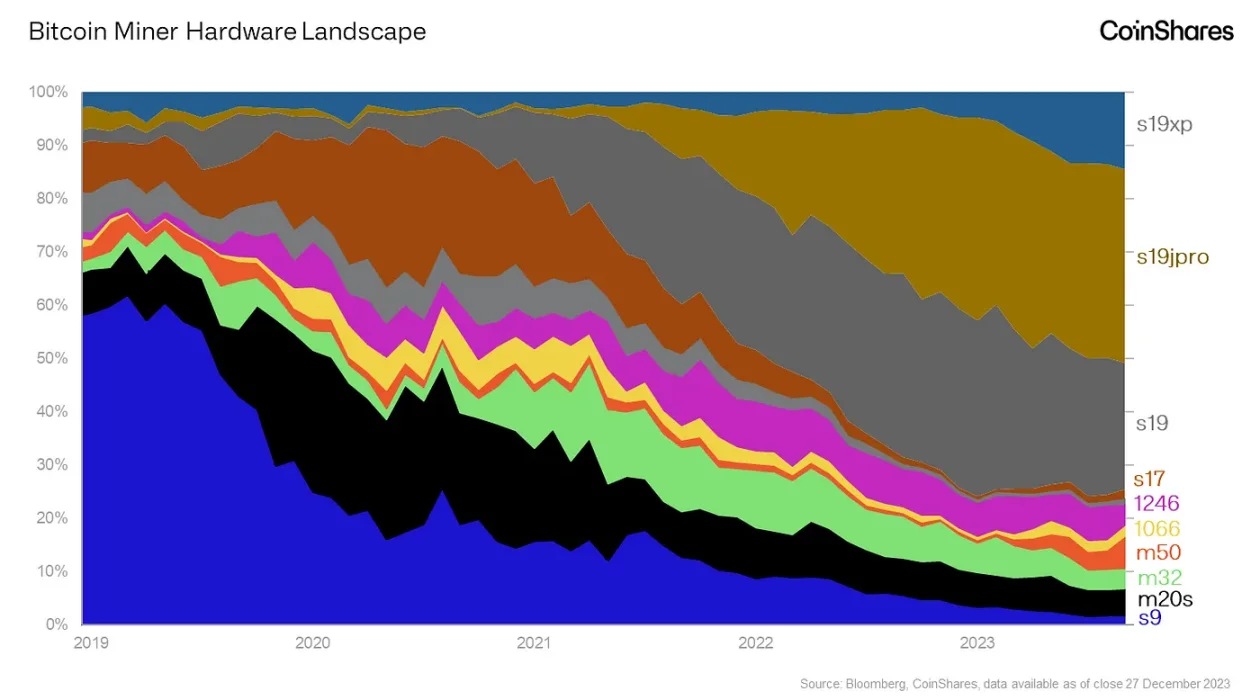

There is a wide variety of mining equipment currently used for Bitcoin, covering a range of power consumption levels, hashrate and resulting power consumption levels. Historically, this diversity has made it challenging to determine the overall efficiency of mining miners.

Karim Helmy of CoinMetrics has conducted some noteworthy research using random number data for hardware fingerprinting. To avoid getting too deep into the technical details, we found that each miner model leaves a unique “vapor trail” on the Bitcoin blockchain similar to the “vapor trail” left by an airplane at high altitude, and this unique signature can then be analyzed , to determine the distribution of different mining models in the network.

Since the efficiency of each mining model is measured in W/T, the overall efficiency of the entire Bitcoin mining network can be calculated. Given that this trend is relatively linear, future trends can also be predicted.

The current Bitcoin mining network has a weighted average efficiency of 34 W/T. The efficiency has increased by 8% in 2023 alone. In the past 3 years, the overall efficiency has increased by 28%.

According to these trend predictions, the overall efficiency level of the Bitcoin mining network may drop to around 10 W/T by mid-2026 as chip designs continue to improve and more efficient mining hardware comes into use.

Bitcoin mining always pursues the cheapest energy, which leads miners to often use discarded electricity - that is, electricity that cannot be easily sold to the existing grid.

Often this involves renewable energy projects located in remote areas, so more and more Bitcoin mining is being powered by sustainable energy sources. According to estimates by Daniel Batten, about 53% of the electricity consumption currently used for Bitcoin mining is sustainable energy. This proportion has exceeded the financial industry. As Daniel Batten pointed out, it is estimated that only about 53% of the electricity consumption in the financial industry is 40% from sustainable energy sources.

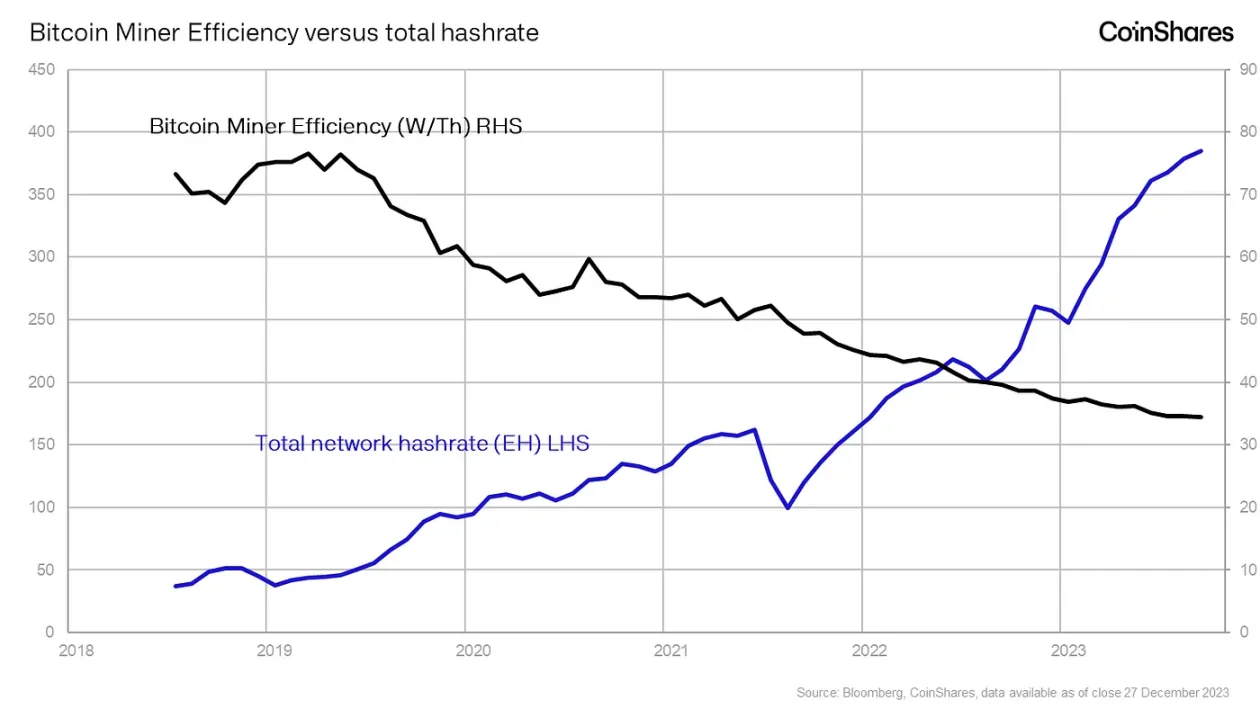

While computing power has risen significantly recently, in stark contrast, network efficiency continues to improve.

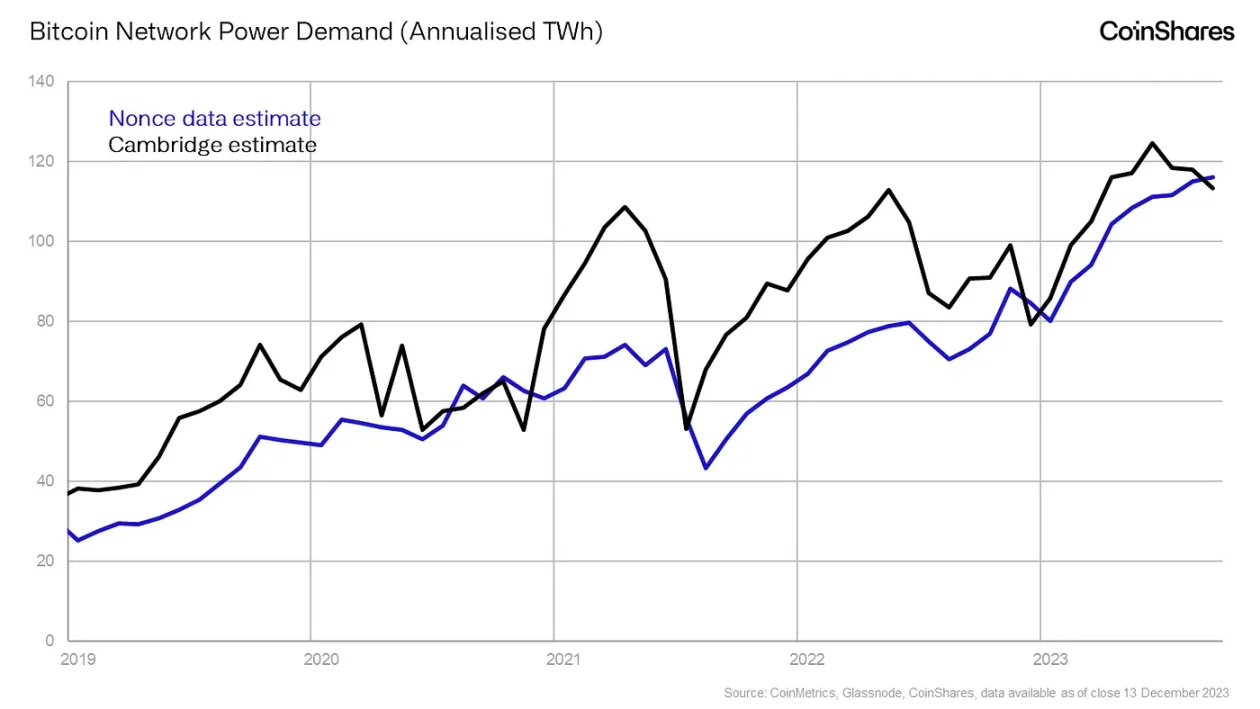

The new level of detail in CoinMetrics nonce data means we can estimate annual electricity costs that are comparable toUniversity of Cambridge estimatesvery close.

The data emphasizes that despite the significant improvement in the mining efficiency of the entire Bitcoin network, the power demand of the mining network has reached a record high of 115 TWh on an annual basis, which will increase by 44% in 2023. However, due to increasing mining efficiency, this increase in power demand has been considered relatively modest compared to the increase in computing power.

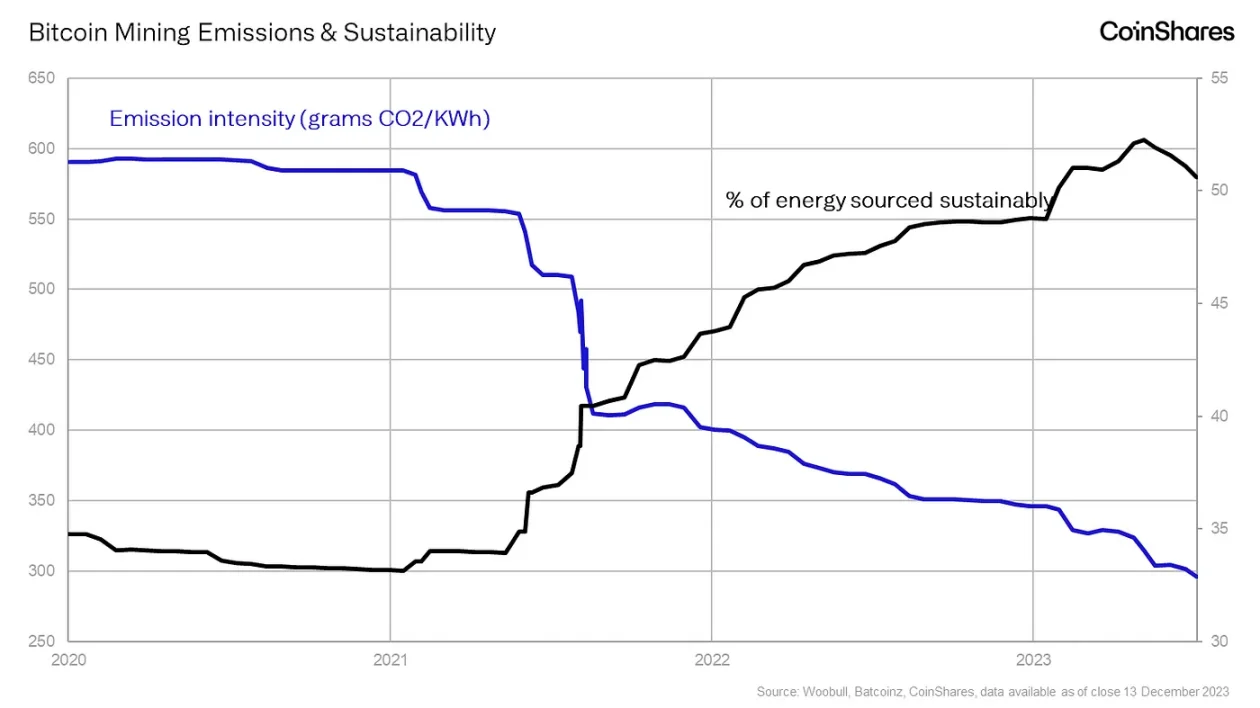

Daniel Batten’s research on the emissions intensity of the mining industry shows that CO2 emissions have indeed fallen significantly, although some of the data sources used are difficult to track:

Since 2021, the mining industry’s CO2 emissions have dropped from nearly 600 grams of CO2 per kWh to just 299 grams of CO2 per kWh. This decrease can be attributed to a significant increase in sustainable energy use - from 33% in 2021 to 52% today.

The Texas grid fuel mix reflects this to some extent - Bitcoin mining activity accounts for a large proportion, and IEEFA data shows that renewable energy has grown from 20% of total energy production in 2017. 31% in 2023.

Bitcoin helps reduce carbon emissions

As a recent BBC report highlighted, gas flaring is becoming a growing problem. The report draws attention to the fact that oil drilling in the Gulf and the associated practice of burning excess natural gas poses a greater threat to millions of people than before.

Mesa Solutions said that although incineration has a lower impact on the environment relative to emissions - as it can reduce carbon dioxide equivalent emissions by 92% - its widespread use is still a concern. Images provided by SkyTruth vividly illustrate the extent of this global problem, with yellow dots clearly marking areas of burning activity.

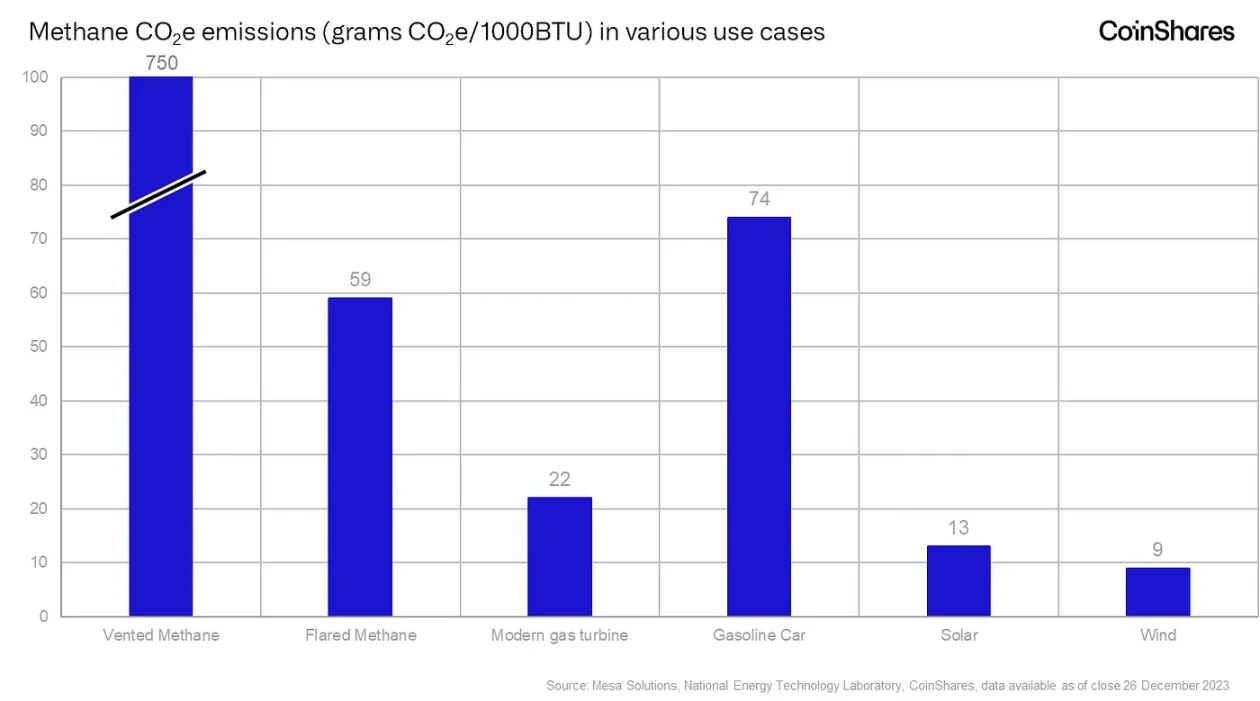

The World Bank estimates that approximately 139 billion cubic meters of natural gas will be incinerated globally in 2022, an amount equivalent to the total natural gas consumption in Central and South America combined. According to Mesa Solutions, current conventional methane combustion emits 59 grams of carbon dioxide equivalent (CO 2 e) per 1,000 BTU.

By comparison, using a modern turbine generator emits only 22 grams of CO2e per 1,000 BTU, which represents a 63% reduction in emissions, making it three times less polluting than a gasoline car.

The main challenge with waste gas being incinerated is that the energy involved cannot be stored or transported economically and is therefore often incinerated. This often occurs in remote areas without access to the grid or pipelines. We believe that Bitcoin mining can greatly Reduce emissions from incineration. This is because the mining hardware, as well as the necessary generators, can be housed in shipping containers and run in these remote locations, far from established power grids.

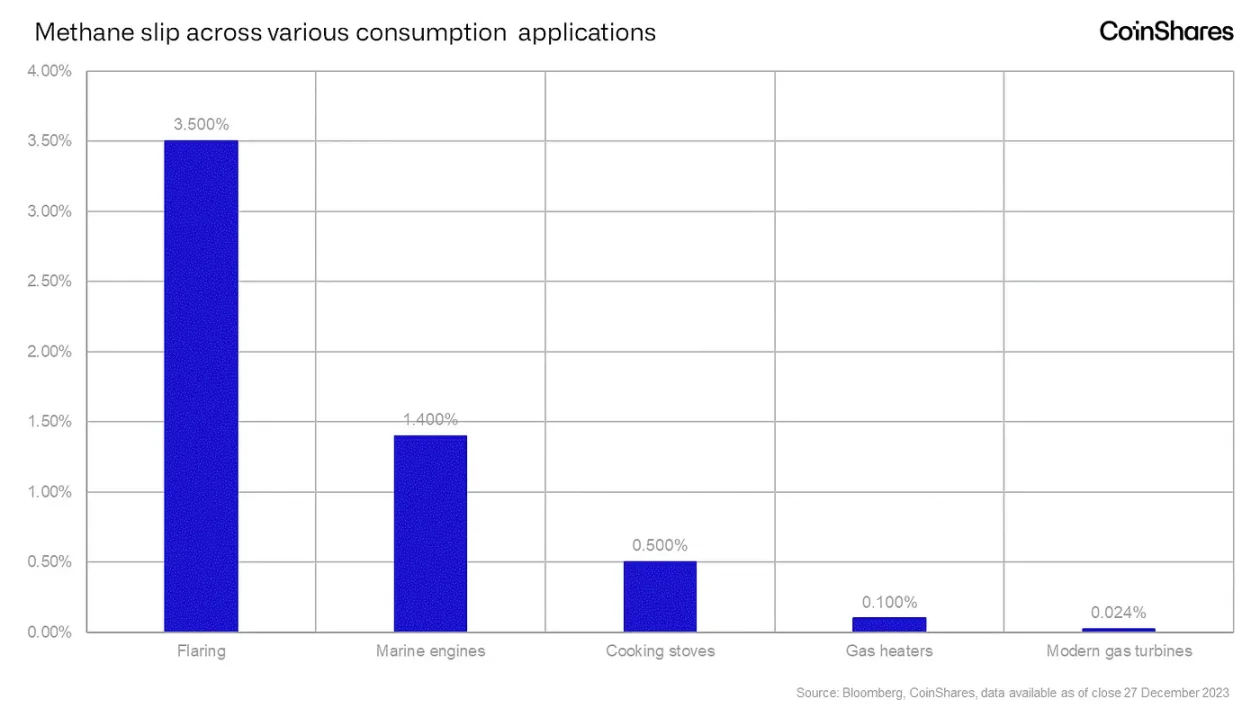

In addition, incineration often results in a higher incidence of methane leaks, which occurs when a small portion of the natural gas fails to burn completely and thus escapes into the atmosphere, which is especially common in windy conditions. In contrast, turbines are known to have one of the lowest methane leak rates, significantly reducing the risk of such an event.

Currently, natural gas incineration emits approximately 406 million tons of carbon dioxide per year, however if all natural gas currently incinerated was used for Bitcoin mining, these emissions could be reduced to approximately 152 million tons of carbon dioxide. Since global waste incineration currently accounts for 1.1% of global carbon dioxide emissions, Bitcoin mining can reduce global waste incineration emissions to only 0.41% of global emissions.

As of now, only about 120 MW of Bitcoin mining capacity is known to be utilizing discarded natural gas energy, so if Bitcoin mining expands its use of this wasted exhaust gas, it has the potential to significantly reduce global CO2 emissions huge potential.

The impact of halving on Bitcoin miners

In this research article, we estimate the weighted average of Bitcoin production costs and cash costs in Q3 2023 – approximately $16,800 and $25,000 per Bitcoin, respectively.

It is expected that after the halving event in April 2024, these costs are likely to drop to $27,900 and $37,800 respectively. Due to its efficient cost structure and long-term growth plans, Riot looks to be the mining company best equipped to handle these changes. We analyzed the financial statements of listed and private mining companies, and assumed a Bitcoin price of $40,000. We found that the upcoming difficulties for most mining companies may stem from bloated sales, general and administrative expenses (SGA) costs.

methodology

We adopted an adjusted consolidated income statement approach to our financial analysis for the third quarter of 2023. The standardized approach applies to the mining operations of 14 miners, 13 of which are publicly listed entities, which together account for 19% of all Bitcoin mining power as of December 2023. After the halving (the network hashrate is 450 EH/s) accounts for about 25%.

Our data for the third quarter of 2023 mainly comes from SEC filings, website production reports or estimates when necessary.

Our approach includes:

Revenue cost represents self-mining revenue cost, mainly electricity cost;

SGA eliminates non-cash expenses such as stock-based compensation, one-time payments;

Interest expense only considers interest on debt and does not include lease fees or other finance charges;

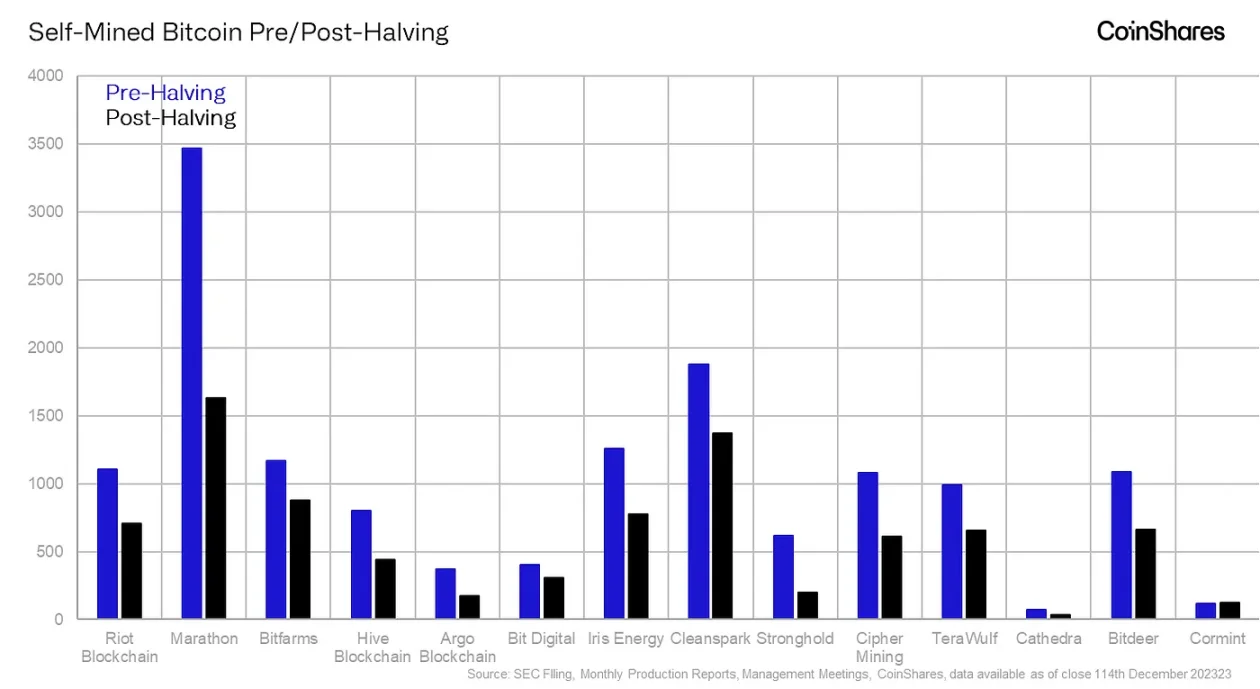

After the halving event, the direct costs to reach the production and operating breakeven points changed dramatically, reaching US$27,900 and US$37,800 respectively. This change stems from the impact of the block reward halving. Our approach to forecasting revenue and expenses is as follows:

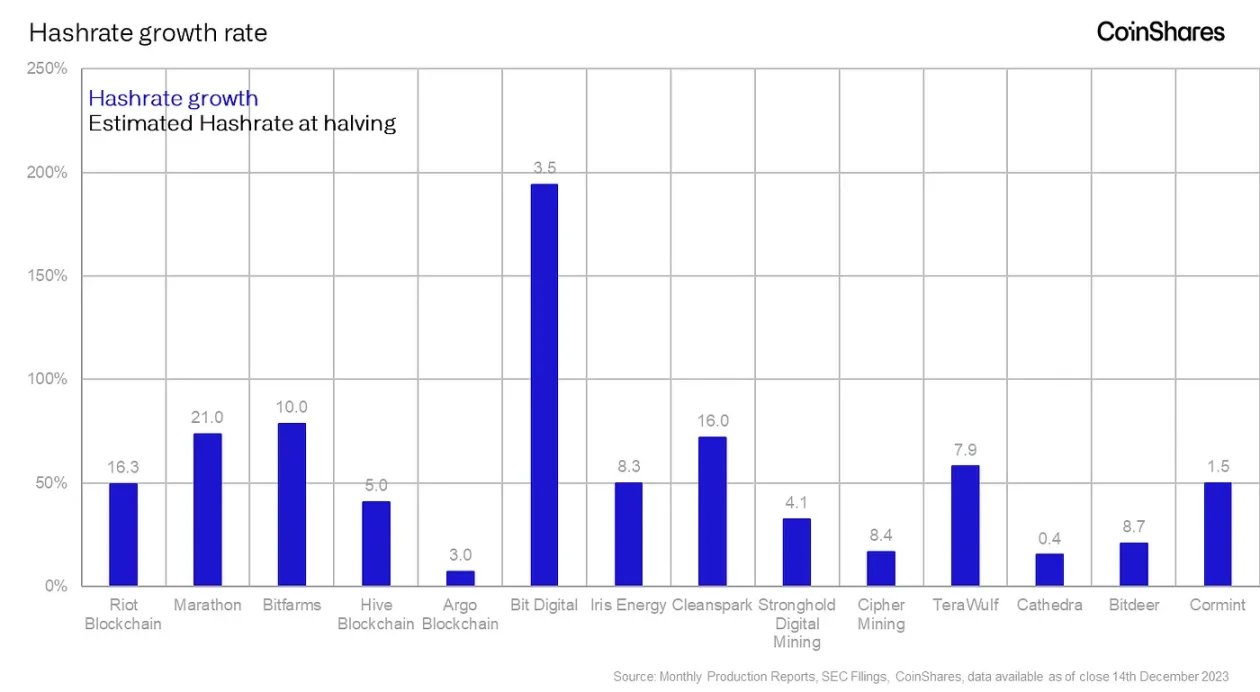

The computing power market share is determined by the pre-computing power disclosed by each company, expressed as a percentage of our estimated computing power at the halving of 450 EH/s, which is a decrease of approximately 10% compared to 500 EH/s;

Production costs are calculated using a bottom-up approach, including mining hardware efficiency, electricity costs, kilowatt-hours used (using flat Q3 2023 utilization) and number of Bitcoins mined;

Assume SGA expenses remain consistent with Q3 2023, as company expenses are not expected to change materially due to the halving;

Interest expense is determined as the sum of the outstanding principal multiplied by the regular interest rate;

Our comprehensive methodology ensures standardized and comparable financial analysis before and after the halving to effectively guide our operational decisions;

Miner computing power

On average every ten minutes, the Bitcoin network generates a block by a miner correctly calculating (guessing) a hash (a pseudo-random 64-bit alphanumeric value), while the rest of the networks miners verify its correctness. Miners with more computing power (more mining machines, resulting in more computing power) control a greater proportion of the networks computing power and therefore have a greater chance of generating a block and receiving the block reward (currently 6.25 BTC , but due to the halving, it will be halved to 3.125 BTC around April 2024) plus transaction fees.

Miners are essentially in an arms race to buy and add as many machines as possible.

The more mining machines a miner uses for self-mining, the larger the data center required (in the megawatt range). Most of this huge capital expenditure is funded by cash, equity or debt, the latter of which can hurt miners total production costs through higher interest payments and put miners at risk during periods of low Bitcoin prices.

For example, Core Scientific went into bankruptcy at the end of 2022 and Mawson failed to pay its Marshall loan, according to filings for the third quarter of 2023. These examples are not isolated.

Bitcoin production

The number of Bitcoins produced is integral to each miner’s unit economics and cost structure. For miners to achieve the same Bitcoin output as before the halving, they need to double their share of computing power, which is very challenging considering that the network’s computing power has grown at a CAGR of about 53% over the past three years. , or the increase in the amount of fees charged per block is needed to fully compensate for the decrease in block rewards caused by the halving.

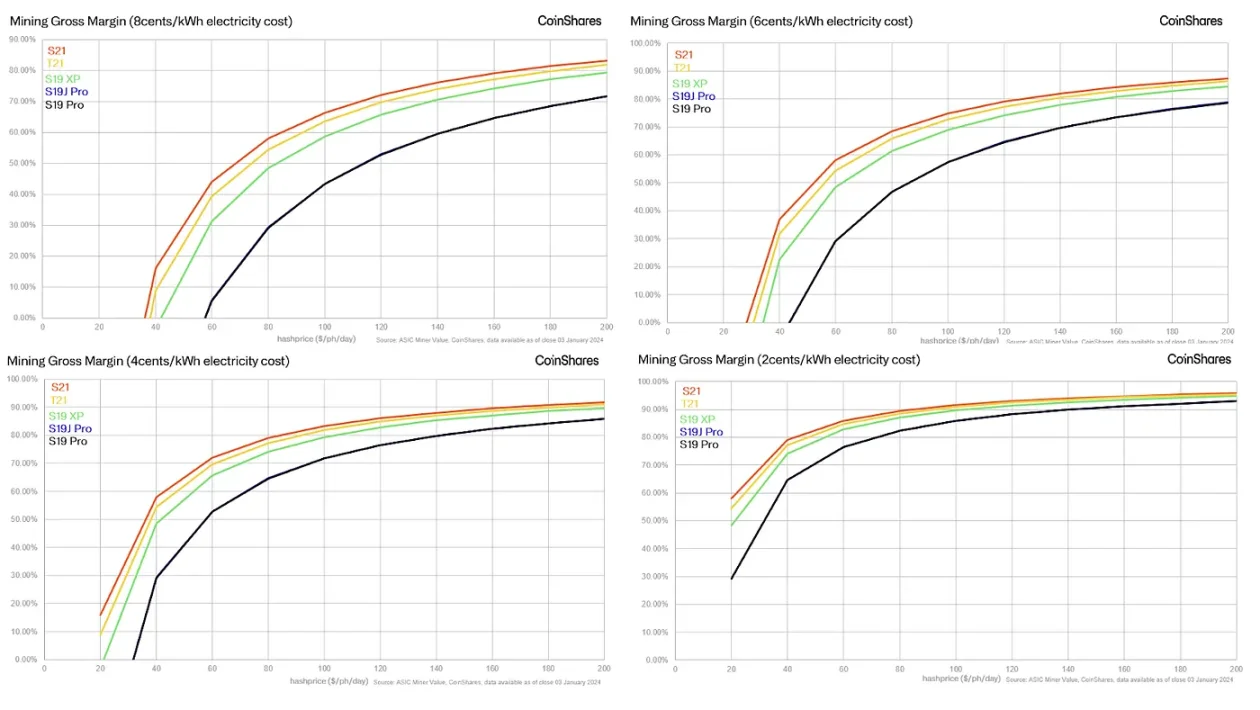

Electricity bill

The cost structure of a Bitcoin miner is a function of two inputs: energy and equipment. The listed companies we track consume an average of 4.5 cents per kilowatt hour of energy. This energy is purchased on the wholesale market, most likely in the spot or futures market, or negotiated with an energy supplier through a power purchase agreement (PPA) contract, which typically provides a fixed price for the energy but often also involves Pay or Not Negotiate clause (Foresight News notes that the electricity purchaser promises to purchase and pay the electricity bill in accordance with the annual minimum amount of electricity agreed in the PPA agreement, regardless of whether the electricity purchaser really needs it).

In contrast, miners have more control over their mining equipment fleets and are able to reduce energy bills by investing in more efficient machines, so that each mining machine consumes relatively less electricity per unit of computing power.

Among the listed miners we track, the efficiency of the entire mining fleet is also expected to drop from 29 W/T to 26 W/T at the halving. An example of how miners are upgrading their fleets of mining equipment to increase efficiency (i.e. reduce W/T) can be seen in the latest machine deals from CleanSpark and Iris Energy:

Among them, they each purchased 4.4 EH/s and 1.4 EH/s Bitmain Antminer S 21 mining machines, with an efficiency ratio of 17.5 W/T and a price of approximately US$14/TH.

The matrix below shows that although the T 21 is the newer model, the S 21 outperforms all other miner types in every electricity and hash rate price scenario due to higher hash rate (impacting revenue) and lower power consumption (affects cost).

The figure below shows the changes in mining machine efficiency before and after the halving. Note that while most miners are improving the efficiency (W/T) of their entire mining fleets, their direct cost structures are not improving. This is because miners, as mentioned earlier, need to increase their electricity consumption and energy consumption to mine the same amount of Bitcoins.

Before and after the halving, the weighted average cost of electricity per Bitcoin in the cash cost structure accounted for approximately 68% and 71% respectively, with the small increase mainly attributed to the slight increase in scale and energy prices.

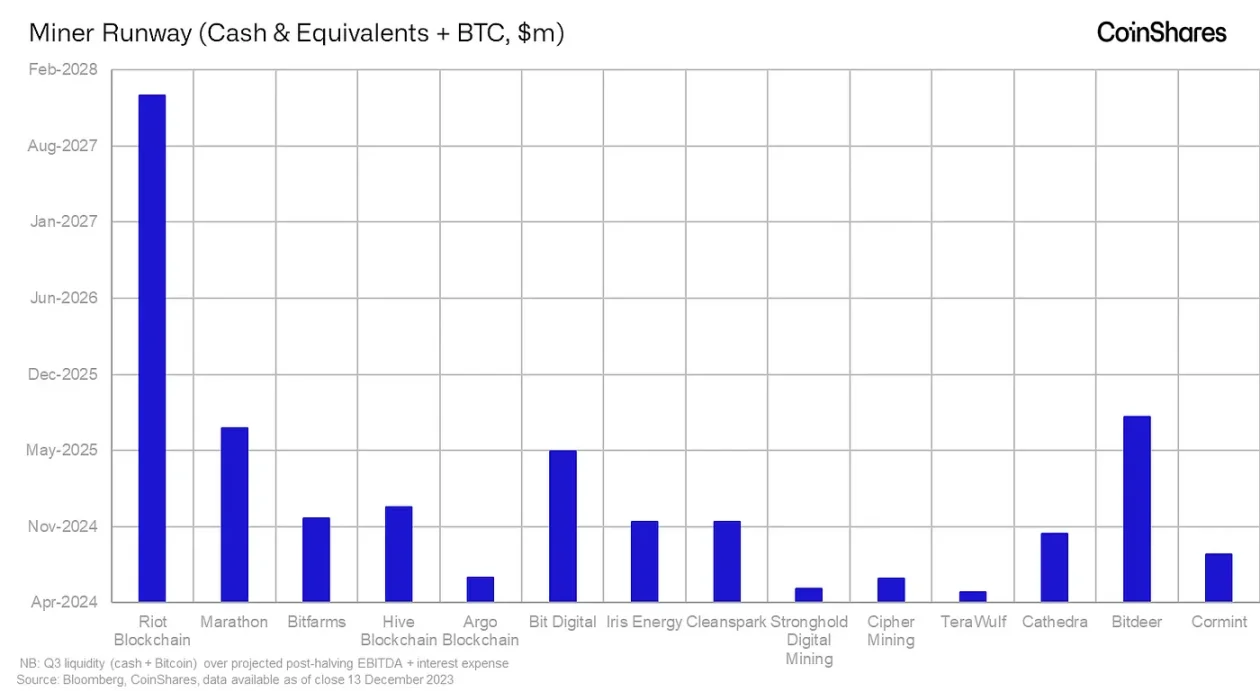

Miner life cycle

We define lifetime as the number of days a miner can repay cash operating expenses using cash and Bitcoin reserves. There is no standard money management strategy across the industry. Some people accumulate as much output as they can, also known as HODLing, while others dont and choose to sell their Bitcoins directly as they are mined.

Mining companies with sufficient capital and large Bitcoin balances, such as Riot, may receive higher premiums in a bull market. However, the combination of a low life cycle and high cash costs puts miners such as Stronghold at risk of a downturn in Bitcoin prices.

cash production costs

Based on the chart below, we believe Riot, TeraWulf, and Cleanspark are in the best position heading into the halving. One of the major issues facing mining companies is the huge SGA costs. For miners to break even, the halving may force them to cut sales and administrative expenses, otherwise they may continue to lose money and have to liquidate their HODL balances and other liquid assets.

Note: Iris Energy and Cormint data are based on Q2 2023 filings, management meetings and monthly production reports.

in conclusion

Our analysis shows that Riot appears to be best equipped to handle the complexities of the halving event, primarily due to its cost structure and long life cycle. Much of the pain miners will experience is likely to stem from huge sales and administrative expenses that may need to be cut to remain profitable.

Overall, unless Bitcoin prices remain above $40,000, we believe only Bitfarms, Iris, CleanSpark, TeraWulf, and Cormint can continue to be profitable. All other miners are likely to eat into share, ultimately forcing further share price dilution as they are likely to raise equity or convert debt.