Why can Solana be reborn from nirvana, and how can we participate?

1. Solana’s past and present life

Background of the birth of Solana: At that time, Ethereum, the King of Public Chains, was the undoubted mainstream operating system for cryptocurrency, with a large number of users and traffic. However, Ethereum also had problems such as network congestion and high handling fees. In terms of experience, Ethereum brings a bad experience to users, and there is unbearable congestion just using DeFi applications.

In March 2020, Solana was launched on the mainnet, and officials called it the fastest high-performance public chain. Solana has high performance and low gas, which solves some of the shortcomings of Ethereum.

In July 2020, FTX announced that it would use Solana as the underlying public chain to build their decentralized exchange, Serum.

In October 2020, Wormhole was launched, and Solanas assets can be transferred cross-chain with assets on Ethereum.

In March 2021, Tether issued tokens on Solana.

In June 2021, Solana completed US$314 million in financing, with participating institutions including Alameda Research, a subsidiary of SBF.

In November 2021, Solanas locked position reached US$1 billion, which was one-tenth of Ethereum and two-thirds of BSC during the same period.

In December 2021, StepN launched Solana. The popularity of StepN allowed more users to understand and participate in Solana.

In February 2022, Solana surpassed Ethereum to become the blockchain with the largest number of active developers.

On November 9, 2022, FTX was hit by a thunderstorm, and SOL plummeted by about 75% within a few days.

From the end of August to the beginning of September 2023, Shopify and Visa announced their integration with Solana, expanding Solanas payment service territory in the Web2 world.

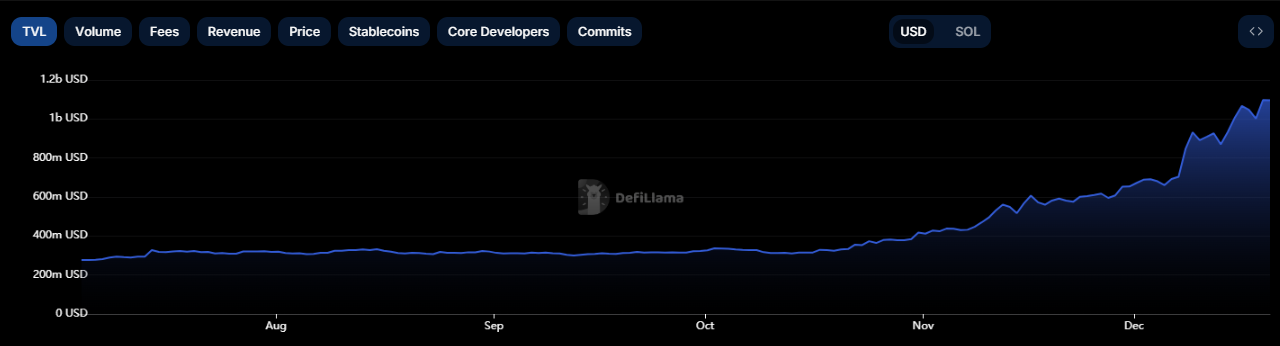

In December 2023, the Solana ecosystem recovered, and the locked-up volume increased from approximately US$300 million to the current level of nearly US$1 billion within two months.

2. FTX may be restarted, and Solana is about to explode?

1.The relationship between FTX and Solana

After the collapse of FTX, Solana was immediately placed at the center of the storm, which dates back to the DeFi Summer of 2020. At that time, Solana was still unknown, just one of many public chains trying to crack the impossible triangle. However, SBF, co-founder and CEO of FTX and founder of Alameda Research, discovered Solana. In addition to participating in multiple rounds of financing for Solana, he also chose to build Serum, a decentralized trading platform on Solana (this is the first decentralized trading platform on Solana). trading platform), and subsequently invested in multiple Solana-based applications. This recognition of real money made everyone bind SBF to Solana. In the early days, some people even mistakenly thought that he was the founder of Solana.

According to FTXs latest court documents, FTX holds approximately 55.8 million SOL, exceeding 10% of the total supply of SOL, with a current value of approximately US$3.5 billion. This is also the largest cryptocurrency asset held by FTX. At the same time, FTX also has SOL worth approximately US$400 million (approximately 6.5 million pieces) in an unreleased state, which will be unlocked linearly over time.

From this we can see that FTX and Solana are highly bound. FTX is the biggest supporter of Solana on its development path, and Solana is also the project on which FTX has bet the most.

2. Impact of FTX restart on Solana

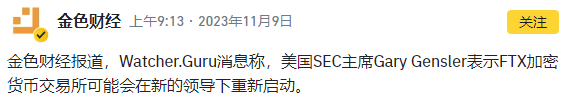

As the FTX case temporarily came to an end, on November 9, local time in the United States, FTXs token FTT suddenly rose by about 90%, rising from a low of around US$1.8 to a high of more than US$3. At the same time, SOL also soared from around $40, reaching a maximum of $63.95, an increase of about 60%.

The surge in FTT is mainly related to the words of US SEC Chairman Gary Gensler. At the Washington, DC Fintech Week, Gary Gensler said: If Tom (former president of NYSE, now in charge of a major bidding company trying to restart FTX) or others want to To enter this field, I would say, just do it within the legal framework.

From the perspective of position structure, once FTX goes bankrupt and reorganizes, besides FTT, SOL will undoubtedly be the biggest beneficiary. If FTX is simply liquidated, it will be similar to the MT.GOX liquidation, and its SOL positions will form huge selling pressure, inhibiting the rise in SOL prices; but if FTX restarts, SOL will become FTXs most important crypto asset and resource, and FTXs The successor will undoubtedly continue to cooperate in depth with SOL to promote the development of SOL. As the value of SOL grows, it will ultimately help FTX get out of financial difficulties.

On October 25, Bloomberg reported that FTX was negotiating with three undisclosed bidders to restart its trading platform, including Silicon Valley investment company Proof Group, financial technology and digital asset company Figure, and venture capital institution Tribe Capital. The company expects to make a decision on how to proceed by mid-December. Options include selling the entire trading platform, which includes a valuable list of more than 9 million customers, or bringing in a partner to help restart the trading platform. In addition, FTX is also considering restarting the trading platform on its own.

The day is very close to decide whether FTX will be sold or restarted in the future. Whether it is sold or reorganized, this is good news for Solana. As long as it avoids simple liquidation, Sol will not face huge upward pressure in the future.

3. To make iron, you need to be strong. What are the advantages of Solana?

In each round of bull-bear transition, a large number of projects fell down. Why did Solana’s locked-up volume and token price perform so strongly? In addition to the impact of the possible restart of FTX, Solanas excellent performance this year also relies on its own advantages.

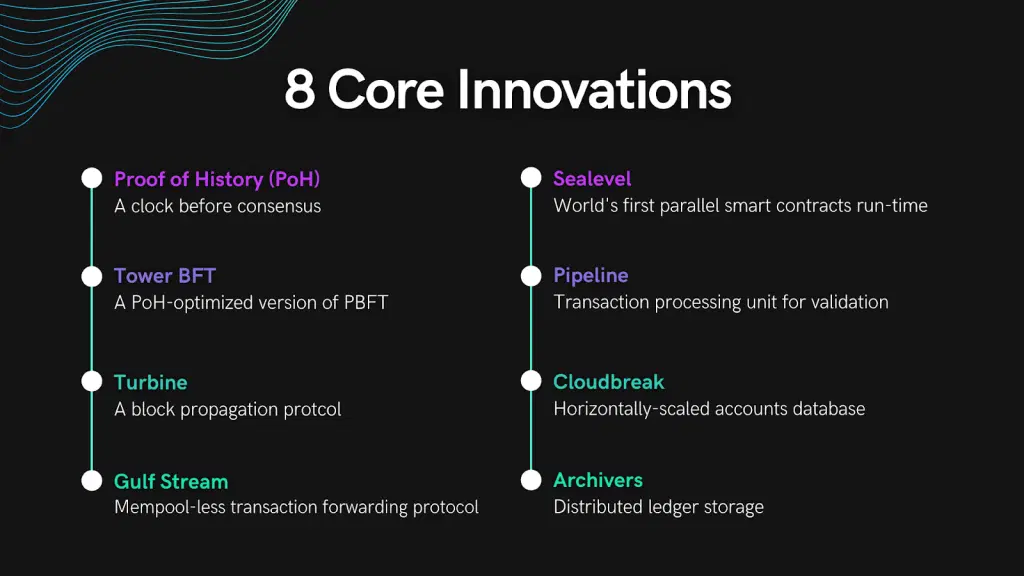

1. Solana’s advanced technical principles

The main feature of Solana in terms of blockchain technology innovation is the introduction of a new consensus mechanism, which is based on the Proof of History (PoH) algorithm and a fast synchronization engine. Unlike traditional consensus algorithms that rely solely on cryptography, PoH utilizes a decentralized clock to establish the order of transactions and events on the Solana network. By efficiently tracking the order of these transactions, it improves the overall efficiency of the network, unlike other blockchains where the order of transactions may not be clear.

Specifically, the PoH algorithm works by generating a series of verifiable timestamps that are stored in a blockchain ledger. Each timestamp contains a hash of the previous timestamp, creating a chain of events that can be efficiently verified. This mechanism allows nodes in the network to reach consensus on the order of operations. PoH is not just a theoretical concept, it is a timing system used to verify the sequence and passage of time between events.

Solana’s Proof of History (PoH) algorithm offers the following advantages:

Scalability: PoH allows transactions to be processed in parallel, creating a reliable and verifiable sequence of events, enabling Solana to achieve high transaction volumes;

Speed: Solana has low latency by using decentralized clocks and historical timestamps to eliminate time-consuming operations, allowing transactions to be confirmed in near real-time;

Security: PoH ensures that the sequence of events in the blockchain network is verifiable, which makes it more difficult for attackers to manipulate the transaction sequence or conduct double-spend attacks, thus improving the overall security of the network;

Efficiency: Parallel processing of transactions and the high throughput achieved by Solana help improve transaction efficiency and reduce marginal costs.

2. The benign development ecosystem built by Solana

The reason why Solana was reborn after the FTX thunderstorm and became more and more popular in the public chain competition is not only related to the superiority of the underlying public chain technology, but also related to its own very high-quality development ecology. This seems to be rooted in it from the beginning. It is in Solanas genes and continues to develop, forming a virtuous cycle.

Solanas core team has backgrounds in high-tech companies such as Qualcomm and Google, which makes Solanas underlying code quality very high and the project development speed also very fast. Compared with the technological development progress of Ethereum, Solana has been launched very quickly and has been logged into multiple centralized trading platforms.

Solana relies on its Silicon Valley background and is committed to building a high-quality developer ecosystem, attracting core developers from large technology companies. Solana mainly cultivates the developer community by recruiting core developers in the technical field and organizing events such as hackathons. These events include short-term pop-up events where investors and founders from around the world serve as judges, called the Hacker House Series.

4. Opportunities to participate in the Solana ecosystem

Solana airdrop season is here, and airdrops have recently been issued by multiple protocols in the Solana ecosystem such as Jito, Jupiter, and Pyth. Among them, Jito’s token JTO was quickly listed on top exchanges such as Binance and Coinbase, attracting attention. Many of the top native projects on Solana were just launched last year and have not issued coins yet. This is also the reason for the recent surge in Solana’s lock-up volume.

Below are some projects we have selected that are worthy of interaction in the Solana ecosystem.

1.Kamino

Introduction: Kamino is a centralized liquidity lending protocol with automatic compounding. Incubated by Hubble Protocol, Kamino’s TVL has soared to $75M.

Interactive methods:

Multiply Deposit SOL and obtain mSOL

Provide mSOL and SOL liquidity

Borrowing and Loans

2.Marginfi

Introduction: The recent TVL of MarginFi, Solanas third largest protocol, has soared from US$25 million to US$200 million. The protocol has officially launched a loyalty points program, and airdrops are also likely to be distributed based on the points. And Marinade is running the MNDE incentive program until the end of this year.

Interactive methods:

Borrowing and Loans. Borrow $1 to earn 1 point per day, and borrow $1 to earn 4 points per day.

Recommend other users to use MarginFi and get 10% of the invitees points.

3.Drift Protocol

Introduction: Solana’s first derivatives protocol, an on-chain cross-margin perpetual futures trading platform, completed a $3.8 million seed round led by Multicoin Capital. Currently, the protocol has suspended new user registrations due to the influx of users.

Interactive methods:

Deposit SOL into the protocol

trade on exchange

Provide liquidity to Drift Liquidity Provider (DLP)

Pledge to insurance fund

Borrowing and Loans

4.Zeta Markets

Introduction: Zeta Markets is an undercollateralized DeFi derivatives trading platform that allows users to effectively hedge the risk of crypto market volatility and extreme events. The protocol launched a points system called Z-Score, and famous brands allocate tokens based on points, but the distribution ratio is not clear.

Interactive methods:

Trade on exchanges. The higher the transaction volume, the more points are rewarded.

Stay tuned for official events. Holding certain NFTs at specific times can earn extra points as rewards.

5.Magic Eden

Introduction: Magic Eden is a cross-chain NFT market that supports NFT transactions in BTC, Ethereum, Solana and Polygon. Magic Eden has received a total of US$160 million in financing and is valued at US$1.6 billion.

Interactive methods:

Trade and mint NFTs on the platform

Try the games above

6.Tensor

Introduction: Tensor is the Solana ecological NFT market platform and a protocol with an official points system (similar to BLUR). SOL NFT had great influence in the last bull market and has been on the rise recently.

Interactive methods:

Buy and sell NFTs in the top 100 collections (points are related to the number of purchases and sales, not the amount)

Complete loyalty points tasks

Buy and stake Tensorian NFTs

7.Cega

Introduction: Cega is a decentralized alternative derivatives protocol that builds exotic options structured products for retail investors. A total of US$9.3 million in financing was obtained, with a valuation of US$60 million.

Interactive methods:

Use Cega’s options products

8.Parcl

Introduction: Parcl is a RWA leveraged trading platform built on Solana and has completed a total of US$11.6 million in financing.

Interactive methods:

Deposit to protocol

Provide liquidity

Leveraged Trading RWA

9.Phantom

Introduction: Phantom is the most popular wallet on Solana, with over 3 million users.

Interactive methods:

Download and use Phantom Wallet

Trade tokens with Phantom

Complete the DRiP Phantom mission

10.Squads

Introduction: Squad is a multi-signature management tool based on Solana, which has raised a total of US$15.7 million in financing.

Interactive methods:

Create a multi-signature address

Deposit tokens (you can refer to the airdrop standards of the multi-signature wallet Gnosis Safe, and airdrops will be issued based on the amount and time of deposited funds)

11.Bonfida

Introduction: Domain name service platform on Solana.

Interactive methods:

Trading domain names, airdrops of famous brands.

References:

《Technische uitleg — Het Solana ecosysteem — een overzicht van projecten》

How far can Solana go? This article will clarify the whole dispute between Solana and FTX for you

Brief Analysis: How will the 1.16 billion SOL held by FTX be unlocked

The white papers of interactive projects will not be listed one by one here.