brc20-swap is online, with a detailed explanation of its development history, product model and future expectations

Original author: Wuhai, PANews

Since the trading mechanism of Ordinals ecological assets is almost all in the pending order sales mode, its liquidity has always been a key focus of the ecosystem. In July 2023, Unisat, which integrates engraving, trading markets and wallets, announced that it would soon launch brc 20-swap in order to improve the liquidity of ecological assets. This product was also launched for testing on October 30.

In this article, PANews will explain in detail the development history, product model and future expectations of brc 20-swap.

brc 20-swap development history

On September 20, 2023, Unisat issued brc 20-swap Early Access invitation inscriptions to 620 addresses. Filter criteria are

1) Active community members who traded at least 1 BTC on UniSat Marketplace between July 16 and September 20.

2) Active community members who have accumulated at least 500 UniSat points through UniSat engraving between July 16 and September 20.

3) Unisat OG PASS holders (snapshot block height is 808559)

On October 10, 2023, UniSat officially released the brc 20-swap mainnet online schedule and other details. It gradually distributes a commemorative inscription called brc 20-swap Prime Access to community users for free. Holding this commemorative inscription can participate in the early testing of the brc 20-swap product. It is distributed through the official discord channel and Twitter user raffles. The total amount distributed is 654, and the current floor price in the secondary market is 0.0067 BTC.

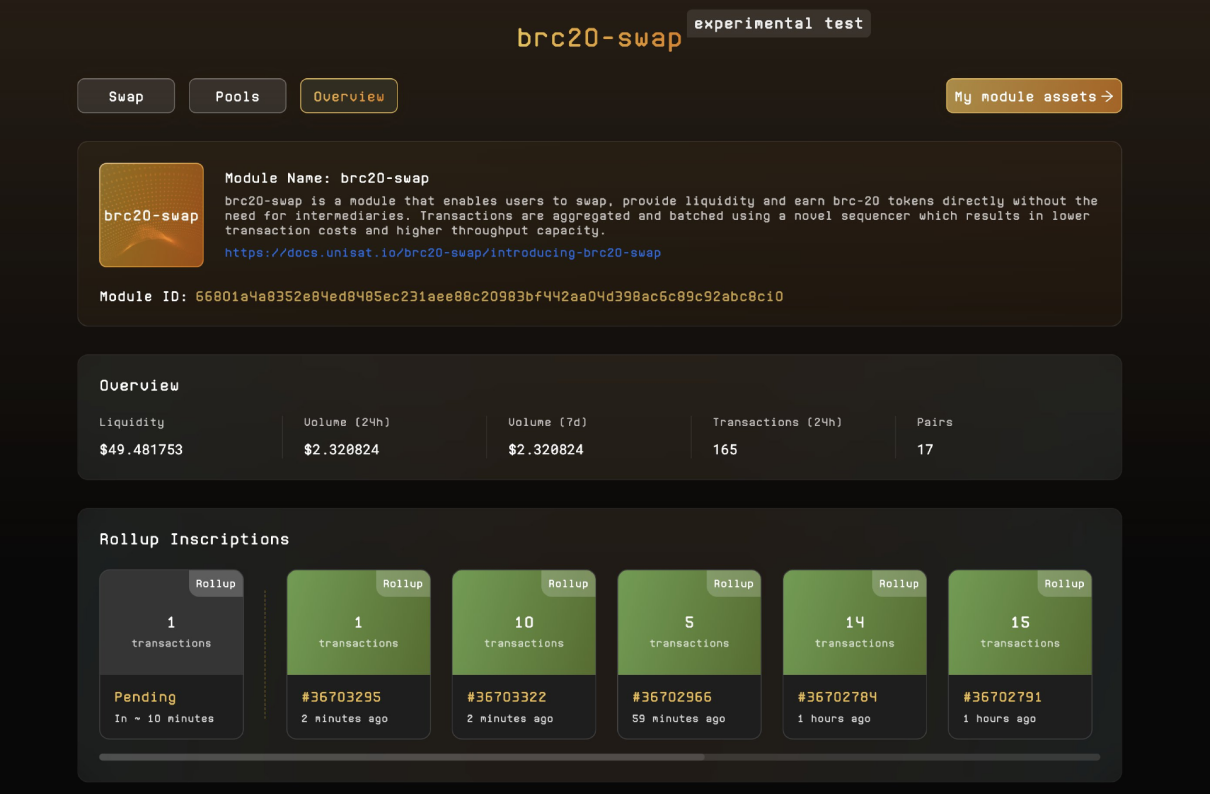

The job of settling and synchronizing transactions to the Bitcoin mainnet is done by the sequencer. In terms of transaction rates, brc 20-swap refers to the rate standard currently used by UniSwap and charges a 0.3% service fee to all users participating in the transaction. Approximately 1/6 (0.05%) of this fee is collected by UniSat, and the remaining 5/6 (0.25%) is distributed to all liquidity providers for each trading pair. The difference is that brc 20-swap uses the brc 20 asset sats as the handling fee.

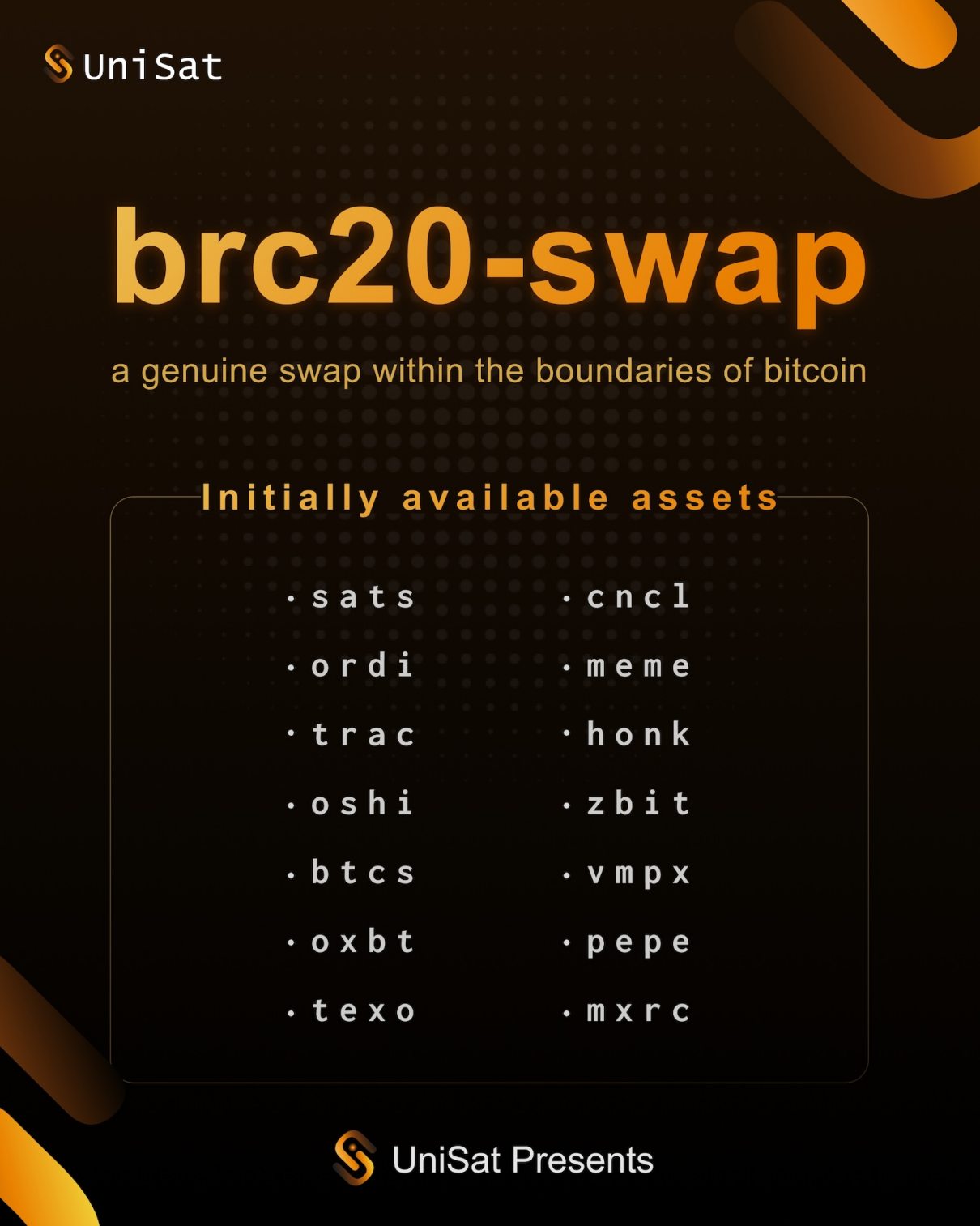

On October 30, 2023, UniSat officially announced the 14 assets initially supported by brc 20-swap. The screening criteria are assets that have at least 15 days of trading activity on the UniSat market in the past 30 days, and the median trading volume in the past 30 days is not zero. After this announcement was issued, the assets involved also experienced significant increases due to positive expectations.

product model

The product is divided into transactions, liquidity pools and data overview, which is roughly the same as the dex form on the EVM chain. Before conducting transactions, users need to first recharge assets into the brc 20-swap module through inscribe TRANSFER, and the recharge confirmation process takes 3 blocks.

brc 20-swap is implemented through modular extension, and each module exists independently of brc 20-swap. The advantages of this model are:

1) License-free development, making the development of new modules for brc-20 a license-free process;

2) Isolated execution to ensure that if there is a problem with the execution of any single module, it will not affect the operation of the core protocol and other modules;

3) Consensus upgrade, when most indexers recognize and implement the indexing of a specific module, it can transition from the current black module to the white module and become an integral part of the brc-20 protocol.

However, the expansion mode of the black module has a disadvantage: users cannot freely withdraw assets. Unisat is improved by designing a dynamic adjustment method that can be withdrawn when other peoples deposited assets are greater than the amount of assets to be withdrawn. The advantage of this is that it avoids the random issuance model on the EVM chain. The disadvantage is that users lose a certain amount of asset liquidity and convenience.

When the behavior of the black module is understood and implemented by users, gradually becomes reliable, and is gradually accepted by more indexers, the product transitions from the black module to the white module and reaches a consensus upgrade. Users can freely deposit and withdraw assets.

In addition, because the brc 20 protocol and even the entire Ordinals ecosystem are still in their early stages, Unisat occupies a greater influence and reputation. It provides complete indexing services such as transactions and balance inquiries for the protocol, and has a unique centralization risk. Its modular operation architecture allows more service providers to participate, thereby achieving a more decentralized index.

future expectations

It is often seen in the community of the Ordinals ecosystem that users complain about low liquidity and low capital capacity for entry, causing large players in the EVM chain to have to wait and see. brc 20-swap uses the brc 20 protocol as the underlying asset basis to realize the first native transaction in the Ordinals ecosystem. Continuously optimizing liquidity means continuously expanding the capacity of entry funds. Therefore, the launch of brc 20-swap is also a progress for the entire ecosystem.

At the same time, Unisat officially announced that it will donate 2% of the brc 20-swap handling fee to the L1 F Foundation participated by domo, the developer of the brc 20 protocol, to promote the further optimization of the development and standards of brc 20. Additionally, UniSat will open source the fully interpreted and verified source code of brc 20-swap to facilitate early support of the indexer.

All signs indicate a cooperative attitude, rather than a single company monopolizing ecological benefits. The Ordinals ecological development cycle is relatively short, and all parties in the ecosystem need to work together to make the pie bigger and achieve a win-win situation.