The DAO funding controversy reappears, and famous detective ZachBXT discloses the chaos in the OP charity fund application

Original - Odaily

Author - Azuma

In the past few days, discussions about the pros and cons of the DAO funding mechanism have become a hot topic in major decentralized communities.

The cause of the incident was that Bankless DAO recently launched a proposal in the Arbitrum Governance Forum, which caused public outrage.

The content of the Bankless DAO proposal is to apply for a budget of 1.82 million ARB to help Arbitrum with its market promotion within the next year. At first glance, it seemed that there was nothing wrong except that the amount was slightly larger. However, the community discovered that Bankless DAO had previously launched the same proposal in a similar form in other project forums such as Optimism, and the difference in actual promotion effects was quite outrageous— — After receiving a budget of 70,000 OP, Bankless DAO did not use the official account to publish all content. Instead, it chose to publicize through multiple accounts. The lowest number of views of the promotional post was only single digits.

As a result, Bankless DAO quickly became the target of verbal and written criticism from the community, and its behavior was also ridiculed as using the brands reputation to profit from the project, opening up a new business model.

Afterwards, the two founders of Bankless came forward urgently and did a lot of crisis public relations, clarifying that Bankless DAO is a completely independent entity from Bankless, and stated that Bankless was not involved in the Bankless DAO proposal.

One wave has not subsided, and another wave has arisen. While the discussion on the Bankless DAO incident is still ongoing, some controversies about the DAO appropriation incident have resurfaced.

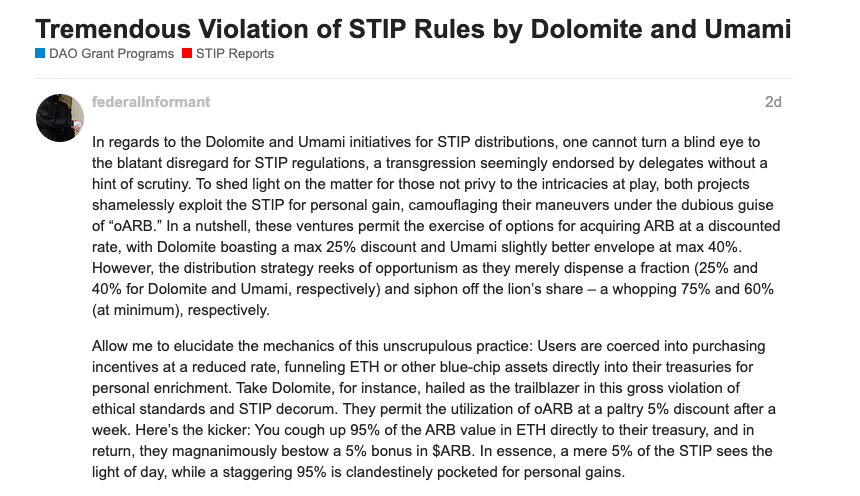

First, the Arbitrum community discovered some small-scale fraud in the Ecological Short-term Incentive Plan (STIP) - two projects, Dolomite and Umami, applied for financial support as false and enriched their own pockets as true.

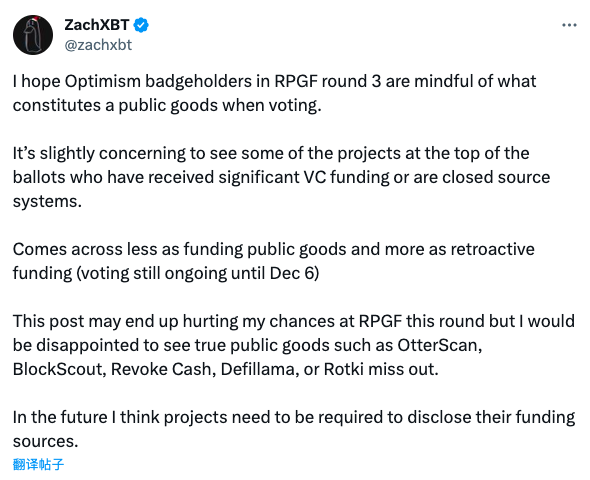

Subsequently, the well-known on-chain detective ZachXBT disclosed some controversial situations within the third round of RetroPGF in the Optimism ecosystem.

RetroPGF is Optimism’s “retrospective public goods funding process”, which aims to provide financial support to some projects of a public welfare nature. The total allocation of the third round of RetroPGF is 30 million OP, which is approximately US$50 million based on the current market price.

ZachXBT said that many of the projects currently ranking high in the RetroPGF governance vote are not truly public welfare projects. Some of them have either received large amounts of financing from VCs or have not yet been open sourced. This may lead to OtterScan, Real public welfare projects such as BlockScout, Revoke Cash, Defillama, Rotki, etc. do not receive the funding they should receive.

ZachXBT also counted which of the top 100 voting projects have received VC investment. It can be found that some of these projects have received tens of millions or even hundreds of millions of dollars in financing, and some projects have also issued tokens:

Gelato (raised $11 million, issued tokens);

Rainbow ($18 million in funding);

ImmunFi (more than $24 million raised);

Mirror (raised over $10 million);

Zora (more than $50 million in funding);

Synthetix (nine-digit treasury, issued coins);

Hop (raised US$2 million, issued tokens);

Tenderly ($40 million in funding);

Snapshot (raised over $4 million);

OpenZeppelin ($23 million via Forta);

Socket ($5.5 million in funding);

Alchemy ($545 million raised);

Rabbithole ($21.6 million in funding);

According to Optimisms governance plan, the voting session of this round of RetroPGF will end on December 6. Based on the current vote situation, the above-mentioned projects are likely to receive a considerable OP grant.

ZachXBT believes that he does not hold any bias against the above-mentioned projects, but compared with such purely public welfare projects, the above-mentioned projects do not seem to lack operating funds, so he calls on each project to disclose the source of funds when applying for funding.

The disclosure of ZachXBT quickly sparked heated discussions within the community. Some voices agree with ZachXBT’s point of view and believe that projects that already have sufficient operating reserves should not come back to “get a share of the pie” and have even begun to help ZachXBT check for leaks and fill in the gaps; however, some voices believe that whether the team has received VC financing should not be used as a basis to judge whether the team has received VC financing. Standards with a public welfare nature, such as OpenZeppelin and Forta, although they have the same origin, OpenZeppelin, as an independent project, can also be regarded as a public welfare project. These discussions are still ongoing, and interested readers can check out ZachXBT’s tweet for more details.

To sum up, from Bankless DAO’s professional wool harvesting, to the suspected fraud of Dolomite and Umami, to the Optimism RetroPGF distribution dispute, the above-mentioned incidents all reflect some shortcomings of the current DAO funding mechanism.

From the perspective of the project side, it is necessary for DAO to continuously distribute treasury reserves to support ecological growth. However, for now, how to fully review fund applications and achieve accurate flow of funds through a more decentralized voting process is temporarily remains a formidable challenge.