OKX Ventures: Exploring the BTC Ecosystem in One Article

Bitcoin ecological data review

From a macro perspective, Bitcoin, as the cornerstone of Crypto, has formed a strong value consensus, including ETFs, halving and macro liquidity. On a micro level, the number of addresses and users on the Bitcoin chain is growing rapidly, and BTC Dominance remains stable.

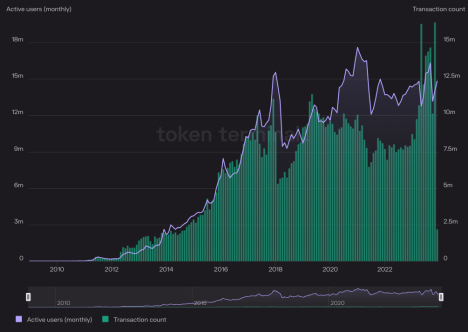

First, the cumulative number of Bitcoin addresses exceeded 1.2 billion.There are more than 420 million cryptoasset users worldwide, a number that has grown rapidly from 5 million users in 2016. According to tokenterminal, the number of monthly active users of Bitcoin is about 13.7m, and the number of on-chain transfers is 17.5m. Regarding the growth of on-chain data, Bitcoin’s blockchain size is approximately 507 GB, an increase of 70% from three years ago. These reflect the explosive growth in usage of crypto assets, especially Bitcoin.

https://studio.glassnode.com/metrics?a=BTC&m=addresses.Count

https://tokenterminal.com/terminal/projects/bitcoin

Secondly, Bitcoin Dominance continues to remain high;Still a cornerstone of the crypto market. Bitcoin accounts for 47% of the total market capitalization of crypto assets. While this ratio fluctuates with the rise of other crypto-assets, Bitcoin remains the market leader.

https://www.coingecko.com/en/global-charts

https://members.delphidigital.io/reports/the-year-ahead-for-markets-2024

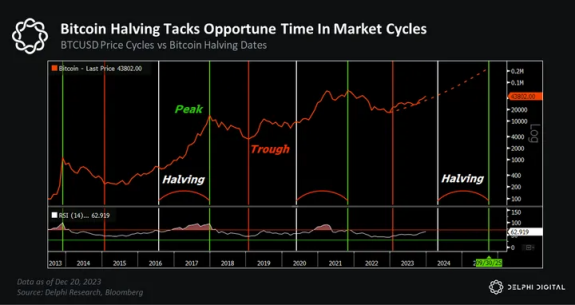

Third, the benefits of halving:When mining output is halved, the supply of new Bitcoins slows down, and if demand remains the same or increases, then prices should theoretically rise. Under this mechanism, halving is seen as a potential value catalyst.

Bitcoin’s YTD price has increased by more than 150% in 2023, and the market’s optimism for Bitcoin has begun to be reflected in the price. The upward trend towards the April 2024 halving may continue, or even accelerate.

Historically, Bitcoin has achieved an average return of over 400% in the 12 months following the previous two halvings. This provides a historical precedent for observing and predicting future movements and provides investors with a level of confidence.

Fourth, Bitcoin spot ETF:Making its volatility gradually more similar to traditional financial markets. Coupled with the support of financial institutions such as Blackrock, the Bitcoin Spot ETF is seen as an endorsement of Bitcoin. It can be expected to attract new capital that was previously wary of the crypto market. Some media previously believed that ETFs are expected to bring tens of billions of dollars in incremental funds to BTC in the next year.

Referring to gold ETFs, the first U.S. gold ETF, SPDR Gold Shares (GLD), launched in November 2004, accumulated more than $1 billion in assets in just three days. In its first year, GLDs assets under management (AUM) soared to more than $3 billion. Global gold ETF assets under management are approximately $150 billion as of 2023, demonstrating the profound long-term impact these investment vehicles have on the gold market.

In addition, macro-level liquidity changes, such as changes in the Federal Reserves balance sheet and changes in the U.S. Treasury market, are potential benefits for the crypto market in 2024. Federal Reserve (Fed) liquidity support may be the main force driving Bitcoin in 2024, as well as the entire crypto asset market.

Technological innovation of the BTC ecosystem and the development trend of the second layer

Technological innovations worthy of more attention in the coming year

1. Asset issuance protocols may lead to innovation:

Ordinals: Use sats, the smallest unit of Bitcoin, to create unique NFTs; currently, the market’s top inscription has generated a certain consensus; there are risks of network congestion and centralization.

RGB: Extends Colored Coin and Lightning Network, optimizing privacy and scalability.

Taproot Assets: Based on the Taproot protocol activated in 2021, it improves the privacy and efficiency of smart contracts; combined with the Lightning Network, it improves the process and speed of asset issuance and transfer.

2. BitVM: Turing-complete virtual machine:

Concept: Realize complex smart contract verification without changing the Bitcoin consensus; the working principle is off-chain calculation and on-chain verification.

Advantages: Enhanced programmability without changing Bitcoin core rules; reduced data burden on the chain; increased fraud protection.

Limitations: Only supports two-party contracts; the theoretical practicality needs to be tested, and implementation may face performance and cost challenges.

Resurrection of OP_CAT: A potential restoration of this opcode could provide additional adaptability and efficiency to BitVM.

3. Development of Bitcoin Contracts (Covenants):

Core value: Allowing additional conditional restrictions when creating UTXO, the diversity and security of smart contracts.

Development and evolution:

Early proposals: Various proposals such as OP_CHECKOUTPUTVERIFY and OP_CHECKSIGFROMSTACK seek to improve Bitcoin smart contract capabilities.

Latest developments: OP_TXHASH and OP_CHECKTXHASHVERIFY improve script access to Segwit data, andFlexibility and decentralization of Layer 2 solutions.

Overall, BTC’s technological innovation is focusing on improving the feasibility of asset issuance standards, privacy, and the complexity and security of smart contracts. These innovations present a range of exciting possibilities for the future of Bitcoin, and with the efforts of the community and developers, the richness of the BTC ecosystem is expected to continue to grow.

Layer 2 innovation includes Rollup and sidechains

Layer 2 solutions include side chains, Plasma, Rollup, etc. The difference between Rollup and side chains is that Rollup cannot run when the main network fails (consensus is formed on the main network), while side chains can still run independently when the main network fails. (There is independent consensus).

Rollup is divided into two options: letting the main network verify and letting the main network witness:

No verification only witness:Only stores and aggregates DAS. For example, Celestia-like solutions generate DAS details and store them in their own sovereignty layer to ensure security, or aggregate DAS and store them in taproot (because the cost of storing detailed DAS is too high);

Verified by ZKP:Fraud proof scheme based on ZKP. For example, B^2 converts the ZKP verification program into an arithmetic circuit. The addition gate and multiplication gate are implemented using NAND gates. The arithmetic circuit is converted into a logic gate circuit as a whole, and is implemented with bitcoin script. Finally, Circuit Taproot is formed, and the taproot commitment is placed in Compared with bitVM, the circuit of the main chain is deterministic and can simplify the design. Its Rollup transaction details and proof data are stored using a variety of decentralized storage protocols, and the rollup can continue to run after it stops running.

Side chain projects have independent solution preferences. The impossible triangle is security, speed and decentralization:

Stacks - Proof of Transfer (PoX):Stacks miners validate transactions by bidding on Bitcoin to become the producer of the next block, and by generating the block and validating it, sending the hashed block header of the completed block in the message field of the Bitcoin transaction, and then It is permanently recorded on the main Bitcoin blockchain;

RSK: Rootstock (RSK) uses the same SHA-256 algorithm as Bitcoin and is connected to Bitcoin through a two-way bridge. Bitcoin miners can perform Merged Mining when mining. , no additional resource consumption is required, and at the same time, transaction fee income in Rootstock can be obtained;

Drivechain: A Bitcoin open sidechain protocol that can customize different sidechains according to different needs. Its design comes from two Bitcoin improvement proposals, BIP 300 Hashrate Escrows which compresses 3-6 months of transaction data into 32 bytes through Container UTXOs, and BIP 301 Joint Blind Mining ” (Blind Merged Mining) Like RSK, the security of the network is also maintained by existing Bitcoin miners through joint mining;

Layer 2 evaluation criteria: To what extent the security of the main network is reused

There are two reuse methods:

1. Reuse the consensus of the main network and reuse POW:That is, if you adopt the da and consensus of the main network, you need to evaluate how to use one layer; zk solutions such as Bitmap and B^2 all adopt the solution of aggregating zkproof and storing it on the main network, and the confirmation of the commitment can be completed through a similar Optimistic Rollup challenge mechanism;

Here, we believe that the mainstream in the short term isMainnet “witness” data plan, but optimistic about the long-termMainnet “verification” data plan, the fraud proof of optimistic rollup may be a better solution:After off-chain ZKP verification, write the inscription and store it in the BTC network. The ZKP verification program generates a logic gate commitment, and the commitment is written into the Bitcoin network as Taproot. The on-chain confirmation of Bitcoin is carried out through fraud proof, which can inherit the security and efficiency of BTC at the same time. Orthodoxy;

Currently, projects such as B^2 are working in this direction. nodes + some Bitcoins jointly serve as the DA layer, responsible for the validity and data availability of ZK-Rollup tx; the BTC main network serves as the settlement layer, responsible for transaction finality.

2. Reuse main network liquidity and reuse POS:For example, Babylon has fully punishable security, pledger security and pledge liquidity; for example, wbtc bridges BTC to ETH and Solana, so ETH and Solana can be understood as BTC side chains, and stacks and Bevm adopt similar solutions;

Here, we are optimistic about Babylon, which uses the security of the Bitcoin native chain while bringing additional trust and capital to the PoS chain. This cross-chain staking structure helps create a new economic model in which PoS chains can strengthen their own security through the market capitalization of Bitcoin, and Bitcoin holders can support the security of the PoS chain. Get potential benefits. This mechanism also increases the usability of Bitcoin and may incentivize more people to participate in the Bitcoin ecosystem.

OKX is committed to building the BTC ecosystem

OKX Ventures invests in supporting the innovation of BTC ecological projects

B^ 2 Network

Project Introduction

The B^2 network is a second-layer (Layer-2) solution on Bitcoin. Combined with ZKPs BTC rollup, the aggregated storage and ZKP can be written into BTC inscription to achieve a BTC layer with higher legitimacy and availability. 2 .

It runs the first ZK Proof Commitment Rollup based on ZK-proof technology. Utilizing rollup technology and supporting Turing complete smart contracts, off-chain transactions can be executed and costs reduced. In Bitcoins transaction confirmation, zero-knowledge proof technology, gate commitment and Taproots challenge response are combined to ensure the privacy and security of the transaction.

The purpose of the network is to transform Bitcoin into a versatile platform, laying the foundation for applications such as DeFi, NFTs, and other decentralized systems.

Project Benefits

Security and decentralization: Based on Bitcoin, all B^2 rollup transactions can be recovered. Through zero-knowledge proof commitment and challenge-response, two-way confirmation is achieved on Bitcoin, not just one-way data writing.

Seamless development and access: EVM compatibility allows developers to quickly migrate from other EVM-compatible chains to the B^2 network and simplify the development of DApps. By implementing account abstraction, Bitcoin address accounts, Ethereum address accounts and email accounts are supported, allowing Bitcoin users to interact across the B^2 chain without changing wallets. Storing the Bitcoin state enables cross-chain transactions to be triggered without the need for a bridge from Layer 1 to Layer 2. It also provides developers with programming capabilities based on Bitcoin transactions and provides a trustworthy decentralized Bitcoin. Indexer service.

Performance readiness for large-scale users: Rollup Layer operations using rollup technology do not require consensus, ensuring high performance, and the B^2 networks strong data availability layer guarantees security. Low cost, affordable to users, and no fees increase when demand surges.

Bitmap Tech (formerly Recursiverse)

Bitmap Tech (formerly Recursiverse) is an innovative project aiming to build an intelligent, decentralized and composable digital world through the Ordinals network and Bitcoin layer 1. The project reflects a strong commitment to building a valuable Metaverse ecosystem and has launched a series of cutting-edge products:

BRC-420 Protocol: A decentralized economic framework operating on the Ordinals network. It allows creators to earn revenue directly without having to accept or host transactions through the platform.

Recursive Indexing and Inception Inscriptions: Demonstrates relationships and citation counts between inscriptions, emphasizing the value that interconnected inscriptions can bring to the network; Inception introduces a multi-layered recursive inscription approach in which top-level inscriptions can occupy very small numbers There is a lot of content and logic packed into the space.

Bitcoin second-layer network: Plans to bridge the BRC 420 protocol and Bitmap with second-layer solutions such as ZKP, rollups, and Lightning Network are expected to further build its vision of a decentralized metaverse and make it a digital world in the ongoing evolution of the world. Important players.

Bitmap.Game: The first Metaverse product based on Bitmap assets. Any user can enter this world and chat/trade/game with other players. It is also the Metaverse product with the largest user base on the Bitcoin network.

Project highlights:

High degree of freedom: Anyone can create their own metaverse inscription using the BRC-420 protocol.

Composability: The protocol is designed to integrate with Bitcoin layer 2 solutions, bringing liquidity and scalability to the second layer.

Innovative storytelling: Introducing a novel “bitmap protocol” for the land of the Metaverse, not limited to a single NFT form, but using it to tell the broader story of the Metaverse.

Clear positioning: Bitmap is positioned as the Metaverse protocol and NFT market on Bitcoin, supports inscriptions based on the BRC-420 protocol, and plans to integrate liquidity mechanisms through the second layer in the future.

Experienced team: The CEO has a rich entrepreneurial history in web2, VR and web3 development engines.

Attractive product: The BRC-420 market already has derivatives and an active community, and high-priced floor-priced items indicate strong user interest and involvement of whale participants.

Operational Momentum: The apparent market FOMO surrounding Bitmap NFTs, significant whale participation, and partnerships within the Bitcoin ecosystem highlight the operational strength of the project.

Babylon

Project Introduction

The Babylon project is a proposed Bitcoin staking protocol that allows Bitcoin holders to pledge their idle Bitcoins to increase the security of the PoS (Proof-of-Stake) chain, and in Earn profits in the process. It aims to integrate Bitcoin with the PoS economic system.

The Babylon project attempts to use Bitcoin staking as a new way of utilization, which not only improves the efficiency of Bitcoin as an asset but also strengthens the economic security of the PoS chain. This new use has positive consequences for Bitcoin itself, Layer 2, and the associated PoS ecosystem.

Project Highlights

Strong security: The Babylon protocol guarantees the comprehensive security of the PoS chain. If there is a security violation, at least 1/3 of the pledged Bitcoins will be deducted.

Pledger Protection: As long as stakers comply with the rules of the PoS protocol, they can guarantee that their funds can be safely withdrawn.

High liquidity: Babylon allows stakers to quickly withdraw bound Bitcoins without relying on the community consensus mechanism.

Plug-in modular design: The protocol is designed to be modular and can be easily combined with various PoS consensus algorithms.

System Architecture: Introduced a system architecture for scaling multiple stakers and multiple PoS chain protocols.

Quick unbundling: A quick and frictionless asset unbundling process is designed to reduce the time required for unbundling.

BitSmiley

BitSmiley is the first native stablecoin project in the BTC ecosystem. It is a comprehensive financial protocol built on the Bitcoin blockchain as part of the Fintegra framework. It contains three key components:

Decentralized stablecoin protocol: Through the Bitcoin network, BitSmiley launched an over-collateralized stablecoin protocol that issued UNO, a stablecoin softly pegged to the U.S. dollar. Users can mint UNO by locking Bitcoin as collateral in a BitSmiley vault, a smart contract on the Bitcoin blockchain.

Trust-free lending protocol: BitSmiley’s built-in native lending platform allows users to participate in decentralized lending activities. Borrowers can receive the tokens they want to borrow by staking BTC, which will be returned upon repayment of the loaned assets plus interest.

Derivatives Protocol: BitSmiley plans to expand into lending-based derivatives, improving capital efficiency and meeting the demand for more complex financial instruments in the DeFi space.

Project highlights:

The stablecoin issuance mechanism integrated with the Bitcoin blockchain: effectively reduces the market risk caused by the fluctuation of Bitcoin value and provides users with a more stable trading medium.

Advanced liquidation and auction design: Dutch auction is used to deal with the problem of insufficient collateral value, and automated execution through smart contracts ensures the robustness and decentralization of the system.

Innovative insurance and risk management solutions: Propose an insurance pricing model based on extreme value theory and T-Copula, which enables lending participants to hedge potential large price fluctuation risks and increases the security of the agreement.

Improved capital efficiency: Loan splitting and merging functions improve capital utilization and meet the borrowing needs of different users.

Future scalability and innovation guidance: The project plans the development of multiple derivatives including credit default swaps (CDS), and is committed to building BitSmiley into a one-stop decentralized financial platform that supports a variety of financial services.

alexGo

Project Introduction:

alexGo is a platform based on the Bitcoin DeFi (decentralized finance) ecosystem. Its goal is to become the top DeFi platform for Bitcoin users, innovators and the broader ecosystem, solving the problems of Bitcoin in the DeFi field due to the need for smart contracts and computing layers. limitations faced.

alexGo uses Stacks Layer 2 solutions to introduce smart contract functionality to Bitcoin, aiming to remove the barriers between Bitcoin L1 and L2 and create a seamless DeFi experience.

ALEX Establishment"Bitcoin Lab"Ecosystem Fund, which provides financial support, technical services, community participation and a platform for project launch and growth, is very attractive to both project developers and investors.

Project Benefits:

Seamless bridging: The entire Bitcoin DeFi experience is enhanced by the seamless bridging it provides between Bitcoin Layer 1 and Stacks Layer 2.

Transaction speed: Reduced confirmation time per block from 10 to 15 minutes to just 5 seconds through Stacks Nakamoto Release.

Reliability and Security: Full integration and cross-layer security, including collaboration with industry groups to build an on-chain oracle for BRC-20 and improve its reliability and security in Bitcoin DeFi.

Portal Defi

Project Introduction:

Portal DeFi proposes the first truly cross-chain private DEX protocol, aiming to solve the risks of centralized exchanges as well as the risks of decentralized exchanges (DEXs) due to the use of cross-chain bridges and wrapped tokens.

Launch of the PortalX system, capable of performing decentralized transactions and creating financial contracts for Bitcoin and other assets.

Users can directly access decentralized services using non-custodial wallets, with response speed and liquidity comparable to centralized exchanges, while maintaining the security of assets and data.

Adopt technological innovations such as multi-party hash time-locked contracts and smart contracts, as well as a set of validators to ensure fast, economical and secure execution of transactions.

Project highlights:

Cross-chain interoperability: PortalX supports asset swaps across different blockchains, completely eliminating the need to rely on a centralized third party.

Zero-knowledge protocol: Using zero-knowledge proof technology, Portal achieves transaction privacy protection and the security of the exchange process.

Censorship resistance: The financial applications provided adhere to the principle of decentralization, ensuring freedom and the ability to resist external interference.

Non-custodial design: Users can trade without giving up control of assets, solving the problem of asset custody.

PortalOS operating system: A comprehensive operating system that supports various functions of Portal DeFi and ensures efficient operation of the system.

Verifier incentive mechanism: Introduce a proof of equity mechanism and use native tokens for pledge to ensure that network participants have sufficient incentives to participate in system maintenance.

Solutions to the Tier-Nolan atomic swap problem: Innovative solutions are provided for the problems existing in the classic atomic swap protocol, such as the fair option problem and the lack of incentives for facilitation.

Liquidity aggregation: Through the design of on-chain contracts and protocols, Portal aims to aggregate and match liquidity in decentralized financial applications.

OKX Ventures empowers the BTC ecosystem and launches Bitcoin Ecosystem Hackathon

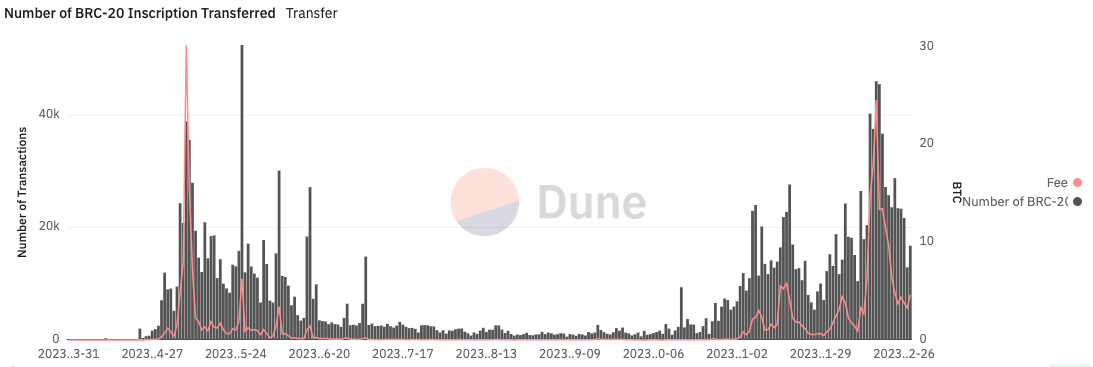

Ordinals exploded this year, essentially a large-scale application of asset issuance capabilities. Subsequently, a dazzling array of asset issuance protocols emerged, including Ordinals, BRC-20, RGB, Taproot Assets, Runes, Taro, Atomics, TAP, PIPE, and more. data:

BRC 20: The cumulative number of BRC-20 transfers exceeds 45.4 million, and the cumulative handling fees generated by BRC-20 exceeds 4,290 BTC;

Ordinals: The cumulative amount of inscriptions exceeds 53 million, and the cumulative handling fees generated by Ordinals exceed 5,383 BTC;

Innovation in asset issuance standards will bring more possibilities to the Bitcoin ecosystem.

The Ordinals ecology explodes, assets are issued on a large scale, and assets require liquidity, infrastructure and applications such as game NFT. Therefore, we hope to guide more developers to invest in the Bitcoin ecosystem and use it to build a richer ecosystem.

OKX Ventures hosted the BTC ecological project winter roadshow day organized by ABCDE and BeWater Lianhe Online. A total of 51 projects applied for it, and 7 projects received final investment. Hackathon details:

The project track involves Layer 2, RGB, Lightning Network, Taproot, Ordinals, BRC 20, stable currency, lending, etc.;

The project team comes from all over the world, including Singapore, Hong Kong, the United States, Russia, and Hungary;

82% of founders are serial entrepreneurs;

For a richer developer ecosystem and application ecosystem, OKX Ventures will continue to invest US$10 million to support new entrepreneurs in the industry.

OKX Web3 is an industry leader in the BTC ecosystem

OKX Web3 Wallet is the first wallet ecosystem in the industry to invest heavily in the BTC ecosystem. It has invested a lot of ecological resources and has received unanimous praise from the market.

OKX Web3 wallet data

As of the end of December 2023, the total transaction volume of the OKX Web3 Wallet Ordinals market has exceeded US$1 billion, with 120,332 independent addresses, a total number of transactions as high as 552,818, and a daily transaction volume market share of up to 92%. Overall, it is in a leading position in the industry .

Currently, the OKX Web3 Wallet Ordinals market is the largest BRC-20 inscription and BTC NFT trading market, with 16,000 BRC-20 tokens available for trading. The OKX Ordinals market is completely decentralized, with no platform service fees for interaction, and supports multiple functions such as batch transfer, trading, engraving BRC-20 and BTC NFT.

As of the end of December, the OKX NFT market had approximately 20 million annual transactions, a daily transaction volume of approximately US$6.5 million, and a total transaction volume of US$2.366 billion. Affected by the inscription craze, the OKX NFT market jumped to become the second largest NFT market in terms of transaction volume in the two months of November and December alone, accounting for 32% of the market share.

OKX Web3 wallet is close to users and continues to meet user needs

OKX Web3 Wallet always insists on starting from user needs and quickly refining user needs into product needs, rather than using its own needs as user needs.

OKX has launched a one-stop DApp exploration and reward interactive platform - Cryptopedia. It regularly launches activities themed on different blockchain networks and works with corresponding partners to jointly set up DApp interactive tasks to help users reduce search costs. At the same time, precise interaction can be achieved by utilizing fragmented time.

OKX Web3 wallet has launched the DeFi sector, a one-stop on-chain investment platform. It aggregates a variety of investment products from 10+ public chains, 60+ projects, and 200+ protocols, supports V3 liquidity pool, one-click cross-currency investment, automatic income calculation, and saves gas, making DeFi investment extremely simple.

The latest ecological map released by OKX Web3 Wallet shows that its wallet section has access to more than 70 public chains, the DeFi section supports more than 120 protocols, the NFT market aggregation platform is more than 30, and supports multiple ecology such as Game, Social, MEME, Tool, etc. In total, more than 300 supported platforms and protocols are supported.

Summarize

In terms of the Bitcoin ecosystem, OKX Ventures has demonstrated its firm commitment and determination to continue to contribute, and is committed to promoting ecological innovation and accelerating the development of blockchain technology. With the number of Bitcoin users, the data growth of the Bitcoin blockchain, and the explosion of new innovative protocols such as Ordinals, the Bitcoin ecosystem is experiencing unprecedented growth. OKX Ventures is not only willing to provide financial support, but also provides services and resources to help partners develop together.

Recognizing the huge space for innovation in the Bitcoin ecosystem, OKX ventures helps projects find a foothold in this majestic crypto field by providing platform-level support such as OKX Web3 wallet and OKX chain. For OKX ventures, the prosperity of the Bitcoin ecosystem goes beyond simple financial investment. We value long-term industry development and scale growth more.

Even if the market environment is unpredictable, OKX Ventures focus is on the continuous progress of the industrys essence, focusing on theoretical innovation, the launch of practical new applications, and the actual growth of user traffic and the overall scale of the industry. We firmly believe that in the next three to five years, OKX Ventures will accompany the market to witness and seize the greater market opportunities brought by the Bitcoin ecosystem.