From mechanism innovation to comprehensive evolution, the potential of the DeFi derivatives track is highlighted

Crypto Contract: Ten years of centralization, two years of decentralization

Ten years ago, an exchange called 796 Exchange quietly went online. By providing quarterly contracts for LTC and BTC, it broke the history that Bitcoin could not be shorted. It also earned the nickname Air Force Base Camp and opened up the contract track. Prelude to the 10-year race.

Over the past 10 years, how many people have created unimaginable wealth through contracts, and how many people have lost everything in the contract market. If they lose in trading technology, most speculators can readily admit that their skills are not as good as others and they will accept the disadvantage. However, the nature of centralization makes centralized exchanges with no bottom line become the last opponent of users.

In 2014, Mt. Gox suffered a thunderstorm, and no BTC has been paid to creditors so far. In August 2016, Bitfinex had 120,000 BTC stolen and was forced to become the first person to conduct a debt-for-equity swap in the cryptocurrency industry. However, now it seems that this debt transaction worth US$4.32 billion based on the currency standard is still a money-losing transaction. There was a thunderstorm in FTX in November 2022. The internal assets of FTX were traded in the OTC market at a minimum discount of 10%. The wealth and destiny of speculators were quietly transferred in the upper and lower shadow lines in the BTC/USD K-line. .

Fortunately, Crypto is a free enough market, and a free market often does not give its participants just one choice. In August 21, at the end of a magnificent bull market, dYdX launched an on-chain perpetual contract transaction that supports cross-margin. Along with the airdrop of 75 million DYDX, it is naturally transparent, fair, and does not touch users. The decentralized contract trading platform for asset rights has officially joined this stage with a high profile.

In just 2 years, although centralized exchanges still dominate contract trading, the trading share of decentralized derivatives has grown rapidly. CoinGecko tracks 87 cryptocurrency derivatives exchanges, of which Binance (Futures), Bybit (Futures) and Deepcoin (Derivatives) are in the top three, and there are many decentralized platforms between 20 and 50.

Data Sources:Derivatives Exchange Open Interest Ranking - CoinGecko

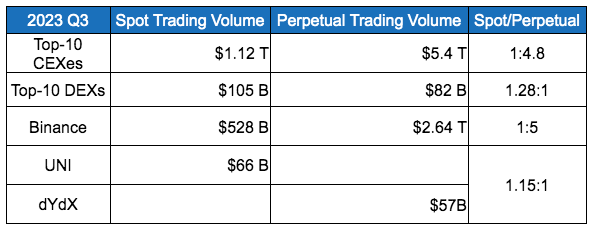

According to CoinGecko statistics in the third quarter of 2023, the spot and derivatives trading volume ratio of the top ten centralized exchanges (CEX) is 1: 4.8, while the opposite situation occurs on the chain. During the same period, the ratio of spot to perpetual contract volume on decentralized exchanges (DEX) was 1.28:1.

Data source: CoinGecko 2023 Q3 Crypto Industry Report

With the transfer of transaction volume from off-chain to on-chain and the rational development of on-chain transaction structures, the on-chain derivatives sector is expected to become a high-growth track in the bull market.

DYDX and GMX respectively established the order book model and capital pool model of derivatives DEX. The derivatives DEX that appeared subsequently,The main development path is to make partial innovations in a certain mechanism based on the two, or to seek an experience close to that of a centralized exchange.

Today we will explore the recent development trends of derivatives DEX through the analysis of three projects in different stages in the past year.

MUX Protocol: Launched in December 2022

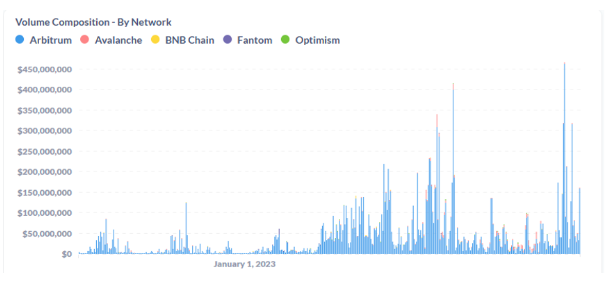

MUX proposes a multi-chain native protocol to maximize capital efficiency by unifying pooled liquidity across cross-chain deployments. The MUX protocol is currently deployed on Arbitrum, BNB Chain, Avalanche and Fantom, and will be expanded to more networks in the future. The predecessor of MUX Protocol is MCDEX, and the Derivatives Protocol is its V4 version, which is also a comprehensive migration of its brand.

Features

Sharing multi-chain liquidity- MUX is a multi-chain project that supports use on multiple public chains such as Arbitrum, OP, BSC, Avax and Fantom. Unlike GMX, MUXs liquidity pool (MUXLP) can be shared across chains. When the liquidity on a certain public chain is insufficient, the MUX protocol can call on the liquidity on other public chains to ensure the execution of transactions.

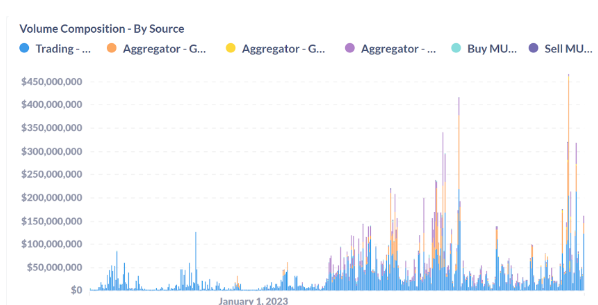

Contract trading aggregator- MUX is not only a perpetual contract trading platform, but also integrates an aggregator function. When the total liquidity of all supported public chains still cannot meet user needs, MUX can allocate transactions to other contract exchanges, such as GMX/Level Finance, ensuring platform user experience and eliminating the need for users to compare different exchanges to find the best liquidity. sex.

But judging from the actual situation, most transactions still occur in the native pool of MUX, especially the MUX pool on Arbitrum. As shown in the figure below, on November 7, the transaction volume of the MUX pool was $123, 392, 194, GMX V1 was $22, 098, 680, GMX V2 was 994, 722, Gains was $14, 603, 299, and other transactions accounted for Than negligible. This shows that multi-chain and aggregation transactions do not actually increase MUX’s transaction volume much.

Mechanism innovation

With 3 version iterations, MCDEX V1 was the order book launched in the first half of 2020, followed by the V3 version of “Exponential Price + Complex AMM” released in the first half of 21, and MUX is their fourth version. The trading mechanism is similar to GMX, integrating a price-feeding oracle.

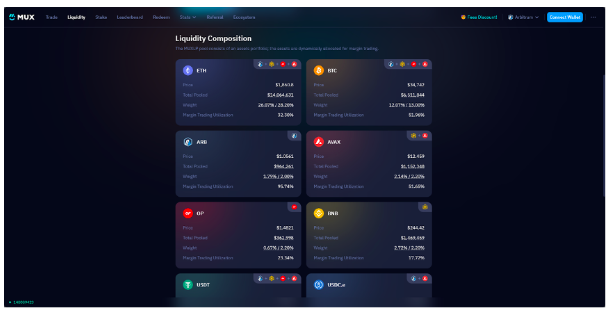

Trading on the MUX protocol involves a three-party game between liquidity providers (LPs), long and short traders, with LPs acting as comprehensive counterparties. When users purchase MUXLP (add liquidity to the pool), they can receive MUXLP liquidity certificates and participate in the distribution of transaction fee income. When traders open or close a position, their counterparty is the MUXLP liquidity pool. The pool consists of stablecoins and a basket of blue-chip assets, each of which has a target weight in the pool. When the weight changes, the protocol balances it by adjusting transaction fees. This mechanism is similar to the GLP liquidity pool setup in GMX, both of which aim to balance bullish and bearish sentiment in the market.

source:MUX

Hyperliquid: Launched in June 2023

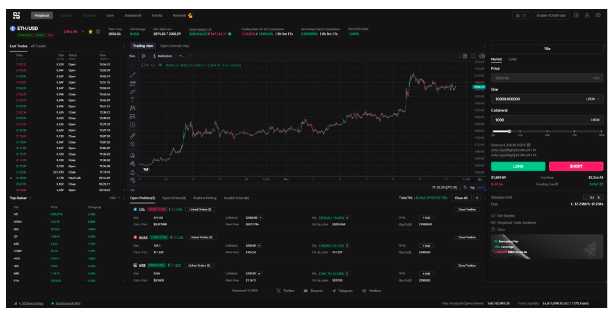

As a project with just over 10k Twitter posts, Hyperliquid doesn’t seem to have a lot of attention. However, its trading volume ranks firmly among the top ten among decentralized derivatives, and even once exceeded established projects such as GNS. Projects started in mid-2023 are no longer satisfied with partial mechanism innovation. They focus on the overall product experience and try their best to move closer to centralization.

Features

Hyperliquid provides a trading experience similar to that of a centralized exchange. For example:

Supports cross margin and isolated margin margin

Default take profit and stop loss orders

Up to 50x leverage available on any trading pair

There are currently 25 trading pairs online and counting

Take Profit/Stop Loss can be adjusted by dragging the order on the chart

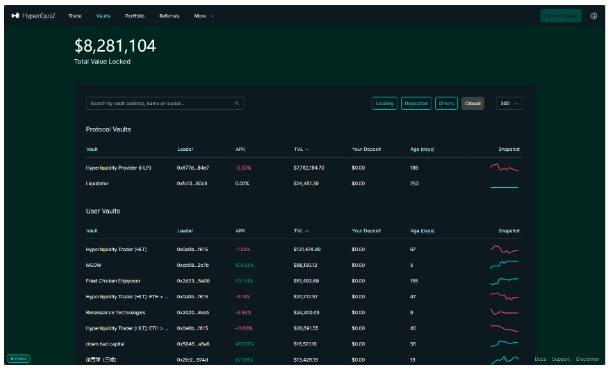

Vaults

On the Hyperliquid platform, vaults are a powerful and flexible base element built into Hyperliquid L1. Strategies running on Vault can enjoy the same advanced features as DEXs, from liquidating over-leveraged accounts to high-throughput market-making strategies. No more simply depositing funds into vaults that simply balance two coins.

Anyone can deposit funds into the vault to earn a share of the profits. In exchange, the vault owner will receive 10% of the total profits. Vaults can be managed by individual traders or automated by market makers. Of course, all strategies come with their own risks, and users should evaluate a vaults risk and performance history before depositing.

Hyperliquid L1

Hyperliquid L1 is a chain specially built for derivatives trading, making the performance of decentralized exchanges close to that of centralized exchanges. Hyperliquid does not rely on off-chain order books, but is completely decentralized and achieves transaction consistency through Byzantine Fault Tolerance (BFT) consensus. Latency is optimized using a specially tuned Tendermint consensus mechanism, resulting in extremely low end-to-end latency, with a median of 0.2 seconds and 99% of orders completed within 0.9 seconds. L1 supports a throughput of 20,000 operations per second, including order, cancellation, and liquidation operations. Hyperliquid L1 uses Proof of Stake (PoS) to ensure security, with similar equity and penalty mechanisms as the Cosmos chain. More details will be released when the native token is launched.

For an exchange as computationally intensive and performance-demanding as Hyperliquid, achieving decentralization will be a challenge. Putting the entire order book on-chain increases the complexity and computational burden of this effort.

It is worth noting that the frequency of new transactions on hot currency contracts on Hyperliquid is very high, and these long-tail assets contribute a large proportion of its trading volume.

Substance Exchange: Launched in November 2023

Decentralized derivatives are already a red ocean. Under the fierce competition on the track, the iterative evolution of the project is very fast. From the early partial innovation in mechanisms to the latecomers emphasis on product experience, to the new generations overall thinking on mechanisms, products and operations, it indicates that derivatives teams are beginning to break away from on-chain involution and have the ability to attack centralization. ability. The newly launched Substance Exchange (SubstanceX) is one of them.

SubstanceX was built by experienced market makers and development and operation teams who came from centralized exchanges. It proposed the slogan of promoting the comprehensive migration of trading to decentralization, and made a complete and long-term design in terms of mechanism, products and operations.

Mechanism innovation

LP Pool for a basket of stablecoins

On the SubstanceX exchange, all profits and losses are priced in SubstanceX U.S. dollars (USDX), which serves as the unit of settlement. Users can deposit USDT, USDC, USDC.e and DAI, convert them into USDX tokens according to the exchange rate to provide LP and obtain income, and even include gDAI and GLP as the underlying assets of the LP Pool in future plans, so that The design helps absorb more fluidity.

The bottom layer of the LP Pool built with stablecoins also supports SubstanceX to connect with projects such as Morpho and Pendle, providing LP with an additional 3 to 4% risk-free annualized rate of return through diversified pledged stablecoin assets on the chain. Because PT-USDX will be a tradable asset, you can lock the interest rate through protocols such as Pendle and withdraw at any time, avoiding the risk of maturity mismatch when obtaining interest.

Monotone queue position liquidation system

SubstanceX uses Multi-Core technology to design a memory-based monotonic queue position liquidation system, which can optimize the speed of searching and liquidating positions through price segmentation, supports millisecond-level liquidation of hundreds of thousands of positions, and greatly improves the efficiency of on-chain position liquidation. , speeding up liquidation and reducing the risk of liquidation.

Flexible rate mechanism

SubstanceX balances OI through capital fees, allowing LPs to control their net exposure when facing unilateral bull market trends, and smoothing the capital return curve for LPs when betting against Trader.

For mainstream currencies, SubstanceX removes borrowing fees and is more user-friendly for holding positions. For new currencies, a comprehensive rate system such as lending fees, funding fees, and price impact can be used to support the rapid introduction of new currencies while balancing the risk of volatility.

Features

SubstanceX trading interface

Up to 10 0X isolated margin

New currencies are updated quickly

Web2 method login

Support users to log in using email, mobile phone number and social media account, and achieve a seamless, secure and autonomous Web3 experience by using ZKP, MPC and account abstraction.

No pop-up experience

SubstanceX has introduced the 1 CT wallet function, which allows users to obtain a smooth trading experience by depositing a small amount of ETH as Gas, without the need for repeated pop-ups like wallets such as Metamask.

High scalability

Unlike other projects, SubstanceX did not choose the fork route, carried out product-level native development for more than half a year, and made innovative product plans for the next three years. Currently, Simple Options and Copy Trading are publicly available.

Strong operational strategy

The SubstanceX team, who came from a centralized exchange, attaches great importance to platform operations. In addition to deploying an AI customer service system on the front end, it also provides manual customer service support services for different VIP levels. Usually DeFi users can only provide feedback through Twitter private messages, Discord, etc. problem, and the cycle is very long.

According to official news, during the testnet activities at the end of July, the project obtained a total of 35,000 valid transaction addresses, and once accounted for more than 30% of the interaction volume on the Arbitrum testnet during the same period.

For newly emerging hot currencies, the SubstanceX team completed a new test on the test network to quickly open the corresponding contract within 2 hours after UniSwap added liquidity. Its quick response to new projects will be a good operational tactic, but how to control the risks and fluctuations of small currencies will be a big test.

Conclusion

In the Crypto centralized market, the trading volume of derivatives is often several times that of spot, and it is the most profitable business of the exchange. However, there is an inversion on the chain where the trading volume of derivatives is smaller than that of spot transactions. Under the dual forces of the natural adjustment of the on-chain transaction structure and the tendency to encroach on the share of centralized transactions, decentralized derivatives are bound to be a growth track with high certainty.

From MUX, Hyperliquid to SubstanceX, we have seen the epitome of iterative upgrades in this track within a year. On-chain derivatives have gradually experienced very rapid upgrades from protocols, products to operations. Comprehensive decentralization of transactions may gradually arrive in the competition of successive generations of products.