Weekly Editors Picks (1209-1215)

Weekly Editors Picks is a functional column of Odaily. In addition to covering a large amount of real-time information every week, it also publishes a lot of high-quality in-depth analysis content, but they may be hidden in the information flow and hot news and pass you by.

Therefore, our editorial department will select some high-quality articles worth spending time to read and collect from the content published in the past 7 days every Saturday. From the perspectives of data analysis, industry judgment, opinion output, etc., we will provide those in the encryption world with You bring new inspiration.

Next, come and read with us:

invest

How to make money in cycles (Complete): A guide to buying the bottom and escaping the top

Master five indicators: Ahr 999 currency hoarding indicator - which implies the return rate of short-term fixed investment in Bitcoin and the deviation of Bitcoin price from expected valuation; Rainbow chart - the rainbow in which Bitcoin price continues to maintain a logarithmic growth channel Within the color band; RSI (Relative Strength Index, relative strength index) - 100 to 0 means rise to fall; 200-week moving average heat map - near the 200-week MA is the bottom point of the cycle; CVDD (Cumulative Value-days Destroyed , cumulative days of value destruction) - buy when it hits the green line.

Strategies suitable for cyclical trading: combine Martingale theory with fixed investment, and use grid strategies to expand returns.

Taking stock of the latest progress of 13 spot Bitcoin ETF proposals

Start a business

Web3s methods of issuing assets include narrative, asset leverage, and equity tokenization. The essence of narrative comes from consensus or the coercive power or credibility of a centralized subject.

In DeFi, the issuance of LSD and LP tokens is essentially asset leverage, allowing a large number of assets to appear out of thin air in the entire system. A large part of the DeFi TVL or AUM we see may come from leveraged assets. When the bull market arrives, the AUM or TVL of the entire Web3 system will expand rapidly, and the expansion speed will increase at a collective level. In addition to the issuance of a large number of assets, another major driving force is the leverage of assets. The biggest use of LSD for the entire DeFi is lossless leverage, that is, it does not require any interest rate costs and there will be no liquidity loss.

The debt of the system can be eliminated by exchanging time for space and the mother currency producing sub-coins. The most typical example of the time-for-space model is Curve Finance: it seized market share through high subsidies in the early days, and now has a monopoly on the liquidity level. After the monopoly is formed, it also has monopoly pricing power for bribe fees. From the last bull market to the present, the secondary price of CRV has continued to fall, and the debt has been eliminated through the decline of assets. Regarding veCRV, it continues to collect bribe fees, lengthening the timeline and smoothly landing the debt. An example from the other side: The introduction of Blast further accelerated the process of Blur debt elimination. Blast serves as Blurs cannon fodder, passing on Blurs system debt due to excessive subsidies.

Also recommended Making Binance: Ultimate Efficiency and Simple Tools》。

DeFi

Thoughts on decentralized lending, plus an introduction to Compound and November data

A complete introduction to Compound.

Compound’s innovations include: cToken’s architecture, capital pool (peer-to-pool) lending, dynamic interest rates, asset isolation, an important promoter of liquidity mining, the concept of governance tokens, etc.

NFT、GameFi

Summary of the NFT track in 2023: Will change move forward or will it fall into silence?

The future of NFTs will depend on the ability of creators and platforms to evolve to provide real value and utility that goes far beyond mere speculation.

Blue-chip NFTs face challenges on many fronts: uncharted territory, evolutionary challenges, complexity, and waning interest.

Solana has become a compelling contender in the NFT space, praised for its high transaction speeds and low costs.

The next wave of developments will have the opportunity to geographically decentralize the industry. Another foreseeable trend is that more and more NFTs will be designed for commercial use, not just personal use.

Take stock of noteworthy projects in the FOCG full-chain game field

Developed in the StarkNet ecosystem: Dojo, Loot Realm, Influence, Briq; chain game engine MUD and second-layer public chain Redstone designed for full-chain games; Argus Paima.

Another recommended article is The chain gaming circuit is recovering, taking stock of 20 popular chain gaming projects in one article》。

Web 3.0

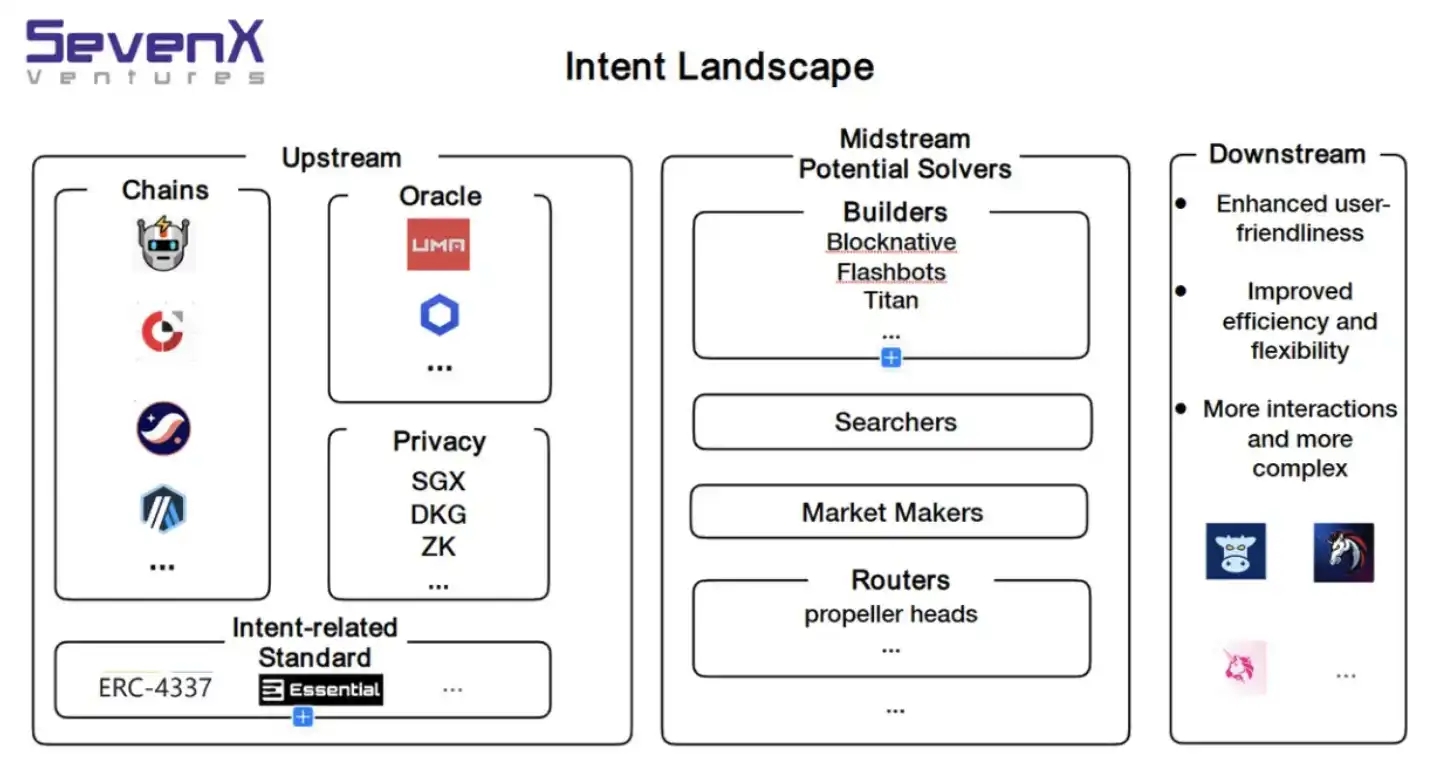

The author divides intent into the following three groups of keywords: result rather than path, conditional authorization rather than code authorization, and competitive solver rather than trusted dapp.

The article uses Cow Swap, 1inch fusion, UniswapX, account abstraction, Essential, Flashbots SUAVE, and Anoma as examples, and further discusses it in five parts: Intent expression and authorization, candidate solvers, solving process, Solver selection, verification, and settlement.

There are striking similarities between the concepts of intents and rollups: off-chain execution and final settlement and verification on-chain. Please pay attention to the potential centralization problems that Intent may bring; in addition, how Intent players can start to make the solver effectively implement Intent for users is also a real problem.

SevenX Ventures: Modular Smart Contract Account Architecture and Challenges

Smart Contract Accounts (SCA) face five major challenges, namely bear market impact, migration difficulty, signature issues, high gas costs, and engineering difficulties. In order to fully realize the potential of SCA, Layer 2 solutions are required to provide additional protocol layer support, powerful bundler infrastructure and peer-to-peer memory pools, more cost-effective and feasible SCA signature mechanisms, cross-chain SCA synchronization and management mechanisms, and development User-friendly interface and more.

inscription

New Narrative of Inscription: Can Inscription with ecological empowerment create a new track?

The RGB protocol has the advantages of low rates and high scalability.

In the future, with the completion of the wallet-side infrastructure and the launch of the Bitcoin chain AMM DEX, more functions such as lending and derivatives may appear. UniSats open API interface can produce a lot of tool projects.

Multiple ecology and cross-chain

Take stock of popular projects worth paying attention to on Stacks

Alex (Bitcoin DeFi platform), StakingDAO (improving capital efficiency for STX token stakers), Arkadiko Protocol (decentralized liquidity protocol), Velar Protocol (DEX inspired by Uniswap), Zest Protocol (decentralized lending platform ), Uwu Protocol (a lending protocol based on the protocol’s own stablecoin), Hermetica Finance (an option strategy protocol that increases the value of BTC), and Bitflow Finance (a highly transparent DEX that brings together BTC liquidity).

Hot Topics of the Week

In the past week,IRS seeks $24 billion from FTX, Binance responded to the SEC’s supplementary briefing:The settlement agreement with the U.S. Department of Justice is not materially related to the SEC charges.;

In addition, in terms of policy and macro market,US SEC: Will continue to advance lawsuit against Binance,Tether announces wallet freezing policy against US OFAC sanctions list, covering secondary market,First version of U.S. cryptocurrency accounting system released,The Korean Financial Services Commission issued a legislative notice on the formulation of implementation regulations such as the Virtual Asset User Protection Act;

In terms of opinions and voices, He Yi:Binance will continue to optimize the wallet experience and may support inscriptions, The Block disclosed DWF Labs trading model:Pushing prices higher ahead of news release;

In terms of institutions, large companies and leading projects,Worldcoin launches World ID 2.0, integrating Telegram, Reddit, MC and other applications,Synthetix Proposal to End Inflation,Portal starts pre-sale;

NFT and GameFi areas,Pudgy Penguins plans to launch the online gaming platform Pudgy World, the Alpha version will be released in Q1 2024;

In terms of security incidents, the X platform may have critical vulnerabilities:Hackers can access user accounts simply by clicking on links, but cannot change passwords,Venus Protocol:Binance oracle issue fixed, OKX responded to DEX being attacked:Already repaired and all losses will be compensated,The Bitcoin serial number inscription (Inscription) vulnerability CVE was officially adopted by the US National Vulnerability Database (NVD),Ledger connectors compromised,Sushi CTO warns users not to interact with any Dapp...Well, it’s been another week of ups and downs.

Attached is the Weekly Editors Picks seriesportal。

See you next time~