a16z crypto:加密投资金手指是如何炼成的?

a16z, whose full name is Andreessen Horowitz (referred to as a16z because there are 16 letters between the first letter a and the last letter z), was founded in 2009 by two founders, Marc Andreessen and Ben Horowitz. Later, it invested in many well-known Internet companies such as Facebook, Twitter, Github, Instagram, and Airbnb, and became the top venture capital institution in Silicon Valley as famous as Sequoia and Benchmark Capital.

a16z currently manages more than US$35 billion in assets, and its investment areas cover artificial intelligence, biotechnology and medical insurance, consumers, cryptocurrency, business operations, financial technology, games and companies that promote the construction of the United States. a16z has set up special funds for different fields. The a16z crypto that this article will focus on is the special fund it set up for the encryption industry.

1. Entering the field of encryption

a16z first came into contact with investment in the encryption field in 2013. When the encryption industry was still questioned by many traditional venture capital, a16z took the lead in leading Coinbase’s $25 million Series B financing, and later made 7 follow-up investments. The bet on Coinbase not only made a16z a lot of money when Coinbase went public, but also made it a star in the crypto investment field.

In order to better invest in the crypto field, a16z established a venture fund a16z crypto in 2018 specifically for the crypto field. Currently, this fund has raised a total of 5 times and manages more than 7.6 billion US dollars:

The first fund was launched with approximately $300 million in size;

Launched second fund in April 2020 with a size of approximately US$515 million;

The third fund was launched in June 2021, with a scale of approximately US$2.2 billion, setting a new record for the fundraising scale of crypto funds at the time;

In May 2022, the fourth fund with a scale of approximately US$4.5 billion and the Web3 Game Fund with a scale of US$600 million were launched.

It is reported that a16z is currently planning to raise approximately US$3.4 billion for its next core early-stage and seed-stage funds, mainly investing in the encryption field, biotechnology and new growth outlets.

2. Team situation

The a16z investment team is a full-person partnership with no hierarchical relationship. Each special fund will recruit professionals as investment partners.

Chris Dixon is the founder of a16z crypto. Even though he only joined a16z in 2012, many of a16zs important investments in the encryption field (such as Ripple, Coinbase, Dapper Labs) were led by Chris Dixon. In 2022, it ranked among the Worlds Best Ventures published by Forbes magazine. Investor List tops the list.

Before joining a16z, Chris Dixon was an entrepreneur and investor. He previously founded the Internet security company SiteAdvisor and the technology recommendation company Hunch. He also founded the venture fund Founder Collective and made multiple personal angel investments in multiple technology companies. .

Theres no doubt that as the crypto industry booms, Chris Dixon is already a key figure in a16z, along with the companys iconic founders Marc Andreessen and Ben Horowitz.

According to the public information on a16z’s official website, its current total number of employees is 546, of which the most people are responsible for the encryption field, with a total of 99 people accounting for 18%. From the headcount ratio, it can also be seen that a16z attaches great importance to the encryption field. At the same time, a16z has always attached great importance to post-investment services. Among these 99 people, only 15 are specifically responsible for investment, while the remaining 80% or so are responsible for serving enterprises such as marketing, recruitment, legal, and technology. Post-investment work.

3. Investment characteristics

Founded in 2009, a16z not only invested in many well-known Internet companies in Web2, but also transformed into a top venture capital institution in Silicon Valley. It also invested in many high-value companies in Web3 (such as Coinbase, Opensea, Dapper Labs, Uniswap, dYdX, Lido , Yuga Labs) has become a benchmark in the field of crypto investment. Why can a16z create such investment records in these two industries?

As a16zs special fund, a16z crypto also inherits a16zs style in terms of investment logic and investment style. The following are several a16z crypto investment characteristics summarized by the author.

Adhere to “all-weather” investment

The so-called all-weather investment means that you will continue to invest regardless of market conditions and crypto prices. a16z crypto also proves this with practical actions. From a distance, a16z crypto’s first two funds were launched in the crypto bear market from 2018 to 2020, with a cumulative management of more than 800 million US dollars; looking closer, in In this year’s crypto winter, compared to the “tightening” investments of crypto funds such as Paradigm, according to Rootdata data, a16z has made more than 30 investments in the past year, including 11 leading investments.

High ratio of lead investors to follow-up investors

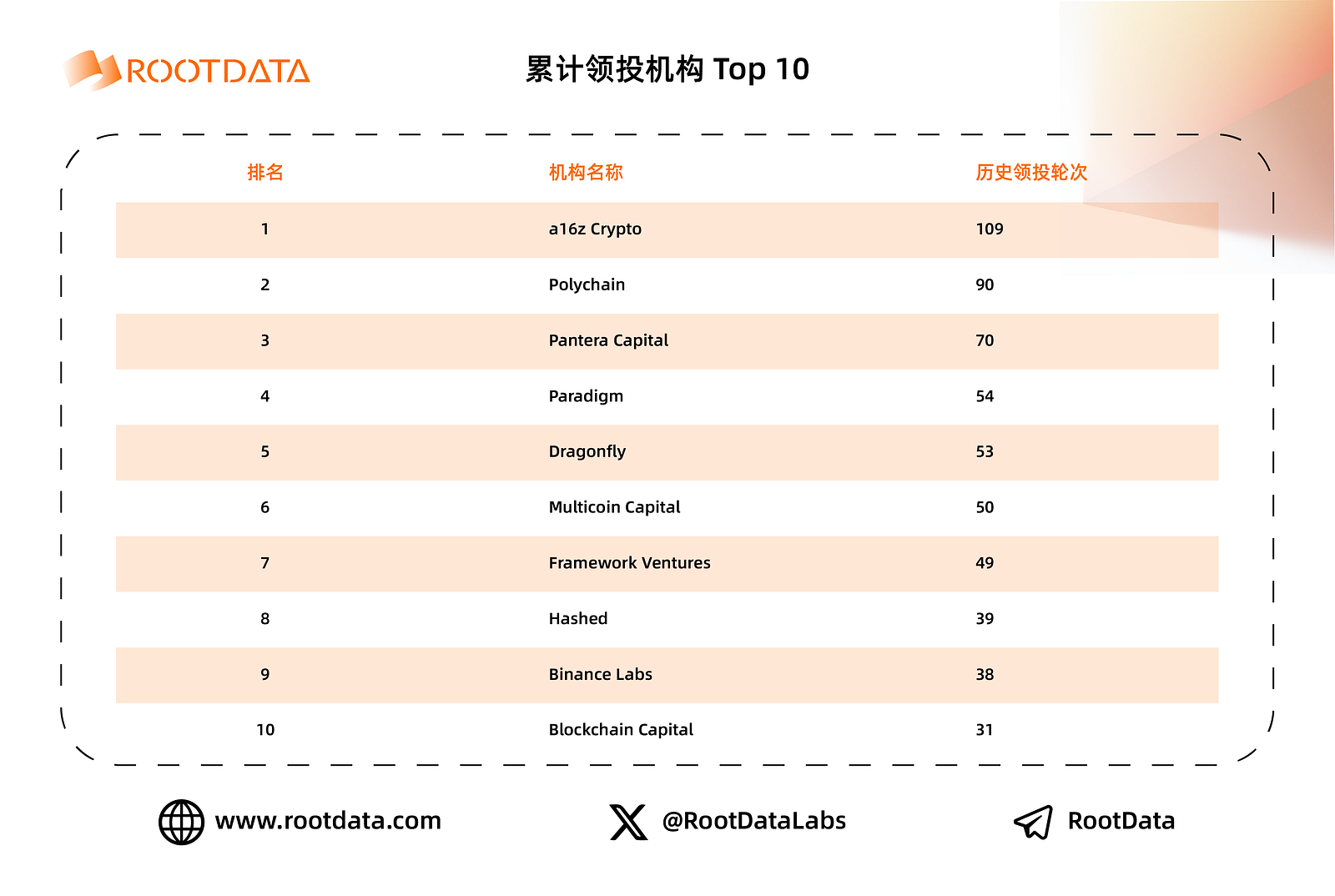

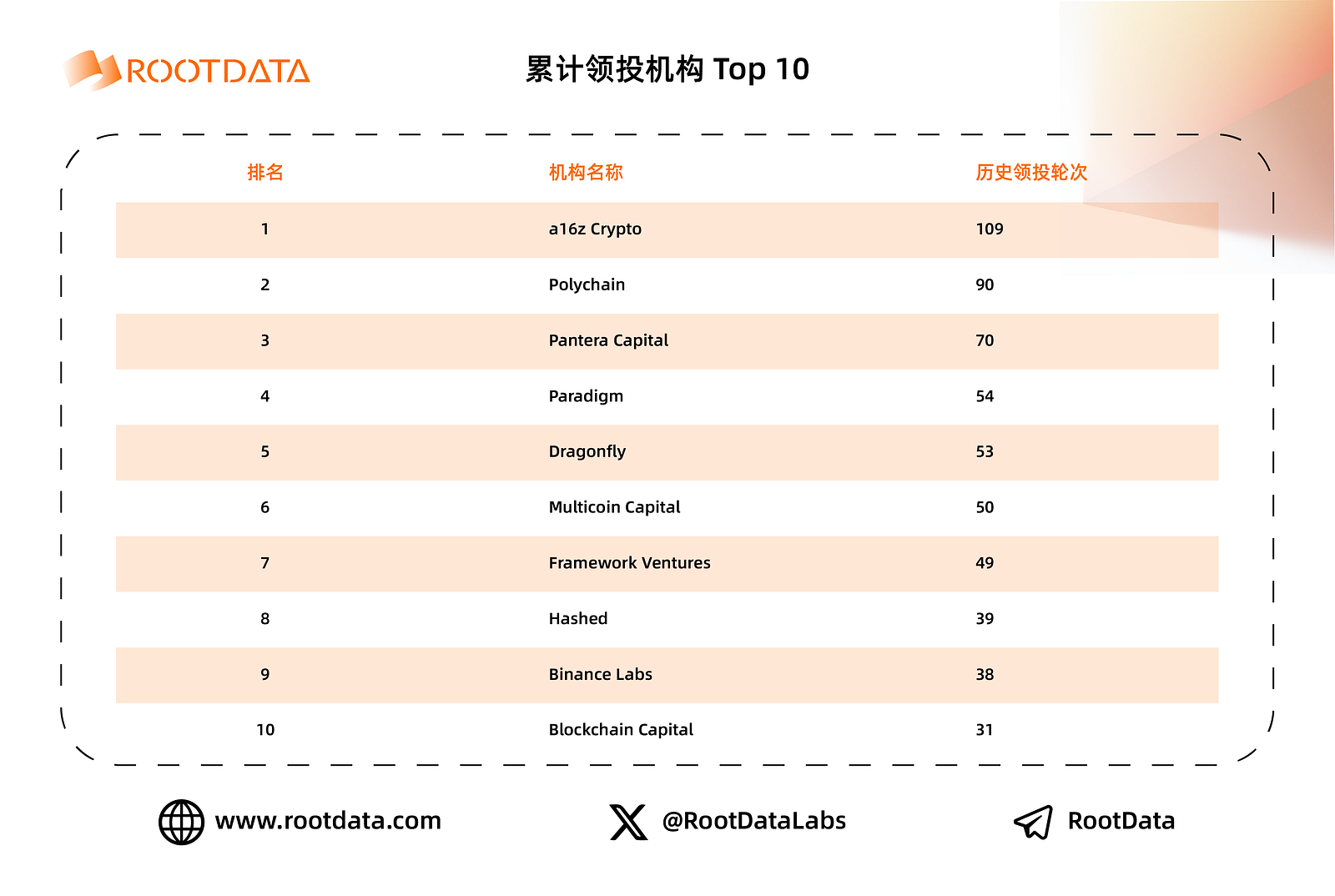

According to Rootdata data, a16z crypto ranks first among the cumulative leading investment institutions, with 109 rounds of leading investment in history.

At the same time, it can be seen from the well-known encryption projects that a16z crypto has invested in in the past that a16z Crypto also loves to pursue investments and shows its determination to no hesitation in promising projects.

Be generous and cast a wide net

Since the establishment of a16z crypto, it has invested in hundreds of encryption projects, covering basically all areas of the encryption industry. a16z is also famous in Silicon Valley for its generous investments. The most typical example is during Githubs Silicon Valley rush to invest in 2011. a16z announced that it would lead an investment of US$100 million. Coupled with various post-investment benefits, Github also Finally chose a16z.

Good at media promotion and packaging

In 2010, the New York Times described a16z as follows: The new generation of venture capitalists represented by a16z is trying to shake up an industry that needs to change. The connotation of this sentence is that a16z has created a new operating model that is different from traditional venture capital institutions. One of the most important features is publicity and marketing through self-built media channels.

When you open the official website of a16z, you will have the illusion of opening a media platform, because the home page is full of various reports and articles. Marc Andreessen, the founder of a16z, once stipulated that every investment partner needs to establish a self-media to share and output investment ideas in front of the public, and promote industry information circulation and cognitive education.

This habit has also been inherited by a16z crypto. Chris Dixon has stood up for the encryption industry many times in various public places. This year he also wrote a book about Web3 Read Write Own, which is scheduled to be published in January 2024. , Chris Dixon is also called the strongest evangelist of Web3.

In addition, a16z also attaches great importance to the packaging of the projects it invests in. It draws on the operating model of CAA, a top Hollywood agency, and has built a large and professional talent system to provide marketing, legal, lobbying and other support to the companies it invests in. Therefore, a16z is also known as a media company that makes profits through investment.

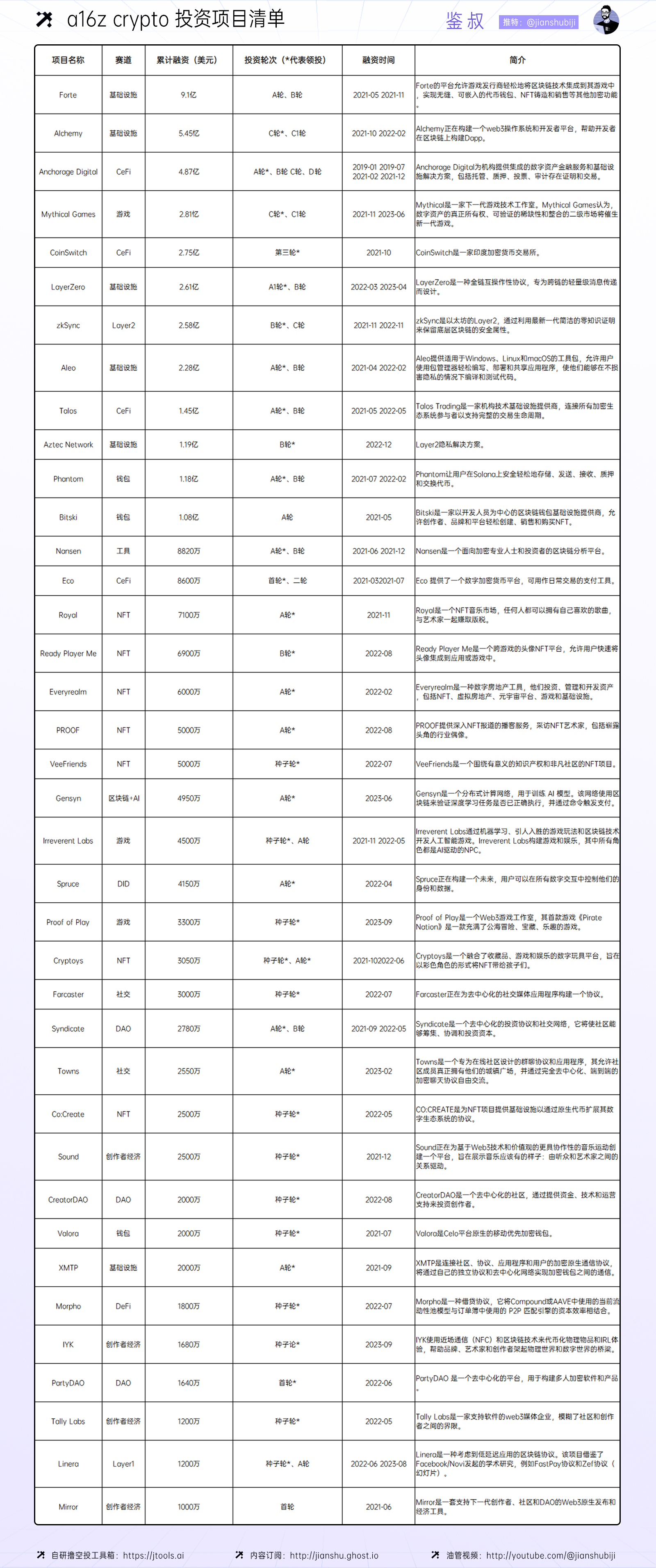

4. Investment map of potential projects

The betting ability of a16z crtpto is obvious to all. The following are the potential projects selected by the author from the investment map of a16z crypto. Among them, those with issued coins, rugs, financing amounts less than 10 million and those serving traditional industries have been eliminated. (Unlikely to issue coins) projects for readers’ reference (based on the cumulative financing amount as the sorting criterion):

5. Summary

Software is eating the world is a16zs most widely known slogan, which originated from Marc Andreessens 2011 Wall Street Journal article Why Software Is Eating the World, which at that time strengthened a16zs confidence in investing in Internet companies in the next few years.

After a16z invested in Web3 start-ups such as Coinbase, faced with confusion from peers and the media, Marc Andreessen wrote another famous article in the New York Times in 2014 Why Bitcoin Matters”, in which he regarded Bitcoin as an innovative technology as important as the personal computer in 1975 and the Internet in 1993. This has actually established a16z’s belief in long-term investment in the encryption industry in the future, and also caused many traditional venture capital investors to begin to re-examine encryption. industry.

From software golden finger to encryption golden finger, a16zs transformation is in line with the times. As the homepage of a16z crypto’s official website describes the three eras of the Internet, the first era (1990 – 2005) did not have a16z, and the second era (2005 – 2020) achieved a16z.

Now in its third era, a16z wants to continue its glory.

References:

【 1 】a16z: A “Hollywood” victory

【 5 】I voted for 86 Web3 companies, is a16z a preacher or a big liar?