This Thanksgiving, avoid falling victim to turkey tactics

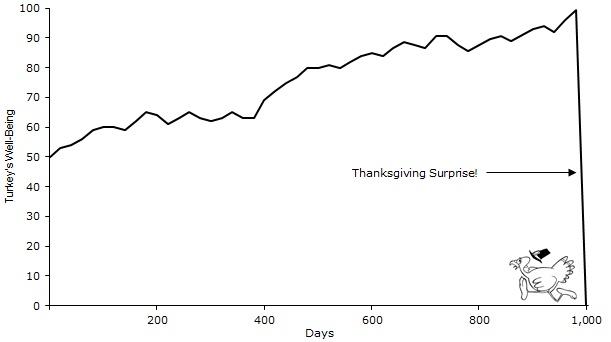

The Turkey Problem was raised by Nassim Taleb in his best-selling book The Black Swan. It tells a story: When the turkeys were in the chicken shed, every morning the farmer would bring a bowl of Corn to feed it. Over time, the turkey got used to this, and when it heard the farmer approaching the chicken shed every morning, it knew it was time for dinner. Gradually, the turkey concluded a rule: as long as the farmer comes close, it is the time to eat a big meal, and this is also the happiest time of the day.

On Thanksgiving day, the farmer approached the chicken shed as usual, and the turkeys cheered as usual. But what the turkey didnt expect was that the farmer was not holding corn, but an axe. Because Thanksgiving is here, and the farmer is coming over to kill the chickens and eat them. The poor turkey, when he was about to die, might not understand why the rule he had concluded, When the farmer comes, there is rice to eat no longer worked.

The essence of the turkey problem is that we forcefully find patterns in events that have no patterns, or summarize patterns based on limited small samples. In financial investment, such behavioral habits can be seen everywhere.

In the investment field, we often encounter strategies or models that have excellent backtest results, but when actually applied to trading, we find that their performance is far less than expected. This phenomenon is vividly called the turkey strategy, which is like fattening a turkey and then killing it. This article will explore how to protect investors interests by avoiding investing in this seemingly ideal but underperforming strategy.

In the current market environment of rising interest rates, more and more investors are beginning to pay attention to the declining return-to-risk ratio of real estate and traditional industry investments. This has resulted in quantitative investment attracting much attention. However, many quantitative investment teams with uneven residuals have emerged in the market. Some of them have achieved astonishing returns in a short period of time and have begun to hype financing. However, when the market environment changes or a black swan event occurs, these teams However, the teams performance dropped off a cliff and eventually became a loser in the industry.

These quantitative teams face some common problems. First of all, their real offer time is short and they have not experienced the test of different market environments. The lack of long-term market validation prevents their strategies from operating stably under different market conditions. Second, the risk control systems of these teams are imperfect. In investment, risk control is crucial, but these teams often have flaws in establishing and executing risk control systems and are unable to respond to violent market fluctuations in a timely manner. In addition, their profit logic is often not clear enough and they lack an in-depth understanding of the principles behind the strategy. This results in their low adaptability to the market and their inability to respond flexibly to various situations.

In order to avoid investors falling into these problems, we need to take some measures to improve our understanding of quantitative investment.

First of all, investors should choose a quantitative investment team that has been proven for a long time and can maintain stable returns in different market environments. This means that the team needs to have a long period of real trading experience and be able to prove that their strategies can be effectively executed in various market conditions.

Secondly, it is necessary to ensure that the team has a complete risk control system that can detect and control risks in a timely manner and protect the interests of investors. This includes establishing effective stop-loss mechanisms, diversifying investment risks, and regularly evaluating and adjusting strategies.

In addition, investors should have a deep understanding of the teams profit logic to ensure that the principles behind its strategies are reasonable and feasible. Only by understanding the nature of a strategy and how it is executed can investors better assess its potential risks and rewards.

In investment decisions, we should be wary of the existence of the turkey strategy and consider the following important factors when selecting a quantitative investment team:

Do you understand the limitations of backtesting?Backtesting can only simulate based on past data and cannot predict future market changes.

Do you have long-term real offer experience?The team’s real trading experience can prove the performance of their strategies in real market environments.

Is there a complete risk control system?Risk control is the key to protecting investors interests. The team should be able to respond to market fluctuations in a timely manner and take appropriate risk management measures.

Is there a clear profit logic?Investors need to deeply understand the principles behind the teams strategy to ensure that it is reasonable and feasible.

Can it adapt to different market environments?Teams should be able to flexibly respond to a variety of market conditions rather than relying solely on specific market conditions.

Is there a unique competitive advantage?The team should have some distinctive features or technical advantages that allow it to stand out in a highly competitive market.

To sum up, in order to avoid investing in the turkey strategy, investors should carefully choose a quantitative investment team and consider factors such as the team’s real-time experience, risk control system, profit logic, market adaptability, and competitive advantages. Through reasonable choices and investment portfolios, investors can better protect their interests and obtain long-term stable returns.

Twitter: @DerivativesCN

Website: https://dcbot.ai/