How to make cyclical money (2): Look at the flow of funds from the perspective of the Federal Reserve’s monetary policy and stable currency

I. Overview

In the previous article, we introduced the Bitcoin halving cycle and how to use the Merrill Lynch clock. In this article, we will introduce how to look at the inflow and outflow of funds from the perspective of the Federal Reserve’s monetary policy and stablecoins, so as to detect the cycle. stage. The Federal Reserves monetary policy determines the flow of funds, and changes in the market value of stablecoins reflect whether funds flow to the crypto market. Whether there is a continuous inflow of funds into the crypto market is the main basis for judging whether a bull market has arrived.

2. The perspective of the Federal Reserve’s monetary policy

The currency circle relies heavily on capital overflows, and the Federal Reserves interest rate decision will determine the direction of liquidity, so it is very important to understand the Federal Reserves monetary policy.

1. Introduction to the functions of the Federal Reserve

The Federal Reserve is the United States Federal Reserve System and is the central bank of the United States. Its full English name is The Federal Reserve System, or Fed for short. It was established to create a stable and flexible monetary and financial system for the country. The main responsibilities of the Federal Reserve include: monetary policy formulation, supervision and supervision of the banking system, maintenance of financial stability, clearing and payment systems.

The monetary policy of the United States is formulated by the Federal Reserve. The so-called Fed interest rate hikes and interest rate cuts are adjustments to the U.S. federal funds interest rate. The Fed adjusts interest rates by at least 25 basis points each time. For example, if it raises interest rates by 25 basis points from 2.25% to 2.50%, it becomes 2.5% to 2.75%. The adjustment decision is announced through the Federal Open Market Committee (FOMC) meeting.

2. The Fed’s motivations for raising interest rates

Prevent the economy from overheating. When the economy is rising, it is easy for the economy to overheat, and the Federal Reserve is likely to raise interest rates to cool the economy. In this case, the interest rate hike policy will have less impact on domestic and foreign financial markets. For the United States, because it is in a period of economic expansion, corporate profitability continues to increase, financing resistance is small, and interest rate hikes have a smaller impact on the real economy; for other countries, the negative impact of capital outflows caused by rising interest rates This was offset by the positive impact of U.S. economic growth and higher imports.

Reduce inflation levels. Although the economy may be stagnating or declining, the Federal Reserve will also choose to raise interest rates in order to curb high inflation. For the United States, the rise in interest rates will slow down the recovery of the U.S. economy and increase corporate financing costs, further affecting corporate growth; for other countries, it will intensify the outflow of funds and require higher debt repayment costs, reducing Exit

the need for monetary policy adjustments. Even if there is no obvious economic overheating and inflation, the Federal Reserve may raise interest rates due to the need for monetary policy adjustments. For example, after implementing a long period of zero interest rates and quantitative easing, the Federal Reserve launched a new round of interest rate hikes in 2015 to return to normal monetary policy.

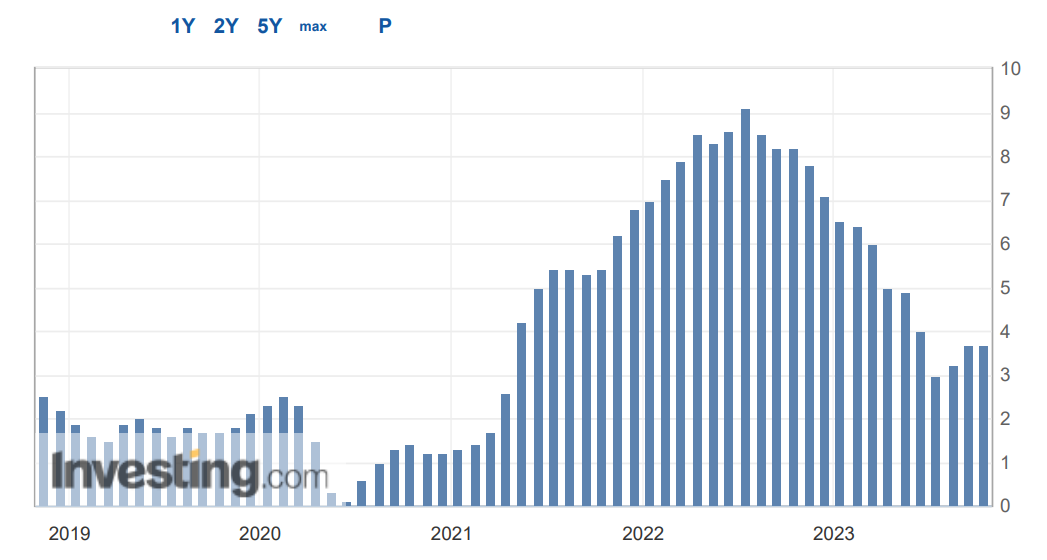

The reason for this round of Fed rate hikes is to reduce high inflation. After the outbreak of the new crown epidemic, the Federal Reserve implemented unconventional fiscal and monetary policies. Factors such as overheating of the domestic economy, rising international commodity prices caused by the Russia-Ukraine conflict, and poor global supply chains under the impact of the epidemic have caused U.S. inflation to soar. In addition, the Federal Reserve misjudged the seriousness and persistence of high inflation and did not introduce tightening policies in a timely manner, resulting in it having to take overcorrective measures to deal with high inflation. The Feds current goal of reducing inflation is to reduce the CPI (Consumer Price Index, which represents the level of inflation) to below 2%. The current CPI has dropped to 3.7%, but there has been a slight rebound in the first two months.

Data Sources:Investing.com

3. Historical analysis of the Federal Reserve’s interest rate hikes

Since July 1954, the Federal Reserve has experienced a total of 13 interest rate hike cycles, with the most recent complete rate hike cycle from December 2015 to December 2018.

Data source: Global Financial Data (GFD)

In terms of interest rate hike time, among the 13 interest rate hike cycles, the shortest was only 4 months, the longest was 69 months, and the average time was no more than two years. This round of interest rate hikes started on March 17, 2022, and 19 months have passed;

In terms of interest rate hike range, the maximum interest rate hike range is 15.25%, the minimum interest rate hike range is only 1.37%, and the average interest rate hike range is 4.74%. In this round of interest rate increases, the federal benchmark interest rate has increased from 0.25% to the current 5.5%, with the rate of increase reaching 5.25%;

In terms of the pace of interest rate hikes, the steepest rate hike was in 1980, with an average monthly interest rate hike of 2.63%. The pace of interest rate hikes was the slowest in 1963 and 2015, with average monthly interest rate hikes of 0.04% and 0.06% respectively. This round of interest rate hikes averaged 0.28% per month. From the initial 0.75% hike, to 0.5%, and then to the latest 0.25%, the pace of interest rate hikes has gradually slowed down.

Summary: Judging from the data of this round of interest rate hikes, the time and magnitude of interest rate hikes have exceeded the average over the past years, and the pace of interest rate hikes has also slowed down, which shows that this round of interest rate hikes has come to an end. However, the end of interest rate hikes does not mean an immediate reduction in interest rates. The most likely scenario is to maintain high interest rates for a period of time, and then the Fed will make adjustments based on macroeconomic data such as CPI, PCE, and non-agriculture.

4. How does monetary policy affect the inflow and outflow of funds in the crypto market?

Impact of raising interest rates: increasing the outflow rate of funds. Interest rates continue to increase, and funds are withdrawing from the crypto market at an accelerated pace and flowing into the U.S. dollar market.

Stop raising interest rates: Funds continue to flow out at a high rate. During the period when high interest rates are maintained, capital also maintains high-speed outflows.

Interest rate cut: Capital outflows slow down, but they are still flowing out until the outflows and inflows reverse.

The growth of the bull market in the crypto market relies on the spillover effect of funds. The release of water was first reflected in the US stock market. Funds flowed into the US stock market, causing the US stock market to start a bull market. Too much funds in the US stock market spilled into the currency circle, and the currency circle was also affected and entered a bull market. .

We can have an intuitive understanding of the strength of the U.S. dollar through the U.S. dollar index, and thus determine whether funds are flowing into the U.S. dollar market from the risk market. The direct result of the Federal Reserves interest rate hike is the influx of funds into the U.S. dollar market, causing capital to flow out of the risk market, causing risk assets such as Bitcoin to fall. How to measure the strength of the U.S. dollar requires the use of the U.S. dollar index (DXY). Because the U.S. dollar index is negatively correlated with Bitcoin, we can judge the future trend of Bitcoin through the U.S. dollar index.

Data Sources:MacroMicro

3. Stablecoin Market Value Perspective

In the first article of the cycle series, the definition of a bull market, we talked about the continuous entry of incremental funds as one of the criteria for judging a bull market. In this part, we will introduce how to judge whether incremental funds have entered the market from the perspective of stablecoins.

1. Why can the market value of stablecoins represent the amount of existing funds?

One thing that people tend to be confused about is: Why is the total market value of the crypto market not the existing funds? First of all, the concept of funds needs to be clarified: funds are money available for use, and money is currency. The only stablecoins that meet this point are anchored to legal currencies, and other cryptocurrencies fall into the category of assets. Many people are accustomed to the fact that the crypto market does not require legal currency as a trading medium, and are guided by the name XX Coin, thus thinking that XX Coin is capital.

Of course, not all stablecoins can represent existing funds, and all decentralized stablecoins that use encrypted assets as collateral are not included in this list. The reason is that decentralized stablecoins cannot be directly converted into legal tender because their collateral is volatile assets. Therefore, decentralized stablecoins do not represent the entry of incremental funds, they are just another form of expression of assets.

The way in which incremental funds enter the market is to use legal currency to purchase centralized stablecoins. Stablecoin issuers issue additional stablecoins on the chain, and the market value of stablecoins increases. In the trading market, stablecoins always flow from one person to another. The total amount of stablecoins remains unchanged. What changes is the price of volatile assets. Therefore, as long as funds do not enter or exit the market, the market value of stablecoins will not change. .

For a simple example, suppose A has 3 BTC, B has 10 USDT, and C has 15 USDT. B bought As 1 BTC at a price of 10 USDT. Later, C also wanted to buy BTC, but at this time, A raised the price of BTC to 15 USDT. At this time, the price of BTC reached 15 USDT. The market value of stable coins in the market did not change, but the price of BTC rose. Later, newcomer D wanted to enter the market and purchased 20 USDT from the stablecoin issuer Tether. Due to the increase in demand, BTC was traded at the price of 20 USDT. At this time, the market value of the stablecoin in the market increased from 25 USD to 45 USD. The price of BTC has also increased, which is the “price increase brought about by incremental funds” mentioned earlier.

It is not difficult to see from the above example that price increases are not necessarily caused by capital inflows. Prices are determined by supply and demand. However, it is unhealthy to only have price growth without capital inflows.

2. Examples illustrate the impact of stablecoin inflows and outflows on the market

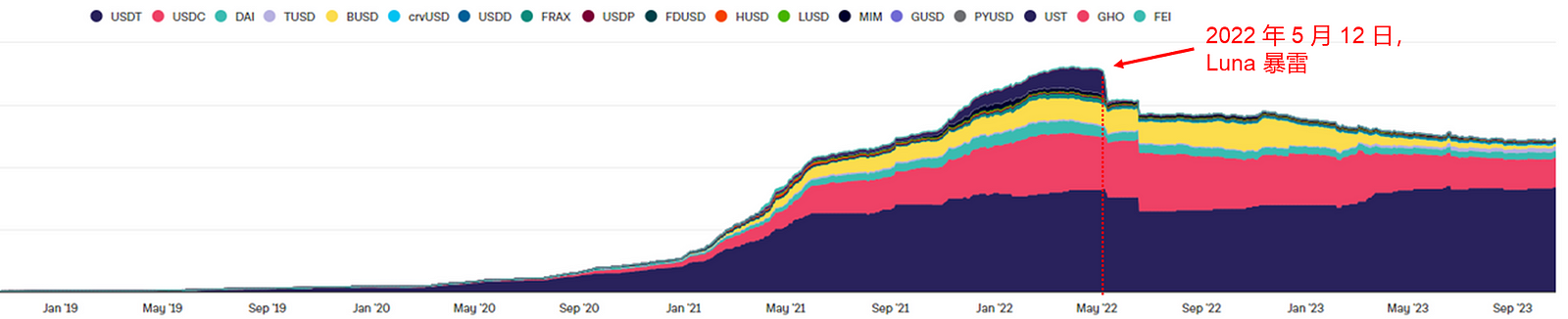

On May 12, 2022, the Luna thunderstorm officially started this round of bear market. From then on, stablecoins in the currency circle began to flow out in large quantities, and they never came back.

Data Sources:THE BLOCK

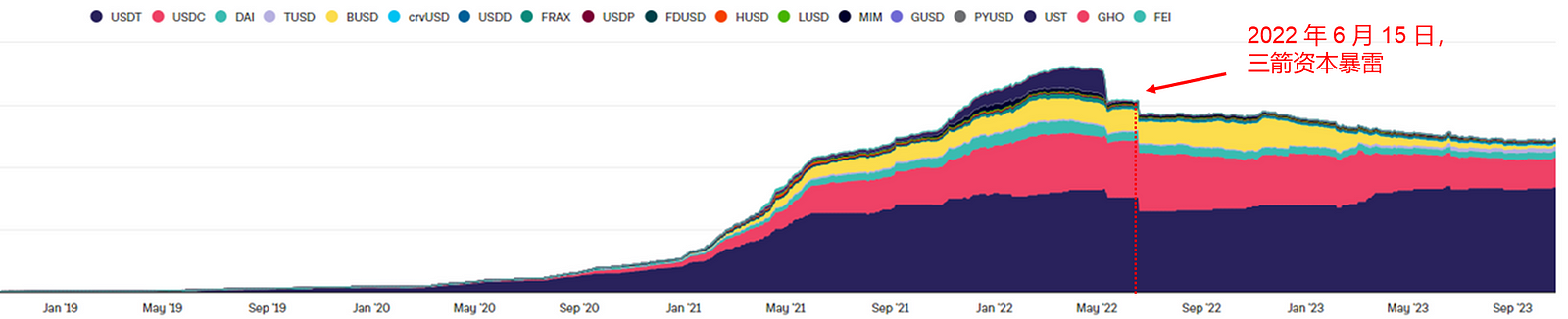

On June 15, 2022, Sanjian Capital suffered a thunderstorm, and stablecoins in the currency circle began a second wave of large-scale outflows, which also never came back.

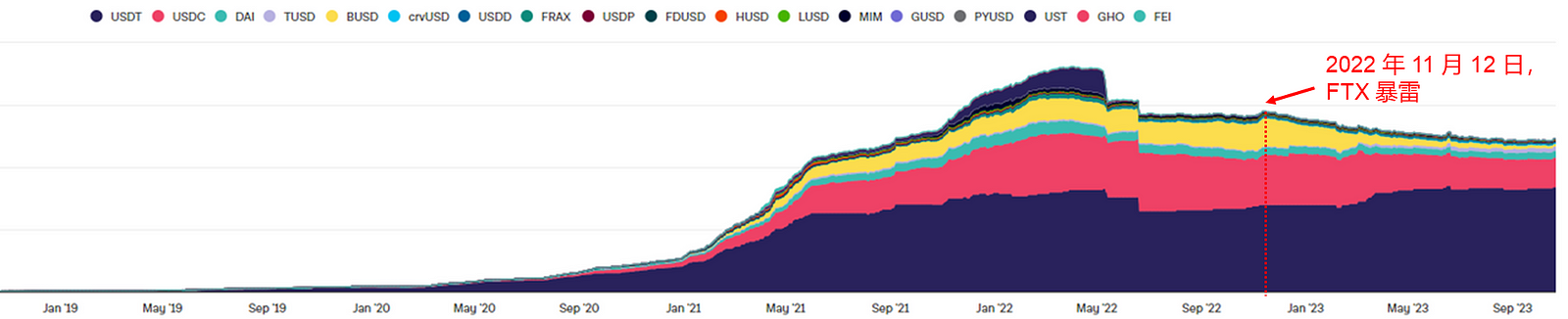

On November 12, 2022, FTX declared bankruptcy, giving the precarious currency circle a final blow and completely dragging the currency circle into the abyss of the bear market.

Looking at the data, we can see that since then, the total market value of stablecoins has been declining without a decent rebound, and the encryption market has also suffered a major blow.

It should be noted here that since the funding information of centralized stablecoins is not transparent, stablecoin issuers are likely to over-issuance, and there are certain limitations in looking at the market capitalization of stablecoins.

3. Does the big market necessarily require incremental capital inflows?

Judging from the actual situation, the big market does not necessarily require the inflow of incremental funds. Although the inflow of incremental funds has played a certain positive role in the subsequent market, the crypto market has also seen good gains amid the ongoing outflow of stablecoins this year. In the first part of the cycle, we summarized the bear market this way: the bear market is a game of existing funds. In this years long-short game, it is obvious that the multiple armies have the advantage by constantly attacking cities and plundering territory in this battle.

4. How to identify the participation of funds on the market

Due to its advantages of good trading depth and high liquidity, centralized exchanges are the main place for large-amount funds to trade. Therefore, the net inflow of stablecoins in centralized exchanges reflects the flow of funds on the exchange to a certain extent. Participation. The greater the net inflow of stablecoins, the higher the activity of funds on the market, and the greater the promotion effect on prices.

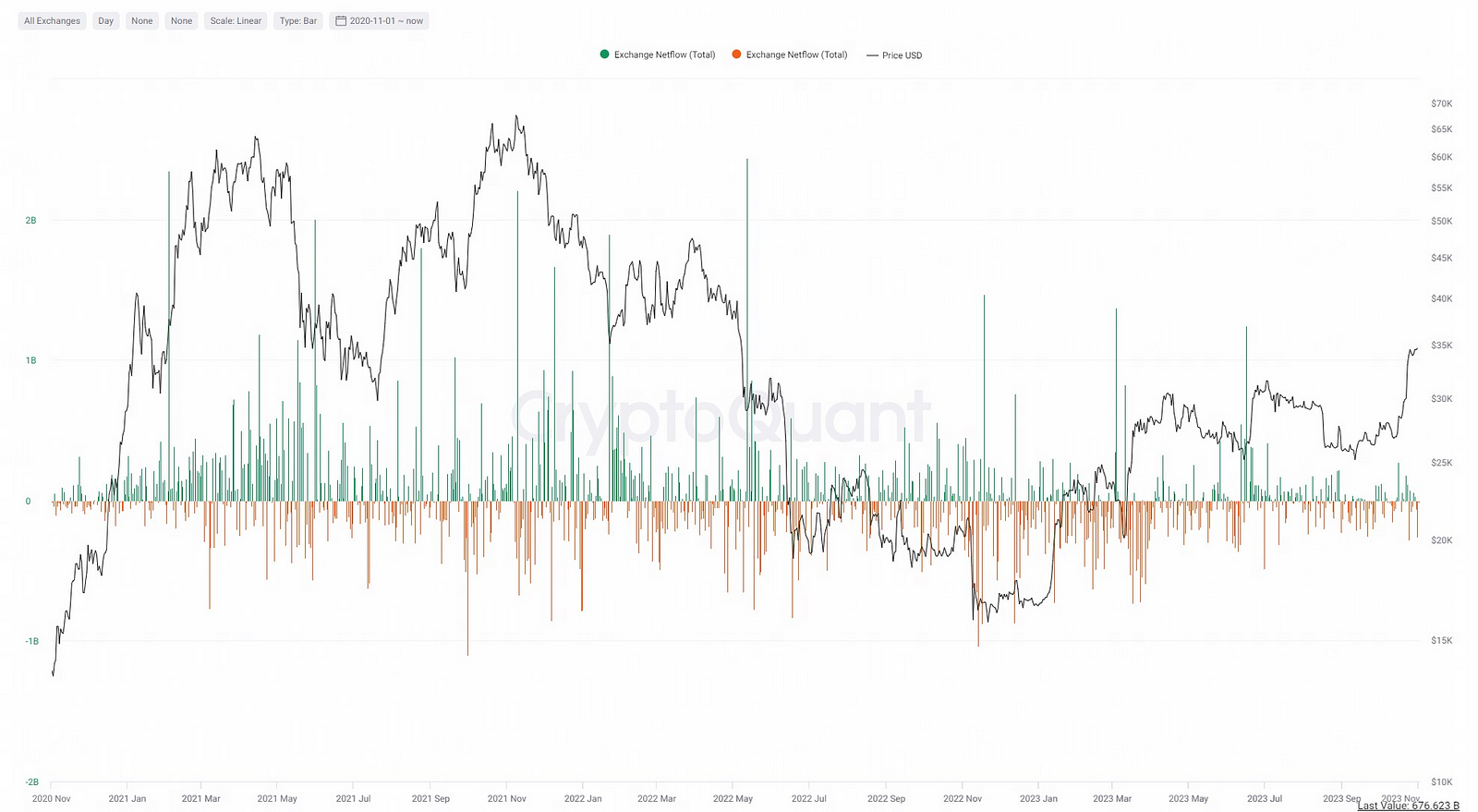

Data Sources:CryptoQuant

From the figure, we can see that during the rise of the last bull market, stablecoins continued to flow into CEX on a net basis, indicating that capital activity was high and traders were bullish; during the decline of the bear market, stablecoins continued to have a net outflow. Expansion indicates that funds are gradually cooling down, activity is reduced, traders are not optimistic about the future market, and trading desire is weakened.

From the data point of view, the peak market value of stablecoins is US$180 billion, and the peak market value of cryptocurrency is US$3 trillion. The current total market value of stablecoins is US$120 billion, and the total market value of cryptocurrencies is US$1 trillion. The market value of stablecoins has shrunk by 33%, and the total market value of the crypto market has shrunk by 67%. This shows that market changes are related to the inflow and outflow of stablecoins. However, the market value of stablecoins has not dropped as much as the total market value of the crypto market, indicating that some of the funds attracted by the last bull market have not yet left the market and are on the sidelines.

At the same time, this also shows that poor liquidity is a false proposition, and there is no need to consider liquidity in a completely free market. If no one buys it, just lower the price. When the price drops, people will naturally buy it, and then liquidity will be there. Lack of liquidity reflects a rigged market. The price itself is overvalued. If you don’t want to lower the price but also want to protect the market, you can only maintain a high price and low liquidity.

4. Summary

The Federal Reserve controls the flow of funds, and the market value of stablecoins is the capital flow dashboard of the crypto market. If you want to profit from the cycle, you must always pay attention to the policy trends of the Federal Reserve. It not only affects the direction of the market in the long term, but also has a huge impact on short-term emotions, which can easily cause short-term violent fluctuations in prices. After the Federal Reserve cuts interest rates, will funds definitely flow to the currency circle? Not necessarily, so you need to look at changes in the market value of stablecoins.

After reading Making Money in Cycles (1) and (2), I believe that everyone has a basic understanding and judgment of the bull and bear cycles in the currency circle. In the next article in this series, we will provide a brief introduction to the factors that stimulate bull markets.

Reference article:

1. Why we should pay attention to the Fed’s interest rate hike